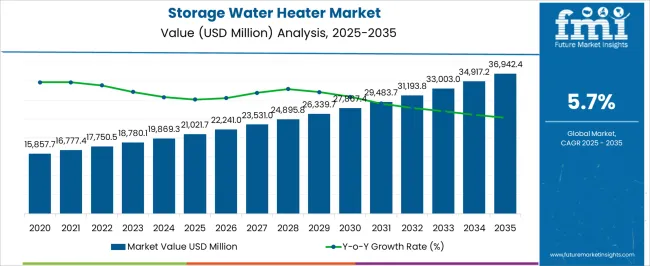

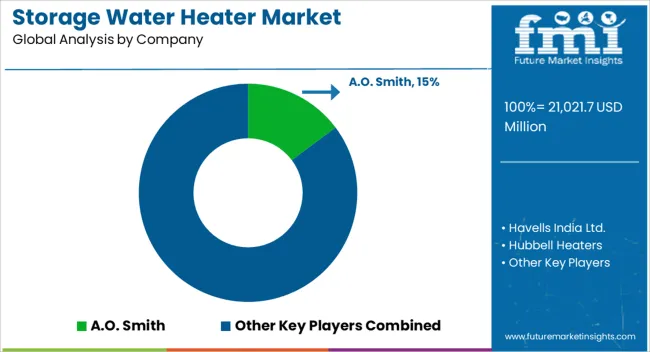

The Storage Water Heater Market is estimated to be valued at USD 21021.7 million in 2025 and is projected to reach USD 36942.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

| Metric | Value |

|---|---|

| Storage Water Heater Market Estimated Value in (2025 E) | USD 21021.7 million |

| Storage Water Heater Market Forecast Value in (2035 F) | USD 36942.4 million |

| Forecast CAGR (2025 to 2035) | 5.7% |

The storage water heater market is witnessing consistent growth, propelled by rising urbanization, improved living standards, and increasing demand for reliable hot water solutions across residential and commercial sectors. Growth is supported by advancements in energy efficiency, smart controls, and safety features, which have enhanced product adoption.

Expanding construction activities, coupled with government incentives promoting energy-efficient appliances, are further reinforcing demand. The current market scenario reflects strong adoption in urban households, while rural penetration is gradually increasing with infrastructure development.

Looking ahead, sustained residential construction, growing consumer inclination toward comfort appliances, and technological integration are expected to strengthen the market trajectory and expand its consumer base.

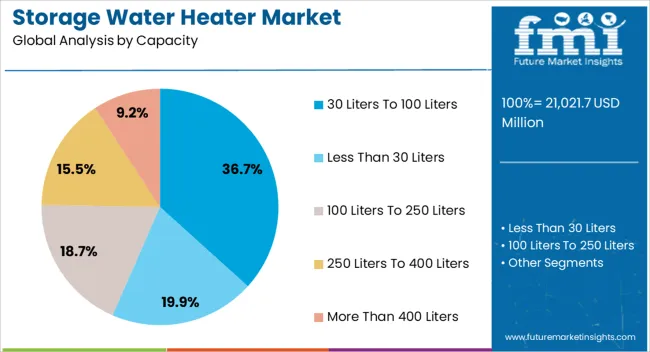

The 30 liters to 100 liters segment holds approximately 36.7% share of the capacity category in the storage water heater market. Its dominance is driven by suitability for medium-sized households requiring adequate hot water for multiple uses.

This capacity range offers a balance between energy consumption and utility, making it a preferred choice in both urban apartments and small family homes. The segment benefits from competitive pricing and wide availability across global markets.

With continued demand from growing middle-class populations and the rise in nuclear families, this segment is expected to maintain its prominence.

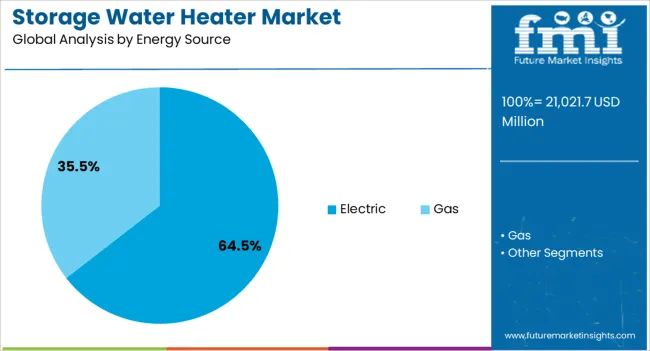

The electric segment leads the energy source category, accounting for approximately 64.5% share of the market. This dominance is supported by widespread electricity access, ease of installation, and compatibility with compact residential setups.

Electric storage water heaters have gained popularity due to their safety features, low maintenance, and integration with energy-efficient technologies. Rising government focus on reducing carbon emissions has also led to improvements in electric heater efficiency.

With increasing urbanization and modernization of residential facilities, the electric segment is anticipated to sustain its market leadership.

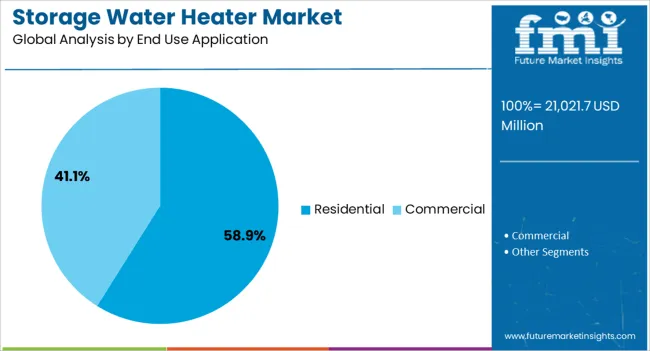

The residential segment dominates the end-use application category with approximately 58.9% share. This leadership is driven by rising demand for comfort-oriented household appliances, supported by growing disposable incomes and urban housing projects.

Water heaters are increasingly viewed as essential fixtures in modern homes, leading to consistent adoption. The segment benefits from rapid expansion of residential infrastructure in emerging economies and strong replacement demand in developed markets.

With ongoing lifestyle upgrades and higher emphasis on convenience, the residential segment is expected to retain its dominant position.

As per the global water heater market analysis report of 2020, the total revenue generated by the market was nearly USD 16,378.6 million. In the following five years, the niche market of storage water heaters advanced with an average 3.8% annual growth rate.

| Attributes | Details |

|---|---|

| Storage Water Heater Market Size (2020) | USD 16,378.6 million |

| Market Value (2025) | USD 19,013.7 million |

| Market (CAGR 2020 to 2025) | 3.8% |

In the last few years, consumer choices have been significantly altered after the growing emphasis on sustainability and energy efficiency globally. Manufacturers of traditional storage water heaters have profited from this trend by creating models that use less energy or can be adapted to different energy supplies.

Prominent Factors for the Growth of the Storage Water Heater Market

Electric storage water heater manufacturers have a greater chance to include smart operation capabilities as IOT technologies have been advancing fast in recent years. So, modern consumers in cities are requesting more smart water heaters that come with remote controls, customizable schedules, and connectivity with home automation systems.

Manufacturers of business water heaters are investing more in research and development to improve the reliability and performance of their products by utilizing recent developments in the material sciences. The lifetime of standard water storage tanks with heating systems can be boosted by increased insulation, practical heating components, and corrosion-resistant materials.

Design aesthetics and the customizability of commercial water heaters, together with utility, are becoming more important for present-day consumers. So, leading market competitors are aspiring to set themselves apart from other vendors by providing a variety of styles, coatings, and customizability options.

The table below lists the countries that could provide lucrative ground for the growth and advancement of storage water heater industries during the projected years. The United States and China, already having well-established markets, are expected to advance on the back of technological developments. Meanwhile, India and Australia are emerging markets in the storage water heater domain and anticipate strengthening their industrial base to increase production capacity.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.1% |

| Australia | 6.7% |

| China | 5.9% |

| India | 7.7% |

According to the market analysis report, the United States storage water heater market is forecast to expand at 4.1% CAGR through 2035.

Regional players are trying to gain a competitive advantage by targeting customers with higher spending capacity demanding cutting-edge home appliances and solutions. Storage water heater manufacturers in the United States can take advantage of this consumer base by emphasizing the effectiveness of quick heating technology or hybrid storage water heaters.

The demand for storage water heaters in Australia is projected to rise at a y-o-y growth rate of 6.7% through 2035.

People in Australia are starting to realize how much energy a family uses for water heating. It has slowed down conventional water heater market growth in the country, and regional players are shifting their focus to classic water storage heaters.

The production capacity of storage water heater industries in China is likely to grow at 5.9% CAGR between 2025 and 2035.

Compact home water storage units with effective heating systems are in greater demand in China due to urbanization trends, especially in highly populated cities with high-rise structures. So, Chinese manufacturers are putting much effort into improving their offerings by developing boiler storage water heaters and hot water storage tanks these days.

Over the next ten years, the sales of the storage water heater market in India are projected to evolve at a 7.7% growth rate.

Standard water heater manufacturers in India are trying to contribute to the energy conservation and affordable heating solutions movement growing in the country. Their key business strategy has come down to informing consumers about the advantages of appropriate insulation and energy-saving modes available in their storage water heater products.

Sales of storage water heaters in 100 to 150 liters capacity are estimated to contribute to nearly 30% of the total sales in 2025.

| Attributes | Details |

|---|---|

| Top Heater Capacity Segment | 100 to 150 liters |

| Market Share in 2025 | 29.9% |

Storage water heaters with 100 to 150 liters capacity can reliably supply hot water and are indispensable to city dwellers and big families in other areas. Nevertheless, demand for commercial water heater units of less capacity that are compact and fit within the space limitations of urban life is also growing at a faster rate.

As per the industry analysis, storage water heater appliances that run on electricity are estimated to hold almost two-thirds of the market share in 2025.

| Attributes | Details |

|---|---|

| Top Energy Source Segment | Electricity |

| Market Share in 2025 | 66.7% |

The electric storage water heater segment is expected to expand further in the coming days due to the convenience and reasonable price of the product. However, higher capacity and convenience of gas storage water heaters in areas without reliable electricity supply are expected to retain their desirability and market share in the future.

Like many other home appliance sectors, the competitive landscape for storage water heater products has also split into two distinct business strategies. Leading market players include features like antimicrobial materials, self-cleaning mechanisms, and water purity maintenance to position themselves as brands of safe and healthful water heating solutions. Meanwhile, emerging players are focusing more on providing reasonably priced, dependable storage water heaters that are customized to the unique requirements and budgets of regional customers.

Recent Developments in the Global Storage Water Heater Market

In October 2025, Voltas, a well-known brand in the home appliances sector and the top air conditioning manufacturer in India, announced its entry into the water heater market. The launch of Voltas Water Heaters line demonstrates the company's commitment to making products that meet changing customer expectations. This new product line comprises storage as well as instant water heaters, each with a capacity of 10 liters, 15 liters, or 25 liters to meet the requirements of the diverse Indian market.

In September 2025, Essency Company introduced a 30-year-lasting EXR water heater for its consumers in the United States. This is the first on-demand tank water heater in the world with a polymer storage tank that makes it appropriate for domestic use. Also, the multitasking capabilities, smart control features, and great energy efficiency. This ground-breaking product has boosted the demand for water heaters from the brand, solidifying the company's market position in the country.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 21021.7 million |

| Projected Market Size (2035) | USD 36942.4 million |

| Anticipated Growth Rate (2025 to 2035) | 5.7% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million or billion for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Middle East & Africa (MEA); East Asia; South Asia and Oceania |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Spain, Italy, France, United Kingdom, Russia, China, India, Australia & New Zealand, GCC Countries, and South Africa |

| Key Segments Covered | By Capacity, By Energy Source, By End Use Application and By Region |

| Key Companies Profiled | Havells India Ltd.; Hubbell Heaters; Saudi Ceramics Company; Linuo Ritter International Co., Ltd.; Jaquar India; Viessmann; Vaillant; Nihon Itomic Co., Ltd.; Atlantic; A.O. Smith; Ariston Holding N.V.; Bosch Thermotechnology Ltd.; Bradford White Corporation, USA; Haier Inc.; Rheem Manufacturing Company; Whirlpool Corporation; Rinnai America Corporation; State Industries; Ferroli S.p.A; Essency |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global storage water heater market is estimated to be valued at USD 21,021.7 million in 2025.

The market size for the storage water heater market is projected to reach USD 36,942.4 million by 2035.

The storage water heater market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in storage water heater market are 30 liters to 100 liters, less than 30 liters, 100 liters to 250 liters, 250 liters to 400 liters and more than 400 liters.

In terms of energy source, electric segment to command 64.5% share in the storage water heater market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Storage Tank Equipment Market Size and Share Forecast Outlook 2025 to 2035

Storage And Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Storage Area Network (SAN) Market Analysis by Component, SAN Type, Technology, Vertical, and Region through 2035

Storage as a Service Market Trends – Growth & Forecast 2020-2030

Storage Virtualization Market

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

LNG Storage Tank Market Growth - Trends & Forecast 2025 to 2035

Toy Storage Market Insights - Trends & Forecast 2025 to 2035

Lab Storage Container Market

Fuel Storage Tank Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Storage Container Market Size and Share Forecast Outlook 2025 to 2035

Kids Storage Furniture Market by Type, Material, End-Use, and Region - Growth, Trends, and Forecast through 2025 to 2035

Tire Storage Rack Market Growth - Trends & Forecast 2025 to 2035

Food Storage Bags Market Trends - Demand & Forecast 2025 to 2035

Cold Storage Tape Market Analysis – Trends & Forecast 2024-2034

Shoe Storage & Organizers Market

Cloud Storage Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Energy Storage Sodium Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA