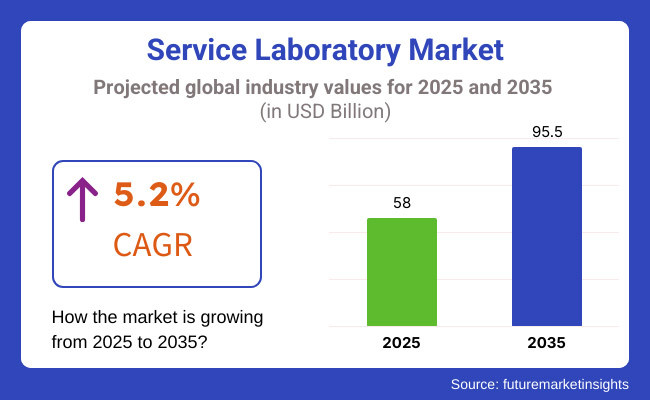

The global service laboratory market is set to register USD 58 billion in 2025. The industry is poised to witness 5.2% CAGR from 2025 to 2035, reaching USD 95.5 billion by 2035.

The industry is in the area of specialized laboratory services, which are provided to health care, pharmaceuticals, and industrial sector. Laboratories are geared for precision testing, diagnostic analysis and quality assurance to support research capabilities while meeting regulatory requirements. The rise in demand for precise and effective testing solutions opines a transformation in how these processes are tuned and executed.

Service labs are adapting towards it by incorporating automation, enabling such processes with AI enabled analytics while reducing precious time and efforts through different Cloud-enabled management systems. This indicates a strong demand for the data and services provided by the businesses operating in the industry, as they strive for innovation while adhering to regulations, which will drive the industry growth considerably in the coming years.

The industry’s revenue is primarily dominated by the share of the service laboratories, in the form of its utilization by health care institutions as well as drug companies, which are progressively refining their treatment operations and medication exploration procedures via advance screening methodologies.

Food and beverage, environmental and materials testing industries and manufacturing industries are using laboratory services to maintain quality assurance, compliance to regulation and safety of product.

Digital enabling solutions for lab management, artificial intelligence for data analysis, automation in testing cloud-based LIMS are driving real-time data sharing, which boosts efficiency in workflows and minimizes mistakes. Likewise, robotics and high-throughput screening are improving productivity in laboratories, leading to faster, more accurate tests in medical diagnostics, genetic research, and chemical analysis.

There are growing global focus towards research & development (R&D) of personalized medicine, biotechnology and environmental surveillance that are likely to drive the need for cost-effective laboratory solutions in terms of automation and efficiency to maximize throughput.

The need for advanced analytical services from several industries is compelling service laboratories to broaden their technical capabilities, that includes the solution of portable analytical laboratories, high-end spectroscopic techniques, and next generation sequencing. Due to the companies' adherence to rules and standards for quality assurance, they are investing heavily in laboratory solutions.

Trends in lab automation, AI-based analytics, and digitalisation of laboratories are positioning the industry for further growth.

The rising need for real-time diagnostics, accurate testing, and compliance with international quality standards is likely to create a pathway for adopting advanced laboratory technologies.

By meeting the demands of modern healthcare, pharmaceutical, and industries, service laboratories will emerge as an essential force behind the delivery of testing and research operations worldwide.

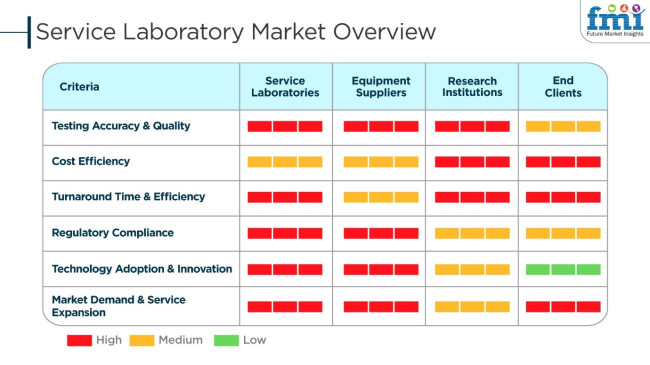

The industry is developing as a result of rapid growth in demand especially for precise analytical testing, regulatory compliance, and industry quality assessments. The priority of service laboratories in maintaining their reliability and credibility is the high-precision testing, rapid turnaround times, and following the global regulatory standards.

The major suppliers, concentrate on the providing of such advanced instruments, automation solutions, and AI-powered diagnostic tools as to increase the efficiency and accuracy of lab operations. Service labs that are contracted by research institutions to the execution of complex quantitative methods are the main reasons of the improvements in analytical methods and in the technology integration.

End clients from pharmaceutical and healthcare industries, food and environmental sectors, seek the reliable, cost-effective, and compliant testing solutions to achieve the rigorous product demands and regulations. The key factors for purchase decisions are the lab accreditation, testing accuracy, scalability, turnaround time, and cost-effectiveness.

The massive rise in requests for laboratory services outsourcing, AI diagnostic solutions, and digital lab management has caused the service laboratories to lay down their investment in the automated technology, cloud-based solutions, and the latest technologies to augment their efficiency and competitiveness.

| Company | Sonic Healthcare and LADR |

|---|---|

| Contract/Development Details | Sonic Healthcare acquired the German laboratory group, Laboratory Group Dr. Kramer and Colleagues (LADR), to expand its European footprint. |

| Date | November 2024 |

| Contract Value (USD Mn) | Approximately USD 700 - USD 720 |

| Estimated Renewal Period | 5 - 7 years |

| Company | Cinven and Labcorp |

|---|---|

| Contract/Development Details | Cinven sold a 15% stake in Synlab to Labcorp to strengthen Labcorp's diagnostic services in Europe. |

| Date | November 2024 |

| Contract Value (USD Mn) | Approximately USD 150 - USD 160 |

| Estimated Renewal Period | 4 - 6 years |

| Company | Healius and Affinity Equity Partners |

|---|---|

| Contract/Development Details | Healius sold its Lumus Imaging division to Affinity Equity Partners, allowing it to focus on core pathology and laboratory services. |

| Date | October 2024 |

| Contract Value (USD Mn) | Approximately USD 960 - USD 980 |

| Estimated Renewal Period | Not applicable |

In late 2024, the industry experienced significant consolidation through high-value acquisitions and strategic partnerships. Sonic Healthcare’s acquisition of LADR for approximately USD 700 - USD 720 million expands its presence in the European industry. Cinven's sale of a 15% stake in Synlab to Labcorp for an estimated USD 150 - USD 160 million strengthens Labcorp's diagnostics portfolio.

Meanwhile, Healius’ divestment of Lumus Imaging to Affinity Equity Partners for nearly USD 960 - USD 980 million aligns with its focus on core laboratory services. These deals highlight a growing trend of specialization and regional expansion in the industry.

From 2020 to 2024, the industry for service laboratories grew due to developments in diagnostic technologies, rising demand for personalized medicine, and rigorous regulatory standards. The use of automated testing platforms and AI-based diagnostics improved laboratory efficiency and accuracy.

Decentralized and at-home testing services increased industry access, while laboratories focused on adherence to changing global standards. In addition, partnerships between diagnostic labs and healthcare providers became stronger, enhancing access to quality testing services.

Between 2025 and 2035, the industry will witness revolutionary changes with AI, machine learning, and robotics at the forefront of laboratory automation. Precision medicine and next-generation sequencing (NGS) will fuel demand for specialized testing services, while blockchain technology will increase data security and interoperability.

The trend toward sustainable and energy-efficient laboratory practices will intensify, with laboratories embracing green practices. As digital health environments progress, service laboratories will seamlessly interface with telemedicine and real-time health monitoring systems.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Laboratories brought precision in diagnosis through next-generation sequencing (NGS). Multiplex testing increased the speed of detection of many pathogens. | Speedy, accurate CRISPR diagnostics enhance speed and accuracy in testing. Continuous monitoring of disease via innovative biosensors helps with early identification and customized therapies. |

| Labs applied robotic sample preparation and computer pathology systems to cut down human mistake. Cloud LIMS expanded the storage capacity for and availability of data. | Fully automated laboratories simplify workflows with little or no human intervention. Digital twins emulate test scenarios for optimizing resource deployment and operating efficiency. |

| Pharmacogenomic testing was in growing demand to make treatment customized based on the patient's genetic makeup. Liquid biopsy picked up popularity for non-surgical cancer testing. | Precision medicine combines multi-omics information (genomics, proteomics, and metabolomics) for managing disease holistically. Personal health dashboards enable real-time intelligence for preventive intervention. |

| Regulated standards made the laboratories to comply with standards such as ISO 15189 and CLIA. Legislation for data privacy shielded patient data. | The new regulations promote cross-border movement of data for international health research. Compliance frameworks ensure responsible use of AI in diagnosis and predictions. |

| Hospitals, clinics, and laboratories joined together to provide complete testing services. Telemedicine arrangements have improved remote sample collection and home testing. | Telehealth platforms are interlinked together in a collaborative health ecosystem with wearable health devices and service laboratories. Predictive analytics enable proactive disease management and population health surveillance. |

| Consumers prioritized wellness and preventive healthcare, driving demand for routine health screenings. Direct-to-consumer genetic testing gained popularity. | Demand for holistic health assessments and personalized wellness plans grows. Service labs expand into lifestyle genomics, offering nutrition and fitness insights based on genetic predispositions. |

| Labs adopted sustainable practices, including reusable consumables and eco-friendly reagents. Digital documentation minimized paper waste. | Circular lab models promote closed-loop recycling of lab equipment and consumables. Green chemistry solutions reduce hazardous waste and environmental impact. |

| Labs optimized inventory management with just-in-time (JIT) delivery of reagents and consumables. Localized suppliers reduced dependency on global supply chains. | Predictive supply chain management ensures consistent reagent availability. Distributed manufacturing hubs enhance supply chain resilience and minimize logistics costs. |

This sector wrestles with a lot of risks, one of them being regulatory compliance, two of them are data security concerns, three of them are technological advancement, four of them are operational inefficiencies, and the last but not least is industry competition. Along with these, one of the crucial is the compliance with the standard industry's strict rules like ISO/IEC 17025, Good Laboratory Practices (GLP), and FDA guidelines.

Data security and confidentiality remain at the forefront of concern, especially for laboratories such as those in medical, pharmaceutical, and forensic fields which deal with sensitive patient data and proprietary research information. Cybersecurity risks like data breaches, hacking, and ransomware attacks may hold the laboratories legally responsible, cause them to incur financial losses, and damage their reputations.

Technological progressors serve as the bearers of both blessings and curses. Besides the fact that laboratories that have not embraced the automation, the AI-driven diagnostics are the digital laboratory solutions fully, they are the only ones to lose. The problem with it is the speed of technology adoption which is a problem causing the investment and the staff training, but in some cases financially they are a burden.

Operational inadequacies might come from issues such as samples backing, decommissioned equipment, and the interruption of supply lines. Labs are required to have a quality management system (QMS) in place which will help to prevent testing errors that could affect the clients' trust and also ensure consistent service provision.

Intensity in industry competition causes pressure for quicker turnaround time, cost-effective methods, and providing innovative services. Competition is maintained through specialized testing services, advanced analytics, and superior customer service.

The repair segment is expected to dominate the industry in 2025 as laboratory equipment has become more complex, and this increasing complexity, coupled with the need for timely restoration in the case of equipment failure, would drive the growth of this segment in the laboratory equipment services industry.

From high-precision analytical instruments through spectrometers and chromatography systems to imaging devices, laboratories rely on them, and even a minor issue can create disruption in both research and diagnostics.

Well-known companies in the industry, including Danaher Corporation, Eppendorf, Sartorius, and Thermo Fisher Scientific, offer advanced repair services for laboratory instruments, optimizing them for peak performance while minimizing equipment outages. Moreover, the demand for repair services is further being driven by the increasing focus on equipment lifespan extension and value-for-money refurbishment solutions.

Further, third-party service providers (like Charles River Laboratories, Eurofins Scientific, and ALS Limited) are extending their repair services to serve diverse end-use industries beyond life sciences. This system offers agile and on-demand solutions for repair that would allow smaller laboratories and research facilities to leverage valuable repair services without long-term contracts.

Particularly when natively high data security, complete control over service management, and customized solutions are needed, on-premises deployment is the favored choice in laboratories. Internal service teams are employed or trusted by external providers such as PerkinElmer, BioMérieux, Merck KGaA, or others are partnered with to better manage their repair and maintenance needs, institutional R&D environments, pharma labs, and healthcare facilities.

Most laboratories that deal with sensitive research data or regulated diagnostic testing prefer on-premise service models since their operations involve strict security and compliance measures.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.9% |

| UK | 8.6% |

| European Union | 8.7% |

| Japan | 8.8% |

| South Korea | 9.0% |

The USA industry grows considerably as companies need accurate testing, certification, and quality assurance services. Firms create sophisticated laboratory solutions to improve accuracy, efficiency, and compliance with regulations-growing demand for analytical services in pharmaceuticals, food safety, and environmental monitoring drives industry growth.

The manufacturing, biotechnology, and healthcare industries use service laboratories to attain higher industry standards. The government encourages companies to invest in sophisticated laboratory testing equipment to enhance product safety and research potential. As per FMI, the USA industry is anticipated to register 8.9% CAGR during the forecast period.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Sophisticated Analytical Services | Improves laboratory testing effectiveness and accuracy across industries. |

| Regulatory Compliance | Strict government regulations enforce quality assurance and testing level requirements. |

| Pharmaceutical & Biotech Expansion | Growing R&D investments fuel demand for service lab solutions. |

| Digital & AI Integration | Laboratories embrace AI-powered automation to improve workflow and minimize errors. |

The UK industry expands as businesses and research organizations implement cutting-edge analytical and diagnostic solutions. Organizations implement laboratory automation through AI to improve testing speed, precision, and laboratory processes the growing need for drug quality assurance, clinical diagnostics, and material testing warrants industry demand.

Government initiatives supporting laboratory innovation also boost the implementation of new analytical methods and computerized laboratory management systems.

Growth Drivers in the UK

| Key Drivers | Detail |

|---|---|

| AI-Based Laboratory Automation | Simplifies activities minimize human mistakes and improves accuracy. |

| Pharmaceutical Testing Demand | Increases in drug research and clinical trials require accurate laboratory analysis. |

| Government Support | The policy encourages investments in new lab technologies. |

| Digital Transformation | The adoption of cloud-based laboratory information management systems boosts activities. |

The European Union industry grows adopting sophisticated laboratory testing of drugs, food safety, and industrial quality control. Germany, France, and Italy dominate the industry by adopting AI-based laboratory analytics and automation technologies.

The European Union has stringent product quality assurance and safety rules that force producers to invest in high-performance laboratory test services. Technological developments in digital laboratory management systems and automated testing make the quality of services even better. FMI believes the European Union Industry will expand at 8.7% CAGR over the study period.

Growth Drivers in the European Union

| Key Drivers | Details |

|---|---|

| Stringent Regulatory Requirements | The EU has excellent quality control and compliance for lab testing. |

| AI & Automation | The labs use AI-driven analytics and automated testing for improved performance. |

| Pharmaceutical & Food Safety Testing | High competition for lab solutions in the pharma and food sectors. |

| Digital Laboratory Management | Firms implement next-generation data management solutions for improved accuracy. |

The Japanese industry increases as businesses invest in precise testing, laboratory robot processes, and artificial intelligence-powered diagnostic equipment. Businesses develop effective lab solutions for increasing test speed, accuracy, and regulation conformity.

Focusing on Japan on quality assurance and technology improvement encourages using advanced laboratory facilities. The pharmaceutical, electronics, and environmental monitoring sectors are buying advanced test technologies to be on the global stage.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Technological Developments | Investment in artificial intelligence and precision testing increases the laboratory infrastructure. |

| Regulatory Compliance | Robust quality control procedures demand precise laboratory tests. |

| Increased Pharmaceutical Industry | More R&D translates to more need for lab space. |

| Computerization of Laboratory Functions | Automation increases efficiency and reduces test turnaround time. |

The South Korean industry is also growing, with firms adopting digital lab solutions, automated test platforms, and AI diagnostics. The government has an important role in developing research and development programs for adopting advanced laboratory technology.

Firms adopt cloud laboratory information management systems, real-time and accurate testing to guarantee optimal laboratory efficiency. Moreover, high-throughput testing innovation and microfluidics help drive the industry's growth.

Growth Drivers in South Korea

| Key Drivers | Details |

|---|---|

| AI-Based Diagnostics | It maximizes the effectiveness of the laboratory and idealizes the test accuracy. |

| Government R&D Support | It encourages investment in advanced laboratory technologies. |

| Cloud-Based Laboratory Systems | Cloud systems enhance better data management and simplify testing. |

| High-Throughput Testing | It maximizes the effectiveness of industrial and pharmaceutical laboratory services. |

The global industry is growing at a fast rate, owing to increasing demand for high-precision testing, regulatory compliance, and advanced quality assurance across industries like pharmaceuticals, healthcare, food & beverages, environmental sciences, and materials testing. Growth drivers for the industry include technological advancements, such as AI-powered diagnostics, automation, and cloud-based laboratory information management systems (LIMS).

The industry is strongly concentrated in favour of leading companies providing comprehensive analytical services covering chemical, biological, and physical testing on SGS SA, Eurofins Scientific, Intertek Group, Bureau Veritas, and ALS Limited. These companies continue to expand their global laboratory networks, raise their testing capabilities, and integrate AI-driven analytics to enhance efficiency and accuracy.

Start-ups and niche providers are gaining ground by delivering specialized services in genetic testing, forensic analysis, and microbiological investigations. Strategic partnerships with research institutions and funding for modern laboratory automation are reforming the competition landscape.

With tightening regulations and industries demanding faster and fail-proof results, the ones who truly embrace digital transformation, high-throughput testing, and innovative service offerings will be the ones securing a foothold.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| SGS SA | 20-25% |

| Eurofins Scientific | 15-20% |

| Intertek Group | 12-17% |

| Bureau Veritas | 8-12% |

| ALS Limited | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| SGS SA | Provides comprehensive analytical services, regulatory compliance testing, and quality control solutions. |

| Eurofins Scientific | Specializes in food safety, pharmaceutical testing, and environmental analysis. |

| Intertek Group | Develops advanced laboratory testing solutions for materials, chemicals, and consumer products. |

| Bureau Veritas | Focuses on quality assurance, industrial safety assessments, and certification services. |

| ALS Limited | Offers specialized laboratory services in minerals, life sciences, and environmental testing. |

Key Company Insights

SGS SA (20-25%)

SGS SA is the industry leader in service laboratories by offering comprehensive analytical testing, comprehensive regulatory compliance assessments, and quality control solutions.

Eurofins Scientific (15-20%)

Eurofins Scientific is using its innovative laboratory solutions to improve the aspects of food safety, pharmaceutical testing, and environmental analysis.

Intertek Group (12-17%)

Intertek Group is a world leader in providing advanced laboratory testing services for materials, chemicals, and consumer products with the purpose of ensuring compliance and quality assurance.

Bureau Veritas (8-12%)

Bureau Veritas is focused on quality assurance and safety assessments from the industrial side, as well as certification services for various industries.

ALS Limited (5-9%)

ALS Limited provides tailored laboratory solutions in minerals, life sciences, and environmental analysis while keeping in view the requirements of various industries.

Other Key Players (20-30% Combined)

By service type, the industry is segmented into repair, support & maintenance, testing & validation, and others.

By deployment, the industry is segmented into on-premise and cloud.

By channel, the industry is segmented into OEMs and third-party service providers.

By end-user, the industry is segmented into industrial (oil & gas, metal & mining, automotive, chemical, pharmaceutical), electronics (semiconductor manufacturing, microelectronics & mems), life sciences, and healthcare.

The industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

The industry is poised to register USD 58 billion in 2025.

The industry is projected to reach USD 95.5 billion by 2035.

South Korea, slated to grow at 9.0% CAGR during the forecast period, is poised for fastest growth.

The key players in the industry include GS SA, Eurofins Scientific, Intertek Group, Bureau Veritas, ALS Limited, TÜV SÜD, Element Materials Technology, Pace Analytical Services, Charles River Laboratories, and NSF International.

Repair is the popular service.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Channel, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Channel, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Channel, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Channel, 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 21: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Asia Pacific Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 23: Asia Pacific Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 24: Asia Pacific Market Value (US$ Million) Forecast by Channel, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 26: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: MEA Market Value (US$ Million) Forecast by Service Type, 2018 to 2033

Table 28: MEA Market Value (US$ Million) Forecast by Deployment, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Channel, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End-User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Channel, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Channel, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Channel, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 21: Global Market Attractiveness by Service Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Deployment, 2023 to 2033

Figure 23: Global Market Attractiveness by Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by End-User, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Channel, 2023 to 2033

Figure 29: North America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Channel, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Channel, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Channel, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 46: North America Market Attractiveness by Service Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Deployment, 2023 to 2033

Figure 48: North America Market Attractiveness by Channel, 2023 to 2033

Figure 49: North America Market Attractiveness by End-User, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Channel, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Channel, 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Channel, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Channel, 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Service Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Deployment, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Channel, 2023 to 2033

Figure 74: Latin America Market Attractiveness by End-User, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Channel, 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Channel, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 96: Europe Market Attractiveness by Service Type, 2023 to 2033

Figure 97: Europe Market Attractiveness by Deployment, 2023 to 2033

Figure 98: Europe Market Attractiveness by Channel, 2023 to 2033

Figure 99: Europe Market Attractiveness by End-User, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 102: Asia Pacific Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 103: Asia Pacific Market Value (US$ Million) by Channel, 2023 to 2033

Figure 104: Asia Pacific Market Value (US$ Million) by End-User, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 110: Asia Pacific Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 111: Asia Pacific Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 112: Asia Pacific Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 113: Asia Pacific Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 114: Asia Pacific Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 115: Asia Pacific Market Value (US$ Million) Analysis by Channel, 2018 to 2033

Figure 116: Asia Pacific Market Value Share (%) and BPS Analysis by Channel, 2023 to 2033

Figure 117: Asia Pacific Market Y-o-Y Growth (%) Projections by Channel, 2023 to 2033

Figure 118: Asia Pacific Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 119: Asia Pacific Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 120: Asia Pacific Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 121: Asia Pacific Market Attractiveness by Service Type, 2023 to 2033

Figure 122: Asia Pacific Market Attractiveness by Deployment, 2023 to 2033

Figure 123: Asia Pacific Market Attractiveness by Channel, 2023 to 2033

Figure 124: Asia Pacific Market Attractiveness by End-User, 2023 to 2033

Figure 125: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 126: MEA Market Value (US$ Million) by Service Type, 2023 to 2033

Figure 127: MEA Market Value (US$ Million) by Deployment, 2023 to 2033

Figure 128: MEA Market Value (US$ Million) by Channel, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) by End-User, 2023 to 2033

Figure 130: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: MEA Market Value (US$ Million) Analysis by Service Type, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Service Type, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Service Type, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Deployment, 2018 to 2033

Figure 138: MEA Market Value Share (%) and BPS Analysis by Deployment, 2023 to 2033

Figure 139: MEA Market Y-o-Y Growth (%) Projections by Deployment, 2023 to 2033

Figure 140: MEA Market Value (US$ Million) Analysis by Channel, 2018 to 2033

Figure 141: MEA Market Value Share (%) and BPS Analysis by Channel, 2023 to 2033

Figure 142: MEA Market Y-o-Y Growth (%) Projections by Channel, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 144: MEA Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 145: MEA Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 146: MEA Market Attractiveness by Service Type, 2023 to 2033

Figure 147: MEA Market Attractiveness by Deployment, 2023 to 2033

Figure 148: MEA Market Attractiveness by Channel, 2023 to 2033

Figure 149: MEA Market Attractiveness by End-User, 2023 to 2033

Figure 150: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analytical Laboratory Service Market Size and Share Forecast Outlook 2025 to 2035

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

ServiceNow Tech Service Market Size and Share Forecast Outlook 2025 to 2035

Service Orchestration Market Size and Share Forecast Outlook 2025 to 2035

Service Robotics Market Size and Share Forecast Outlook 2025 to 2035

Service Trucks Market Size and Share Forecast Outlook 2025 to 2035

Service Resource Planning (SRP) SaaS Solutions Market Size and Share Forecast Outlook 2025 to 2035

Service Bureau Market Analysis - Size, Growth, and Forecast 2025 to 2035

Service Integration & Management Market Report – Forecast 2017-2027

IT Service Management Tools Market Growth – Trends & Forecast through 2034

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Foodservice Paper Bag Companies

Europe Foodservice Disposables Market Insights – Growth & Trends 2024-2034

Foodservice Disposable Market Growth & Trends Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA