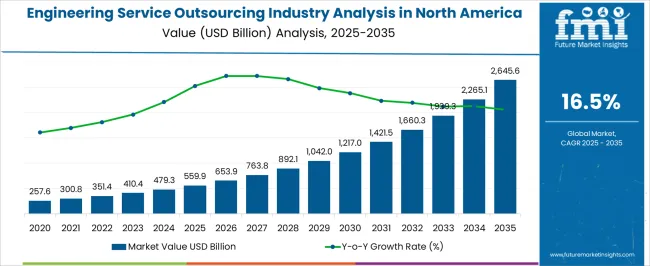

The Engineering Service Outsourcing Industry Analysis in North America is estimated to be valued at USD 559.9 billion in 2025 and is projected to reach USD 2645.6 billion by 2035, registering a compound annual growth rate (CAGR) of 16.5% over the forecast period.

| Metric | Value |

|---|---|

| Engineering Service Outsourcing Industry Analysis in North America Estimated Value in (2025 E) | USD 559.9 billion |

| Engineering Service Outsourcing Industry Analysis in North America Forecast Value in (2035 F) | USD 2645.6 billion |

| Forecast CAGR (2025 to 2035) | 16.5% |

The engineering service outsourcing industry in North America is experiencing sustained growth, driven by the rising demand for cost optimization, access to specialized expertise, and the need to accelerate product development cycles. Companies across sectors are increasingly outsourcing engineering functions to improve efficiency, reduce operational risks, and leverage global talent pools.

Advancements in digital technologies, including cloud computing, artificial intelligence, and simulation tools, have enabled seamless collaboration between onshore teams and offshore service providers. The current market landscape reflects a balanced mix of strategic partnerships and project-based outsourcing, supporting innovation and scalability.

Regulatory compliance and intellectual property protection in North America have also created a secure environment for outsourcing high-value engineering activities. Looking ahead, growth is expected to be fueled by expanding digital engineering requirements, rising adoption of Industry 4.0 practices, and the demand for engineering support in renewable energy, mobility, and advanced manufacturing sectors.

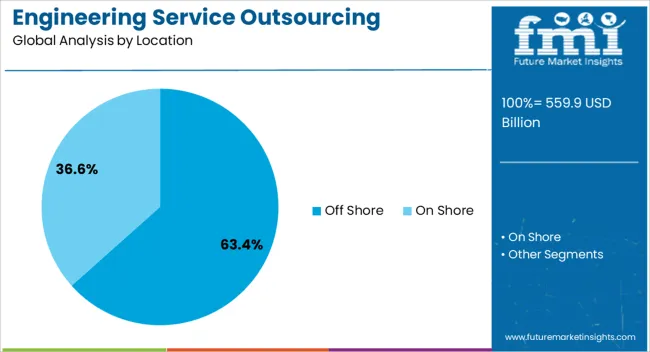

The offshore segment dominates the location category, holding approximately 63.40% share in the engineering service outsourcing industry in North America. This segment’s growth is driven by cost-efficiency, availability of skilled labor, and scalability of operations across global delivery centers.

Offshore outsourcing allows organizations to access engineering expertise at competitive rates while maintaining operational flexibility. Time-zone advantages and advancements in digital communication platforms have minimized collaboration barriers, reinforcing the segment’s dominance.

Companies are increasingly relying on offshore partners for CAD modeling, prototyping, and process engineering to accelerate project timelines. With demand for large-scale outsourcing continuing across industries, the offshore segment is expected to maintain its leadership over the forecast horizon.

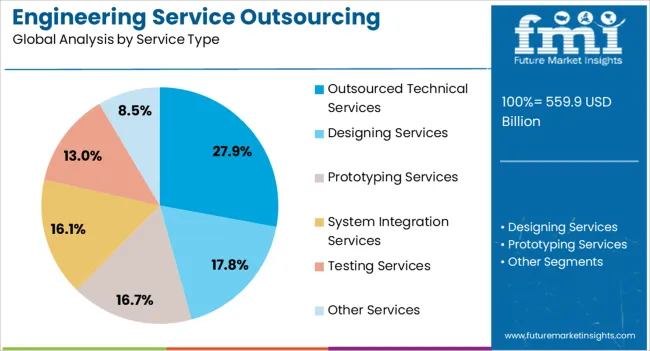

The outsourced technical services segment accounts for approximately 27.90% of the service type category, supported by the need for specialized engineering support in product design, simulation, and testing. The segment’s prominence stems from its ability to deliver value-added services that enhance product quality while reducing in-house resource requirements.

Organizations leverage outsourced technical expertise to handle complex design validation, compliance documentation, and digital twin creation. The adoption of cloud-based platforms has enabled real-time collaboration, ensuring seamless delivery of outsourced projects.

As engineering processes become increasingly digitized, demand for technical service outsourcing is expected to expand, solidifying the segment’s relevance in the industry.

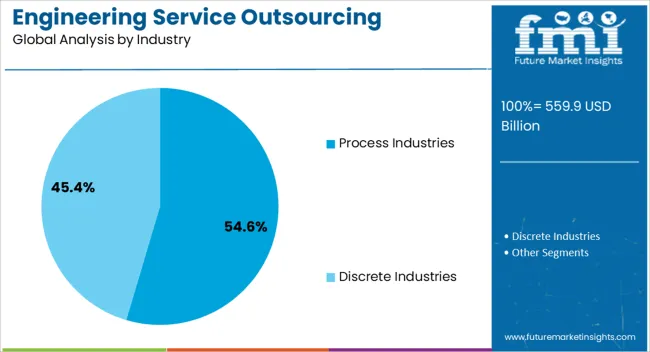

The process industries segment holds approximately 54.60% share in the industry category, reflecting strong outsourcing demand from sectors such as chemicals, oil and gas, pharmaceuticals, and food processing. These industries rely heavily on outsourced engineering services to ensure operational efficiency, compliance with safety standards, and optimization of production systems.

Outsourcing partners provide expertise in process simulation, plant design, and maintenance engineering, enabling cost savings and performance improvements. The complexity of process industry operations, coupled with the need for continuous innovation, reinforces reliance on external engineering resources.

With ongoing investment in process automation and sustainability initiatives, the process industries segment is projected to sustain its leadership.

From 2020 to 2025, the North America engineering service outsourcing demand grew at a CAGR of 12.4%. Total valuation in North America at the end of 2025 reached about USD 410.4 billion.

During the historical period, the adoption of designing service outsourcing gained significant traction, and integration with onshore and system integration services became key drivers for its usage. Organizations increasingly embraced the benefits of engineering service outsourcing, which provided impetus for sales growth.

Future Forecast for North America Engineering Service Outsourcing

Over the forecast period, the North America engineering service outsourcing industry is projected to advance at a CAGR of 16.8%. It will likely attain a massive valuation of USD 1,940.5 billion in 2035.

Engineering service outsourcing is undergoing a promising change. Solution providers are evolving to provide shortened development cycles and reduce production costs, enabling engineering services to include improved resource utilization, product innovation, and industry scalability.

Engineering service outsourcing is expected to play an increasingly pivotal role in industries like automotive, semiconductors, and electronics. Hence, the expansion of these industries will uplift the demand for engineering outsourcing services during the forecast period.

Semi-annual Update

| Particular | Value CAGR |

|---|---|

| H1 | 13.3% (2025 to 2035) |

| H2 | 14.4% (2025 to 2035) |

| H1 | 16.4% (2025 to 2035) |

| H2 | 16.8% (2025 to 2035) |

The United States remains the undisputed leader in engineering service outsourcing in North America. As per the latest analysis, the United States engineering service outsourcing industry is projected to expand with 17.6% CAGR, totaling a gigantic valuation of USD 1,587.54 billion in 2035.

Several factors are expected to spur growth of the engineering service outsourcing industry in the United States. These include rising emphasis of industries on reducing operational costs and digital transformation.

The United States leads from the forefront when it comes to adoption of digital technologies like IoT, AI, and cloud computing. High adoption of these technologies is expected to create new opportunities for outsourcing engineering services remotely and collaboratively.

The rapid advancement of communication technologies in the United States is anticipated to improve the engineering service outsourcing industry share. With the continual evolution of communication tools, such as high-speed internet, cloud computing, and collaborative software platforms, United States-based companies can seamlessly connect with engineering service providers.

The enhanced connectivity fosters real-time collaboration, efficient project management, and the swift exchange of information. It is breaking down geographical barriers and enabling United States companies to leverage specialized engineering expertise from around the world.

The section below highlights key segments' estimated value shares and CAGRs, including service type, location, and industry. The information obtained can be crucial for companies to frame their strategies accordingly for maximum profits.

Growth Outlook by Location

| Location | Value CAGR |

|---|---|

| Onshore | 18.4% |

| Offshore | 14.3% |

The onshore segment's significant revenue share in North America engineering service outsourcing (ESO) is due to its geographical proximity. Clients frequently favor onshore outsourcing because of the ease of communication, collaboration, and real-time contact.

Close physical proximity makes face-to-face meetings, site inspections, and a deeper grasp of the local business environment possible, promoting stronger client-vendor connections. Several prominent companies in North America opt for outsourcing on-shore engineering services. As a result, the target segment held a value share of 58.2% in 2025.

Growth Outlook by Service Type

| Service Type | Value CAGR |

|---|---|

| Outsourced Technical Services | 13.3% |

| Designing Services | 20.7% |

| Prototyping Services | 17.1% |

| System Integration Services | 18.7% |

| Testing Services | 14.5% |

| Other Services | 11.5% |

As per the latest North America engineering service outsourcing industry analysis, designing services are expected to witness higher demand across North America during the assessment period. The target segment is projected to thrive at an impressive CAGR of 20.7% between 2025 and 2035.

The surge in demand for comprehensive Product Lifecycle Management (PLM) solutions significantly contributes to the design services segment's growth. Companies are seeking end-to-end support in product development, from concept ideation to retirement, and outsourcing design services has proven instrumental in optimizing the entire product lifecycle.

Growing popularity of engineering design outsourcing is expected to play a key role in boosting the North America industry. Similarly, growing need for reducing cost associated with the complex designing process will foster segment growth.

Growth Outlook by Industry

| Industry | Value CAGR |

|---|---|

| Process Industries | 14.8% |

| Discrete Industries | 18.1% |

Adoption of engineering service outsourcing is expected to remain high in discrete industries like automotive, electronics, and medical devices. This is because these industries are seeking to optimize their operations and stay competitive in the rapidly evolving world.

Automotive manufacturers and suppliers are increasingly turning to outsourcing partners to leverage specialized skills and access cutting-edge expertise. This trend is driven by the need for cost-effective solutions, accelerated product development cycles, and the demand for innovative technologies such as electric and autonomous vehicles.

As industries like automotive continue to pursue innovation, cost-effectiveness, and adaptability, demand for engineering service outsourcing in Norther America is expected to rise significantly. As a result, the discrete industries segment is projected to expand at 18.1% CAGR during the forecast period.

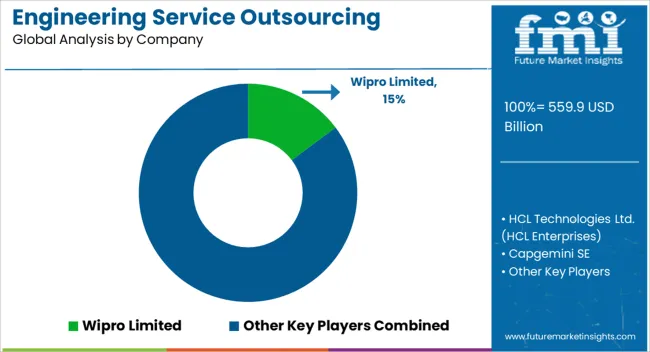

Key players in North America are focusing on offering novel engineering services to meet evolving end user demand. They are also adopting strategies like partnerships, collaborations, mergers, and acquisitions to expand their customer base and strengthen their presence in the region.

Key Developments in the North America Engineering Service Outsourcing Industry

| Attribute | Details |

|---|---|

| Estimated Value (2025) | USD 559.9 billion |

| Projected Value (2035) | USD 2645.6 billion |

| Expected Growth Rate (2025 to 2035) | 16.5% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Industry Analysis | USD Billion for Value |

| Key Regions Covered | North America |

| Key Countries Covered | United States, Canada |

| Key Segments Covered | Location, Service Type, Industry, and Country |

| Key Companies Profiled | Wipro Limited; HCL Technologies Ltd. (HCL Enterprises); Capgemini SE; Infosys Limited; Tata Consultancy Services Ltd.; Tech Mahindra Limited; Tata Elxsi Limited; Entelect Software (Pty) Ltd.; AKKA Technologies SE |

| Report Coverage | Industry Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Key Dynamics and Challenges, and Strategic Growth Initiatives |

The global engineering service outsourcing industry analysis in North America is estimated to be valued at USD 559.9 billion in 2025.

The market size for the engineering service outsourcing industry analysis in North America is projected to reach USD 2,645.6 billion by 2035.

The engineering service outsourcing industry analysis in North America is expected to grow at a 16.5% CAGR between 2025 and 2035.

The key product types in engineering service outsourcing industry analysis in North America are off shore and on shore.

In terms of service type, outsourced technical services segment to command 27.9% share in the engineering service outsourcing industry analysis in North America in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Engineering Analytics Market Growth & Demand 2025 to 2035

Engineering Plastic Market Analysis - Size, Share & Forecast 2025 to 2035

Engineering Service Outsourcing Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Geoengineering Market Analysis – Size, Demand & Forecast 2025 to 2035

Civil Engineering Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Engineering Service Market Size and Share Forecast Outlook 2025 to 2035

Network Engineering Service Market Trends – Demand & Forecast 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

Automotive Engineering Services Market Growth - Trends & Forecast 2025 to 2035

Automotive Engineering Service Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Computer-aided Engineering Market Analysis - Size, Share, and Forecast 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Civil Construction Design And Detailing Engineering Market Size and Share Forecast Outlook 2025 to 2035

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

ServiceNow Tech Service Market Size and Share Forecast Outlook 2025 to 2035

Service Orchestration Market Size and Share Forecast Outlook 2025 to 2035

Service Robotics Market Size and Share Forecast Outlook 2025 to 2035

Service Trucks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA