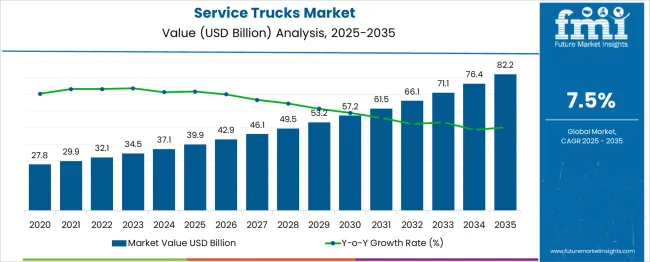

The Service Trucks Market is estimated to be valued at USD 39.9 billion in 2025 and is projected to reach USD 82.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. The first phase of this growth occurs between 2020 and 2024, when the market rises from USD 27.8 billion to USD 37.1 billion, accounting for around 17.1% of the total projected expansion. This period reflects steady adoption driven by increasing demand in sectors such as construction, utilities, and maintenance, supported by advancements in vehicle durability, fuel efficiency, and specialized equipment integration.

Between 2025 and 2030, the market continues to accelerate, expanding from USD 39.9 billion to USD 57.2 billion, which contributes an incremental gain of USD 17.3 billion. This phase is marked by growing investments in fleet upgrades, increasing infrastructure development, and the integration of innovative technologies to enhance service truck performance. The final period, from 2031 to 2035, witnesses further acceleration with the market increasing from USD 61.5 billion to USD 82.2 billion, representing about 38% of the overall growth. This surge is driven by the electrification of service vehicles, the implementation of telematics and IoT for better fleet management, and the expansion into emerging markets. Continuous innovation in vehicle customization and compliance with evolving regulations will provide competitive advantages to market players. Overall, the Service Trucks Market is positioned for sustained and robust growth fueled by industry demands, technological advancements, and global infrastructure expansion through 2035.

| Metric | Value |

|---|---|

| Service Trucks Market Estimated Value in (2025 E) | USD 39.9 billion |

| Service Trucks Market Forecast Value in (2035 F) | USD 82.2 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The service trucks market is growing steadily due to increasing demand from infrastructure, utility, and industrial maintenance sectors. The market is supported by a rise in fleet modernization programs and infrastructure investments across both developed and emerging economies.

Service trucks are becoming more specialized, integrating hydraulic systems, storage customization, and real-time monitoring technologies to improve productivity on field sites. Advancements in chassis design and telematics are further enhancing fleet reliability, uptime, and route efficiency.

Regulations concerning vehicle emissions and operator safety are influencing OEMs to innovate fuel systems and payload capacities. As industries continue to prioritize mobility, on-site service, and turnaround efficiency, the role of service trucks is expected to become even more critical across varied end-use verticals.

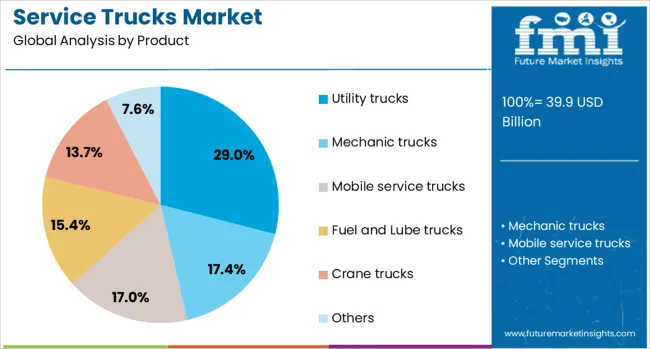

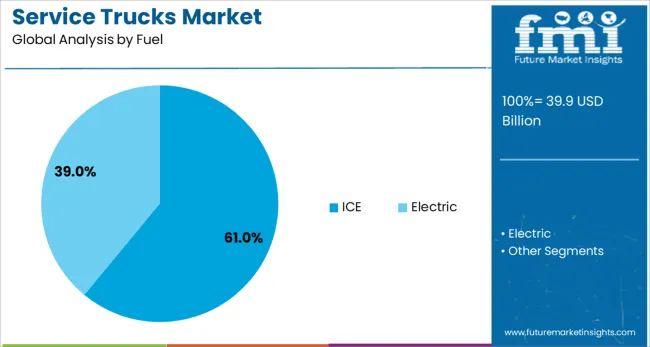

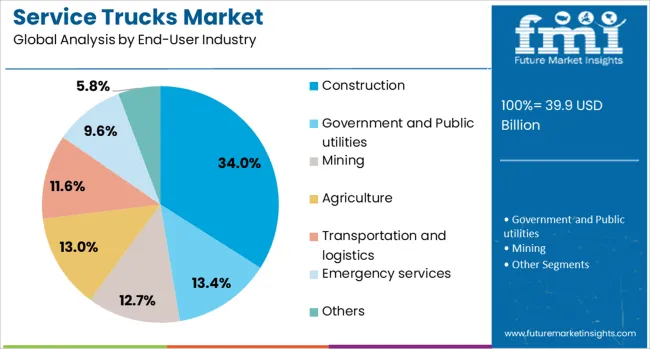

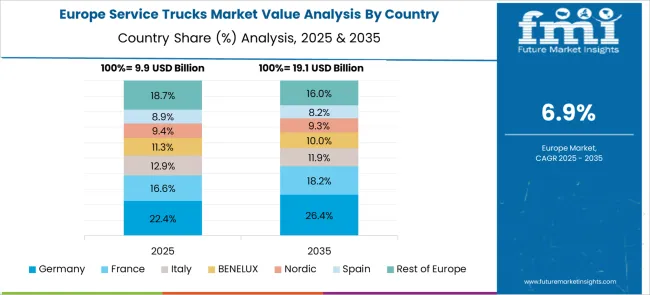

The service trucks market is segmented by product, fuel end-user industry, and geographic regions. By product of the service trucks market is divided into Utility trucks, Mechanic trucks, Mobile service trucks, Fuel and Lube trucks, Crane trucks Others. In terms of fuel of the service trucks market is classified into ICE Electric. Based on end-user industry of the service trucks market is segmented into Construction, Government and Public utilities, Mining, Agriculture, Transportation and logistics, Emergency services Others. Regionally, the service trucks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Utility trucks are projected to dominate the product segment of the service trucks market with a 29.00% share in 2025. Their versatility in handling maintenance, repair, and infrastructure servicing has made them essential for sectors such as telecom, water, energy, and road utilities.

With features like aerial lifts, storage compartments, and hydraulic lifts, utility trucks provide an efficient mobile base for field operations. Their modular design allows customization to suit task-specific functions, reducing downtime and increasing operational reach.

Their rising deployment by municipal and private operators continues to drive segment expansion.

Internal combustion engine (ICE)-powered service trucks are expected to lead the market with a 61.00% share in 2025. This dominance stems from the segment’s extensive existing fleet base, reliable power performance, and compatibility with heavy-duty operations.

ICE-powered trucks offer longer refueling intervals and are preferred in remote or underdeveloped regions where electric vehicle infrastructure is limited.

While the electrification trend is rising, ICE trucks continue to be favored for high-load and high-utilization duty cycles, especially in rugged, off-grid work environments.

Construction is set to emerge as the largest end-use industry in the service trucks market, holding a 34.00% share in 2025. The sector’s high equipment density and continuous demand for on-site maintenance and materials transport create strong growth opportunities.

Service trucks used in construction often carry tools, generators, welders, and compressors, reducing reliance on fixed facilities.

Increasing infrastructure development, particularly in emerging markets, is pushing contractors to invest in reliable service truck fleets that enhance jobsite productivity and safety compliance.

Service trucks play a vital role in supporting construction, energy, and fleet maintenance operations. Increased reliance on telematics and customized designs is shaping demand, ensuring efficiency and responsiveness across industrial applications.

The construction sector significantly drives the need for service trucks, as heavy equipment and on-site machinery require continuous maintenance to reduce downtime. Projects involving road development, housing, and commercial complexes increasingly rely on service trucks equipped with advanced repair tools and mobile workshops. These trucks enable immediate troubleshooting and replacement of critical components at remote job sites, reducing delays and operational costs. The ability to perform preventive maintenance on-site improves project timelines, creating strong adoption trends among contractors and fleet operators. Service trucks tailored for specific construction needs, such as hydraulic lift systems and modular storage, are becoming integral to infrastructure development initiatives worldwide.

Energy and utility companies are emerging as key users of service trucks due to the growing requirement for uninterrupted operations across power distribution networks, oil and gas installations, and renewable energy facilities. These sectors demand mobile service solutions capable of handling diverse repairs, from electrical systems to heavy mechanical components. Service trucks equipped with specialized hydraulic cranes, lifting equipment, and advanced storage modules support rapid response during breakdowns and routine maintenance. Utility providers increasingly adopt telematics-enabled trucks to monitor operations and optimize service routes. This reliance reinforces the importance of service trucks in ensuring efficiency and reliability within energy infrastructure management.

Fleet maintenance has become a critical driver for service truck adoption, particularly among logistics, mining, and industrial transportation operators. Companies prioritize reducing vehicle downtime by investing in trucks capable of performing diagnostics and repairs directly on-site. Service trucks designed with built-in diagnostic systems, pneumatic tools, and modular storage improve turnaround time and operational control. In addition to routine checks, they enable emergency response, minimizing disruptions for time-sensitive operations. The trend toward predictive maintenance in fleet management further enhances the demand for well-equipped service trucks, positioning them as essential assets for businesses seeking operational continuity and lower maintenance costs.

Service truck manufacturers are increasingly focusing on integrating telematics and offering tailored configurations to meet specific industry demands. Telematics solutions allow real-time monitoring of truck usage, fuel consumption, and service efficiency, enabling companies to optimize fleet deployment and manage costs effectively. Customization options, such as installing hydraulic lifts, welding units, or air compressors, are shaping purchasing decisions among contractors and utilities. Enhanced safety features, improved load capacity, and modular layouts also drive adoption across diverse sectors. These developments underscore the shift toward high-performance service trucks that not only provide mobility but also deliver operational intelligence and versatility on-site.

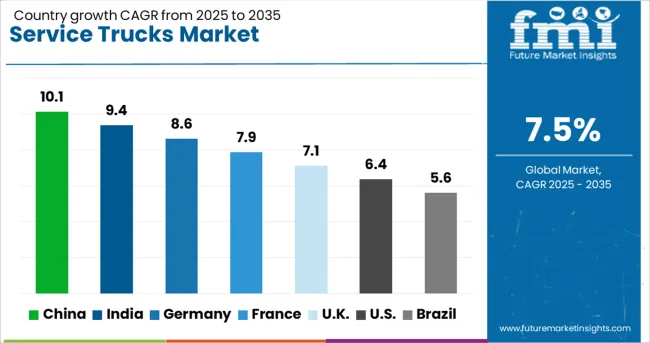

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The service trucks market is projected to expand globally at a CAGR of 7.5% from 2025 to 2035, driven by the rising need for mobile maintenance, predictive service operations, and on-site equipment support across multiple industries. China leads with a CAGR of 10.1%, fueled by rapid industrialization, infrastructure investments, and fleet modernization programs emphasizing efficiency. India follows at 9.4%, supported by the expansion of construction projects, energy services, and logistics operations that demand advanced field service capabilities. Germany achieves 8.6%, leveraging strong adoption in automotive and industrial maintenance sectors along with increasing utility service requirements. The United Kingdom grows at 7.1%, influenced by infrastructure renovation and growing dependence on mobile repair solutions for public service fleets. The United States records 6.4%, reflecting steady demand from utility companies and fleet service providers combined with investments in telematics-enabled service trucks for operational control and compliance. This growth outlook highlights Asia as the dominant region, while Europe and North America maintain consistent adoption driven by safety compliance and cost-efficiency goals in service operations.

The CAGR for the service trucks market in the United Kingdom was around 5.2% during 2020–2024 and later advanced to 7.1% for the 2025–2035 period, indicating stronger momentum in mobile service adoption. The initial growth was moderate as investment in specialized service fleets remained limited, driven primarily by essential utility and construction applications. In the following decade, higher demand for predictive maintenance services, integration of telematics, and the expansion of infrastructure renovation projects pushed adoption rates significantly upward. The preference for rental-based service fleets offering quick response capabilities also contributed to accelerated procurement among contractors. The integration of modular configurations enhanced versatility, increasing fleet value and operational efficiency.

China’s CAGR for the service trucks market stood at 7.6% during 2020–2024 and surged to 10.1% in 2025–2035, reflecting rapid industrial expansion and urban infrastructure projects requiring on-site support vehicles. The early phase saw stable progress driven by baseline construction growth, but constraints on heavy equipment servicing slowed acceleration. The next period witnessed a dramatic increase due to rising investments in power grids, large-scale logistics facilities, and predictive maintenance practices across industries. The availability of locally manufactured service trucks at competitive costs enabled quicker adoption, while integration of advanced hydraulic and lifting systems positioned Chinese manufacturers as key global suppliers.

India recorded a CAGR of 6.9% from 2020–2024, which increased to 9.4% between 2025 and 2035, supported by accelerating infrastructure development and logistics expansion. The earlier period was marked by incremental adoption among construction contractors and utility service firms, primarily focused on basic fleet requirements. Growth in the next few years was driven by the surge in rental-based service models and adoption of telematics for predictive servicing. Investments in renewable energy projects and transportation corridors further strengthened demand for advanced trucks with integrated hydraulic and diagnostic features. The expansion of regional OEM networks and improved financing options allowed small and medium contractors to upgrade fleets.

The CAGR for Germany’s service trucks segment was 6.1% during 2020-2024, rising to 8.6% for 2025-2035, reflecting a stronger inclination toward efficiency-driven field services. Initial growth was fueled by demand from industrial and automotive sectors requiring advanced mobile repair solutions. Later, growth accelerated with higher adoption of telematics-enabled service units and predictive maintenance technologies in large-scale manufacturing and construction sites. Fleet modernization programs by utility companies also created significant opportunities for truck manufacturers offering customized configurations. Germany’s regulatory push for service safety and emission standards encouraged investment in smart-enabled service trucks, enhancing reliability for urban and industrial applications.

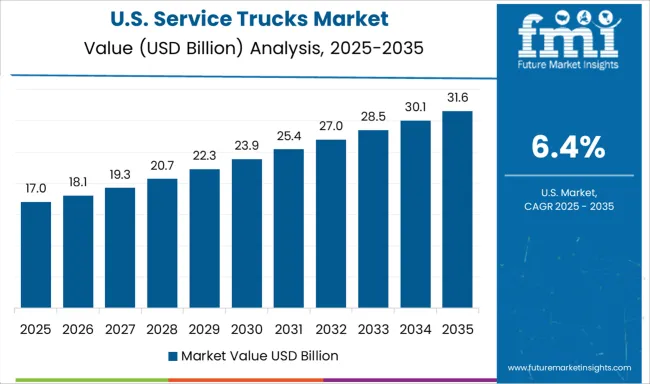

The United States recorded a CAGR of 5.0% between 2020-2024, which climbed to 6.4% during 2025-2035, indicating a steady growth pattern. Earlier, adoption rates were restrained by reliance on centralized maintenance facilities, limiting investment in mobile service units. The subsequent period experienced a rise in demand driven by utility companies and large fleet operators seeking on-site maintenance to reduce downtime costs. The shift toward telematics-supported service management systems and the development of rental fleets equipped with advanced hydraulic tools supported industry-wide adoption. Growing emphasis on uptime efficiency and lower lifecycle costs further positioned smart service trucks as strategic assets in USA industrial maintenance models.

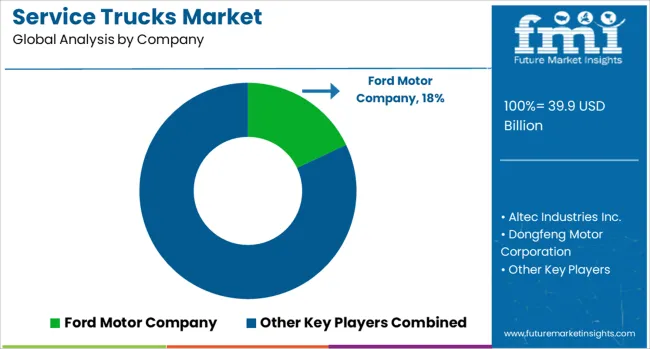

The service trucks market is highly competitive, with a diverse mix of global automotive giants and specialized vehicle manufacturers driving product development and market expansion. Ford Motor Company and General Motors Company dominate the North American segment, leveraging extensive dealer networks and integrating advanced telematics for fleet efficiency. Altec Industries Inc. specializes in utility service trucks, delivering customized configurations for energy and telecommunications sectors. Dongfeng Motor Corporation and Isuzu Motors Limited strengthen their position in Asia through cost-effective service truck models tailored for construction and logistics industries. Mercedes-Benz focuses on premium solutions incorporating advanced safety systems and connectivity features for operational control.

Oshkosh Corporation maintains a strong presence in heavy-duty service applications with rugged trucks designed for extreme conditions. Scania AB and Volvo Trucks lead the European market with technology-rich offerings, emphasizing modular design, fuel efficiency, and fleet monitoring systems. Key competitive strategies revolve around integrating real-time diagnostics, predictive maintenance tools, and telematics to enhance service truck capabilities. Manufacturers are investing in modular configurations to cater to sector-specific needs such as construction, utilities, and fleet servicing. Additionally, partnerships with telematics providers and expansion into rental service segments are shaping future growth. Companies are prioritizing low-emission engine options and hybrid systems to meet evolving compliance standards while enhancing total cost-of-ownership advantages. Strategic collaborations, digital integration, and aftermarket support remain crucial levers for differentiation in this evolving market landscape.

In May 2024, Oshkosh Corporation announced the acquisition of AUSA (AUSACORP S.L.), expanding its specialty construction and terrain equipment portfolio

| Item | Value |

|---|---|

| Quantitative Units | USD 39.9 Billion |

| Product | Utility trucks, Mechanic trucks, Mobile service trucks, Fuel and Lube trucks, Crane trucks, and Others |

| Fuel | ICE and Electric |

| End-User Industry | Construction, Government and Public utilities, Mining, Agriculture, Transportation and logistics, Emergency services, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ford Motor Company, Altec Industries Inc., Dongfeng Motor Corporation, General Motors Company, Isuzu Motors Limited, Mercedes-Benz, Oshkosh Corporation, Scania AB, and Volvo Trucks |

| Additional Attributes | Dollar sales by vehicle configuration, share by application segment, regional demand trends, pricing benchmarks, fleet electrification impact, competitive landscape, distribution channel analysis, regulatory compliance, growth projections, and emerging telematics integration patterns. |

The global service trucks market is estimated to be valued at USD 39.9 billion in 2025.

The market size for the service trucks market is projected to reach USD 82.2 billion by 2035.

The service trucks market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in service trucks market are utility trucks, mechanic trucks, mobile service trucks, fuel and lube trucks, crane trucks and others.

In terms of fuel, ice segment to command 61.0% share in the service trucks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

ServiceNow Tech Service Market Size and Share Forecast Outlook 2025 to 2035

Service Orchestration Market Size and Share Forecast Outlook 2025 to 2035

Service Robotics Market Size and Share Forecast Outlook 2025 to 2035

Service Resource Planning (SRP) SaaS Solutions Market Size and Share Forecast Outlook 2025 to 2035

Service Bureau Market Analysis - Size, Growth, and Forecast 2025 to 2035

Service Laboratory Market Analysis by Service Type, Deployment, Channel, End-user, and Region Through 2035

Service Integration & Management Market Report – Forecast 2017-2027

IT Service Management Tools Market Growth – Trends & Forecast through 2034

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Foodservice Paper Bag Companies

Europe Foodservice Disposables Market Insights – Growth & Trends 2024-2034

Foodservice Disposable Market Growth & Trends Forecast 2024-2034

Self-service Billiards System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA