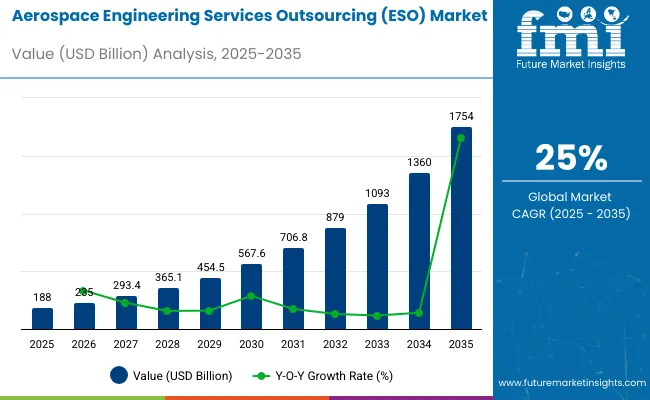

The aerospace engineering services outsourcing (ESO) market stands at USD 188 billion in 2025 and will reach USD 1,754 billion by 2035, expanding at a CAGR of 25%, which equates to a multiplying factor of around 9.3x over the decade.

Breakpoint analysis highlights distinct phases where growth accelerates due to structural shifts in demand, technological advancement, and cost optimization strategies by aerospace manufacturers. The first breakpoint occurs in the late 2020s as OEMs and Tier 1 suppliers increase outsourcing to reduce costs and focus on core competencies, particularly in design, simulation, and testing services.

A second breakpoint emerges in the early 2030s, when digital engineering, model-based systems, and artificial intelligence integration create new outsourcing opportunities. This stage accelerates adoption as companies seek partners with advanced capabilities in digital twin development, avionics software, and next-generation propulsion systems.

By 2035, with the market reaching 1,754 billion, a critical breakpoint is crossed where outsourcing becomes not only a cost-reduction strategy but a central enabler of innovation and speed-to-market. The trajectory underscores how the ESO market evolves from tactical support to strategic collaboration, positioning service providers as integral contributors to aerospace innovation, lifecycle management, and global competitiveness.

The aerospace ESO market draws support from multiple upstream industries. Aircraft and spacecraft manufacturing contributes about 39%, as OEMs rely heavily on outsourced design, simulation, and certification services. Engineering and IT services providers account for approximately 28%, delivering specialized expertise in CAD modeling, product lifecycle management, and digital twin technologies.

Avionics and systems integration represents nearly 17%, where outsourcing facilitates complex software development and hardware validation. Research and development institutions and testing services hold close to 10%, ensuring innovation, structural validation, and compliance. Aftermarket engineering and maintenance support contributes the remaining 6%, addressing retrofitting, upgrades, and technical documentation.

The market is advancing with greater reliance on digital engineering, automation, and global collaboration. Companies are adopting model-based system engineering and simulation-driven design to accelerate time-to-market. Cloud-enabled collaboration platforms are enabling cross-border outsourcing partnerships, ensuring seamless integration between design centers and manufacturers.

Key service providers are expanding their capabilities in artificial intelligence, cybersecurity, and digital twin development to address the growing complexity of aerospace programs. Outsourcing strategies are increasingly centered on long-term partnerships with OEMs and tier-one suppliers, allowing for cost optimization, access to specialized talent, and alignment with strict aerospace quality standards.

Growth is strongly tied to rising aircraft production, digital engineering adoption, and cost optimization initiatives. Service providers are increasingly engaged in design, structural analysis, system integration, and digital twin development. Outsourcing penetration already exceeds 35% in commercial aviation engineering functions, and defense programs are steadily adopting ESO to manage development cycles. North America and Europe together account for more than 60% of outsourcing demand, while Asia Pacific is expanding at a faster pace, driven by engineering hubs in India and China that provide scalable and cost-efficient services for global aerospace OEMs and tier-1 suppliers.

Growth Opportunity Expansion of Digital and Simulation Services

Aerospace OEMs and tier-1 suppliers are increasingly outsourcing digital engineering, simulation, and virtual prototyping to reduce development costs. Simulation-based design is estimated to cut physical testing requirements by 25-30%, directly lowering program expenses. Engineering firms with capabilities in digital twin technologies are securing long-term contracts to support predictive maintenance solutions for fleets.

Outsourcing partners are also focusing on artificial intelligence and machine learning integration, enabling faster structural analysis and system validation. By 2035, digital and simulation outsourcing is projected to account for nearly 40% of total ESO revenues, creating strong opportunities for service providers specializing in high-end virtual engineering platforms.

Driving Force Cost Optimization and Capacity Expansion

The rising complexity of aircraft programs is driving OEMs and suppliers to outsource engineering to manage costs and expand design capacity. Outsourcing enables aerospace companies to save 20-25% in development expenditure by leveraging offshore engineering hubs. Labor cost differentials, combined with scalability, allow companies to manage peak workloads more efficiently.

ESO also supports shorter development cycles, particularly for new-generation aircraft that require continuous design modifications. With aircraft deliveries projected to double over the next decade, outsourcing engineering services provides OEMs a flexible model to meet rising demand without significantly increasing in-house engineering resources.

Emerging Trend Shift Toward High-Value Engineering Work

Earlier outsourcing contracts were focused mainly on drafting and documentation, but the industry is moving toward complex engineering services such as system integration, avionics software development, and advanced materials research. High-value engineering outsourcing already represents around 45% of current ESO contracts, with expectations of surpassing 60% by 2035.

Service providers are building domain-specific expertise in propulsion systems, structural composites, and unmanned aircraft design. The integration of cloud-based collaborative platforms allows real-time engineering development across multiple geographies. This shift positions outsourcing partners not just as cost-saving vendors but as strategic engineering collaborators for aerospace OEMs.

Market Challenge Compliance, Security, and IP Protection

Compliance with aerospace certification standards such as DO-178C for software and AS9100 for quality management adds cost and time to outsourced projects. Data security and intellectual property protection remain major concerns, with aerospace companies requiring multi-layered cybersecurity systems before engaging in outsourcing contracts.

Certification processes and security compliance can add 12-18% to outsourcing costs, affecting profitability for service providers. Additionally, defense programs impose strict restrictions on cross-border outsourcing, limiting global participation. Dependence on a few large outsourcing hubs also creates concentration risks. Balancing cost benefits with compliance and security challenges remains a critical restraint for the ESO market.

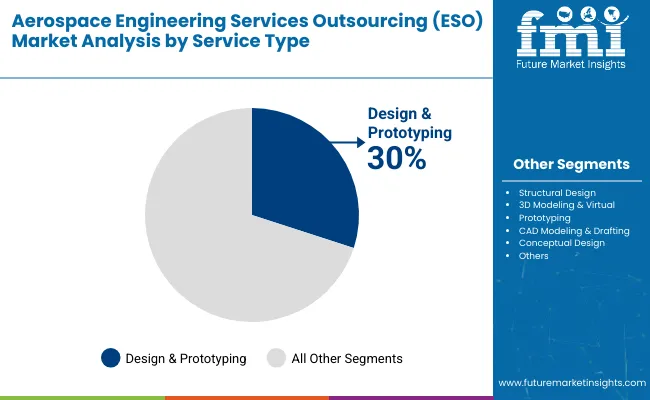

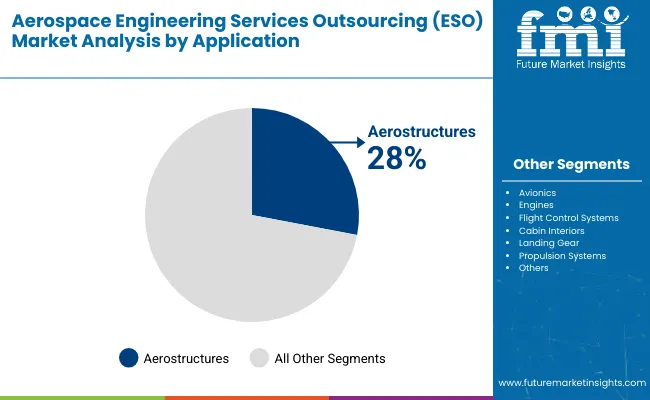

The Aerospace Engineering Services Outsourcing (ESO) market in 2025 shows consistent demand from OEMs, Tier 1 suppliers, airlines, and space agencies. Design engineering, structural development, and 3D modeling account for the largest service contributions, while aerostructures and avionics lead application-related outsourcing.

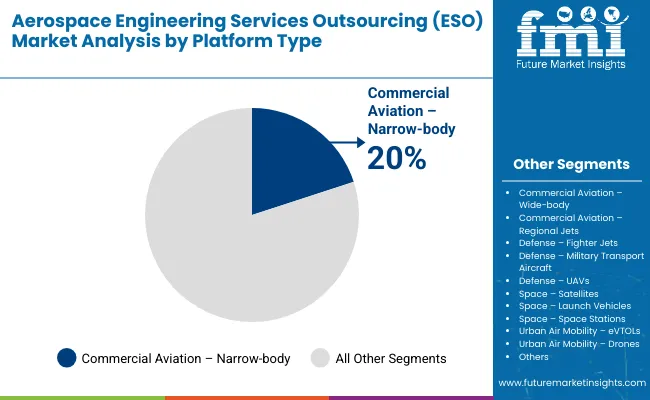

Narrow-body aircraft dominate by platform demand, with offshore outsourcing serving as the preferred delivery approach. OEMs remain the primary clients, driving partnerships with global engineering service providers. The market demonstrates how outsourcing has become integral in managing aerospace design, certification, and production efficiency across multiple programs.

Design and prototyping leads ESO services with a 30% share in 2025. OEMs such as Airbus and Boeing outsource this function to global partners like Alten, HCLTech, and Capgemini Engineering. Outsourced design ensures faster validation of new aircraft programs including the Airbus A320neo and Boeing 737 MAX.

Prototyping services help reduce testing costs and accelerate time-to-market by applying simulation and digital mock-ups. Service providers manage component-level prototyping, virtual modeling, and design validation, which enables OEMs to improve operational efficiency. The growing reliance on digital engineering workflows makes this segment the foundation of aerospace outsourcing, particularly for commercial aviation programs requiring rapid adaptability.

Aerostructures dominate ESO applications with 28% share, highlighting the complexity of fuselage, wings, and structural assemblies in aerospace programs. Leading firms such as Safran, Collins Aerospace, and Leonardo rely on outsourcing partners including Quest Global, Tata Technologies, and Tech Mahindra. Service providers deliver engineering support for composite aerostructures, lifecycle management, and certification requirements.

Outsourced aerostructure engineering reduces design cycle bottlenecks and enables suppliers to handle large production volumes for both commercial and defense platforms. The increasing use of lightweight composites and demand for fuel-efficient designs reinforce outsourcing in aerostructures as a long-term growth segment in ESO.

Narrow-body aircraft outsourcing holds the largest share by platform at 20%. Aircraft such as Airbus A320neo and Boeing 737 MAX drive demand for outsourced design validation, avionics integration, and digital modeling. Outsourcing providers including Alten, Wipro Engineering, and Capgemini assist OEMs in managing engineering workloads for high-volume production programs.

Airlines’ preference for single-aisle aircraft in both developed and emerging markets supports outsourcing activity. Narrow-body platforms remain the focus of aerospace ESO due to their role in fleet modernization, high passenger capacity efficiency, and global airline orders. The segment’s importance continues to expand as OEMs prioritize timely delivery and certification compliance.

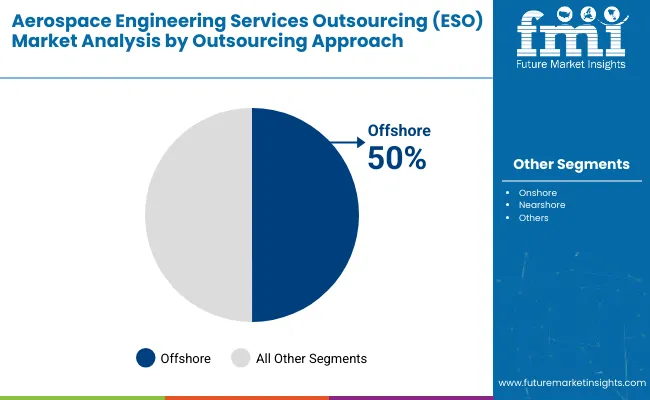

Offshore outsourcing represents 50% of the ESO market, reflecting its importance as the preferred approach for aerospace engineering services. Service hubs in India and Eastern Europe provide OEMs and Tier 1 suppliers with cost-efficient solutions, large engineering talent pools, and scalable operations. Infosys operates aerospace offshore centers in India and Poland, supporting digital prototyping.

Tata Technologies collaborates with Airbus and Rolls Royce on offshore structural and design engineering. Tech Mahindra contributes offshore CAD modeling and avionics support. Offshore delivery centers help reduce program delays, control costs, and ensure access to specialized engineering expertise. Their dominance underlines the long-term role of offshore outsourcing in aerospace development cycles.

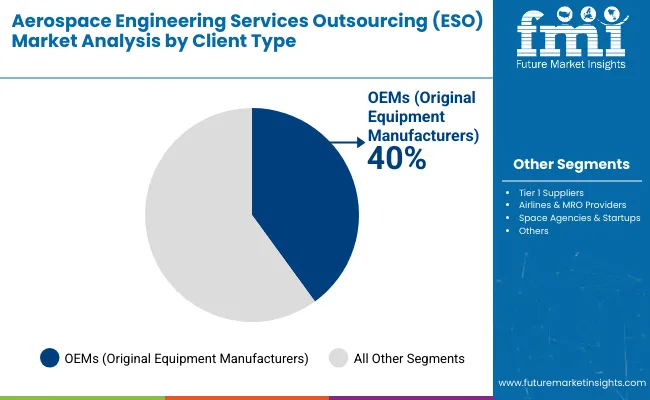

OEMs account for the highest share of ESO clients with 40% in 2025. Global manufacturers including Airbus, Boeing, and Embraer outsource engineering tasks to partners such as Alten, Capgemini, and Quest Global. Outsourcing enables OEMs to focus on final assembly and certification while delegating design, validation, and systems integration tasks.

Airbus collaborates with Alten for 3D modeling and product development, Boeing engages Capgemini for avionics and system engineering, while Embraer partners with Quest Global for cabin design. Outsourced ESO partnerships improve OEMs’ ability to manage production backlogs, accelerate program launches, and optimize engineering throughput across multiple aircraft platforms.

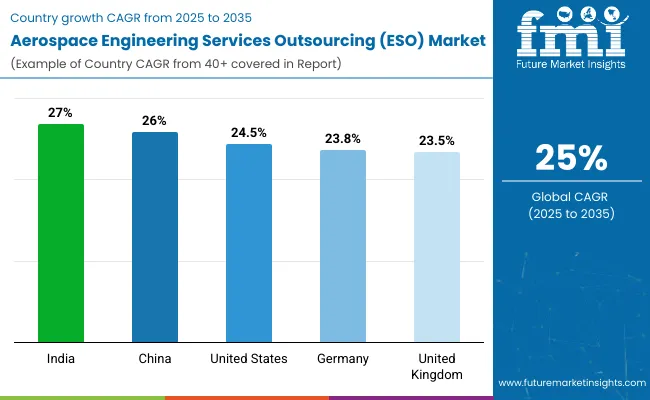

The global aerospace engineering services outsourcing (ESO) market is forecast to grow at a CAGR of 25.0% from 2025 to 2035. India leads at 27.0%, +8% above the global average, supported by BRICS-led cost competitiveness, a strong engineering workforce, and expanding collaborations with international aerospace manufacturers. China follows at 26.0%, +4% higher than the global benchmark, fueled by large-scale investments in aerospace design, component manufacturing, and increasing demand for outsourcing solutions.

The United States records 24.5%, −2% below the global average, where growth is influenced by OECD-backed innovation but tempered by higher labor costs that reduce outsourcing volumes. Germany posts 23.8% and the United Kingdom 23.5%, both slightly below the global rate, with demand shaped by premium aerospace manufacturing and outsourcing directed toward cost-efficient hubs. Growth patterns reflect BRICS strength in scalability and affordability, while OECD markets sustain demand through high-value engineering expertise and advanced technological frameworks.

The aerospace engineering services outsourcing market in India is projected to record a CAGR of 27.0%, outperforming the global CAGR of 25% with a multiplication factor of 1.08. This trend is viewed as a clear indication of the country’s competitive edge in engineering delivery for aerospace programs. It is believed that India’s large pool of aerospace engineers, combined with cost efficiency, provides unmatched scalability. The sector is driven by projects in avionics design, structural analysis, and simulation modeling.

Large outsourcing contracts have been awarded to Indian providers by leading aerospace OEMs. By 2035, the opinion is strong that India will dominate as one of the largest hubs for ESO delivery in aerospace, supported by increasing collaboration across global supply chains.

The aerospace ESO market in China is expanding at a CAGR of 26.0%, above the global average of 25%, producing a multiplication factor of 1.04. The view is that this performance demonstrates the strength of China’s aerospace ambitions and its growing reliance on ESO to meet aggressive production goals. Local service providers are delivering CAD modeling, propulsion analysis, and digital engineering to both civil and defense projects.

The market is also supported by growing partnerships between Chinese outsourcing firms and global aerospace companies, boosting competitiveness. It is believed that China’s focus on new material adoption and autonomous aviation programs is further accelerating outsourced engineering. Market observers suggest that China will remain a dominant player in the global ESO industry by 2035.

The United States is anticipated to witness an aerospace ESO CAGR of 24.5%, slightly below the global CAGR of 25%, reflecting a multiplication factor of 0.98. The opinion is that outsourcing in the US aerospace sector is adopted to optimize costs while focusing domestic resources on high-value design. Services such as systems integration, advanced avionics development, and predictive maintenance are commonly outsourced.

It is believed that outsourcing also shortens design cycles and supports a shift toward digital twins and model-based engineering. By 2035, the US is projected to outsource a notable portion of its aerospace engineering activities, while still maintaining strong in-house R&D. The country’s ESO market is likely to sustain demand by balancing cost efficiency and technical expertise.

Germany is expected to see its aerospace ESO market grow at a CAGR of 23.8%, slightly below the global 25%, equating to a multiplication factor of 0.95. Observers believe that outsourcing is increasingly relied upon for avionics testing, lightweight structure design, and composite materials development.

The country is recognized for strong aerospace engineering standards, and outsourcing complements its innovation programs in both civil and defense aviation. It is thought that collaborations with eastern European service providers are helping reduce engineering cycle times. Growth is also linked to higher adoption of model-based testing frameworks in aerospace R&D. By 2035, Germany’s ESO share is forecast to remain resilient, ensuring the country’s aerospace competitiveness remains intact.

The United Kingdom is forecasted to grow at a CAGR of 23.5% in aerospace ESO, below the global 25%, resulting in a multiplication factor of 0.94. It is widely considered that ESO growth in the UK is shaped by rising demand for propulsion system development, digital modeling, and systems testing.

The market is supported by outsourcing strategies aimed at cost competitiveness in both commercial and defense projects. Service providers are increasingly active in offering advanced visualization and 3D simulation to aerospace manufacturers. It is believed that the UK ESO market will remain essential in supporting core aerospace innovation while outsourcing drives scalability. By 2035, the country is anticipated to account for a stable share of global ESO activity.

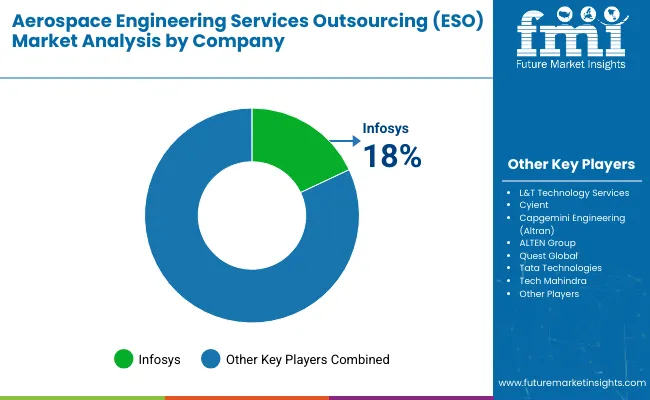

The aerospace engineering services outsourcing (ESO) market is shaped by global engineering firms and IT service providers offering design, testing, simulation, and lifecycle management for aircraft programs. Infosys is often regarded as the leading company in this space, supported by its strong aerospace partnerships, digital engineering capabilities, and dedicated centers of excellence for aviation clients.

L&T Technology Services continues to expand its presence through specialized engineering support for avionics and structural analysis, while Cyient focuses on digital design and aftermarket support solutions. Capgemini Engineering (formerly Altran) strengthens its market position through extensive collaborations with OEMs and tier-1 suppliers, providing end-to-end engineering outsourcing solutions across multiple aerospace platforms.

Other companies are driving growth with targeted investments and strategic alliances. ALTEN Group and AKKA Technologies (now Akkodis) expand their global engineering networks by supporting aircraft manufacturers in Europe and North America, while Quest Global and Tata Technologies focus on cost-efficient design and manufacturing support.

Tech Mahindra, HCLTech, and Wipro integrate advanced engineering with IT services to enhance efficiency in aerospace development. Emerging players such as Assystem, Segula Technologies, and Expleo Group are strengthening their positions with specialized offerings in testing, certification, and simulation. These collective efforts highlight a competitive ecosystem where R&D investments, OEM partnerships, and global delivery centers remain central to market success.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 188 billion |

| Projected Market Size (2035) | USD 1,754 billion |

| CAGR (2025 to 2035) | 25% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Service Types Analyzed | Design & Prototyping (CAD modeling & drafting, conceptual design, structural design, 3D modeling & prototyping), Testing & Simulation (CFD, FEA, wind tunnel testing, material testing), Manufacturing Support (tooling design, jigs & fixtures, CNC programming, process automation), Embedded Systems & Avionics (control systems, flight software, avionics integration, IoT integration), MRO Engineering Services (maintenance procedures, retrofit & modifications, technical publications), Systems Engineering & Integration (payload, electrical and mechanical integration), Others (reverse engineering, analytics, compliance consulting) |

| Application Segments | Aerostructures , Avionics, Engines, Cabin Interiors, Landing Gear, Propulsion Systems, Flight Control Systems |

| Platform Types | Commercial Aviation (narrow-body, wide-body, regional jets), Defense (fighter jets, military transport, UAVs), Space (satellites, launch vehicles, space stations), Urban Air Mobility ( eVTOLs , drones) |

| Outsourcing Approach | Onshore, Nearshore, Offshore |

| Client Types | OEMs, Tier 1 Suppliers, Airlines & MRO Providers, Space Agencies & Startups |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, South Korea, Australia, UAE, Saudi Arabia, South Africa |

| Leading Players | Infosys, Tata Technologies, Tech Mahindra, HCLTech , Wipro, L&T Technology Services, Cyient , Capgemini Engineering, Bertrandt , Alten Calsoft Labs, EPAM Systems, Accenture, Altrimetrik , Assystem , Segula Technologies, Safran Engineering Services, Expleo Group, Alten Group, AKKA Technologies ( Akkodis ), Quest Global |

| Additional Attributes | Dollar sales by service type and aircraft program, demand dynamics across commercial, defense, and space sectors, regional adoption trends across North America, Europe, and Asia-Pacific, innovation in digital engineering, simulation, and AI-driven modeling, environmental impact of optimized resource efficiency, emerging use cases in electric aircraft, UAV design, and next-generation space missions |

Commercial Aviation

Defense

Space

Urban Air Mobility (UAM)

The market size is valued at USD 188 billion in 2025.

It is projected to reach USD 1,754 billion by 2035.

The market is expected to grow at a CAGR of 25% during 2025–2035.

Design and prototyping holds the largest share with 30% in 2025.

Infosys is the leading player with 18% share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Outsourcing Civil Engineering Services Market Size and Share Forecast Outlook 2025 to 2035

Engineering Service Outsourcing Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Engineering Service Outsourcing Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

ATM Outsourcing Services Market Analysis by Service Type, ATM Deployment, and Region - Growth, Trends, and Forecast from 2025 to 2035

Automotive Engineering Services Market Growth - Trends & Forecast 2025 to 2035

Automotive Engineering Service Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Web Development Outsourcing Services Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Web Development Outsourcing Services Market Size and Share Forecast Outlook 2025 to 2035

Engineering Machinery Counterweight Iron Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Esophageal Implant Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA