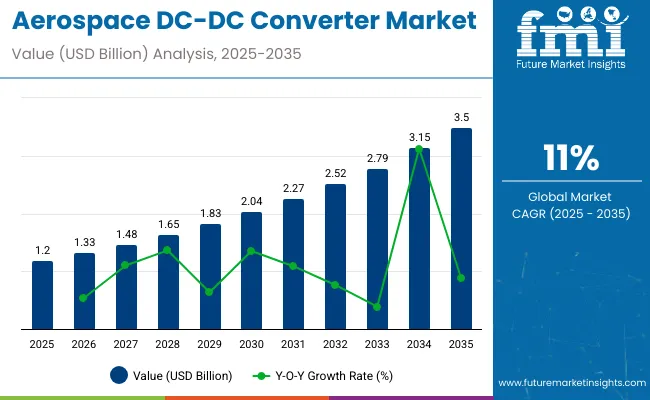

The aerospace DC-DC converter market stands at USD 1.2 billion in 2025 and will reach USD 3.5 billion by 2035, expanding at a CAGR of 11%, corresponding to a multiplying factor of approximately 2.9x over the decade.

Analysis of the growth rate volatility index shows that the market experiences fluctuations driven by technological innovation cycles, evolving defense and commercial aerospace requirements, and regulatory adjustments. Periods of faster expansion occur when high-efficiency, lightweight converters are introduced to meet rigorous aerospace performance standards, while slower phases result from budget constraints, delayed aircraft programs, or supply chain disruptions.

Short-term disruptions, such as component shortages or changes in production schedules, can temporarily affect growth rates but do not disrupt the long-term upward trajectory. Advances in thermal management, miniaturization, and higher power density have contributed to more consistent expansion in recent years.

By 2035, as the market reaches 3.5 billion, volatility is expected to moderate due to broader adoption of advanced DC-DC converters across commercial and military aerospace applications. Recognizing these fluctuations allows manufacturers and investors to plan strategically in production, inventory, and research and development, ensuring temporary slowdowns are managed while long-term growth opportunities are captured.

The market is witnessing a shift towards miniaturized, energy-efficient, and thermally optimized DC-DC converters. Aerospace manufacturers are increasingly adopting converters with advanced digital control capabilities to enhance voltage stability and reduce power losses. Radiation-tolerant and high-reliability designs are gaining prominence for space-bound applications and high-altitude aviation.

Modular and scalable converter architectures are facilitating easier integration, upgrades, and retrofitting across diverse aircraft platforms. Strategic collaborations between OEMs, power electronics manufacturers, and system integrators are accelerating innovation, ensuring compliance with rigorous safety standards while supporting the transition toward hybrid-electric and electrically augmented propulsion systems.

The market is primarily underpinned by several critical sectors. Aerospace and defense avionics systems contribute approximately 42%, reflecting the essential role of converters in power management for aircraft and spacecraft. Power electronics manufacturing accounts for around 27%, encompassing the production of high-efficiency converters, voltage regulators, and isolation modules.

Aircraft and spacecraft assembly represents close to 18%, integrating these components into commercial airliners, military platforms, and unmanned systems. Certification, testing, and compliance services contribute roughly 8%, ensuring adherence to stringent aerospace standards. Lifecycle support and aftermarket services comprise the remaining 5%, covering maintenance, retrofitting, and reliability management across operational fleets.

Driven by the growing electrification of avionics, flight control, and auxiliary systems. Commercial aircraft account for roughly 65% of total installations, while regional and military platforms contribute the remainder. Power ratings typically range from 50 W to 10 kW, with higher wattage units used in emergency and auxiliary systems. Replacement cycles of 8-12 years ensure predictable aftermarket demand, and North America and Europe together represent over 60% of installed units, with Asia Pacific expanding steadily as commercial aircraft production rises.

Growth Opportunity Modular and High-Efficiency Designs

Modular DC-DC converters enable integration with multiple voltage architectures, supporting both 28 V and 270 V networks commonly used in commercial and regional aircraft. Compact units reduce installation footprint by 20-25%, improving cabin and payload efficiency. High-efficiency designs lower energy losses by up to 12% and reduce thermal management requirements, which supports lighter cooling systems.

Emerging platforms like eVTOL and hybrid-electric regional aircraft are increasing demand for lightweight, reliable, and high-power-density modules. Standardized modular systems also allow faster fleet upgrades, reduce maintenance downtime, and extend lifecycle value, presenting growth opportunities across both commercial and defense aviation sectors.

Driving Force Electrification and Operational Efficiency

Electrification of aircraft systems is accelerating the adoption of DC-DC converters to replace hydraulic and pneumatic power. These converters stabilize voltage for avionics, lighting, and emergency backup systems, ensuring consistent operation under variable load.

Weight reduction of 3-5% per aircraft through higher power density modules improves fuel efficiency, while enhanced thermal designs reduce the need for additional cooling equipment. Airlines and military operators are prioritizing solid-state converters to improve reliability, redundancy, and overall system safety. Integration with advanced flight control and autopilot systems further drives the requirement for high-precision voltage regulation across a growing number of aircraft subsystems.

Emerging Trend Smart Monitoring and Connectivity

Modern DC-DC converters are increasingly integrated with intelligent power management platforms that enable real-time load monitoring and predictive diagnostics. Early detection of potential faults reduces in-service failures by 12-15% and minimizes downtime. Higher switching frequencies combined with advanced thermal dissipation allow smaller form factors without compromising efficiency.

Communication-enabled converters feed data into fleet management systems, providing analytics for maintenance scheduling and system optimization. Integration with avionics, auxiliary, and emergency systems allows coordinated power distribution, supporting electrification trends and improving overall operational safety.

Market Challenge Cost, Certification, and Supply Constraints

Advanced aerospace DC-DC converters are priced between USD 5,000 and USD 50,000 per unit, depending on power, voltage, and certification levels. Compliance with DO-160 and DO-254 standards requires extensive testing, extending development cycles by 6-9 months. High reliability requirements for thermal, vibration, and electromagnetic compatibility increase engineering complexity.

Supply chain limitations for high-grade semiconductors and magnetic materials can create lead time variability of 8-12 weeks. Fleet operators require planned replacements to maintain operational continuity, and high costs combined with certification and reliability demands continue to limit adoption among smaller manufacturers.

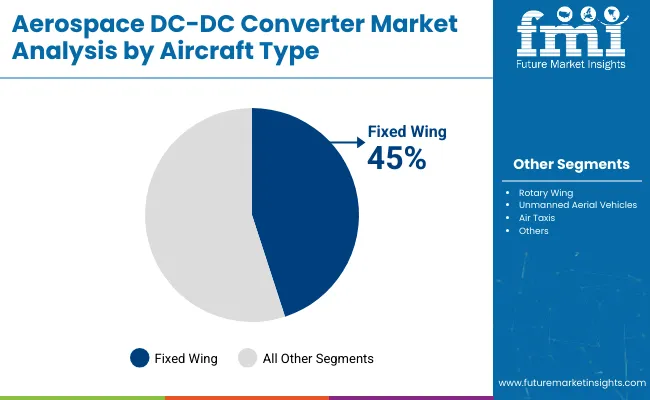

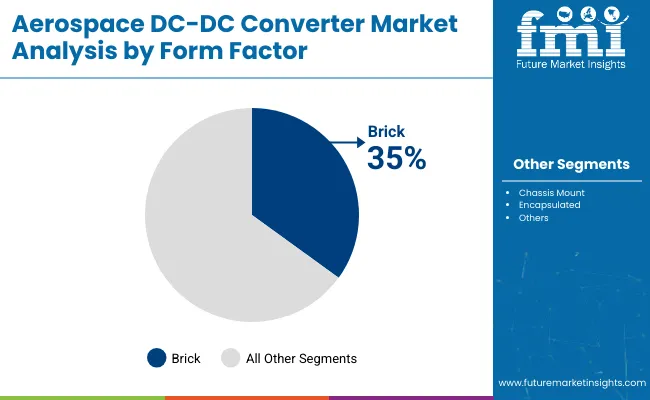

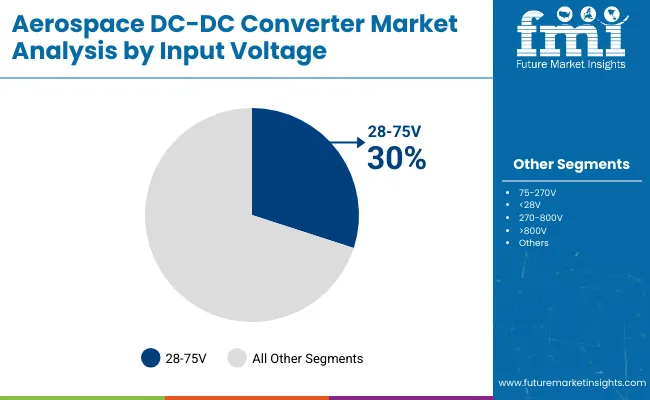

The Aerospace DC-DC Converter market is segmented by aircraft type, form factor, input voltage, output voltage, output power, output number, type, and application. Fixed wing aircraft dominate adoption due to commercial and military integration. Brick and chassis mount form factors are preferred for compact installation and thermal efficiency.

Converters with 28-75V input and 24V output are widely used in avionics and flight control. Single-output isolated converters account for the largest share, providing reliable and safe power. Manufacturers such as Vicor, TDK Lambda, and Murata focus on lightweight, high-efficiency designs with wide voltage ranges. UAVs and air taxis are gaining traction due to urban air mobility and surveillance requirements, creating growth opportunities across all segments.

Fixed wing aircraft hold 45% of market share as they integrate multiple DC-DC converters for avionics, navigation, flight control, and auxiliary systems. Rotary wing aircraft follow at 25%, primarily helicopters used in defense, emergency rescue, and commercial transport. UAVs account for 20%, driven by surveillance, mapping, and reconnaissance missions requiring lightweight, high-efficiency power modules.

Air taxis, emerging at 10% share, are adopting DC-DC converters for electric propulsion and onboard electronics. Manufacturers including Vicor, TDK Lambda, and Murata optimize converters for fixed wing platforms to handle higher power demands, maintain thermal stability, and reduce weight. Fixed wing adoption remains strongest in North America and Europe, supported by both civil aviation growth and military fleet modernization programs.

Brick form factor DC-DC converters lead at 35% due to compact design, efficient cooling, and flexibility in avionics rack integration. Chassis-mount units’ account for 30%, offering modular installation for commercial aircraft and industrial systems. Encapsulated converters hold 25%, valued for durability in harsh conditions such as UAVs and rotorcraft.

Brick converters provide high power density while supporting wide input voltage ranges, critical for modern fixed wing and rotary wing aircraft. Manufacturers like Murata, Vicor, and TDK Lambda focus on optimizing thermal performance, EMI suppression, and weight reduction. Demand for brick converters is driven by the need for reliable, lightweight, and efficient power modules across military, commercial, and urban air mobility applications.

Converters with 28-75V input voltage hold 30% of the market, offering compatibility with standard aircraft electrical systems. Units with 75-270V account for 25%, <28V at 20%, 270-800V at 15%, and >800V at 10%. Lower and mid-range input converters are widely adopted in fixed wing and rotary wing aircraft, while higher voltage units are emerging for UAVs and air taxis.

Wide input tolerance ensures stable operation under fluctuating aircraft power conditions. Manufacturers like Vicor and TDK Lambda design converters with robust EMI suppression and thermal management to operate reliably across all aerospace platforms, maintaining precise output voltage even under variable load conditions.

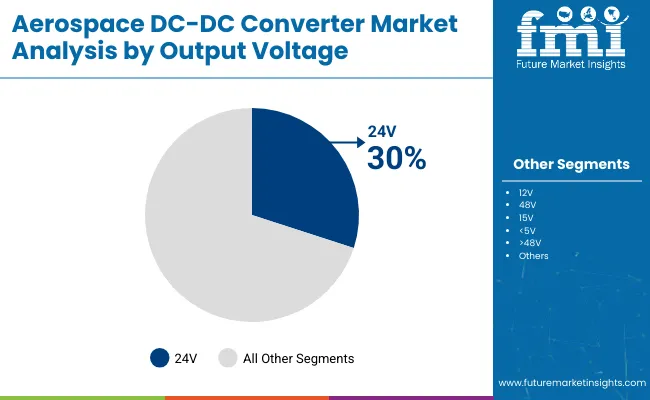

24V output converters dominate at 30% as they are compatible with most avionics, flight control, and auxiliary systems. 12V outputs follow at 25%, 48V at 20%, 15V and <5V at 10% each, and >48V at 5%. Multiple output voltages are increasingly used to supply power to sensors, communications, actuators, and energy storage systems simultaneously.

These converters must maintain stable voltage under extreme temperature, vibration, and EMI conditions. Manufacturers including Vicor, Murata, and TDK Lambda focus on producing lightweight, high-efficiency 24V converters with integrated protection features, making them the preferred choice across fixed wing, rotary wing, and UAV platforms.

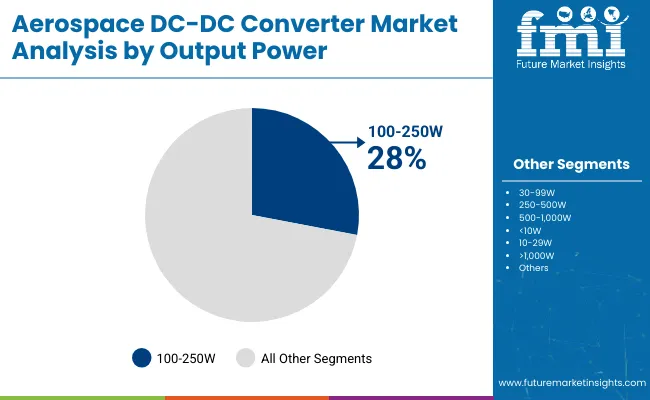

Converters rated 100-250W lead the market with 28% share, providing power for avionics, sensors, and flight control electronics. Units in the 30-99W range account for 25%, 250-500W at 20%, 500-1,000W at 15%, <10W and 10-29W at 5% each, and >1,000W at 2%. Medium-power converters balance size, weight, and efficiency, ideal for fixed wing aircraft and UAVs.

High-power units are often used in propulsion and energy storage systems, while low-power converters are suited for payload electronics. Manufacturers prioritize thermal management, efficiency, and EMI mitigation to ensure reliable operation in high-stress aerospace environments.

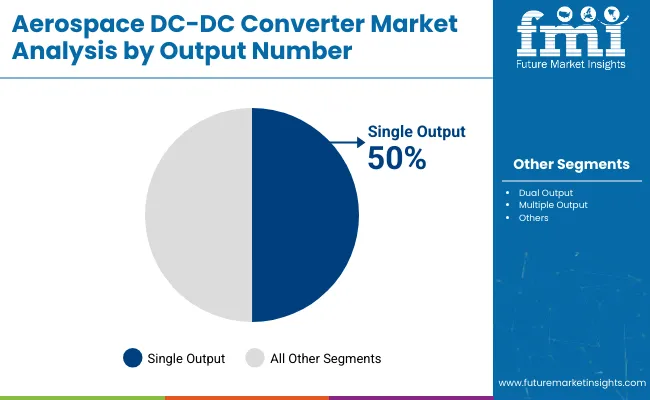

Single-output converters dominate with 50% share due to simplicity, reliability, and focused power delivery to individual avionics subsystems. Dual-output units account for 35% and multiple-output units 15%, providing simultaneous power for sensors, flight control, and communications.

UAVs and air taxis increasingly adopt dual or multiple output converters for compact, lightweight, and energy-efficient systems. Manufacturers including Vicor, TDK Lambda, and Murata design single-output converters to ensure stable voltage under variable load, with protection against thermal stress and voltage spikes. Single-output units are widely preferred for critical avionics where isolation and dedicated power are required.

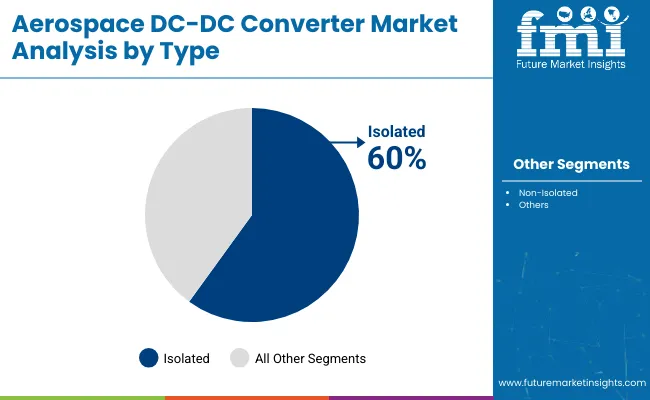

Isolated DC-DC converters lead with 60% share to provide galvanic separation between input and output, ensuring protection of sensitive avionics and flight systems. Non-isolated converters account for 40% and are used in low-risk circuits. Isolated converters reduce EMI, prevent voltage surges, and improve reliability for avionics, flight control, and surveillance systems.

Manufacturers focus on designing compact, lightweight isolated converters with wide input tolerance and high thermal stability. These units are critical for high-density avionics racks, UAV payload electronics, and urban air mobility platforms.

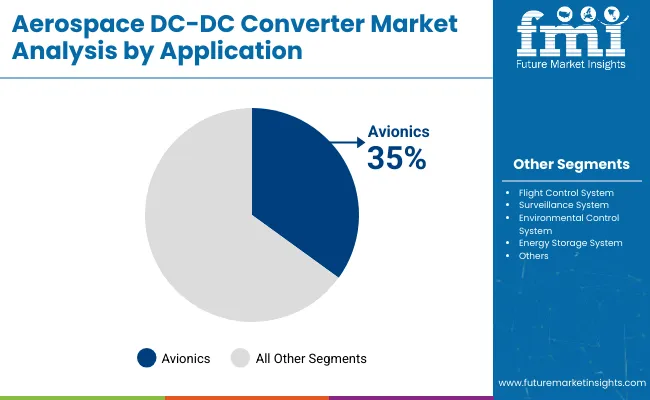

Avionics systems lead application demand at 35%, powering navigation, communication, radar, and mission-critical electronics. Flight control systems account for 25%, surveillance 15%, environmental control and energy storage 10% each. DC-DC converters must maintain precise voltage under extreme vibration, temperature, and EMI conditions. Single-output and isolated converters dominate avionics power delivery, while dual and multiple-output units support complex UAV and electric aircraft systems. Leading manufacturers such as Vicor, TDK Lambda, and Murata focus on high-efficiency, lightweight units to reduce system weight while providing reliable power in commercial, defense, and urban air mobility platforms.

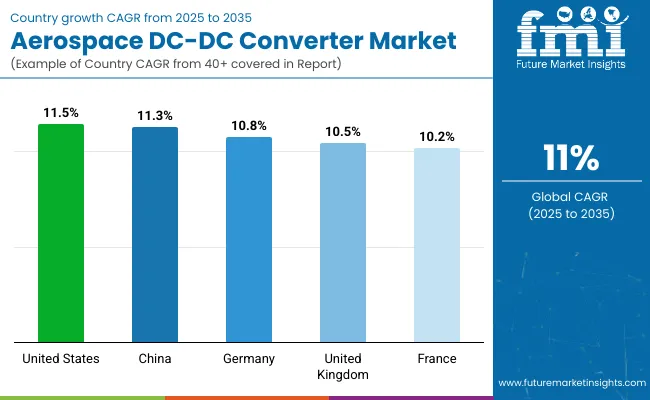

The global aerospace DC-DC converter market is growing at a CAGR of 11.0% from 2025 to 2035. The United States leads at 11.5%, +5% above the global average, driven by OECD-supported aerospace modernization, integration of advanced avionics, and increasing focus on power-efficient aircraft systems. China follows closely at 11.3%, +3% above the global rate, reflecting BRICS-led investments in aircraft electrification, expanding domestic production, and modernization of commercial and defense fleets. Germany records 10.8%, −2% under the global benchmark, with growth tempered by a mature aerospace sector and incremental adoption of new power management technologies.

The United Kingdom posts 10.5%, −5% below the global rate, influenced by steady fleet upgrades and limited scale of new aircraft programs. France stands at 10.2%, −7% under the global average, where expansion is moderated by slower replacement cycles and gradual implementation of advanced DC-DC systems. The BRICS and OECD economies show balanced growth, with the United States and China leading innovation and production.

The United States aerospace DC-DC converter market grows at a CAGR of 11.5%, above the global 11%, giving a multiplication factor of 1.045. Growth is supported by large-scale commercial aviation expansion, defense aircraft modernization, and increasing demand for unmanned aerial platforms.

Advanced DC-DC converters are being deployed to reduce system weight, improve thermal stability, and enhance vibration tolerance, enabling higher efficiency in both manned and unmanned aircraft. Federal and state-level investments support consistent procurement across diverse fleets. Research and development efforts are focused on increasing energy density, integrating digital diagnostics, and optimizing reliability in extreme operational conditions. By 2035, the total installed base of DC-DC converters in the United States is projected to surpass 15,000 units, securing its position as a leading global market.

The demand of aerospace DC-DC converter in China grows at 11.3% CAGR, slightly above the global 11%, resulting in a multiplication factor of 1.027. Growth is driven by expanding domestic commercial aircraft production, defense fleet upgrades, and regional aerospace export demand.

The market emphasizes high-performance converters designed to be compact, lightweight, and vibration-resistant, supporting both civil and defense aircraft platforms. Manufacturers prioritize reliability testing, thermal efficiency improvements, and compliance with international aerospace standards. China has emerged as a major supplier to Asia-Pacific defense programs, exporting advanced converters while scaling domestic installations. By 2035, the installed base is expected to exceed 12,500 units, with ongoing R&D focusing on enhanced energy density, reduced weight, and automated power management solutions across new aircraft models.

The aerospace DC-DC converter market in Germany grows at 10.8% CAGR, slightly below the global 11%, with a multiplication factor of 0.982. Growth is driven by high-performance requirements in commercial airliners, UAVs, and defense platforms, where precision, thermal efficiency, and compact designs are critical. Manufacturers emphasize miniaturized converters with vibration and electromagnetic compatibility, supporting safe operation in demanding aerospace environments.

Production for both new builds and retrofitted platforms continues steadily, with contracts spanning European aerospace programs and specialized UAV deployments. By 2035, Germany is projected to supply over 10,000 converters, balancing domestic demand and exports, while R&D efforts enhance energy density, thermal management, and operational reliability across high-performance platforms.

The United Kingdom aerospace DC-DC converter market grows at a CAGR of 10.5%, below the global 11%, resulting in a multiplication factor of 0.955. Market expansion is concentrated on UAVs, rotary-wing aircraft, and urban air mobility platforms requiring compact, reliable, and high-energy-density converters.

The UK market emphasizes miniaturization, thermal management, and integration into both civil and defense fleets. Manufacturers focus on optimizing weight, improving operational efficiency, and meeting strict aviation safety standards. By 2035, over 8,500 platforms in the UK are expected to feature advanced DC-DC converters, with ongoing R&D enhancing performance, reliability, and suitability for diverse operational conditions, including unmanned and experimental aircraft applications.

The aerospace DC-DC converter market grows at 10.2% CAGR, slightly below the global 11%, with a multiplication factor of 0.927. Growth is supported by regional jet programs, defense aircraft, and satellite applications, emphasizing lightweight, thermally efficient, and vibration-resistant converters.

French manufacturers are enhancing multifunctional designs and standardization across civil and defense applications, while collaborative projects within Europe optimize platform compatibility. By 2035, the installed base is expected to exceed 7,500 units, with hybrid and electric aerospace platforms contributing to adoption. Advanced R&D focuses on improving converter energy density, thermal performance, and operational reliability, ensuring that France maintains a competitive position in European aerospace power management systems.

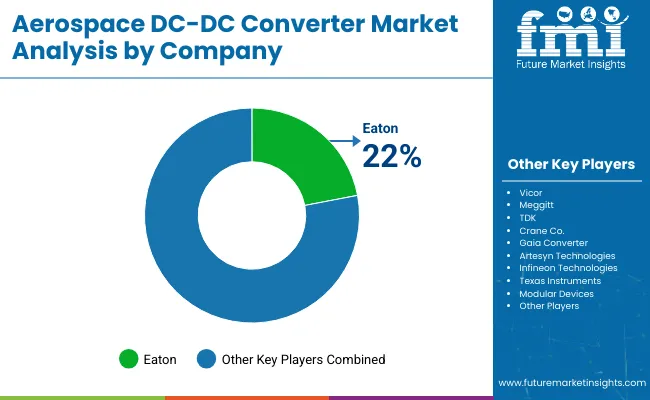

The market is dominated by established global companies and specialized suppliers focusing on high-reliability, lightweight, and high-efficiency power solutions for aircraft and defense applications. Eaton is considered the assumed market leader, due to its extensive portfolio of aerospace-grade converters, long-standing OEM partnerships, and investment in compact, high-efficiency designs suitable for commercial and military aircraft. Vicor and Meggitt follow closely, offering modular and scalable power conversion systems, often integrated into avionics and onboard electronics for next-generation aircraft. TDK and Crane Co. focus on designing converters with high thermal tolerance and voltage stability, catering to stringent aerospace standards.

Other key players are shaping the market with targeted innovations and regional strategies. Artesyn Technologies and Gaia Converter emphasize lightweight and high-efficiency DC-DC modules for commercial aviation, while Infineon Technologies and Texas Instruments provide high-reliability semiconductor solutions that enhance converter performance.

Modular Devices, AJ's Power Source, Tame-Power, Bel Power Solutions, Lone Star Aviation, VPT Inc., Advanced Energy, and Avionics Instrument focus on niche applications, customized designs, and integration support for aerospace and defense clients. These strategies, including R&D, product launches, and OEM collaborations, enable companies to maintain competitive positions in the aerospace DC-DC converter market globally.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.2 billion |

| Projected Market Size (2035) | USD 3.5 billion |

| CAGR (2025 to 2035) | 11% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value, units for volume where applicable |

| Aircraft Types Analyzed | Fixed Wing, Rotary Wing, Unmanned Aerial Vehicles (UAVs), Air Taxis |

| Form Factors Analyzed | Chassis Mount, Encapsulated, Brick, Others |

| Input Voltage Segments | <28V, 28-75V, 75-270V, 270-800V, >800V |

| Output Voltage Segments | <5V, 12V, 15V, 24V, 48V, >48V |

| Output Power Segments | <10W, 10-29W, 30-99W, 100-250W, 250-500W, 500-1,000W, >1,000W |

| Output Number Segments | Single Output, Dual Output, Multiple Output |

| Type Segments | Isolated, Non-Isolated |

| Application Segments | Avionics, Flight Control System, Surveillance System, Environmental Control System, Energy Storage System, Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, South Korea, Australia, UAE, Saudi Arabia, South Africa |

| Leading Players | Eaton, Vicor, Meggitt, TDK, Crane Co., Gaia Converter, Artesyn Technologies, Infineon Technologies, Texas Instruments, Modular Devices |

| Additional Attributes | Dollar sales by converter type and aircraft platform, demand dynamics across commercial, military, and space applications, regional adoption trends across North America, Europe, and Asia-Pacific, innovation in high-efficiency, lightweight, and radiation-hardened designs, environmental impact of energy efficiency and material usage, emerging use cases in electric propulsion, avionics power management, and satellite systems |

The market is projected to reach USD 3.5 billion by 2035.

The market is expected to grow at a CAGR of 11% during 2025-2035.

Fixed wing aircraft accounts for 45% share in 2025.

Brick form factor holds 35% share in 2025.

Eaton is the leading player with 22% market share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Aerospace 3D Printing Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Radome Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Interior Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Tester Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Avionics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA