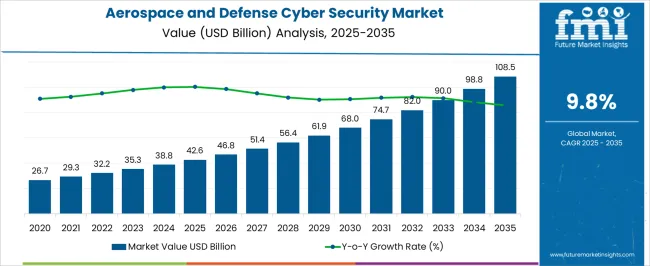

The aerospace and defense cyber security market is projected to reach 42.6 USD billion in 2025 and expand to 108.5 USD billion by 2035, growing at a CAGR of 9.8%. The market trajectory is shaped by increasing reliance on digital platforms, networked defense systems, and cloud-based aerospace operations, which heighten vulnerability to cyber threats.

Early years, from 2025 to 2030, witness steady adoption of perimeter security solutions, threat intelligence platforms, and endpoint protection systems across defense and aerospace enterprises. Mid-period, 2030–2033, shows accelerated growth driven by integration of AI-assisted anomaly detection, secure communication protocols, and real-time monitoring across unmanned aerial systems, satellites, and critical defense infrastructure.

The later phase, 2033–2035, experiences peak adoption of comprehensive cybersecurity frameworks combining network segmentation, zero-trust architecture, and advanced encryption, reflecting heightened regulatory compliance and geopolitical pressures. Increasing digitization of defense supply chains, rise in autonomous aircraft deployment, and growing focus on protecting sensitive aerospace data underscore the demand for robust cyber solutions. Investments in cyber-resilience training, incident response teams, and continuous monitoring further reinforce market expansion, while collaborations with cybersecurity startups and global defense contractors enhance capability integration and threat mitigation.

| Metric | Value |

|---|---|

| Aerospace and Defense Cyber Security Market Estimated Value in (2025 E) | USD 42.6 billion |

| Aerospace and Defense Cyber Security Market Forecast Value in (2035 F) | USD 108.5 billion |

| Forecast CAGR (2025 to 2035) | 9.8% |

The aerospace and defense cyber security market is shaped by several interrelated parent markets, each contributing uniquely to adoption and growth. The defense and military systems market holds the largest share at 35%, as military aircraft, naval vessels, and ground-based defense infrastructure require advanced cyber protection to safeguard classified data, mission-critical operations, and communication networks.

The commercial aviation and airline market contributes 25%, with airlines investing in threat detection, network security, and secure cloud-based operations to protect passenger data, flight management systems, and connected aircraft platforms. The space and satellite systems market accounts for 15%, driven by secure satellite communications, navigation systems, and payload data protection. The aerospace manufacturing and supply chain market holds a 15% share, focusing on safeguarding design files, intellectual property, and production processes from cyber threats.

The aviation MRO and IT services market represents 10%, providing continuous monitoring, incident response, and software updates to maintain operational resilience and regulatory compliance. Defense, commercial aviation, and space sectors account for 75% of overall demand, highlighting that mission-critical system security, data protection, and operational continuity are the primary growth drivers, while aerospace manufacturing and MRO services support incremental adoption and global market expansion.

The aerospace and defense cyber security market is experiencing strong growth driven by rising threats of cyber attacks targeting mission critical systems, sensitive defense data, and operational technologies. The increasing complexity of networked platforms, reliance on satellite communications, and integration of advanced avionics have expanded the cyber threat landscape.

Governments and defense contractors are investing heavily in robust cyber defense frameworks, next generation encryption, and real time threat intelligence systems to safeguard assets. Additionally, compliance with evolving defense cyber regulations and international security standards is compelling stakeholders to upgrade existing infrastructure.

The market outlook remains positive as national security priorities and the need for operational resilience continue to reinforce demand for advanced cyber security solutions across the aerospace and defense sectors.

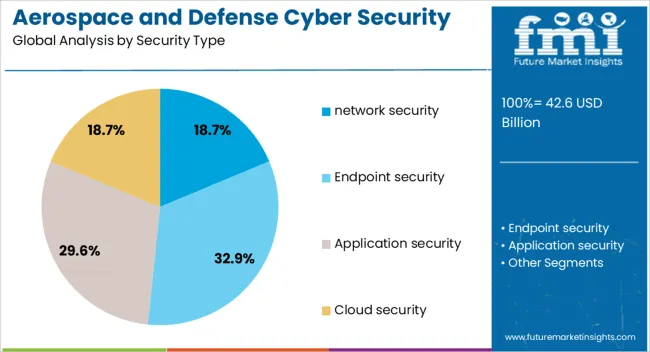

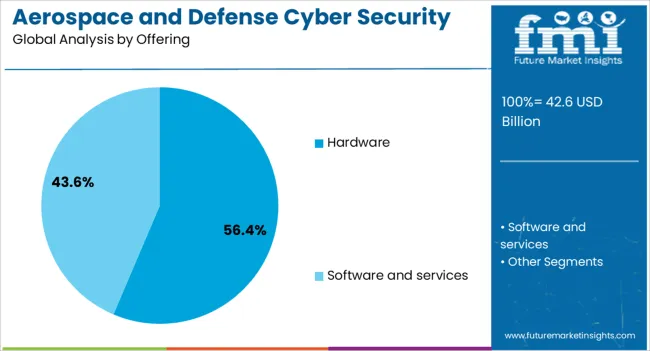

The aerospace and defense cyber security market is segmented by security type, offering, application, end use, and geographic regions. By security type, aerospace and defense cyber security market is divided into network security, Endpoint security, Application security, and Cloud security. In terms of offering, aerospace and defense cyber security market is classified into Hardware and Software and services.

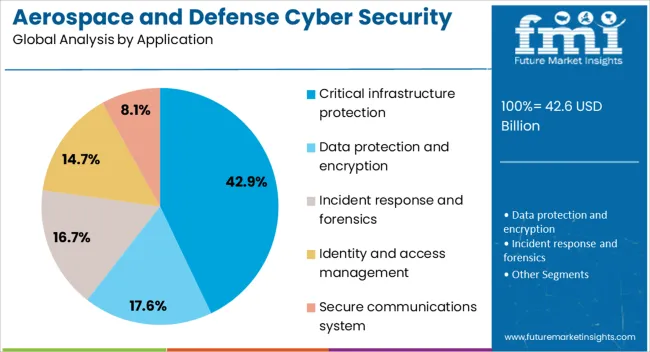

Based on application, aerospace and defense cyber security market is segmented into Critical infrastructure protection, Data protection and encryption, Incident response and forensics, Identity and access management, and Secure communications system. By end use, aerospace and defense cyber security market is segmented into Army, Navy, and Air force. Regionally, the aerospace and defense cyber security industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The network security segment is projected to account for 18.70% of total market revenue by 2025, making it a significant focus area within the security type category. This growth is driven by the rising volume of cyber threats targeting communication networks, command and control systems, and classified information channels.

Enhanced firewall systems, intrusion detection, and encrypted communication protocols are being deployed to mitigate breaches.

The strategic importance of protecting network integrity in aerospace and defense missions has solidified this segment’s role in ensuring operational continuity and mission success.

The hardware segment is expected to contribute 56.40% of total market revenue by 2025, positioning it as the leading offering category. This dominance is attributed to the extensive use of secure communication devices, dedicated encryption modules, and hardened servers in defense and aerospace operations.

Hardware based solutions provide enhanced tamper resistance, faster data processing for threat detection, and compliance with stringent military security standards.

Continuous modernization programs and fleet upgrades are further driving demand for advanced cyber security hardware, reinforcing its leadership in this market.

The critical infrastructure protection segment is projected to hold 42.90% of the total market revenue by 2025 within the application category, making it the foremost area of application. This is due to the necessity of safeguarding mission-essential assets such as air traffic control systems, satellite networks, and defense communication hubs.

Rising geopolitical tensions and the increasing frequency of state-sponsored cyber threats have heightened the focus on protecting these infrastructures. Implementation of multi-layered security architectures, AI-driven monitoring systems, and advanced threat intelligence platforms is driving adoption.

The critical importance of these assets to national defense and public safety ensures the continued dominance of this application segment.

The aerospace and defense cyber security market is driven by increasing cyber threats, regulatory compliance mandates, and the adoption of integrated protection and monitoring solutions. Continuous investments in advanced response systems ensure operational resilience across the sector.

The aerospace and defense cyber security market is being shaped by a surge in sophisticated cyber threats targeting military, commercial, and satellite systems. State-sponsored attacks, ransomware, phishing, and advanced persistent threats are increasingly compromising sensitive operational data and mission-critical communications. Defense networks, air traffic management systems, and connected aircraft platforms face heightened exposure due to increased digitalization of avionics, cloud-based applications, and interconnected supply chains. Enterprises are adopting multi-layered security solutions including intrusion detection, endpoint protection, and real-time monitoring to mitigate risks. Regulatory mandates and government directives emphasize proactive threat intelligence, vulnerability assessments, and compliance audits to safeguard assets. Vendors offering AI-assisted threat detection, anomaly analytics, and automated incident response are gaining traction among defense contractors, airlines, and aerospace integrators worldwide.

Organizations across aerospace and defense sectors are prioritizing the integration of comprehensive cyber security frameworks to ensure operational continuity. Network segmentation, encryption protocols, and secure communication channels are being deployed alongside identity and access management systems to prevent unauthorized intrusions. Airlines, defense agencies, and satellite operators are increasingly investing in cloud security, managed detection services, and software assurance programs to protect mission-critical data.

Supply chain partners and subcontractors are required to comply with stringent cyber regulations, ensuring secure design, production, and maintenance processes. Investments in simulation-based security testing, red teaming, and penetration assessments are rising to identify potential vulnerabilities before exploitation. Such holistic adoption strategies strengthen resilience against increasingly sophisticated and targeted cyber attacks across multiple operational domains.

Cyber security in aerospace and defense is heavily influenced by global regulations, standards, and compliance requirements. Guidelines from authorities such as the USA Department of Defense, NATO, and the European Union dictate security protocols for classified systems, critical infrastructure, and defense supply chains. Compliance with frameworks like NIST, ISO 27001, and DFARS ensures secure handling of sensitive design, production, and operational data. Regulatory oversight is driving investments in audit, risk management, and reporting capabilities, as non-compliance can result in penalties and reputational damage. Vendors and end-users are collaborating to implement standardized encryption, authentication, and monitoring practices. As cyber threats evolve, regulatory frameworks are periodically updated, making adherence a continuous strategic priority for defense contractors and aerospace operators globally.

Continuous monitoring and rapid incident response are becoming critical components of aerospace and defense cyber security strategies. Organizations are deploying Security Operations Centers (SOCs) equipped with real-time analytics, threat intelligence feeds, and automated alerting mechanisms to detect intrusions immediately. Endpoint protection, anomaly detection, and intrusion prevention systems are integrated with cloud and on-premises environments to ensure comprehensive coverage. Incident response protocols, disaster recovery planning, and forensic investigation capabilities are emphasized to minimize operational disruptions and data loss. Partnerships between technology vendors, government agencies, and defense contractors enhance collaborative threat intelligence sharing. Investments in cyber resilience, employee training, and scenario-based simulations are helping aerospace and defense organizations maintain continuous operational readiness and safeguard mission-critical systems globally.

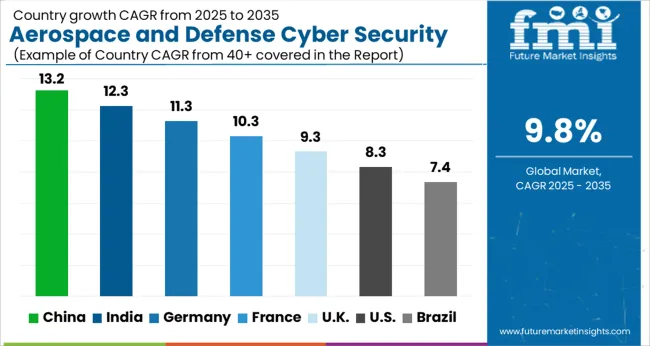

| Country | CAGR |

|---|---|

| China | 13.2% |

| India | 12.3% |

| Germany | 11.3% |

| France | 10.3% |

| UK | 9.3% |

| USA | 8.3% |

| Brazil | 7.4% |

The global aerospace and defense cyber security market is projected to grow at a CAGR of 9.8% from 2025 to 2035. China leads at 13.2%, followed by India at 12.3%, Germany at 11.3%, the UK at 9.3%, and the USA at 8.3%. Growth is fueled by increasing cyber threats targeting military networks, aircraft systems, and defense infrastructure, as well as the rising adoption of connected avionics and satellite communications. Governments and defense contractors are investing heavily in integrated threat detection, real-time monitoring, and secure communication solutions. Asia, particularly China and India, demonstrates rapid expansion due to strategic defense initiatives and modernization programs, whereas Europe and North America prioritize compliance, risk mitigation, and resilient cyber architectures for both civil and defense aerospace applications. The analysis spans over 40+ countries, with the leading markets detailed below.

The aerospace and defense cyber security market in China is projected to grow at a CAGR of 13.2% from 2025 to 2035, driven by increasing cyber threats targeting military networks, satellite communications, and connected aircraft systems. Government defense modernization programs are accelerating adoption of advanced threat detection, real-time monitoring, and secure communication solutions. Major defense contractors are investing in resilient cyber architectures, encryption protocols, and AI-enabled anomaly detection systems. Civil aviation and space agencies are implementing regulatory compliance measures, mandating robust security frameworks for both domestic and international operations. Collaborations with global technology providers facilitate knowledge transfer, innovative solutions, and advanced training programs for cybersecurity personnel.

The aerospace and defense cyber security market in India is expected to expand at a CAGR of 12.3% from 2025 to 2035, fueled by strategic defense initiatives, increasing digitalization of air defense systems, and growing adoption of connected avionics. Defense organizations, including the Indian Air Force, Navy, and space agencies, are implementing advanced intrusion detection, secure communications, and risk mitigation strategies. Domestic cyber security firms collaborate with international solution providers to develop tailored defense-grade solutions. Civil aviation stakeholders are adopting cyber risk management frameworks to comply with national and international aviation standards. Training programs, simulated attack exercises, and security audits strengthen operational resilience across defense and aerospace networks.

The aerospace and defense cyber security market in Germany is projected to grow at a CAGR of 11.3% from 2025 to 2035, supported by high adoption of connected aircraft systems, advanced defense electronics, and industrial aerospace networks. German defense agencies and aerospace OEMs are investing in AI-driven threat detection, secure communications, and cyber resilience frameworks. Stringent EU regulations on aviation cyber security, combined with NATO compliance standards, drive continuous upgrades and certifications. Collaboration between defense contractors, research institutions, and tech startups is fostering innovative solutions in threat intelligence, vulnerability management, and secure system integration. Both civil and military aviation sectors are prioritizing comprehensive incident response protocols to mitigate risks and ensure mission-critical operational continuity.

The aerospace and defense cyber security market in the UK is anticipated to grow at a CAGR of 9.3% from 2025 to 2035, driven by increasing cyber threats targeting defense infrastructure, military aircraft, and satellite systems. UK defense agencies, including the Royal Air Force and defense contractors, are implementing advanced intrusion detection systems, encryption, and network segmentation. Civil aviation authorities mandate cyber security compliance for airlines and airports, emphasizing resilience against cyberattacks. Partnerships with global cyber security firms and defense technology providers enable cutting-edge solutions, threat intelligence sharing, and specialized workforce training. The focus on integrated cyber defense strategies ensures protection of mission-critical operations and maintains international standards for defense readiness.

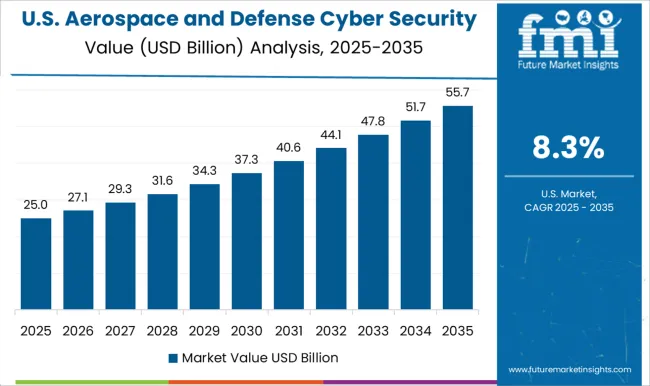

The aerospace and defense cyber security market in the USA is projected to grow at a CAGR of 8.3% from 2025 to 2035, fueled by modernization programs for military aircraft, defense networks, and satellite communications. The Department of Defense and aerospace OEMs prioritize advanced threat detection, secure communications, and AI-enabled cyber intelligence platforms. Civil aviation authorities enforce stringent cyber compliance standards, driving airlines and airport operators to adopt integrated security frameworks. Partnerships between domestic defense contractors and international cyber security firms enhance solution capabilities, while specialized training programs develop a skilled workforce for incident response and vulnerability management. Continuous R&D investment ensures resilience against emerging cyber threats across both military and civil aviation domains.

The aerospace and defense cybersecurity market is driven by global cybersecurity firms, specialized defense contractors, and technology solution providers focusing on protecting sensitive military and aviation data. Key players such as Raytheon Technologies, Northrop Grumman, Lockheed Martin, and BAE Systems hold strong positions by offering integrated cybersecurity solutions, secure communication systems, threat intelligence services, and advanced encryption technologies tailored for aerospace and defense applications.

Competition is shaped by the ability to deliver real-time threat detection, incident response, secure network infrastructure, and compliance with stringent defense regulations. Regional cybersecurity firms, especially in North America and Europe, compete by offering niche services such as aircraft system protection, industrial control system security, and secure software development. Strategic partnerships with government agencies, defense ministries, and aviation OEMs help companies expand market reach and credibility. Innovation in artificial intelligence-driven threat monitoring, secure cloud solutions, and blockchain-based data protection provides a competitive edge.

Companies prioritizing technological excellence, regulatory compliance, and reliable service networks are positioned to capture substantial shares in the aerospace and defense cybersecurity market, which is expected to grow alongside increasing digitalization and cyber threats in the sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 42.6 Billion |

| Security Type | network security, Endpoint security, Application security, and Cloud security |

| Offering | Hardware and Software and services |

| Application | Critical infrastructure protection, Data protection and encryption, Incident response and forensics, Identity and access management, and Secure communications system |

| End Use | Army, Navy, and Air force |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Airbus, BAE Systems, Boeing, CACI International, Carlyle Group, Cisco, CrowdStrike, General Dynamics, Hanwha Systems, IBM, Israel Aerospace Industries, L3Harris Technologies, Leonardo, Lockheed Martin, ManTech International, Northrop Grumman, Palo Alto, Rafael Advanced Defense Systems, Raytheon Technologies, Rheinmetall, Saab, SAIC, Salient CRGT, and Thales |

| Additional Attributes | Dollar sales by solution type (network security, endpoint, cloud), share by region, adoption trends in defense contracts, regulatory compliance impact, emerging threat vectors, government and private sector spend, key technology integrations, vendor concentration, M&A activity, growth projections, and regional defense modernization programs. |

The global aerospace and defense cyber security market is estimated to be valued at USD 42.6 billion in 2025.

The market size for the aerospace and defense cyber security market is projected to reach USD 108.5 billion by 2035.

The aerospace and defense cyber security market is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types in aerospace and defense cyber security market are network security, _firewall and security appliance, _intrusion detection system (ids), _intrusion prevention system (ips), _secure network infrastructure, endpoint security, _antivirus/antimalware solution, _encryption tool, _biometric device, application security, _encryption device, _secure development tool, _application security testing, cloud security, _secure cloud server and storage device, _cloud encryption software and _cloud access security broker (casb).

In terms of offering, hardware segment to command 56.4% share in the aerospace and defense cyber security market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Aerospace DC-DC Converter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Aerospace 3D Printing Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Radome Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Interior Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Tester Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Avionics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Lightning Strike Protection Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Titanium Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Maintenance Chemical Market - Trends & Forecast 2025 to 2035

Aerospace Head-Up Display Market Report – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA