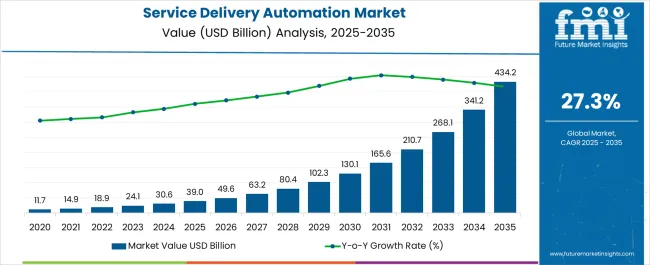

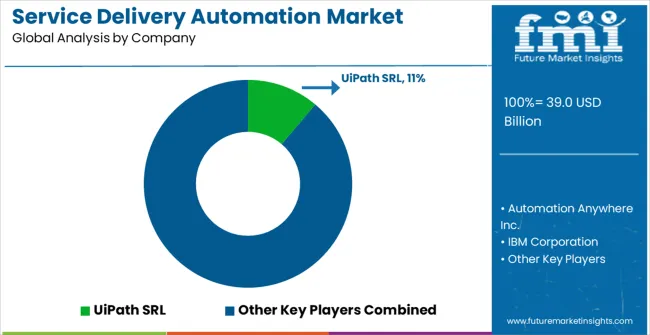

The Service Delivery Automation Market is estimated to be valued at USD 39.0 billion in 2025 and is projected to reach USD 434.2 billion by 2035, registering a compound annual growth rate (CAGR) of 27.3% over the forecast period.

| Metric | Value |

|---|---|

| Service Delivery Automation Market Estimated Value in (2025 E) | USD 39.0 billion |

| Service Delivery Automation Market Forecast Value in (2035 F) | USD 434.2 billion |

| Forecast CAGR (2025 to 2035) | 27.3% |

The Service Delivery Automation market is expanding rapidly as enterprises prioritize efficiency, accuracy, and scalability in operations. Businesses are adopting automation technologies to reduce human error, minimize costs, and accelerate service delivery cycles. The growing shift toward digital transformation, coupled with heightened demand for enhanced customer experience, is fueling adoption across industries.

Advancements in artificial intelligence, robotic process automation, and machine learning are enabling organizations to handle repetitive and rule-based tasks more efficiently while freeing employees to focus on strategic responsibilities. Integration with cloud platforms and analytics solutions is further strengthening automation’s role in enterprise workflows. The rising focus on compliance, risk management, and data security is also encouraging companies to deploy structured automation systems that ensure transparency and accountability.

In addition, heightened competition across industries is prompting enterprises to optimize resource utilization and streamline processes to maintain agility As enterprises worldwide increasingly invest in next-generation technologies, the Service Delivery Automation market is expected to witness sustained growth, establishing itself as a critical enabler of operational excellence and digital innovation.

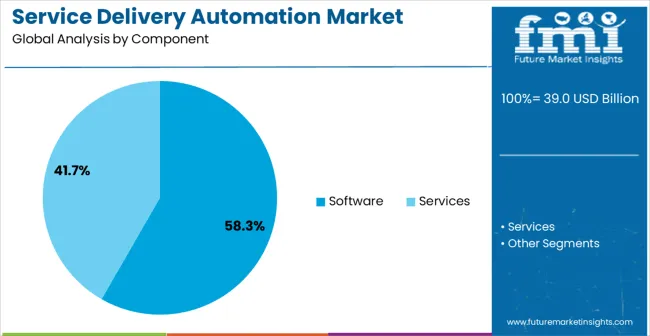

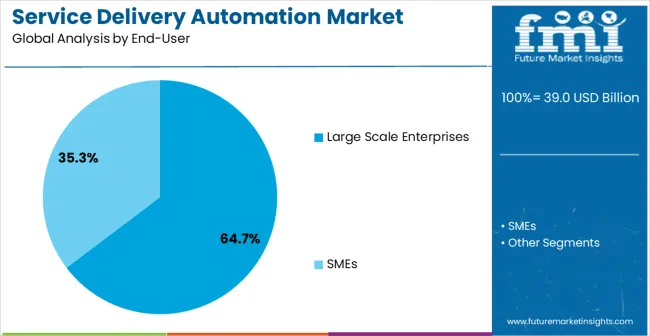

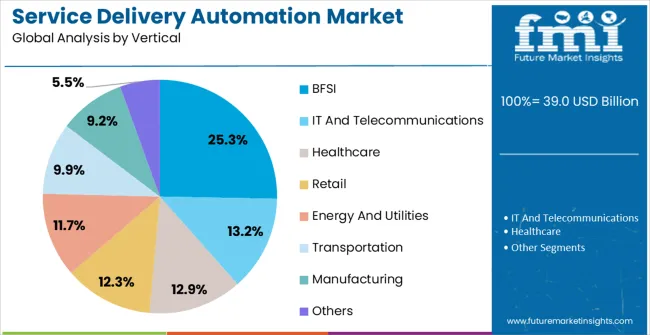

The service delivery automation market is segmented by component, end-user, vertical, and geographic regions. By component, service delivery automation market is divided into Software and Services. In terms of end-user, service delivery automation market is classified into Large Scale Enterprises and SMEs. Based on vertical, service delivery automation market is segmented into BFSI, IT And Telecommunications, Healthcare, Retail, Energy And Utilities, Transportation, Manufacturing, and Others. Regionally, the service delivery automation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software component segment is projected to account for 58.3% of the Service Delivery Automation market revenue in 2025, positioning it as the dominant component category. This leadership is being driven by the increasing deployment of automation platforms that streamline repetitive tasks, reduce costs, and enhance consistency in service delivery. Software solutions enable real-time process monitoring, analytics, and integration with enterprise systems such as CRM, ERP, and HRM platforms.

The adoption of artificial intelligence and robotic process automation within these solutions is allowing businesses to manage complex workflows with greater efficiency and flexibility. Enterprises are also leveraging automation software to ensure compliance with industry standards and regulatory requirements, minimizing the risk of operational errors.

The ability of software-based platforms to scale according to organizational needs while providing measurable returns on investment is a significant contributor to their growth As businesses increasingly demand comprehensive and adaptable automation tools, the software segment is expected to maintain its dominance, supported by continuous innovation and integration with advanced digital ecosystems.

The large scale enterprises segment is expected to hold 64.7% of the Service Delivery Automation market revenue in 2025, making it the leading end-user category. This dominance is being driven by the complex operational structures and high transaction volumes of large enterprises, which require advanced automation for efficiency and scalability. By adopting automation, large enterprises are reducing manual intervention in routine tasks, thereby cutting costs and improving accuracy.

Automation platforms also enable large enterprises to enhance compliance, improve service delivery times, and strengthen customer engagement by streamlining back-office and front-office operations. The increasing use of robotic process automation and AI-powered solutions is enabling large organizations to handle large datasets and complex processes seamlessly. Furthermore, global enterprises are using automation to drive digital transformation initiatives, ensure operational resilience, and remain competitive in dynamic markets.

The scale of resources and the capacity to invest in cutting-edge solutions position large enterprises as the primary adopters of automation technologies Consequently, the large scale enterprises segment is set to maintain its leadership role, supported by sustained investment and a growing emphasis on enterprise-wide automation strategies.

The BFSI vertical segment is projected to capture 25.3% of the Service Delivery Automation market revenue in 2025, establishing itself as the leading vertical. This dominance is being reinforced by the sector’s reliance on high-volume, rule-based transactions such as loan processing, claims handling, customer onboarding, and fraud detection. Automation technologies enable BFSI organizations to improve accuracy, reduce operational costs, and comply with stringent regulatory requirements while managing large data flows.

The integration of artificial intelligence and robotic process automation into BFSI workflows allows for faster decision-making and improved customer experience, particularly in areas such as digital banking and insurance services. The sector is also leveraging automation to enhance risk management, ensure data security, and achieve higher transparency in reporting and compliance. As customer expectations shift toward instant and personalized services, automation is enabling BFSI firms to remain competitive and agile.

Continuous advancements in analytics, fraud detection algorithms, and cloud-based automation platforms are further strengthening adoption As a result, the BFSI segment is anticipated to sustain its leadership in driving revenue growth within the Service Delivery Automation market.

Companies across different verticals are constantly trying to find out new areas through which they can reduce their total operational costs. Service delivery automation is one such area via which this objective can be achieved. Service delivery automation basically refers to replacement of manpower with technology in order to reduce operational costs and eliminate human error and thus achieve additional benefits.

Gradually service delivery automation vendors will either form strategic partnerships with technology leaders in order to combine their products with latest technologies or some service delivery automation vendors will develop technologies on their own and automate their products accordingly to compete with technology vendors.

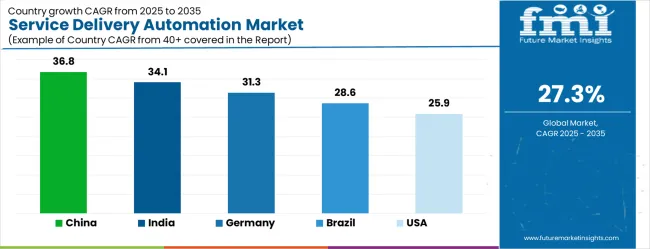

| Country | CAGR |

|---|---|

| China | 36.8% |

| India | 34.1% |

| Germany | 31.3% |

| Brazil | 28.6% |

| USA | 25.9% |

| UK | 23.2% |

| Japan | 20.4% |

The Service Delivery Automation Market is expected to register a CAGR of 27.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 36.8%, followed by India at 34.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 20.4%, yet still underscores a broadly positive trajectory for the global Service Delivery Automation Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 31.3%. The USA Service Delivery Automation Market is estimated to be valued at USD 14.0 billion in 2025 and is anticipated to reach a valuation of USD 14.0 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 2.0 billion and USD 1.1 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 39.0 Billion |

| Component | Software and Services |

| End-User | Large Scale Enterprises and SMEs |

| Vertical | BFSI, IT And Telecommunications, Healthcare, Retail, Energy And Utilities, Transportation, Manufacturing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | UiPath SRL, Automation Anywhere Inc., IBM Corporation, Blue Prism Ltd, NICE Ltd, IPsoft Inc., Xerox Holdings Corporation, Celaton Limited, Arago GmbH, Accenture plc, AutomationEdge Technologies, Pegasystems Inc., Microsoft Corporation, SAP SE, ServiceNow Inc., WorkFusion Inc., and Kofax Inc. |

The global service delivery automation market is estimated to be valued at USD 39.0 billion in 2025.

The market size for the service delivery automation market is projected to reach USD 434.2 billion by 2035.

The service delivery automation market is expected to grow at a 27.3% CAGR between 2025 and 2035.

The key product types in service delivery automation market are software and services.

In terms of end-user, large scale enterprises segment to command 64.7% share in the service delivery automation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

ServiceNow Tech Service Market Size and Share Forecast Outlook 2025 to 2035

Service Orchestration Market Size and Share Forecast Outlook 2025 to 2035

Service Robotics Market Size and Share Forecast Outlook 2025 to 2035

Service Trucks Market Size and Share Forecast Outlook 2025 to 2035

Service Resource Planning (SRP) SaaS Solutions Market Size and Share Forecast Outlook 2025 to 2035

Service Bureau Market Analysis - Size, Growth, and Forecast 2025 to 2035

Service Laboratory Market Analysis by Service Type, Deployment, Channel, End-user, and Region Through 2035

Service Integration & Management Market Report – Forecast 2017-2027

IT Service Management Tools Market Growth – Trends & Forecast through 2034

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Foodservice Paper Bag Companies

Europe Foodservice Disposables Market Insights – Growth & Trends 2024-2034

Foodservice Disposable Market Growth & Trends Forecast 2024-2034

Self-service Billiards System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA