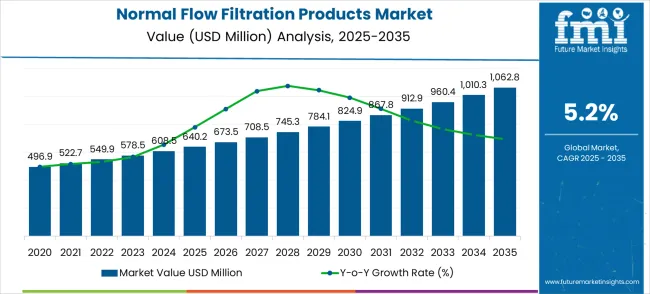

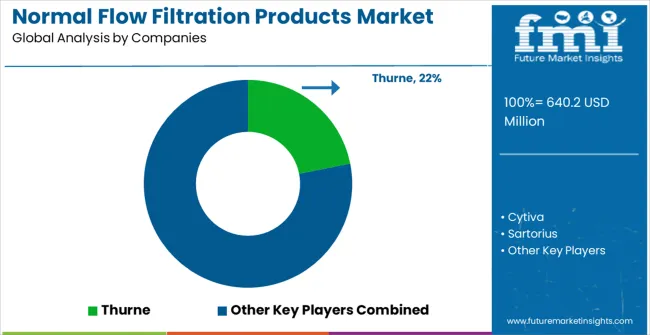

The global normal flow filtration products market is projected to expand from USD 640.2 million in 2025 to approximately USD 1,062.8 million by 2035, recording an absolute increase of USD 422.6 million over the forecast period. This translates into a total growth of 66.0%, with the market forecast to expand at a CAGR of 5.2% between 2025 and 2035. The overall market size is expected to grow by nearly 1.66X during the same period, supported by increasing biopharmaceutical production and growing demand for high-purity filtration solutions across various pharmaceutical manufacturing, chemical processing, and food & beverage applications.

Between 2025 and 2030, the normal flow filtration products market is projected to expand from USD 640.2 million to USD 824.9 million, resulting in a value increase of USD 184.7 million, which represents 43.7% of the total forecast growth for the decade. This phase of growth will be shaped by rising biopharmaceutical manufacturing across global markets, increasing demand for sterile filtration systems in drug production, and growing adoption of single-use filtration technologies in bioprocessing applications. Pharmaceutical manufacturers are investing in advanced filtration systems to improve product purity and meet stringent regulatory requirements for drug manufacturing.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 640.2 million |

| Market Forecast Value (2035) | USD 1,062.8 million |

| Forecast CAGR (2025–2035) | 5.2% |

From 2030 to 2035, the market is forecast to grow from USD 824.9 million to USD 1,062.8 million, adding another USD 237.9 million, which constitutes 56.3% of the overall ten-year expansion. This period is expected to be characterized by expansion of biosimilar production in developing countries, integration of continuous manufacturing technologies in pharmaceutical processes, and development of specialized filtration solutions for personalized medicine and gene therapy applications. The growing focus on process efficiency and quality assurance will drive demand for innovative and precisely engineered normal flow filtration solutions across multiple life sciences and industrial sectors.

Between 2020 and 2025, the normal flow filtration products market experienced steady expansion, driven by increasing global pharmaceutical production and growing recognition of filtration importance in ensuring product quality and regulatory compliance. The market developed as pharmaceutical companies recognized the need for reliable, high-performance filtration systems to support critical manufacturing processes and meet evolving regulatory standards. Quality requirements and contamination control mandates began influencing procurement decisions toward advanced filtration technologies from established life sciences equipment manufacturers.

Market expansion is being supported by the increasing biopharmaceutical production activities across global economies and the corresponding need for high-purity filtration systems that ensure product quality and regulatory compliance in pharmaceutical and bioprocessing applications. Modern pharmaceutical manufacturing requires sophisticated filtration technologies that provide superior separation efficiency while maintaining sterile processing conditions and preventing contamination. The excellent filtration performance and reliability characteristics of normal flow filtration products make them essential components in demanding life sciences environments where product purity and process integrity are paramount.

The growing emphasis on pharmaceutical quality assurance and regulatory compliance is driving demand for advanced filtration technologies from certified manufacturers with proven track records of life sciences equipment reliability and performance validation. Pharmaceutical companies are increasingly investing in high-performance filtration systems that offer improved separation efficiency and enhanced contamination control compared to conventional filtration methods. Regulatory requirements and quality standards are establishing performance benchmarks that favor precision-engineered filtration solutions with comprehensive validation documentation and regulatory compliance support.

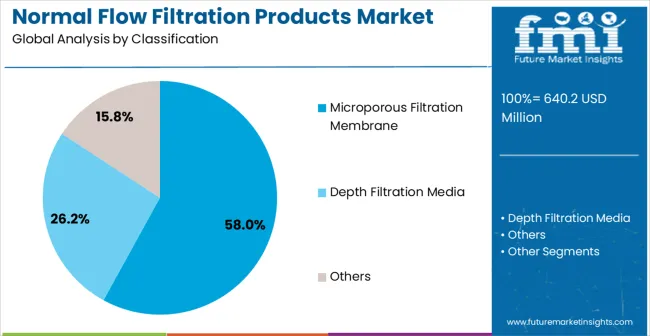

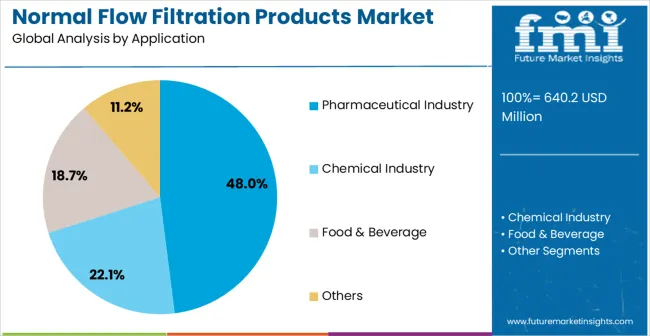

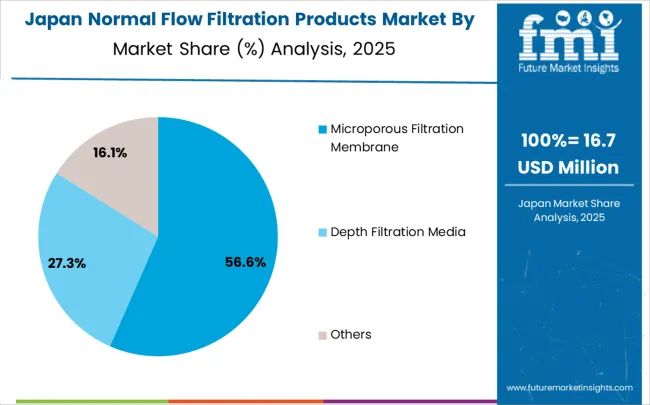

The market is segmented by filtration technology, application, and region. By filtration technology, the market is divided into microporous filtration membrane, depth filtration media, and other specialized filtration products. Based on application, the market is categorized into pharmaceutical industry, chemical industry, food & beverage, and other industrial applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Microporous filtration membrane products are projected to account for 58% of the normal flow filtration products market in 2025. This leading share is supported by the superior separation precision and versatility that microporous membranes provide in pharmaceutical and bioprocessing applications. Microporous filtration membranes offer excellent particle retention with predictable pore size distribution, making them the preferred choice for sterile filtration, protein purification, and pharmaceutical manufacturing applications requiring precise separation control. The segment benefits from technological advancements that have improved membrane performance and durability while reducing fouling tendency and extending operational life.

Modern microporous filtration membranes incorporate advanced polymer technologies, optimized pore structures, and sophisticated surface treatments that ensure superior filtration efficiency while maintaining consistent flow rates and minimal protein binding. These innovations have significantly improved process reliability and product quality while reducing operational costs through extended membrane life and reduced replacement frequency. The pharmaceutical and biotechnology sectors particularly drive demand for microporous membrane solutions, as these industries require precise separation capabilities with validated performance and regulatory compliance documentation.

Additionally, the biopharmaceutical manufacturing sector increasingly adopts microporous membranes for applications where sterile filtration and product purity are essential for meeting regulatory requirements and ensuring patient safety. The integration of single-use membrane systems and automated filtration processes creates opportunities for improved process flexibility and reduced contamination risks, further accelerating market adoption as manufacturers seek reliable yet efficient filtration solutions.

Pharmaceutical industry applications are expected to represent 48% of normal flow filtration products demand in 2025. This dominant share reflects the critical importance of filtration in pharmaceutical manufacturing and the stringent requirements for product purity and sterile processing in drug production. Pharmaceutical applications require advanced filtration systems for drug substance purification, sterile drug product manufacturing, and process intermediate filtration. The segment benefits from continuous expansion of pharmaceutical manufacturing globally and increasing regulatory requirements for pharmaceutical quality and safety assurance.

Pharmaceutical applications demand exceptional filtration performance to ensure product purity and regulatory compliance across diverse manufacturing processes and therapeutic product categories. These applications require filtration systems capable of removing contaminants, maintaining sterile conditions, and supporting validated manufacturing processes while meeting comprehensive regulatory documentation requirements. The growing emphasis on pharmaceutical quality and patient safety drives consistent demand for proven filtration technologies that demonstrate superior performance and regulatory compliance. Major pharmaceutical companies and contract manufacturing organizations contribute significantly to market growth as facilities invest in advanced filtration systems to support growing production volumes and meet evolving regulatory standards.

Additionally, the trend toward biopharmaceutical manufacturing and personalized medicine creates opportunities for specialized filtration systems designed for complex biological products and novel therapeutic modalities. The segment also benefits from increasing biosimilar production and generic drug manufacturing requiring proven filtration technologies for cost-effective yet compliant production processes.

The normal flow filtration products market is advancing steadily due to increasing pharmaceutical production volumes and growing recognition of filtration importance in ensuring product quality and regulatory compliance. However, the market faces challenges including membrane fouling and replacement costs affecting operational economics, complex validation requirements for pharmaceutical applications, and varying filtration needs across different manufacturing processes. Technical innovation and regulatory support programs continue to influence adoption patterns and operational efficiency optimization.

The growing implementation of single-use filtration systems and continuous manufacturing processes is enabling improved process flexibility and reduced contamination risks in pharmaceutical and bioprocessing applications. Single-use filtration technologies provide simplified validation, reduced cleaning requirements, and enhanced process security while supporting flexible manufacturing operations. These technologies are particularly valuable for biopharmaceutical facilities that require rapid product changeovers and comprehensive contamination control without extensive cleaning validation procedures.

Modern filtration manufacturers are incorporating advanced membrane technologies and specialized surface modifications that improve filtration capacity while addressing specific application requirements such as protein binding reduction and enhanced chemical compatibility. Integration of optimized pore structures and advanced materials enables superior filtration performance and significant operational advantages compared to conventional filtration products. Advanced manufacturing techniques and quality control systems also support development of application-specific filtration solutions for specialized pharmaceutical and bioprocessing requirements.

| Country | CAGR (2025–2035) |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| Brazil | 5.5% |

| United States | 4.9% |

| United Kingdom | 4.4% |

| Japan | 3.9% |

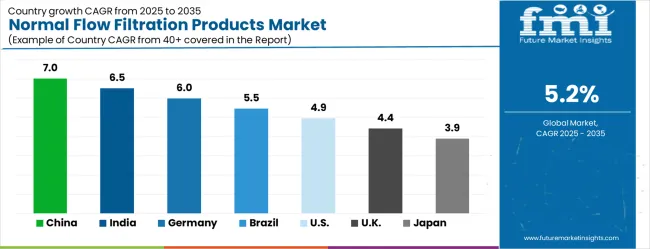

The market is growing rapidly, with China leading at a 7.0% CAGR through 2035, driven by massive pharmaceutical manufacturing expansion, increasing biopharmaceutical production capabilities, and growing demand for high-quality filtration systems in drug manufacturing. India follows at 6.5%, supported by rising pharmaceutical industry development and growing investments in modern pharmaceutical manufacturing equipment and process technologies. Germany records strong growth at 6.0%, emphasizing pharmaceutical engineering excellence, quality standards, and advanced bioprocessing capabilities. Brazil grows steadily at 5.5%, integrating modern filtration technologies into expanding pharmaceutical and chemical manufacturing operations. The United States shows moderate growth at 4.9%, focusing on biopharmaceutical innovation and advanced manufacturing technologies. The United Kingdom maintains steady expansion at 4.4%, supported by pharmaceutical industry development and life sciences research programs. Japan demonstrates stable growth at 3.9%, emphasizing technological innovation and precision pharmaceutical manufacturing excellence.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China recorded a 7.0% CAGR, driven by growing pharmaceutical, biotechnology, and chemical manufacturing industries. Adoption of normal flow filtration products increased due to demand for high purity, reliable, and scalable filtration solutions. Manufacturers emphasized advanced membranes, single-use systems, and automation for efficiency and contamination control. Competitive strategies included partnerships with pharmaceutical firms, expansion of regional production, and R&D in high-performance filters. Growth was further supported by rising domestic pharmaceutical production and expansion of biotech facilities. Companies focused on compliance with local and international quality standards while optimizing throughput and reducing operational costs.

India demonstrated a 6.5% CAGR, supported by expanding pharmaceutical and biopharmaceutical manufacturing and rising demand for high quality filtration systems. Manufacturers developed scalable, reliable, and contamination-resistant products tailored for small to large batch processing. Adoption was strongest in vaccine, biologics, and chemical production. Competitive strategies included collaborations with pharmaceutical companies, regional distribution expansion, and in-house R&D to optimize filtration efficiency. Government initiatives promoting local pharmaceutical manufacturing further strengthened market growth. Manufacturers focused on operational reliability, compliance with global quality standards, and cost-effective solutions for diverse end users.

Germany progressed at a 6.0% CAGR, driven by strong biotechnology, pharmaceutical, and chemical sectors requiring high precision and quality standards. Manufacturers emphasized advanced filtration products, single-use systems, and automation integration for efficient production. Adoption was strongest in biologics, chemical intermediates, and research laboratories. Competitive strategies included innovation in membrane technologies, partnerships with industrial users, and compliance with European safety and quality standards. Germany’s focus on high-performance production, export potential, and stringent regulations reinforced demand for reliable and advanced filtration solutions, supporting both domestic and international market growth.

Brazil advanced at a 5.5% CAGR, supported by pharmaceutical, biotechnology, and food and beverage industries requiring reliable filtration systems. Manufacturers emphasized robust, high capacity, and scalable filtration solutions for local and regional markets. Adoption was strongest in vaccine production, chemical processing, and dairy applications. Competitive strategies included collaborations with pharmaceutical companies, regional manufacturing expansion, and product customization for tropical climates. Growth was further driven by government incentives for local pharmaceutical production and industrial modernization. Companies focused on compliance, operational efficiency, and regional availability of filtration products.

The United States expanded at a 4.9% CAGR, influenced by demand from pharmaceuticals, biopharmaceuticals, and chemical manufacturing requiring high reliability and throughput. Manufacturers invested in single-use systems, automated filtration units, and advanced membrane technologies. Adoption was strongest in biologics, vaccine production, and specialty chemicals. Competitive strategies included collaborations with biotech companies, R&D for high efficiency and contamination control, and scaling production capacity. Strict FDA and ISO compliance further reinforced market growth. Manufacturers focused on product innovation, process reliability, and operational efficiency to meet high standards of the domestic and export markets.

The United Kingdom registered a 4.4% CAGR, supported by pharmaceutical, biotechnology, and chemical industries requiring high precision filtration. Manufacturers emphasized reliable, scalable, and automation-ready filtration solutions. Adoption was strongest in biologics, chemical production, and research laboratories. Competitive strategies included product innovation, compliance with UK and EU regulations, and partnerships with local industrial users. R&D targeted membrane performance, contamination control, and throughput optimization. Government incentives and growing investment in life sciences facilities further encouraged adoption. Companies focused on quality, operational efficiency, and regulatory adherence to maintain competitiveness in both domestic and export markets.

Japan advanced at a 3.9% CAGR, influenced by pharmaceutical, biotechnology, and chemical manufacturing sectors requiring precision and reliability. Manufacturers invested in advanced filtration technologies, single-use systems, and automated solutions to improve efficiency and product safety. Adoption was strongest in biologics, specialty chemicals, and research applications. Competitive strategies included R&D for high efficiency, contamination control, and compact design, as well as collaboration with pharmaceutical companies. Government standards and stringent quality regulations supported the use of high-performance filtration products. Continuous innovation and operational reliability reinforced market growth across domestic and export-focused pharmaceutical and biotechnology sectors.

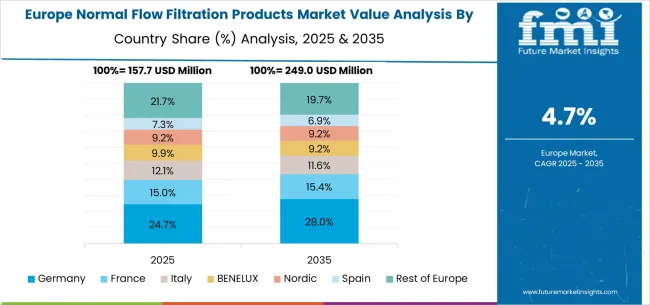

The normal flow filtration products market in Europe is projected to grow from USD 172.7 million in 2025 to USD 286.6 million by 2035, registering a CAGR of 5.2% over the forecast period. Germany is expected to maintain its leadership with a 28.9% share in 2025, supported by its strong pharmaceutical base and advanced bioprocessing infrastructure. The United Kingdom follows with 18.4% market share, driven by pharmaceutical industry development and life sciences research programs. France holds 15.7% of the European market, benefiting from pharmaceutical manufacturing expansion and biotechnology investments. Italy and Spain collectively represent 22.0% of regional demand, with growing focus on pharmaceutical filtration applications and manufacturing development. The Rest of Europe region accounts for 15.0% of the market, supported by pharmaceutical development in Eastern European countries and Nordic life sciences sectors.

The market is defined by competition among established life sciences equipment manufacturers, specialized filtration technology companies, and integrated bioprocessing solution providers. Companies are investing in advanced membrane technologies, filtration system innovation, validation support programs, and comprehensive technical services to deliver reliable, efficient, and regulatory-compliant filtration solutions. Strategic partnerships, technology development, and geographic expansion are central to strengthening product portfolios and market presence. Thurne, operating globally, offers comprehensive pharmaceutical filtration solutions with focus on membrane performance, regulatory compliance, and technical support services. Cytiva provides advanced filtration systems with emphasis on biopharmaceutical applications and process integration. Sartorius, multinational life sciences company, delivers comprehensive bioprocessing solutions with focus on single-use technologies and process optimization. Mettler Toledo offers specialized filtration equipment with proven analytical and process applications.

Parker delivers specialized filtration solutions with focus on industrial and pharmaceutical applications. Nalgene offers comprehensive filtration products with laboratory and process applications. Repligen provides bioprocessing filtration systems with focus on downstream purification applications. APPLEXION, Solaris Biotech, Pall, and 3M offer specialized filtration expertise, comprehensive product portfolios, and technical support across global and regional pharmaceutical and industrial markets.

The normal flow filtration products market underpins pharmaceutical quality assurance, bioprocessing excellence, regulatory compliance, and manufacturing safety. With pharmaceutical quality mandates, regulatory compliance requirements, and demand for high-purity processing solutions, the sector must balance innovation leadership, operational reliability, and cost effectiveness. Coordinated contributions from governments, regulatory bodies, manufacturers, pharmaceutical companies, and investors will accelerate the transition toward quality-assured, compliant, and technologically advanced filtration systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 640.2 million |

| Classification Type | Microporous Filtration Membrane, Depth Filtration Media, Others |

| Application | Pharmaceutical Industry, Chemical Industry, Food & Beverage, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | Thurne, Cytiva, Sartorius, Mettler Toledo, Parker, Nalgene, Repligen, APPLEXION, Solaris Biotech, Pall, 3M |

| Additional Attributes | Dollar sales by filtration technology and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established life sciences equipment manufacturers and specialized suppliers, buyer preferences for microporous versus depth filtration technologies, integration with advanced bioprocessing and single-use technologies, innovations in membrane materials and filtration efficiency for enhanced pharmaceutical manufacturing performance, and adoption of intelligent filtration solutions with embedded monitoring and process control capabilities for improved regulatory compliance and operational optimization. |

The global normal flow filtration products market is estimated to be valued at USD 640.2 million in 2025.

The market size for the normal flow filtration products market is projected to reach USD 1,062.8 million by 2035.

The normal flow filtration products market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in normal flow filtration products market are microporous filtration membrane, depth filtration media and others.

In terms of application, pharmaceutical industry segment to command 48.0% share in the normal flow filtration products market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Normal and Specialty Fats Market Analysis by Type, Application, End Use and Region through 2035

Flower Box Market Size and Share Forecast Outlook 2025 to 2035

Flow Pack Films Market Size and Share Forecast Outlook 2025 to 2035

Flow Pack Machine Market Size and Share Forecast Outlook 2025 to 2035

Flow Indicator Market Size and Share Forecast Outlook 2025 to 2035

Flow Chemistry Market Size and Share Forecast Outlook 2025 to 2035

Flow Wrappers Market Size and Share Forecast Outlook 2025 to 2035

Flow Computer Market Size and Share Forecast Outlook 2025 to 2035

Flow Meter Devices Market Size, Share, and Forecast 2025 to 2035

Flow Cytometry Market - Trends & Growth Forecast 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flow Wrap Packaging Market Growth from 2025 to 2035

Flower Extract Market Analysis by Type, Application and Form Through 2035

Flow Meters Market Growth - Trends & Forecast 2025 to 2035

Flow Wrap Machines Market Analysis – Size, Share & Industry Trends 2025-2035

Flow Diverter Market Analysis – Size, Trends & Forecast 2024-2034

Flow Wrap Market from 2024 to 2034

Flowback Tank Market Growth – Trends & Forecast 2024-2034

Flowpack Paper Packaging Market

Flow Cytometer Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA