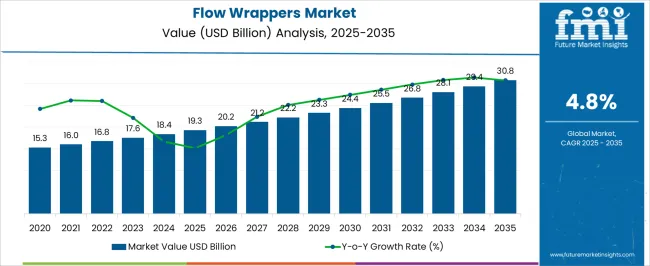

The flow wrappers market is valued at USD 19.3 billion in 2025 and increases to USD 30.8 billion by 2035, at a CAGR of 4.8%. Examining the acceleration and deceleration pattern across the timeline shows that growth follows a front-loaded acceleration phase, followed by gradual moderation in later years. Between 2021 and 2025, the market grows from USD 15.3 billion to USD 19.3 billion. This period reflects moderate acceleration, averaging close to 6% annually, supported by rising demand for efficient, high-speed wrapping machines in food, beverage, and pharmaceutical packaging. Expansion is driven by consumer-packaged goods growth and enhanced automation adoption. From 2026 to 2030, the market advances from USD 20.2 billion to USD 24.4 billion, with yearly increments stabilizing between 4.5% and 5%. This represents a phase of balanced acceleration, where adoption remains strong but incremental growth begins to normalize as key industries standardize automated packaging lines. Competitive pricing and equipment upgrades drive steady expansion, but without the sharp uptick seen earlier. The period from 2031 to 2035 shows deceleration, with growth slowing as the market moves from USD 25.5 billion to USD 30.8 billion. Average annual gains taper closer to 4%, highlighting maturity effects. Replacement demand, incremental innovations, and regional penetration sustain value but with less intensity.

| Metric | Value |

|---|---|

| Flow Wrappers Market Estimated Value in (2025 E) | USD 19.3 billion |

| Flow Wrappers Market Forecast Value in (2035 F) | USD 30.8 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The flow wrappers market holds a distinct position across multiple packaging-related domains, with its share varying according to end-use orientation and machinery integration. Within the packaging machinery market, flow wrappers contribute nearly 7 to 8%, positioned alongside cartoners, labeling systems, and vertical form-fill-seal equipment. In the food processing and packaging equipment market, their presence is stronger at about 12 to 14%, reflecting extensive deployment in bakery, confectionery, and ready-to-eat food packaging. Within the pharmaceutical packaging equipment market, flow wrappers account for around 5 to 6%, offering protective packs for blister alternatives, medical kits, and unit-dose products. In the broader consumer goods packaging market, their share stands close to 4 to 5%, serving personal care, stationery, and household categories that require hygienic and tamper-proof wrapping. The industrial packaging solutions market represents a smaller but steady outlet, where flow wrappers capture about 3 to 4%, applied to hardware, electrical components, and spare parts requiring consistent sealing. These percentages highlight a dual pattern: flow wrappers command meaningful influence in food and pharmaceutical lines, where hygiene and efficiency drive adoption, while their role in general consumer goods and industrial segments is modest yet stable.

The Flow Wrappers market is experiencing notable growth, driven by the increasing demand for efficient, high-speed packaging solutions across food, beverage, pharmaceutical, and consumer goods industries. The adoption of flow wrappers has been propelled by the need for extended shelf life, improved product safety, and enhanced visual appeal of packaged goods. Technological advancements in sealing, cutting, and wrapping mechanisms are enabling higher production throughput while reducing material waste.

Market expansion is also being influenced by the growing focus on automation, operational efficiency, and compliance with hygiene and safety regulations. Manufacturers are investing in flexible machinery capable of handling a wide variety of product sizes and materials, aligning with the diverse needs of global markets.

The rising consumption of packaged food, along with increasing e-commerce shipments requiring secure wrapping, is further accelerating adoption With the integration of intelligent controls and IoT-based monitoring, flow wrappers are being positioned as critical assets in modern packaging lines, ensuring consistent quality and operational cost savings.

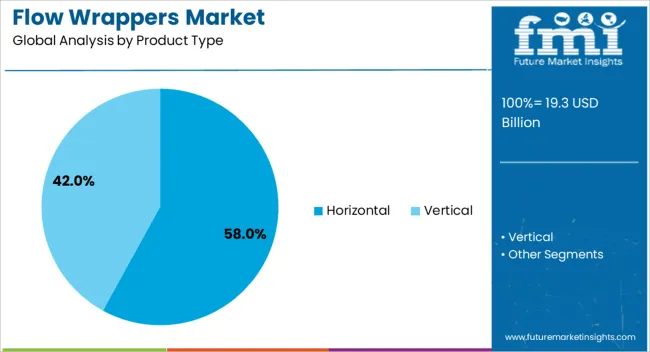

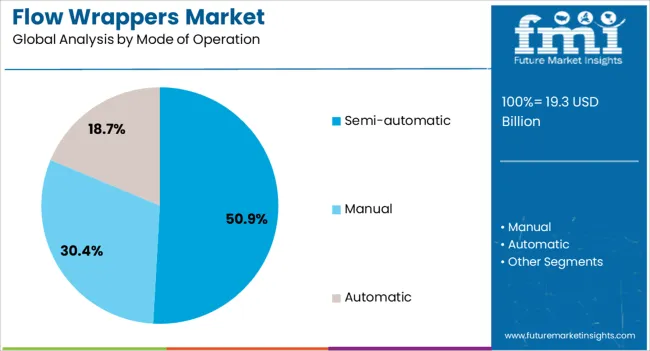

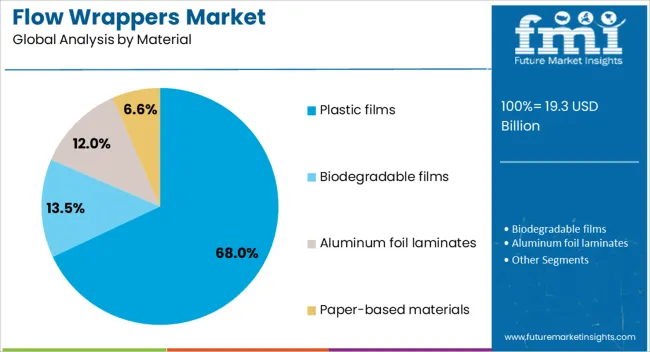

The flow wrappers market is segmented by product type, mode of operation, material, end use, distribution channel, and geographic regions. By product type, flow wrappers market is divided into Horizontal and Vertical. In terms of mode of operation, flow wrappers market is classified into Semi-automatic, Manual, and Automatic. Based on material, flow wrappers market is segmented into Plastic films, Biodegradable films, Aluminum foil laminates, and Paper-based materials. By end use, flow wrappers market is segmented into Food processing industry, Pharmaceutical companies, FMCG manufacturers, E-commerce packaging, Healthcare supplies, and Others. By distribution channel, flow wrappers market is segmented into Direct and Indirect. Regionally, the flow wrappers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The horizontal product type segment is projected to hold 58% of the Flow Wrappers market revenue share in 2025, making it the leading product type. This segment’s dominance has been supported by its suitability for packaging a wide range of products in various shapes and sizes, while maintaining high production speeds. Horizontal flow wrappers are widely adopted for their efficiency in continuous packaging processes, which minimizes downtime and boosts operational output.

Their adaptability to integrate with automated feeding systems and advanced sealing technologies has made them a preferred choice for high-volume manufacturing environments. The ability to maintain product integrity and aesthetic appeal, while ensuring a tight, protective seal, has further reinforced their demand.

Additionally, horizontal machines are capable of accommodating diverse packaging materials, enhancing their versatility across multiple industries The continued investment in horizontal flow wrapper designs that offer easy changeovers and reduced maintenance needs has contributed to their sustained leadership in the market.

The semi-automatic mode of operation segment is expected to account for 50.90% of the Flow Wrappers market revenue share in 2025, emerging as the leading operational mode. This segment’s growth has been driven by the balance it offers between automation and manual control, making it cost-effective for medium-scale production lines.

Semi-automatic flow wrappers provide flexibility in handling varied product types without extensive reconfiguration, which is advantageous for manufacturers with diverse portfolios. Their relatively lower initial investment compared to fully automatic systems has encouraged adoption among small and medium enterprises seeking to improve efficiency without incurring high capital costs.

The segment has also benefited from the ability to maintain quality and precision while enabling operators to adjust settings for specific packaging requirements Industries prioritizing adaptable production processes and reduced downtime have increasingly relied on semi-automatic systems, ensuring consistent performance and reliable packaging output in both food and non-food applications.

The plastic films material segment is anticipated to hold 68% of the Flow Wrappers market revenue share in 2025, making it the dominant packaging material. The segment’s leadership is attributed to the material’s versatility, durability, and cost-effectiveness, which align with the high-speed demands of flow wrapping processes. Plastic films provide excellent moisture, oxygen, and contamination barriers, extending the shelf life of perishable goods and maintaining product freshness.

Their adaptability to various printing and lamination techniques has enabled brands to enhance product presentation and consumer appeal. The widespread availability of plastic films in multiple grades and thicknesses allows manufacturers to tailor packaging to specific product needs, balancing protection with cost efficiency.

Advances in recyclable and biodegradable film technologies are further supporting the segment’s growth, aligning with increasing sustainability initiatives The compatibility of plastic films with modern sealing technologies ensures consistent wrapping quality, reinforcing their position as the preferred material in high-volume packaging operations.

Flow wrappers benefit from rising volumes in foods, personal care, and hygiene, where pillow packs and fin seals offer speed, graphics, and strong shelf presentation. Barriers remain in film cost swings, seal integrity on challenging products, and the complexity of upstream and downstream integration. Clear upside lies in automation ready formats, quick change features, specialized films, and validated medical or hygiene overwraps. Adoption is reinforced by connected diagnostics, recipe control, and regional service footprints. Suppliers that pair format expertise with line integration, film know how, and reliable field support will capture the strongest pipeline wins.

Demand for flow wrappers is being shaped by rising volumes in bakery, confectionery, snacks, dairy portions, and ready to eat items where pillow packs and fin seals are standard. Personal care and household categories adopt horizontal flow wrap for bars, tissues, and wipes, while medical device overwrap and cleanroom items require controlled environments. Brand owners favor compact HFFS lines that support SKU proliferation, quick film change, and consistent registration on high gloss laminations. Modified atmosphere modules, gas flush, and tight seal profiles are being specified to manage shelf life targets. Retail planograms reward tidy, scannable packs that stack well and print clearly for code dating. As omnichannel fulfillment increases, flow wrapped singles and multipacks are being treated as carrier friendly, scuff resistant units. In this context, flow wrap is being viewed as a fast, versatile format that balances speed, pack integrity, and graphics for high cadence operations.

Growth is tempered by resin and laminate price volatility, which complicates budgeting for converters and end users. Frequent changeovers for seasonal SKUs can reduce overall equipment effectiveness when infeeds, formers, and seal jaws are not optimized, raising labor and waste. Seal integrity remains a risk on heavy inclusions or dusty products, where crumb migration and film memory can cause leakers, rework, and retailer chargebacks. Print registration drift, date code smearing, and bar code contrast failures generate quality complaints when film specs are loosely controlled. Washdown and allergen protocols add downtime unless frames, guarding, and cable routing are designed for fast sanitation. Integration with upstream slicers, depositors, and downstream checkweighers, metal detectors, and case packers is not trivial, requiring tighter controls and recipe discipline. Short lead times for spare parts, trained technicians, and validated change parts remain decisive, and gaps in service coverage slow broader adoption.

Opportunities are emerging around automation ready formats that shorten setup and reduce touches. Wicketed or fanfold films, automatic splicing, and recipe driven jaw profiles help stabilize uptime on high mix lines. Application specific films for easy open, hermetic seals, anti fog produce packs, and anti static electronics accessories are expanding the addressable base. Multipack banding and on machine perforations enable club and promotion builds without separate equipment. Digital print and shorter runs allow limited editions and regional launches without long prepress cycles. Paper based and monomaterial structures are being evaluated where retailer mandates or labeling rules favor simpler materials. In medical and hygiene, validated overwraps for devices, swabs, and sterile barrier companions strengthen the case for dedicated cleanroom configurations. Vendors that bundle format development, film trials, and line simulation with strong commissioning support are positioned to win conversions from cartoning or pouching alternatives.

Machine connectivity is being prioritized for live OEE dashboards, fault trees, and remote diagnostics that reduce unplanned stops. Recipe libraries and guided changeover videos are being used to standardize shifts across multi site networks. Film choices are broadening, with thinner gauges, high slip or matte finishes, cold seal for heat sensitive fillings, and lidding compatible structures for combo lines. Fin seal design, gusset geometry, and jaw coating selection are being tuned to reduce scuffing and improve shelf presentation. Regionalization continues as OEMs add local assembly, film converting partners, and spare parts depots to cut lead times. Financing, rental, and performance tied service agreements are gaining traction with co packers that scale capacity to seasonality. The competitive edge favors suppliers that deliver hygienic frames, verified sealing windows, accurate registration on complex prints, and faster recovery after jams, all supported by responsive field engineering capability.

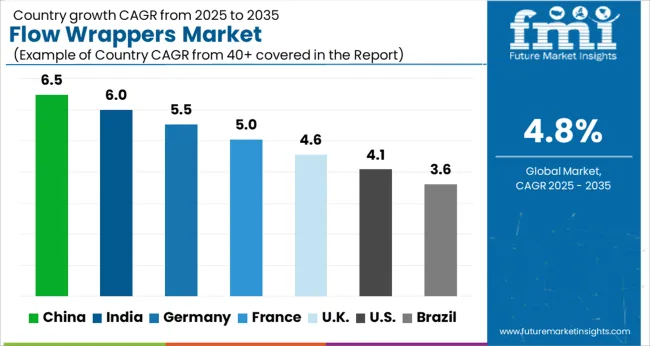

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The flow wrappers market is expected to grow globally at a CAGR of 4.8% from 2025 to 2035. China leads with 6.5%, followed by India at 6.0% and Germany at 5.5%, while the UK posts 4.6% and the USA records 4.1%. China secures the strongest growth premium at +1.7%, supported by food processing, confectionery, and e-commerce-driven packaging needs. India follows with +1.3%, benefitting from rising FMCG and pharmaceutical packaging demand. Germany sustains strong adoption due to advanced machinery and exports. The UK and USA show moderate growth but remain significant markets due to their retail, healthcare, and premium food packaging industries. The analysis includes over 40+ countries, with the leading markets detailed below.

The flow wrappers market in China is projected to grow at a CAGR of 6.5% from 2025 to 2035, the fastest among the profiled countries. Growth is supported by strong demand from the packaged food, confectionery, and bakery sectors, where flow wrapping ensures extended shelf life and attractive presentation. Rising e-commerce in grocery and snacks is driving demand for secure and tamper-proof packaging. Local manufacturers are scaling capacity, while international players are introducing advanced flow wrappers with faster speeds and greater flexibility. Automation in food production lines is further supporting adoption. With consumer preferences shifting toward portion-controlled snacks and convenience packaging, the role of flow wrappers is becoming increasingly vital across multiple product categories.

The flow wrappers market in India is expected to expand at a CAGR of 6.0% between 2025 and 2035. Rising consumption of biscuits, chocolates, and bakery products is fueling demand for flow wrapping systems. Small and medium enterprises in India’s food sector are increasingly investing in affordable, semi-automatic flow wrappers to meet growing packaging needs. Large FMCG companies are upgrading to fully automatic, high-speed machines to support mass production. The pharmaceutical sector is also adopting flow wrappers for packaging tablets, syringes, and medical devices. Government initiatives supporting the modernization of food processing industries further strengthen the market outlook. Imports from Europe and China remain significant, but domestic manufacturers are gradually gaining presence with cost-competitive systems.

The flow wrappers market in Germany is projected to grow at a CAGR of 5.5% from 2025 to 2035. Germany’s advanced food and confectionery industries are major contributors to growth, with manufacturers emphasizing automation, efficiency, and hygiene. Flow wrappers are widely used in chocolate, bakery, and dairy segments, where packaging speed and consistency are critical. The pharmaceutical sector is another significant driver, adopting flow wrapping systems for precision and safety. German manufacturers are recognized globally for high-performance machinery, with exports playing a substantial role. Innovation in energy-efficient and digitally connected flow wrappers is shaping market direction. With rising demand for premium packaged goods, Germany is expected to maintain its leadership in Europe.

The flow wrappers market in the United Kingdom is forecasted to grow at a CAGR of 4.6% between 2025 and 2035. Growth is shaped by the country’s expanding snack food, bakery, and ready-to-eat meal sectors. Flow wrappers are valued for providing tamper-proof, hygienic, and shelf-life-extending packaging. The UK’s strong retail and supermarket presence drives consistent packaging demand across food categories. Manufacturers are increasingly adopting versatile machines that can switch between different product sizes and formats. Imports continue to play an important role, though local packaging machinery suppliers are gaining traction with customized systems. The pharmaceutical and healthcare industries also represent growing end-user segments, particularly for single-use medical supplies.

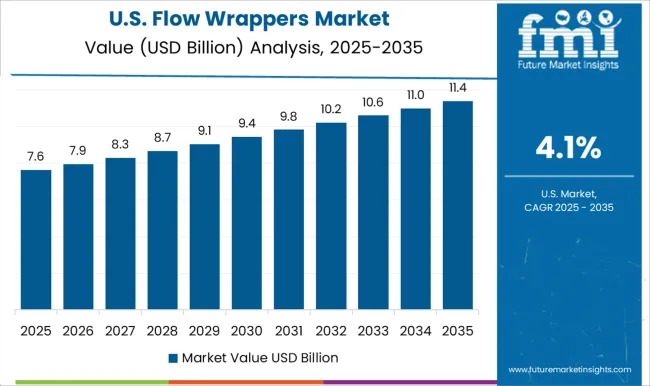

The flow wrappers market in the United States is expected to grow at a CAGR of 4.1%, the slowest among the profiled countries but still substantial in value. Growth is anchored in the confectionery, snack food, and frozen food industries, which require high-speed and reliable packaging. Pharmaceutical packaging is another important segment, with flow wrappers used for medical devices, syringes, and over-the-counter products. USA manufacturers are innovating with robotics integration and IoT-enabled monitoring systems to improve efficiency and reduce downtime. Imports from Europe complement domestic supply, particularly for specialized machinery. With consumer preference for convenience-driven packaging and rising foodservice demand, flow wrappers will continue to play a vital role in USA packaging infrastructure.

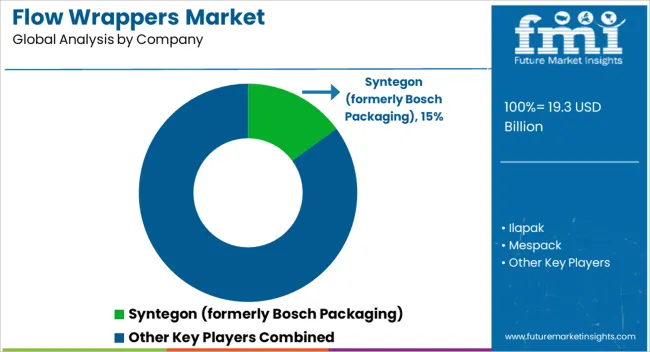

Competition in flow wrappers has been defined by hygienic design, changeover speed, film versatility, and integration at the pack cell. Syntegon has been positioned at the premium end with servo driven horizontal form fill seal platforms, hermetic and rotary jaw options, automatic film splicing, and infeed solutions for high speed bars, bakery, and confectionery. Ilapak has competed on washdown capable flow packs for produce, meat, cheese, and bakery, where IP rated construction, tool less changeovers, and adaptable forming boxes are valued. Mespack has targeted flexible operations that require horizontal flow packing alongside pouches and stick formats, so common controls and HMI logic are promoted across lines. PAC Machinery has focused on versatile flow wrappers for ecommerce, bakery, and medical device kitting, with no product no bag logic, photo eye registration, and quick length bagging. Fuji Machinery has been recognized for stable long run performance in confectionery and snacks, with box motion sealing for thicker films and tight dwell control for gas flushed packs. Strategies are centered on modular platforms, regional service parts availability, and OEE uplift through line audits. Syntegon has emphasized turnkey cells that combine distribution, flow wrap, and cartoning. Ilapak has leaned on application specific kits and local service hubs. Mespack has pursued common parts strategies across multiple package formats to simplify spares. PAC Machinery has highlighted simple operator training and retrofit paths. Fuji has concentrated on high uptime wrappers with feeder integration for continuous runs. Product brochures specify film types from heat seal to cold seal, paper like and mono material films, MAP capability, gusset or fin orientation, serrated or smooth crimp jaws, zigzag cut, tear notch, euro slot, and integrated printers. Standard options include automatic film tracking, motorized reel lifting, reject stations, inline checkweigh, vision verification, and upstream accumulation. Outputs are listed in packs per minute bands with typical product dimensions, sanitation notes, and utility requirements.

Syntegon Technology GmbH (formerly Bosch Packaging Technology) ILAPAK (an IMA Group company)

Mespack (a Duravant company)

PACRAFT Co., Ltd. (formerly Toyo Jidoki)

PAC Machinery

FUJI MACHINERY CO., LTD.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Product Type | Horizontal and Vertical |

| Mode of Operation | Semi-automatic, Manual, and Automatic |

| Material | Plastic films, Biodegradable films, Aluminum foil laminates, and Paper-based materials |

| End Use | Food processing industry, Pharmaceutical companies, FMCG manufacturers, E-commerce packaging, Healthcare supplies, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Syntegon (formerly Bosch Packaging), Ilapak, Mespack, PACRAFT / PAC Machinery, Fuji Machinery, and [Other regional suppliers] |

| Additional Attributes | Dollar sales by product type span horizontal versus vertical wrappers, film-based variations, and single- versus multi-lane configurations. Dollar sales by end use cover bakery, confectionery, snacks, pharmaceuticals, personal care, and industrial packaging. Demand dynamics are driven by the need for portion packs, single-serve formats, hygiene-focused packaging, branding and label integration, and compatibility with high-speed automated production. Regional trends indicate Asia Pacific as the growth leader with high packaged food uptake, North America as a strong adopter of advanced automation, and Europe emphasizing hygienic compliance and efficient film utilization. |

The global flow wrappers market is estimated to be valued at USD 19.3 billion in 2025.

The market size for the flow wrappers market is projected to reach USD 30.8 billion by 2035.

The flow wrappers market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in flow wrappers market are horizontal and vertical.

In terms of mode of operation, semi-automatic segment to command 50.9% share in the flow wrappers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flow Pack Films Market Size and Share Forecast Outlook 2025 to 2035

Flow Pack Machine Market Size and Share Forecast Outlook 2025 to 2035

Flow Indicator Market Size and Share Forecast Outlook 2025 to 2035

Flow Chemistry Market Size and Share Forecast Outlook 2025 to 2035

Flow Computer Market Size and Share Forecast Outlook 2025 to 2035

Flow Meter Devices Market Size, Share, and Forecast 2025 to 2035

Flow Cytometry Market - Trends & Growth Forecast 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flow Wrap Packaging Market Growth from 2025 to 2035

Flower Extract Market Analysis by Type, Application and Form Through 2035

Flow Meters Market Growth - Trends & Forecast 2025 to 2035

Flow Wrap Machines Market Analysis – Size, Share & Industry Trends 2025-2035

Flower Box Market Demand & Floral Packaging Innovations 2024 to 2034

Flow Diverter Market Analysis – Size, Trends & Forecast 2024-2034

Flow Wrap Market from 2024 to 2034

Flowback Tank Market Growth – Trends & Forecast 2024-2034

Flowpack Paper Packaging Market

Flow Cytometer Market

Inflow Pressure Screen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Inflow Control Devices Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA