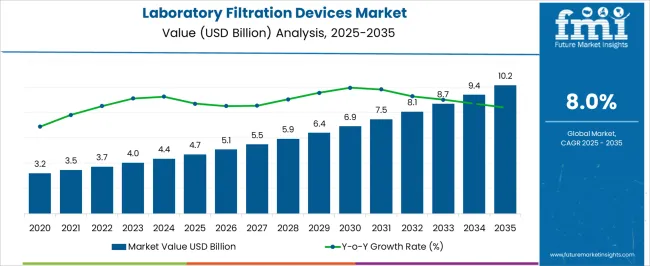

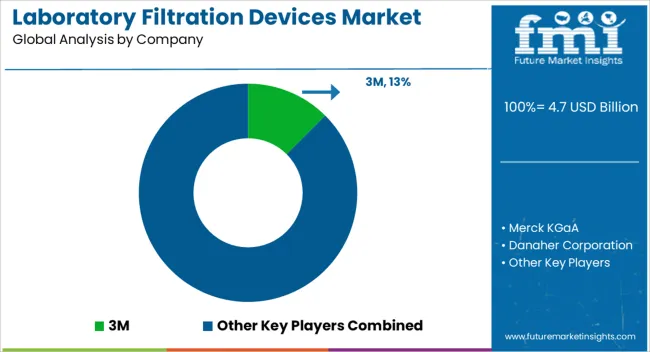

The Laboratory Filtration Devices Market is estimated to be valued at USD 4.7 billion in 2025 and is projected to reach USD 10.2 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

| Metric | Value |

|---|---|

| Laboratory Filtration Devices Market Estimated Value in (2025 E) | USD 4.7 billion |

| Laboratory Filtration Devices Market Forecast Value in (2035 F) | USD 10.2 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The Laboratory Filtration Devices market is expanding steadily, driven by the growing demand for precision, sterility, and safety in laboratory workflows across pharmaceutical, biotechnology, food testing, and academic research sectors. Filtration devices are becoming integral to laboratory operations as they ensure reliable separation of particulates, microorganisms, and other contaminants from liquids and gases. Growing investments in drug discovery, biologics development, and advanced diagnostic solutions are increasing the adoption of laboratory filtration systems.

The market is also benefiting from stringent regulatory requirements for laboratory practices, which emphasize the use of validated and high-quality filtration equipment. Technological advancements, including the development of advanced filter membranes and automation-enabled devices, are improving performance and scalability for research and industrial use.

Rising applications in protein purification, cell culture, and sample preparation are creating new opportunities, while the increased focus on disposable and contamination-free solutions further strengthens demand As laboratories continue to scale their operations and pursue innovation-driven research, the Laboratory Filtration Devices market is expected to witness long-term growth supported by compliance requirements, technological upgrades, and global demand for high-quality testing solutions.

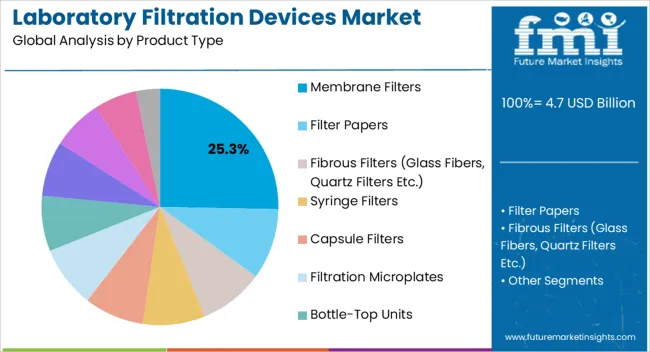

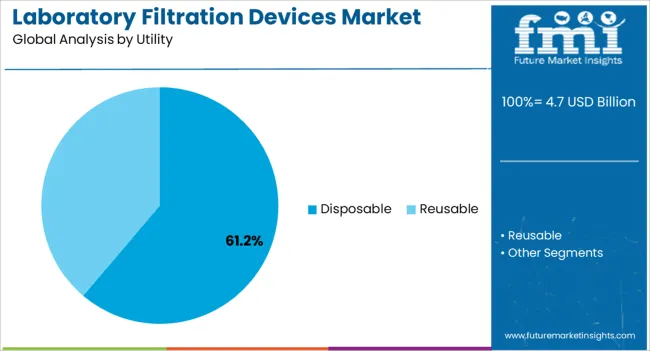

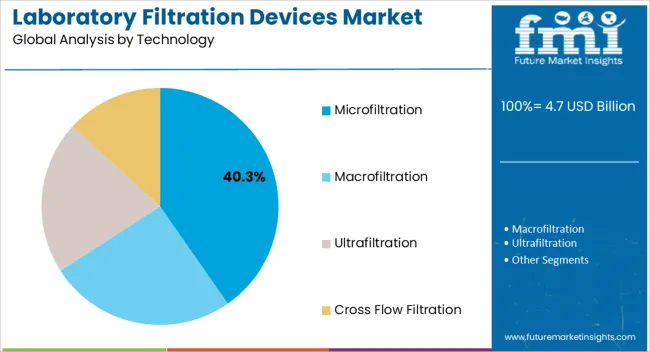

The laboratory filtration devices market is segmented by product type, utility, technology, retail end user, and geographic regions. By product type, laboratory filtration devices market is divided into Membrane Filters, Filter Papers, Fibrous Filters (Glass Fibers, Quartz Filters Etc.), Syringe Filters, Capsule Filters, Filtration Microplates, Bottle-Top Units, Filtration Assembly, Vacuum Filtration Devices, Pressure Driven Filtration Devices, and Stirred Cells. In terms of utility, laboratory filtration devices market is classified into Disposable and Reusable. Based on technology, laboratory filtration devices market is segmented into Microfiltration, Macrofiltration, Ultrafiltration, and Cross Flow Filtration. By retail end user, laboratory filtration devices market is segmented into Academic And Research Institutes, Pharmaceutical Companies, Biotechnology Companies, Diagnostic Centers, Contract Research Organizations, and Food And Beverage Companies. Regionally, the laboratory filtration devices industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The membrane filters product type segment is projected to account for 25.3% of the Laboratory Filtration Devices market revenue in 2025, positioning it as a leading product category. This growth is being supported by the increasing need for reliable and efficient separation processes in laboratories handling complex biological samples. Membrane filters offer high precision in retaining particles, microorganisms, and other impurities, ensuring the quality and reproducibility of experiments.

Their extensive use in protein purification, water testing, and sterilization processes underscores their importance in laboratory workflows. The ability to customize pore sizes and materials for diverse applications enhances their adaptability across different scientific and industrial uses. Advancements in polymeric membrane technologies are further improving performance in terms of durability, chemical compatibility, and flow rates.

Cost efficiency and ease of integration into laboratory filtration systems also strengthen their adoption As laboratories worldwide pursue higher accuracy and contamination-free environments, the membrane filters segment is expected to continue its expansion, driven by strong demand from pharmaceutical and biotechnology sectors.

The disposable utility segment is anticipated to hold 61.2% of the Laboratory Filtration Devices market revenue in 2025, making it the leading category by utility. Growth in this segment is being fueled by the increasing preference for single-use systems that minimize cross-contamination risks and reduce time spent on cleaning and sterilization. Disposable filtration devices provide laboratories with improved safety and operational efficiency, especially in high-throughput environments where quick turnaround is essential.

Their role in critical applications such as cell culture, sterility testing, and diagnostic sample preparation further enhances their value. The growing adoption of disposable solutions is also aligned with regulatory requirements for maintaining contamination-free laboratory practices. Moreover, disposables are cost-effective in terms of labor reduction and consistent performance, making them attractive to laboratories with limited resources.

As pharmaceutical and biotechnology companies expand their research pipelines, the need for scalable, disposable filtration solutions will continue to rise This segment’s growth trajectory reflects the broader industry shift toward efficiency, safety, and compliance in laboratory operations, ensuring its strong market presence.

The microfiltration technology segment is expected to capture 40.3% of the Laboratory Filtration Devices market revenue in 2025, positioning it as the leading technology type. Growth is being driven by the broad applicability of microfiltration in sterilization, cell harvesting, clarification, and water purification processes. This technology provides an effective barrier against bacteria and suspended particles while maintaining high flow rates, making it indispensable across laboratories and industrial research environments.

Its widespread use in pharmaceutical manufacturing, biotechnology workflows, and academic research highlights its versatility. Microfiltration membranes are available in various pore sizes and materials, which enhances adaptability for diverse scientific applications. The increasing demand for biologics and vaccines, which require highly reliable sterile filtration, further strengthens the role of microfiltration technologies.

Continuous improvements in membrane materials and system integration are supporting higher efficiency and reduced operational costs As laboratories and industries prioritize contamination-free environments and scalable filtration solutions, microfiltration is expected to remain central to laboratory filtration systems, securing its leadership in the market.

Filtration is one of the commonly used separation process for removing solid particles, microorganisms or droplets from a liquid or a gas by depositing them on a filter medium. Laboratory filtration devices have enormous applications in everyday research practices being performed in various setups including research and development laboratories, academic institutes, pharmaceutical and biotechnology industries, food industries and many more.

In all these industries filter membranes or filter assemblies are routinely used for water treatment and filtration of particulate matter. Filtration is the important process used in many chemical, clinical, biological and analytical laboratories for various applications such as water treatment, percolation, concentrating the solution, gas purification in analytical processes etc.

Various filtration techniques are used to separate solid from liquids or solutions by interposing a filter medium through which solutions or liquids can pass. Ultrafiltration technique is commonly used in biotechnology industry for protein concentration or purification, DNA or RNA concentration, etc.

Microfiltration techniques are commonly used in pharmaceutical industry in preparation of sterile formulations. Some of the commonly used brands of laboratory filtration devices are Whatman, Millex syringe filters, Minisart syringe filters, Vivapore ultrafiltration membrane filters, ÄKTAcrossflow systems and others. Cross flow filtration techniques are specifically in bioprocess filtration where purification of biomolecules is desired.

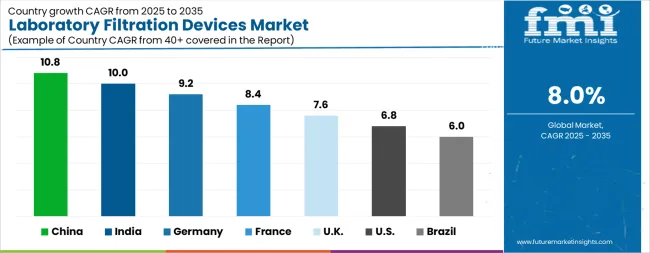

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

The Laboratory Filtration Devices Market is expected to register a CAGR of 8.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.8%, followed by India at 10.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.0%, yet still underscores a broadly positive trajectory for the global Laboratory Filtration Devices Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.2%. The USA Laboratory Filtration Devices Market is estimated to be valued at USD 1.6 billion in 2025 and is anticipated to reach a valuation of USD 3.1 billion by 2035. Sales are projected to rise at a CAGR of 6.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 214.4 million and USD 160.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.7 Billion |

| Product Type | Membrane Filters, Filter Papers, Fibrous Filters (Glass Fibers, Quartz Filters Etc.), Syringe Filters, Capsule Filters, Filtration Microplates, Bottle-Top Units, Filtration Assembly, Vacuum Filtration Devices, Pressure Driven Filtration Devices, and Stirred Cells |

| Utility | Disposable and Reusable |

| Technology | Microfiltration, Macrofiltration, Ultrafiltration, and Cross Flow Filtration |

| Retail End User | Academic And Research Institutes, Pharmaceutical Companies, Biotechnology Companies, Diagnostic Centers, Contract Research Organizations, and Food And Beverage Companies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Merck KGaA, Danaher Corporation, Sartorius AG, Thermo Fisher Scientific Inc., GVS SpA, Cole-Parmer Instrument LLC, Agilent Technologies Inc., Ahlstrom-Munksjö, Abcam PLC, Purolite Corp., Repligen Corp., Parker Hannifin, Sterlitech Corp., and Advantec MFS Inc. |

The global laboratory filtration devices market is estimated to be valued at USD 4.7 billion in 2025.

The market size for the laboratory filtration devices market is projected to reach USD 10.2 billion by 2035.

The laboratory filtration devices market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in laboratory filtration devices market are membrane filters, filter papers, fibrous filters (glass fibers, quartz filters etc.), syringe filters, capsule filters, filtration microplates, bottle-top units, filtration assembly, vacuum filtration devices, pressure driven filtration devices and stirred cells.

In terms of utility, disposable segment to command 61.2% share in the laboratory filtration devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Laboratory Filtration Equipment Market Growth – Trends & Forecast 2019-2027

Laboratory Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Information System Market Forecast and Outlook 2025 to 2035

Laboratory Centrifuge & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Shakers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Washers Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Rockers and Shakers Market Size and Share Forecast Outlook 2025 to 2035

Filtration and Separation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Laboratory and Medical Scale Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Furnaces Market Analysis - Size, Share, and Forecast 2025 to 2035

Laboratory Supplies Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Benchtop Automation Market Growth – Trends & Forecast 2025 to 2035

Laboratory Balances and Scales Market Growth - Industry Forecast 2025 to 2035

Filtration Paper Market Growth and Forecast 2024 to 2034

Global Laboratory Filter Paper Market Growth – Trends & Forecast 2024-2034

Laboratory Sample Container Market

Laboratory Glassware and Plasticware Market

Laboratory Ovens Market Analysis by Mechanical Convection and Vacuum Ovens Type through 2035

Ultrafiltration Membranes Market Analysis by Material Type, End-Use, and Region through 2025 to 2035

FBAR Devices Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA