The hydrogen storage tank and transportation market is expanding rapidly due to increasing adoption of hydrogen as a clean energy carrier and the global shift toward decarbonization. Growing investments in hydrogen infrastructure, advancements in composite materials, and rising fuel cell vehicle production are driving demand. Current trends indicate strong government support through policy frameworks and funding for hydrogen refueling networks, ensuring market stability and scalability.

The need for safe, efficient, and lightweight storage systems is promoting continuous innovation in tank design and pressure optimization. Market growth is further supported by the expansion of industrial hydrogen applications across sectors such as power generation, chemicals, and transportation.

The future outlook remains positive as economies aim for carbon neutrality and expand hydrogen distribution networks Rising R&D investment in compression technology, thermal management, and modular storage integration is expected to improve efficiency and cost competitiveness, ensuring steady market progression and broader commercial adoption across global energy systems.

| Metric | Value |

|---|---|

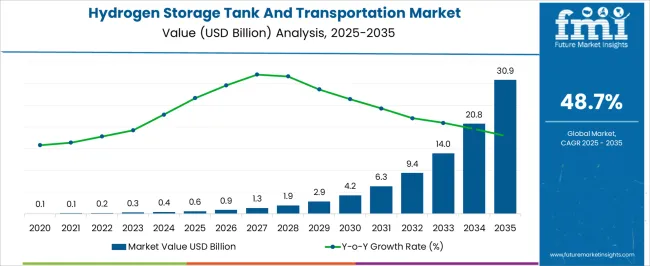

| Hydrogen Storage Tank And Transportation Market Estimated Value in (2025 E) | USD 0.6 billion |

| Hydrogen Storage Tank And Transportation Market Forecast Value in (2035 F) | USD 30.9 billion |

| Forecast CAGR (2025 to 2035) | 48.7% |

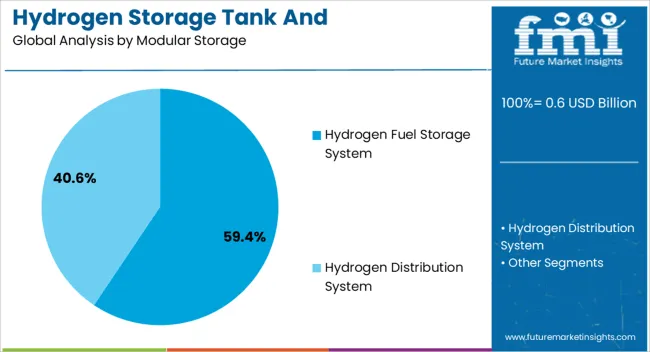

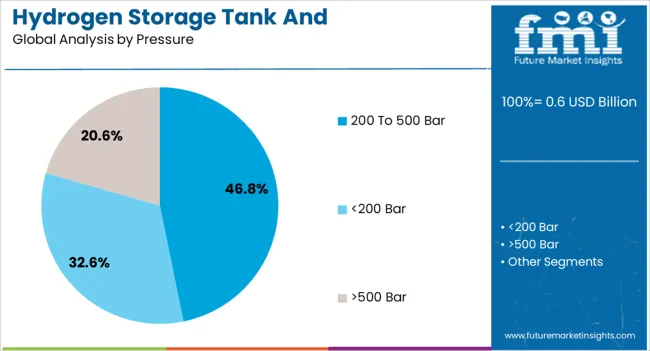

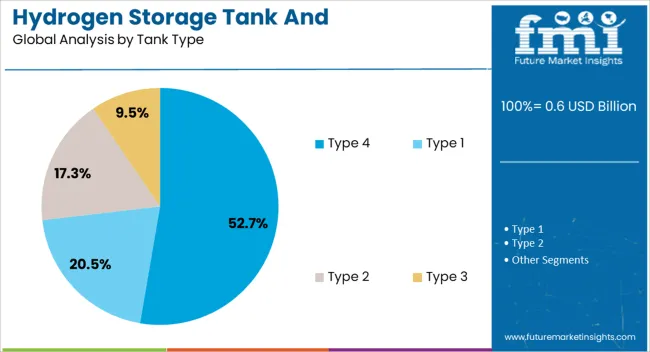

The market is segmented by Modular Storage, Pressure, Tank Type, and Application and region. By Modular Storage, the market is divided into Hydrogen Fuel Storage System and Hydrogen Distribution System. In terms of Pressure, the market is classified into 200 To 500 Bar, <200 Bar, and >500 Bar. Based on Tank Type, the market is segmented into Type 4, Type 1, Type 2, and Type 3. By Application, the market is divided into Vehicles, Marine, Rail, Stationary Storage, and Trailer For H2 Transportation. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hydrogen fuel storage system segment, accounting for 59.40% of the modular storage category, has maintained leadership due to its integral role in ensuring safe and efficient hydrogen containment. Market dominance has been reinforced by the growing adoption of fuel cell vehicles and stationary power systems that require compact, high-capacity storage.

Manufacturers are focusing on optimizing system weight, design flexibility, and pressure resilience to improve storage efficiency. Integration of modular storage systems within transportation and industrial applications has enhanced scalability and ease of maintenance.

Regulatory compliance with international hydrogen safety standards has increased user confidence and accelerated commercial deployment Continuous innovations in composite materials and digital monitoring systems are strengthening operational safety and reducing maintenance costs, ensuring that the hydrogen fuel storage system segment continues to lead the market over the forecast period.

The 200 to 500 bar segment, holding 46.80% of the pressure category, dominates the market due to its balance between safety, storage efficiency, and cost-effectiveness. This pressure range is widely used in hydrogen transportation and refueling infrastructure as it provides optimal density without compromising tank integrity.

Advances in carbon fiber and polymer liner materials have enhanced durability, allowing tanks to operate safely under varying temperature and pressure conditions. The segment’s growth is being supported by expanding hydrogen mobility projects and the standardization of storage parameters across regions.

Manufacturers are focusing on improving valve systems, pressure management, and leak detection to ensure operational reliability With regulatory frameworks promoting higher-pressure storage for future hydrogen networks, the 200 to 500 bar category is expected to maintain its leading position and support large-scale hydrogen mobility and industrial applications.

The Type 4 tank segment, representing 52.70% of the tank type category, has emerged as the leading design due to its lightweight composite structure and superior pressure endurance. The use of advanced carbon fiber reinforcement has significantly reduced tank weight while maintaining high storage efficiency, making it ideal for both transportation and stationary applications.

Its corrosion resistance, thermal stability, and lower maintenance requirements have enhanced adoption across hydrogen mobility and industrial sectors. Ongoing R&D efforts aimed at cost reduction, recyclability, and performance optimization are further strengthening market competitiveness.

The segment benefits from favorable safety certifications and compliance with international hydrogen standards, ensuring long-term reliability As demand for zero-emission vehicles and distributed hydrogen systems continues to rise, Type 4 tanks are expected to remain the preferred choice, driving the overall expansion of the hydrogen storage tank and transportation market.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 46.9 million |

| Market Value for 2025 | USD 259.8 million |

| Market CAGR from 2020 to 2025 | 53.4% |

The segmented market analysis of hydrogen storage tank and transportation is included in the following subsection. Based on comprehensive studies, the hydrogen fuel storage system sector is leading the modular storage category, and the <200 bar segment is commanding the pressure category.

| Attributes | Details |

|---|---|

| Top Modular Storage | Hydrogen Fuel Storage System |

| CAGR % 2020 to 2025 | 52.9% |

| CAGR % 2025 to End of Forecast (2035) | 48.2% |

| Attributes | Details |

|---|---|

| Top Pressure | <200 Bar |

| CAGR % 2020 to 2025 | 52.5% |

| CAGR % 2025 to End of Forecast (2035) | 47.8% |

The hydrogen storage tank and transportation market can be observed in the subsequent tables, which focus on the leading economies in South Korea, Japan, China, the United States, and the United Kingdom. A comprehensive evaluation demonstrates that South Korea has enormous market opportunities for hydrogen storage tank and transportation.

| Country | South Korea |

|---|---|

| HCAGR (2020 to 2025) | 61.0% |

| CAGR (2025 to 2035) | 51.1% |

| Nation | Japan |

|---|---|

| HCAGR (2020 to 2025) | 57.8% |

| CAGR (2025 to 2035) | 50.8% |

| Nation | China |

|---|---|

| HCAGR (2020 to 2025) | 56.4% |

| CAGR (2025 to 2035) | 50.0% |

| Nation | United Kingdom |

|---|---|

| HCAGR (2020 to 2025) | 58.2% |

| CAGR (2025 to 2035) | 49.5% |

| Nation | United States |

|---|---|

| HCAGR (2020 to 2025) | 54.9% |

| CAGR (2025 to 2035) | 49.1% |

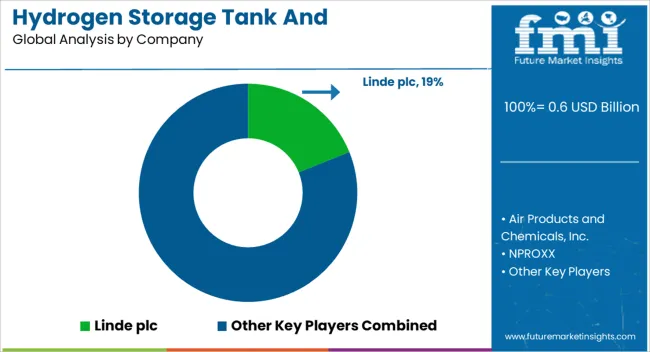

The hydrogen storage tank and transportation vendors are influencing developments and the direction of the business in the fiercely competitive market. Air Liquide, Linde plc, and Chart Industries Inc. are reputable hydrogen storage tank and transportation suppliers that lead the industry in innovation and dependability. The leading hydrogen storage tank and transportation providers are essential to the development and set the standard for innovation.

Companies that contribute to diversifying hydrogen storage and transportation solutions include Worthington Industries, Hexagon Composites ASA, and Luxfer Holdings PLC. These companies offer their special capabilities to the competitive field. The hydrogen storage tank and transportation vendors use their experience to promote sustainable practices and adapt to changing market demands.

The market participants of hydrogen storage tanks and transportation who actively participate and contribute significantly to the development of the industry include Praxair Technology Inc., Quantum Fuel Systems LLC, and VRV S.p.A. The demand for transportation and hydrogen storage tanks is dynamic due to their technological prowess and various options.

The hydrogen storage tank and transportation sector are quite competitive, encouraging ongoing developments as the major businesses manage the opportunities and challenges.

Notable Strides

| Company | Details |

|---|---|

| Hexagon Purus | A major competitor in the market, Hexagon Purus, announced intentions to expand its hydrogen manufacturing facility in Weeze in April 2025. The project aims to accelerate the company's growth in the energy transition industry by incorporating office and training spaces and a hydrogen refueling center. The three-phase plan will help the corporation reach its clean hydrogen production target and increase production capacity. |

| NPROXX | At the International Trade Fair in Germany in October 2025, NPROXX, a pioneer in high-pressure hydrogen storage technologies, unveiled its most recent developments in hydrogen storage. Refueling hubs, compressed natural gas, and hydrogen-powered cars are some of these creative options. The company has expanded its hydrogen storage portfolio thanks to these product breakthroughs, which help ensure that low-carbon and hydrogen-based technologies are a major part of the future. |

| Tenaris | Tenaris and Nel Hydrogen partnered in November 2024 to offer a hydrogen truck recharging network throughout California. They create hydrogen technology and provide high-pressure solutions for Shell's planned installation of hydrogen storage in Long Beach. |

| Worthington Industries | Van Hool and Worthington Industries partnered in October 2024 to supply cylinders made by Worthington Industries and an onboard fueling system intended for public transportation. |

The global hydrogen storage tank and transportation market is estimated to be valued at USD 0.6 billion in 2025.

The market size for the hydrogen storage tank and transportation market is projected to reach USD 30.9 billion by 2035.

The hydrogen storage tank and transportation market is expected to grow at a 48.7% CAGR between 2025 and 2035.

The key product types in hydrogen storage tank and transportation market are hydrogen fuel storage system and hydrogen distribution system.

In terms of pressure, 200 to 500 bar segment to command 46.8% share in the hydrogen storage tank and transportation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Refueling Station Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Peroxide Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fuel Cell Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Pipeline Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Combustion Engine Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Hubs Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Buses Market Growth – Trends & Forecast 2025 to 2035

Hydrogen Truck Market Growth – Trends & Forecast 2024 to 2034

Hydrogen Fueling Station Market Growth – Trends & Forecast 2024-2034

Hydrogenated Palm Oil Market

Hydrogenerators Market

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA