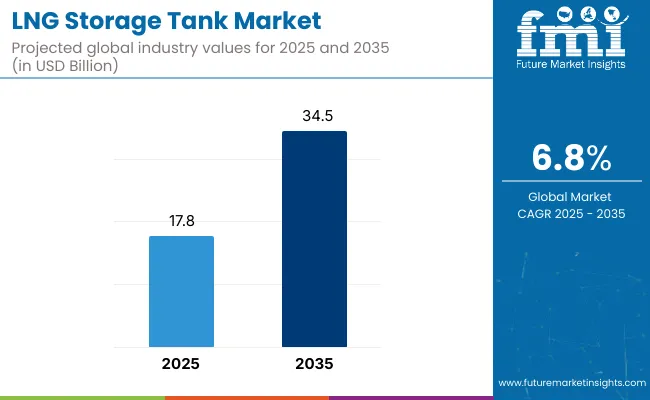

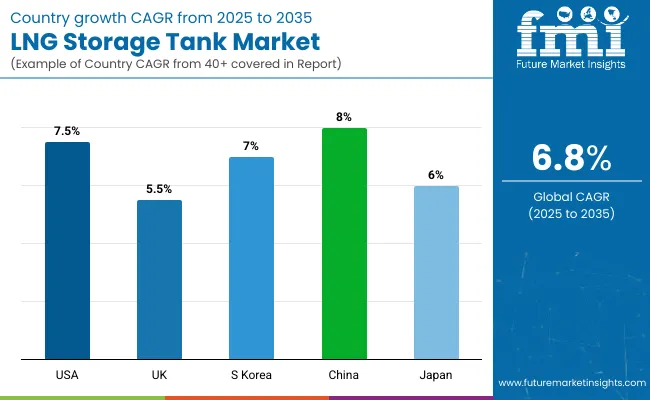

The global LNG storage tank market is estimated to be valued at USD 17.8 billion in 2025 and is projected to reach USD 34.5 billion by 2035, advancing at a CAGR of 6.8% during the forecast period. Growth is supported by rising LNG consumption in emerging economies, infrastructure development initiatives, and the expansion of global LNG trade routes.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 17.8 billion |

| Industry Value (2035F) | USD 34.5 billion |

| CAGR (2025 to 2035) | 6.8% |

LNG storage tanks function as essential components of the liquefied natural gas supply chain, enabling storage at cryogenic temperatures near -162°C to maintain the liquid state of natural gas. These tanks are designed with advanced double-walled containment systems and insulation materials such as 9% nickel steel, aluminum alloys, and pre-stressed concrete to ensure operational safety under extreme conditions.

Their integration into LNG infrastructure provides a critical link between liquefaction, transportation, and regasification stages, particularly in areas lacking extensive pipeline networks.

Market demand is supported by the development of onshore import and export terminals, peak-shaving plants, and offshore floating LNG (FLNG) units. Floating storage and regasification units (FSRUs) are gaining preference as cost-effective and flexible solutions in regions where land-based infrastructure is limited. Small-scale LNG tanks are being deployed in fueling stations, marine bunkering operations, and industrial facilities to cater to the rising adoption of LNG as a cleaner energy source across various sectors.

Asia-Pacific remains the primary growth hub, led by China and India, where LNG demand is driven by power generation, industrial consumption, and transportation. Strategic collaborations between governments, energy companies, and infrastructure developers are accelerating investments in new storage capacity. North America and Europe are also witnessing expansions aimed at improving energy security and supporting emission reduction commitments through LNG utilization.

Innovation in tank design and insulation systems is reducing boil-off rates and improving efficiency. Membrane-type tanks are widely used in FSRUs, while modular storage systems are facilitating LNG bunkering in European ports. The application of LNG storage in marine transportation and decentralized energy distribution is strengthening its role in sustainable energy transition strategies.

Regulatory frameworks emphasizing safety and environmental compliance are shaping material choices and operational standards, reinforcing LNG storage tanks as a critical component of the global energy infrastructure.

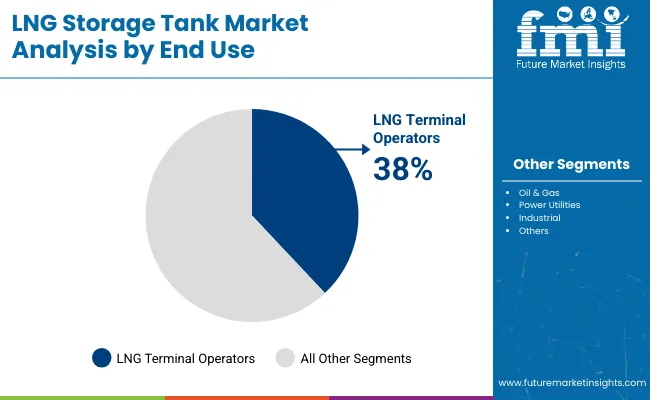

LNG terminal operators are estimated to hold 38% share of the LNG storage tank market in 2025 and are projected to grow at a CAGR of 6.9% through 2035. This dominance is linked to the expansion of LNG regasification and liquefaction terminals worldwide, driven by increasing natural gas demand as a transitional energy source.

Investments in large-scale terminals across Asia-Pacific and Europe have accelerated the installation of storage tanks designed for long-term containment and efficient handling of cryogenic LNG. Strategic projects in emerging economies focusing on energy diversification and import security are further reinforcing demand from terminal operators.

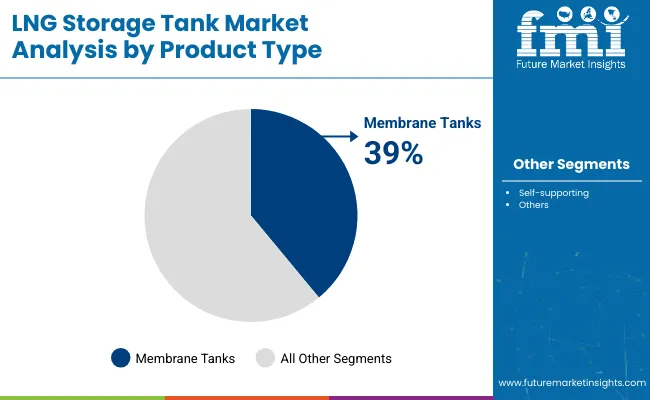

Membrane-type LNG storage tanks are projected to account for 39% share in 2025 and are expected to expand at a CAGR of 7.1% through 2035. Their popularity stems from design flexibility, reduced construction timelines, and optimized use of space compared to self-supporting variants.

Membrane tanks have become the standard for large-capacity onshore and offshore LNG facilities, particularly in regions prioritizing scalability and operational safety. Technological advancements enabling enhanced insulation and leak prevention have further strengthened adoption among global EPC contractors and LNG storage solution providers.

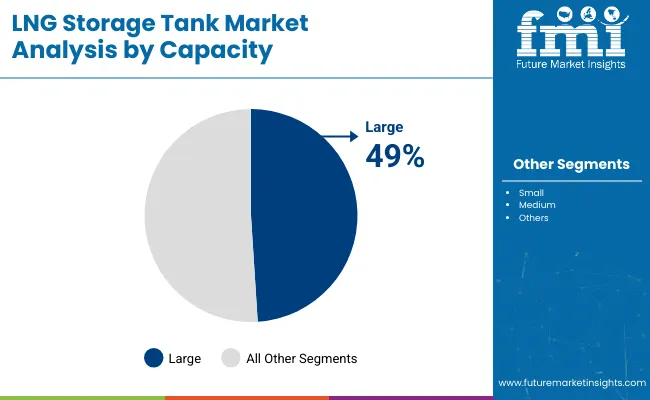

Large LNG storage tanks with capacities above 150,000 cu.m. are expected to capture 49% share of the global market in 2025 and are forecast to grow at a CAGR of 7.0% through 2035. The requirement for large-scale tanks is being driven by the development of mega LNG liquefaction projects in the Middle East, North America, and Asia-Pacific.

These tanks enable operators to achieve economies of scale and reduce unit storage costs while meeting growing LNG trade volumes. Integration of advanced thermal insulation systems to minimize boil-off losses is further enhancing their appeal for both import terminals and liquefaction hubs.

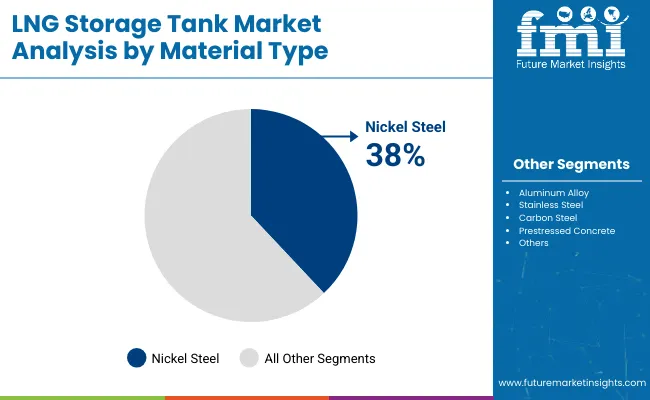

Nickel steel is estimated to represent 38% of the LNG storage tank market in 2025 and is projected to grow at a CAGR of 6.7% through 2035. Its dominance is attributed to superior cryogenic toughness, durability, and resistance to thermal stress, making it the preferred choice for LNG containment systems.

Increasing demand for safe and reliable storage under extreme low-temperature conditions has reinforced reliance on nickel-based alloys. Continuous R&D aimed at cost optimization and weldability improvements is expected to sustain material preference among leading tank manufacturers.

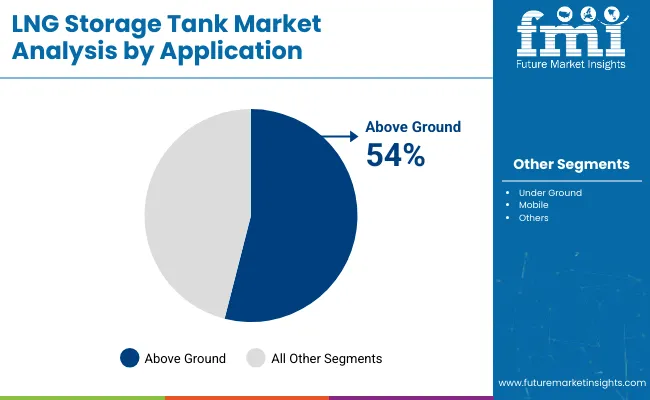

Above-ground LNG storage tanks are anticipated to hold 54% share of the market in 2025 and are projected to grow at a CAGR of 6.8% through 2035. Widespread adoption is driven by ease of installation, structural accessibility, and lower excavation requirements compared to underground alternatives.

These tanks are widely deployed at LNG terminals, refueling stations, and power generation sites where monitoring and maintenance efficiency is critical. Rising investments in modular LNG storage solutions for flexible deployment in energy-intensive regions further support growth for above-ground configurations.

The global demand for LNG continues to rise due to its cleaner burning properties compared to other fossil fuels, and its increasing use in power generation, transportation, and industrial applications.

The construction of LNG storage tanks requires significant upfront investment, including costs associated with materials, engineering, and safety features, which can deter new entrants and project development.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

| United Kingdom | 5.5% |

| South Korea | 7.0% |

| China | 8.0% |

| Japan | 6.0% |

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by Korea and Japan. The countries are expected to lead the market through 2035.

The LNG storage tank market in the United States expected to expand at a CAGR of 7.5% through 2035. The United States has become a major LNG exporter due to the shale gas revolution and the development of LNG export terminals along the Gulf Coast.

The expansion of LNG export capacity drives the need for additional LNG storage infrastructure to support loading, storage, and distribution operations.

There is increasing domestic demand for LNG in the United States, particularly in sectors such as power generation, industrial applications, and transportation. The growing demand necessitates investments in LNG storage facilities to ensure adequate supply and storage capacity.

The LNG storage tank market in the United Kingdom is anticipated to expand at a CAGR of 5.5% through 2035. The United Kingdom is transitioning towards cleaner energy sources and reducing its reliance on traditional fossil fuels. LNG serves as a flexible and cleaner alternative, driving demand for LNG storage infrastructure, including storage tanks.

The country relies on LNG imports to meet its energy needs, especially during peak demand periods and to supplement declining domestic gas production. The expansion of LNG import terminals and storage capacity stimulates growth in the LNG storage tank market.

LNG storage tank trends in China are taking a turn for the better. An 8.0% CAGR is forecast for the country from 2025 to 2035. LNG is used in various industrial processes and residential applications, such as heating and cooking.

The expanding use of LNG in industry and households increases the demand for storage infrastructure to ensure reliable supply and distribution.

Ongoing advancements in LNG storage tank design, materials, and construction techniques improve safety, efficiency, and reliability. Technological innovations drive the adoption of advanced storage solutions to meet stringent safety and environmental standards in China.

The LNG storage tank market in Japan is poised to expand at a CAGR of 6.0% through 2035. Japan, with the prolonged shutdown of nuclear power plants, has been investing in alternative energy sources, including LNG, to fill the gap in electricity generation. The transition away from nuclear power increases the demand for LNG and storage capacity to support power generation.

The country is investing in modernizing its energy infrastructure and enhancing its resilience to natural disasters, including earthquakes and tsunamis. Robust LNG storage infrastructure plays a critical role in ensuring energy supply stability and resilience during emergencies.

Companies are prioritizing increased capacity, safety, and efficiency to address the rising global demand for liquefied natural gas. Investments are being made in advanced materials and innovative designs to enhance tank durability and reduce the environmental impact of storage operations.

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 17.8 billion |

| Projected Market Valuation in 2035 | USD 34.5 billion |

| Value-based CAGR 2025 to 2035 | 6.8% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Product Type, Material Type, End User Industry, Business Type, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Vijay Tanks and Vessels Ltd; Corban Energy Group; Luxi New Energy Equipment Group Co. Ltd; Vinci Construction; MHI Engineering and International Project India Ltd; Lloyds Energy; Transtech Energy LLC; Cryocan; Cryogas Equipment Pvt. Ltd.; Whessoe |

The LNG storage tank market is projected to reach a valuation of USD 17.8 billion.

The LNG storage tank industry is set to expand by a CAGR of 6.8% through 2035.

The LNG storage tank market is forecast to reach USD 34.5 billion by 2035.

China is expected to be the top performing market, exhibiting a CAGR of 8.0% through 2035.

Top Product Type is Membrane Tanks and is expected to account for a share of 39% in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LNG Intermediate Fluid Vaporizer (IFV) Market Size and Share Forecast Outlook 2025 to 2035

LNG Open Rack Vaporizer (ORV) Market Size and Share Forecast Outlook 2025 to 2035

LNG Liquefaction Equipment Market Size and Share Forecast Outlook 2025 to 2035

LNG Marine Gensets Market Size and Share Forecast Outlook 2025 to 2035

LNG Bunkering Market Size and Share Forecast Outlook 2025 to 2035

LNG Terminal Market Size and Share Forecast Outlook 2025 to 2035

LNG Virtual Pipeline Market Size and Share Forecast Outlook 2025 to 2035

LNG Tank Containers Market Size and Share Forecast Outlook 2025 to 2035

Floating LNG Power Vessel Market Growth – Trends & Forecast 2024-2034

Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Storage And Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Storage Area Network (SAN) Market Analysis by Component, SAN Type, Technology, Vertical, and Region through 2035

Storage as a Service Market Trends – Growth & Forecast 2020-2030

Storage Virtualization Market

Storage Tank Equipment Market Size and Share Forecast Outlook 2025 to 2035

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

Toy Storage Market Insights - Trends & Forecast 2025 to 2035

Lab Storage Container Market

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Storage Container Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA