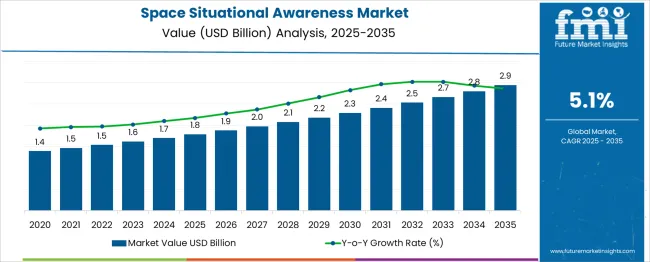

The Space Situational Awareness Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

The space situational awareness market is projected to generate an absolute dollar opportunity of USD 1.1 billion over the forecast period at a CAGR of 5.1%. Phase-wise analysis highlights a balanced yet slightly back-weighted growth structure. During the first half (2025–2030), the market expands from USD 1.8 billion to 2.3 billion, contributing USD 0.5 billion, which accounts for approximately 45% of the total incremental gain, driven by growing requirements for collision avoidance systems and compliance with debris mitigation standards as satellite launches increase.

The second phase (2030 to 2035) adds USD 0.6 billion, representing 55% of cumulative growth, indicating stronger momentum in later years as orbital traffic management solutions, space surveillance networks, and AI-based tracking technologies gain wider integration. Annual increments widen from USD 0.1 billion in the early years to USD 0.2 billion toward the end of the period, suggesting rising investments in real-time data platforms and predictive analytics for space object monitoring. This back-weighted growth pattern creates opportunities for technology providers to focus on high-precision tracking systems, cross-agency data-sharing frameworks, and cloud-based space monitoring platforms to support expanding low-Earth orbit (LEO) and geostationary satellite constellations.

| Metric | Value |

|---|---|

| Space Situational Awareness Market Estimated Value in (2025 E) | USD 1.8 billion |

| Space Situational Awareness Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The space situational awareness (SSA) market holds a strategic yet niche position within multiple space and aerospace segments. In the space infrastructure and services market, SSA accounts for 5–6%, as the broader market includes satellite manufacturing, launch services, and ground systems. Within the defense and aerospace surveillance market, its share is higher at 8–10%, due to growing military reliance on space monitoring for threat detection and asset protection. In the satellite communication support market, SSA contributes 4–5%, since primary spending focuses on payload operations and connectivity rather than monitoring. For the space safety and debris monitoring market, SSA dominates with a share of 30–35%, given its role in collision avoidance and debris tracking. In the advanced analytics and aerospace data market, SSA accounts for 6–8%, as analytics capabilities underpin orbital predictions and risk assessments.

While the overall share is modest in some areas, rising concerns over space congestion, mega-constellations, and debris mitigation are boosting demand for SSA systems. Integration of AI-driven analytics, real-time data feeds, and ground-to-space coordination tools is further shaping this segment. These factors position SSA as a critical enabler for ensuring operational safety, regulatory compliance, and long-term sustainability of global space assets.

The proliferation of low earth orbit satellite constellations, combined with heightened geopolitical focus on orbital dominance, has elevated the urgency for real-time space traffic management and debris tracking solutions. Technological advancements in surveillance optics, radar systems, and AI-powered orbital analytics are facilitating better prediction, avoidance, and response to potential collisions.

Regulatory emphasis from spacefaring nations on transparency, object cataloging, and orbital debris mitigation is contributing to structured development across commercial and military applications. With increased investment by government space agencies, private satellite operators, and space surveillance companies, the market is poised for significant expansion.

Collaborative frameworks between public and private stakeholders are promoting shared access to orbital data, accelerating innovation in tracking algorithms and simulation platforms. These factors are expected to drive continuous growth, particularly in capabilities offering real-time awareness and predictive risk assessment for near-earth operations.

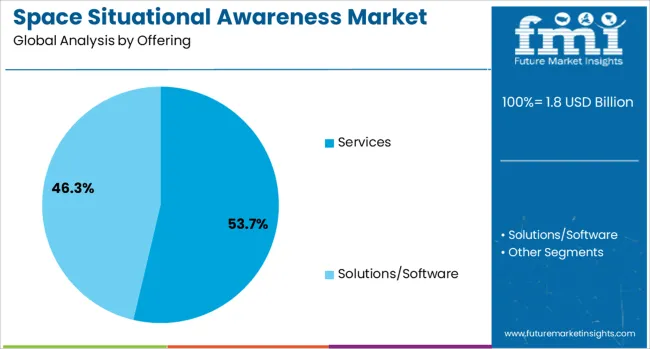

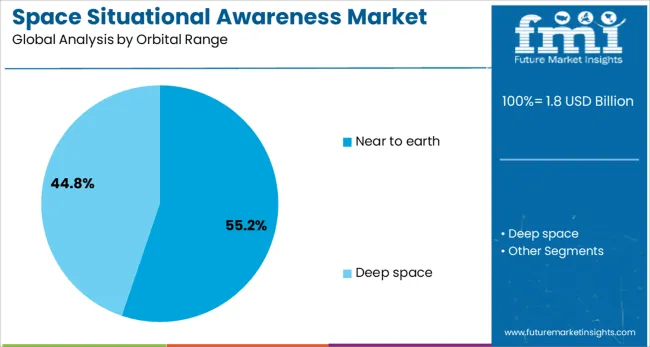

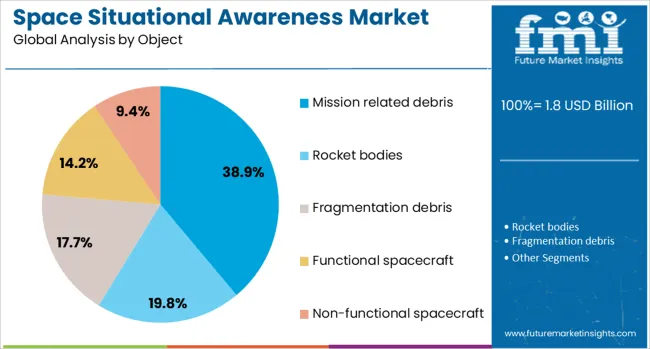

The space situational awareness market is segmented by offering, orbital range, object, end use, and geographic regions. The space situational awareness market is divided into Services and Solutions/Software. In terms of orbital range, the space situational awareness market is classified into near-earth and Deep space. Based on the object, the space situational awareness market is segmented into Mission-related debris, Rocket bodies, Fragmentation debris, Functional spacecraft, and Non-functional spacecraft. The end use of the space situational awareness market is segmented into Government and military, Commercial, and Research and academic institutions. Regionally, the space situational awareness industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The services segment is expected to hold 53.7% of the total revenue share in the Space Situational Awareness market in 2025, establishing itself as the leading contributor by value. This dominance is being driven by growing demand for orbital tracking, conjunction analysis, threat detection, and satellite health monitoring across both defense and commercial operations.

Services such as orbital debris tracking, risk assessment, and predictive analytics are being outsourced to specialized providers due to their complexity and the need for advanced infrastructure. The segment’s momentum is supported by the rise of third-party analytics platforms, global SSA data providers, and AI-enabled early warning systems that reduce the likelihood of satellite collisions and service disruptions.

Government contracts and public-private partnerships have further elevated the importance of service-based models, especially in scenarios requiring international cooperation or coordination across multiple satellite operators. As orbital environments become more congested, continuous situational awareness and expert analysis will remain essential, reinforcing the role of services as a foundational component of SSA strategy.

The near to earth orbital range segment is projected to account for 55.2% of the total revenue share in the Space Situational Awareness market by 2025. The concentration of commercial, scientific, and military satellites in lower orbital bands has made near to earth regions the most active and risk-prone, necessitating precise tracking and congestion management. The segment’s growth is being fueled by the expansion of large-scale satellite constellations supporting broadband connectivity, earth observation, and defense surveillance.

These missions require real-time monitoring and maneuverability support, which is enabled through software-defined ground-based and space-based tracking systems. The need to prevent collisions and manage traffic around these crowded orbits is reinforcing investment in near to earth SSA capabilities.

Policy frameworks and national space strategies are prioritizing this orbital layer due to its economic and strategic value, further boosting demand for constant situational visibility. The integration of near to earth SSA into launch licensing and fleet operations is expected to sustain the segment’s leadership throughout the forecast period.

The mission related debris segment is anticipated to represent 38.9% of the total revenue share in the Space Situational Awareness market in 2025, leading among tracked object categories. The accumulation of non-functional spacecraft components, upper stages, and defunct payloads from past launches has contributed significantly to collision risks, particularly in densely occupied orbits.

This segment’s prominence is being driven by the increasing need to track remnants that retain velocity and mass, posing threats to operational satellites. Regulatory bodies and defense organizations are prioritizing identification and mapping of mission-related debris to mitigate satellite loss, maintain operational continuity, and protect astronauts in crewed missions.

The ability to predict and model potential conjunctions with such debris is becoming a critical service offered by SSA providers, often integrated with dynamic orbital simulations. Advancements in radar cross-section detection, spectral imaging, and data fusion have enhanced the precision of debris cataloging, ensuring that mission-related debris continues to be a focal point for preventive space traffic management strategies.

Optical telescopes, radar networks, and telescope arrays are being combined with data processing platforms to deliver real-time orbital tracking. Demand has been observed from defense agencies, commercial satellite operators, and space agencies requiring collision avoidance, launch coordination, and debris monitoring functions. Providers delivering integrated sensor-data networks with predictive alerting and visualization tools are positioned to lead in this strategic space infrastructure sector.

SSA systems have been implemented to enhance detection of orbital debris, active satellites, and space weather anomalies that pose risks to spacecraft integrity and mission continuity. Sensor fusion from ground‑based radars, optical telescopes, and space-based sensors has allowed rapid identification of collision threats and trajectory deviations. Data-processing platforms combining automated tracking, conjunction analysis, and license renewal reports have enabled operators to mitigate collision risk proactively. As mega‑constellation deployments and satellite launches have accelerated, regulatory bodies and satellite firms have leveraged SSA capabilities to coordinate orbital slot usage and secure space traffic management. Agencies with satellite fleets have prioritized SSA integration to improve safety, compliance, and mission assurance across crowded low Earth orbit environments.

SSA adoption has been constrained by the complexity of integrating disparate sensor networks, data formats, and tracking systems into unified platforms without standard interoperability protocols. Investment in high‑precision radar arrays, optical observatories, and space‑based sensors has required significant capital outlay. Calibration, data validation, and orbit determination workflows have demanded specialized personnel and precise timing systems to ensure accuracy. Global SSA networks may require coordination across national jurisdictions, raising security and data-sharing challenges. Latency in data exchange and predictive model updates has limited rapid decision-making in high-velocity orbital events. Smaller operators and emerging space nations have faced barriers to entry due to infrastructure costs, limited access to datasets, and fragmented analytical tools.

Significant opportunities have emerged due to the rapid increase in satellite constellations for communication, navigation, and Earth observation. Rising space traffic has driven demand for advanced SSA capabilities to prevent collisions and manage orbital congestion. Defense and security agencies are prioritizing investment in tracking systems to ensure national security and support strategic surveillance programs. The rise of mega-constellations in low Earth orbit has amplified requirements for monitoring and data analytics services. Public-private partnerships focusing on debris monitoring and orbital risk mitigation are opening new pathways for innovation. Expansion into deep-space awareness solutions is creating additional opportunities as lunar and interplanetary missions increase in frequency and complexity.

Prevailing trends indicate the growing adoption of AI and machine learning algorithms to enhance detection accuracy and automate collision prediction processes. Deployment of optical and radar-based sensors is expanding for both ground-based and in-orbit applications, enabling precise cataloging of debris and active satellites. Real-time data sharing frameworks are being developed through global alliances to facilitate cross-border cooperation in space traffic management. The use of small satellite clusters for surveillance and deep-space tracking is gaining prominence. Integration of cloud computing and digital twin technologies for scenario simulation is improving operational efficiency. Development of standardized protocols for interoperability between space agencies and commercial operators is shaping the future of SSA solutions.

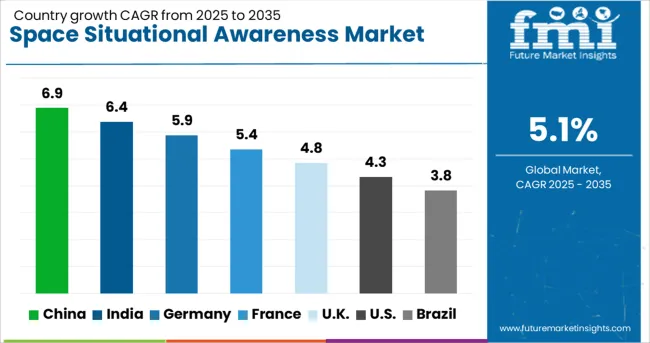

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global space situational awareness sector is projected to grow at a 5.1% CAGR from 2025 to 2035, supported by heightened orbital traffic, defense-driven monitoring initiatives, and demand for collision avoidance solutions. China leads with a 6.9% CAGR, propelled by national satellite programs and the expansion of space debris tracking infrastructure. India follows at 6.4%, driven by collaborations in international space safety and indigenous sensor deployment. Among OECD countries, Germany posts 5.9%, focusing on advanced optical systems and AI-based orbit prediction. France records 5.4%, emphasizing cross-agency data-sharing for orbital security, while the UK grows at 4.8%, leveraging commercial partnerships for real-time satellite surveillance. The report evaluates 40+ countries, with five profiled below.

China is projected to grow at a 6.9% CAGR, supported by national investments in orbital debris monitoring and collision prevention systems. Large-scale deployment of ground-based radar and optical observatories is underway to strengthen tracking accuracy across geostationary and low-earth orbits. AI-driven algorithms for predictive orbit modeling are being integrated into government space control frameworks. Domestic enterprises are collaborating with aerospace organizations to deliver automated constellation management tools for commercial operators. Rising satellite launches for navigation and communication amplify the demand for advanced SSA systems.

India is forecast to grow at a 6.4% CAGR, driven by efforts to strengthen orbital safety under national space policy frameworks. The Indian Space Research Organisation (ISRO) is advancing SSA systems by deploying high-precision radar arrays and telescopic tracking stations. Indigenous development of software platforms for orbital analytics supports faster data processing and collision prediction. Private-sector collaborations with global technology partners are enabling adoption of advanced SSA tools across satellite operators. Growing launches for communication, navigation, and remote sensing underscore the need for real-time monitoring to safeguard operational continuity.

Germany is projected to grow at 5.9% CAGR, supported by strong participation in the European Space Surveillance and Tracking (EUSST) initiative and extensive investment in predictive monitoring platforms. Deployment of high-precision optical telescopes and radar systems is improving orbital coverage for satellite safety. Aerospace companies are integrating AI-based analytics to enhance accuracy in collision risk assessments. Public-private partnerships under EU research programs drive innovation in SSA-related hardware and software. Increasing demand for secure orbital data-sharing mechanisms reflects the growing role of Germany in global space safety frameworks.

France is projected to grow at a 5.8% CAGR, driven by increased packaged food consumption and growth in beverage production. Shrink films are widely applied in multipack beverage packaging and retail-ready formats for convenience stores. Advanced barrier films with sealing integrity are preferred for perishable items in cold chain distribution. Regional packaging companies are upgrading machinery to support faster wrapping cycles, boosting demand for high-performance films. Customized printing on shrink wraps for brand visibility is another emerging trend. Partnerships between retailers and packaging converters focus on delivering high-clarity display films to enhance shelf appeal while ensuring load stability.

The United Kingdom is expected to grow at a 4.8% CAGR, emphasizing commercial innovation and integration of SSA services across satellite operations. The UK Space Agency is supporting initiatives focused on debris mitigation and real-time monitoring platforms for private operators. Domestic firms are deploying cloud-based SSA solutions with predictive modeling capabilities for satellite fleet management. The rising adoption of small satellite constellations by commercial players underscores the importance of automated orbital safety systems. Policy-driven standards for space traffic compliance encourage technology providers to enhance platform interoperability.

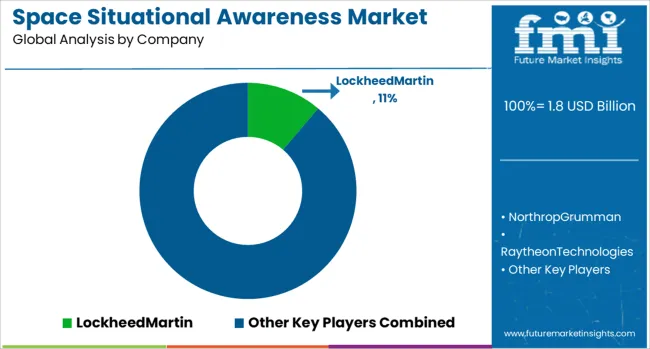

The space situational awareness (SSA) market is highly competitive and technology-driven, led by major aerospace and defense companies such as Lockheed Martin, Northrop Grumman, Raytheon Technologies, L3Harris Technologies, and Airbus Defence and Space, which dominate through advanced capabilities in satellite monitoring, orbital debris tracking, and space surveillance solutions.

These firms benefit from strong government contracts and significant defense investments, creating substantial entry barriers due to the high cost of infrastructure, specialized expertise, and regulatory requirements. Key players like Peraton, Kratos Defense & Security Solutions, BAE Systems, and The Aerospace Corporation enhance the market with mission-critical software, command-and-control systems, and advanced simulation tools that support collision avoidance and orbital safety.

Emerging innovators such as ExoAnalytic Solutions, Applied Defense Solutions, Schafer Corporation, GMV Innovating Solutions, and Elecnor Deimos Group are advancing cloud-based SSA platforms and AI-powered analytics to meet the growing need for real-time tracking and predictive modeling. Companies including NorthStar Earth & Space Inc. and Vision Engineering Solutions are investing in space-based observation systems, addressing rising congestion in low Earth orbit and expanding commercial satellite operations.

Differentiation in this market hinges on proprietary sensor networks, integration of predictive algorithms, and interoperability with global defense frameworks. Future competition will focus on autonomous SSA systems, cyber-secure architectures, and scalable platforms for space traffic management. Strategic emphasis is shifting toward public-private collaborations, AI-driven data analytics, and digital twin technologies to enable accurate orbit forecasting and ensure safe, sustainable space operations amid rapidly increasing satellite deployments and stricter regulatory frameworks.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Offering | Services and Solutions/Software |

| Orbital Range | Near to earth and Deep space |

| Object | Mission related debris, Rocket bodies, Fragmentation debris, Functional spacecraft, and Non-functional spacecraft |

| End Use | Government and military, Commercial, and Research and academic institutions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | LockheedMartin, NorthropGrumman, RaytheonTechnologies, L3HarrisTechnologies, AirbusDefenceandSpace, Peraton, KratosDefense&SecuritySolutions, BAESystems, TheAerospaceCorporation, ExoAnalyticSolutions, ParsonCorporation, AppliedDefenseSolutions(ADS), SchaferCorporation, GMVInnovatingSolutions, ElecnorDeimosGroup, TelespazioS.P.A, HarrisGeospatialSolutions, NorthstarEarth&SpaceInc, EtamaxSpace, VisionEngineeringSolutions,LLC, Globvision, and SpaceNav |

| Additional Attributes | Dollar sales by segment (space surveillance systems, ground-based sensors, data analytics software) and end use (defense, commercial satellite operators, government agencies). Market growth is driven by increased satellite launches, debris mitigation mandates, and collision risk reduction initiatives. North America leads adoption, while Europe and Asia-Pacific expand via collaborative SSA programs and partnerships for global space traffic coordination. |

The global space situational awareness market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the space situational awareness market is projected to reach USD 2.9 billion by 2035.

The space situational awareness market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in space situational awareness market are services and solutions/software.

In terms of orbital range, near to earth segment to command 55.2% share in the space situational awareness market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Space-based C4ISR Market Size and Share Forecast Outlook 2025 to 2035

Space Lander and Rover Market Size and Share Forecast Outlook 2025 to 2035

Space-Based Solar Power Market Size and Share Forecast Outlook 2025 to 2035

Space Frame Market Size and Share Forecast Outlook 2025 to 2035

Space Robotics Market Size and Share Forecast Outlook 2025 to 2035

Space On Board Computing Platform Market Size and Share Forecast Outlook 2025 to 2035

Space Militarization Market Size and Share Forecast Outlook 2025 to 2035

Space Economy Market Size and Share Forecast Outlook 2025 to 2035

Space Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Space Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Space Tourism Providers

Space Tourism Industry Analysis by Supplier, by Age Group, by Tourism Type, by Demographics, by Nationality, by Booking Channel, by Tour Type, and by Region - Forecast for 2025 to 2035

Spacer Tapes Market Insights & Growth Outlook through 2034

Space DC-DC Converter Market Insights – Growth & Forecast 2024-2034

In Space Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA