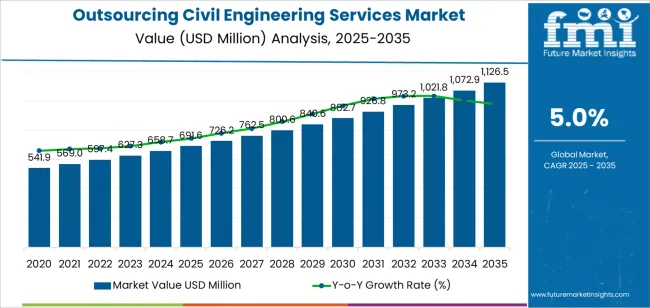

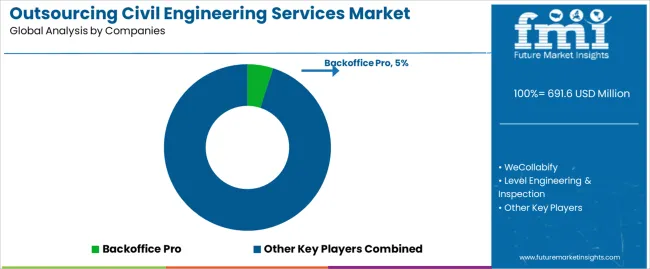

The outsourcing civil engineering services market is valued at USD 691.6 million in 2025 and is projected to reach USD 1,126.5 million by 2035, at a CAGR of 5.0%. This expansion creates an absolute dollar opportunity of USD 434.9 million, driven by rising infrastructure spending, wider adoption of external engineering teams, and growing reliance on project-based technical support across transport, energy, water, and urban development programs. The outsourcing civil engineering services market gains momentum through 2025–2030, reaching the USD 900–960 million range as construction pipelines expand and engineering firms outsource structural modeling, CAD drafting, BIM workflows, geotechnical tasks, and feasibility studies to manage workload variability and accelerate delivery timelines. During the 2030–2033 period, the outsourcing civil engineering services market enters a moderate acceleration phase in which outsourcing relationships mature, digital engineering workflows deepen, and procurement increasingly favors firms with ISO-aligned processes and multidisciplinary design capabilities. Beyond 2033, growth transitions into a deceleration stage as global infrastructure cycles stabilize. Even as expansion moderates, investment in transportation corridors, water infrastructure, industrial facilities, and energy networks sustains year-to-year outsourcing demand.

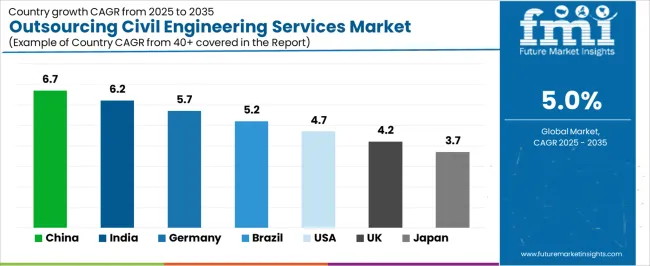

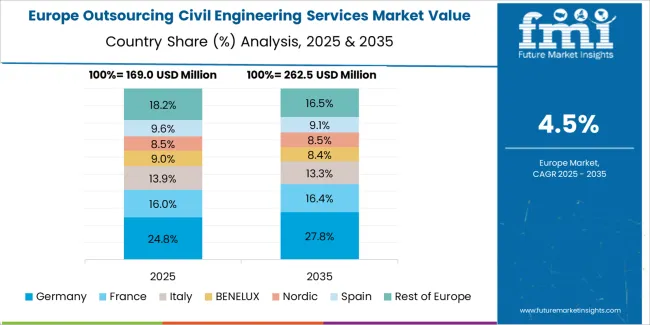

By 2035, long-term contract renewals, lifecycle design support, and digital-twin adoption dominate buyer priorities. Outsourced engineering hours rise as asset owners integrate BIM Level 3 coordination, predictive modeling, and fatigue-based structural evaluations into operational planning. Large outsourcing firms with 500–1,000+ engineering specialists maintain competitive strength by supporting multi-year infrastructure programs across roads, utilities, industrial corridors, and public-sector upgrades. Emerging markets—including South Asia, Eastern Europe, and parts of Africa, contribute 12–15% of new outsourced workloads through expanded use of cloud-based engineering collaboration. Regions such as China (6.7% CAGR), India (6.2%), and Germany (5.7%) lead global demand, supported by transportation investment, industrial expansion, and increased outsourcing of digital modeling tasks.

Between 2025 and 2030, the Outsourcing Civil Engineering Services Market expands from USD 691.6 million to roughly USD 900-960 million, positioning the sector in the late growth stage of the maturity curve. Demand rises as infrastructure development, transportation upgrades, and urban expansion projects accelerate across Asia-Pacific, the Middle East, and North America. Outsourced engineering workloads increase across structural design, BIM modeling, drainage and utility planning, and geotechnical assessments, with digital engineering accounting for 35-40 % of project volume by 2030.

Procurement criteria shift toward firms that demonstrate ISO-aligned quality processes, multi-disciplinary design capability, and track records of cost accuracy within 5-10 %. Project timelines shorten as advanced simulation tools improve seismic modeling, load calculations, and traffic-flow design accuracy.

From 2030 to 2035, the market grows toward USD 1,126.5 million, transitioning into the early maturity stage where long-term contract renewals and lifecycle design support dominate activity. Annual outsourced engineering hours increase as public and private owners adopt digital twins, BIM Level 3 workflows, and predictive modelling for asset management. Replacement-driven demand strengthens as operator’s upgrade road networks, water systems, and industrial facilities using real-time analytics and fatigue-based structural evaluations.

Large outsourcing firms with 500-1,000+ engineering specialists gain competitive advantage in managing multi-year infrastructure programs spanning transport, utilities, and industrial corridors. Emerging markets in South Asia, Eastern Europe, and Africa contribute 12-15 % of new contract activity by 2035 as cloud-based collaboration platforms become standard for cross-border engineering execution.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 691.6 million |

| Market Forecast Value (2035) | USD 1,126.5 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

Demand for outsourced civil engineering services is increasing as governments, developers, and industrial operators seek specialized technical expertise while managing project costs. Firms outsource tasks such as structural design, geotechnical analysis, transportation planning, and hydraulic modeling to engineering providers with established software capabilities and domain specialization. This approach reduces the need for in-house teams during fluctuating project cycles and shortens design timelines for roads, bridges, utilities, and site-development projects. Providers strengthen capabilities in BIM modeling, digital surveying, and simulation tools to support accurate planning across complex terrain and regulatory constraints. Growth is particularly strong in regions pursuing rapid urban expansion, where public agencies rely on external consultants to meet tight schedules and ensure design compliance with evolving safety and environmental standards.

Market expansion also reflects increasing project complexity, driven by climate-resilient design requirements, renewable energy installations, and large-scale transportation upgrades. Outsourcing firms develop multidisciplinary teams covering structural, environmental, and construction-phase engineering to support end-to-end project execution. Clients value clear documentation, quality-assurance systems, and secure data-handling processes that protect sensitive project information. Continuous investment in training and advanced modeling tools enables service providers to meet international codes and support cross-border project delivery. Although challenges include coordination across time zones and strict contractual risk management, improvements in digital collaboration platforms and transparent workflow controls reduce these barriers. As infrastructure spending rises worldwide, outsourced civil engineering services remain essential for delivering efficient, compliant, and scalable project support.

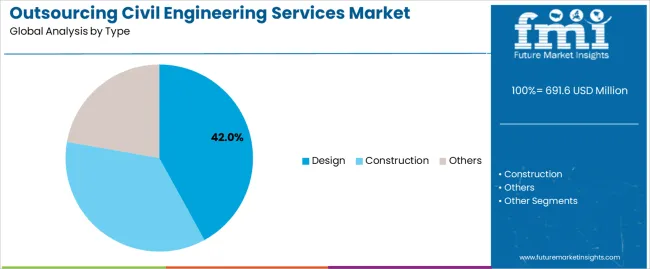

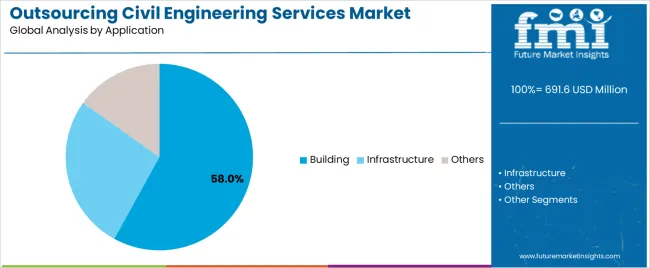

The outsourcing civil engineering services market is segmented by service type, application, and region. By type, the market includes design & engineering, project management, surveying & mapping, BIM & modeling, and others. Based on application, it is categorized into infrastructure, commercial buildings, residential, industrial, and energy & utilities. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect differing procurement models, technical capability needs, and regional construction investment patterns shaping demand for outsourced engineering services.

The design & engineering segment accounts for approximately 34.0% of the outsourcing civil engineering services market in 2025, making it the leading type category. This position is supported by steady demand for external technical capacity to prepare detailed designs, structural calculations, and regulatory submissions for large-scale projects. Owners, developers, and contractors outsource design work to access specialist disciplines—geotechnical, structural, transport, and water resources—without maintaining full-time in-house teams. Outsourced design teams provide scalable staffing that aligns with project pipelines and reduces fixed overhead for clients.

Market adoption is reinforced by the trend toward integrated delivery models where external design partners collaborate with contractors and BIM groups to compress schedules. Design outsourcing also supports risk sharing through defined deliverables and liability frameworks, making it attractive for firms managing diverse regional regulatory environments. Suppliers invest in domain expertise, cross-border collaboration tools, and quality assurance processes to meet client expectations for code compliance and constructability. Regions with large infrastructure investment programs East Asia and North America drive a significant share of demand, while Europe sources specialized engineering inputs for complex retrofit and urban projects. The design & engineering segment retains its lead because it delivers core technical value that directly influences project feasibility, cost control, and regulatory acceptance across varied construction markets.

The infrastructure application segment represents about 40.0% of the total outsourcing civil engineering services market in 2025, making it the largest application category. This reflects the high volume and technical complexity of public works projects—roads, bridges, rail, water supply, and sewage systems—that routinely require extended design, detailed surveying, environmental assessment, and construction supervision services. Infrastructure projects often exceed the capacity of single contractors’ in-house teams, prompting procurement of specialist outsourcing partners to meet tight delivery schedules and compliance conditions.

Demand in this segment is reinforced by public-sector investment cycles, stimulus programs, and urbanization-driven upgrades in transport and utilities networks. Outsourced firms supply end-to-end services including preliminary feasibility studies, environmental permitting support, detailed engineering, and supervision during construction and commissioning. Digital tools—BIM, GIS, and remote-sensing—are increasingly integrated into outsourced workflows to improve accuracy and reduce rework. Regional concentration of demand is notable in East Asia and South Asia where rapid infrastructure expansion persists, and in North America where renovation of aging assets creates recurring outsourcing needs. The infrastructure segment remains dominant because its projects produce sustained, large-scale workload that favors contractors and public clients leveraging external engineering capacity to manage technical risk, control cost escalation, and accelerate delivery timelines.

The outsourcing civil engineering services market is expanding as public and private developers seek external technical expertise to manage design, drafting, modelling and project-support functions. Outsourcing allows firms to handle fluctuating workloads, reduce operating costs and access specialised capabilities without expanding in-house teams. Growth is supported by rising infrastructure investment, increased use of digital engineering tools and broader adoption of remote collaboration models. Adoption is moderated by data-security concerns, varying service quality and integration challenges across distributed teams. Providers are refining workflow transparency, technical specialisation and digital coordination to meet project demands across global markets.

Demand rises as governments and private investors advance transportation, utilities and urban development projects requiring large volumes of engineering design and documentation. Firms turn to outsourcing partners for CAD drafting, BIM modelling, structural detailing and survey processing to accelerate project delivery. Digital collaboration platforms enable distributed teams to integrate outputs more efficiently, encouraging broader use of external engineering support. Fluctuating project cycles also push companies to rely on outsourced resources to manage peak workloads without long-term staffing commitments.

Adoption is limited by data-security concerns, especially for projects requiring sensitive design information or regulatory compliance. Differences in standards, codes and communication practices create risks in cross-border collaboration. Quality-control requirements increase coordination time, and poorly aligned workflows may lead to revisions or schedule delays. Some firms prefer maintaining in-house control to ensure consistency or protect proprietary methods. Budget constraints and unfamiliarity with vendor capabilities also slow uptake among smaller engineering practices.

Key trends include expanded use of BIM-based coordination, cloud-enabled design platforms and integrated project-delivery models that streamline multi-team collaboration. Providers are strengthening niche services in transportation design, utility networks, geospatial analysis and 3D modelling. Nearshore and hybrid outsourcing models are gaining traction to reduce communication barriers. Demand is growing for sustainability-focused design support and lifecycle documentation aligned with green-building criteria. As engineering workloads diversify, outsourcing firms increasingly differentiate through specialised expertise, transparent quality frameworks and scalable delivery teams.

| Country | CAGR (%) |

|---|---|

| China | 6.7% |

| India | 6.2% |

| Germany | 5.7% |

| Brazil | 5.2% |

| USA | 4.7% |

| UK | 4.2% |

| Japan | 3.7% |

The outsourcing civil engineering services market is expanding steadily across global regions, with China leading at a 6.7% CAGR through 2035, driven by large-scale infrastructure development, strong engineering talent availability, and competitive service costs. India follows at 6.2%, supported by its established engineering outsourcing industry, government-backed digital infrastructure initiatives, and growing demand for structural design, CAD drafting, and BIM services.

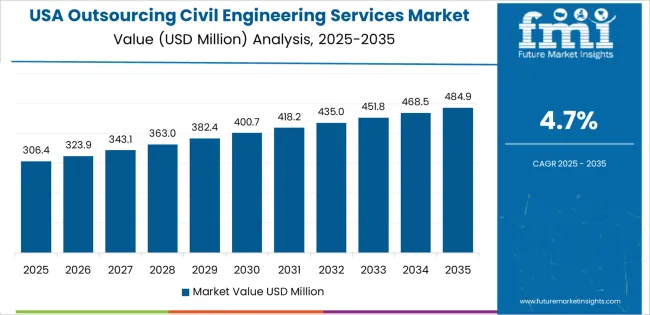

Germany records 5.7%, reflecting advanced engineering standards, high-quality deliverables, and increased nearshoring by European firms. Brazil grows at 5.2%, fueled by expanding urban development projects and adoption of outsourced technical services. The USA, at 4.7%, remains a mature yet innovation-oriented market emphasizing specialized consulting and advanced design technologies, while the UK (4.2%) and Japan (3.7%) focus on precision engineering, sustainability-driven design work, and the outsourcing of time-intensive modeling tasks.

China is projected to grow at a CAGR of 6.7% through 2035 in the outsourcing civil engineering services market. Rising demand for transportation networks, industrial parks, and new urban districts increases reliance on external engineering firms. Providers supply structural modelling, site surveys, and digital drafting support suited for high-volume development work. Municipal authorities commission outsourced design tasks supporting fast project execution. Foreign companies collaborate with domestic teams to manage geotechnical assessments and documentation. Remote engineering centres expand service capacity across multiple provinces. Growing interest in digital workflows strengthens adoption of coordinated modelling platforms for large infrastructure assignments.

India is expected to expand at a CAGR of 6.2% through 2035 in the outsourcing civil engineering services market. Large investments in highways, metro corridors, and industrial townships raise the need for external engineering teams. Providers deliver structural detailing, surveying tasks, and soil evaluations for diverse projects. Remote design hubs support contractors managing high workloads. Adoption of drafting standards enhances documentation consistency across states. Cross-functional teams assist developers preparing tenders and compliance reports. Urban growth fosters continuous demand for drainage planning and utility layout work. Market progression aligns with increasing acceptance of distributed engineering models supporting national infrastructure growth.

Germany is forecast to grow at a CAGR of 5.7% through 2035 in the outsourcing civil engineering services market. Demand from transportation upgrades, renewable energy installations, and industrial facilities increases the need for external engineering capacity. Providers emphasize precision in structural calculations, detailing quality, and reliable digital modelling. Contractors request outsourced support for documentation required under national engineering regulations. Remote teams assist with repetitive design tasks, allowing in-house engineers to focus on complex work. Market activity grows as firms adopt digital review processes to maintain consistent standards. Outsourcing supports predictable delivery timelines during intensive construction phases across national regions.

Brazil is projected to rise at a CAGR of 5.2% through 2035 in the outsourcing civil engineering services market. Urban expansion, transportation upgrades, and industrial zone development increase demand for external engineering firms. Providers support structural drawings, topographic surveys, and drainage layout services. Construction companies outsource documentation to manage varied project scales. Remote teams assist with geotechnical reports and early-stage feasibility evaluations. Market growth aligns with regional infrastructure spending in coastal and inland states. Distributed engineering models help firms maintain schedules during busy construction cycles. Outsourced services provide technical continuity for long-term development programs across national regions.

USA is projected to grow at a CAGR of 4.7% through 2035 in the outsourcing civil engineering services market. Demand rises from highway upgrades, commercial buildings, and utility modernization programmes. Engineering firms outsource drafting, modelling, and calculation-heavy tasks to manage workloads. Providers supply structural detailing, traffic analysis, and site-planning support. Remote collaboration tools improve coordination across distributed teams. Contractors rely on outsourced services to accelerate permit documentation. Market activity benefits from increased investment in public infrastructure. Outsourcing supports predictable resource allocation as firms manage fluctuating project volumes across national markets. Expansion of digital-review standards supports consistent design quality.

UK markets are expected to grow at a CAGR of 4.2% through 2035 in the outsourcing civil engineering services market. Expanding construction programs across housing, transport, and public facilities increase external engineering requirements. Providers deliver structural calculations, BIM modelling, and detailed drafting for contractors. Demand grows as firms manage tight project deadlines. Regional councils request outsourced support to accelerate planning documentation. Remote engineering units supply cost-effective capacity for repetitive tasks. Adoption of digital collaboration platforms improves workflow consistency. Market development aligns with increasing need for structured design support across varied urban and regional construction programmes nationwide.

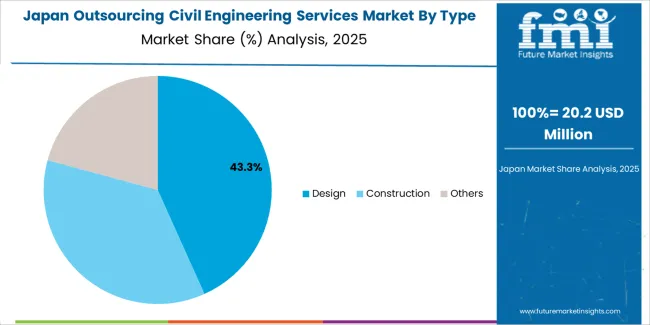

Japan is projected to grow at a CAGR of 3.7% through 2035 in the outsourcing civil engineering services market. Rising upgrades in public facilities, transportation lines, and utility systems increase outsourced workload. Providers focus on accurate modelling, precise detailing, and reliable structural calculations. Contractors request external support to manage seasonal project peaks. Remote teams assist with repetitive documentation, improving turnaround time. Infrastructure renewal programmes strengthen demand for drafting and alignment tasks. Market expansion aligns with emphasis on technical reliability and controlled scheduling. Outsourcing provides continuity for engineering firms navigating complex construction environments across national metropolitan and regional areas.

The global outsourcing civil engineering services market is moderately fragmented, shaped by firms providing design support, drafting, estimation, structural detailing, and inspection services for infrastructure and commercial projects. Backoffice Pro and WeCollabify hold strong positions with broad delivery models that support survey drafting, BIM coordination, and structural calculations for engineering firms seeking scalable external capacity. Level Engineering & Inspection and IDSS Global focus on specialized structural assessment, code compliance, and project documentation.

OURS GLOBAL and Sumer Innovations contribute multidisciplinary capabilities suited for residential and commercial development. Brigen Consulting, AXA Engineers, and Flatworld Solutions expand competition through CAD drafting, 3D modeling, and cost-estimation services delivered through offshore or hybrid teams. Across these providers, competition is shaped by turnaround reliability, engineering accuracy, and adherence to client standards.

Leedeo Engineering, Aidedo, IndiaCADworks, and Pure Prime Solutions reinforce mid-tier offerings with workflow-specific support for transportation, utilities, and industrial projects. Connext Global and Indovance add established offshore engineering capacity with teams trained for USA and European regulatory frameworks.

OEG Outsourcing strengthens support for large contractors seeking continuous drafting and permitting assistance, while Stantec and Monarch Innovation integrate outsourcing with broader engineering and design portfolios. Market differentiation depends on quality control processes, software capabilities, and the ability to manage varied jurisdictional requirements. Long-term competitiveness will rely on BIM proficiency, digital collaboration tools, and scalable staffing models that reduce project-cycle bottlenecks for global engineering firms.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Design, Construction, Others |

| Application | Infrastructure, Building, Others |

| End User | Government Agencies, Construction Firms, Engineering Consultants, Industrial & Utility Operators |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | Backoffice Pro, WeCollabify, Level Engineering & Inspection, IDSS Global, OURS GLOBAL, Sumer Innovations, Brigen Consulting, AXA Engineers, Flatworld Solutions, Leedeo Engineering, Aidedo, IndiaCADworks, Pure Prime Solutions, Connext Global, Indovance, OEG Outsourcing, Stantec, Monarch Innovation |

| Additional Attributes | Dollar sales by type and application categories, regional adoption trends across North America, Europe, and Asia-Pacific, competitive landscape among outsourced engineering service providers, workflow and software capability requirements, integration with BIM, CAD, and digital engineering platforms, project-based outsourcing models across infrastructure and building sectors |

The global outsourcing civil engineering services market is estimated to be valued at USD 691.6 million in 2025.

The market size for the outsourcing civil engineering services market is projected to reach USD 1,126.5 million by 2035.

The outsourcing civil engineering services market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in outsourcing civil engineering services market are design, construction and others.

In terms of application, building segment to command 58.0% share in the outsourcing civil engineering services market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ATM Outsourcing Services Market Analysis by Service Type, ATM Deployment, and Region - Growth, Trends, and Forecast from 2025 to 2035

Desktop Outsourcing Market

Document Outsourcing Service Market Analysis - Size, Share, and Forecast 2025 to 2035

Logistics Outsourcing Market Analysis - Growth & Forecast 2025 to 2035

Proteomics Outsourcing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Data Center Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Global Non-Sterile Outsourcing Market Analysis – Size, Share & Forecast 2024-2034

Legal Process Outsourcing LPO Size Market Size and Share Forecast Outlook 2025 to 2035

Healthcare IT Outsourcing Market Growth - Analysis & Forecast 2025 to 2035

Drug Discovery Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Web Development Outsourcing Services Market Size and Share Forecast Outlook 2025 to 2035

Global Biomarker Discovery Outsourcing Service Market Analysis – Size, Share & Forecast 2024-2034

Engineering Service Outsourcing Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Engineering Service Outsourcing Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Formulation Development Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Early Phase Clinical Trial Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Web Development Outsourcing Services Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Regulatory Affairs Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA