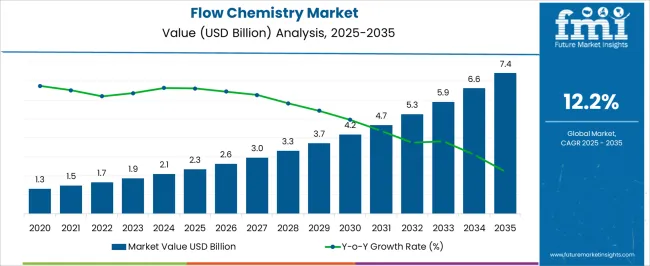

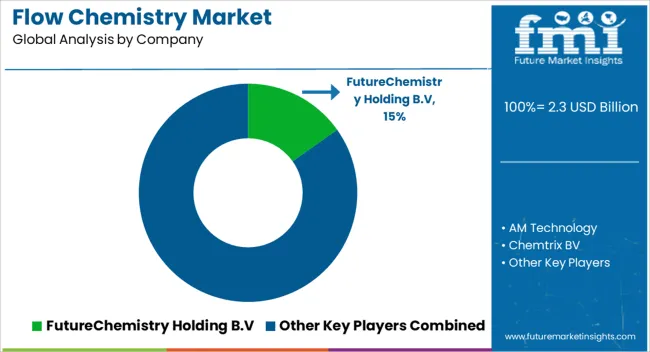

The flow chemistry market is valued at USD 2.3 billion in 2025 and will reach USD 7.4 billion by 2035, growing at a CAGR of 12.2%. A rolling CAGR analysis provides a detailed view of how growth momentum evolves across overlapping periods rather than appearing uniform across the decade. In the initial window from 2025 to 2028, rolling CAGR values are slightly above the average, driven by early adoption in pharmaceutical synthesis, fine chemicals, and process intensification initiatives.

Adoption is supported by increasing demand for continuous manufacturing, higher efficiency in chemical reactions, and improved safety and reproducibility compared with traditional batch processes. From 2028 to 2032, rolling CAGR demonstrates acceleration as applications broaden to agrochemicals, specialty polymers, and emerging biotech processes. Technological innovations, including microreactors, modular flow systems, and in-line analytics, contribute to higher growth rates during this period. Increased investment from contract manufacturing organizations and industrial research facilities further boosts expansion.

This rolling analysis highlights that while the decade’s overall CAGR is 12.2%, periods of acceleration and moderation exist, providing insight into timing for strategic investment, capacity planning, and technology deployment in the flow chemistry market.

| Metric | Value |

|---|---|

| Flow Chemistry Market Estimated Value in (2025 E) | USD 2.3 billion |

| Flow Chemistry Market Forecast Value in (2035 F) | USD 7.4 billion |

| Forecast CAGR (2025 to 2035) | 12.2% |

Pharmaceutical and biotechnology companies represent around 38%, as continuous flow processes are widely used for drug synthesis and process intensification. Chemical manufacturing and specialty chemicals contribute approximately 27%, utilizing flow reactors for improved reaction efficiency and safety. Research and academic institutions account for nearly 16%, adopting flow chemistry for experimentation, scale-up studies, and method development. Equipment and reactor manufacturers hold close to 12%, supplying pumps, microreactors, and modular setups. Contract research and development organizations (CROs) make up the remaining 7%, providing outsourced flow chemistry solutions and process optimization services.

The Flow Chemistry Market is evolving with the increasing adoption of continuous processing in pharmaceuticals and fine chemicals. Pharmaceutical applications now account for over 50% of reactor installations, driven by faster reaction times, enhanced yield, and improved safety. Integration of in-line analytical tools such as IR, UV, and mass spectrometry has increased reaction monitoring efficiency by 15–18%. Microreactor and modular system adoption grew by 12% year-on-year, supporting rapid scale-up and process intensification.

Additionally, chemical manufacturers are increasingly shifting from batch to continuous production, reducing waste generation by 10–12% and improving energy efficiency. Collaborative partnerships between equipment manufacturers and R&D labs are accelerating the deployment of advanced flow chemistry platforms.

The flow chemistry market is expanding at a steady pace, driven by the increasing need for efficient, scalable, and sustainable chemical processing solutions across multiple industries. Technological advancements in reactor design and automation have enhanced process safety, product consistency, and energy efficiency, making flow chemistry an attractive alternative to traditional batch processing.

Industry developments and corporate announcements have highlighted the growing adoption of flow chemistry in sectors such as pharmaceuticals, chemicals, and materials science, owing to its capability to handle hazardous reactions and precise process control. Regulatory emphasis on greener production methods and reduced chemical waste has further accelerated its market penetration.

The integration of process analytical technologies (PAT) into flow systems is enabling real-time monitoring and optimization, thereby improving yield and reducing costs. Over the coming years, market growth is expected to be supported by innovations in reactor technologies, the expansion of continuous manufacturing in regulated industries, and increased investment in modular and scalable systems for both research and commercial production.

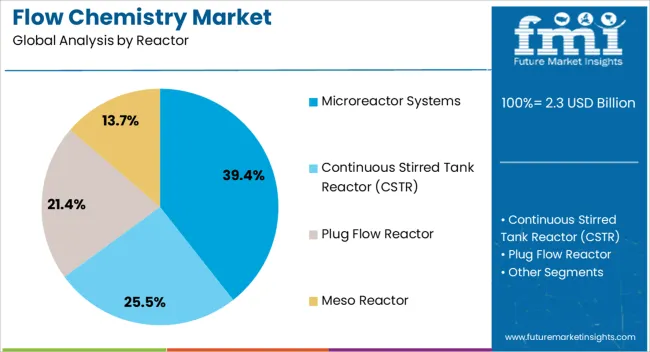

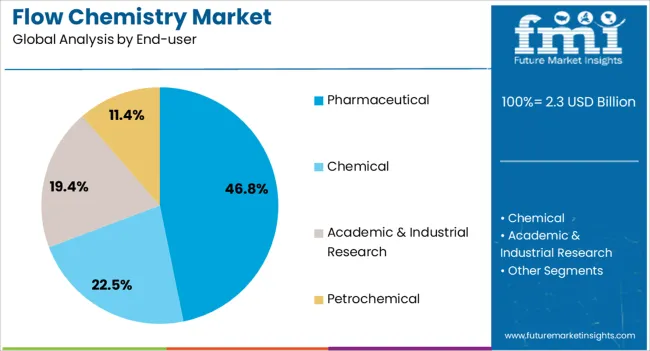

The flow chemistry market is segmented by reactor, end-user, and geographic regions. By reactor, flow chemistry market is divided into Microreactor Systems, Continuous Stirred Tank Reactor (CSTR), Plug Flow Reactor, and Meso Reactor. In terms of end-user, flow chemistry market is classified into Pharmaceutical, Chemical, Academic & Industrial Research, and Petrochemical. Regionally, the flow chemistry industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The microreactor systems segment is projected to account for 39.4% of the flow chemistry market revenue in 2025, maintaining its leading position in reactor type adoption. This growth is attributed to the segment’s ability to provide superior heat and mass transfer, resulting in highly efficient and controlled chemical reactions.

Microreactor systems enable safe handling of reactive intermediates and hazardous chemicals, which has been a significant factor in their widespread use. Industry reports have indicated that these systems are particularly effective for high-value chemical synthesis, where precision and reproducibility are critical.

Their compact footprint and modular design have also made them suitable for both laboratory-scale research and industrial-scale production. Furthermore, advancements in microfabrication techniques have reduced production costs, making these systems more accessible to a broader range of end-users. As demand for safe, efficient, and sustainable chemical processing continues to rise, microreactor systems are expected to remain at the forefront of reactor technology adoption in flow chemistry.

The pharmaceutical segment is projected to contribute 46.8% of the flow chemistry market revenue in 2025, securing its position as the dominant end-user. Growth in this segment has been driven by the pharmaceutical industry’s increasing adoption of continuous manufacturing processes to improve product quality, reduce production timelines, and meet stringent regulatory requirements.

Flow chemistry allows for precise control over reaction parameters, enabling faster synthesis of active pharmaceutical ingredients (APIs) and intermediates. This approach also enhances safety in handling hazardous reactions and facilitates seamless scale-up from research to commercial production.

Regulatory agencies have encouraged the use of advanced manufacturing technologies, including flow chemistry, to ensure consistent product quality and supply chain resilience. Additionally, the growing trend toward small-batch, high-potency drug production has aligned well with the capabilities of flow chemistry systems. With continued investment in process innovation and the shift toward more flexible manufacturing platforms, the pharmaceutical segment is expected to sustain its leadership in end-use adoption.

The flow chemistry market is expanding due to its growing adoption in pharmaceuticals, fine chemicals, agrochemicals, and specialty chemical production. Continuous processing enables higher reaction efficiency, improved safety, and precise control over reaction conditions compared with traditional batch processing. Asia Pacific is leading adoption due to robust pharmaceutical manufacturing and chemical process industries, while Europe and North America focus on high-value specialty and fine chemical applications. Innovations in microreactors, automated process control, and integrated reaction systems are accelerating industrial implementation.

Regulatory and quality standards for chemical production further encourage the shift toward flow chemistry. Increasing demand for scalable, efficient, and safer chemical processes is expected to sustain market growth across multiple industrial segments.

Pharmaceutical and fine chemical manufacturers are increasingly implementing flow chemistry to enhance process efficiency, safety, and reproducibility. Continuous processing reduces reaction times, energy consumption, and waste generation while allowing better heat and mass transfer. Flow chemistry also enables more precise reaction control for multi-step syntheses and high-value molecules. Rising demand for complex active pharmaceutical ingredients (APIs) and specialty chemicals supports adoption. Industrial sectors, including agrochemicals, flavors, and fragrances, are integrating flow reactors to achieve high-quality output. The combination of enhanced operational efficiency, product consistency, and environmental compliance is driving the expansion of flow chemistry across global chemical manufacturing.

Flow chemistry offers opportunities in specialty chemical and agrochemical production due to high precision, scalability, and reduced waste. Advanced flow reactors enable multi-step synthesis with improved yield and minimal by-products. Agrochemical manufacturers are adopting continuous processing to accelerate time-to-market while maintaining regulatory compliance. Specialty chemical companies are leveraging flow technology to produce high-purity products for coatings, adhesives, and electronic applications. The shift toward greener, more efficient chemical processes is further stimulating adoption. Industrial investment in modular, automated flow systems is expected to support long-term growth by improving manufacturing flexibility and reducing operational costs.

Automation, inline analytics, and microreactor integration are emerging trends in flow chemistry. Automated systems reduce human error, improve reaction reproducibility, and enable real-time monitoring. Microreactors offer enhanced heat and mass transfer, increasing reaction efficiency and safety. Integration with process analytical technology (PAT) allows continuous quality control and rapid optimization. These innovations are particularly valuable in pharmaceutical and fine chemical production, where consistency, speed, and scalability are critical. Adoption of advanced flow systems supports faster product development and reduces production costs, positioning manufacturers to meet growing global demand for complex and high-value chemicals efficiently.

The high capital expenditure for flow chemistry equipment and infrastructure presents a barrier for smaller manufacturers. Technical expertise is required for system design, process optimization, and safety management. Retrofitting existing batch plants with continuous systems also demands additional investment. Regulatory compliance for pharmaceuticals and fine chemicals adds complexity during implementation. Companies focusing on training, process standardization, and modular systems can mitigate these challenges while achieving operational efficiency. Optimizing resource utilization and maintaining consistent product quality are essential for maintaining competitiveness in the evolving flow chemistry market.

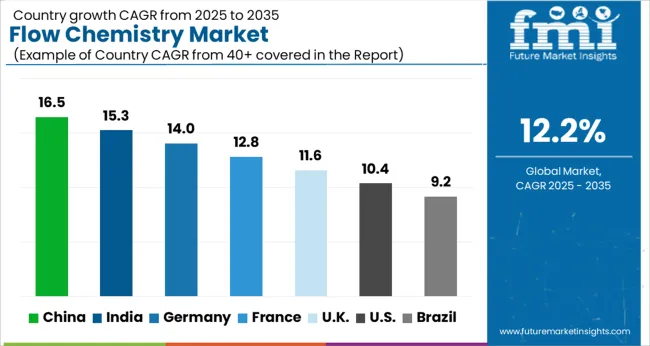

| Country | CAGR |

|---|---|

| China | 16.5% |

| India | 15.3% |

| Germany | 14.0% |

| France | 12.8% |

| UK | 11.6% |

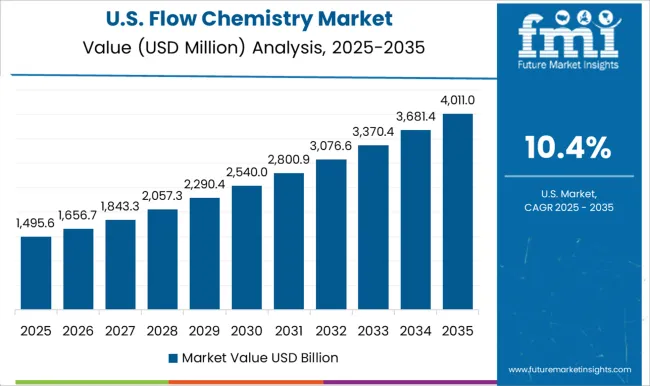

| USA | 10.4% |

| Brazil | 9.2% |

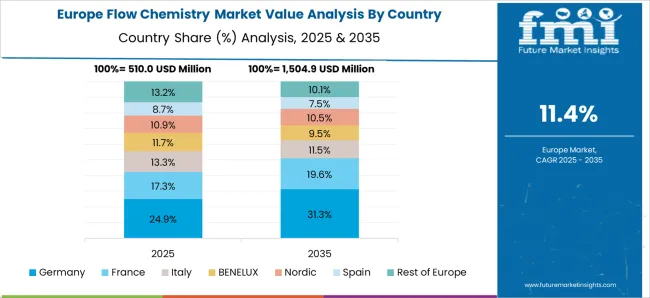

The flow chemistry market is growing at a global CAGR of 12.2% from 2025 to 2035, driven by rising demand for continuous processing, improved efficiency, and safety in chemical manufacturing. China leads with a CAGR of 16.5%, +35% above the global benchmark, supported by BRICS-driven expansion in pharmaceutical and fine chemical production, and large-scale adoption of continuous processing technologies. India follows at 15.3%, +25% higher than the global average, reflecting growing chemical manufacturing capacities and government-backed initiatives to modernize production facilities. Germany records 14.0%, +15% over the global CAGR, shaped by OECD-supported innovation in automated chemical processes and integration of sustainable technologies. The United Kingdom posts 11.6%, slightly below the global rate, influenced by selective adoption in specialty chemicals. The United States stands at 10.4%, −15% under the global benchmark, with growth moderated by mature industrial operations but supported by demand for high-value pharmaceuticals and coatings. BRICS nations are driving scale, while OECD countries focus on precision, efficiency, and technology-driven innovation.

China is leading the flow chemistry market with a CAGR of 16.5%, driven by rapid adoption in pharmaceuticals, specialty chemicals, and fine chemical synthesis. Industrial R&D centers are increasingly integrating continuous flow reactors to improve reaction efficiency and reduce cycle times. Local chemical manufacturers are expanding production of high-purity reagents and catalysts to support both domestic and export markets. Pharmaceutical companies are deploying flow chemistry for API production, enabling faster scale-up and consistent product quality. Strategic partnerships between chemical suppliers and research institutions are fostering innovation. China’s robust industrial ecosystem and government-backed chemical clusters further accelerate the adoption of flow chemistry technologies.

Germany is growing at a CAGR of 14.0% in the flow chemistry market, driven by pharmaceutical, chemical, and biotech industries. German manufacturers are integrating continuous flow technologies to enhance reaction selectivity, reduce waste, and comply with stringent environmental regulations. Demand from pharmaceutical synthesis, polymer precursors, and fine chemicals is rising steadily. Research institutions are collaborating with industry to develop scalable and safe continuous flow processes. Germany’s strong export orientation ensures that flow chemistry applications are in high demand both for domestic production and for supplying European and global markets.

India is recording a CAGR of 15.3% in the flow chemistry market, supported by expanding pharmaceutical and agrochemical industries. Continuous flow reactors are being adopted to improve process safety, reduce batch-to-batch variation, and scale chemical production efficiently. Local manufacturers in Gujarat, Maharashtra, and Telangana are investing in high-capacity production units for API intermediates and specialty chemicals. Growing R&D in drug synthesis and increasing outsourcing by multinational companies are accelerating market adoption. Industrial clusters and chemical parks are providing infrastructure for technology implementation and cost-efficient operations.

The United Kingdom is advancing at a CAGR of 11.6% in the flow chemistry market, supported by pharmaceutical research, chemical innovation, and industrial process optimization. Continuous flow reactors are being implemented to improve throughput, enhance safety, and reduce production time for APIs and specialty chemicals. Adoption is higher in contract research and manufacturing organizations (CRAMS) as well as academic research facilities. Import of high-purity reagents from Europe and Asia complements local supply. Strategic partnerships and pilot-scale implementations are enabling technology transfer and broader adoption of continuous flow processes.

The United States is progressing at a CAGR of 10.4% in the flow chemistry market, led by pharmaceutical, biotech, and specialty chemical sectors. Continuous flow reactors are increasingly used for API production, chemical intermediates, and high-value specialty chemicals. USA manufacturers are focusing on high-throughput and automated systems to enhance process efficiency and reduce environmental impact. Industrial R&D centers are exploring novel chemistries using flow technologies. Demand is further supported by contract manufacturing organizations and large-scale pharmaceutical production. Imports of reagents and catalysts from Europe and Asia supplement domestic production to meet specialized requirements.

The flow chemistry market is driven by companies providing continuous processing solutions for pharmaceutical, fine chemical, and specialty chemical production. Lonza Group Ltd. is assumed to be the leading player, supported by a wide range of modular flow reactors, integrated process solutions, and scalable systems that enhance reaction control and production efficiency. FutureChemistry Holding B.V. and Chemtrix BV maintain strong positions by offering advanced microreactor platforms and tubular reactor technologies, allowing precise handling of reaction kinetics and high-throughput synthesis.

AM Technology and ThalesNano Inc. focus on compact, flexible flow systems suitable for research and pilot-scale applications, prioritizing rapid process optimization and safety. Milestone Srl and Cambrex Corporation contribute with specialized instrumentation, automation solutions, and tailored chemical flow applications that meet industrial and laboratory requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Reactor | Microreactor Systems, Continuous Stirred Tank Reactor (CSTR), Plug Flow Reactor, and Meso Reactor |

| End-user | Pharmaceutical, Chemical, Academic & Industrial Research, and Petrochemical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FutureChemistry Holding B.V, AM Technology, Chemtrix BV, Lonza Group Ltd., ThalesNano Inc., Milestone Srl, and Cambrex Corporation |

| Additional Attributes | Dollar sales by reactor type and application segment, demand dynamics across pharmaceuticals, fine chemicals, and specialty materials, regional trends across North America, Europe, and Asia-Pacific, innovation in continuous-flow reactors, microreactor technology, and process intensification, environmental impact of reduced waste and energy consumption, and emerging use cases in automated synthesis, personalized medicine, and green chemical manufacturing. |

The global flow chemistry market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the flow chemistry market is projected to reach USD 7.4 billion by 2035.

The flow chemistry market is expected to grow at a 12.2% CAGR between 2025 and 2035.

The key product types in flow chemistry market are microreactor systems, continuous stirred tank reactor (cstr), plug flow reactor and meso reactor.

In terms of end-user, pharmaceutical segment to command 46.8% share in the flow chemistry market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flow Pack Films Market Size and Share Forecast Outlook 2025 to 2035

Flow Pack Machine Market Size and Share Forecast Outlook 2025 to 2035

Flow Indicator Market Size and Share Forecast Outlook 2025 to 2035

Flow Wrappers Market Size and Share Forecast Outlook 2025 to 2035

Flow Computer Market Size and Share Forecast Outlook 2025 to 2035

Flow Meter Devices Market Size, Share, and Forecast 2025 to 2035

Flow Cytometry Market - Trends & Growth Forecast 2025 to 2035

Flow Wrap Packaging Market Growth from 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flower Extract Market Analysis by Type, Application and Form Through 2035

Flow Meters Market Growth - Trends & Forecast 2025 to 2035

Flow Wrap Machines Market Analysis – Size, Share & Industry Trends 2025-2035

Flower Box Market Demand & Floral Packaging Innovations 2024 to 2034

Flow Diverter Market Analysis – Size, Trends & Forecast 2024-2034

Flow Wrap Market from 2024 to 2034

Flowback Tank Market Growth – Trends & Forecast 2024-2034

Flowpack Paper Packaging Market

Flow Cytometer Market

Inflow Pressure Screen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Inflow Control Devices Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA