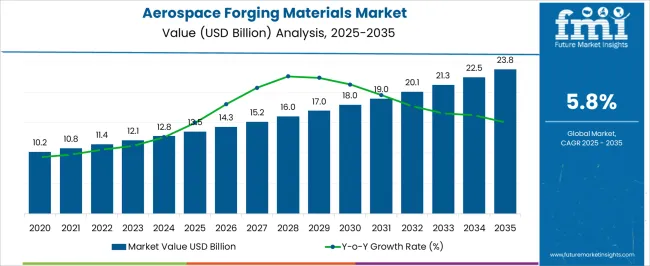

The aerospace forging materials market is projected to grow from USD 13.5 billion in 2025 to USD 23.8 billion by 2035, representing a CAGR of 5.8%. From 2021 to 2025, the market demonstrates steady growth, increasing from USD 10.2 billion in 2021 to USD 13.5 billion in 2025. This compound annual growth reflects rising adoption of high-performance materials in aerospace manufacturing, driven by demand for lighter, stronger, and more durable components for commercial and defense aircraft. Key factors supporting growth include increased aircraft production, replacement cycles for aging fleets, and stricter safety standards that require advanced forging materials.

Between 2021 and 2025, the market shows incremental increases, rising to USD 10.8 billion in 2022, USD 11.4 billion in 2023, USD 12.1 billion in 2024, and USD 12.8 billion prior to reaching USD 13.5 billion in 2025. These figures highlight a consistent annual expansion driven by the gradual integration of titanium, nickel-based superalloys, and aluminum alloys in aerospace components such as landing gears, engine shafts, and structural airframe parts.

From 2025 to 2035, the market is expected to maintain its growth trajectory, reaching USD 14.3 billion in 2026 and USD 15.2 billion in 2027, with subsequent rises to USD 16.0 billion in 2028 and USD 17.0 billion in 2029. By 2035, the market will attain USD 23.8 billion, reflecting steady compound growth driven by technological refinements in forging processes, increased demand from commercial aviation expansion, and adoption in emerging aerospace sectors including electric and hybrid aircraft.

| Metric | Value |

|---|---|

| Aerospace Forging Materials Market Estimated Value in (2025 E) | USD 13.5 billion |

| Aerospace Forging Materials Market Forecast Value in (2035 F) | USD 23.8 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The aerospace forging materials market is supported by several parent markets that drive its expansion and demand across commercial, defense, and industrial applications. The aerospace materials market plays a dominant role, with forging materials accounting for nearly 12-15% of the share. Titanium, nickel, aluminum, and high-strength steels are widely used in aerospace due to their ability to withstand fatigue and extreme conditions in aircraft structures, engines, and landing gear.

The forging industry market contributes around 10-12%, since aerospace is one of the most material-intensive end-use segments requiring precise, high-quality alloys designed to endure stress and temperature variations during flight. The aerospace components market also significantly influences the demand for forging materials, accounting for about 8-10% of the share.

Forged parts such as turbine discs, shafts, and engine mounts are vital to aircraft performance and safety. In the defense and military equipment market, aerospace forging materials represent roughly 6-8% of the share, with applications across military aircraft, helicopters, and missiles that demand unmatched performance and durability.The commercial aviation market accounts for about 7-9%, as airlines continue to expand fleets and rely on forged alloys for engines, airframes, and landing gear to ensure safety, efficiency, and long service life.

The market is experiencing sustained growth, driven by the increasing demand for lightweight, high-strength materials to improve fuel efficiency and performance in aircraft manufacturing. Expanding global air travel, coupled with rising orders for new-generation aircraft, has elevated the need for advanced forging materials that can withstand extreme operational conditions. The integration of next-generation alloys with superior fatigue resistance and corrosion protection has been accelerated by technological advancements in aerospace forging processes.

Manufacturers are focusing on precision forging techniques to meet stringent safety and performance standards, while also optimizing material utilization to reduce production costs. The ongoing modernization of military fleets, coupled with significant investments in commercial aviation, is providing robust growth momentum.

Additionally, the shift toward sustainable aviation practices has encouraged the use of recyclable and durable materials in the forging process.

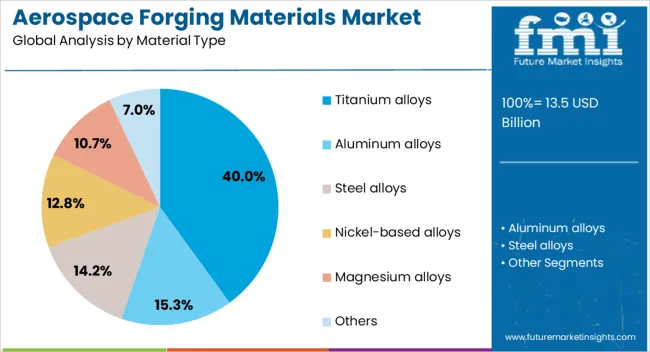

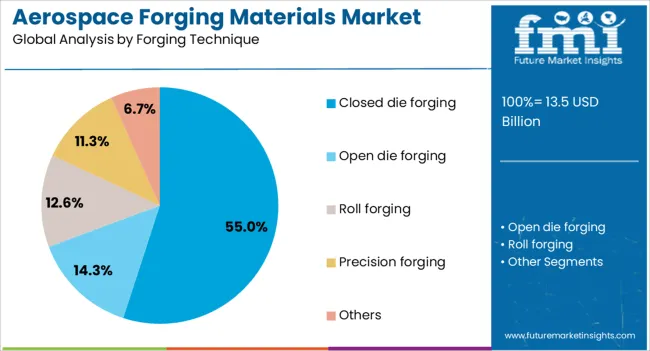

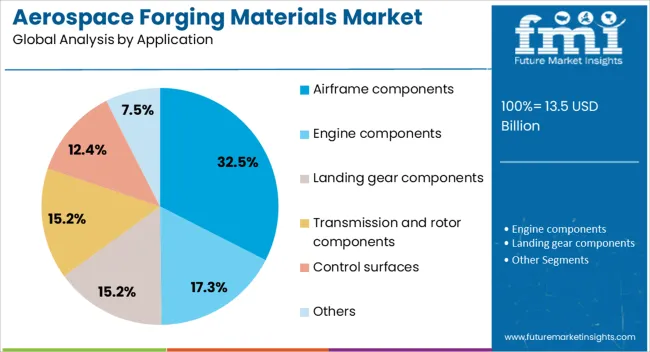

The aerospace forging materials market is segmented by material type, forging technique, application, and geographic regions. By material type, aerospace forging materials market is divided into Titanium alloys, Aluminum alloys, Steel alloys, Nickel-based alloys, Magnesium alloys, and Others. In terms of forging technique, aerospace forging materials market is classified into Closed die forging, Open die forging, Roll forging, Precision forging, and Others. Based on application, aerospace forging materials market is segmented into Airframe components, Engine components, Landing gear components, Transmission and rotor components, Control surfaces, and Others. Regionally, the aerospace forging materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The titanium alloys material type segment is projected to hold 40% of the Aerospace Forging Materials market revenue share in 2025, making it the leading material type. This dominance has been driven by the exceptional strength-to-weight ratio of titanium alloys, which significantly enhances fuel efficiency and aircraft performance. Titanium’s inherent resistance to corrosion and extreme temperatures has made it an ideal choice for critical aerospace components that operate under high stress.

The demand for titanium alloys has been further supported by their compatibility with precision forging techniques, enabling the production of complex shapes with minimal material wastage. These properties have been instrumental in meeting the stringent safety and durability requirements of both commercial and military aircraft.

The segment’s growth has also been reinforced by the increasing production of new aircraft models that incorporate higher proportions of titanium in their structures As the aerospace industry continues to prioritize lightweight materials for improved operational efficiency, titanium alloys are expected to retain their leading position.

The closed die forging forging technique segment is anticipated to command 55% of the Aerospace Forging Materials market revenue share in 2025, making it the most widely adopted forging technique. This dominance has been attributed to the ability of closed die forging to produce components with superior mechanical properties, close dimensional tolerances, and excellent surface finishes. The process enables the manufacturing of complex aerospace parts that require high precision, such as turbine blades, landing gear components, and engine parts.

The strength and reliability imparted by closed die forging have been critical in meeting the rigorous safety standards of the aerospace sector. Additionally, the technique’s capacity to handle a variety of high-performance alloys, including titanium and nickel-based superalloys, has expanded its application scope.

Advancements in die design and automation have further improved efficiency, reduced production lead times, and minimized material wastage These advantages have positioned closed die forging as the preferred method for high-value aerospace components.

The airframe components application segment is expected to account for 32.50% of the Aerospace Forging Materials market revenue share in 2025, establishing it as the leading application segment. This prominence has been supported by the critical role airframe components play in determining aircraft strength, durability, and aerodynamic efficiency. The use of forged materials in airframes ensures the structural integrity necessary to withstand fluctuating stresses during flight.

Titanium alloys and other advanced materials have been extensively utilized in these components to achieve weight reduction while maintaining exceptional mechanical performance. The rising production rates of commercial aircraft, coupled with the refurbishment and modernization of existing fleets, have fueled demand for high-quality forged airframe parts.

Furthermore, advancements in forging technology have enabled the creation of more complex geometries, supporting the development of next-generation aircraft designs. With the aerospace industry prioritizing fuel efficiency and extended service life, the demand for forged materials in airframe components is set to remain strong.

The aerospace forging materials market focuses on high-strength alloys shaped into critical airframe and engine components. Materials like titanium, nickel-base superalloys, advanced aluminums, and aerospace-grade steels are essential for fatigue resistance, fracture toughness, and thermal stability. Demand is rising from aircraft build rates, defense programs, and space launch activities.

OEMs prefer alloys such as Ti-6Al-4V and Inconel for weight reduction and durability. Innovations in near-net forging, isothermal processes, and precision rolling reduce machining needs, while strict standards and digital traceability ensure long-term reliability and supplier competitiveness.

Production increases for single-aisle and widebody aircraft are driving long-cycle orders for forgings across fuselage nodes, pylons, landing systems, and nacelle structures. On the propulsion side, hotter cores and higher pressure ratios are boosting demand for nickel-base superalloys and powder-metal derivatives in discs, seals, and shafts, while titanium remains favored for fan and compressor structures due to its strength-to-weight balance and corrosion resistance. Defense modernization programs covering fighters, rotorcraft, transport aircraft, and missile systems provide steady volumes with strict fatigue and survivability needs. Expanding space launch activity is supporting ring-rolled sections, thrust-frame parts, and cryogenic alloys. Airlines focused on lifecycle cost efficiency further sustain aftermarket demand for forged replacements and certified spares. Evolving design requirements such as optimized load paths, laminar aero surfaces, and thermal shielding push for tighter cleanliness and inclusion controls. Supply strategies emphasizing dual sourcing, local content, and long-term contracts enhance stability for qualified forgers.

Capacity limitations at large-tonnage press lines and isothermal cells are extending lead times, particularly for large diameters and complex closed-die parts. Volatility in titanium sponge, nickel, alloying elements, and specialty steel melts complicates pricing strategies and inventory management. Stringent qualification cycles such as AMS, ASTM, and customer-specific standards require extensive process validation, destructive testing, and recurring audits, which raise overall costs. The energy-intensive nature of forging, heat treatment, and solution-aging exposes producers to power cost fluctuations and outage risks. Geopolitical issues affecting ore, sponge, and ferroalloy trade routes add further uncertainty. Maintaining uniformity and preventing defects such as segregation, porosity, alpha case, and grain-flow discontinuities requires strict billet conditioning, forge modeling, and non-destructive evaluation, stretching engineering resources. Workforce shortages in experienced forge operators, metallurgists, and advanced NDT talent further constrain throughput.

Investments in larger presses, faster manipulators, and isothermal forging enable the production of larger, integrally forged structures, reducing the need for multi-piece assemblies and minimizing inspection steps. Near-net preform methods like ring rolling and closed-die finishing can lower buy-to-fly ratios and machining time. Hybrid approaches combining additive preforms with forging improve grain flow while maintaining design flexibility. Advanced materials such as powder-metallurgy superalloys, gamma-strengthened alloys, and corrosion-resistant titanium and aluminum are driving innovations in high-performance engines and lightweight airframes. Space and hypersonic programs create demand for specialized components like rings and thrust structures. Regional strategies and digital technologies, including predictive maintenance and inline NDE, are improving efficiency, reducing waste, and enhancing supply chain management, offering compelling returns on investment.

Digitalization is advancing in forging, with finite-element modeling, sensorized dies, and thermocouple-dense furnaces enhancing microstructure precision and repeatability. Closed-loop press controls and advanced inspection techniques, including ultrasonic phased-array and thermography, are streamlining processes and improving detection. Additive-to-forge hybrids and tailored-grain preforms are gaining traction for complex components. Materials are trending toward cleaner melts, such as ESR/VAR and vacuum arc re-melting, to meet the demands of high-performance, life-limited parts. Long-term agreements with metal clauses and performance KPIs are strengthening market stability. Qualification frameworks are evolving towards risk-informed approaches, reducing redundant testing. Supply chains are being restructured with regional billet conversion and heat-treating capabilities, enhancing logistical efficiency and reducing risk.

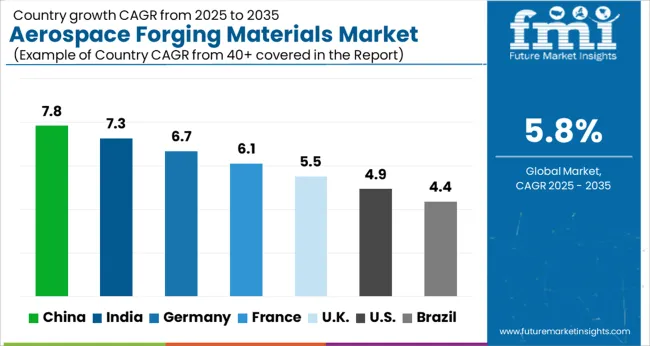

| Countries | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The global aerospace forging materials market is projected to grow at a CAGR of 5.8% from 2025 to 2035. China leads with a growth rate of 7.8%, followed by India at 7.3%, and Germany at 6.7%. The United Kingdom and the United States post moderate growth rates of 5.5% and 4.9%, respectively. The market is supported by rising demand for titanium, nickel, and aluminum alloys across aircraft engines, structures, and defense aviation. Strong government initiatives, advanced R&D, and global partnerships are shaping the demand landscape, with China and India emerging as high-growth markets while developed economies like Germany, the UK, and the USA emphasize innovation and long-term aerospace efficiency. The analysis spans over 40+ countries, with the leading markets shown below.

China is projected to lead the aerospace forging materials market, expanding at a CAGR of 7.8% between 2025 and 2035. The surge is driven by growing aircraft production and the country’s strong aerospace supply chain development. With rising domestic air travel demand and government support for aviation programs, the need for high-performance forging materials such as titanium, aluminum, and nickel alloys is increasing. China’s manufacturing base continues to invest in advanced forging technologies to meet the requirements of both domestic and international aerospace clients. The focus on lightweight, high-strength materials for new-generation aircraft further boosts demand.

India’s aerospace forging materials market is forecast to expand at a CAGR of 7.3% from 2025 to 2035. The country is witnessing strong demand driven by defense modernization, commercial aircraft expansion, and indigenous aerospace manufacturing programs. The “Make in India” initiative has strengthened domestic capabilities, creating opportunities for forging materials suppliers. The rising demand for lighter and stronger alloys, particularly titanium and aluminum, in defense and commercial aviation supports steady growth. As India invests heavily in aerospace R&D and builds partnerships with global aircraft manufacturers, the need for specialized forging materials is set to increase.

Germany’s aerospace forging materials market is projected to grow at a CAGR of 6.7% from 2025 to 2035. As a hub for European aerospace manufacturing, Germany supplies critical materials to both civil and defense aviation. The demand for forged titanium, nickel-based alloys, and high-performance steels is increasing, particularly for aircraft engines and structural components. The strong presence of major aerospace OEMs and suppliers in Germany strengthens the need for advanced forging materials. Germany’s engineering expertise and commitment to innovation in material science ensure steady adoption of high-strength alloys designed to improve efficiency and durability in aircraft production.

The aerospace forging materials market in the United Kingdom is expected to grow at a CAGR of 5.5% from 2025 to 2035. The UK has a long-standing aerospace industry, particularly in aircraft engine manufacturing, which drives consistent demand for forging materials. The increasing requirement for lightweight alloys to improve aircraft efficiency is a key growth driver. Government support for aerospace R&D and strategic collaborations with international manufacturers further enhance opportunities. The rising need for high-performance materials for both military and civil aviation strengthens the demand for forging alloys in the UK market.

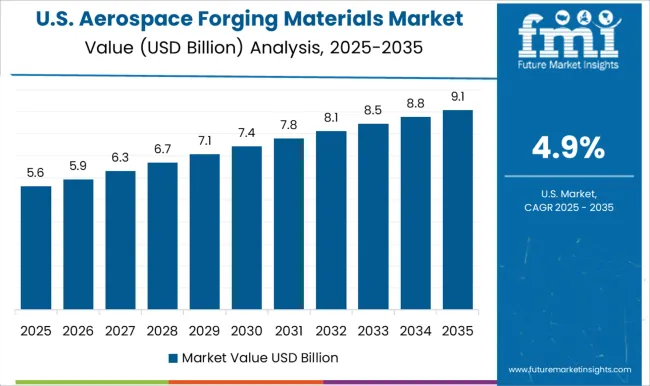

The USA aerospace forging materials market is projected to expand at a CAGR of 4.9% from 2025 to 2035. With the world’s largest aerospace sector, the USA is a major consumer of forged titanium, aluminum, and nickel alloys. Demand is supported by strong defense budgets, continuous production of commercial aircraft, and the expansion of space exploration programs. The USA market emphasizes innovation in advanced materials and forging technologies to improve efficiency and durability. The adoption of lightweight alloys for next-generation aircraft and spacecraft ensures ongoing demand for specialized forging materials.

Competition in aerospace forging materials remains highly defined by certification, alloy pedigree, and program approvals. Howmet Aerospace holds advantage through broad catalogs that cover seamless rings, titanium mill products, fasteners, and investment castings, securing positions across engines and airframes where reliability is non-negotiable. Bharat Forge competes through vertically integrated systems, AS9100 certification, and machining facilities that support landing gear, engine shafts, and structural links, with focus placed on titanium expansion and higher value programs.

Arconic operates at the feedstock and structural tier, supplying high-strength plate, sheet, and extrusions that serve as forging stock or structural inputs for fuselage panels, wing skins, floor beams, and seat tracks. Scot Forge is positioned in the large-diameter and open-die forging niche, with rolled rings and gear blanks offered for high-load aerospace applications where geometry and turnaround time carry greater weight. L&T is active as an India-based partner, combining AS9100-certified facilities with multidisciplinary engineering that enables complex build-to-print packages and compliance-sensitive deliveries.

Strategy across these players emphasizes long-term platform capture, qualification-driven barriers, and content expansion. Howmet targets next-generation engine families and aftermarket pull through coatings and fastening systems. Bharat Forge builds capacity with a new ring mill and machining centers to qualify higher precision landing gear parts. Arconic advances alloy development and supply agreements to secure volume commitments, while Scot Forge continues to leverage scale and metallurgical control to serve urgent spares and development lots. Product brochures emphasize parts such as fasteners, blades, landing gear trunnions, fuselage panels, rings, and forged structural components used throughout commercial and defense fleets.

| Item | Value |

|---|---|

| Quantitative Units | USD 13.5 Billion |

| Material Type | Titanium alloys, Aluminum alloys, Steel alloys, Nickel-based alloys, Magnesium alloys, and Others |

| Forging Technique | Closed die forging, Open die forging, Roll forging, Precision forging, and Others |

| Application | Airframe components, Engine components, Landing gear components, Transmission and rotor components, Control surfaces, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Howmet Aerospace, Bharat Forge Limited, Arconic / Alcoa (forgings business), Scot Forge Company, Larsen & Toubro Ltd., and Other global and specialist forgings suppliers |

| Additional Attributes | Dollar sales by material type (titanium, nickel-based alloys, aluminum, specialty alloys), forging type (open-die, closed-die, precision), and application (engines, landing gear, airframe, structural components). Regional trends highlight significant adoption in North America, Europe, and Asia-Pacific, driven by aerospace manufacturing expansion, fleet modernization programs, and increasing demand for lightweight, high-strength components. |

The global aerospace forging materials market is estimated to be valued at USD 13.5 billion in 2025.

The market size for the aerospace forging materials market is projected to reach USD 23.8 billion by 2035.

The aerospace forging materials market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in aerospace forging materials market are titanium alloys, aluminum alloys, steel alloys, nickel-based alloys, magnesium alloys and others.

In terms of forging technique, closed die forging segment to command 55.0% share in the aerospace forging materials market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Aerospace DC-DC Converter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Aerospace Radome Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Interior Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Tester Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Avionics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Lightning Strike Protection Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Titanium Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA