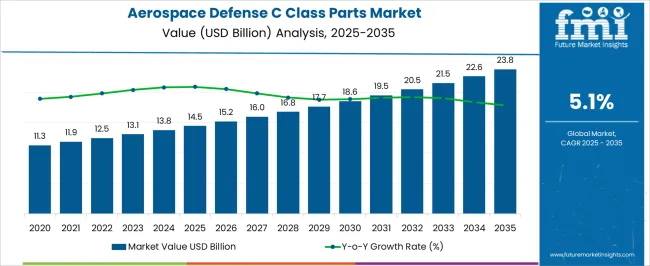

The aerospace defense C-class parts market is estimated to be valued at USD 14.5 billion in 2025 and is projected to reach USD 23.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period. In 2025, the market stands at USD 14.5 billion, with incremental annual growth rising from USD 11.3 billion in 2021 to USD 15.2 billion in 2026. Each year experiences an increase of approximately 4–5%, reflecting consistent demand across aircraft maintenance, repair, and operational support. This predictable YoY expansion allows suppliers and manufacturers to plan procurement, optimize inventory, and secure recurring contracts efficiently.

By 2035, the market is expected to reach USD 23.8 billion, representing an absolute increase of USD 9.3 billion from 2025, supported by the 5.1% CAGR. Year-on-year, values grow steadily from USD 16.0 billion in 2027 to USD 23.8 billion in 2035. This consistent growth pattern enables stakeholders to anticipate component demand, adjust production schedules, and expand operational capacity incrementally. The steady YoY trend underscores a reliable outlook for revenue planning and provides a foundation for long-term engagement across aerospace and defense maintenance operations.

| Metric | Value |

|---|---|

| Aerospace Defense C Class Parts Market Estimated Value in (2025 E) | USD 14.5 billion |

| Aerospace Defense C Class Parts Market Forecast Value in (2035 F) | USD 23.8 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The global aerospace and defense components market, of which C-class parts are a key segment, is projected to grow steadily over the next decade. In 2025, C-class parts account for USD 14.5 billion, representing approximately 22% of the total aerospace and defense components market. By 2035, the segment is expected to reach USD 23.8 billion, maintaining a similar share of around 21–22% of the parent market. This indicates that C class parts will continue to be a significant contributor to revenue, driven by consistent demand for aircraft maintenance, repair, and operational support components. The stable percentage share highlights their continued importance within the broader aerospace supply chain. Year-on-year, the segment grows at a CAGR of 5.1% from USD 14.5 billion in 2025 to USD 23.8 billion in 2035, mirroring the steady growth of the parent market. Maintaining roughly a 22% share over the decade provides manufacturers and distributors with predictable revenue streams and operational planning opportunities. The consistent contribution emphasizes the strategic value of C class parts within the overall aerospace and defense components ecosystem, offering incremental revenue opportunities while supporting the larger market’s expansion.

The aerospace defense C class parts market is gaining momentum due to increased global aircraft production, modernization of defense fleets, and growing emphasis on supply chain reliability. These parts often small, low-cost, and high-volume play a critical role in aircraft assembly, maintenance, and safety compliance.

Demand is being amplified by rising passenger and cargo traffic, alongside aggressive investments in military aviation. Technological improvements in materials, standardization across platforms, and tighter quality control requirements are further fueling adoption.

As OEMs and MRO providers prioritize cost efficiency and traceability, the importance of robust inventory systems and vendor-managed stocking for C class parts is becoming central to market expansion.

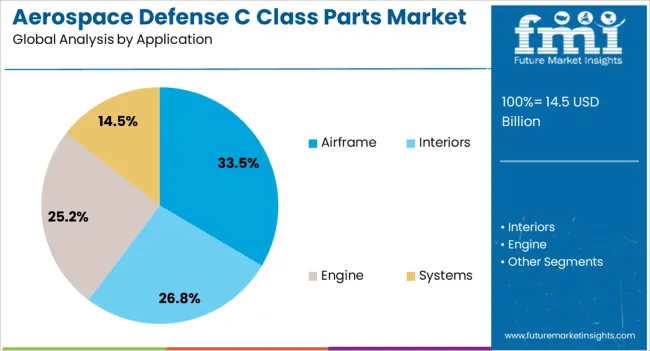

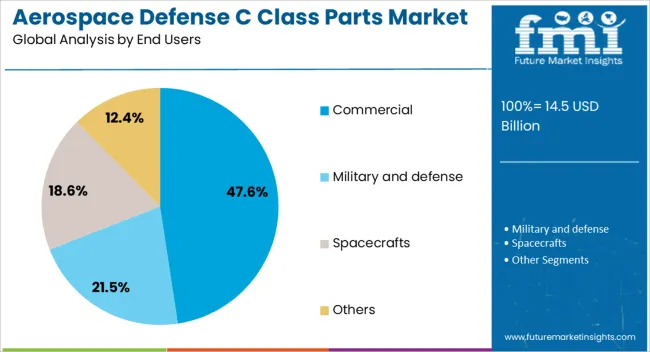

The aerospace defense C-class parts market is segmented by part family/components, application, end users, distribution channel, and geographic regions. By part family/components, the aerospace defense C-class parts market is divided into Fasteners, Bearings, Electrical, and Machined parts. In terms of application, the aerospace defense C-class parts market is classified into Airframe, Interiors, Engine, and Systems. Based on end users, the aerospace defense C-class parts market is segmented into Commercial, Military and defense, Spacecrafts, and Others.

By distribution channel, the aerospace defense C-class parts market is segmented into OEM and Aftermarket. Regionally, the aerospace defense C-class parts industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Fasteners are projected to contribute 39.70% of the total aerospace defense C class parts market by 2025, making them the most dominant component segment. Their widespread use in airframes, engines, interiors, and landing gear supports this high share.

As aircraft designs evolve with composite materials and modular assemblies, fasteners have become critical to both structural integrity and maintainability. The high replacement rate during routine checks and retrofitting, particularly in aging fleets, further boosts demand.

Advanced coatings, lightweight alloys, and precision engineering are helping manufacturers meet stringent performance requirements, enhancing the value proposition of aerospace-grade fasteners.

Airframe applications are expected to command 33.50% of the aerospace defense C class parts market by 2025, the highest among all application types. This share is driven by the substantial volume of components such as clips, clamps, seals, and rivets used in assembling fuselages, wings, and empennages.

The structural complexity and weight sensitivity of airframes necessitate precise, lightweight, and durable parts, directly boosting demand for specialized C class components.

Additionally, as airframe designs shift toward next-generation lightweight materials, there’s increased focus on compatible fastening and support systems that maintain performance while minimizing maintenance downtime.

Commercial end users are estimated to hold 47.60% of the total market share in 2025, emerging as the leading end-use category. The surge in global airline fleets, especially in Asia-Pacific and the Middle East, has created sustained demand for high-volume, cost-sensitive C class parts.

Airlines are placing greater emphasis on lifecycle management, in-service reliability, and inventory efficiency, all of which are directly influenced by the performance of fast-moving consumables like C class parts.

Additionally, growing passenger expectations and aircraft utilization rates are prompting operators to accelerate MRO cycles, thereby increasing consumption of components such as washers, brackets, and latches within the commercial aviation segment.

The aerospace defense C-class parts market is growing as military and commercial aviation sectors demand reliable, cost-effective, and standardized components. C-class parts, which include fasteners, bolts, nuts, washers, and other small yet critical components, are essential for aircraft assembly, maintenance, and operational readiness. Rising defense budgets, modernization programs, and increasing aircraft fleet expansions are driving demand.

Technological advancements in materials, coatings, and manufacturing processes are enhancing durability, corrosion resistance, and precision. Companies offering high-quality, certified, and traceable C-class parts are well-positioned to capture growth across maintenance, repair, overhaul, and new aircraft production segments globally.

The market faces challenges related to supply chain complexity, quality assurance, and regulatory compliance. Aerospace defense C-class parts require strict adherence to standards for safety, material integrity, and traceability. Variations in sourcing, production processes, or raw material quality can compromise component reliability, impacting operational safety. Managing inventory for thousands of part numbers, ensuring timely delivery, and preventing counterfeit components are critical challenges for suppliers and defense contractors. Compliance with multiple certifications, including AS9100 and military specifications, adds to operational complexity. Manufacturers must implement robust quality management systems, traceable sourcing, and rigorous inspection procedures to ensure component reliability, meet regulatory requirements, and maintain customer trust in both commercial and defense aerospace sectors.

The aerospace defense C-class parts market is trending toward advanced materials, automation, and digital inventory management. Use of high-strength alloys, titanium, and corrosion-resistant coatings is enhancing component durability and performance. Automation in production, including precision machining and additive manufacturing, is improving efficiency, accuracy, and consistency. Digital inventory systems, ERP integration, and AI-driven demand forecasting are enabling better supply chain visibility, reducing stockouts, and optimizing order fulfillment. Suppliers are increasingly adopting traceability technologies, such as barcoding and RFID, to ensure authenticity and quality compliance. These trends are helping aerospace and defense operators manage complex inventories, reduce downtime, and improve overall operational efficiency while maintaining stringent safety standards.

The market offers significant opportunities in aircraft maintenance, fleet modernization, and defense procurement programs. Aging military and commercial aircraft fleets require regular replacement of C-class parts to ensure airworthiness and operational readiness. Defense modernization initiatives and new aircraft acquisitions are increasing demand for standardized, certified components. Maintenance, repair, and overhaul (MRO) services rely heavily on timely availability of C-class parts, providing recurring revenue opportunities for suppliers. Expansion into emerging markets with growing defense spending and aviation sectors also presents potential. Companies that provide reliable, traceable, and certified C-class components, along with efficient logistics and inventory solutions, can capitalize on long-term growth across global aerospace and defense programs.

Market growth is restrained by price sensitivity, intense competition, and regulatory complexity. C-class parts are often purchased in large volumes, making cost competitiveness crucial for suppliers. Competition from low-cost regional manufacturers can affect pricing and margins. Regulatory and certification requirements for aerospace and defense applications, including material standards, traceability, and quality compliance, add operational complexity and cost. Delays in approvals or audits can slow supply chain operations, impacting MRO and production timelines. Until cost-effective manufacturing, streamlined compliance processes, and reliable supply chains are widely established, adoption may remain concentrated among operators with robust procurement capabilities and strict quality assurance frameworks.

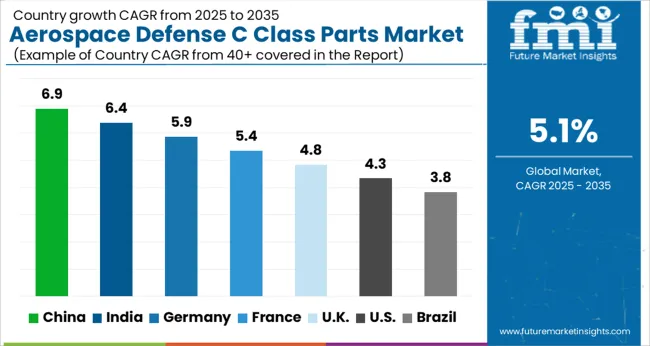

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

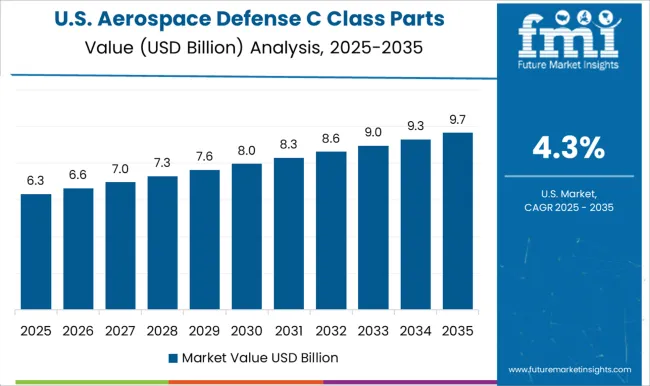

| USA | 4.3% |

| Brazil | 3.8% |

The global aerospace defense C class parts market is projected to grow at a CAGR of 5.1% through 2035, supported by increasing demand across aircraft maintenance, repair, and operational supply chains. Among BRICS nations, China has been recorded with 6.9% growth, driven by large-scale production and deployment in military aircraft and defense logistics, while India has been observed at 6.4%, supported by rising utilization in maintenance and operational readiness programs. In the OECD region, Germany has been measured at 5.9%, where production and adoption for aircraft component supply and defense maintenance operations have been steadily maintained. The United Kingdom has been noted at 4.8%, reflecting consistent use in aerospace and defense maintenance, while the USA has been recorded at 4.3%, with production and utilization across military aviation, repair, and operational support sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China is witnessing significant growth in its aerospace defense C-class parts market, fueled by expanding defense manufacturing capabilities, domestic aerospace programs, and modernization initiatives, with a CAGR of 6.9%. Manufacturers are focusing on precision components, fasteners, and standard parts critical for aircraft, drones, and defense systems. Government programs promoting indigenous defense production, military modernization, and aerospace R&D are accelerating market adoption. Pilot projects in fighter aircraft, UAVs, and commercial aerospace validate operational benefits such as reduced lead times, cost efficiency, and enhanced system reliability. Collaborations between domestic suppliers, research institutes, and defense contractors are enhancing quality, precision manufacturing, and compliance with military standards. Rising demand for advanced aerospace systems and localized supply chain solutions continues to drive China’s C-class parts market.

Aerospace defense C-class parts market in India is expanding at a CAGR of 6.4%, supported by increasing defense procurement, aircraft modernization, and domestic aerospace production. Manufacturers are focusing on fasteners, standard components, and critical parts used in aircraft, UAVs, and defense systems. Government programs promoting Make in India, defense modernization, and indigenous aerospace production are driving adoption. Pilot projects in fighter jets, transport aircraft, and UAV platforms demonstrate operational benefits such as reduced procurement costs, improved supply chain efficiency, and compliance with military standards. Collaborations between domestic suppliers, aerospace research institutions, and defense contractors are advancing production technologies, precision engineering, and quality assurance. Growing investment in defense modernization and aerospace infrastructure is expected to continue driving growth across India’s C-class parts market.

The United Kingdom is experiencing a CAGR of 4.8% in the aerospace defense C-class parts market, driven by domestic aerospace manufacturing, defense upgrades, and precision engineering requirements. Manufacturers are developing fasteners, structural components, and standard parts for aircraft, UAVs, and defense systems. Government programs promoting defense modernization, aerospace research, and industrial supply chain efficiency support market adoption. Pilot projects in fighter jets, transport aircraft, and UAV systems demonstrate operational benefits such as reduced lead times, improved reliability, and supply chain optimization. Collaborations between manufacturers, research institutions, and defense contractors are enhancing precision, quality assurance, and production efficiency. Rising investment in aerospace innovation and defense modernization continues to drive growth in the UK C-class parts market.

The United States aerospace defense C class parts market is growing at a CAGR of 4.3%, driven by domestic military modernization, UAV deployment, and commercial aerospace initiatives. Manufacturers focus on high-strength, precision-engineered, and corrosion-resistant components for engines, airframes, and auxiliary systems. Government programs supporting aerospace R&D, defense procurement, and advanced manufacturing encourage adoption. Pilot projects in fighter jets, transport aircraft, and UAVs show operational benefits such as improved reliability, optimized weight, and enhanced system performance. Collaborations between manufacturers, research institutions, and defense contractors advance precision manufacturing, material innovation, and production efficiency. USA emphasis on defense modernization and aerospace technology sustains growth in the C class parts market.

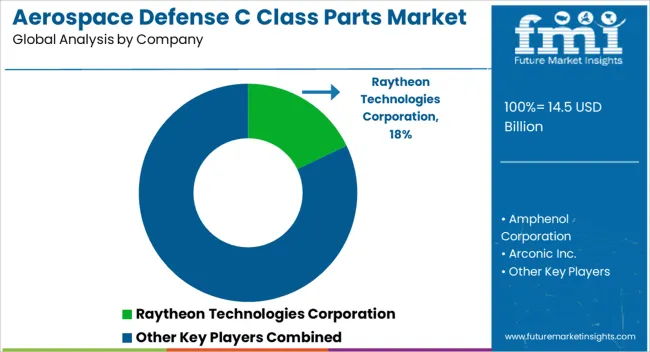

Demand for C-class aerospace and defense components is served by a mix of global OEMs and specialized suppliers, each competing on precision, certification compliance, and delivery reliability. Raytheon Technologies Corporation is positioned as a leading provider, with brochures emphasizing high-precision fasteners, brackets, and small mechanical assemblies, along with detailed tolerance specifications and material certifications. Amphenol Corporation competes with electrical connectors and cabling components, with technical literature highlighting environmental durability, vibration resistance, and aerospace-grade compliance. Arconic Inc. provides aluminum and titanium parts, with brochures detailing dimensional accuracy, fatigue limits, and heat-treatment processes. BAE Systems PLC and Boeing Company offer integrated C-class parts solutions for airframes and systems, with brochures presenting installation instructions, compatibility charts, and material property data. General Dynamics Corporation, Honeywell International, Inc., and Lockheed Martin Corporation focus on mission-critical assemblies, with literature specifying operational tolerances, shock resistance, and regulatory certifications.

Meggitt PLC, NTN Corporation, Precision Castparts Corporation, RCB Bearings Incorporated, Safran SA, SKF Bearings Inc., and Thales Group supply niche components, with brochures highlighting component performance, wear characteristics, and integration guidelines for aircraft, defense vehicles, and spacecraft. Other regional players compete by offering fast lead times, lower volume production, and customized assemblies tailored to specific contractor requirements. Strategies across the market are centered on precision, quality assurance, and supply chain reliability. Investments are directed toward advanced material processing, dimensional control, and traceable manufacturing practices. Partnerships with aerospace OEMs and defense contractors are leveraged to secure long-term contracts and facilitate integration of components into larger systems. Observed industry patterns indicate emphasis on meeting military and civil certification standards, reducing production variances, and providing rapid replacement cycles for C-class components. Product roadmaps frequently include expansions of material types, miniature assemblies, and specialized coatings to withstand operational stresses.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.5 Billion |

| Part Family/Components | Fasteners, Bearings, Electrical, and Machined parts |

| Application | Airframe, Interiors, Engine, and Systems |

| End Users | Commercial, Military and defense, Spacecrafts, and Others |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Raytheon Technologies Corporation, Amphenol Corporation, Arconic Inc., BAE Systems PLC, Boeing Company, General Dynamics Corporation, Honeywell International, Inc., Lockheed Martin’s Corporation, Meggitt PLC, NTN Corporation, Precision Castparts Corporation, RCB Bearings Incorporated, Safran SA, SKF Bearings Inc., and Thales Group |

| Additional Attributes | Dollar sales vary by part type, including fasteners, nuts, bolts, seals, and standard mechanical components; by application, such as airframes, engines, avionics, and maintenance equipment; by end-use, spanning military aircraft, commercial aviation, and unmanned aerial systems; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising aircraft maintenance, repair & overhaul (MRO) activities and increasing defense spending. |

The global aerospace defense C class parts market is estimated to be valued at USD 14.5 billion in 2025.

The market size for the aerospace defense C class parts market is projected to reach USD 23.8 billion by 2035.

The aerospace defense C class parts market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in aerospace defense C class parts market are fasteners, bearings, electrical and machined parts.

In terms of application, airframe segment to command 33.5% share in the aerospace defense C class parts market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Aerospace DC-DC Converter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Aerospace 3D Printing Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Radome Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Interior Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Tester Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Avionics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Lightning Strike Protection Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Titanium Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA