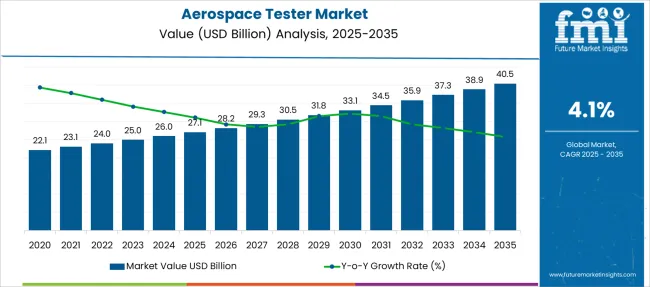

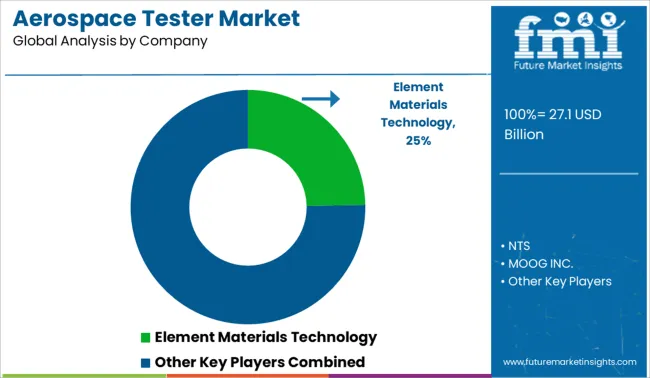

The Aerospace Tester Market is estimated to be valued at USD 27.1 billion in 2025 and is projected to reach USD 40.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Aerospace Tester Market Estimated Value in (2025 E) | USD 27.1 billion |

| Aerospace Tester Market Forecast Value in (2035 F) | USD 40.5 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The aerospace tester market is expanding steadily due to increasing demand for air travel, rising aircraft production rates, and strict regulatory standards for safety and performance validation. Continuous innovation in aircraft design and the use of advanced composite materials have made testing critical at every development and maintenance stage.

As aerospace manufacturers aim to minimize downtime, ensure airworthiness, and meet global compliance benchmarks, the role of high precision testing equipment has become central to operations. The market is further driven by the integration of smart sensors and automated testing systems, which enhance data accuracy and reduce operational inefficiencies.

With growing investments in next generation aircraft and a focus on fuel efficiency and material integrity, the need for reliable aerospace testing technologies continues to accelerate, making this sector a vital component in the aerospace value chain.

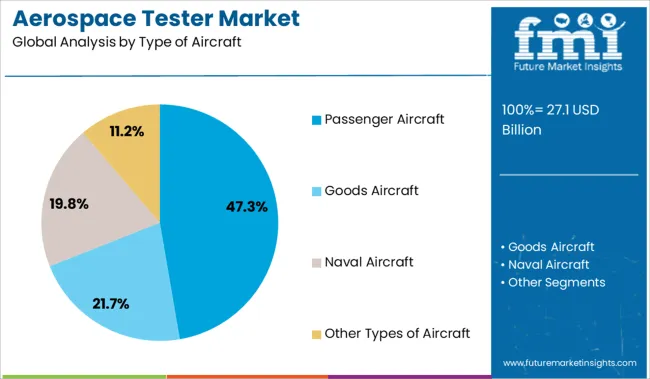

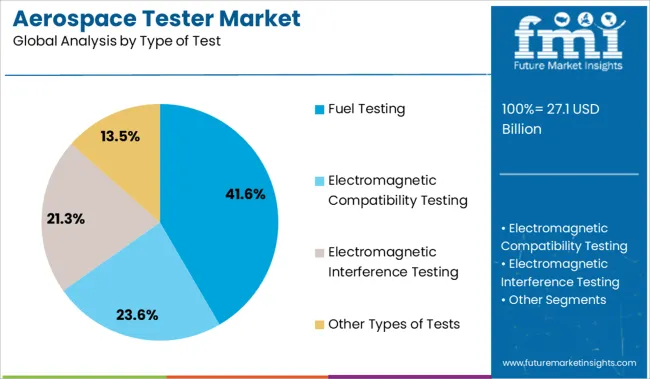

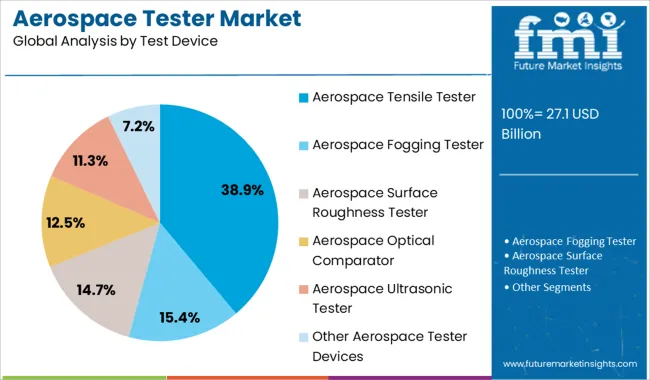

The market is segmented by Type of Aircraft, Type of Test, and Test Device and region. By Type of Aircraft, the market is divided into Passenger Aircraft, Goods Aircraft, Naval Aircraft, and Other Types of Aircraft. In terms of Type of Test, the market is classified into Fuel Testing, Electromagnetic Compatibility Testing, Electromagnetic Interference Testing, and Other Types of Tests. Based on Test Device, the market is segmented into Aerospace Tensile Tester, Aerospace Fogging Tester, Aerospace Surface Roughness Tester, Aerospace Optical Comparator, Aerospace Ultrasonic Tester, and Other Aerospace Tester Devices. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The passenger aircraft segment is projected to contribute 47.30% of the total aerospace tester market revenue by 2025, establishing it as the dominant aircraft type category. This leadership is driven by the continuous surge in global passenger traffic, particularly in emerging economies, and subsequent fleet expansion by commercial airlines.

Regulatory mandates for periodic maintenance, material durability assessment, and fatigue analysis are prompting extensive testing across the lifecycle of passenger aircraft. Moreover, increased demand for lightweight airframes and fuel efficient designs has amplified the need for thorough testing at the component and system levels.

The consistent growth of the commercial aviation sector reinforces the demand for advanced aerospace testing systems specifically tailored for passenger aircraft.

Fuel testing is expected to represent 41.60% of the aerospace tester market revenue by 2025, making it the leading test type segment. This dominance is attributed to growing emphasis on fuel quality assurance, engine performance optimization, and regulatory compliance related to emissions and safety.

With the aviation industry under pressure to reduce carbon footprints, fuel systems are being tested more rigorously for efficiency, contamination, and thermal stability. Additionally, alternative aviation fuels are undergoing extensive validation before commercial integration, further boosting the demand for precise fuel testing systems.

The segment's prominence is reinforced by the critical role of fuel integrity in ensuring safe, reliable, and environmentally compliant flight operations.

The aerospace tensile tester segment is projected to hold 38.90% of the market share by 2025 within the test device category, positioning it as the most utilized device in the industry. This is due to the essential role of tensile testing in evaluating material strength, elasticity, and durability under load bearing conditions.

As aerospace manufacturers increasingly adopt composite materials and advanced alloys, tensile testing has become a cornerstone of material qualification and structural validation processes. These devices offer accurate stress strain analysis, enabling engineers to verify component performance under real world flight conditions.

The aerospace tensile tester’s widespread application in both R and D and maintenance operations secures its leadership position in the test device segment.

The market for aerospace testers is primarily driven by the growing proportion of aircraft. Aerospace testers are in huge demand owing to the stringent standards for aircraft testing during manufacturing. Continuous technological advancements and software upgrades are projected to significantly drive the aerospace tester market during the forecast period.

On the other hand, another major driver of the aerospace tester market is the rising number of aircraft deliveries as the global travel and tourism industry expands. Stringent aviation regulations governing aircraft safety in various countries are increasing demand for aerospace testing services, positively impacting the growth of the aerospace testing market during the forecast period from 2025 to 2035. In the next ten years, technological advancements in aircraft testing, such as magnetic optic imagers and 3D scanning, will surge the growth of the aerospace testing market.

The manufacturers in the aerospace tester market are using the most advanced technologies as well as devices to fulfill the demand of the buyers. But still, the aerospace tester market is not short of impediments.

One of the biggest threats to this industry is software failure and false data recording and this continues to be a major challenge for the worldwide aerospace tester market. Nevertheless, vendors are constantly working to develop sophisticated software to address the current challenges.

Asia is forecasted to surge up at the quickest pace in the upcoming years. As a result of increasing disposable income as well as urbanization, more and more people are beginning to travel a lot more than they used to.

Hence, the demand for more aircraft has soared to whole another level which is in turn anticipated to surge the sales of aerospace testers in the region over the assessment period from 2025 to 2035. Moreover, the aerospace tester market is experiencing rapid year-on-year growth due to an increase in the number of aircraft in developing countries such as China and India.

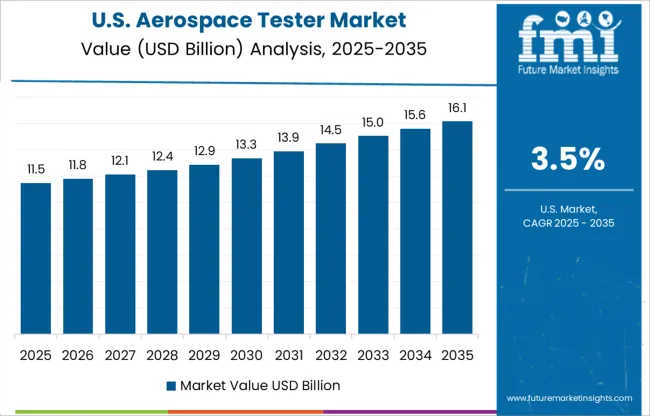

According to Future Market Insights, North America is anticipated to attain a significant market share of the global aerospace tester market. This is because of the presence of an enormous number of aircraft manufacturers in the USA. Owing to this, the demand for aerospace testers is on a spike in North America, and this trend is anticipated to continue during the projected timeframe from 2025 to 2035.

Some of the key participants present in the global aerospace tester market include Element Materials Technology, NTS, MOOG INC., Qualitest International Inc., ADMET, Inc., ECA GROUP, CapitalWorks, Teradyne Inc., Astronics Corporation, Dayton T. Brown, Inc. and others.

The aerospace tester manufacturers are now shifting their focus to the Asia-Pacific region as a result of government initiatives, the availability of cheap labor, and skilled employees.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.1% from 2025 to 2035 |

| Market Value in 2025 | USD 27.1 billion |

| Market Value in 2035 | USD 40.5 billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Type of Aircraft, Type of Test, Test Device, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, United Kingdom, France, Spain, Italy, BENELUX, Russia, China, Japan, South Korea, India, ASIAN, Australia & New Zealand, GCC Countries, Turkey, South Africa |

| Key Companies Profiled | Element Materials Technology; NTS; MOOG INC.; Qualitest International Inc.; ADMET, Inc.; ECA GROUP; CapitalWorks; Teradyne Inc.; Astronics Corporation; Dayton T. Brown, Inc. |

| Customization | Available Upon Request |

The global aerospace tester market is estimated to be valued at USD 27.1 billion in 2025.

The market size for the aerospace tester market is projected to reach USD 40.5 billion by 2035.

The aerospace tester market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in aerospace tester market are passenger aircraft, goods aircraft, naval aircraft and other types of aircraft.

In terms of type of test, fuel testing segment to command 41.6% share in the aerospace tester market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Aerospace DC-DC Converter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Aerospace 3D Printing Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Radome Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Interior Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Avionics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA