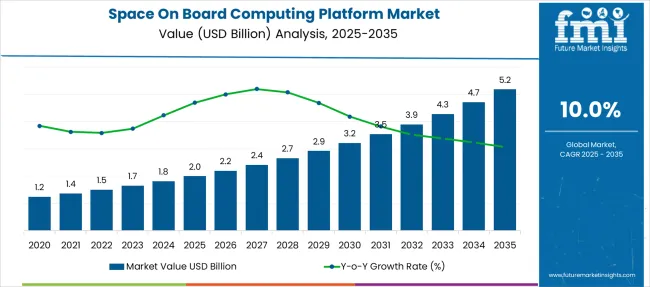

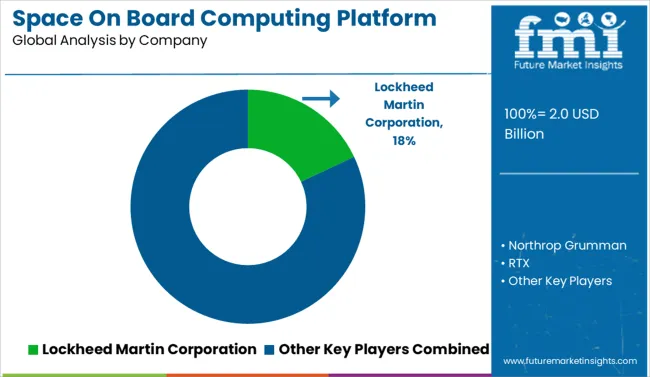

The Space On Board Computing Platform Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 5.2 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period.

| Metric | Value |

|---|---|

| Space On Board Computing Platform Market Estimated Value in (2025 E) | USD 2.0 billion |

| Space On Board Computing Platform Market Forecast Value in (2035 F) | USD 5.2 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The space on board computing platform market is advancing rapidly, driven by increased satellite deployment, miniaturization of components, and the demand for real-time data processing in orbit. Growing reliance on satellite-based services such as earth imaging, global communications, and scientific missions is accelerating investment in high-performance onboard computing systems that can manage autonomy, AI-based analytics, and edge computing.

With the shift toward constellation models and small satellite missions, mission-critical computing is being adapted to operate efficiently under radiation-hardened, thermally constrained environments. Integration of COTS (commercial-off-the-shelf) components alongside specialized aerospace-grade hardware is enabling a balance of cost-efficiency and operational robustness.

Regulatory support for commercial space ventures and collaborative partnerships among public and private players are expanding the addressable market. Looking ahead, future growth is expected to be underpinned by advancements in low-power architectures, AI accelerators, and the growing need for inter-satellite networking capabilities..

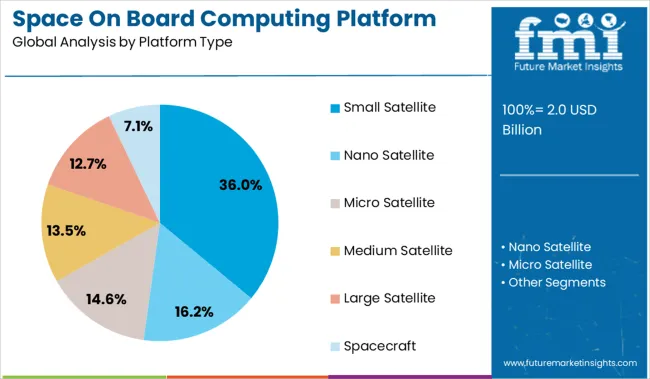

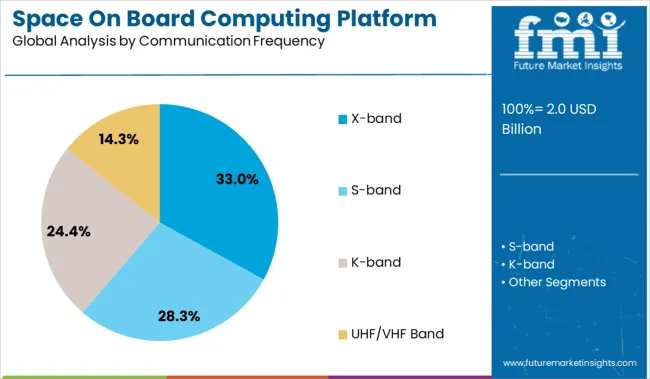

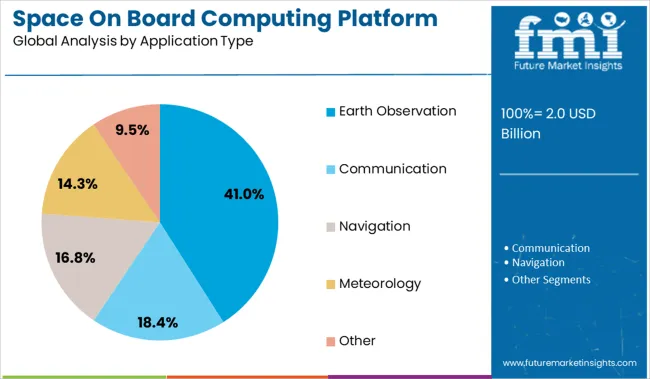

The space on board computing platform market is segmented by platform type, communication frequency, and application type and geographic regions. The space on board computing platform market is divided by platform type into Small Satellite, Nano Satellite, Micro Satellite, Medium Satellite, Large Satellite, and Spacecraft. In terms of communication frequency, the space on board computing platform market is classified into X-band, S-band, K-band, and UHF/VHF bands. Based on the application type of the space on board computing platform market, it is segmented into Earth Observation, Communication, Navigation, Meteorology, and Other. Regionally, the space on board computing platform industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Small satellites are projected to capture 36.0% of the total revenue share in the space on board computing platform market by 2025, making them the leading platform type. Their dominance is being driven by the increasing use of nanosatellites and microsatellites in LEO constellations, which require compact, low-power, and cost-effective computing platforms for autonomous operation.

The shift toward small, distributed satellite systems for communications, earth observation, and technology demonstration missions has accelerated demand for adaptable onboard processors. Development cycles for small satellites are shorter, creating a need for modular and upgradable computing systems.

Additionally, rising commercial interest in rapid deployment and real-time data access has pushed OEMs to innovate lightweight, radiation-tolerant computing solutions that can be integrated without adding excessive mass or power burden to the satellite bus..

The X-band frequency segment is expected to account for 33.0% of the overall market share in 2025, emerging as the most prominent frequency in use for onboard computing integration. Its adoption is being fueled by the band’s high data transmission capability, atmospheric resilience, and established use in defense, earth observation, and deep space missions.

X-band frequencies offer a balance between bandwidth efficiency and antenna size, enabling efficient downlink of large imaging and sensor datasets from LEO and MEO satellites. With missions increasingly demanding onboard processing and high-volume data transfer, computing systems are being designed to handle optimized packet routing and dynamic bandwidth management over X-band.

Its compatibility with both government and commercial mission protocols further solidifies its relevance in next-generation platform design..

Earth observation applications are forecast to lead the market with a 41.0% revenue share by 2025, positioning the segment as the top adopter of onboard computing systems. The growth of this segment is being supported by increasing demand for high-resolution satellite imagery and real-time environmental monitoring across agriculture, defense, disaster management, and climate analytics.

Onboard computing allows for immediate data preprocessing, compression, and analysis, reducing latency and transmission costs. The requirement to autonomously manage sensor calibration, payload operation, and anomaly detection has made edge computing an essential capability in earth observation missions.

Investments in commercial remote sensing and governmental climate initiatives are further driving the development of resilient, AI-enabled processing units that meet the rigorous data throughput and autonomy needs of modern observation satellites..

Demand for space on board computing platforms is increasing due to expanding satellite constellations, AI-driven in-orbit analytics, and private-sector-led payload launches. Sales of modular, radiation-tolerant architectures are surging in low-earth orbit and deep-space missions.

Demand for space on board computing platforms with AI and edge inference capabilities rose by 23% in 2025, reflecting the pivot to real-time onboard analytics in Earth observation and imaging. Over 60% of small satellites launched in 2025 integrated reprogrammable processors or FPGA-based accelerators, supporting autonomous image classification, object detection, and fault response. Providers offering sub-150 millisecond signal processing latency are gaining traction in multi-orbit constellations. Operators using onboard inference have reduced data transmission volumes by 30%, improving bandwidth efficiency and network agility. Growth is strongest in the 50 to 500-kilogram satellite category used in commercial agriculture and environmental surveillance.

Sales of radiation-hardened space on board computing systems expanded by 28% in 2025, supported by high demand from geostationary and interplanetary missions. More than 75% of new orders for systems used above 20,000 kilometers now include ECC memory and latch-up prevention. Quad-core fault-tolerant SoCs are emerging as standard configurations in telecom satellite hardware, enabling sustained compute throughput over operational lifespans exceeding 12 years. Design priorities in deep-space platforms are shifting toward enhanced thermal cycling tolerance, power management, and firmware-driven maintenance. Penetration is rising across government-led exploration and defense aerospace programs.

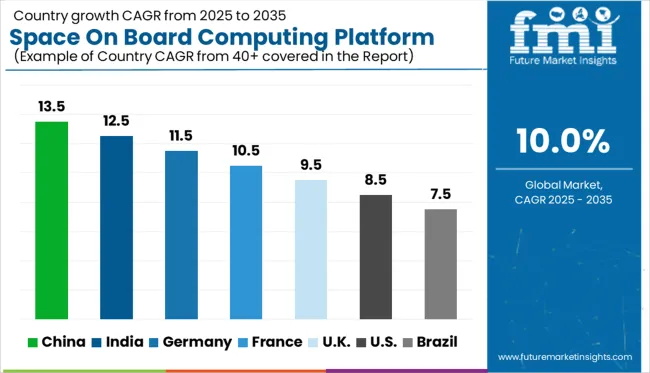

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

The global market is expected to grow at a CAGR of 10.0% between 2025 and 2035. China leads with 13.5% CAGR, 3.5%age points above the global average, reflecting strong investment in satellite mega-constellations and lunar missions. India follows at 12.5%, boosted by ISRO expansion and private-sector ventures. Germany posts 11.5%, backed by ESA participation and aerospace R&D. The United Kingdom records 9.5% CAGR, slightly below the global rate due to evolving post-Brexit partnerships. The United States grows at 8.5%, with growth moderated by legacy platforms and slower procurement cycles. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is forecast to expand at a CAGR of 13.5% through 2035, led by national initiatives promoting advanced satellite infrastructure and defense-grade payload capabilities. From 2020 to 2024, growth was constrained by dependence on imported legacy computing modules. However, the government is now prioritizing domestic production of AI-capable onboard systems for LEO missions. Public-private efforts are accelerating the fabrication of radiation-hardened processors. Strategic investments are also targeting reusable launch platforms and hardware for deep-space probes.

India is expected to grow at a CAGR of 12.5% during 2025 to 2035, supported by its constellation programs and vibrant space-tech startup scene. Between 2020 and 2024, growth stemmed from ISRO-driven missions. Future momentum is shifting toward private microsatellite makers and defense-sector projects. The country is emphasizing low-power, high-performance hardware suitable for both commercial and military use. Innovation hubs in Bengaluru and Hyderabad are working with international firms to enhance system reliability and export readiness.

Germany is projected to grow at a CAGR of 11.5% between 2025 and 2035, driven by its role in ESA-led missions and strong government support for aerospace innovation. From 2020 to 2024, adoption centered on academic cubesats and scientific payloads. Over the next decade, demand is rising for automation-ready onboard systems aligned with climate monitoring and deep-space exploration goals. German aerospace suppliers are co-developing platforms that meet stringent fault-tolerance and thermal performance standards.

The United Kingdom is forecast to grow at a CAGR of 9.5% from 2025 to 2035, following a stable trajectory from 2020 to 2024. British technology providers are advancing ultra-efficient computing systems for nanosatellite missions. Government accelerators have catalyzed partnerships between hardware innovators and launch service firms. Growth is also supported by increasing deployment of autonomous onboard processing in commercial Earth observation. The researchers are developing quantum-resilient firmware tailored to defense payloads.

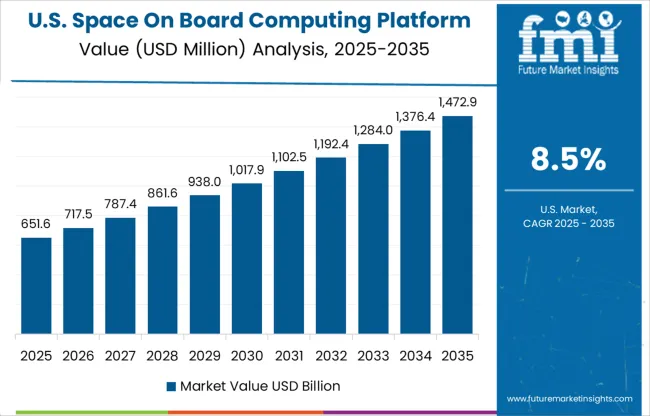

The United States is projected to grow at a CAGR of 8.5% during 2025 to 2035, rising from a more mature base built during 2020 to 2024. NASA, Department of Defense, and commercial ventures like SpaceX are investing in scalable onboard systems with AI acceleration. Replacement of legacy computers with real-time inference-capable hardware is accelerating. Hybrid architectures that combine FPGA and GPU cores are gaining adoption across LEO and planetary missions.

The market is expanding in 2025 as commercial constellations, interplanetary missions, and defense programs increase demand for high-performance onboard platforms. Lockheed Martin leads with a significant share, offering radiation-tolerant and modular systems. Northrop Grumman and RTX are scaling secure processors designed for autonomous operation. Boeing and Honeywell are focused on AI-integrated computers capable of real-time telemetry and decision-making. BAE Systems has consolidated its position with widespread adoption of the RAD750 and RAD5545 platforms in military satellites. Thales Alenia Space is serving European and Middle Eastern markets with compact, low-SWaP platforms. Across the board, vendors are optimizing for resilience, low power usage, and cross-platform compatibility.

In June 2024, Northrop Grumman deployed the Arctic Satellite Broadband Mission, featuring two satellites equipped with onboard processors to enable high-speed communications over polar regions. This underscores Northrop’s growing focus on space-based digital infrastructure and in-orbit edge computing capabilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.0 Billion |

| Platform Type | Small Satellite, Nano Satellite, Micro Satellite, Medium Satellite, Large Satellite, and Spacecraft |

| Communication Frequency | X-band, S-band, K-band, and UHF/VHF Band |

| Application Type | Earth Observation, Communication, Navigation, Meteorology, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lockheed Martin Corporation, Northrop Grumman, RTX, Honeywell International Inc., Boeing, BAE Systems, and Thales Alenia Space |

| Additional Attributes | Dollar sales by platform type (nano, micro, small satellites) and computing architecture (COTS vs radiation-hardened), demand dynamics across communication, earth observation, navigation, and AI-driven missions, regional trends in North America vs. APAC growth, innovation in on‑board AI/ML and edge processing, environmental impact of space-grade hardware sourcing. |

The global space on board computing platform market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the space on board computing platform market is projected to reach USD 5.2 billion by 2035.

The space on board computing platform market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in space on board computing platform market are small satellite, nano satellite, micro satellite, medium satellite, large satellite and spacecraft.

In terms of communication frequency, x-band segment to command 33.0% share in the space on board computing platform market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Space-based C4ISR Market Size and Share Forecast Outlook 2025 to 2035

Space Lander and Rover Market Size and Share Forecast Outlook 2025 to 2035

Space-Based Solar Power Market Size and Share Forecast Outlook 2025 to 2035

Space Frame Market Size and Share Forecast Outlook 2025 to 2035

Space Robotics Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Space Tourism Providers

Space Tourism Industry Analysis by Supplier, by Age Group, by Tourism Type, by Demographics, by Nationality, by Booking Channel, by Tour Type, and by Region - Forecast for 2025 to 2035

Spacer Tapes Market Insights & Growth Outlook through 2034

Space Economy Market Size and Share Forecast Outlook 2025 to 2035

Space Situational Awareness Market Size and Share Forecast Outlook 2025 to 2035

Space DC-DC Converter Market Insights – Growth & Forecast 2024-2034

Space Militarization Market Size and Share Forecast Outlook 2025 to 2035

Space Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Space Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

In Space Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA