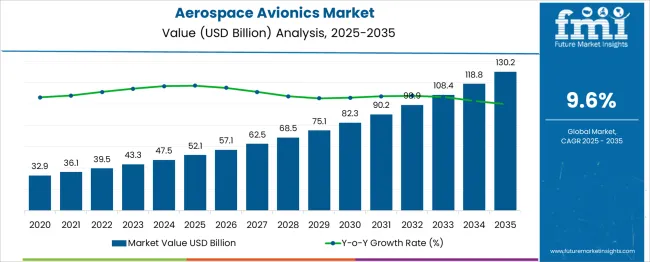

The Aerospace Avionics Market is estimated to be valued at USD 52.1 billion in 2025 and is projected to reach USD 130.2 billion by 2035, registering a compound annual growth rate (CAGR) of 9.6% over the forecast period. The data shows a consistent increase in annual market value, with gains accelerating notably in the latter half of the decade. Between 2025 and 2030, the market grows from USD 52.1 billion to USD 82.3 billion, adding USD 30.2 billion, which accounts for nearly 39% of the total decade’s opportunity.

Annual value increments rise from USD 5.0 billion between 2025 and 2026 to USD 7.2 billion by 2029–2030, reflecting strong demand from commercial fleet modernization, advanced navigation systems, and military avionics upgrades. From 2030 to 2035, the market expands from USD 82.3 billion to USD 130.2 billion, adding USD 47.9 billion, representing about 61% of the total opportunity.

Annual additions in this phase accelerate further, with the largest single-year gain of USD 11.4 billion occurring between 2034 and 2035. Next-generation aircraft platforms drive this surge, integrated digital cockpit systems, and increasing avionics content per aircraft. The absolute dollar opportunity analysis indicates significant and compounding value creation, particularly in the latter years, suggesting that market participants with scalable production and advanced technology portfolios will be best positioned to capture this growth.

| Metric | Value |

|---|---|

| Aerospace Avionics Market Estimated Value in (2025 E) | USD 52.1 billion |

| Aerospace Avionics Market Forecast Value in (2035 F) | USD 130.2 billion |

| Forecast CAGR (2025 to 2035) | 9.6% |

The aerospace avionics market is viewed as a specialized yet steadily expanding category within its parent industries. It is estimated to account for about 3.3% of the global aerospace systems market, supported by continuous upgrades in flight control, navigation, and communication systems. Within the commercial aircraft equipment sector, a share of approximately 3.9% is assessed as airlines modernize fleets with advanced avionics for fuel efficiency and safety.

In the military aircraft systems market, around 3.1% is observed reflecting demand for mission critical avionics in defense operations. Within the unmanned aerial systems (UAS) industry, about 2.8% is evaluated due to integration of autonomous navigation and sensor systems. In the space and satellite launch vehicle segment, a contribution of roughly 2.4% is calculated as avionics play a role in guidance and telemetry systems.

Market advancement has been shaped by the demand for real time data processing, enhanced situational awareness, and integration of digital technologies in aviation. Innovations have been directed toward next generation flight management systems, open architecture avionics platforms, and augmented reality displays for pilots. Interest has been increasing in avionics supporting autonomous flight capabilities and predictive maintenance analytics.

The North America region has been observed to lead in technology development and adoption, while Asia Pacific is experiencing rapid growth through expanding airline fleets and defense modernization programs. Strategic initiatives have included collaborations between avionics manufacturers and aircraft OEMs to develop modular, upgradeable systems that reduce lifecycle costs, improve interoperability, and comply with evolving global aviation regulations.

The aerospace avionics market is evolving rapidly due to rising commercial aircraft production, increasing defense modernization initiatives, and growing demand for next-gen cockpit technologies. Integrated digital flight control systems and real-time data communication platforms are being prioritized to enhance operational safety and reduce pilot workload.

Governments and OEMs are collaborating to embed AI and predictive diagnostics into avionics suites, which is expanding upgrade cycles and aftermarket opportunities. As sustainability becomes central, the shift toward lightweight, power-efficient avionics is supporting fuel economy and emissions compliance.

Strategic investments in connected flight technologies and autonomous navigation systems are likely to accelerate innovation. Regulatory frameworks favoring digital aviation infrastructure and heightened focus on pilot assistance during long-haul operations are expected to drive steady avionics system adoption.

The aerospace avionics market is segmented by systems, platforms, fit, point of sales, and geographic regions. The aerospace avionics market is divided into Flight management computers, Communications, Power & data management, Weather detection, Flight management, Electronic flight display, and Payload & mission management. In terms of the platform, the aerospace avionics market is classified into Commercial aviation.

The aerospace avionics market is segmented into Line-fit and Retrofit. The point of sales of the aerospace avionics market is segmented into Original Equipment Manufacturer (OEM) and Aftermarket. Regionally, the aerospace avionics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

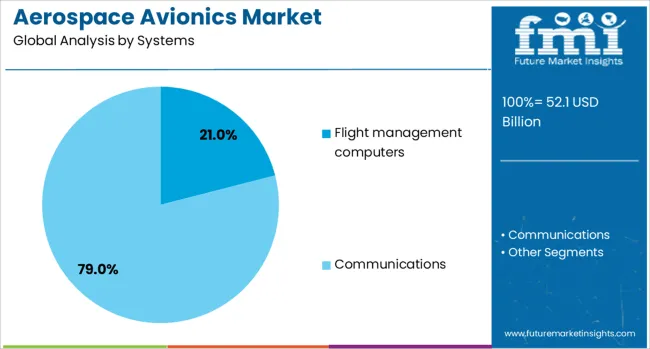

Flight management computers are anticipated to account for 21.0% of total market revenue by 2025, making them the leading avionics system segment. Their dominance is being supported by the critical role they play in route optimization, fuel efficiency, and in-flight automation.

As flight operations become increasingly digitized, these computers are central to achieving compliance with evolving air traffic management protocols. The integration of performance-based navigation, 4D trajectory calculations, and auto-throttle controls has expanded their functionality in both commercial and military aircraft.

Demand is further reinforced by airlines’ emphasis on operational cost reduction and error minimization, which has made FMS upgrades a key priority in retrofit programs.

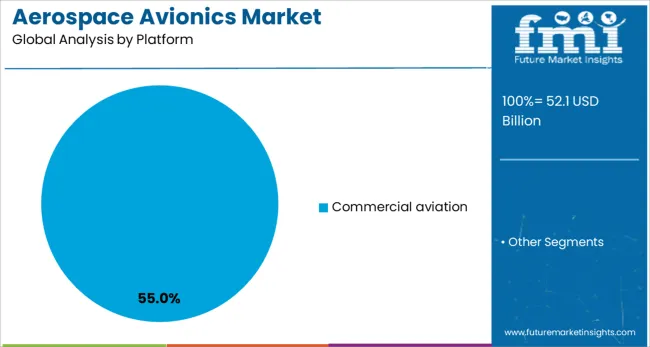

Commercial aviation is projected to hold 55.0% of the total aerospace avionics market by 2025, making it the leading platform segment. This leadership is driven by the continued expansion of passenger air traffic, especially in the Asia-Pacific and the Middle East, prompting airlines to expand and modernize their fleets.

Avionics systems in this segment are being upgraded to meet stringent safety standards, reduce pilot workload, and support long-haul connectivity. The push toward digital transformation, including EFB integration and satellite-based navigation, is accelerating investments in avionics modernization across narrow-body and wide-body aircraft.

Furthermore, aircraft OEMs are embedding smart avionics during manufacturing to align with airline preferences for enhanced fuel performance and operational analytics.

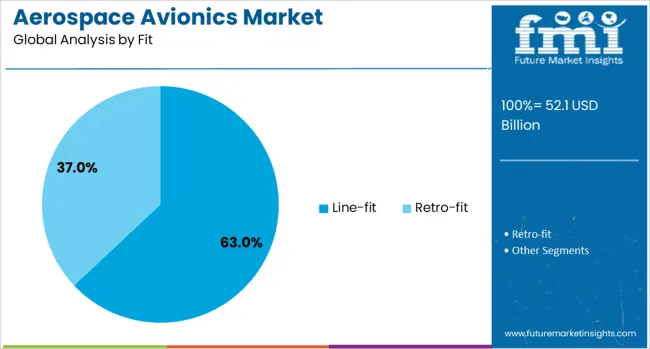

Line-fit avionics installations are expected to command 63.0% of the total market share in 2025, solidifying their position as the dominant fit type. This preference is being reinforced by OEM-driven standardization of advanced systems into new aircraft production lines.

Line-fit solutions offer cost efficiencies, reduced integration complexity, and immediate airworthiness compliance, which are critical for commercial airline procurement. The trend toward pre-certified, modular avionics suites further supports line-fit adoption, especially for time-sensitive aircraft deliveries.

Additionally, OEM partnerships with avionics suppliers are ensuring early-stage technology integration, which simplifies lifecycle management and reduces post-delivery retrofitting costs for airlines and defense contractors alike.

The aerospace avionics market has been advancing steadily as demand for enhanced flight safety, navigation accuracy, and operational efficiency has increased in both commercial and defense aviation. Avionics systems, including communication, navigation, surveillance, and flight control modules, are being installed to support modern airspace management requirements. Growth has been supported by fleet modernization programs, rising passenger traffic, and evolving air traffic regulations. Technological innovations in sensor integration, data processing, and human-machine interfaces have improved cockpit performance. Expanding aircraft production and retrofit activities across global fleets have further accelerated market adoption, making avionics a critical enabler of aerospace safety and efficiency.

Significant advancements in avionics technology have been observed to improve aircraft operational capabilities. Integration of satellite-based navigation systems, real-time weather tracking, and predictive maintenance analytics has enhanced decision-making for pilots and operators. Fly-by-wire systems, advanced autopilot features, and head-up displays have improved precision and reduced pilot workload. Connectivity enhancements such as integrated data links and in-flight broadband have increased situational awareness for crews. Modular and upgradeable architectures have been developed to extend system lifespan and facilitate compliance with evolving regulations. These innovations have reinforced avionics as a vital element in ensuring efficiency, safety, and reliability in modern aviation operations.

Aerospace avionics have been widely adopted across multiple aviation sectors. In commercial aviation, advanced avionics suites have been installed to meet stringent navigation, communication, and safety requirements while enhancing fuel efficiency. Defense aviation has utilized ruggedized systems with advanced targeting, surveillance, and electronic warfare capabilities. General aviation and business jets have integrated compact, lightweight avionics to improve operational convenience and situational awareness. The increasing use of unmanned aerial systems (UAS) has driven demand for specialized avionics supporting autonomous operations and remote piloting. This broad application spectrum has sustained steady demand across varying market cycles and regional economic conditions.

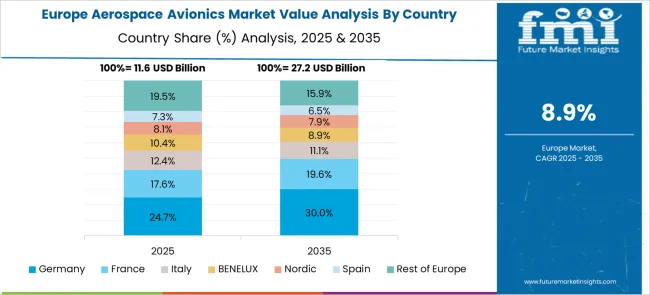

Regional demand patterns have been shaped by varying levels of aircraft production, defense spending, and regulatory requirements. North America has maintained strong adoption due to extensive commercial and military aviation fleets and robust R&D capabilities. Europe has focused on integrating avionics solutions aligned with Single European Sky initiatives and sustainability goals. Asia-Pacific has experienced rapid growth, driven by increasing passenger traffic and large-scale fleet expansion in China, India, and Southeast Asia. The Middle East has invested heavily in avionics for modernizing fleets and supporting new airport infrastructure. Collaborative programs between avionics manufacturers and regional aerospace companies have facilitated localized production and customization.

Despite positive growth trends, the aerospace avionics market has faced challenges, including high system costs and complex certification processes. Compliance with stringent safety and performance standards has extended development timelines and increased R&D expenses. Rapid technological evolution has led to shorter product life cycles, creating pressure for frequent upgrades. Cybersecurity threats to connected avionics systems have raised concerns about data integrity and flight safety. Supply chain disruptions, particularly for specialized electronic components, have delayed production schedules. Addressing these challenges through standardization, cybersecurity enhancements, and strategic partnerships has been considered essential to maintaining market competitiveness and long-term growth.

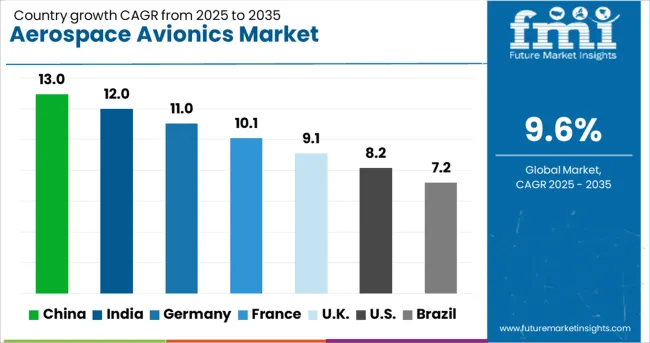

| Country | CAGR |

|---|---|

| China | 13.0% |

| India | 12.0% |

| Germany | 11.0% |

| France | 10.1% |

| UK | 9.1% |

| USA | 8.2% |

| Brazil | 7.2% |

The aerospace avionics market is expected to grow at a global CAGR of 9.6% between 2025 and 2035, driven by increasing aircraft production, demand for advanced navigation and communication systems, and modernization of defense and commercial fleets. China leads with a 13.0% CAGR, supported by rapid expansion in commercial aviation manufacturing and defense programs. India follows at 12.0%, fueled by indigenous aerospace projects and growing airline fleets. Germany, at 11.0%, benefits from strong aerospace engineering capabilities and participation in European aviation initiatives. The UK, projected at 9.1%, sees growth from avionics upgrades and defense contracts. The USA, at 8.2%, reflects steady demand from commercial, defense, and space sectors. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is forecasted to grow at a CAGR of 13.0% from 2025 to 2035, driven by increasing domestic aircraft production and modernization of commercial fleets. State-owned manufacturers such as AVIC and COMAC are integrating advanced avionics suites with enhanced navigation, communication, and flight management capabilities. Growing investments in indigenous satellite navigation systems are boosting demand for compatible avionics solutions. The civil aviation sector’s expansion, coupled with regional airport development, is accelerating installations in both passenger and cargo aircraft.

India is expected to register a CAGR of 12.0% from 2025 to 2035, supported by rising air travel demand and expansion of domestic airlines. Companies such as Hindustan Aeronautics Limited (HAL) and private suppliers are partnering with global avionics firms to deliver upgraded cockpit systems for both civilian and military aircraft. Government-backed programs for regional air connectivity are creating demand for modern avionics in small and medium-sized aircraft. The defense aviation sector’s modernization is also driving procurement.

Germany is projected to grow at a CAGR of 11.0% from 2025 to 2035, with strong demand from both civil aviation and defense aerospace segments. Leading players such as Lufthansa Technik and Diehl Aerospace are advancing avionics integration with real-time data analytics, enhanced automation, and improved fuel efficiency. Collaborations with European aerospace programs, including Airbus projects, are boosting innovation. Demand is further supported by export contracts to NATO and allied countries.

The United Kingdom is forecasted to grow at a CAGR of 9.1% from 2025 to 2035, driven by fleet modernization in both commercial and military aviation. BAE Systems and Cobham Aerospace are enhancing avionics solutions with advanced communication, situational awareness, and safety features. Investment in research programs for next-generation flight control systems is shaping future product offerings. The market also benefits from ongoing upgrades in training aircraft used by the Royal Air Force.

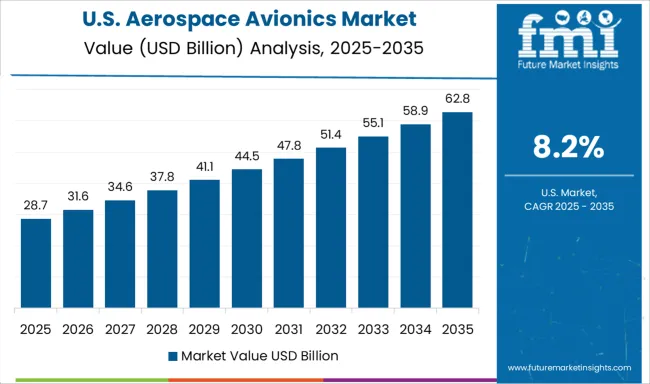

The United States is projected to grow at a CAGR of 8.2% from 2025 to 2035, with strong demand from commercial aviation, defense programs, and space exploration initiatives. Companies such as Honeywell Aerospace, Collins Aerospace, and Garmin are focusing on integrated avionics systems with enhanced connectivity and cybersecurity. FAA mandates for upgraded navigation and surveillance systems are accelerating adoption. The defense sector’s emphasis on advanced avionics for unmanned aerial systems (UAS) is also fueling growth.

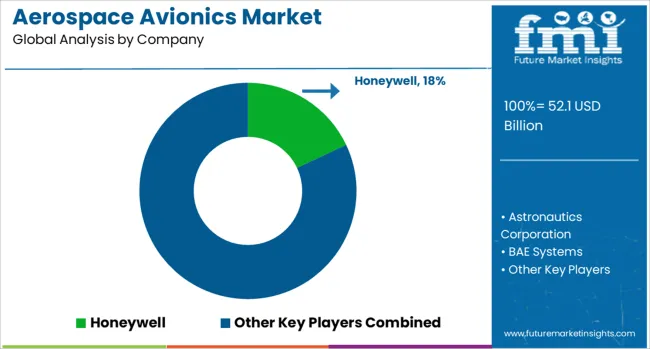

The aerospace avionics market is led by global aerospace technology companies and defense contractors supplying advanced flight control, navigation, communication, and monitoring systems for commercial, business, and military aircraft. Honeywell and Thales dominate with comprehensive avionics suites covering cockpit displays, flight management systems, and integrated communication platforms.

BAE Systems and Northrop Grumman provide mission-critical avionics for military and aerospace applications, focusing on situational awareness and electronic warfare capabilities. Garmin is a leader in general aviation and business jet avionics, offering integrated flight decks and GPS-based navigation solutions.

Raytheon and L3Harris deliver advanced radar, surveillance, and communication systems for both civil and defense aviation sectors. Elbit Systems and Leonardo specialize in military and rotary-wing avionics, incorporating helmet-mounted displays and mission management systems. General Electric supplies engine monitoring, flight data, and electrical power systems, while Curtiss-Wright provides precision flight control components and data acquisition solutions.

Safran focuses on flight data systems, avionics software, and cockpit integration for commercial aircraft. Meggitt delivers sensors and monitoring systems critical to avionics performance. Astronautics Corporation offers specialized display and navigation solutions, particularly for retrofit markets, and TransDigm provides avionics components and subsystems through its portfolio of aerospace brands.

Key strategies include long-term OEM partnerships, modernization programs for existing aircraft, and development of modular avionics architectures for adaptability across multiple platforms. Entry barriers are high due to stringent certification requirements, extensive integration expertise, and established supplier relationships within the aerospace industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 52.1 Billion |

| Systems | Flight management computers, Communications, Power & data management, Weather detection, Flight management, Electronic flight display, and Payload & mission management |

| Platform | Commercial aviation |

| Fit | Line-fit and Retro-fit |

| Point of Sales | Original equipment manufacturer (OEM) and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell, Astronautics Corporation, BAE Systems, Curtiss-Wright, Elbit Systems, Garmin, General Electric, L3Harris, Leonardo, Meggitt, Northrop Grumman, Raytheon, Safran, Thales, and TransDigm |

| Additional Attributes | Dollar sales by system type and aircraft category, demand dynamics across commercial aviation, military aircraft, and business jets, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in integrated modular avionics, satellite-based navigation, and AI-enabled flight management systems, environmental impact of avionics manufacturing, power consumption, and end-of-life recycling, and emerging use cases in unmanned aerial systems, urban air mobility platforms, and next-generation air traffic management solutions. |

The global aerospace avionics market is estimated to be valued at USD 52.1 billion in 2025.

The market size for the aerospace avionics market is projected to reach USD 130.2 billion by 2035.

The aerospace avionics market is expected to grow at a 9.6% CAGR between 2025 and 2035.

The key product types in aerospace avionics market are flight management computers, _flight management, _flight management computers, _autopilot computers, _i/o and interface controllers, _analog attitude indicators, _analog vertical speed indicators, communications, _transponders, _transceivers, _antennas, _transmitters, _receivers, _others, power & data management, _power conversion devices, _cockpit voice recorders, _flight data recorders, _data transfer systems, weather detection, _weather radar, _lighting detection sensors, flight management, _flight management computers, _autopilot computers, _i/o and interface controllers, _analog attitude indicators, _analog vertical speed indicators, electronic flight display, _primary flight display, _multi-function flight display, _navigation display, _others, payload & mission management, _payload management computers, _mission computers, _electro-optics, _sonar and _radar.

In terms of platform, commercial aviation segment to command 55.0% share in the aerospace avionics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Aerospace DC-DC Converter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Aerospace 3D Printing Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Radome Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Interior Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Tester Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA