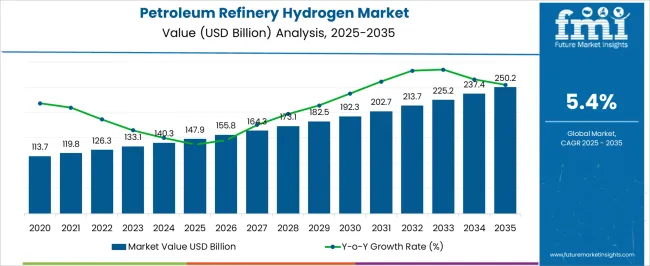

The petroleum refinery hydrogen market is estimated to be valued at USD 147.9 billion in 2025 and is projected to reach USD 250.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

Market growth is anticipated to follow a steady upward trajectory, with notable acceleration between 2028 and 2032 as refineries increase hydrogen integration to meet stricter environmental regulations and improve refinery efficiency. Demand is bolstered by rising requirements for hydrocracking and desulfurization processes, which rely heavily on hydrogen. Early years (2025 to 2027) exhibit moderate growth as existing refineries optimize operations and incremental capacity expansions take place. From 2030 onward, expansion accelerates as new refinery projects, particularly in Asia-Pacific and the Middle East, come online with advanced hydrogen generation and management systems.

Deceleration is expected post-2033 as market saturation in mature regions like North America and Europe tempers demand growth, though continuous technological improvements and government incentives sustain overall adoption. Strategic investments in hydrogen production, pipeline infrastructure, and integration with renewable sources further influence the acceleration-deceleration cycle.

The market is shaped by refinery modernization, regulatory compliance, energy transition policies, and competition between gray, blue, and green hydrogen technologies. Overall, the petroleum refinery hydrogen market demonstrates a balanced growth pattern driven by operational optimization, environmental mandates, and strategic expansion across high-demand regions globally.

The petroleum refinery hydrogen market is strongly influenced by interconnected parent markets, each contributing distinctively to overall demand and growth. The refining and petrochemical processing market holds the largest share at 40%, as hydrogen is essential for hydrocracking, desulfurization, and other refining operations that improve fuel quality and meet stringent regulatory standards.

The chemical manufacturing market contributes 20%, with hydrogen serving as a feedstock for ammonia, methanol, and other basic chemicals, supporting large-scale industrial applications. The energy transition and low-emission fuel market accounts for 15%, driven by demand for cleaner fuels, carbon reduction initiatives, and integration of hydrogen in refinery operations to lower the carbon footprint. The industrial gas and infrastructure market holds a 15% share, providing production, storage, and distribution solutions that ensure steady hydrogen availability for refinery and chemical processes.

Finally, the equipment and technology market represents 10%, offering reformers, electrolyzers, and catalytic systems that enhance hydrogen generation efficiency and reliability. Collectively, refining, chemical, and energy transition segments account for 75% of total demand, highlighting that core refinery applications, chemical feedstock needs, and decarbonization initiatives remain the primary growth drivers, while infrastructure and equipment markets support incremental global expansion.

| Metric | Value |

|---|---|

| Petroleum Refinery Hydrogen Market Estimated Value in (2025 E) | USD 147.9 billion |

| Petroleum Refinery Hydrogen Market Forecast Value in (2035 F) | USD 250.2 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The petroleum refinery hydrogen market is witnessing consistent growth, driven by the critical role of hydrogen in desulfurization, hydrocracking, and other refining processes aimed at producing cleaner fuels. The current market scenario is characterized by high demand for hydrogen production from fossil-based sources, supported by well-established infrastructure and mature technology adoption in refineries.

Regulatory pressure to meet stringent sulfur content limits in transportation fuels is reinforcing hydrogen consumption, while the future outlook points toward a gradual shift toward low-carbon hydrogen production pathways to align with decarbonization objectives. Despite ongoing energy transition efforts, grey hydrogen remains dominant due to its cost-effectiveness, operational reliability, and integration into existing refinery configurations.

Growth rationale includes rising crude oil processing volumes, increased investment in refinery modernization, and the sustained requirement for hydrogen in producing ultra-low-sulfur fuels Over the coming years, market expansion is expected to be underpinned by capacity upgrades, adoption of efficiency-enhancing technologies, and transitional strategies that integrate blue and green hydrogen without disrupting existing operational continuity.

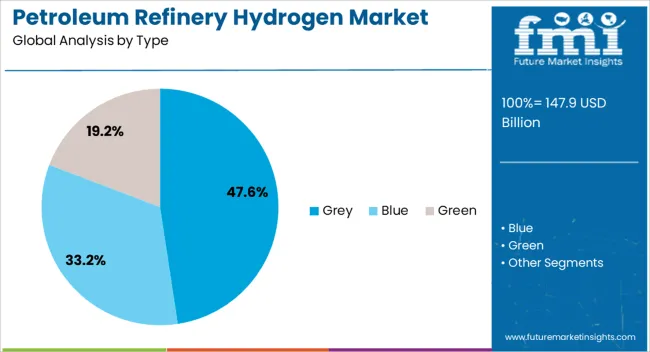

The petroleum refinery hydrogen market is segmented by type, and geographic regions. By type, petroleum refinery hydrogen market is divided into grey, blue, and green. Regionally, the petroleum refinery hydrogen industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The grey hydrogen segment, holding 47.60% of the type category, remains the leading production pathway in petroleum refineries due to its established cost advantage and compatibility with current refining operations. Produced primarily from natural gas through steam methane reforming, grey hydrogen benefits from mature process efficiency and widespread infrastructure availability, enabling reliable large-scale output.

The segment’s prominence is supported by its critical role in hydrotreating and hydrocracking processes, which are essential for meeting fuel quality regulations. Although environmental concerns and carbon emission targets are creating long-term pressure to transition toward cleaner hydrogen alternatives, grey hydrogen continues to dominate in the short to medium term due to lower production costs and faster scalability compared to green or blue hydrogen.

Refinery operators are optimizing grey hydrogen production through process integration, heat recovery systems, and operational improvements, which enhance yield and reduce unit costs This entrenched position is expected to remain stable until alternative hydrogen production technologies achieve cost competitiveness and wider industrial adoption.

Refining, chemical feedstock, and cleaner fuel adoption drive the petroleum refinery hydrogen market, while production and distribution infrastructure ensure steady global growth. Regulatory compliance and operational efficiency remain key growth enablers.

The petroleum refinery hydrogen market is primarily driven by increasing hydrogen requirements in refining processes such as hydrocracking, hydrotreating, and desulfurization. Refineries aim to produce cleaner fuels that comply with stringent global regulations on sulfur content and emissions. Hydrogen enhances fuel quality by enabling the removal of impurities, improving octane levels, and meeting international standards like Euro 6 and BS-VI. The demand is further supported by refinery expansions, upgrades of existing units, and retrofitting older refineries with hydrogen-intensive processing equipment. As crude slates become heavier and sourer, the consumption of hydrogen rises proportionally, positioning refining operations as the core segment driving consistent market growth globally.

Hydrogen serves as a vital feedstock in the chemical industry, particularly for producing ammonia, methanol, and other bulk chemicals. The chemical manufacturing sector contributes significantly to hydrogen consumption, as large-scale production facilities require continuous, high-purity hydrogen supply. Increasing global demand for fertilizers, plastics, and industrial chemicals has reinforced reliance on hydrogen, driving procurement contracts and investments in hydrogen production units. Integration of hydrogen with petrochemical complexes ensures cost efficiencies, reduced supply chain risks, and operational flexibility. The chemical sector’s demand remains resilient due to its foundational role in supporting downstream industries, positioning it as a consistent contributor to overall market expansion and reinforcing long-term growth prospects.

Refineries are increasingly adopting hydrogen to produce low-emission fuels in response to environmental regulations and carbon reduction mandates. Hydrogen enables production of ultra-low sulfur diesel, cleaner gasoline, and sustainable aviation fuels, helping companies achieve corporate sustainability and regulatory targets. Governments and international bodies are incentivizing hydrogen integration to reduce carbon intensity and align with global climate goals. The transition towards greener fuels also encourages refineries to explore onsite hydrogen generation and blending with renewable energy sources. The emphasis on reducing greenhouse gas emissions while maintaining operational efficiency is propelling refinery investment in hydrogen infrastructure, positioning it as a strategic enabler in the energy transition.

The industrial gas sector plays a critical role in supplying, storing, and distributing hydrogen for refinery operations. Investments in production units, including steam methane reformers, electrolyzers, and storage facilities, ensure reliable and cost-effective hydrogen availability. Logistics, pipelines, and on-site generation systems reduce downtime and maintain operational continuity. Emerging markets are witnessing new hydrogen hubs to support both refining and chemical demand. Collaboration between hydrogen producers and refineries enhances supply chain security and enables scaling to meet increasing demand. Expansion of infrastructure is crucial to accommodate rising global refinery throughput, positioning production and distribution networks as key drivers in enabling the petroleum refinery hydrogen market’s growth.

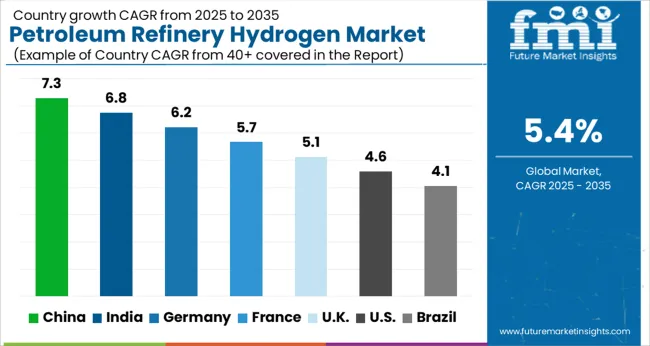

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

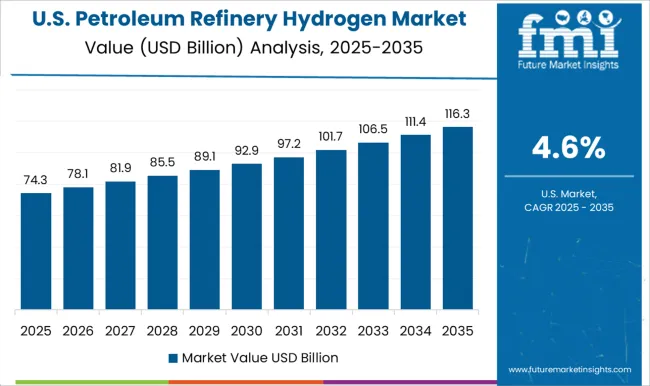

| USA | 4.6% |

| Brazil | 4.1% |

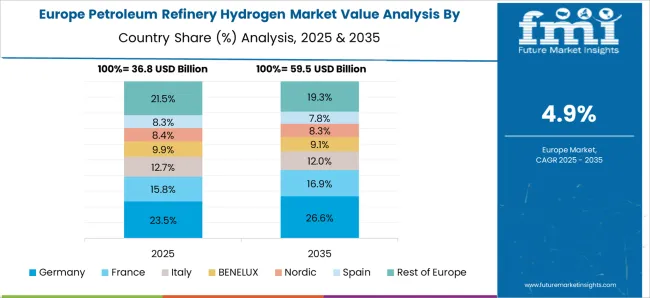

The global petroleum refinery hydrogen market is projected to grow at a CAGR of 5.4% from 2025 to 2035. China leads the market with 7.3%, followed by India at 6.8%, Germany at 6.2%, the UK at 5.1%, and the USA at 4.6%. Growth is driven by rising hydrogen consumption for hydrocracking, hydrotreating, and desulfurization to meet stringent fuel quality and emission standards.

Asia, particularly China and India, exhibits rapid expansion due to refinery upgrades, crude slate diversification, and increasing demand for low-sulfur fuels. Europe and North America focus on cleaner fuel production, chemical feedstock applications, and regulatory compliance. Investments in hydrogen generation, storage, and distribution infrastructure further support consistent market growth globally. The analysis spans over 40+ countries, with the leading markets shown below.

The petroleum refinery hydrogen market in China is projected to expand at a CAGR of 7.3% from 2025 to 2035, driven by rising demand for low-sulfur fuels, hydrocracking, and hydrotreating operations. Refineries are upgrading hydrogen production units to comply with stringent emission standards and to improve fuel quality across diesel, gasoline, and jet fuel segments.

China’s expanding chemical and petrochemical sectors further boost hydrogen consumption as feedstock for ammonia, methanol, and other derivatives. Government incentives supporting cleaner fuel technologies and refinery modernization accelerate adoption. Major domestic players are investing in large-scale hydrogen generation, storage, and distribution infrastructure. International collaborations and technology transfers enable advanced catalytic processes, optimizing production efficiency and reducing operational costs.

The petroleum refinery hydrogen market in India is expected to grow at a CAGR of 6.8% between 2025 and 2035, supported by refinery expansion, crude diversification, and increasing diesel and gasoline consumption. Hydrogen is critical for hydrotreating and desulfurization to meet Bharat Stage VI emission norms. Rapid industrialization, coupled with rising demand for cleaner fuels, is prompting investment in hydrogen production units and distribution networks.

Domestic refineries are incorporating state-of-the-art steam methane reforming and electrolysis technologies, while partnerships with global technology providers improve operational efficiency. Government-backed energy policies, including subsidies for cleaner fuels, facilitate infrastructure development. Hydrogen also serves as feedstock for ammonia and methanol production, contributing to overall demand growth.

Germany’s petroleum refinery hydrogen market is projected to grow at a CAGR of 6.2% from 2025 to 2035, driven by stringent European Union fuel quality regulations and low-carbon initiatives. Hydrogen is essential for hydrodesulfurization, hydrocracking, and producing cleaner fuels for domestic and export markets. German refineries are increasingly investing in green hydrogen and combined electrolysis-steam methane reforming units to reduce carbon intensity.

Advanced process optimization, catalytic technologies, and integration with petrochemical plants enhance operational efficiency. Supply chain collaborations with chemical manufacturers and technology providers enable consistent hydrogen availability for fuel and industrial feedstock needs. Policy frameworks incentivizing low-emission fuels and energy-efficient production further support market growth.

The petroleum refinery hydrogen market in the UK is expected to expand at a CAGR of 5.1% from 2025 to 2035, with growth fueled by compliance with European emission standards and increasing demand for ultra-low sulfur fuels. Hydrogen is required for hydrotreating and hydrocracking operations in major refineries serving both domestic and European markets. Investments in hydrogen production, storage, and pipeline infrastructure are ongoing to meet industrial and energy sector needs. The UK government supports hydrogen adoption through incentives and regulatory frameworks aimed at cleaner fuel production. Refineries are also integrating hydrogen into chemical and petrochemical processes, enhancing operational flexibility and reducing environmental impact.

The petroleum refinery hydrogen market in the USA is projected to grow at a CAGR of 4.6% from 2025 to 2035, driven by rising demand for cleaner fuels, refinery modernization, and industrial feedstock applications. Hydrogen is crucial for hydrocracking, hydrotreating, and desulfurization to comply with EPA fuel quality standards.

Refineries across Gulf Coast and Midwest regions are expanding production capacity and adopting advanced hydrogen generation technologies, including steam methane reforming and partial oxidation. Hydrogen also supports petrochemical and ammonia production, contributing to diversified market demand. Public-private partnerships, technology licensing, and operational efficiency improvements enhance competitiveness and supply security.

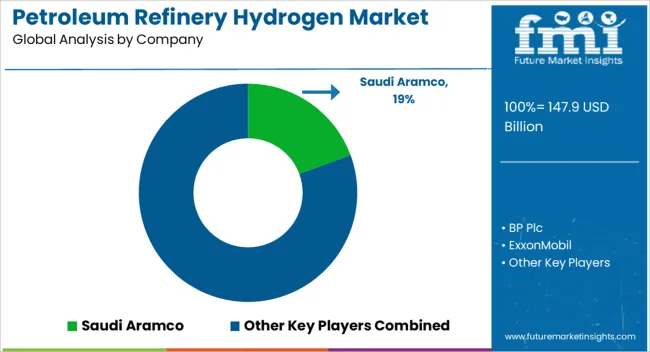

Competition in the petroleum refinery hydrogen market is defined by production capacity, feedstock flexibility, and compliance with stringent fuel quality and emission standards. Saudi Aramco leads through large-scale hydrogen generation units, integration with hydrocracking and hydrotreating operations, and global supply chain optimization, supporting domestic and export markets.

BP Plc emphasizes low-carbon hydrogen and advanced catalytic processes to produce ultra-low sulfur fuels and meet European emission standards. ExxonMobil and Chevron Corporation focus on refinery modernization, steam methane reforming, and partial oxidation technologies, enhancing operational efficiency and hydrogen output. Indian Oil Corporation Ltd leverages strategic refinery expansion and collaboration with technology providers to improve hydrogen availability for domestic fuel and chemical production. Messer Group and Nel Hydrogen compete through advanced hydrogen production, storage, and distribution technologies, targeting both industrial and energy applications.

PetroChina and Reliance Industries Ltd integrate hydrogen into petrochemical and ammonia production, emphasizing feedstock flexibility and operational efficiency. Shell Global differentiates with its focus on cleaner fuel solutions, process optimization, and low-carbon hydrogen initiatives aligned with regulatory frameworks. Strategies across leading players include capacity expansion, technology partnerships, green hydrogen adoption, and refinery process integration.

Brochure and technical content highlight hydrogen generation capacity, purity levels, feedstock types, storage solutions, and compliance with environmental and fuel quality standards, reflecting a market centered on reliability, regulatory alignment, and diversified industrial applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 147.9 billion |

| Type | Grey, Blue, and Green |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Saudi Aramco, BP Plc, ExxonMobil, Chevron Corporation, Indian Oil Corporation Ltd, Messer Group, Nel Hydrogen, PetroChina, Reliance Industries Ltd, and Shell Global |

| Additional Attributes | Dollar sales, share, production capacity, feedstock type, technology adoption (SMR, electrolysis, POX), refinery integration, regional demand, regulatory compliance, hydrogen purity, cost per kg, supply chain efficiency, and expansion plans. |

The global petroleum refinery hydrogen market is estimated to be valued at USD 147.9 billion in 2025.

The market size for the petroleum refinery hydrogen market is projected to reach USD 250.2 billion by 2035.

The petroleum refinery hydrogen market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in petroleum refinery hydrogen market are grey, blue and green.

In terms of type, the grey segment is set to occupy 47.6% share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Captive Petroleum Refinery Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Jelly Market Growth - Trends & Forecast 2025 to 2035

Petroleum Fuel Dyes and Markers Market 2025 to 2035

Petroleum Refining Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Yellow Petroleum Jelly Market Size and Share Forecast Outlook 2025 to 2035

Liquefied Petroleum Gas Storage Market Size and Share Forecast Outlook 2025 to 2035

Refinery Process Chemical Market Size and Share Forecast Outlook 2025 to 2035

Refinery fuel additives Market Size and Share Forecast Outlook 2025 to 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Refinery Catalyst Market Growth - Trends & Forecast 2025 to 2035

UK Refinery Catalyst Market Insights – Growth, Applications & Outlook 2025-2035

USA Refinery Catalyst Market Report - Trends & Innovations 2025 to 2035

Japan Refinery Catalyst Market Report – Trends, Demand & Industry Forecast 2025-2035

ASEAN Refinery Catalyst Market Analysis

Germany Refinery Catalyst Market Analysis – Size, Share & Forecast 2025-2035

High Performance Refinery Additives Market Trend Analysis Based on Product, Application, and Region 2025-2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA