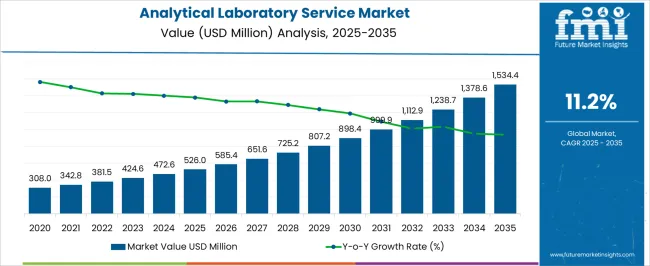

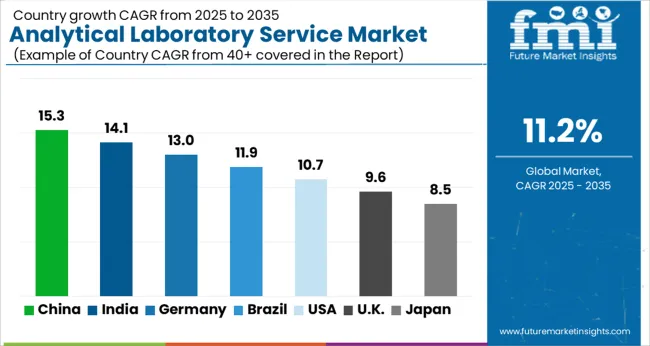

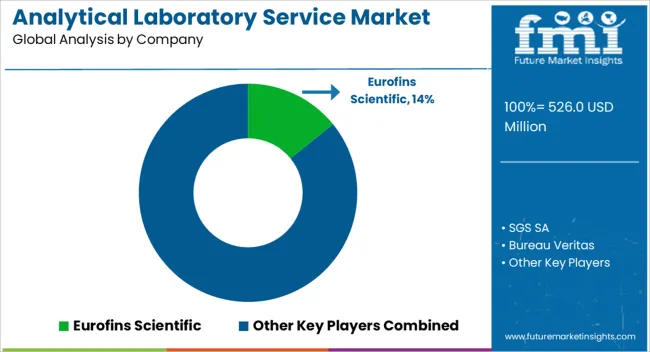

The Analytical Laboratory Service Market is estimated to be valued at USD 526.0 million in 2025 and is projected to reach USD 1534.4 million by 2035, registering a compound annual growth rate (CAGR) of 11.2% over the forecast period.

| Metric | Value |

|---|---|

| Analytical Laboratory Service Market Estimated Value in (2025 E) | USD 526.0 million |

| Analytical Laboratory Service Market Forecast Value in (2035 F) | USD 1534.4 million |

| Forecast CAGR (2025 to 2035) | 11.2% |

The analytical laboratory service market is witnessing robust growth, fueled by rising demand for high-precision testing in pharmaceuticals, biotechnology, food safety, and environmental monitoring. Increased regulatory scrutiny and stringent quality standards are driving reliance on third-party laboratories for specialized analytical capabilities.

The market is shaped by advancements in molecular diagnostics, bioanalytical methods, and data-driven laboratory automation. Outsourcing trends have strengthened demand for cost-effective and flexible testing services, enabling organizations to focus on core operations while ensuring compliance.

Service providers are expanding capabilities through strategic partnerships, technological integration, and global network development to meet the rising complexity of client needs. Looking forward, the market is expected to benefit from continued investment in healthcare innovation, biopharmaceutical research, and global safety regulations, positioning analytical laboratory services as a critical enabler of scientific and industrial progress.

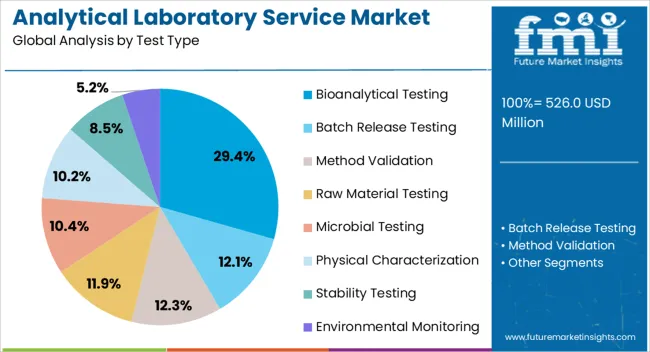

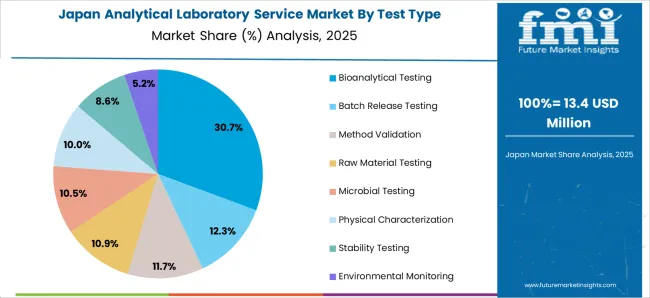

The bioanalytical testing segment leads the test type category with approximately 29.4% share, driven by rising demand for precise analysis in drug development and clinical research. Bioanalytical methods support pharmacokinetic and pharmacodynamic studies, ensuring accuracy in evaluating drug safety and efficacy.

The segment’s growth is reinforced by the increasing complexity of biopharmaceuticals, including monoclonal antibodies and cell-based therapies, which require specialized testing frameworks. Contract research organizations (CROs) and dedicated laboratories are investing in advanced bioanalytical platforms to enhance throughput and regulatory compliance.

With continued expansion of biopharma pipelines and personalized medicine initiatives, the bioanalytical testing segment is expected to sustain its leading position.

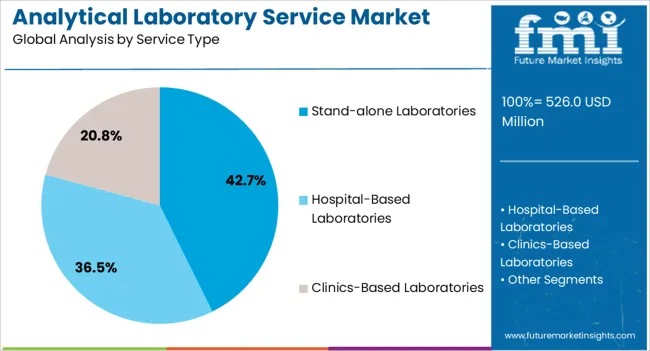

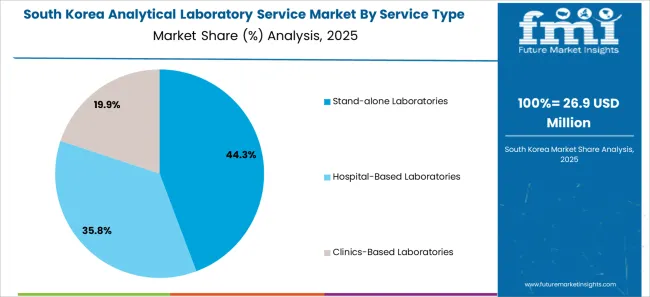

The stand-alone laboratories segment dominates the service type category with approximately 42.7% share. Independent laboratories offer broad service portfolios, scalability, and specialized expertise, making them preferred partners for pharmaceutical, biotechnology, and food companies.

The segment benefits from flexibility in adapting to evolving client demands and regulatory changes, supported by significant investments in infrastructure and technology. Competitive pricing and global service availability enhance adoption across diverse industries.

With increasing outsourcing of non-core functions by healthcare and industrial organizations, stand-alone laboratories are positioned to remain a cornerstone of the analytical laboratory service market.

The biomarker testing segment accounts for approximately 34.1% share in the method type category, reflecting its growing role in precision medicine and clinical trials. Biomarker-based methods enable early detection, disease monitoring, and therapeutic response evaluation, making them essential in modern healthcare research.

The segment’s growth is fueled by the increasing emphasis on personalized medicine, where targeted therapies rely heavily on biomarker validation. Technological advancements in genomics, proteomics, and imaging are further enhancing the accuracy and reliability of biomarker testing.

With rising adoption in oncology, neurology, and chronic disease management, this segment is expected to expand significantly over the forecast period.

Growing Demand for Point-of-Care Testing Reshapes the Market Landscape

The market for analytical laboratory services is undergoing shifts due to the growing popularity of point-of-care testing, especially in the healthcare industry. This trend highlights how crucial it is to perform diagnostic tests closer to the patient to expedite sample processing and shipping. Point-of-care testing laboratories meet the increasing need for quick, on-site diagnostic solutions.

This approach makes healthcare services more efficient and establishes analytical laboratories as essential players in the larger movement toward patient-centered and individualized healthcare delivery models.

Adoption of Smart Lab Infrastructure with Sensor Networks Rises in the Market

The implementation of smart lab infrastructure with sensor networks is a significant step in developing data-driven laboratory environments. Sensor networks facilitate proactive maintenance and resource management by supplying real-time data on vital parameters.

The deployment of smart lab infrastructure is consistent with a business strategy emphasizing data-driven decision-making and operational efficiency. Utilizing sensor networks gives laboratories a competitive advantage by guaranteeing equipment dependability, decreasing downtime, and showcasing a dedication to state-of-the-art technology in providing superior analytical services.

Flourishing Biopharmaceutical and Biotechnology Sectors Present Opportunities in the Market

Analytical labs have the chance to provide specialized services for the testing and characterization of cutting-edge biopharmaceutical products due to the expanding biopharmaceutical and biotechnology industries. This covers biosimilars, gene treatments, and monoclonal antibodies.

By specializing in advanced analytical methods unique to the biopharmaceutical development industry, laboratories can gain a competitive edge and establish themselves as the preferred suppliers for companies involved in these fast-growing industries.

| Attributes | Details |

|---|---|

| Trends | In analytical laboratories, a notable trend is the combination of automation, digital technology, and data analytics. This involves maximizing the effectiveness and precision of analytical procedures by utilizing machine learning (ML) and artificial intelligence (AI) algorithms for data analysis, interpretation, and decision-making. Blockchain technology is becoming increasingly popular in analytical labs, particularly in medicines and food safety. There is a growing market that demands specialized and customized testing services that are suited to certain industry requirements. To meet customers' changing needs in industries like healthcare and life sciences, laboratories are providing specialized services like genomics, proteomics, and metabolomics. Analytical laboratories are implementing sustainable practices. This complies with the worldwide focus on environmental sustainability and involves using eco-friendly materials, energy-efficient technology, and green laboratory efforts. Analytical equipment is outfitted with Internet of Things (IoT) integration, allowing for remote instrument operation, data collecting, and real-time monitoring. Predictive maintenance is made easier by this connectedness, which also improves the overall effectiveness of laboratory operations. |

| Opportunities | The use of cutting-edge technology to provide remote testing services allows laboratories to meet the changing demands of their clientele, particularly when physical presence is difficult. There is a chance for laboratories to provide more complex solutions and in-depth insights due to the growing demand for advanced data analytics services. Laboratories can create and supply specific testing services in emerging sectors like biopharmaceuticals and cannabis testing. As environmental concerns grow, laboratories have more opportunities to offer services linked to sustainability and ecological monitoring. Labs that use blockchain technology to handle and trace data securely can set themselves apart by providing tamper-proof records and increasing customer trust in the veracity of test findings. |

| Challenges | The operational continuity of laboratories is threatened by events like pandemics, which also affect personnel availability, supply networks, and overall corporate resilience. Quick technological advances could prove problematic for well-established labs that find it difficult to stay up to date with new developments and risk becoming obsolete. |

| Segment | Bioanalytical Testing (Test Type) |

|---|---|

| Value CAGR (2025 to 2035) | 11.1% |

Based on test type, the bioanalytical testing segment is projected to lead with an 11.1% CAGR through 2035. This is attributable to the following factors:

| Segment | Hospital-based Laboratories (Service Type) |

|---|---|

| Value CAGR (2025 to 2035) | 10.8% |

Based on service type, the hospital-based laboratories segment is anticipated to dominate with a 10.8% CAGR through 2035. The key factors boosting the segment’s growth are:

The analytical laboratory services market size in the United States is projected to rise at an 11.1% CAGR through 2035. The key drivers are:

The demand for analytical laboratory services in the United Kingdom is anticipated to surge at a 12.5% CAGR through 2035. The key factors are:

The growth of the analytical laboratory service market in China is estimated at an 11.9% CAGR through 2035. The key drivers are:

The demand for analytical laboratory services in Japan is expected to increase at a 12.8% CAGR through 2035. The key factors are:

The analytical laboratory services market size in South Korea is projected to rise at a 13.1% CAGR through 2035. The key drivers are:

Specialized analytical services are necessary, given South Korea's emphasis on the development of nanotechnology and innovative materials. Testing facilities for high-performance materials, sophisticated polymers, and nanomaterials help South Korean firms succeed in producing innovative goods.

The global analytical laboratory service market is highly competitive, with top rivals struggling for market share and advantageous positioning. Well-known international firms with a wide global presence and diverse testing service offerings, such as Bureau Veritas, SGS SA, and Eurofins Scientific, influence the market.

These industry titans make use of economies of scale to make substantial investments in state-of-the-art analytical technologies, which allow them to serve a variety of industries, such as biotechnology, pharmaceuticals, environmental testing, and industrial testing.

Recent Developments

The global analytical laboratory service market is estimated to be valued at USD 526.0 million in 2025.

The market size for the analytical laboratory service market is projected to reach USD 1,534.4 million by 2035.

The analytical laboratory service market is expected to grow at a 11.2% CAGR between 2025 and 2035.

The key product types in analytical laboratory service market are bioanalytical testing, batch release testing, method validation, raw material testing, microbial testing, physical characterization, stability testing and environmental monitoring.

In terms of service type, stand-alone laboratories segment to command 42.7% share in the analytical laboratory service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analytical Ultracentrifuge Systems Market Size and Share Forecast Outlook 2025 to 2035

Analytical Balance Market

Healthcare Analytical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Analytical Testing Outsourcing Market Trends – Growth & Forecast 2024-2034

Large Molecule Bioanalytical Testing Services Market - Growth & Demand 2025 to 2035

Laboratory Centrifuge & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Shakers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Washers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Rockers and Shakers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Filtration Devices Market Size and Share Forecast Outlook 2025 to 2035

Laboratory and Medical Scale Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Furnaces Market Analysis - Size, Share, and Forecast 2025 to 2035

Laboratory Supplies Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Benchtop Automation Market Growth – Trends & Forecast 2025 to 2035

Laboratory Balances and Scales Market Growth - Industry Forecast 2025 to 2035

Laboratory Information System Market Analysis - Size, Share, and Forecast 2024 to 2034

Global Laboratory Filter Paper Market Growth – Trends & Forecast 2024-2034

Laboratory Sample Container Market

Laboratory Filtration Equipment Market Growth – Trends & Forecast 2019-2027

Laboratory Glassware and Plasticware Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA