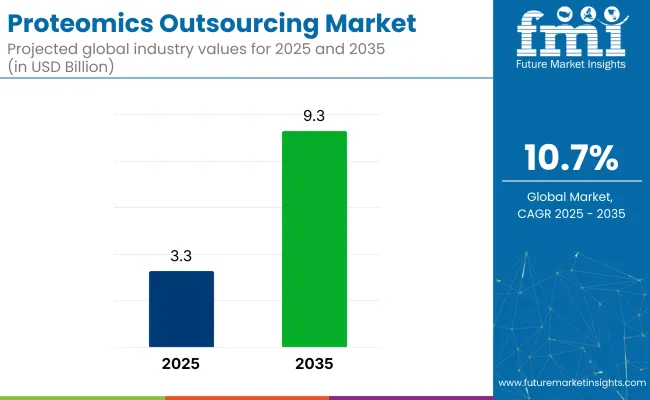

The proteomics outsourcing market is experiencing rapid expansion, projected to grow from USD 3.3 billion in 2025 to USD 9.3 billion by 2035, reflecting a CAGR of 10.7%.

China, with a 13.2% CAGR, is expected to be the fastest-growing region, driven by increasing investment in healthcare infrastructure and biotechnology. This growth is driven by the increasing complexity of proteomics research, the rising demand for personalized medicine, and the need for cost-effective, high-quality outsourcing solutions.

The industry holds a specialized share within its parent markets. In the biotechnology market, its share is around 3-5%, as proteomics plays a crucial role in drug development, but is just one aspect of biotechnology. Within the pharmaceutical market, it accounts for approximately 6-8%, driven by the increasing reliance on proteomics for biomarker discovery and drug discovery.

In the Contract Research Organization (CRO) market, proteomics outsourcing holds about 10-12%, as CROs are often contracted to handle proteomics research for drug development and clinical trials. Within the clinical research market, its share is around 2-3%, mainly supporting diagnostic and clinical trial applications. In the life sciences research market, proteomics outsourcing contributes approximately 5-7%, due to its importance in advanced biological studies.

In the 2024 annual results, Christopher Pearce, Executive Chairman of Proteome Sciences plc, expressed optimism about the future of the industry, stating, “We are optimistic that our proteomics business has gone through a significant inflection point and that it can deliver substantial increases and returns in the future.” This reflects the company's confidence in the growth and potential of the sector, highlighting a pivotal moment for their business.

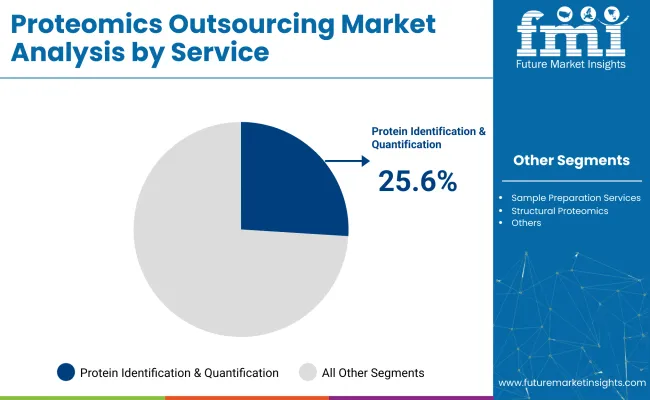

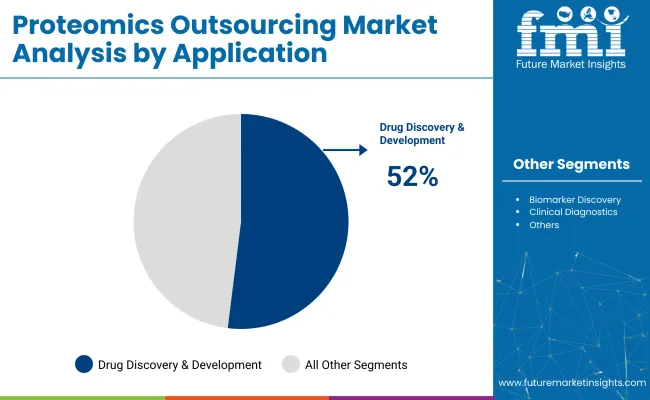

The global industry is set for significant growth through 2035. By 2025, protein identification & quantification will capture 25.6%, drug discovery & development will dominate with 52%, and pharmaceutical companies will lead the end-user segment with 36.7% in 2025. Major players include Thermo Fisher Scientific, Agilent Technologies, and Charles River Laboratories.

The protein identification & quantification segment is expected to capture 25.6% of the industry share in 2025. This service is essential for understanding the protein composition in biological samples, which is pivotal for drug discovery, disease research, and biomarker identification.

Companies like Thermo Fisher Scientific and Agilent Technologies are at the forefront, offering mass spectrometry and chromatography solutions that provide accurate protein analysis. The growing demand for proteomics in biomarker discovery, diagnostics, and personalized medicine continues to drive this segment’s growth. As proteomics becomes integral to pharmaceutical and biotechnology research, the industry for these services is poised for significant expansion.

The drug discovery & development segment is projected to lead the industry, holding 52% of the industry share in 2025. Proteomics is becoming a core component of the drug discovery process, aiding in the identification of new drug targets, the evaluation of drug efficacy, and the monitoring of clinical outcomes.

Outsourcing proteomics services allows pharmaceutical companies to access cutting-edge technology and specialized expertise without the need for significant in-house investment. This reduces time-to-market and enhances the probability of successful outcomes, particularly as pharmaceutical companies focus on biologics, targeted therapies, and personalized medicine.

Pharmaceutical companies are expected to dominate the industry, capturing 36.7% of the industry share in 2025. These companies leverage outsourcing services to accelerate drug development, precision medicine, and biomarker discovery. By outsourcing proteomics work, pharmaceutical companies gain access to specialized expertise and high-end technology, enabling more efficient research processes without the need to invest heavily in in-house capabilities.

The increasing focus on personalized medicine, biologics, and targeted therapies will continue to drive pharmaceutical companies’ reliance on proteomics outsourcing services, further solidifying their position as the largest end-user segment in the industry.

The industry is expanding, driven by increasing demand for advanced research in biotechnology and pharmaceuticals. However, challenges such as data security concerns and high outsourcing costs are limiting growth, especially for smaller organizations seeking specialized services.

Rising Demand for Advanced Proteomics Research in Biotechnology and Pharmaceuticals

The growing demand for proteomics services in biotechnology and pharmaceutical research is a major driver of the industry. As drug discovery, biomarker identification, and personalized medicine gain momentum, proteomics becomes critical in understanding protein functions, structures, and interactions. With increasing R&D investments in these sectors, many organizations opt to outsource to reduce costs and access specialized technologies. This enables faster, more accurate results and enhances the overall efficiency of research processes.

Data Security Concerns and High Outsourcing Costs Limit Market Growth

Despite strong demand, the industry faces challenges related to data security and the high cost of services. Proteomics research involves sensitive biological data, making data protection crucial. Unauthorized access or data breaches could lead to significant legal and financial consequences, causing hesitation among potential clients. Outsourcing can be expensive, particularly for smaller organizations that struggle to afford state-of-the-art technology and specialized personnel, making it a significant financial burden.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 8.7% |

| Germany | 10.6% |

| China | 13.2% |

| Japan | 7.9% |

| United Kingdom | 11.2% |

The global industry is expected to grow at a CAGR of 10.7% from 2025 to 2035. The United States, with a CAGR of 8.7%, demonstrates steady growth, driven by a strong demand for proteomics services in drug discovery, diagnostics, and biotechnology. Germany, at 10.6%, shows stable growth, supported by its well-established biotechnology and pharmaceutical industries. China, with the highest CAGR of 13.2%, is rapidly advancing, fueled by significant investments in life sciences, an expanding biotech industry, and increasing adoption of proteomics services in research and development.

Japan, at 7.9%, shows more moderate growth, influenced by ongoing developments in biotechnology and healthcare sectors. The United Kingdom, with an 11.2% CAGR, leads in growth within the OECD countries, driven by a strong research and development base, as well as increasing reliance on outsourcing for proteomics services in both academic and pharmaceutical sectors. While OECD countries show steady to moderate growth, China stands out as the fastest-growing industry, highlighting the shift towards emerging economies as key drivers of the industry’s future expansion.

The report covers in-depth analysis of 40+ countries; five top-performing OECD and BRICS countries are highlighted below.

The USA industry is expected to grow at a CAGR of 8.7% from 2025 to 2035, driven by the country’s robust pharmaceutical and biotechnology sectors. The need for high-throughput analysis and growing complexity in biological research are key drivers.

Cities like Boston, San Francisco, and San Diego are emerging as biotech hubs, where proteomics services are increasingly outsourced to specialized laboratories and CROs. United States leads in adopting next-generation sequencing (NGS) and mass spectrometry technologies, further propelling demand for proteomics services, especially in drug discovery and personalized medicine.

The United Kingdom industry is projected to grow at a CAGR of 11.2% from 2025 to 2035. With world-class academic institutions like the University of Cambridge and University College London, the UK has a strong academic foundation supporting the outsourcing of proteomics services.

The growing demand for precision medicine and personalized healthcare is fueling the outsourcing of proteomics, especially in drug discovery and biomarker identification. The UK government’s support for life sciences and biotechnology research, alongside a thriving biopharma sector, further enhances the country’s position as a leader in proteomics outsourcing.

The industry in Germany is projected to grow at a CAGR of 10.6% from 2025 to 2035. The country’s advanced research infrastructure and strong healthcare sector are key contributors to this growth. Research institutions such as the Max Planck Institute and the German Cancer Research Center play a significant role in advancing proteomics, with many companies outsourcing testing and analysis to specialized providers. The rising focus on precision medicine and clinical trials in areas such as oncology, neurology, and cardiovascular diseases is further driving demand for outsourced proteomics services.

The industry in China is expected to grow at a CAGR of 13.2% from 2025 to 2035, largely driven by the country’s expanding biotechnology and pharmaceutical sectors. Increasing investments in biotech research and government initiatives to enhance healthcare infrastructure are boosting outsourcing activities.

As personalized medicine gains traction, the adoption of high-throughput technologies in Chinese research institutions is also growing, supporting the outsourcing of proteomics services. The expanding clinical trials and pharmaceutical industries, along with China’s large population, offer significant industry potential, particularly in biomarker discovery and early-stage clinical research.

The industry in Japan is expected to grow at a CAGR of 7.9% from 2025 to 2035. The country’s strong focus on life sciences and biopharmaceuticals is driving the demand for outsourced proteomics services in drug discovery, cancer research, and clinical diagnostics.

Japanese pharmaceutical companies are increasingly relying on outsourcing to conduct complex biological research in areas such as autoimmune diseases and oncology. Japan’s established research infrastructure, combined with government support for biotechnology innovations, provides a strong foundation for continued growth in proteomics outsourcing services.

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as Thermo Fisher Scientific Inc., Agilent Technologies, and Merck KGaA lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across pharmaceutical, biotechnology, and clinical research sectors.

Key players including Danaher Corporation, PerkinElmer, and BGI Group offer specialized services tailored to specific applications and regional industries. Emerging players, such as Charles River Laboratories, Creative Proteomics, and VProteomics, focus on innovative technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Proteomics Outsourcing Industry News

| Report Attributes | Key Insights |

|---|---|

| Industry Size (2025) | USD 3.3 billion |

| Projected Industry Value (2035) | USD 9.3 billion |

| CAGR (2025 to 2035) | 10.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| Services | Protein identification & quantification, sample preparation services, post-translational modification, protein-protein interaction studies, structural proteomics |

| Application | Drug discovery & development, biomarker discovery, clinical diagnostics, personalized medicine research, others |

| End User | Pharmaceutical companies, biopharmaceutical companies, academic & research institutions, clinical diagnostic companies, agricultural & environmental research |

| Region | North America, Latin America, Asia Pacific, Middle East & Africa (MEA), Europe |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players | Charles River Laboratories, Thermo Fisher Scientific, Creative Proteomics, LABTOO, VProteomics, OHMX.bio, ICON plc |

| Additional Attributes | Dollar sales growth driven by increased demand for drug discovery services; Strong CAGR attributed to technological advancements in proteomics; Increasing demand for personalized medicine and biomarker discovery services. |

The segmentation is into protein identification & quantification, sample preparation services, post-translational modification, protein-protein interaction studies, structural proteomics, custom antibody development & validation, and target discovery & biomarker services.

The segmentation is into drug discovery & development, biomarker discovery, clinical diagnostics, personalized medicine research, and others.

The segmentation is into pharmaceutical companies, biopharmaceutical companies, academic & research institutions, clinical diagnostic companies, and agricultural & environmental research.

The regions covered in the report include North America, Latin America, Asia Pacific, Middle East and Africa(MEA), and Europe.

The projected value of the industry in 2025 is USD 3.3 billion.

The forecast value of the industry by 2035 is USD 9.3 billion.

The expected CAGR for the industry from 2025 to 2035 is 10.7%.

Drug discovery & development is expected to lead the industry in 2035, with approximately 52% industry share.

China is expected to be the fastest-growing in the industry, with a projected 13.2% CAGR.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Proteomics Market Insights - Growth & Forecast 2025 to 2035

Outsourcing Civil Engineering Services Market Size and Share Forecast Outlook 2025 to 2035

ATM Outsourcing Services Market Analysis by Service Type, ATM Deployment, and Region - Growth, Trends, and Forecast from 2025 to 2035

Desktop Outsourcing Market

Document Outsourcing Service Market Analysis - Size, Share, and Forecast 2025 to 2035

Logistics Outsourcing Market Analysis - Growth & Forecast 2025 to 2035

Data Center Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Global Non-Sterile Outsourcing Market Analysis – Size, Share & Forecast 2024-2034

Legal Process Outsourcing LPO Size Market Size and Share Forecast Outlook 2025 to 2035

Healthcare IT Outsourcing Market Growth - Analysis & Forecast 2025 to 2035

Drug Discovery Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Web Development Outsourcing Services Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Engineering Service Outsourcing Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Engineering Service Outsourcing Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Global Biomarker Discovery Outsourcing Service Market Analysis – Size, Share & Forecast 2024-2034

Formulation Development Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Web Development Outsourcing Services Market Size and Share Forecast Outlook 2025 to 2035

Early Phase Clinical Trial Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Regulatory Affairs Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA