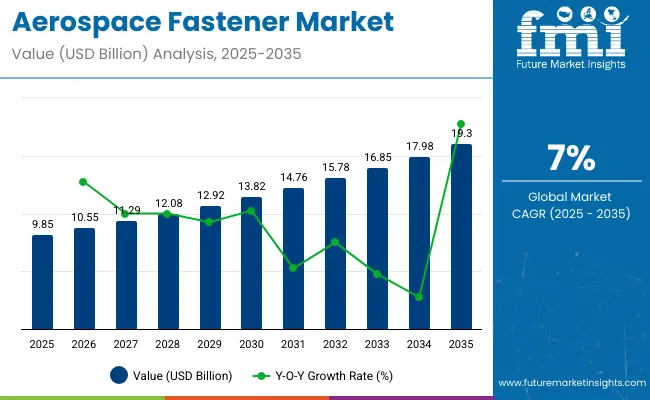

The aerospace fastener market is valued at USD 9.85 billion in 2025 and is expected to reach approximately USD 19.3 billion by 2035, growing at a CAGR of 7%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 9.85 billion |

| Industry Value (2035F) | USD 19.3 billion |

| CAGR (2025 to 2035) | 7% |

Analysis of seasonality and cyclicality reveals recurring patterns influenced by aircraft production cycles, maintenance schedules, and defense procurement timelines. Demand for fasteners tends to peak during periods of high commercial aircraft deliveries and major defense equipment rollouts, while slower intervals coincide with program delays, economic slowdowns, or periods of reduced airline expansion.

Cyclicality is also linked to technological transitions, such as the introduction of lightweight materials, corrosion-resistant alloys, or fasteners compatible with composite structures, which can temporarily boost demand as manufacturers adapt production lines. Maintenance, repair, and overhaul (MRO) cycles contribute additional predictable fluctuations, as older fleets undergo scheduled overhauls requiring replacement fasteners.

By 2035, as the market reaches 19.3 billion, these cyclical trends are expected to stabilize to some extent, supported by steady growth in aircraft manufacturing and global fleet expansion. Understanding these seasonal and cyclical patterns allows manufacturers, suppliers, and investors to optimize inventory management, production planning, and procurement strategies, ensuring alignment with periods of peak demand and minimizing exposure during slower intervals, while capturing long-term value from consistent aerospace activity.

The market is growing alongside increasing commercial aircraft deliveries, which reached over 2,600 units globally in 2024, driving demand for high-performance fasteners. Titanium fasteners accounted for nearly 35% of the market by value, reflecting their use in lightweight aircraft structures. The adoption of composite-compatible fasteners increased by 18% year-on-year, supporting the rise of carbon-fiber-reinforced airframes.

Automated machining and precision coating processes are being implemented in over 60% of manufacturing facilities, improving production consistency. MRO operations are increasingly utilizing predictive inventory systems, reducing downtime by an estimated 12-15% per fleet. Strategic collaborations between OEMs and fastener suppliers are expanding production capacity and aligning supply chains with projected 5-6% CAGR growth in aerospace manufacturing over the next five years.

The aerospace fasteners market is supported by multiple upstream sectors. Aircraft and spacecraft manufacturing represents approximately 41%, as fasteners are essential for structural assembly and component integration. Metal fabrication and precision machining contributes around 26%, supplying titanium, stainless steel, and specialty alloys. Avionics and systems integration accounts for close to 16%, where fasteners are critical for electronics and control modules. Maintenance, repair, and overhaul (MRO) services hold roughly 11%, ensuring replacement, retrofitting, and lifecycle management. Engineering design and certification services contribute the remaining 6%, providing testing, standardization, and compliance for aerospace applications.

Fasteners include rivets, bolts, screws, nuts, and specialty locking devices used across airframes, engines, and interiors. Titanium, high-strength aluminum, and steel alloys dominate, with titanium representing roughly 30% of total fastener volume due to weight reduction advantages. Replacement cycles of 5-7 years sustain aftermarket demand. North America and Europe collectively account for more than 60% of global consumption, while Asia Pacific is the fastest-growing region, driven by rising aircraft production and fleet modernization programs.

Driving Force Aircraft Production and Weight Optimization

Rising aircraft production and demand for lightweight, fuel-efficient designs are key drivers of fastener adoption. Titanium and high-strength aluminum fasteners reduce airframe weight by 5-8%, improving fuel efficiency, while ensuring structural integrity and vibration resistance. Defense aircraft programs increasingly adopt advanced alloys and coated fasteners to withstand harsh environments. Retrofit and maintenance programs provide continuous replacement demand, particularly for engines, landing gear, and control surfaces. OEMs and MRO providers prioritize modular and standardized fasteners to reduce assembly time and improve maintenance efficiency.

Growth Opportunity Specialty and Coated Fasteners

Specialty fasteners with high fatigue strength and corrosion-resistant coatings are driving growth. Coated titanium fasteners are widely used in engines, while anodized aluminum fasteners dominate fuselage and interior assemblies. Emerging smart fasteners with embedded sensors or RFID tracking provide structural health monitoring capabilities, reducing maintenance downtime. Additive manufacturing allows complex geometries with improved strength-to-weight ratios and reduces part count in assemblies. Growth in hybrid-electric and eVTOL aircraft is also creating demand for lightweight, high-performance fasteners that meet stringent aerospace standards.

Emerging Trend Lightweight and Smart Fasteners

Manufacturers are emphasizing lightweight materials and performance enhancements. Titanium and composite fasteners reduce airframe mass while maintaining durability. Smart fasteners with embedded monitoring systems allow real-time tracking of torque, stress, and fatigue life, enhancing safety and reducing maintenance intervals. Advanced manufacturing methods, including additive manufacturing, create complex fasteners with optimized geometries for weight and strength. Adoption of these technologies is higher in next-generation aircraft, supporting both operational efficiency and predictive maintenance programs.

Market Challenge Cost and Regulatory Requirements

Advanced aerospace fasteners carry high costs, ranging from USD 5 to over USD 500 per unit depending on material and function. Compliance with AS9100, SAE AMS, and EN9100 standards requires extensive testing and certification, adding 6-10 weeks to lead times. Supply chain limitations for titanium and specialty alloys create production constraints. Maintenance requires trained personnel and certified torque tools, increasing the total cost of ownership. Price volatility in raw materials further challenges adoption in cost-sensitive aircraft programs.

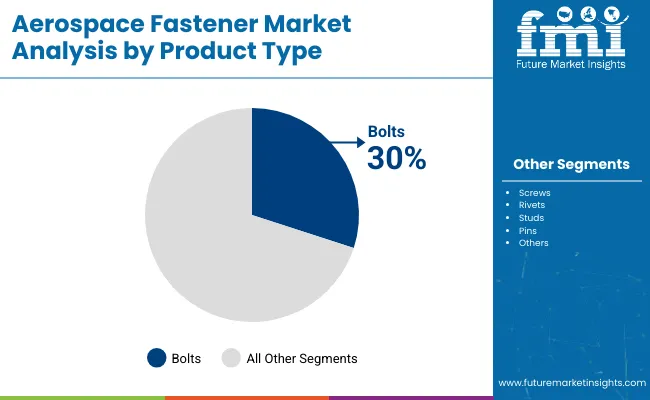

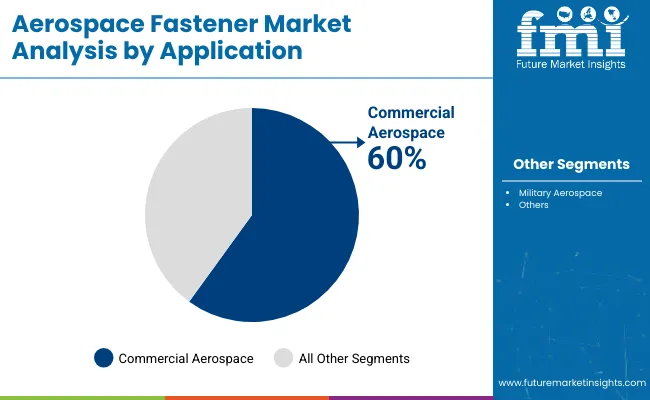

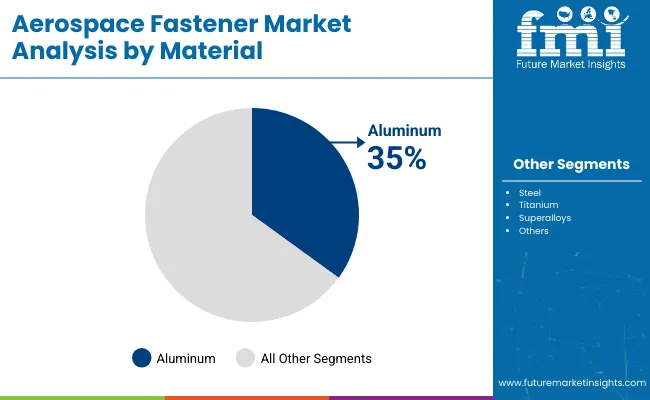

The aerospace fastener market in 2025 is driven by precise engineering requirements across commercial and military aerospace. Bolts, screws, and rivets dominate product demand, contributing 30%, 25%, and 20% respectively. Commercial aerospace accounts for 60% of applications, while military aerospace represents 40%. Aluminum fasteners lead materials at 35%, followed by steel at 30% and titanium at 20%. Key OEMs such as Airbus, Boeing, and Embraer source fasteners from suppliers including Alcoa Fastening Systems, ARaymond, and Stanley Engineered Fastening. Demand is driven by aircraft production, maintenance programs, and the need for lightweight, corrosion-resistant components. Fasteners remain essential for structural integrity, avionics, cabin interiors, and load-bearing assemblies.

Bolts capture the largest share at 30%, followed by screws at 25% and rivets at 20%. Bolts are widely used in fuselage (45%), wing structures (30%), and landing gear assemblies (25%). Screws serve avionics panels (40%), cabin interiors (35%), and control surfaces (25%). Rivets are preferred for fuselage panels (50%), wing skins (30%), and tail assemblies (20%). OEMs including Boeing, Airbus, and Lockheed Martin source these fasteners from Alcoa Fastening Systems, ARaymond, and Stanley Engineered Fastening. Titanium bolts and screws account for 25-30% of total demand, steel 30-35%, and aluminum 40-45%. High precision, corrosion resistance, and fatigue strength are critical for structural and avionics applications.

Commercial aerospace dominates the market with 60% share, driven by fleet expansion and aircraft maintenance requirements. Military aerospace contributes 40%, focusing on fighter jets, transport aircraft, and specialized platforms. Bolts account for 35% of commercial aerospace fasteners, rivets 25%, and screws 20%. In military applications, titanium fasteners are preferred (30%) for high-strength and corrosion-resistant properties. OEMs such as Boeing, Airbus, Embraer, and Lockheed Martin rely on suppliers including ARaymond, Alcoa Fastening Systems, and PennEngineering to meet precise load-bearing and avionics requirements. Both sectors prioritize fatigue resistance, reliability, and material optimization for efficient assembly and long-term performance.

Aluminum leads material demand at 35%, followed by steel at 30% and titanium at 20%. Aluminum is primarily used in fuselage assemblies (45%), wing structures (30%), and cabin interiors (25%) due to its lightweight and corrosion-resistant properties. Steel is employed in landing gear (40%), high-load structural joints (35%), and engine mount assemblies (25%). Titanium is preferred for military aerospace components (50%), control surfaces (30%), and avionics panels (20%). Suppliers such as Alcoa Fastening Systems, ARaymond, and PennEngineering provide aerospace-grade fasteners meeting fatigue, tensile, and certification standards. Material selection directly impacts weight reduction, fuel efficiency, and durability across commercial and defense aircraft.

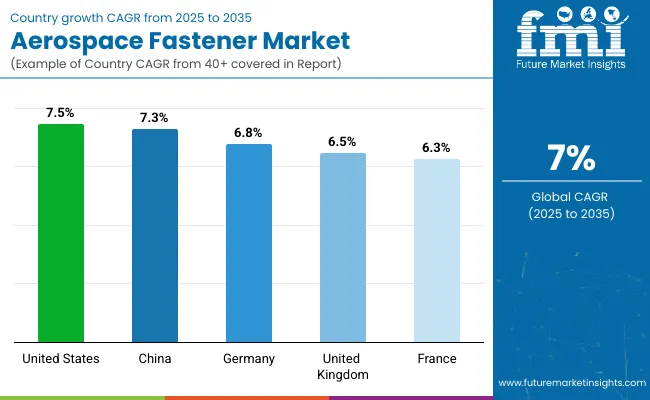

In 2025, the global aerospace fastener market is growing at a CAGR of 7.0% through 2035. The United States leads at 7.5%, +7% above the global average, driven by OECD-backed aerospace production, fleet upgrades, and demand for high-performance components. China follows at 7.3%, +4% higher than the global benchmark, supported by BRICS-focused expansion in commercial and defense aircraft manufacturing and strengthening domestic supply chains. Germany records 6.8%, −3% below the global rate, reflecting steady adoption in a mature aerospace sector. The United Kingdom posts 6.5% and France 6.3%, −7% and −10% under the global CAGR, shaped by incremental fleet modernization and niche aerospace manufacturing. Overall, BRICS countries like China are advancing production capacity, while OECD markets maintain growth through precision engineering, quality control, and regulatory adherence in aerospace fastener operations.

The aerospace fastener market in the United States is projected to grow at a CAGR of 7.5%, above the global 7.0%, yielding a multiplication factor of 1.07. This trend is viewed as a result of increasing demand for advanced airframe assembly and maintenance activities. Adoption of high-strength, corrosion-resistant fasteners is emphasized to meet the needs of commercial jets and defense aircraft. The market is influenced by retrofitting programs in aging fleets and the integration of lightweight alloys. It is believed that US manufacturers are investing in automation and precision tooling to improve production efficiency. By 2035, the installed base of advanced aerospace fasteners is expected to expand significantly, supporting both domestic and international aerospace programs.

China is expected to record a CAGR of 7.3%, slightly above the global CAGR, producing a multiplication factor of 1.04. Growth is driven by expansion of domestic commercial aircraft programs and increasing defense aircraft production. Emphasis is placed on fasteners capable of handling high vibration and thermal cycling conditions. Chinese manufacturers are investing in advanced alloy development and precision machining to enhance product reliability. It is widely believed that outsourcing of fastener assembly to regional suppliers is further accelerating adoption. By 2035, China’s aerospace fastener market is forecast to achieve broad penetration across commercial and defense platforms, supporting large-scale manufacturing programs.

The aerospace fastener market in Germany is growing at a CAGR of 6.8%, slightly below the global 7.0%, yielding a multiplication factor of 0.97. Growth is supported by high-performance applications in commercial airliners and UAVs. Emphasis is placed on lightweight designs and aerospace-grade alloys capable of sustaining operational stress. Adoption of automated quality inspection techniques has enhanced fastener reliability and reduced production errors. Collaborative programs with other European manufacturers are further driving market activity. By 2035, Germany is expected to supply fasteners to a majority of European aircraft projects, while R&D initiatives continue to improve mechanical strength and corrosion resistance.

The United Kingdom aerospace fastener market is projected to expand at a CAGR of 6.5%, below the global 7.0%, with a multiplication factor of 0.93. Growth is primarily driven by retrofitting programs and defense fleet modernization. Fasteners are increasingly designed for durability under high stress and thermal variations. Adoption of standardized designs across multiple aircraft platforms enhances production efficiency. UK aerospace manufacturers focus on integrating advanced alloys and surface coatings to extend service life. By 2035, the United Kingdom is expected to maintain a stable position in the European fastener market, providing solutions for both civil and defense applications.

France is anticipated to record a CAGR of 6.3%, below the global CAGR, resulting in a multiplication factor of 0.90. Market expansion is largely influenced by regional jets and military aircraft programs. Emphasis is placed on fasteners with high corrosion resistance and thermal stability. Advanced CNC machining techniques are increasingly adopted to meet precision requirements. Collaboration between French aerospace suppliers and international OEMs is enhancing design standardization and material performance. By 2035, France is expected to maintain a consistent installed base for aerospace fasteners, supporting both domestic production and exports.

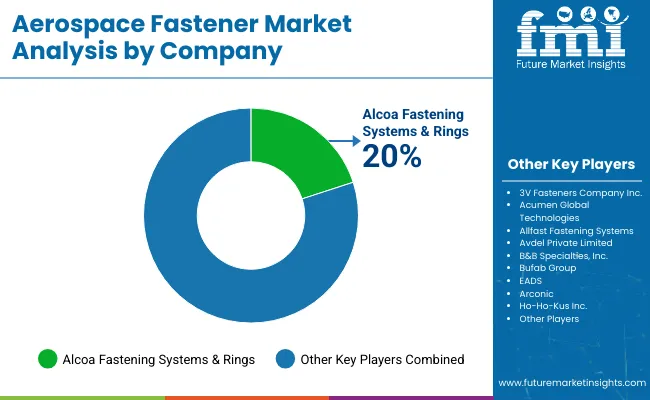

The aerospace fastener market is dominated by global suppliers providing high-strength, lightweight, and corrosion-resistant components for aircraft assembly and maintenance. Alcoa Fastening Systems & Rings is considered the leading player, supported by its extensive product range, global distribution network, and long-term contracts with commercial and defense aircraft manufacturers. 3V Fasteners Company Inc. and Acumen Global Technologies maintain strong positions through specialized fastener solutions and precision manufacturing capabilities, catering to both OEMs and aftermarket needs. Allfast Fastening Systems focuses on threaded inserts and installation systems that simplify assembly processes, while Avdel Private Limited emphasizes rivets and blind fasteners for high-performance aerospace applications.

Other players strengthen the market through niche expertise and regional reach. Companies compete through product quality, precision engineering, and reliable supply chains, ensuring both established and emerging players meet diverse aerospace requirements effectively.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 9.85 billion |

| Projected Market Size (2035) | USD 19.3 billion |

| CAGR (2025 to 2035) | 7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Types Analyzed (Segment 1) | Pins, Bolts, Studs, Screws, Rivets |

| Application Segments Analyzed (Segment 2) | Commercial Aerospace, Military Aerospace |

| Material Types Analyzed (Segment 3) | Aluminum, Steel, Superalloys, Titanium |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, Oceania |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, South Korea, Australia, UAE, Saudi Arabia, South Africa |

| Leading Players | 3V Fasteners Company Inc., Acumen Global Technologies, Advanced Logistics for Aerospace, Alcoa Fastening Systems & Rings, Allfast Fastening Systems, Avdel Private Limited, B&B Specialties, Inc., Bufab Group, EADS, Arconic, Ho-Ho- Kus Inc. |

| Additional Attributes | Dollar sales by fastener type and aircraft application, demand dynamics across commercial, military, and space sectors, regional trends, innovation in lightweight alloys and corrosion-resistant coatings, environmental impact of material use, emerging use in UAVs and electric aircraft |

The market size is valued at USD 9.85 billion in 2025.

It is projected to reach USD 19.3 billion by 2035.

The market is expected to grow at a CAGR of 7% during 2025-2035.

Bolts hold the largest share with 30% in 2025.

Alcoa Fastening Systems & Rings is the leading player with 20% share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Aerospace DC-DC Converter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aerospace 3D Printing Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Radome Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Interior Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Tester Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Avionics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA