The AI-powered storage market will continue to challenge the space with the advent of new solutions, new use cases, new verticals, and partnerships. Businesses are implementing AI-powered storage across industries to improve data processing speed, scalability, and resource efficiency. As businesses create higher volumes of structured and unstructured data than ever, traditional storage architectures face challenges. AI-driven storage sorts, categorizes, and retrieves data in real-time to minimize latency and improve operational efficiency.

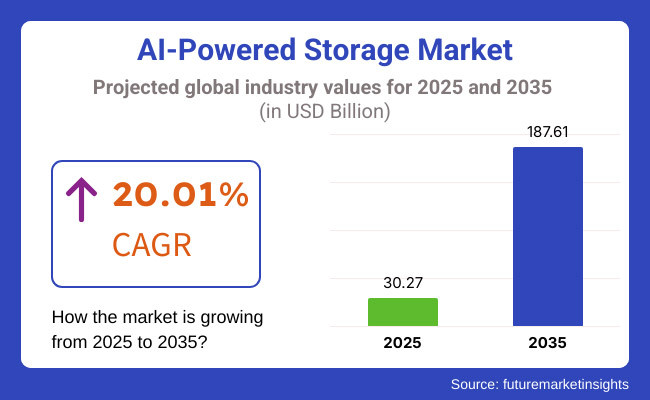

The market size for AI-powered storage is expected to see an upward trajectory with a market value of USD 30.27 billion in 2025 and is projected to reach USD 187.61 billion by 2035 growing at a CAGR of 20.01% during the forecast period (2025 to 2035). The adoption of AI/ML-driven storage solutions will continue to rise as big data workloads, the increase in cybersecurity threats, automation of data backup, recovery, and training of AI/ML models evolve. Demand for AI-powered storage systems is also being driven by the rapid evolution of cloud computing, edge computing and IoT ecosystems.

North America is anticipated to hold the largest share of the AI-powered storage market, owing to technological innovations, strong cloud adoption, and rising focus on data-based decision-making. The leaders are in the USA and Canada where the largest cloud service providers, tech powerhouses, and AI research institutions invest as their joint effort in an AI-enhanced storage infrastructure.

Be it healthcare or finance, retail or manufacturing, organizations are adopting AI-powered storage systems to automate data workflows, simplify operations and enhance cybersecurity. Moreover, the expansion of edge computing, 5G networks, and hybrid cloud storage solutions are also positively impacting market growth. Government-led support for AI innovation, in conjunction with the growing demand for high-performance computing (HPC) and AI-based analytics, strengthens the market position of the region.

The EU is a notable contributor to the AI-powered storage landscape owing to stricter data regulations (GDPR), a rising trend toward AI implementation, alongside robust investments in cloud infrastructure. Germany, the UK, and France are leading in AI research and development and are working to create partnerships between AI start-ups, enterprises, and cloud service providers.

As companies are increasingly digitizing businesses, expanding their Industry 4.0 initiatives, and deploying AI-driven cybersecurity solutions, enterprises are widely implementing AI-enabled storage architecture to ensure compliance, increase automation, and optimize data storage costs. Moreover, increasing adoption of autonomous data centres, real-time data analytics and AI-powered storage virtualization is also contributing to market growth across the region.

Rapid industrialization, digital transformation and rising adoption of AI in enterprises drive the region to be the fastest growing region in the AI-enabled storage market. Key Country Analysis Bringing the Market Ahead The market is primarily dominated by countries such as China, Japan, India, and South Korea. Major players are therefore implementing AI-based data management to improve scalability, better storage efficiency, and optimized IT infrastructure.

The rise of e-commerce, fintech, and cloud-based applications is driving the need for intelligent storage architectures that can analyse and manage huge volumes of data in real time. AI-powered storage providers are also getting new opportunities in the region, as governments are backing AI-driven innovations in smart cities, healthcare and autonomous systems. Battery life is being extended by integrating AI with edge computing technology and IoT networks, allowing IoT devices to process information closer to where it is needed, minimizing latency, and enhancing accessibility of data when it is needed in remote and decentralized environments.

Challenges

Opportunities

2020 to 2024: Growth Fueled by Rising Data Volumes and AI Integration

Between 2020 and 2024, the market for future AI-powered storage grew significantly to cope with exponentially growing data volume in business and industry. From healthcare to finance, retail to autonomous driving, organizations deployed AI-driven storage solutions to provide more advanced and effective data retrieval, security, and operational efficiency.

The proliferation of cloud computing, IoT, and edge AI created an immediate demand for high-speed intelligent storage solutions to process massive unstructured datasets. AI algorithms were integrated into data management platforms which led to automated storage tiering, predictive analytics, and real-time optimization. Enterprises embraced NVMe-based SSDs, AI-driven caching mechanisms, and machine learning-powered storage automation to drastically lower latency and get the most out of their performance.

The most prominent challenge came in the form of the cybersecurity issues organizations faced, as they worked to keep sensitive information secure. Machine learning storage solutions integrated automatic threat detection, encryption algorithms, and anomaly-based security technologies to minimize vulnerabilities to data breaches. Nevertheless, high initial costs of training, integration complexities across sensors and online analysis, and a shortage of AI-skilled workforce in some regions slowed adaptation.

2025 to 2035: AI-Optimized Storage Architecture, Quantum Storage, and Hyper-Automation

Over the 2025 to 2035 window, the AI-enhanced storage landscape will innovate with quantum storage, AI-controlled data compression, and fully autonomous storage systems. They will move away from traditional centralized storage, toward distributed AI-powered storage networks, allowing real-time, self-optimizing data management across multiple locations.

Could you imagine self-healing storage systems powered with AI which can pre-tense a hardware failure, redistribute workloads seamlessly, optimizing the storage resources all without human intervention, thus transforming how data centers function altogether? Also, one of the most emerging fields, Edge AI will significantly reduce latency in the smart cities, autonomous driving, and 5G IoT ecosystems to process data in real-time.

With AI-powered DNA storage and holographic storage, data retention would go far beyond that offered by conventional SSDs and HDDs. Thus neural network-based storage algorithms will conduct dynamic analysis of the stored data and reorganize the information ensuring optimal access speed and efficient utilization of storage infrastructure.

As businesses transition to zero-trust architectures, AI-powered storage will incorporate blockchain-based authentication and decentralised security frameworks, rendering data breaches all next to impossible. Data security will be enhanced by real-time cyber threat monitoring and mitigation by AI.

Greenhouse gas emissions will inspire new storage technology. Organizations will create energy-efficient AI data centers with zero carbon cooling technologies, AI-optimized power management, and biodegradable storage components. Similarly, AI will also facilitate predictive energy allocation, not only minimizing environmental footprints but also cutting operational costs.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Data protection laws and AI compliance regulations evolved. |

| Technological Advancements | AI-assisted storage tiering, SSDs, and intelligent caching improved efficiency. |

| Industry Adoption | Enterprises relied on AI-powered data analytics and storage automation. |

| Smart Connectivity | AI-driven cloud storage and hybrid architectures gained traction. |

| Market Growth Drivers | Demand for faster data access, real-time AI analytics, and cloud storage. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Governments will enforce AI-driven storage security and privacy mandates. |

| Technological Advancements | Quantum and DNA-based AI storage will redefine data management. |

| Industry Adoption | AI-automated storage networks and decentralized data security frameworks will become standard. |

| Smart Connectivity | Fully AI-managed edge storage and self-healing storage ecosystems will dominate. |

| Market Growth Drivers | AI-powered cybersecurity, autonomous storage optimization, and energy-efficient storage will drive expansion. |

AI-Powered Storage Market in USA and Canada The AI-powered storage market in the United States is projected to witness a significant growth owing to the high adoption of AI-based data management solutions among enterprises, cloud service providers, and government organizations.

The Need for Scalability and Automation Drives AI in Storage Infrastructure AI is helping organizations in securing their data, distributing workloads, improving predictive maintenance, and companies are investing in AI-based storage. Moreover, the growth of data centers and hyperscale computing is also accelerating the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 19.5% |

AI-Powered Storage Market in the UK is an emerging and next-gen market as the enterprises are dependent on the smart data management for their business operations. As digital transformation continues to soar, businesses are embracing AI-driven storage solutions to process data faster, securer and facilitate real time analytics.

The supporting government initiatives fueling AI innovations and strict data protection regulations like GDPR are prompting businesses to adopt AI-trained storage, serving as a compliance and operational mandate. Hybrid cloud adoption is another force driving demand for AI-enabled storage solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 19.2% |

European countries leading the adoption of AI-driven storage technology, particularly in healthcare, banking, and manufacturer sectors. AI in storage infrastructure leads to increased data retrieval speed and reduced downtimes and predictive analytics development that make them important around industry. In addition, stringent data privacy laws in the EU are also driving organizations to adopt AI-embedded storage solutions that help them comply with regulations while enhancing operational performance.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 19.7% |

Japan's market for AI-powered storage is growing with rising investments in AI research, automation, and digital transformation. At a national level, the forerunners of robotics, 5G, and IoT on Chinese soil are driving the demand for high-quality storage solutions to process large volumes of data efficiently.

AI-powered storage for faster processing, automated workflows and improved cybersecurity measures is being put to use by businesses in Japan. The government’s drive to shift toward the adoption of AI in a number of areas including automotive to finance is also propelling market growth. AI-powered storage for real-time data analytics and smart city initiatives, for example, have also become critical in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 20.3% |

The AI-powered storage market has been on the rise in South Korea due to rapid development of AI, cloud computing, and the fifth-generation (5G) wireless telecommunication technologies. Top-tier technology companies in the country are making significant investments in the development of AI-based storage systems to address complex information needs and enhance data management, network productivity and information security.

The government’s focus on AI and smart infrastructure, along with the rapid expansion of data centers is propelling the market adoption further. In South Korea’s financial sector, where companies are looking for the fastest, most secure and automated methods of data management to meet growing transaction volumes, including fraud detection, AI-powered storage is also gaining traction.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 20.1% |

As machine learning, deep learning, and big data analytics gain traction, the demand for high-performance, smart storage solutions capable of automating data classification, optimizing performance, and improving security further intensifies.

By designing intelligent algorithms, predictive analytics, and automation to elevate accessibility of information, diminish latency and also maximize optimizing resource utilization, AI-powered storage provides the above conditions within the data storage mechanisms. Both hardware as well as software components help organizations to make this shift to achieve a scalable, high-Gb and cost-effective store systems to manage the surroundings having structured and unstructured data.

Hardware Solutions Enhance AI-driven Data Storage with High-performance Computing Capabilities

Hardware solutions are the building blocks of the AI-based storage including high-speed processors like NVMe-based SSDs, GPU-accelerated storage controllers, and high-bandwidth memory (HBM) that facilitate AI and deep learning models and real-time data analytics.

AI-optimized storage hardware is used by organizations to process complex datasets, perform predictive analytics, and speed up AI model training. FPGA-based storage controllers and computational storage drives can be integrated into advanced storage architectures to accelerate data processing, cut power usage and enhance input/output operations per second (IOPS).

To address their needs, tech companies are engineering purpose-built AI storage server systems that incorporate dedicated AI accelerators, hybrid-flash and disk array installations, and high-speed interconnects for large-scale AI workloads to thrive in the autonomous systems, edge, and cloud AI platform environments. While such algorithmic storage hardware enables these benefits, challenges such as price tag, power consumption, and cooling needs still plague adoption. Fortunately, the bleak recent scenario is alleviated through progressive AI storage data compression, dynamic workload balancing, and self-holistic storage technologies that create more powerful query plans for the transactions recorded on a hardware-focused AI storage device.

AI-powered Storage: Intelligent Data Management and Automation with Software Solutions

Software solutions are the backbone of the AI-powered storage framework and facilitate automated data tiering, intelligent workload balancing, and real-time anomaly detection. AI-based storage software improves data security, predictive analytics, and adaptive resource allocation, leading to more efficient cloud and enterprise storage ecosystems.

AI storage orchestration software uses machine learning algorithms to forecast data storage needs, optimize caching and automate backup processes. The self-learning feature allows AI storage software to learn from the data it manages over time, specifically focusing on improving data deduplication and storage efficiency, as well as reducing latency in high-performance computing (HPC) environments.

AI-based cybersecurity inside storage software also detects anomalies (preventing ransomware attacks), and maintains data integrity and compliance to regulatory frameworks. Though there might be some hurdles in using AI-based storage software along with the existing IT infrastructure, the continuous advancements in cloud-based AI storage management platforms are enabling a more seamless and scalable adoption.

Direct-attached Storage (DAS) Accelerates AI Workloads with Low-latency, High-throughput Capabilities

DAS is never going to go out of style, it will always be one of the preferred data architectures for AI workloads with low latency, high-throughput, and local data processing demands. With fast data transfer rates, minimal reliance on networks, and affordability in storage expansion, DAS is favorable for artificial intelligence (AI) model training, analytics on the move, and edge computing applications.

Rate of growth - Organizations deploying AI-powered storage solutions in on premises data centers and edge environments favor DAS due to a high rate of growth for increasing bandwidth, faster read/write speed and direct server integration. AI workloads that require high compute power like HPC, GPU-based AI model training, or financial risk analysis heavily depend on DAS, as they lower throughput latencies and improve overall compute power.

Although DAS has some advantages, it has a low scalability level compared with network storage systems. The scalability limitations have led to the emergence of AI-driven storage controllers and NVMe-over-Fabric (NVMe-oF) technologies that are bridging the gap and positioning DAS as an attractive option for AI-driven companies, research institutions, and developers of autonomous systems.

NAS Enables A.I.-Fuelled Data Sharing and Cloud Integration

Thus, there is an exponential growth of network-attached storage (NAS) in AI-powered storage environments as it offers centralized data access, zettabyte scalability, and cloud integration capabilities. AI-powered NAS solutions intelligently utilize caching, automate load balancing, and enable real-time data synchronization, enhancing the collaborative training of AI models, big data processing, and content delivery networks (CDNs).

For businesses needing work done over distributed AI workloads, data access multi-users, and seamless integration with cloud AI services, NAS is nice due it flexibility, remote access capabilities, and AI-powered storage enhance tools. AI-based video analytics, medical imaging, and geospatial data processing in enterprises deploying NAS systems offer high-efficiency data transfer and intelligent workload distribution.

These advanced NAS architectures leverage AI-driven storage analytics, auto-tiering mechanisms, and predictive storage allocation to achieve improved performance, minimized downtime, and reduced operational costs. Performance can be affected by like network congestion and bandwidth limitations, but NAS is more scalable than DAS. AI-driven network traffic optimization and edge caching solutions are addressing these concerns, with NAS being a core component in AI-powered cloud storage infrastructures

Machine learning-based data management, automated tiering, and real-time analytics are all leading contributors to the growth of AI-powered storage market with enterprises deploying it. High-performance NVMe, AI-optimized flash memory, and software-defined storage (SDS) architectures are embraced by companies to eliminate bottlenecks and improve speed, scalability, and efficiency. Competition stems from innovations in edge AI storage, deep-learning-based data indexing, and intelligent workload balancing.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Intel Corporation | 18-22% |

| NVIDIA Corporation | 12-16% |

| IBM | 10-14% |

| Samsung Electronics | 8-12% |

| Pure Storage | 6-10% |

| NetApp | 5-9% |

| Micron Technology | 5-9% |

| CISCO | 4-8% |

| Toshiba | 3-7% |

| Hitachi | 3-7% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Intel Corporation | Develops AI-optimized storage solutions with high-speed Optane memory, NVMe SSDs, and AI-accelerated data processing. |

| NVIDIA Corporation | Provides AI-driven storage acceleration, featuring GPU-powered deep-learning storage analytics and real-time inferencing. |

| IBM | Offers AI-integrated hybrid cloud storage, leveraging IBM Watson for intelligent data classification and workload optimization. |

| Samsung Electronics | Manufactures AI-enhanced SSDs and HBM (High Bandwidth Memory), improving real-time AI training and inference storage efficiency. |

| Pure Storage | Focuses on AI-driven all-flash storage, featuring deep-learning-based data management and NVMe-over-Fabric (NVMe-oF) solutions. |

| NetApp | Provides AI-powered storage orchestration, optimizing hybrid cloud data movement and AI-ready storage frameworks. |

| Micron Technology | Develops AI-accelerated memory and storage solutions, including next-gen NAND and high-performance DRAM. |

| CISCO | Delivers AI-enabled data center storage solutions, integrating software-defined storage and AI-based performance monitoring. |

| Toshiba | Produces AI-integrated enterprise HDDs and SSDs, enhancing big data storage for AI training models. |

| Hitachi | Offers AI-powered storage automation, incorporating intelligent tiering and predictive analytics for cloud and on-premise workloads. |

Key Company Insights

Intel Corporation (18-22%)

Intel leads the AI-powered storage market with high-speed Optane memory, NVMe SSDs, and AI-driven data processing technologies, enabling faster deep-learning model training and inference acceleration.

NVIDIA Corporation (12-16%)

NVIDIA dominates GPU-powered AI storage acceleration, leveraging parallel computing for AI-driven real-time data processing and storage analytics.

IBM (10-14%)

IBM integrates AI into hybrid cloud storage, using IBM Watson for automated data indexing, workload distribution, and self-healing storage systems.

Samsung Electronics (8-12%)

Samsung enhances AI-driven SSDs and high-bandwidth memory (HBM) to boost AI training workloads and real-time inferencing performance.

Pure Storage (6-10%)

Pure Storage delivers all-flash AI storage solutions, featuring deep-learning-powered data optimization, NVMe-oF architectures, and intelligent caching.

NetApp (5-9%)

NetApp optimizes AI-ready storage orchestration, integrating hybrid cloud AI workloads and high-speed AI data pipelines.

Micron Technology (5-9%)

Micron innovates AI-enhanced memory and NAND flash storage, improving real-time AI data processing and deep-learning model efficiency.

CISCO (4-8%)

CISCO enhances AI-based storage networking, offering AI-powered data movement, software-defined storage, and workload-aware optimization.

Toshiba (3-7%)

Toshiba pioneers AI-integrated enterprise HDDs and SSDs, ensuring seamless big data storage for AI applications.

Hitachi (3-7%)

Hitachi develops AI-powered storage automation, featuring predictive data tiering, AI-driven workload balancing, and self-healing storage architectures.

Other Key Players (30-40% Combined)

Several AI-driven storage providers contribute to next-generation storage automation, deep-learning-based storage management, and real-time AI inferencing storage solutions. These include:

The overall market size for the AI-powered Storage Market was USD 30.27 billion in 2025.

The AI-powered Storage Market is expected to reach USD 187.61 billion in 2035.

The demand is driven by increasing data generation, growing adoption of AI-driven data management, rising need for high-performance storage solutions, and expanding use of AI in cloud computing and edge storage.

The top 5 countries driving market growth are the USA, UK, Europe, South Korea, and Japan.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ million) Forecast by Offering, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Storage System, 2018 to 2033

Table 4: Global Market Value (US$ million) Forecast by Storage Architecture, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Storage Medium, 2018 to 2033

Table 6: Global Market Value (US$ million) Forecast by End User, 2018 to 2033

Table 7: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 8: North America Market Value (US$ million) Forecast by Offering, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Storage System, 2018 to 2033

Table 10: North America Market Value (US$ million) Forecast by Storage Architecture, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Storage Medium, 2018 to 2033

Table 12: North America Market Value (US$ million) Forecast by End User, 2018 to 2033

Table 13: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Value (US$ million) Forecast by Offering, 2018 to 2033

Table 15: Latin America Market Value (US$ million) Forecast by Storage System, 2018 to 2033

Table 16: Latin America Market Value (US$ million) Forecast by Storage Architecture, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Storage Medium, 2018 to 2033

Table 18: Latin America Market Value (US$ million) Forecast by End User, 2018 to 2033

Table 19: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Value (US$ million) Forecast by Offering, 2018 to 2033

Table 21: Europe Market Value (US$ million) Forecast by Storage System, 2018 to 2033

Table 22: Europe Market Value (US$ million) Forecast by Storage Architecture, 2018 to 2033

Table 23: Europe Market Value (US$ million) Forecast by Storage Medium, 2018 to 2033

Table 24: Europe Market Value (US$ million) Forecast by End User, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Value (US$ million) Forecast by Offering, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ million) Forecast by Storage System, 2018 to 2033

Table 28: Asia Pacific Market Value (US$ million) Forecast by Storage Architecture, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ million) Forecast by Storage Medium, 2018 to 2033

Table 30: Asia Pacific Market Value (US$ million) Forecast by End User, 2018 to 2033

Table 31: Middle East & Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 32: Middle East & Africa Market Value (US$ million) Forecast by Offering, 2018 to 2033

Table 33: Middle East & Africa Market Value (US$ million) Forecast by Storage System, 2018 to 2033

Table 34: Middle East & Africa Market Value (US$ million) Forecast by Storage Architecture, 2018 to 2033

Table 35: Middle East & Africa Market Value (US$ million) Forecast by Storage Medium, 2018 to 2033

Table 36: Middle East & Africa Market Value (US$ million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Offering, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Storage System, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Storage Architecture, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Storage Medium, 2023 to 2033

Figure 5: Global Market Value (US$ million) by End User, 2023 to 2033

Figure 6: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ million) Analysis by Offering, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Offering, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Offering, 2023 to 2033

Figure 13: Global Market Value (US$ million) Analysis by Storage System, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Storage System, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Storage System, 2023 to 2033

Figure 16: Global Market Value (US$ million) Analysis by Storage Architecture, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Storage Architecture, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Storage Architecture, 2023 to 2033

Figure 19: Global Market Value (US$ million) Analysis by Storage Medium, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Storage Medium, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Storage Medium, 2023 to 2033

Figure 22: Global Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 25: Global Market Attractiveness by Offering, 2023 to 2033

Figure 26: Global Market Attractiveness by Storage System, 2023 to 2033

Figure 27: Global Market Attractiveness by Storage Architecture, 2023 to 2033

Figure 28: Global Market Attractiveness by Storage Medium, 2023 to 2033

Figure 29: Global Market Attractiveness by End User, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ million) by Offering, 2023 to 2033

Figure 32: North America Market Value (US$ million) by Storage System, 2023 to 2033

Figure 33: North America Market Value (US$ million) by Storage Architecture, 2023 to 2033

Figure 34: North America Market Value (US$ million) by Storage Medium, 2023 to 2033

Figure 35: North America Market Value (US$ million) by End User, 2023 to 2033

Figure 36: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ million) Analysis by Offering, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Offering, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Offering, 2023 to 2033

Figure 43: North America Market Value (US$ million) Analysis by Storage System, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Storage System, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Storage System, 2023 to 2033

Figure 46: North America Market Value (US$ million) Analysis by Storage Architecture, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Storage Architecture, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Storage Architecture, 2023 to 2033

Figure 49: North America Market Value (US$ million) Analysis by Storage Medium, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Storage Medium, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Storage Medium, 2023 to 2033

Figure 52: North America Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 55: North America Market Attractiveness by Offering, 2023 to 2033

Figure 56: North America Market Attractiveness by Storage System, 2023 to 2033

Figure 57: North America Market Attractiveness by Storage Architecture, 2023 to 2033

Figure 58: North America Market Attractiveness by Storage Medium, 2023 to 2033

Figure 59: North America Market Attractiveness by End User, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) by Offering, 2023 to 2033

Figure 62: Latin America Market Value (US$ million) by Storage System, 2023 to 2033

Figure 63: Latin America Market Value (US$ million) by Storage Architecture, 2023 to 2033

Figure 64: Latin America Market Value (US$ million) by Storage Medium, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) by End User, 2023 to 2033

Figure 66: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ million) Analysis by Offering, 2018 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Offering, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Offering, 2023 to 2033

Figure 73: Latin America Market Value (US$ million) Analysis by Storage System, 2018 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Storage System, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Storage System, 2023 to 2033

Figure 76: Latin America Market Value (US$ million) Analysis by Storage Architecture, 2018 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Storage Architecture, 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Storage Architecture, 2023 to 2033

Figure 79: Latin America Market Value (US$ million) Analysis by Storage Medium, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Storage Medium, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Storage Medium, 2023 to 2033

Figure 82: Latin America Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Offering, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Storage System, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Storage Architecture, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Storage Medium, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ million) by Offering, 2023 to 2033

Figure 92: Europe Market Value (US$ million) by Storage System, 2023 to 2033

Figure 93: Europe Market Value (US$ million) by Storage Architecture, 2023 to 2033

Figure 94: Europe Market Value (US$ million) by Storage Medium, 2023 to 2033

Figure 95: Europe Market Value (US$ million) by End User, 2023 to 2033

Figure 96: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 97: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ million) Analysis by Offering, 2018 to 2033

Figure 101: Europe Market Value Share (%) and BPS Analysis by Offering, 2023 to 2033

Figure 102: Europe Market Y-o-Y Growth (%) Projections by Offering, 2023 to 2033

Figure 103: Europe Market Value (US$ million) Analysis by Storage System, 2018 to 2033

Figure 104: Europe Market Value Share (%) and BPS Analysis by Storage System, 2023 to 2033

Figure 105: Europe Market Y-o-Y Growth (%) Projections by Storage System, 2023 to 2033

Figure 106: Europe Market Value (US$ million) Analysis by Storage Architecture, 2018 to 2033

Figure 107: Europe Market Value Share (%) and BPS Analysis by Storage Architecture, 2023 to 2033

Figure 108: Europe Market Y-o-Y Growth (%) Projections by Storage Architecture, 2023 to 2033

Figure 109: Europe Market Value (US$ million) Analysis by Storage Medium, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Storage Medium, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Storage Medium, 2023 to 2033

Figure 112: Europe Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 113: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 114: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 115: Europe Market Attractiveness by Offering, 2023 to 2033

Figure 116: Europe Market Attractiveness by Storage System, 2023 to 2033

Figure 117: Europe Market Attractiveness by Storage Architecture, 2023 to 2033

Figure 118: Europe Market Attractiveness by Storage Medium, 2023 to 2033

Figure 119: Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ million) by Offering, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ million) by Storage System, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ million) by Storage Architecture, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ million) by Storage Medium, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ million) by End User, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ million) by Country, 2023 to 2033

Figure 127: Asia Pacific Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ million) Analysis by Offering, 2018 to 2033

Figure 131: Asia Pacific Market Value Share (%) and BPS Analysis by Offering, 2023 to 2033

Figure 132: Asia Pacific Market Y-o-Y Growth (%) Projections by Offering, 2023 to 2033

Figure 133: Asia Pacific Market Value (US$ million) Analysis by Storage System, 2018 to 2033

Figure 134: Asia Pacific Market Value Share (%) and BPS Analysis by Storage System, 2023 to 2033

Figure 135: Asia Pacific Market Y-o-Y Growth (%) Projections by Storage System, 2023 to 2033

Figure 136: Asia Pacific Market Value (US$ million) Analysis by Storage Architecture, 2018 to 2033

Figure 137: Asia Pacific Market Value Share (%) and BPS Analysis by Storage Architecture, 2023 to 2033

Figure 138: Asia Pacific Market Y-o-Y Growth (%) Projections by Storage Architecture, 2023 to 2033

Figure 139: Asia Pacific Market Value (US$ million) Analysis by Storage Medium, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Storage Medium, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Storage Medium, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 143: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 144: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 145: Asia Pacific Market Attractiveness by Offering, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Storage System, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Storage Architecture, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Storage Medium, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by End User, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: Middle East & Africa Market Value (US$ million) by Offering, 2023 to 2033

Figure 152: Middle East & Africa Market Value (US$ million) by Storage System, 2023 to 2033

Figure 153: Middle East & Africa Market Value (US$ million) by Storage Architecture, 2023 to 2033

Figure 154: Middle East & Africa Market Value (US$ million) by Storage Medium, 2023 to 2033

Figure 155: Middle East & Africa Market Value (US$ million) by End User, 2023 to 2033

Figure 156: Middle East & Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 157: Middle East & Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 158: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: Middle East & Africa Market Value (US$ million) Analysis by Offering, 2018 to 2033

Figure 161: Middle East & Africa Market Value Share (%) and BPS Analysis by Offering, 2023 to 2033

Figure 162: Middle East & Africa Market Y-o-Y Growth (%) Projections by Offering, 2023 to 2033

Figure 163: Middle East & Africa Market Value (US$ million) Analysis by Storage System, 2018 to 2033

Figure 164: Middle East & Africa Market Value Share (%) and BPS Analysis by Storage System, 2023 to 2033

Figure 165: Middle East & Africa Market Y-o-Y Growth (%) Projections by Storage System, 2023 to 2033

Figure 166: Middle East & Africa Market Value (US$ million) Analysis by Storage Architecture, 2018 to 2033

Figure 167: Middle East & Africa Market Value Share (%) and BPS Analysis by Storage Architecture, 2023 to 2033

Figure 168: Middle East & Africa Market Y-o-Y Growth (%) Projections by Storage Architecture, 2023 to 2033

Figure 169: Middle East & Africa Market Value (US$ million) Analysis by Storage Medium, 2018 to 2033

Figure 170: Middle East & Africa Market Value Share (%) and BPS Analysis by Storage Medium, 2023 to 2033

Figure 171: Middle East & Africa Market Y-o-Y Growth (%) Projections by Storage Medium, 2023 to 2033

Figure 172: Middle East & Africa Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 173: Middle East & Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 174: Middle East & Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 175: Middle East & Africa Market Attractiveness by Offering, 2023 to 2033

Figure 176: Middle East & Africa Market Attractiveness by Storage System, 2023 to 2033

Figure 177: Middle East & Africa Market Attractiveness by Storage Architecture, 2023 to 2033

Figure 178: Middle East & Africa Market Attractiveness by Storage Medium, 2023 to 2033

Figure 179: Middle East & Africa Market Attractiveness by End User, 2023 to 2033

Figure 180: Middle East & Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Storage Tank Equipment Market Size and Share Forecast Outlook 2025 to 2035

Storage And Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Storage Area Network (SAN) Market Analysis by Component, SAN Type, Technology, Vertical, and Region through 2035

Storage as a Service Market Trends – Growth & Forecast 2020-2030

Storage Virtualization Market

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

LNG Storage Tank Market Growth - Trends & Forecast 2025 to 2035

Toy Storage Market Insights - Trends & Forecast 2025 to 2035

Lab Storage Container Market

Fuel Storage Tank Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Storage Container Market Size and Share Forecast Outlook 2025 to 2035

Kids Storage Furniture Market by Type, Material, End-Use, and Region - Growth, Trends, and Forecast through 2025 to 2035

Tire Storage Rack Market Growth - Trends & Forecast 2025 to 2035

Food Storage Bags Market Trends - Demand & Forecast 2025 to 2035

Cold Storage Tape Market Analysis – Trends & Forecast 2024-2034

Shoe Storage & Organizers Market

Cloud Storage Industry Analysis in MENA Size and Share Forecast Outlook 2025 to 2035

Energy Storage Sodium Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA