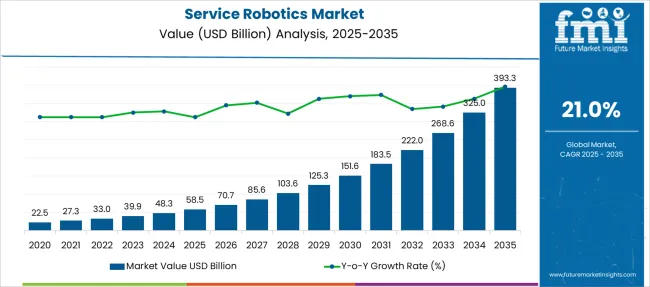

The Service Robotics Market is estimated to be valued at USD 58.5 billion in 2025 and is projected to reach USD 393.3 billion by 2035, registering a compound annual growth rate (CAGR) of 21.0% over the forecast period.

| Metric | Value |

|---|---|

| Service Robotics Market Estimated Value in (2025 E) | USD 58.5 billion |

| Service Robotics Market Forecast Value in (2035 F) | USD 393.3 billion |

| Forecast CAGR (2025 to 2035) | 21.0% |

The service robotics market is expanding rapidly due to accelerated advancements in artificial intelligence, sensor technology, and autonomous navigation systems. Growing labor shortages, rising demand for automation across sectors, and increased operational efficiency expectations are driving the deployment of service robots in both consumer and professional domains.

Robotics applications have diversified from cleaning and surveillance to complex tasks such as surgical assistance, agricultural operations, and last mile delivery. Investments in compact and modular hardware, as well as software integration for enhanced mobility and decision making, are fueling adoption rates.

Government initiatives and funding aimed at advancing robotics infrastructure, coupled with greater acceptance of collaborative machines in workplaces, continue to shape market dynamics. The outlook remains promising as industries seek scalable robotic solutions to optimize cost, improve accuracy, and reduce human intervention in critical and repetitive operations.

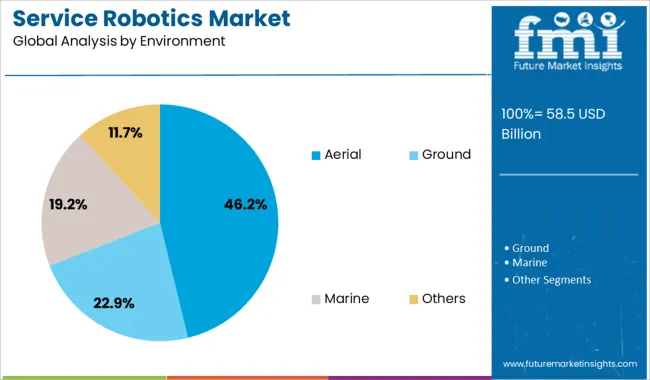

The market is segmented by Component, Field of Application, and Environment and region. By Component, the market is divided into Hardware and Software. In terms of Field of Application, the market is classified into Professional or Commercial Service Robotics and Personal or Domestic Service Robotics. Based on Environment, the market is segmented into Aerial, Ground, Marine, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment is anticipated to represent 58.30% of the total revenue by 2025 under the component category, making it the dominant segment. This is largely due to the rising investment in physical infrastructure including sensors, actuators, power systems, and robotic arms which are essential for real time task execution and environment interaction.

Continuous improvements in battery life, structural materials, and miniaturization have further elevated the efficiency and range of service robots. Additionally, as end users demand reliable and durable robotic platforms for long term deployment, hardware components remain the focal point of development and spending.

The critical role of hardware in ensuring performance, precision, and operational safety has solidified its position as the leading component in the service robotics ecosystem.

The professional or commercial service robotics segment is expected to account for 41.60% of the overall market revenue by 2025, positioning it as the leading field of application. This growth is driven by increased deployment of robots in industries such as healthcare, logistics, agriculture, and hospitality where consistent performance and task automation are crucial.

The ability of service robots to reduce operational costs, improve service delivery, and operate in hazardous or repetitive conditions has enhanced their utility in commercial settings. Moreover, demand for robots capable of working alongside human operators in real world environments has led to their widespread integration in professional workflows.

With expanding use cases and proven return on investment, this segment continues to lead the market by addressing productivity and workforce challenges across sectors.

The aerial environment segment is projected to contribute 46.20% of the total market revenue by 2025 within the environment category, making it the top performing segment. This growth is attributed to the increasing use of aerial service robots such as drones in applications like surveillance, mapping, precision agriculture, and infrastructure inspection.

Their ability to access hard to reach locations, collect data efficiently, and operate autonomously over large areas has made them indispensable in modern operational strategies. Advancements in flight control systems, GPS technologies, and onboard imaging have further enhanced performance and reliability.

As industries seek cost effective alternatives to manual monitoring and inspection, aerial robotics are being adopted at scale, driving their dominant position in the environment segment.

In the upcoming years, numerous newly industrializing economies are anticipated to have a strong requirement for the supply chain and distribution procedures consequently boosting the demand for remote control robots.

The regional service robotics market is also anticipated to benefit from an increase in expenditures made by government organizations to modernize current healthcare systems that require reform.

Many people in emerging countries are now enjoying higher standards of living, which is anticipated to help fuel the demand for personal service robots. However, the development of service robotics market players would be a little slower in the regions with limited technological development and lower literacy rate.

Unfortunately, issues including the rising cost of raw materials and semiconductor chips have had a detrimental effect on the market expansion. Moreover, the expansion of the service robotics business has been constrained by large upfront investment and maintenance costs.

The industrial or commercial services robotics sector should dominate over the forecast years and indeed capture the bigger market share until the year 2025. Again, in this segment, the sub-segments of medical, construction, and demolition activities, defense, logistics & transportation, and agricultural sectors would remain the major buyers of industrial service robots.

Contrarily, due to a growing trend among people of using integrated robotic solutions for numerous crucial processes, the personal or domestic service robotics segment is anticipated to grow significantly throughout the forecast years. Service robotics for education and medical care at home or elder care robots are the two rapidly growing sub-segments at present time.

In addition to these two sectors, the restaurant service robot sub-segment is anticipated to exhibit consistent growth over the forecast years. There has been a significant rise in the popularity of humanoid service robots in the restaurant and hospitality business due to the rise in theme restaurant projects throughout the world. The proliferation of such ideas is anticipated to create more opportunities for service robotics market players in the coming days.

Since the implementation of commercial as well as home service robots are going to be more application-specific, the market demand and value for service robotics software components is predicted to be greater than the hardware component in particular.

Whereas through the forecast years, the market segment of aerial drones is anticipated to register the highest CAGR. It can be attributed to the growing use of industrial drones for tasks like inspecting farmlands and tracking traffic, as well as the greater cost of these drones in comparison to general-purpose consumer drones.

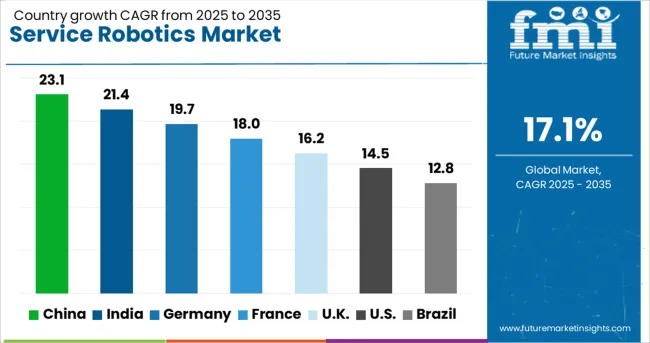

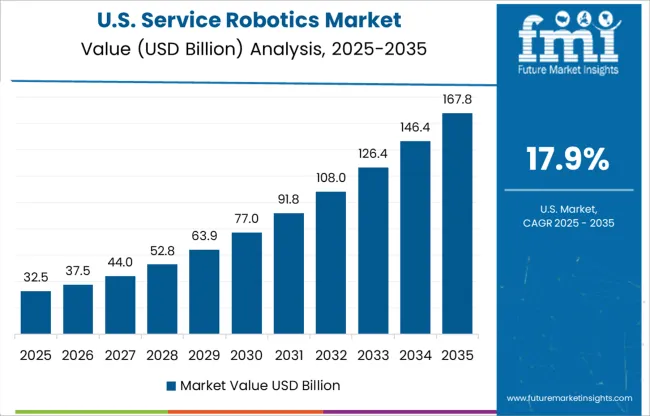

According to the services robotics market report for the years 2025 to 2035 released by FMI, the USA leads the overall market with a substantial number of market players in the country. As per the report, it still has got sufficient groundwork and opportunities to retain its shareholding during the forecast years as well.

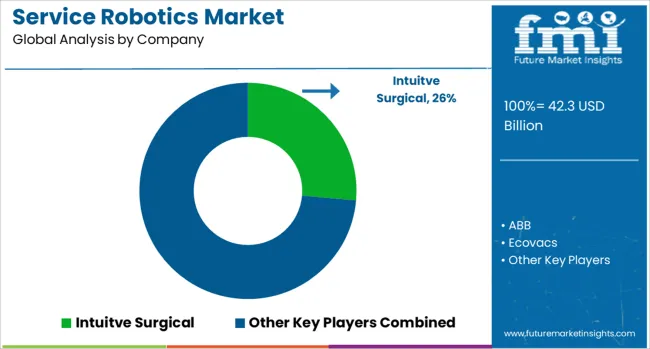

Most of the large players are also indulged in acquiring smaller players for expanding their regional influence to retain their competitiveness in the future service robotics market. Intuitive Surgical Inc. ended up buying Orpheus Medical in early 2024 to broaden its unified informatics platform since Orpheus Medical offers hospitals access to IT resources and knowledge about quickly processing and preserving surgical recordings.

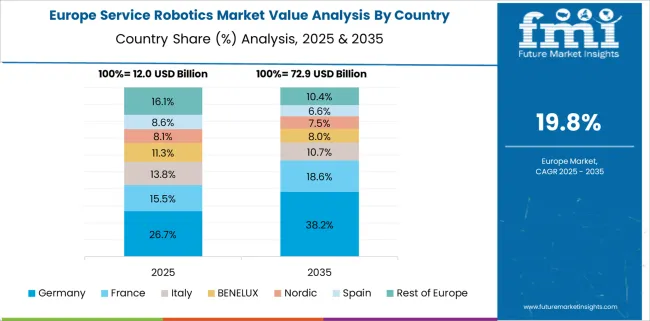

In regards to the global service robotics market survey report, European Union holds the largest market share due to the rising interest in the home and personal assistant robots in several of its member states. Due to the increased acceptance of such robotic solutions in these nations, countries like Germany, the United Kingdom, France, and Italy are predicted to expand strongly throughout the forecast years.

Furthermore, there are several key market participants present in the region who are striving to advance in this sector by adopting cutting-edge technologies. For instance, in November 2020, the Italian business Piaggio staged Gita, which is a smart delivery robot that can carry groceries and cost almost USD 3,250 in the year 2020. Such an indoor delivery robot has a hands-free carrier to lift various articles, and can even follow its operator along the street.

Following Europe, China is anticipated to hold the second-highest position in the production and sales of service robotics in the global market. The Research and Development efforts put in by the industrial robot tech sector of the country are the most significant driver of the China service robotics market.

Governments in other Asia Pacific countries such as South Korea and Japan are also expanding their investments in technology like automation, AI, and vector robots. For instance, in South Korea, to assist senior citizens with safe and efficient walk training, Panasonic Corporation unveiled a mass-production version of its Walk Training Robot in April 2024. The Company also provides elder care robots for assistance services in homes, healthcare institutions, and other organizations.

Yaskawa India Pvt. Ltd., which is a division of Yaskawa Electric Corporation, and Wipro Limited confirmed their collaboration in February 2024 by signing an MOU that outlines their commitment to working together to pursue global automation and humanoid robot projects. Through this relationship, the business is capable of supplying Yaskawa service robots both domestically and internationally.

Besides, after building a humanoid service robot called Sona-1.5, in 2020, Modern Railway Coach Factory in India has brought industrial technology to new heights. In a busy setting, it is useful for moving items from place to place.

In the present time, major market participants are fiercely competing to attract customers to their service robots for a range of applications, and in order to expand their clientele and increase their skills, companies are acquiring and collaborating with top service robotics companies.

For instance, in January 2024, iRobot formed an alliance with If This Then That (IFTTT), which is a well-known platform for the integration and realization of web-based services that provide new integrated and smart home configurations. IFTTT is expected to assist iRobot to integrate products and services into its iRobot HOME application categories, including smart thermostats, scanners, and home security robots.

The global service robotics market is estimated to be valued at USD 58.5 billion in 2025.

The market size for the service robotics market is projected to reach USD 393.3 billion by 2035.

The service robotics market is expected to grow at a 21.0% CAGR between 2025 and 2035.

The key product types in service robotics market are hardware, _airframe, _sensors, _cameras, _actuators, _power supply, _control systems, _navigation systems, _propulsion systems, _others and software.

In terms of field of application, professional or commercial service robotics segment to command 41.6% share in the service robotics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Robotics as a Service (RaaS) Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robotics Retrofit Service Market Size and Share Forecast Outlook 2025 to 2035

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

ServiceNow Tech Service Market Size and Share Forecast Outlook 2025 to 2035

Service Orchestration Market Size and Share Forecast Outlook 2025 to 2035

Service Trucks Market Size and Share Forecast Outlook 2025 to 2035

Service Resource Planning (SRP) SaaS Solutions Market Size and Share Forecast Outlook 2025 to 2035

Service Bureau Market Analysis - Size, Growth, and Forecast 2025 to 2035

Service Laboratory Market Analysis by Service Type, Deployment, Channel, End-user, and Region Through 2035

Service Integration & Management Market Report – Forecast 2017-2027

IT Service Management Tools Market Growth – Trends & Forecast through 2034

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Foodservice Paper Bag Companies

Europe Foodservice Disposables Market Insights – Growth & Trends 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA