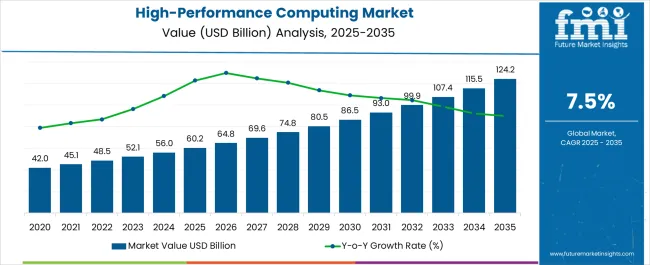

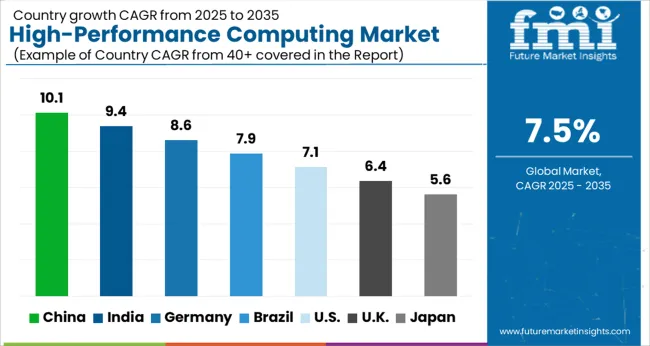

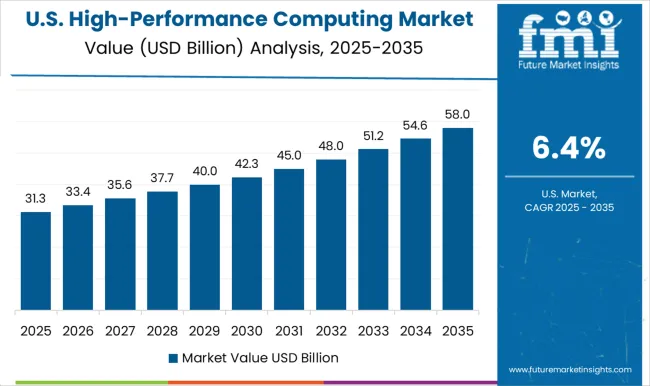

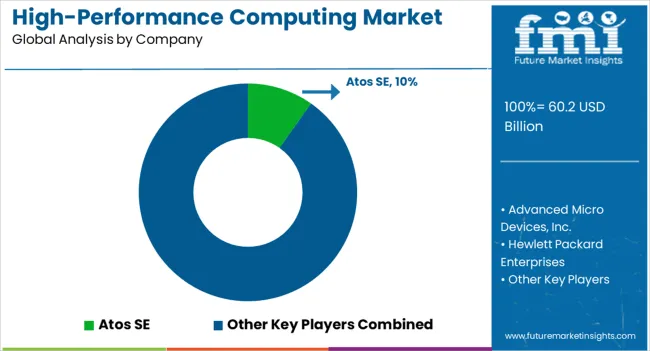

The High-Performance Computing Market is estimated to be valued at USD 60.2 billion in 2025 and is projected to reach USD 124.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| High-Performance Computing Market Estimated Value in (2025 E) | USD 60.2 billion |

| High-Performance Computing Market Forecast Value in (2035 F) | USD 124.2 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The high performance computing market is expanding rapidly as enterprises and institutions adopt advanced computing capabilities to handle increasingly complex workloads. Rising demand for faster data processing, real time analytics, and artificial intelligence applications has strengthened the relevance of high performance systems across multiple industries.

Government initiatives supporting technological infrastructure, coupled with investments in research and development, are propelling adoption. The combination of enhanced processor architectures, improved storage solutions, and energy efficient designs has also enabled broader deployment.

As industries prioritize digital transformation and competitive advantage through computational power, the outlook for high performance computing remains positive, with opportunities for growth across both commercial and scientific applications.

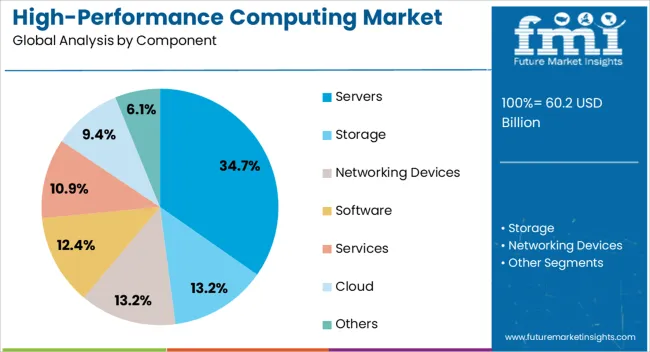

The servers segment is expected to hold 34.70% of total revenue by 2025 within the component category, making it the leading contributor. This growth is being driven by the central role of servers in delivering scalable processing capacity and efficient workload management.

Continuous advancements in processor design, memory integration, and high bandwidth interconnects have reinforced their adoption in both enterprise and research environments. Furthermore, the increasing application of high performance servers in machine learning, big data analytics, and advanced simulations has positioned this segment as the backbone of computing infrastructure.

The ability of servers to provide flexible, modular, and reliable solutions ensures their ongoing leadership within the component segment.

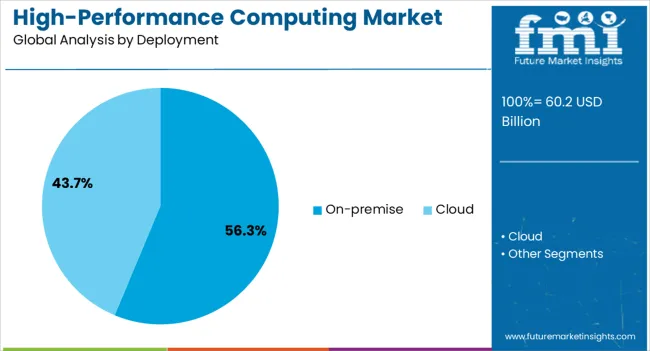

The on premise deployment segment is projected to contribute 56.30% of total market revenue by 2025, securing its dominance within the deployment category. Its leadership is attributed to the need for enhanced security, regulatory compliance, and full control over computing infrastructure.

Industries handling sensitive data, including finance, healthcare, and defense, continue to prioritize on premise installations to safeguard operations. High levels of customization and integration with existing IT frameworks further strengthen adoption.

Additionally, the ability to manage performance intensive workloads without dependency on third party cloud providers has sustained its dominance. This segment continues to lead as organizations balance scalability with stringent governance requirements.

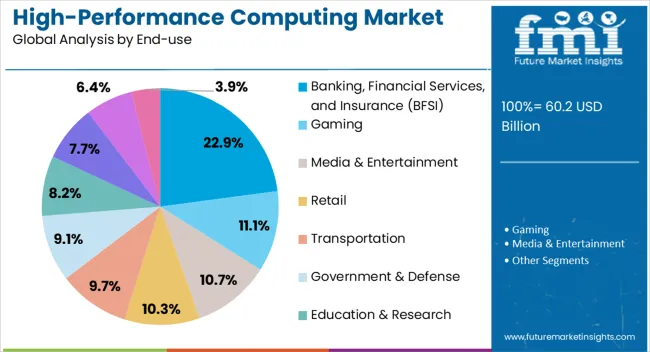

The banking financial services and insurance segment is expected to hold 22.90% of total revenue by 2025 within the end use category, establishing it as the leading industry adopter. The increasing reliance on high performance computing for risk modeling, fraud detection, and real time transaction monitoring has strengthened its adoption.

Institutions within the BFSI sector are leveraging HPC capabilities to process vast volumes of data, improve predictive analytics, and comply with regulatory demands for transparency. Additionally, the growing use of algorithmic trading and advanced financial simulations has reinforced demand.

With its critical dependence on speed, accuracy, and data security, the BFSI sector has emerged as the most significant end use segment within the high performance computing market.

With a CAGR of 12.28% from 2020 to 2025, the global high-performance computing market increased in value from USD 42 billion in 2020 to USD 60.2 billion in 2025. It is necessary to create powerful HPC systems, implement them across academic, commercial, and governmental institutions, and use them to tackle social issues, including public safety, weather forecasting, climate change, and environmental preservation.

Many advantages are offered by computing technology advancements, including quick processing speeds, improved performance effectiveness, smart operation, and management. These advantages may help the market grow during the anticipated period. Whereas, from 2025 to 2035, the high-performance computing market is to register at a 7.5% CAGR.

The factor propelling the HPC market expansion is the rise in high-performance computing demand in genomics research. The high-performance computing demand for improved scalability, dependable storage, IT expansion, rising computing, and virtualization advancement enhance the market growth.

As high-performance computing systems can process enormous volumes of data swiftly and are widely used in industries, there is an increase in high-performance computing adoption, which has an impact on the market.

Enhanced adoption of Big Data Analytics is a Critical Enabler Influencing the Adoption of the High-performance Computing Market

In light of the growing use of big data analytics, the demand for supercomputers has skyrocketed. The extraction of insights from large data is becoming popular. This necessitates the development of improved computing infrastructure. Supercomputers are perfect for processing massive volumes of data available on the market due to their ample storage and strong processing capabilities.

This is evident in the financial services business, where corporations like PayPal have purchased cluster supercomputers in the previous two to three years. The introduction of additional sophisticated analytics methods and tools is gaining traction among organizations to maximize the intelligence obtained from big data analytics. Over the projected period, all these factors may drive the high-performance computing (HPC) market expansion.

A Significant High-performance Computing Market Trend Fostering Market Expansion is Evolving Adoption of Cloud

Some customers require the elasticity and flexibility of the cloud to fulfill their computational and data needs.

Factor Impeding the High-performance Computing Market Growth is Expensive Investments and Associated Costs

The energy needs for these improved HPC systems may go up because of the regular updates made to increase processing power. Cost increases can impede the expansion of the HPC sector.

Lack of experience and the high cost of high-performance computing upkeep are impediments to the industry's expansion. The absence of developments in high-performance workstations is one of the industry's stumbling blocks.

Concerns related to cyber security are growing as the use of HPC systems expands. Data security is a serious concern because HPC systems are accessed by various entities. As a result, the high-performance computing industry's expansion is projected to be hindered by security concerns.

Services Segment:

| CAGR (2025 to 2035) | Around 5.0% |

|---|---|

| Market Share - 2025 | >9.0% |

| Market Size | USD 7,000 million |

Servers Segment:

| Market Share - 2025 | 41% |

|---|

The component segment has been further subdivided into servers, networking devices, storage, software, cloud, services, and others. The servers segment held the dominant share of the high-performance computing industry in 2025 and is scheduled to thrive at a substantial rate during the forecast period.

The growing amount of data centers can be linked to the proliferation of small and medium-sized businesses (SMEs). Several firms are investing in on-premises and colocation infrastructure to meet the increased high-performance computing demand.

The services sector made for more than 9.0% of the HPC market in 2025, and it is anticipated to register a CAGR of around 5.0% between 2025 and 2035. The HPC manufacturers offer a variety of services, such as maintenance, support, and management.

Assistance is especially important during the installation and first use of HPC systems. Maintenance services, on the other hand, include system upgrades and troubleshooting. In conclusion, it is predicted that the services segment's market can prosper to be large than USD 7,000 million over the forecast year.

On-Premise Segment:

| Market Share - 2025 | 80% |

|---|---|

| Market Size | USD 32,592.7 million |

Cloud Segment:

| Market CAGR | 8.5% |

|---|

In 2025, the on-premise category held the dominant share of the high-performance computing industry and is to rise significantly throughout the forecast period. While governments are focused on securing sensitive data relating to national security and citizens' personal information, businesses are concerned about the security of their own organizational data. As a result, on-premise infrastructure continues to be chosen over cloud technology.

To ensure national security, the Mexican government, for example, claims that all citizen-related information and information used by government agencies should remain within the country's jurisdiction. Such elements are projected to promote the on-premise segment's growth.

Throughout the projection period, the cloud segment is to develop at a significant CAGR of 8.5% in the high-performance computing business. Since no additional in-house computing resources are required, cloud implementation allows enterprises to cut their operational costs. Additional benefits, such as enhanced efficiency and cost-effectiveness, are likely to accelerate the rise of the cloud segment.

Government and Defence Segment:

| Market CAGR | 9.0% |

|---|

The manufacturing segment is to witness a significant HPC market share during the predicted period. Industrial operations are typically computationally intensive and time-consuming. Manufacturing companies frequently use simulation and CAD software in conjunction with HPC systems.

HPC systems can be very beneficial in the manufacturing industry for computational fluid dynamics, computational structural mechanics, and computational electromagnetics. These characteristics boost performance, increase computational speeds, and assure quick data access.

The government and defense segment is to increase at a CAGR of 9.0% in the high-performance computing business. While defense organizations may actively acquire cutting-edge IT solutions to boost computing efficiency, government agencies may likely need to employ HPC systems to support digitalization projects and contribute to economic development.

| Attributes | Details |

|---|---|

| Market Share | 40% |

In 2025, North America continued to hold 40.0% of the entire high-performance computing market share. North America is the most important market for technological solutions. Its goal is to be a global economic player, particularly in the development and application of innovative technologies. Since the need to process large amounts of raw data grows, so does the need to have strong security measures in place. This is pushing the need to apply cutting-edge technology, which is encouraging the use of HPC systems.

Several of the top businesses in the sector are based in North America that are quickly adopting HPC systems to help them get over technical limitations. As a result, the adoption of HPC systems is ramping up throughout North America.

| Attributes | Details |

|---|---|

| Market CAGR | 8.9% |

Due to the increasing HPC systems adoption for scientific research and weather forecasting, the Asia Pacific region is expected to develop at a considerable CAGR of about 8.9% throughout the forecast period. At the same time, China is one of the top ten countries in the high-performance computing business.

Supercomputers such as Sunway TaihuLight and Tianhe-2 (Milkyway-2) can be found in China. Tianhe-2 (Milkyway-2) was developed by China's National University of Defence Technology and supported by the governments of Guangzhou and Guangdong provinces.

The global high-performance computing business is a highly concentrated and competitive market dominated by a few significant firms. Various governments encourage research and academic institutions to implement modern information technology systems and contribute to economic development.

Acquisition - January 2025

Acquisition - July 2024

Partnership - November 2024

Collaboration - 2020

The global high-performance computing market is estimated to be valued at USD 60.2 billion in 2025.

The market size for the high-performance computing market is projected to reach USD 124.2 billion by 2035.

The high-performance computing market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in high-performance computing market are servers, storage, networking devices, software, services, cloud and others.

In terms of deployment, on-premise segment to command 56.3% share in the high-performance computing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fog Computing Market

Brain Computing Interfaces Market Size and Share Forecast Outlook 2025 to 2035

Swarm Computing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Visual Computing Market Size and Share Forecast Outlook 2025 to 2035

Mobile Computing Devices Market Insights – Growth & Forecast 2023-2033

Central Computing Architecture Vehicle OS Market Forecast and Outlook 2025 to 2035

Spatial Computing Market Size and Share Forecast Outlook 2025 to 2035

Quantum Computing Market Growth – Trends & Forecast 2025 to 2035

Wearable Computing Market Trends – Growth & Forecast 2025 to 2035

Wearable Computing Devices Market Analysis - Size, Share & Forecast 2025 to 2035

Affective Computing Market Size and Share Forecast Outlook 2025 to 2035

Cognitive Computing Market Size and Share Forecast Outlook 2025 to 2035

Pervasive Computing Technology Market Size and Share Forecast Outlook 2025 to 2035

Server Less Computing Market Size and Share Forecast Outlook 2025 to 2035

Confidential Computing Market Size and Share Forecast Outlook 2025 to 2035

Military Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Space On Board Computing Platform Market Size and Share Forecast Outlook 2025 to 2035

Virtual Client Computing Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Computing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA