The Aerospace Foams Market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 9.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period.

| Metric | Value |

|---|---|

| Aerospace Foams Market Estimated Value in (2025 E) | USD 4.4 billion |

| Aerospace Foams Market Forecast Value in (2035 F) | USD 9.3 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

The aerospace foams market is experiencing substantial growth, driven by the increasing demand for lightweight, high-performance materials in commercial and military aircraft. Rising focus on fuel efficiency, noise reduction, and enhanced passenger comfort is accelerating the adoption of advanced foam materials. The market is further influenced by growing aerospace production in both emerging and established economies, with manufacturers seeking materials that reduce overall aircraft weight while maintaining structural integrity and thermal insulation properties.

Polyurethane and other high-performance foams are being increasingly applied to cabin interiors, seating, insulation panels, and vibration dampening solutions due to their superior mechanical properties and compliance with stringent fire, smoke, and toxicity regulations. Continuous innovations in foam chemistry and processing techniques are enabling customized solutions for diverse aerospace applications.

Increasing collaborations between aircraft OEMs and material suppliers are also facilitating the development of foams that improve safety, efficiency, and lifecycle performance As global air travel demand rises and sustainability initiatives gain traction, the aerospace foams market is positioned for sustained expansion with significant opportunities for technologically advanced materials.

The aerospace foams market is segmented by foam type, application, and geographic regions. By foam type, aerospace foams market is divided into Polyurethane Aerospace Foam, Polyethylene Aerospace Foam, Ceramic Aerospace Foam, Metal Aerospace Foam, and Other Aerospace Foam Types. In terms of application, aerospace foams market is classified into Aerospace Foam for Commercial Aircrafts and Aerospace Foam for Defense Aircrafts. Regionally, the aerospace foams industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyurethane aerospace foam segment is projected to hold 21.3% of the aerospace foams market revenue share in 2025, making it the leading foam type. Its prominence is being driven by superior mechanical strength, thermal insulation, and lightweight properties, which collectively enhance aircraft performance and passenger comfort. Polyurethane foams provide excellent resistance to vibration, compression, and temperature fluctuations, making them ideal for both cabin interiors and insulation panels.

The material’s adaptability allows for precise density and hardness customization, enabling OEMs to meet specific design and safety requirements. Additionally, polyurethane foams are compatible with fire retardant additives and coatings, ensuring compliance with strict aerospace safety standards.

Increasing demand for fuel-efficient aircraft and enhanced cabin comfort has further reinforced adoption of polyurethane foams Ongoing innovations in foam formulations are also improving durability, acoustic dampening, and ease of installation, supporting long-term growth in both commercial and specialty aerospace applications.

The aerospace foam for commercial aircrafts application segment is anticipated to account for 58.7% of the aerospace foams market revenue share in 2025, establishing itself as the dominant application. Its leadership is being driven by the expansion of commercial air travel and rising aircraft production globally, which has increased the requirement for lightweight and high-performance cabin materials. Foams are extensively used in seating, insulation panels, galleys, and overhead compartments to improve passenger comfort, reduce noise, and enhance thermal insulation.

The ability of modern foams to maintain structural integrity under varying pressure and temperature conditions is critical for compliance with aerospace safety standards. Continuous innovations in polyurethane and hybrid foams are enabling improved durability, acoustic performance, and weight reduction, aligning with airline operators’ goals of operational efficiency and fuel savings.

Growing investment in new commercial aircraft programs and retrofitting older fleets is further accelerating the adoption of advanced aerospace foams This segment’s prominence is expected to continue as aircraft manufacturers prioritize materials that optimize performance, passenger experience, and regulatory compliance.

Aerospace foams market demand was valued at USD 3,286.02 Million in 2025, and is projected to reach USD 3,517.64 Million by the end of 2025. From 2025 to 2035, the market is expected to expand at a 7.7% CAGR, poised to be valued at USD 7,385.63 Million.

| Report Attribute | Details |

|---|---|

| Estimated Base Year Value (2025) | USD 3,286.02 Million |

| Anticipated Market Value (2035) | USD 3,517.64 Million |

| Projected Forecast Value (2035) | USD 7,385.63 Million |

| Growth Rate (2025 to 2035) | 7.7% CAGR |

Foams are an important class of materials that finds a variety of applications across a diverse set of industries. The low density, cellular structured materials namely foams are usually used for cushioning, as an insulating material, as vibration damping, or for packaging applications.

The aerospace industry necessitates materials that fulfill the intended function, are lighter in weight at the same time exhibit exceptional strength and resilience. The foams that cater to the demands of the aerospace industry are collectively termed aerospace foams.

The most commonly used foams for aerospace applications include polyurethane foam, polyethylene foam, metal foams, and ceramic foams.

Economic growth especially in the developing regions of the world, coupled with rapid urbanization is a major factor that is expected the propel the global aircraft market. This in turn is expected to drive the growth of the aerospace foams market.

Moreover, the increasing investments on the part of the government in aircraft for the defense sector is another factor expected to drive the global aerospace foams market. The emergence of low-cost airlines has led to an increase in passenger traffic, this has resulted to fuel the growth of global aerospace foams during the forecast period.

The variations in raw materials prices, availability of raw materials, and governmental regulations in polyurethane foams have hindered market growth. Moreover, polyurethane foams are flammable and utilize toxic isocyanates which restraints its applications over the globe.

Based on geography, Asia Pacific will witness the highest growth throughout the conjecture period. The region currently captures 37% of the global market share. Aspects such as swelling construction activities and the growing demand for electronic appliances will be critical in steering the growth of the polyurethane foams market in the region.

China is likely to lead the regional market, consuming over half of the demand for aerospace foams, followed by Japan where consumption is mounting gradually. Upsurge in the consumption of polyurethane foam, polyethylene foam, fluoropolymer foam, and metal foam has been detected in Asia-Pacific.

Owing to the continuous industrialization and growth in the manufacturing sector, the demand for Aerospace foams is likely to witness consistent significant growth. The incessant growth and novelty, along with industry consolidations, are expected to discover a bright future for the industry.

European Industry is a world leader in the production of civil aircraft, including helicopters, aircraft engines, parts, and components. It also plays a leading role in terms of export to other countries. Hence, the aerospace industry is witnessing significant growth in the region, backed by the presence of large aeronautical enterprises in the region.

As per the Destination 2050 roadmap, the European aeronautics industry along with the other European players of the aviation division has recently taken the strong commitment to ensure the air transport in Europe meets Europe 2050 climate’s objectives.

This includes the development of zero-emission aircraft based on novel propulsion technologies. These aspects intend to provide a stronghold of the aerospace foams market to the regional manufacturers and suppliers.

North America is likely to dominate the aerospace foams market owing to a subsequent increase in scheduled commercial flights. The rapidly flourishing commercial aircraft segment is anticipated to positively impact the foams consumption over the forecast period. On account of the rising increase in the number of passengers and rising military expenditure in the USA, the demand for the polyurethane foams is estimated to increase in the coming future.

Moreover, the prominent airline manufacturers such as Lockheed Martin, Airbus, Bombardier, and Boeing have been investing on new manufacturing and repair activities in the United States lately which is one of the primary growth driver.

Some of the key participants present in the global demand of the Aerospace Foams market include BASF SE, Huntsman Corporation, ARMACELL, Boyd Corporation, Evonik Industries, Rogers Corporation, SABIC Innovative Plastics, General Plastics Manufacturing Company, Zetofoams Plc, and ERG Materials., among others.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 7.7% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2025 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered |

|

| Regions Covered |

|

| Key Countries Profiled |

|

| Key Companies Profiled |

|

| Customization | Available Upon Request |

Foam Type:

Application:

Region:

| Country | CAGR |

|---|---|

| China | 10.4% |

| India | 9.6% |

| Germany | 8.9% |

| France | 8.1% |

| UK | 7.3% |

| USA | 6.5% |

| Brazil | 5.8% |

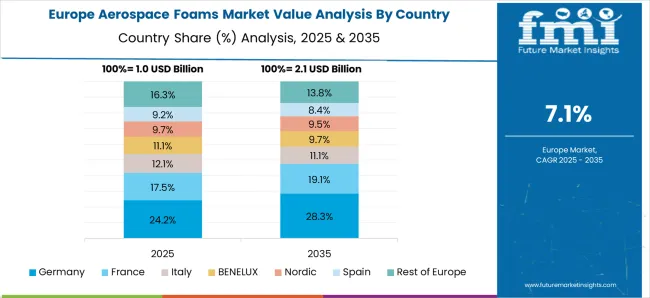

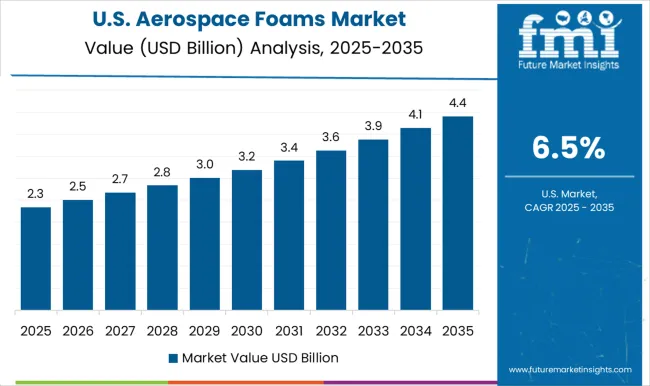

The Aerospace Foams Market is expected to register a CAGR of 7.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.4%, followed by India at 9.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.8%, yet still underscores a broadly positive trajectory for the global Aerospace Foams Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.9%. The USA Aerospace Foams Market is estimated to be valued at USD 1.5 billion in 2025 and is anticipated to reach a valuation of USD 2.9 billion by 2035. Sales are projected to rise at a CAGR of 6.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 210.4 million and USD 140.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.4 Billion |

| Foam Type | Polyurethane Aerospace Foam, Polyethylene Aerospace Foam, Ceramic Aerospace Foam, Metal Aerospace Foam, and Other Aerospace Foam Types |

| Application | Aerospace Foam for Commercial Aircrafts and Aerospace Foam for Defense Aircrafts |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Huntsman Corporation, ARMACELL, Boyd Corporation, Evonik Industries, Rogers Corporation, SABIC Innovative Plastics, General Plastics Manufacturing Company, Zetofoams Plc., and ERG Materials |

| Additional Attributes |

The global aerospace foams market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the aerospace foams market is projected to reach USD 9.3 billion by 2035.

The aerospace foams market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in aerospace foams market are polyurethane aerospace foam, polyethylene aerospace foam, ceramic aerospace foam, metal aerospace foam and other aerospace foam types.

In terms of application, aerospace foam for commercial aircrafts segment to command 58.7% share in the aerospace foams market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Aerospace DC-DC Converter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Aerospace 3D Printing Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Radome Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Interior Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Tester Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Avionics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA