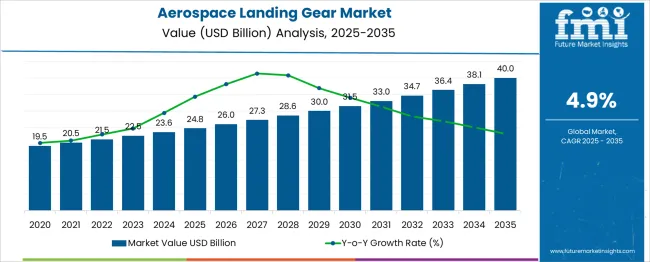

The Aerospace Landing Gear Market is estimated to be valued at USD 24.8 billion in 2025 and is projected to reach USD 40.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period. The data reflects a steady upward trend with no periods of stagnation, indicating a market environment where established suppliers are positioned to maintain or slightly increase share over the decade.

From 2025 to 2030, the market advances to USD 31.5 billion, adding USD 6.7 billion in value. Annual increments during this period average USD 1.3 billion, driven by stable demand for new aircraft production, fleet modernization programs, and aftermarket replacement cycles. Incumbents with long-term OEM partnerships and certification advantages are expected to retain a dominant position, making share erosion unlikely in the early phase.

Between 2030 and 2035, growth adds USD 8.5 billion, with annual gains approaching USD 1.9 billion by the final years. This phase benefits from rising air travel demand, expansion of regional fleets, and upgrades to more advanced and lightweight landing gear systems. The consistent growth trajectory suggests that competitive displacement will be limited, as entry barriers remain high due to regulatory, engineering, and lifecycle support requirements, enabling current leaders to protect and potentially enhance their market share.

| Metric | Value |

|---|---|

| Aerospace Landing Gear Market Estimated Value in (2025 E) | USD 24.8 billion |

| Aerospace Landing Gear Market Forecast Value in (2035 F) | USD 40.0 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The aerospace landing gear market is viewed as a specialized yet steadily expanding category within its parent industries. It is estimated to account for about 3.1% of the global aerospace components market, supported by continuous aircraft production and fleet upgrades. Within the commercial aviation equipment sector, a share of approximately 3.8% is assessed due to the critical role of landing gear systems in passenger and cargo aircraft.

In the military aircraft systems market, around 2.9% is observed reflecting demand for durable and high performance gear in defense fleets. Within the aircraft maintenance, repair, and overhaul (MRO) industry, about 3.4% is evaluated as landing gear overhaul is a recurring service requirement. In the aerospace precision engineering segment, a contribution of roughly 2.6% is calculated due to the high tolerance manufacturing needed for safety critical components.

Market progress has been shaped by growing aircraft deliveries, modernization programs, and focus on weight reduction without compromising safety. Innovations have been directed toward advanced materials such as titanium alloys and high strength composites, as well as integration of health monitoring sensors for predictive maintenance. Interest has been increasing in electric and hybrid actuation systems to replace traditional hydraulics for efficiency gains.

North America has been observed to maintain a dominant position due to established aerospace OEMs and suppliers, while the Asia Pacific is recording rapid growth through expanding commercial airline fleets. Strategic initiatives have included partnerships between landing gear manufacturers and aircraft producers to develop modular, lighter, and more serviceable gear systems that meet next-generation aircraft performance and regulatory standards.

The aerospace landing gear market is witnessing significant expansion, driven by the surge in global aircraft production, increased fleet modernization, and rising demand for fuel-efficient, lightweight systems. Manufacturers are increasingly integrating advanced materials such as titanium alloys and carbon composites to enhance strength-to-weight ratios, reduce maintenance cycles, and meet emission norms.

Moreover, the sector is gaining momentum due to rising aircraft deliveries across the commercial, military, and business aviation sectors. Regulatory compliance, particularly in terms of landing gear reliability and crashworthiness, is also influencing innovation in this domain.

As aviation rebounds from pandemic-related setbacks, robust order backlogs and investments in next-generation aircraft platforms are expected to catalyze long-term growth across key landing gear configurations.

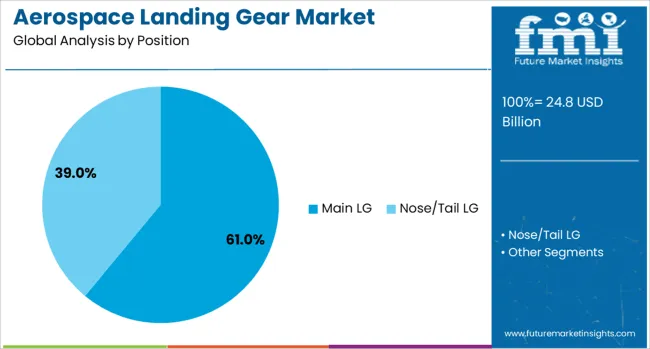

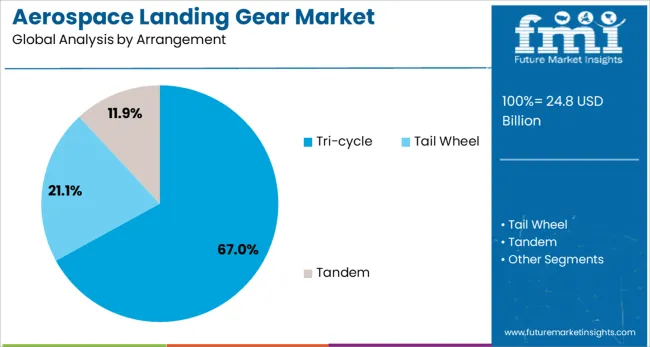

The aerospace landing gear market is segmented by position, arrangement, platform, aircraft category, distribution channel, and geographic regions. The aerospace landing gear market is divided by position into Main LG and Nose/Tail LG. The aerospace landing gear market is classified into Tri-cycle, Tail-Wheel, and Tandem.

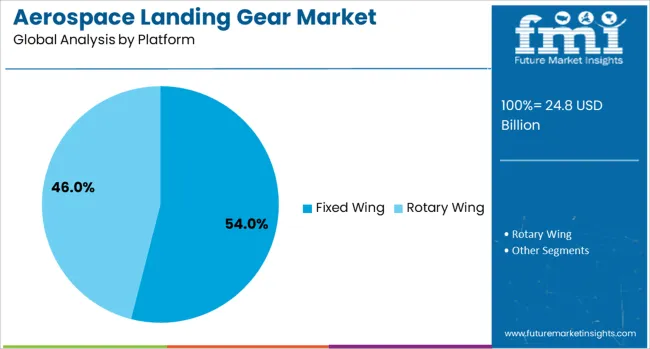

The aerospace landing gear market is segmented into Fixed Wing and Rotary Wing. The aerospace landing gear market is segmented by aircraft category into Commercial Aviation, Military, and General Aviation. The aerospace landing gear market is segmented by distribution channel into OEM and MRO.

Regionally, the aerospace landing gear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Main landing gear (LG) is projected to account for 61.00% of the market share in 2025, establishing it as the dominant landing gear position. This leadership is attributed to the critical structural function it performs by bearing the maximum load during taxi, takeoff, and landing.

Enhanced design focus on shock absorption, retraction systems, and load distribution mechanisms has significantly improved the reliability of the main LG systems. Increased aircraft production and MRO requirements, especially in the narrow-body and wide-body categories, have amplified demand for more durable and easily serviceable main gear assemblies.

Weight optimization and modular integration trends are further solidifying the segment's central role in new airframe designs.

Tri-cycle landing gear configurations are forecast to dominate with a 67.00% revenue share by 2025, led by their widespread application across both commercial and military aircraft platforms. The tri-cycle setup offers superior balance, reduced drag during taxiing, and better pilot visibility, which aligns with operational safety priorities.

Engineering advancements in nose-wheel steering, hydraulic actuation, and distributed braking systems have elevated the functional performance of tri-cycle arrangements.

Moreover, fleet standardization efforts and global airworthiness directives continue to endorse tri-cycle systems as the preferred configuration for new-generation aircraft, contributing to the segment’s sustained dominance.

'

Fixed-wing aircraft are expected to hold 54.00% of the total aerospace landing gear market share in 2025, led by growing commercial and defense aviation demand. The fixed wing category includes a wide range of aircraft, from regional jets to large wide-body airliners and military surveillance planes- each requiring customized yet robust landing gear solutions.

Increasing investments in air cargo transport, along with rapid fleet expansion in Asia-Pacific and the Middle East, are driving platform-specific landing gear innovations. Enhanced lifecycle management, reduced turnaround times, and integration with digital diagnostics are strengthening OEM and Tier 1 supplier focus on fixed-wing landing systems.

The segment’s contribution is set to remain high as next-gen aircraft programs are rolled out globally.

Aerospace landing gear systems have been critical for supporting aircraft during takeoff, landing, and ground operations. These assemblies, which include wheels, shock absorbers, brakes, and retraction mechanisms, have been designed to withstand high loads and varying operational conditions. Demand has been influenced by increasing aircraft production, replacement cycles for existing fleets, and advancements in lightweight and corrosion-resistant materials. Manufacturers have focused on improving structural integrity, reliability, and maintainability to meet the performance requirements of commercial aviation, defense aviation, and emerging advanced air mobility platforms.

The steady rise in commercial and defense aircraft deliveries has been a key driver for landing gear demand. Major aircraft manufacturers in North America, Europe, and Asia-Pacific have placed orders for new gear systems to support expanding fleets. Single-aisle and regional aircraft programs have contributed significantly due to their higher production rates compared to widebody aircraft. Defense programs, including fighter jets, transport aircraft, and maritime patrol planes, have maintained consistent demand for specialized landing gear configurations. Fleet modernization initiatives have also led to replacement orders for upgraded gear assemblies with extended service intervals. The direct link between aircraft production volumes and landing gear orders has created stable growth opportunities for both OEM and aftermarket suppliers.

Innovations in aerospace landing gear design have centered on weight reduction, increased durability, and improved maintenance efficiency. The use of advanced composites, titanium alloys, and high-strength steels has lowered component weight while maintaining load-bearing capacity. Manufacturers have implemented health monitoring systems with embedded sensors to track gear performance in real time, enabling predictive maintenance. Improved corrosion protection coatings and advanced lubrication systems have extended operational lifespans, particularly for aircraft operating in maritime or high-humidity environments. Hydraulic system upgrades and noise reduction features have also been introduced to improve operational smoothness. These advancements have aligned with the aviation sector’s focus on reducing operational costs and enhancing aircraft reliability.

The maintenance, repair, and overhaul (MRO) sector has been a major contributor to landing gear market revenues due to the need for periodic inspections, refurbishments, and component replacements. Regulatory requirements mandate comprehensive landing gear overhauls after a specific number of flight cycles or years in service. MRO providers in North America, Europe, and Asia-Pacific have expanded capabilities to handle a wide range of commercial and defense aircraft models. The increasing trend of outsourcing landing gear maintenance by airlines has created opportunities for independent MRO companies. The integration of digital record-keeping and component traceability has improved service turnaround times, further supporting aftermarket growth.

Aerospace landing gear manufacturing involves high-precision engineering, advanced materials, and stringent testing, all of which contribute to elevated production costs. Long lead times for custom components have created supply chain challenges, particularly when unplanned replacements are required. Smaller airlines and operators of older aircraft have sometimes deferred landing gear upgrades due to budget constraints. Maintenance downtime during gear overhauls has also impacted fleet availability, affecting operational schedules. Fluctuations in raw material prices, especially for titanium and high-grade steel, have further pressured profit margins. Without supply chain optimization and cost reduction initiatives, these challenges may continue to limit broader adoption of advanced landing gear technologies.

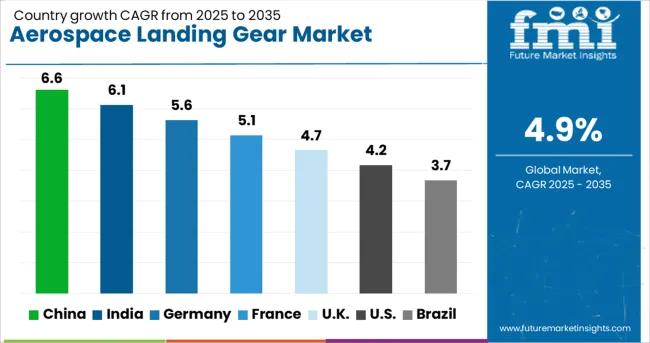

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The aerospace landing gear market is expected to grow at a global CAGR of 4.9% between 2025 and 2035, driven by increasing aircraft production, modernization of fleets, and demand for lightweight, high-strength components. China leads with a 6.6% CAGR, supported by expanding commercial aviation manufacturing and domestic airline growth. India follows at 6.1%, fueled by investments in aerospace infrastructure and rising defense aircraft procurement. Germany, at 5.6%, benefits from advanced engineering capabilities and strong participation in European aerospace programs. The UK, projected at 4.7%, sees growth from maintenance, repair, and overhaul (MRO) activities and aerospace component exports. The USA, at 4.2%, reflects steady demand from commercial, defense, and space sectors. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 6.6% from 2025 to 2035 in the aerospace landing gear market, supported by rapid expansion of domestic aircraft production and fleet modernization programs. Manufacturers such as AVIC Landing Gear Advanced Manufacturing and Xian Aircraft Industrial Corporation are supplying systems for both commercial and military aircraft. Collaboration with international suppliers is enhancing capabilities in composite materials and weight reduction technologies. Growth in regional air travel and government-driven aerospace projects is expected to sustain demand for advanced landing gear assemblies with improved durability and corrosion resistance.

India is forecasted to achieve a CAGR of 6.1% from 2025 to 2035, driven by rising air passenger traffic and expanding defense aircraft procurement. Companies such as HAL, Dynamatic Technologies, and Tata Advanced Systems are investing in landing gear manufacturing for indigenous aircraft programs, including trainer and light combat aircraft. Partnerships with global aerospace firms are accelerating the transfer of advanced machining and assembly technologies. Increasing MRO (maintenance, repair, and overhaul) activity is also boosting demand for replacement landing gear components.

Germany is projected to post a CAGR of 5.6% from 2025 to 2035, supported by its strong position in the European aerospace supply chain. Companies such as Liebherr-Aerospace, Airbus Germany, and Safran Landing Systems Germany are focusing on lightweight alloys, composite structures, and advanced braking systems. Electric taxiing capabilities are being incorporated into new designs to reduce fuel consumption during ground operations. Research into predictive maintenance systems is improving operational reliability and reducing lifecycle costs.

The United Kingdom is expected to record a CAGR of 4.7% from 2025 to 2035, driven by its aerospace manufacturing base and active role in international aircraft programs. Companies such as GKN Aerospace, Safran Landing Systems UK, and Magellan Aerospace are producing advanced landing gear assemblies for both civil and defense aircraft. Demand is growing for systems with enhanced load-bearing capacity to support new-generation wide-body jets. The market is also benefiting from retrofit programs in existing fleets to extend aircraft operational life.

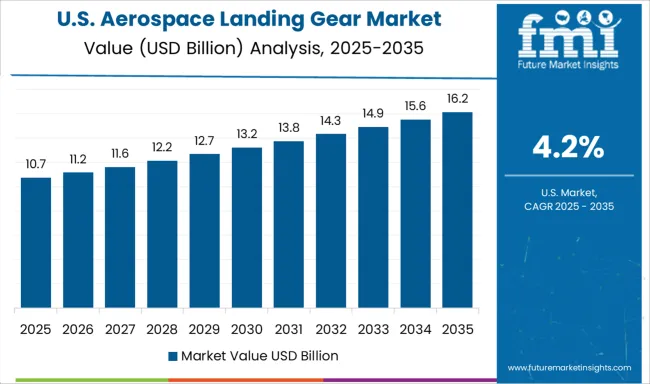

The United States is forecasted to grow at a CAGR of 4.2% from 2025 to 2035, supported by its dominant aerospace manufacturing industry and robust defense procurement pipeline. Major players such as Collins Aerospace, Boeing, and Honeywell Aerospace are advancing landing gear designs with digital health monitoring systems and additive manufacturing processes. The push toward more sustainable aviation operations are driving the use of lightweight composite gear structures. Strong demand from the business jet sector is also contributing to market stability.

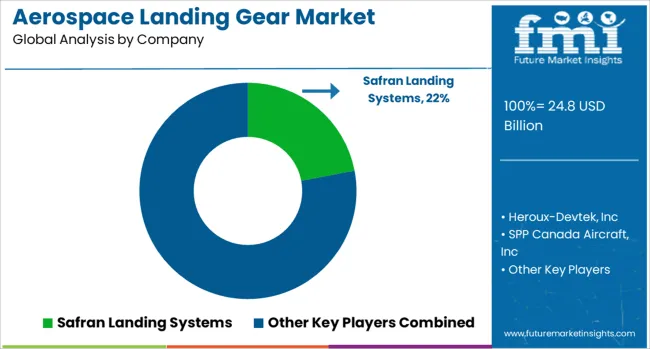

The aerospace landing gear market is led by major aerospace system integrators and precision engineering companies supplying commercial, military, and business aircraft segments. Safran Landing Systems holds a dominant position with comprehensive design, manufacturing, and MRO services for main and nose landing gear, supported by partnerships with leading aircraft OEMs. UTC Aerospace Systems, now part of Collins Aerospace, provides advanced landing gear assemblies featuring weight-reduction technologies and integrated braking systems.

Heroux-Devtek, Inc and Liebherr Group are recognized for supplying both OEM and aftermarket markets, offering fully customized gear systems for regional jets, business aircraft, and military platforms. Triumph Group and GKN Aerospace deliver structural and actuation components, often collaborating with OEMs on next-generation aircraft programs. Magellan Aerospace supports landing gear production with precision machining and assembly capabilities for critical components. SPP Canada Aircraft, Inc specializes in high-performance landing gear for narrow-body and regional aircraft, while Eaton Corporation supplies hydraulic and actuation systems integral to landing gear operation.

Hawker Pacific Aerospace focuses on MRO services, extending the lifecycle of landing gear systems through overhaul, repair, and parts replacement. Key strategies include long-term supply agreements with aircraft manufacturers, investment in lightweight materials such as titanium and advanced composites, and expansion of global MRO networks. Entry into this market is restricted by stringent aerospace certification requirements, high engineering complexity, and established supplier relationships within the aviation industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 24.8 Billion |

| Position | Main LG and Nose/Tail LG |

| Arrangement | Tri-cycle, Tail Wheel, and Tandem |

| Platform | Fixed Wing and Rotary Wing |

| Aircraft Category | Commercial Aviation, Military, and General Aviation |

| Distribution Channel | OEM and MRO |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Safran Landing Systems, Heroux-Devtek, Inc, SPP Canada Aircraft, Inc, Triumph Group, UTC Aerospace Systems, Magellan Aerospace, Liebherr Group, Hawker Pacific Aerospace, GKN Aerospace, and Eaton Corporation |

| Additional Attributes | Dollar sales by landing gear type and vehicle class, demand dynamics across commercial fixed‑wing, business/regional jets, military aircraft, rotary/widebody segments, regional trends in retractable versus fixed gear, main versus nose/tail gear, stainless steel versus titanium, aluminum alloy versus composite material adoption, innovation in lightweight composites, electric/hydraulic actuation, IoT‑enabled predictive maintenance, additive manufacturing, environmental impact of weight-driven fuel emissions, end‑of‑life recycling of alloys, and emerging use cases in urban air mobility (eVTOL), modular gear swap programs, and smart fleet support services. |

The global aerospace landing gear market is estimated to be valued at USD 24.8 billion in 2025.

The market size for the aerospace landing gear market is projected to reach USD 40.0 billion by 2035.

The aerospace landing gear market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in aerospace landing gear market are main lg and nose/tail lg.

In terms of arrangement, tri-cycle segment to command 67.0% share in the aerospace landing gear market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Aerospace DC-DC Converter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Aerospace 3D Printing Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Radome Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Interior Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Tester Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Avionics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA