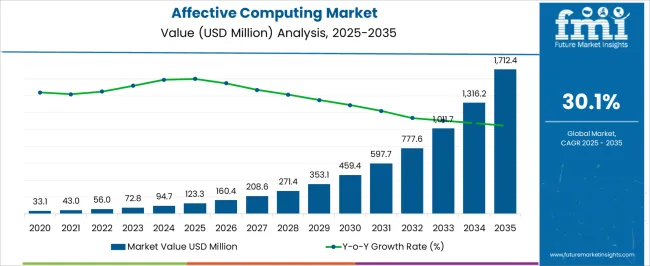

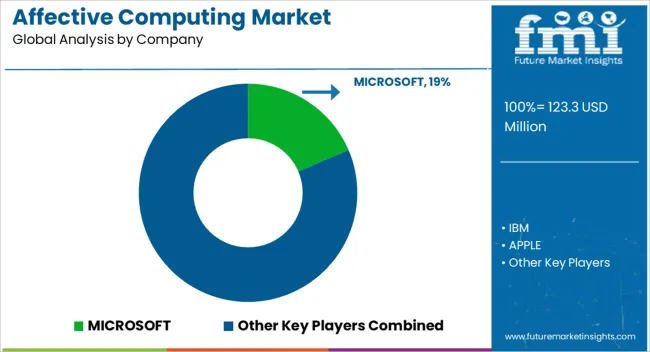

The Affective Computing Market is estimated to be valued at USD 123.3 million in 2025 and is projected to reach USD 1712.4 million by 2035, registering a compound annual growth rate (CAGR) of 30.1% over the forecast period.

| Metric | Value |

|---|---|

| Affective Computing Market Estimated Value in (2025 E) | USD 123.3 million |

| Affective Computing Market Forecast Value in (2035 F) | USD 1712.4 million |

| Forecast CAGR (2025 to 2035) | 30.1% |

The affective computing market is expanding rapidly due to rising adoption of artificial intelligence driven solutions that interpret human emotions to improve human machine interaction. Demand is being fueled by the growth of applications in customer experience management, healthcare monitoring, and education technology where emotional insights enhance outcomes and engagement.

Increasing investments in natural language processing, machine learning, and multimodal emotion recognition are strengthening the technological foundation of this field. Additionally, the proliferation of wearable devices and IoT platforms has created new opportunities for embedding affective computing capabilities into everyday applications.

Ethical considerations and data privacy compliance are shaping responsible innovation, while government initiatives and academic research continue to accelerate advancements. With industries seeking personalized and empathetic user experiences, the market outlook remains highly promising, supported by continuous integration of affective technologies into enterprise, healthcare, and educational ecosystems.

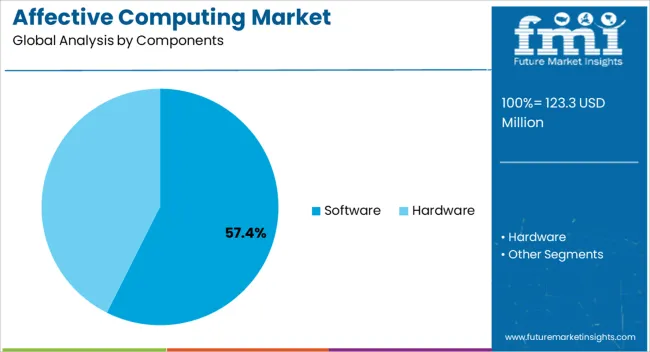

The software segment is projected to account for 57.40% of total market revenue by 2025 within the component category, establishing it as the leading segment. Growth in this area is being supported by increasing reliance on advanced algorithms and emotion recognition software that can be seamlessly integrated across platforms.

Software solutions offer scalability, real time analytics, and customization, making them critical for sectors such as customer service, healthcare, and education.

Their adaptability across multiple devices and applications ensures that they remain central to innovation in affective computing, reinforcing their dominance in the component segment.

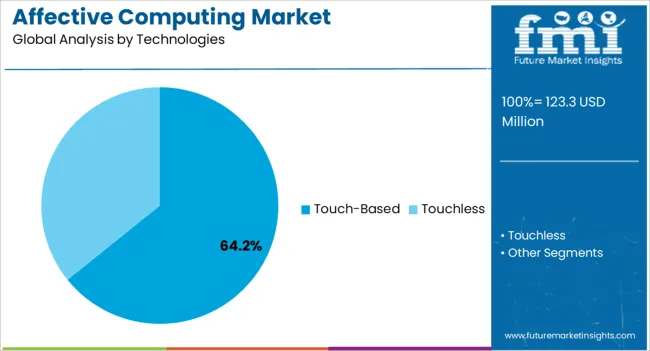

The touch based segment is expected to hold 64.20% of total market revenue by 2025 within the technology category, positioning it as the dominant segment. This growth is driven by the widespread use of smartphones, tablets, and interactive kiosks where touch gestures provide valuable emotional data.

Touch based systems capture pressure, speed, and rhythm of user interactions, enabling accurate inference of emotional states. Their integration into consumer electronics, automotive interfaces, and healthcare devices has further strengthened adoption.

The ability of touch based technology to deliver non intrusive, cost effective, and highly reliable emotional insights has secured its leading role in the technology segment.

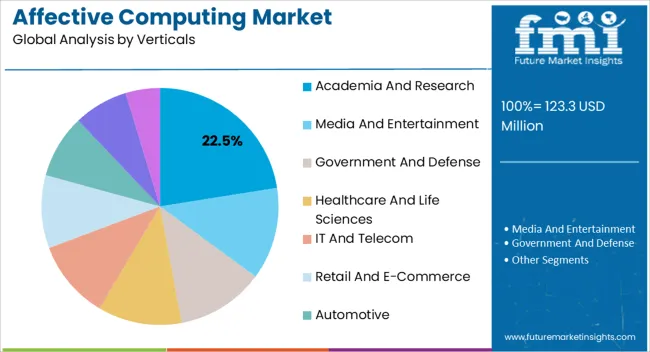

The academia and research segment is anticipated to contribute 22.50% of total market revenue by 2025 within the vertical category, making it the leading area of application. This prominence is attributed to the critical role of universities and research institutions in advancing emotion AI models, developing ethical frameworks, and experimenting with multimodal affective systems.

Significant funding support from public and private institutions has enabled exploratory studies and pilot programs, while partnerships with technology companies have accelerated innovation.

The ability of academia and research to drive foundational progress and provide benchmarks for industry standards has established this segment as the primary contributor within the vertical category.

The development of industry is anticipated to increase the performance of the affective computing system through technological advances such as streamlined computing, a better user interface, and the latest networking innovations.

Various sectors are looking for many secure products and the increasing need for virtual assistants that can detect fraudulent activity is creating growth in the market. In addition to affective computing, voice-activated biometrics are also contributing to the explosion of the market. As a result, the future of any company is projected to be affected by affective computing. It is going to have a big impact on productivity, human resource management, and organizational transitions.

Various market verticals around the world are now adopting emotion AI/affective computing solutions in the market. The advances in computing capacity, the development of new communications technologies, and the arrival of new solutions, such as artificial intelligence, have enabled opportunities to emerge that were previously inaccessible due to a lack of resources.

The growing use of virtual assistance in smart homes and the application of AI-based technologies to customer service are what are propelling the growth of this market. In the world of affective computing, there is a continuous growth of different software in the market for various industry verticals. This is further expected to stimulate the market growth for affective computing in the market.

Various end-user verticals are expected to adopt connected devices, and continuous advancements in enabling technologies are expected to fuel market growth during the forecast period.

The high implementation costs and technological issues related to compatibility are expected to restrict the market's growth. Most data collected on customer behavior is collected in a complex lab setting and is reflected in the behavior of customers through emotions and gestures. Due to these challenges, companies are building models for affective computing that address these challenges while identifying and making decisions from data accumulated.

Affective computing tends to incur high development costs, such as wearable computing and gesture recognition. In the current market situation, this appears to be the key stumbling block to growth. To remain competitive and increase their product offering, solution providers are now focusing hugely on technological partnerships.

Until affective computing is better understood, the AI emotion/affective computing market faces a big challenge. The technology sector has also received a lot of attention, but business leaders have not managed to distinguish it from the real thing. In addition, the economic and social implications of this technology are not yet fully understood. The presence of affective computing is ambiguous both in terms of its potential and its limits.

| Country/Region | North America |

|---|---|

| Value Share % (2025) | 32.2% |

| Country/Region | The United States |

|---|---|

| Value Share % (2025) | 18.4% |

North America is expected to hold a prominent market share for affective computing. The market for computing solutions in the United States is expected to account for a 32.3% CAGR during the forecast period. By 2035, the market is expected to be worth more than USD 303.2 billion in the coming decades.

A rise in the number of research and development projects and investments in this region is expected to increase the market demand for affective computing in the market. A market for AI-based technologies and next-generation equipment on a large scale has boosted the market demand for affective computing in this region.

Economic growth and the increasing use of robotics in this region have greatly stimulated the market demand for affective computing in this region.

| Country/Region | China CAGR (2025 to 2035) |

|---|---|

| Value Share % (2025) | 34.3% |

| Country/Region | India CAGR (2025 to 2035) |

|---|---|

| Value Share % (2025) | 30.2% |

| Country/Region | Japan Market Share (2025) |

|---|---|

| Value Share % (2025) | 5.5% |

Asia Pacific is expected to dominate the affective computing market during the forecast period. The Asian Pharmaceutical and Biotechnology industry is expected to grow considerably in the coming years due to the increasing adoption of the latest technological advances across the region as well as the emergence of economies in China and India. The market is expected to see revenue growth of 34.3% CAGR in China during the forecast period.

The market for affective computing in China is expected to reach USD 1712.4 billion by 2035. With a growing market for smart wearables in China as well as various initiatives for electronic devices, affective computing is gaining traction in this region.

According to the forecast, the economy of Japan is anticipated to expand at a CAGR of 31.2% from 2025 to 2035. As industrial production increases and IT technologies expand in this area, market demand for affective computing is expected to grow.

The development of sensors and cameras in this region is expected to lead to growth in affective computing. Market value in South Korea is expected to reach USD 33.8 billion during the forecast period. A CAGR of 30.2% is predicted for the market during the forecast period.

High-tech healthcare infrastructures and booming e-commerce companies are fueling the development of affective computing. As smart cities and smart homes continue to grow in popularity in this region, there is likely to be an increase in market demand for affective computing in this region.

| Country/Region | Europe Market Share (2025) |

|---|---|

| Value Share % (2025) | 23.2% |

| Country/Region | Germany’s Market Share (2025) |

|---|---|

| Value Share % (2025) | 10.5% |

| Country/Region | The United Kingdom CAGR (2025 to 2035) |

|---|---|

| Value Share % (2025) | 32.3% |

During the forecast period, the artificial intelligence market for affective computing in the United Kingdom is projected to expand at a compound annual growth rate of 32.3% during the period. Due to the emergence and development of artificial intelligence and machine learning technologies, affective computing is anticipated to experience high demand in this area.

The market demand for affective computing is growing notably due to the increasing popularity of innovative new products for voice processing and speech recognition.

Key players in the market are raising their production capacity via strategic partnerships, and catering to consumer demand; thus, elevating their market share and revenue. The introduction of new products and technologies is expected to allow end-users to reap the benefits of new technologies.

Current Trends in Affective Computing:

The global affective computing market is estimated to be valued at USD 123.3 million in 2025.

The market size for the affective computing market is projected to reach USD 1,712.4 million by 2035.

The affective computing market is expected to grow at a 30.1% CAGR between 2025 and 2035.

The key product types in affective computing market are software, _speech recognition, _gesture recognition, _facial feature extraction, _analytics software, _enterprise software, hardware, _sensors, _cameras, _storage devices and processors and _others.

In terms of technologies, touch-based segment to command 64.2% share in the affective computing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seasonal Affective Disorder Therapeutics Market Trends – Growth & Forecast 2025 to 2035

Depression And Seasonal Affective Disorder Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Fog Computing Market

Brain Computing Interfaces Market Size and Share Forecast Outlook 2025 to 2035

Swarm Computing Market Size and Share Forecast Outlook 2025 to 2035

Cloud Computing Market Size and Share Forecast Outlook 2025 to 2035

Visual Computing Market Size and Share Forecast Outlook 2025 to 2035

Mobile Computing Devices Market Insights – Growth & Forecast 2023-2033

Spatial Computing Market Size and Share Forecast Outlook 2025 to 2035

Quantum Computing Market Growth – Trends & Forecast 2025 to 2035

Wearable Computing Market Trends – Growth & Forecast 2025 to 2035

Wearable Computing Devices Market Analysis - Size, Share & Forecast 2025 to 2035

Cognitive Computing Market Size and Share Forecast Outlook 2025 to 2035

Pervasive Computing Technology Market Size and Share Forecast Outlook 2025 to 2035

Server Less Computing Market Size and Share Forecast Outlook 2025 to 2035

Confidential Computing Market Size and Share Forecast Outlook 2025 to 2035

Space On Board Computing Platform Market Size and Share Forecast Outlook 2025 to 2035

Virtual Client Computing Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Computing Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Computing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA