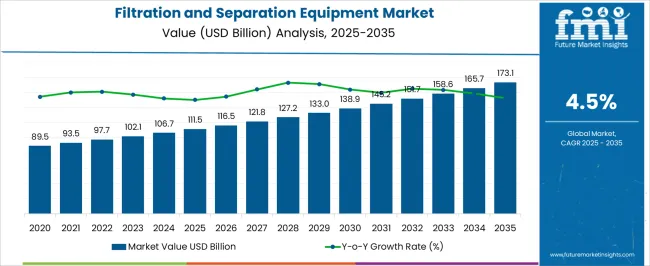

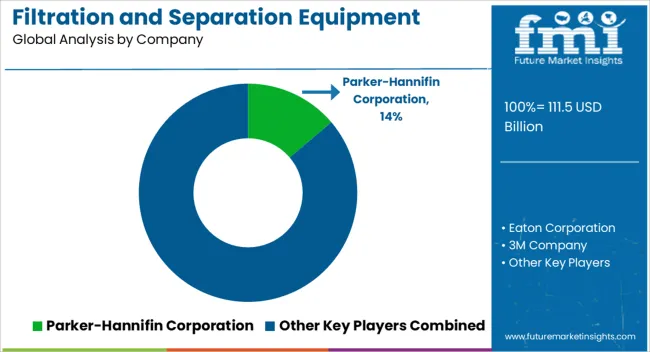

The filtration and separation equipment market is projected to grow from USD 111.5 billion in 2025 to USD 173.1 billion by 2035, reflecting a CAGR of 4.5%. Over the decade, the market is expected to expand steadily, with annual increments reaching USD 173.1 billion in 2035. This growth is being driven by increasing demand for efficient separation and purification processes across industrial, chemical, and pharmaceutical sectors. Operational reliability, process optimization, and compliance with industrial standards are being prioritized by end-users, which is supporting the adoption of advanced filtration systems.

The market is also influenced by cost efficiency and ease of maintenance, which are being recognized as critical factors in equipment selection. During the forecast period, the filtration and separation equipment market is anticipated to demonstrate consistent value accumulation through gradual adoption across multiple industrial applications, including water treatment, chemical processing, and food and beverage operations. Incremental gains are being observed in both emerging and mature industrial regions, where production efficiency and process control are being emphasized. Investors and manufacturers are expected to capitalize on predictable market trends, while performance metrics such as throughput and separation efficiency are being leveraged to enhance product appeal.

The market trajectory reflects steady growth driven by industrial demand, operational performance, and strategic deployment of filtration and separation solutions.

| Metric | Value |

|---|---|

| Filtration and Separation Equipment Market Estimated Value in (2025 E) | USD 111.5 billion |

| Filtration and Separation Equipment Market Forecast Value in (2035 F) | USD 173.1 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The filtration and separation equipment market is estimated to hold a notable proportion within its parent markets, representing approximately 14-16% of the industrial filtration market, around 12-13% of the water and wastewater treatment equipment market, close to 10-11% of the chemical processing equipment market, about 8-9% of the pharmaceutical and biotechnology equipment market, and roughly 6-7% of the food and beverage processing equipment market.

The cumulative share across these parent segments is observed in the range of 50-56%, reflecting a strong presence of filtration and separation solutions across industrial, water treatment, chemical, pharmaceutical, and food processing applications. The market has been influenced by the demand for efficient particle removal, product purity, and process optimization, where operational reliability, material compatibility, and filtration efficiency are highly prioritized. Adoption is guided by procurement strategies that emphasize system scalability, low maintenance requirements, and integration with existing production or treatment processes. Market participants have focused on advanced membrane technologies, robust filtration media, and modular systems to ensure consistent performance and process control across diverse applications.

As a result, the filtration and separation equipment market has not only captured a substantial share within industrial and water treatment segments but has also influenced chemical processing, pharmaceutical, and food and beverage equipment markets, highlighting its strategic role in improving product quality, operational efficiency, and process reliability across multiple sectors.

The filtration and separation equipment market is experiencing sustained expansion, driven by the increasing demand for cleaner industrial processes, stricter environmental regulations, and rising concerns about water and air quality across multiple sectors. Growth is being reinforced by significant infrastructure investments in water and wastewater treatment, industrial processing, pharmaceuticals, food and beverage, and chemical manufacturing.

The growing need for high-performance, energy-efficient, and scalable filtration technologies is pushing industries to adopt more advanced solutions that ensure regulatory compliance while minimizing operating costs. Technological innovations in membrane systems, automation, and self-cleaning filters are enhancing equipment durability, reducing downtime, and improving separation precision.

Global awareness around resource conservation, along with a focus on zero-discharge processes, is encouraging adoption of sophisticated filtration systems in both emerging and developed economies As environmental standards become more stringent and industrial throughput rises, the market is expected to maintain long-term growth momentum, with manufacturers investing in modular designs, advanced materials, and digital monitoring systems to meet evolving customer expectations and application requirements.

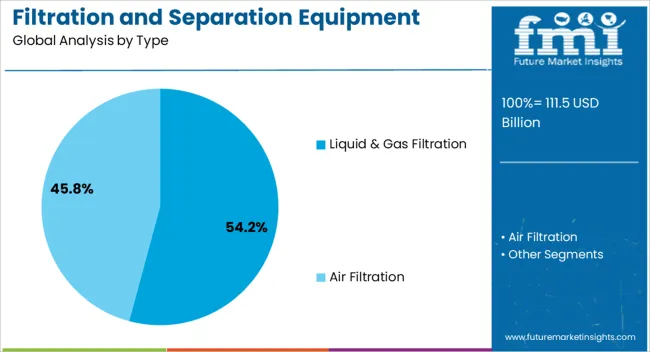

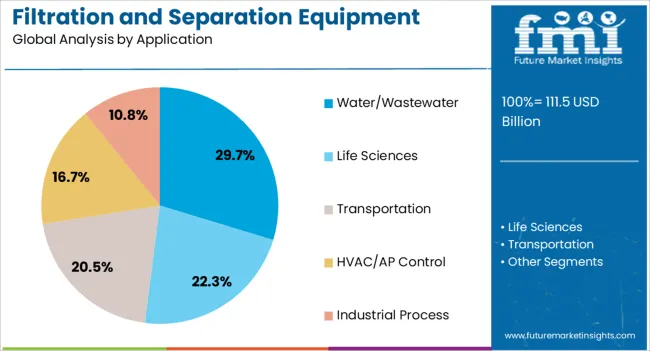

The filtration and separation equipment market is segmented by type, application, technology, distribution channel, and geographic regions. By type, filtration and separation equipment market is divided into Liquid & Gas Filtration and Air Filtration. In terms of application, filtration and separation equipment market is classified into Water/Wastewater, Life Sciences, Transportation, HVAC/AP Control, and Industrial Process.

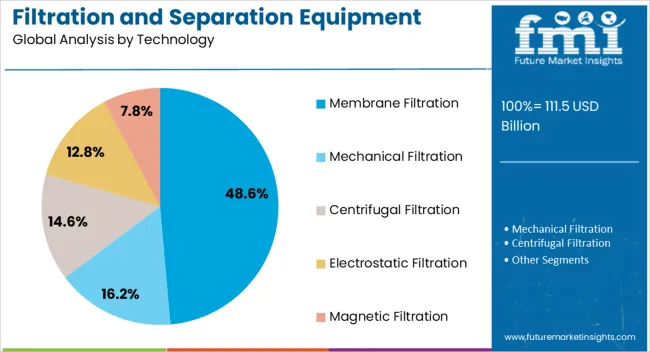

Based on technology, filtration and separation equipment market is segmented into Membrane Filtration, Mechanical Filtration, Centrifugal Filtration, Electrostatic Filtration, and Magnetic Filtration. By distribution channel, filtration and separation equipment market is segmented into Direct Sales and Indirect Sales. Regionally, the filtration and separation equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The liquid and gas filtration segment is projected to capture 54.2% of the filtration and separation equipment market revenue share in 2025, making it the dominant type. This leading position is being driven by the segment’s critical role in a wide array of industries, including water treatment, chemical processing, oil and gas, food and beverage, and pharmaceuticals.

Its ability to remove particulates, impurities, and contaminants from both liquids and gases is essential for ensuring product quality, equipment longevity, and regulatory compliance. The increasing complexity of industrial processes, along with the need for finer and more reliable filtration, is fueling demand for high-capacity and high-precision systems.

The segment is also benefiting from advancements in filter media, modular system designs, and real-time monitoring technologies, which are enabling longer service life and improved operational efficiency. As industries continue to prioritize process optimization and environmental sustainability, liquid and gas filtration systems are expected to remain at the forefront of capital investments, solidifying the segment’s leadership across both established and emerging markets.

The water and wastewater application segment is expected to account for 29.7% of the filtration and separation equipment market revenue share in 2025, marking it as the most significant application area. This segment’s growth is being driven by the rising global demand for clean and safe water in both municipal and industrial settings, alongside heightened environmental regulations governing wastewater discharge. Increasing urbanization, industrial expansion, and water scarcity issues are intensifying the focus on water reuse and advanced treatment technologies.

The integration of filtration equipment in primary, secondary, and tertiary water treatment processes is critical for removing solids, biological contaminants, and chemical residues. Governments and private sector players are investing heavily in modernizing water infrastructure, including decentralized treatment plants, which is further strengthening market adoption.

Technological advancements such as energy-efficient filters, smart control systems, and modular treatment units are enhancing the performance and adaptability of filtration systems in this application. As water management challenges grow in complexity, the role of filtration and separation equipment in ensuring sustainable and compliant operations will continue to expand.

The membrane filtration segment is projected to hold 48.6% of the filtration and separation equipment market revenue share in 2025, making it the leading technology. Its strong position is being attributed to the growing demand for highly efficient, low-energy, and scalable filtration solutions that can operate under diverse conditions and offer fine separation capabilities. Membrane technologies such as ultrafiltration, nanofiltration, and reverse osmosis are increasingly being used in applications ranging from water purification and wastewater treatment to food processing, biopharmaceuticals, and chemical production.

The segment is benefitting from advancements in membrane materials, including polymeric and ceramic variants, which provide enhanced durability, chemical resistance, and selectivity. Additionally, the adoption of membrane-based systems is being supported by their compact design, ease of integration, and lower environmental footprint compared to conventional methods.

Regulatory frameworks promoting zero-liquid discharge and higher purification standards are further driving adoption. As industries continue to prioritize cleaner production and resource recovery, membrane filtration is expected to maintain its growth trajectory as the preferred technology in complex and high-volume separation processes.

The filtration and separation equipment market is being driven by industrial and water treatment demand, while opportunities are growing in healthcare and pharmaceutical sectors. Trends emphasize automation, process optimization, and modular solutions, whereas regulatory compliance and operational costs present significant challenges. Despite these constraints, adoption is being reinforced by the critical role of equipment in maintaining process integrity, product purity, and operational efficiency. Market expansion is being sustained as industries increasingly rely on reliable and high-performance filtration and separation systems across diverse applications worldwide.

The demand for filtration and separation equipment is being driven by industrial operations and water treatment requirements. Industries including chemical processing, pharmaceuticals, food and beverage, and oil and gas are increasingly relying on these systems to ensure product purity, operational efficiency, and regulatory compliance. Municipal water treatment plants and wastewater management facilities are adopting filtration and separation technologies to remove contaminants and maintain water quality standards. The growing emphasis on minimizing downtime, reducing process inefficiencies, and maintaining consistent output has reinforced reliance on these systems. As a result, the market is being propelled by industrial adoption, regulatory enforcement, and the essential role of equipment in maintaining safe and clean processes across multiple sectors.

Opportunities in the filtration and separation equipment market are being unlocked by healthcare and pharmaceutical sector adoption. Hospitals, laboratories, and manufacturing units are increasingly implementing advanced filtration systems to ensure sterile environments and high-quality formulations. Separation equipment is being applied in biopharmaceutical processes, vaccine production, and diagnostic operations to remove impurities and maintain process integrity. The rising focus on minimizing contamination risks and ensuring patient safety is encouraging the integration of reliable filtration solutions. This expanding application scope in healthcare and pharmaceuticals provides manufacturers with growth avenues while diversifying market presence beyond conventional industrial uses.

Current market trends indicate that automation and process optimization are shaping equipment adoption. Filtration and separation systems are being integrated with monitoring and control mechanisms to enhance efficiency, reduce human error, and maintain consistent performance. Remote operation capabilities, predictive maintenance, and process analytics are increasingly being incorporated to optimize throughput and reduce operational costs. The trend of moving towards compact, modular, and customizable equipment reflects a market focus on adaptability, precision, and operational reliability. Overall, the emphasis on automated and controlled operations is positioning filtration and separation solutions as critical enablers for process excellence across industries.

Challenges in the filtration and separation equipment market arise from regulatory requirements and high operational costs. Equipment must comply with strict standards for industrial, healthcare, and environmental applications, and noncompliance can lead to fines or operational interruptions. Initial capital investment, energy consumption, and maintenance expenses create barriers for smaller operators. Disposal of filtered waste and adherence to environmental limits further complicate adoption. Companies are compelled to implement robust maintenance strategies, staff training, and monitoring protocols to overcome these challenges, making operational efficiency and regulatory alignment critical factors in maintaining long-term market competitiveness and acceptance.

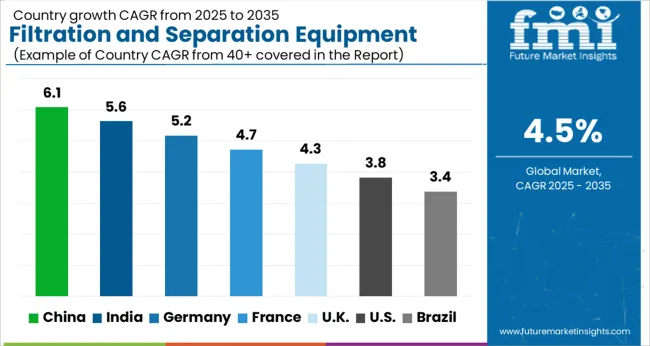

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global filtration and separation equipment market is projected to grow at a CAGR of 4.5% from 2025 to 2035. China leads with a growth rate of 6.1%, followed by India at 5.6%, and Germany at 5.2%. The United Kingdom records a growth rate of 4.3%, while the United States shows the slowest growth at 3.8%. The market expansion is driven by increasing demand for clean water, industrial process efficiency, and pollution control solutions. Emerging markets like China and India experience higher growth due to rapid industrialization, growing manufacturing sectors, and rising urban water treatment initiatives. Mature markets such as Germany, UK, and the USA focus on technological upgrades, regulatory compliance, and adoption of high-performance separation and filtration solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The filtration and separation equipment market in China is projected to grow at a CAGR of 6.1%, driven by rapid industrialization, expansion of the chemical, pharmaceutical, and food processing sectors, and increased focus on water purification and pollution control. Municipal water treatment projects, power plants, and industrial wastewater management systems are key end-users of advanced filtration and separation solutions. Rising environmental regulations and government incentives for pollution reduction further accelerate market adoption. Investments in research for energy-efficient and high-performance filtration technologies also contribute to market growth. The demand for industrial process optimization, along with rising awareness about waterborne contaminants and environmental protection, is expanding the market footprint across China.

The filtration and separation equipment market in India is expected to grow at a CAGR of 5.6%, supported by expanding industrial operations and urban infrastructure development. The chemical, pharmaceutical, and food processing industries increasingly adopt filtration systems to ensure product quality and regulatory compliance. Municipal water treatment, industrial cooling, and wastewater management require advanced separation technologies to meet sanitation and environmental standards. Government initiatives for clean water access and pollution reduction stimulate market growth. Research investments in efficient filtration systems and eco-friendly separation solutions also contribute to expanding adoption. The rising awareness of industrial hygiene, environmental safety, and operational efficiency drives steady growth in the Indian market.

The filtration and separation equipment market in Germany is projected to grow at a CAGR of 5.2%, with growth fueled by strict environmental regulations and increasing demand from chemical, pharmaceutical, and food processing sectors. Industrial cooling, wastewater management, and municipal water treatment systems require advanced filtration technologies for microbial control and operational efficiency. The German market emphasizes eco-efficient, high-performance equipment to comply with environmental standards. Rising industrial hygiene awareness and investments in research for next-generation filtration solutions support continued adoption. Growing focus on sustainability and operational safety ensures steady market expansion across Germany.

The filtration and separation equipment market in the UK is expected to grow at a CAGR of 4.3%, driven by demand from chemical processing, food manufacturing, and municipal water treatment applications. Regulatory mandates for clean water, pollution control, and environmental safety encourage adoption of advanced filtration systems. Industrial operations and municipal wastewater projects increasingly rely on separation technologies to maintain operational efficiency and comply with hygiene standards. Research and development investments in high-efficiency, eco-friendly equipment are supporting market expansion. Rising awareness about environmental protection and industrial process optimization further drives adoption in the UK market.

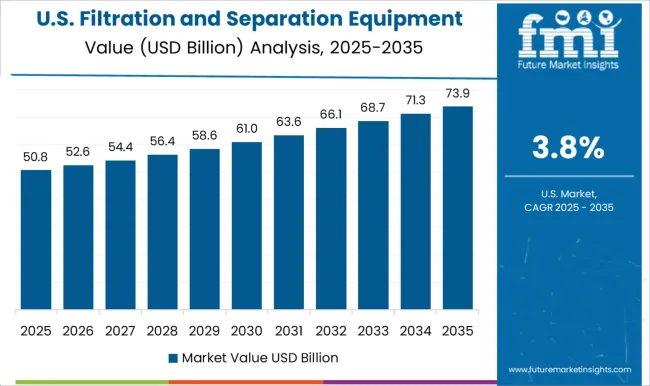

The filtration and separation equipment market in the USA is projected to grow at a CAGR of 3.8%, with growth supported by industrial water treatment, wastewater management, and chemical processing applications. Industries and municipalities are increasingly adopting advanced filtration technologies to ensure environmental compliance, maintain operational efficiency, and reduce contamination risks. Regulatory standards focusing on water quality, environmental protection, and industrial safety drive adoption of high-performance equipment. Investments in energy-efficient and eco-friendly solutions further support market expansion. Awareness about sustainability, public health, and operational optimization continues to increase adoption in key industrial sectors, sustaining steady growth in the USA filtration and separation equipment market.

The filtration and separation equipment market is shaped by rising demand across water treatment, chemical processing, food and beverage, and pharmaceutical industries. Leading players such as Parker-Hannifin Corporation, Eaton Corporation, and 3M Company focus on advanced filtration technologies, offering high-efficiency filters, membranes, and separators that ensure operational reliability and regulatory compliance. Companies like Pall Corporation (Danaher Corporation), Donaldson Company, Inc., and MANN+HUMMEL emphasize innovation through specialized solutions for critical industrial applications. Alfa Laval AB, GEA Group AG, and Suez Water Technologies & Solutions highlight energy-efficient designs and process optimization in their product brochures, underscoring sustainability and cost-effectiveness. Firms such as Hydac International GmbH, Lydall, Inc., and Pentair Plc target niche markets with custom filtration solutions, while Porvair Filtration Group, SPX Flow, Inc., and Graver Technologies showcase expertise in high-purity applications for pharmaceuticals and electronics, enhancing their market credibility and technical leadership.

Competition in the filtration and separation equipment market is driven by technology differentiation, performance reliability, and geographic reach. Companies aim to gain an edge through product innovation, modular designs, and enhanced maintenance support. Brochures emphasize specifications, compliance standards, and operational efficiency, allowing industrial buyers to select solutions that meet stringent safety and quality requirements. Strategic collaborations, acquisitions, and regional expansions strengthen market positions, while R&D investments foster next-generation filtration and separation technologies. Overall, market dynamics reflect a balance between efficiency, innovation, and service excellence, fostering widespread adoption across critical industries globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 111.5 Billion |

| Type | Liquid & Gas Filtration and Air Filtration |

| Application | Water/Wastewater, Life Sciences, Transportation, HVAC/AP Control, and Industrial Process |

| Technology | Membrane Filtration, Mechanical Filtration, Centrifugal Filtration, Electrostatic Filtration, and Magnetic Filtration |

| Distribution Channel | Direct Sales and Indirect Sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Parker-Hannifin Corporation, Eaton Corporation, 3M Company, Pall Corporation (Danaher Corporation), Donaldson Company, Inc., MANN+HUMMEL, Alfa Laval AB, GEA Group AG, Suez Water Technologies & Solutions, Hydac International GmbH, Lydall, Inc., Pentair Plc, Porvair Filtration Group, SPX Flow, Inc., and Graver Technologies |

| Additional Attributes | Dollar sales by equipment type (filters, membranes, centrifuges, separators) and application (water & wastewater, chemical processing, food & beverage, pharmaceuticals) are key metrics. Trends include rising demand for efficient purification and separation solutions, growth in industrial and municipal applications, and adoption of advanced filtration technologies. Regional deployment, technological advancements, and regulatory compliance are driving market growth. |

The global filtration and separation equipment market is estimated to be valued at USD 111.5 billion in 2025.

The market size for the filtration and separation equipment market is projected to reach USD 173.1 billion by 2035.

The filtration and separation equipment market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in filtration and separation equipment market are liquid & gas filtration and air filtration.

In terms of application, water/wastewater segment to command 29.7% share in the filtration and separation equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Filtration Paper Market Growth and Forecast 2024 to 2034

Ultrafiltration Membranes Market Analysis by Material Type, End-Use, and Region through 2025 to 2035

Dairy Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Depth Filtration Market Size, Growth, and Forecast 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Coolant Filtration Skids Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Portable Filtration System Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Filtration Devices Market Size and Share Forecast Outlook 2025 to 2035

Industrial Filtration Market Growth - Trends & Forecast 2025 to 2035

Single-use Filtration Assemblies Market Growth – Trends & Forecast 2025 to 2035

Laboratory Filtration Equipment Market Growth – Trends & Forecast 2019-2027

Normal Flow Filtration Products Market Size and Share Forecast Outlook 2025 to 2035

Membrane Microfiltration Market Size and Share Forecast Outlook 2025 to 2035

Industrial Air Filtration Market Size and Share Forecast Outlook 2025 to 2035

Mask Bacterial Filtration Efficiency Tester Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Filtration Market Growth - Trends & Forecast 2025 to 2035

Compressed Air Filtration and Dryer System Market Growth - Trends & Forecast 2025 to 2035

GCC Industrial Air Filtration Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA