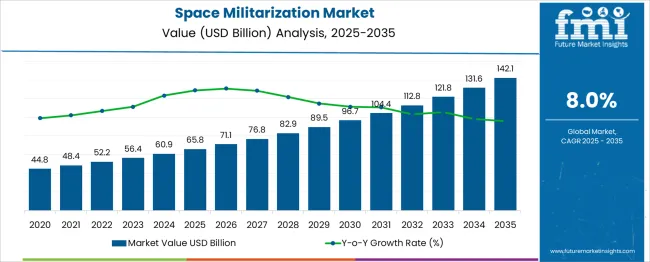

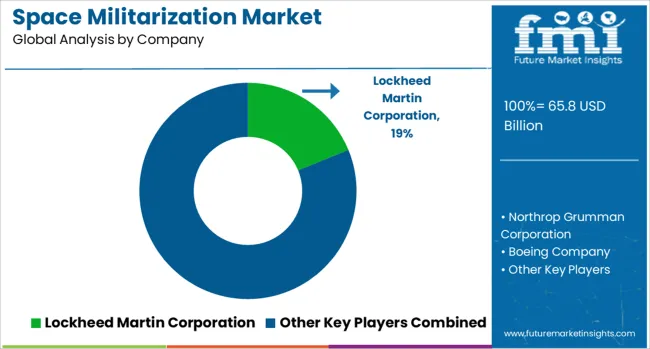

The Space Militarization Market is estimated to be valued at USD 65.8 billion in 2025 and is projected to reach USD 142.1 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

| Metric | Value |

|---|---|

| Space Militarization Market Estimated Value in (2025 E) | USD 65.8 billion |

| Space Militarization Market Forecast Value in (2035 F) | USD 142.1 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

Governments are prioritizing the development and deployment of advanced space weapons to protect critical assets and ensure security in increasingly contested orbital environments. The rise of space-based solutions reflects the growing reliance on satellites and other space infrastructure for surveillance, communication, and missile defense. Defense agencies have focused on integrating these technologies with terrestrial systems to create multi-domain operational capabilities.

The competitive geopolitical landscape and evolving threats have accelerated the deployment of space weaponry and related technologies. Looking ahead, growth is expected to be driven by continued technological advancements, international partnerships, and increased budget allocations for space defense initiatives. Segment growth is anticipated to be led by weapons offerings, space-based solutions, and government and defense end users.

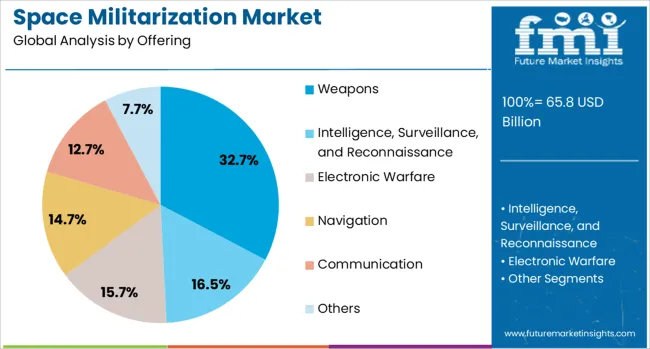

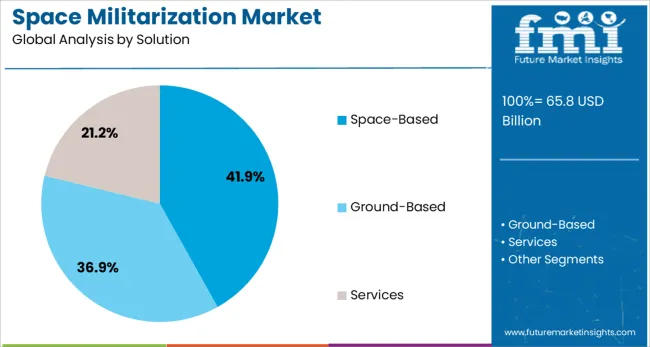

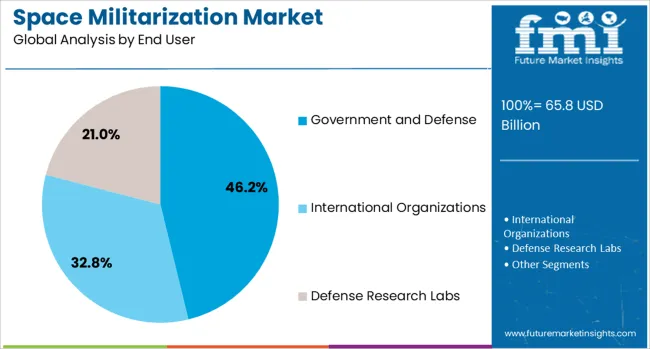

The space militarization market is segmented by offering, solution, and end user and geographic regions. The space militarization market is divided into Weapons, Intelligence, Surveillance, and Reconnaissance, Electronic Warfare, Navigation, Communication, and Others. In terms of the solution, the space militarization market is classified into Space-Based, Ground-Based, and Services. Based on the end user, the space militarization market is segmented into Government and Defense, International Organizations, and Defense Research Labs. Regionally, the space militarization industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The weapons segment is projected to hold 32.7% of the space militarization market revenue in 2025, reflecting its key role in offensive and defensive space strategies. This segment’s growth is driven by the need for systems capable of disrupting or neutralizing adversary satellites and space assets. Governments have prioritized the development of directed energy weapons, kinetic interceptors, and electronic warfare systems designed for space environments.

The critical importance of space superiority has resulted in focused investments and accelerated research efforts in weapons technologies. As space becomes a contested domain, the demand for versatile and effective weapon systems in orbit continues to grow.

This segment is expected to maintain its market leadership due to ongoing geopolitical tensions and strategic priorities.

The space-based solutions segment is expected to contribute 41.9% of the market revenue in 2025, underscoring its significance in the overall space militarization landscape. Growth has been driven by the deployment of satellites and related assets that support real-time intelligence, surveillance, reconnaissance, and communications.

These solutions provide persistent coverage and rapid response capabilities essential for modern military operations. Investments in resilient satellite architectures and space situational awareness technologies have further enhanced the effectiveness of space-based systems.

The integration of space-based assets with ground and airborne platforms has expanded operational flexibility. As defense strategies evolve, space-based solutions are anticipated to remain central to maintaining strategic advantage and operational readiness.

The government and defense segment is projected to account for 46.2% of the space militarization market revenue in 2025, representing the dominant end user group. Growth in this segment has been fueled by increasing national security concerns and the recognition of space as a critical domain for defense operations.

Governments have committed significant resources to space defense programs, fostering research, development, and deployment of advanced militarization technologies. Policy frameworks and strategic initiatives aimed at space security have further strengthened this segment.

The segment benefits from large-scale funding, regulatory support, and dedicated military space commands. As international competition intensifies, government and defense agencies are expected to continue driving demand for space militarization capabilities.

The space militarization market is growing due to rising investments in surveillance, early warning, missile defense, and anti-satellite capabilities. Governments are deploying orbital assets to secure strategic advantages, with strong funding from defense budgets in the USA, China, India, and Europe. Private aerospace firms are partnering with national agencies to develop constellations for ISR and secure communications. Small satellite systems with AI-based tracking and signal processing tools are accelerating procurement cycles. The push for deterrence, combined with the need for space situational awareness, is shaping demand for multi-domain military coordination tools.

Defense agencies are allocating higher budgets to intelligence, surveillance, and reconnaissance constellations equipped with low-latency sensors and autonomous signal monitoring. The US has increased satellite deployment rates to expand orbital coverage of potential missile threats, while Europe is fielding encrypted constellations with dual-use capability for strategic command functions. China has scaled up its counterspace research programs with the deployment of robotic systems for inspection and jamming. India is advancing satellite-based targeting and surveillance platforms to strengthen border security and launch-time response windows. Global focus remains on dual-use platforms with encrypted uplinks, synthetic aperture radar, and optical surveillance payloads.

Defense suppliers are adapting to modular satellite platforms that reduce lead times and support payload upgrades during orbit. Aerospace contractors are bundling launch services with low Earth orbit hardware to meet fast-track procurement requirements. Some firms have transitioned toward vertically integrated solutions with in-house launch, AI processing, and ground control. Compact RF detection satellites and secure communication nodes are being integrated into existing military systems for hybrid operations. Companies are expanding offerings in orbital refueling, debris tracking, and multispectral threat detection as part of counterspace readiness planning. Public-private contracts increasingly emphasize short deployment cycles and resilience under contested conditions.

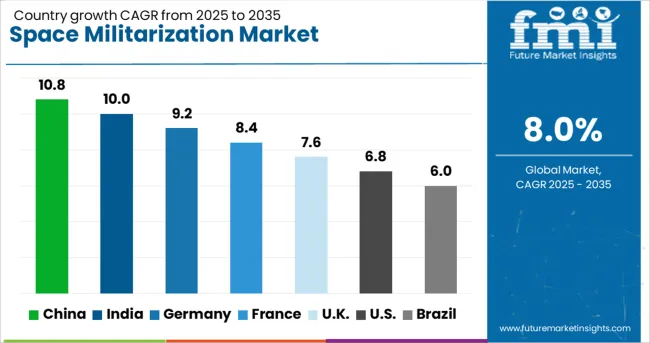

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

The global space militarization market is projected to grow at an 8% CAGR between 2025 and 2035. China leads with a CAGR of 10.8%, which is +35% above the global average, reflecting its increased satellite deployment and space-based surveillance systems. India records 10%, or +25% higher, supported by ISRO–DRDO integration and orbital defense monitoring initiatives. Germany stands at 9.2%, or +15% above, as the Bundeswehr expands space situational awareness programs. The UK, at 7.6%, falls -5% below the global rate, while the USA, at 6.8%, is -15% lower, indicating a shift toward private-sector collaboration rather than centralized defense-led projects. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The space militarization market in China is advancing at a CAGR of 10.8%, reflecting the country’s investment in orbital defense assets and satellite-based command systems. The People's Liberation Army Strategic Support Force continues to coordinate satellite networks for early warning, missile tracking, and electronic warfare. New launches by CASC include payloads for anti-satellite defense and high-frequency imaging. Space situational awareness (SSA) infrastructure is expanding with ground-based radar and optical systems integrated with AI analytics.

India is expected to post a CAGR of 5.6% in the butane market through 2035, led by growing petrochemical manufacturing and residential LPG demand. Butane blending in LPG cylinders is rising due to distribution across remote regions. Refineries are also optimizing crude runs to generate higher butane yields. IOCL and HPCL are adding storage terminals in Visakhapatnam and Gujarat, improving supply logistics. Aromatics plants in Maharashtra and Tamil Nadu use butane as a feedstock, increasing localized consumption in coastal states. Regulatory support for import duty exemptions is also improving import feasibility.

The space militarization market in Germany is growing at a CAGR of 9.2%, led by federal coordination with NATO and the EU for orbital threat response and early-warning systems. The Bundeswehr is enhancing resilience through secure communications satellites and multi-spectral Earth observation. Government contracts with OHB and Airbus focus on military-grade navigation systems and satellite defense against jamming. A dedicated space command unit was operationalized to oversee defensive posturing in LEO and MEO orbits.

The space militarization market in the United Kingdom is expanding at a CAGR of 7.6%, with initiatives aimed at space resilience, command autonomy, and orbital threat monitoring. The UK Space Command is advancing early warning satellite projects through partnerships with defense firms and NATO coordination. Government support extends to Spaceport Cornwall and Northern Scotland for defense satellite launches. Research is underway to simulate space warfare scenarios for secure communication and ISR operations.

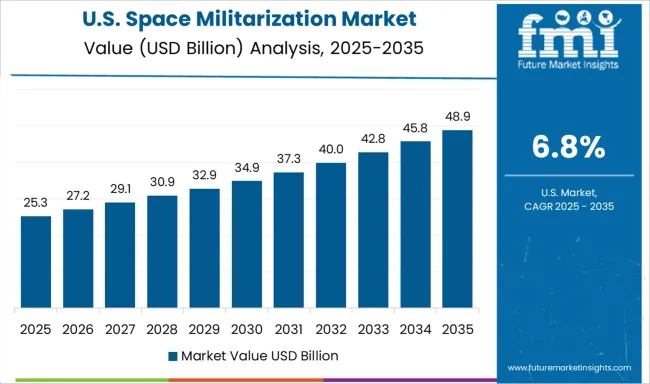

The USA space militarization market is forecast to expand at a CAGR of 6.8%, is driven by long-term investment in space command operations and layered defense strategies. The USA Space Force and Space Command lead deployment of satellite constellations for missile defense, communications, and surveillance. Private firms such as Lockheed Martin and Northrop Grumman are supplying ISR payloads, sensor integration systems, and orbital defense platforms. Legislative support includes expanded Pentagon funding for anti-satellite response systems.

The global space militarization market is dominated by Lockheed Martin Corporation, with major competitors including Northrop Grumman Corporation, Boeing Company, and Raytheon Technologies Corporation developing advanced satellite, missile defense, and space surveillance systems.

Specialized defense contractors such as L3Harris Technologies Inc. and Thales Group provide critical communication and imaging technologies for space-based military applications, while General Dynamics Corporation focuses on ground control systems and cybersecurity for orbital assets.

The market is experiencing significant growth due to increasing geopolitical tensions and the strategic importance of space domain awareness, driving investments in anti-satellite capabilities and resilient satellite constellations. Technological advancements include directed-energy weapons for space defense and AI-powered threat detection systems. The industry faces challenges from international arms control discussions but benefits from substantial defense budget allocations for space security programs across major military powers.

On May 20, 2025, former President Trump officially unveiled the “Golden Dome” missile defense program in the Oval Office. He presented it as a USD 175 billion, multilayered shield spanning ground, sea, air, and space featuring space-based interceptors and satellites intended to defend the USA against ballistic, hypersonic, cruise, or even space-launched missile threats.

| Item | Value |

|---|---|

| Quantitative Units | USD 65.8 Billion |

| Offering | Weapons, Intelligence, Surveillance, and Reconnaissance, Electronic Warfare, Navigation, Communication, and Others |

| Solution | Space-Based, Ground-Based, and Services |

| End User | Government and Defense, International Organizations, and Defense Research Labs |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lockheed Martin Corporation, Northrop Grumman Corporation, Boeing Company, Raytheon Technologies Corporation, L3Harris Technologies Inc., Thales Group, and General Dynamics Corporation |

| Additional Attributes | Dollar sales by system type (satellite-based ISR, anti-satellite weapons, space-based missile defense) and application (communications, surveillance, navigation), demand dynamics across defense modernization, low Earth orbit (LEO) monitoring, and deterrence architecture, regional trends led by North America with Asia‑Pacific expanding dual-use satellite capabilities, innovation in directed energy payloads, on-orbit servicing, and autonomous threat tracking, and strategic impact of space domain awareness protocols, cross-border launch policies, and arms control compliance. |

The global space militarization market is estimated to be valued at USD 65.8 billion in 2025.

The market size for the space militarization market is projected to reach USD 142.1 billion by 2035.

The space militarization market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in space militarization market are weapons, intelligence, surveillance, and reconnaissance, electronic warfare, navigation, communication and others.

In terms of solution, space-based segment to command 41.9% share in the space militarization market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Space-based C4ISR Market Size and Share Forecast Outlook 2025 to 2035

Space Lander and Rover Market Size and Share Forecast Outlook 2025 to 2035

Space-Based Solar Power Market Size and Share Forecast Outlook 2025 to 2035

Space Frame Market Size and Share Forecast Outlook 2025 to 2035

Space Situational Awareness Market Size and Share Forecast Outlook 2025 to 2035

Space Robotics Market Size and Share Forecast Outlook 2025 to 2035

Space On Board Computing Platform Market Size and Share Forecast Outlook 2025 to 2035

Space Economy Market Size and Share Forecast Outlook 2025 to 2035

Space Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Space Management Solutions Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Space Tourism Providers

Space Tourism Industry Analysis by Supplier, by Age Group, by Tourism Type, by Demographics, by Nationality, by Booking Channel, by Tour Type, and by Region - Forecast for 2025 to 2035

Spacer Tapes Market Insights & Growth Outlook through 2034

Space DC-DC Converter Market Insights – Growth & Forecast 2024-2034

In Space Manufacturing Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA