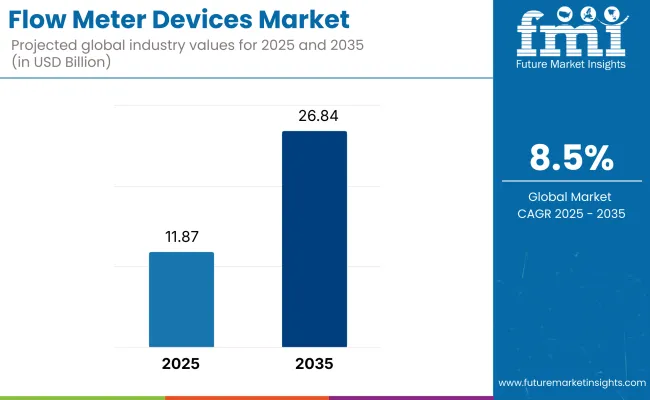

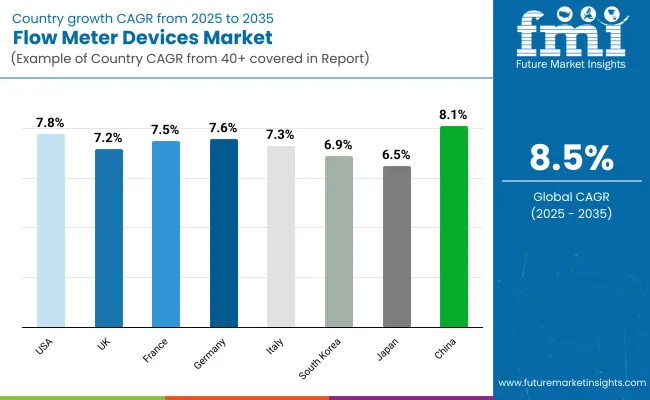

The global flow meter devices market is expected to rise from USD 11.87 billion in 2025 to USD 26.84 billion by 2035, reflecting a robust CAGR of 8.5%. The surge is primarily driven by widespread adoption of smart meters integrated with IoT, wireless communication, and AI analytics.

In 2024, industries such as oil & gas, water management, and pharmaceuticals accelerated investment in precision flow technologies to improve operational efficiency and regulatory compliance. Coriolis and ultrasonic flow meters, in particular, have become preferred technologies for their non-intrusive, high-accuracy performance.

In addition to automation, real-time data acquisition and cloud-based diagnostics are gaining traction. Governments globally are mandating stricter emissions tracking and water conservation, which is prompting industries to shift from legacy flow systems to smart, self-calibrating devices.

Demand is also supported by large-scale infrastructure development across Asia-Pacific and continued investment in pipeline and water treatment modernization in the USA and Europe. These trends are placing pressure on manufacturers to provide energy-efficient, digitally connected, and cost-effective solutions.

Looking forward, the evolution of flow meters will be marked by predictive maintenance capabilities, battery-efficient sensors, and compatibility with digital twins and remote operations. As industries progress toward Industry 4.0, flow meter devices are becoming critical tools for ensuring accuracy, safety, and sustainability. Regional variations in adoption models-from high-end smart systems in North America and Western Europe to cost-optimized solutions in Asia-will shape competitive strategies over the next decade.

Technological innovation is at the heart of this industry’s transformation. Manufacturers are rapidly shifting toward AI-enabled flow meters capable of learning from usage patterns, detecting anomalies, and optimizing energy consumption autonomously. The integration of blockchain for custody transfer in oil & gas, and smart metering in urban water utilities, is further driving demand for transparent, tamper-proof flow data. However, supply chain disruptions, semiconductor shortages, and rising input costs remain pressing challenges, especially for advanced sensor components.

Regional disparities are also evident-while North America and Europe are embracing premium smart meters with predictive analytics, emerging economies in Asia-Pacific are prioritizing affordability and scale, especially in water infrastructure and municipal wastewater applications. As digital maturity accelerates and environmental accountability intensifies, flow meter devices will be foundational to industrial resilience, regulatory alignment, and sustainable growth through 2035.

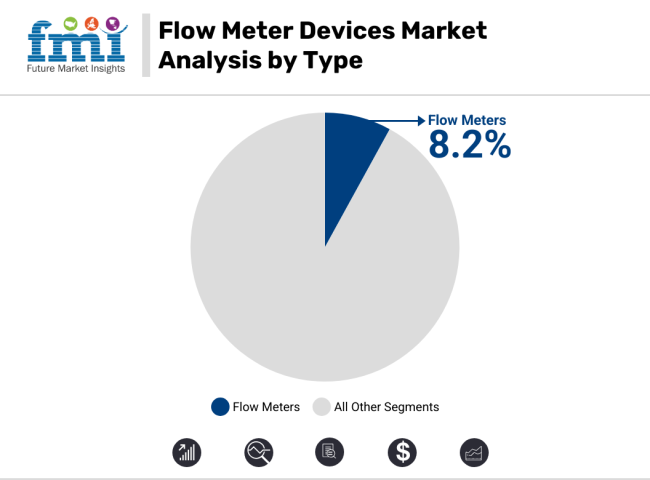

Among the device types, flow meters are projected to lead the market, expanding at a CAGR of 8.2% from 2025 to 2035. Their widespread application across industries like oil & gas, water treatment, power generation, and chemicals is driven by the need for precision measurement and compliance with environmental regulations.

Coriolis and ultrasonic flow meters are gaining strong traction due to their high accuracy, real-time diagnostics, and suitability for both clean and complex fluids. In parallel, electromagnetic and thermal mass meters are seeing increased adoption in wastewater and industrial process environments.

With growing preference for wireless, battery-operated, and self-calibrating variants, traditional flow meters are evolving into smart devices aligned with Industry 4.0. While flow controllers and flow sensors play a critical role in system-level monitoring and automation, they occupy smaller shares and are mostly bundled with broader process control systems. Nevertheless, rising demand for miniaturized and IoT-integrated sensors will gradually elevate their role in niche applications.

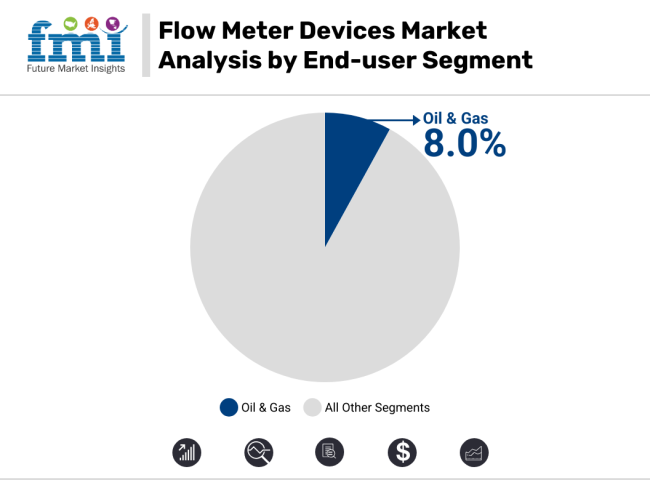

The oil & gas industry will remain the largest and most lucrative end-user of flow meter devices, growing at a CAGR of 8.0% through 2035. Flow meters are indispensable across upstream, midstream, and downstream operations-for custody transfer, pipeline integrity monitoring, refining processes, and emissions control.

Increasing exploration in offshore and shale reserves, along with pipeline expansions across the USA, China, and the Middle East, is driving significant demand for high-performance flow technologies like Coriolis and ultrasonic meters. Additionally, real-time leak detection and predictive maintenance capabilities are becoming critical in minimizing downtime and environmental risk.

Outside of oil & gas, the water and wastewater sector is emerging rapidly, backed by government mandates on water conservation and infrastructure modernization. Flow meter adoption is also accelerating in the pharmaceutical and chemical industries, where hygiene, accuracy, and compliance standards require precise fluid handling. As decarbonization initiatives scale up, new opportunities will emerge in hydrogen and biofuel applications, expanding the scope of industrial demand for advanced metering.

Surveyed Q4 2024, n=500 stakeholder participants across manufacturers, distributors, and industrial end-users in North America, Europe, and Asia-Pacific

The survey revealed that 79% of stakeholders identified IoT integration and wireless monitoring as the primary drivers of flow meter adoption. The push for higher accuracy and operational efficiency was a top concern for the oil & gas (82%) and water management (74%) industries. Regulatory compliance also ranked high, with 67% of respondents citing environmental mandates on water conservation and emissions monitoring as key influences on purchase decisions.

Regional Variances

The survey found a clear shift towards digitalization, with 65% of respondents incorporating cloud-based monitoring into operations. Smart meters with AI-powered flow analysis were in use across high-precision sectors, with pharmaceuticals (58%) and chemical processing (52%) leading adoption.

Regional Variances

Stakeholders exhibited clear preferences for specific flow meter technologies based on industry demands. Ultrasonic flow meters led in water management (62%), while Coriolis meters dominated in oil & gas (57%). The survey also indicated that stainless steel (69%) remains the preferred material due to its durability and corrosion resistance.

Regional Variances

A major concern across regions was cost efficiency, with 84% of stakeholders citing rising material and energy costs as a challenge. Automation costs were also debated, with North American (63%) and European (55%) respondents willing to pay a 15-20% premium for advanced features, while Asia-Pacific (72%) preferred lower-cost models (< USD 7,000).

Investment Priorities

Stakeholders highlighted multiple challenges in supply chain reliability, skilled labor shortages, and regulatory compliance. 53% of manufacturers faced delays in semiconductor components for smart meters, while 49% of distributors struggled with rising tariffs on electronic imports.

Regional Variances

The survey findings indicate a strong global demand for smart, efficient, and sustainable flow meter solutions. However, regional priorities vary, requiring industry players to tailor their strategies. North America and Europe will see higher automation investments, while Asia-Pacific remains cost-sensitive but rapidly expanding. Companies must focus on affordable innovations, enhanced connectivity, and regulatory compliance to maximize growth opportunities.

| Country/Region | Regulations & Mandatory Certifications |

|---|---|

| United States | EPA Clean Water Act (CWA): Requires precise flow measurement for wastewater discharge compliance. National Institute of Standards and Technology (NIST) Certification: Ensures accuracy standards for custody transfer applications in oil & gas. American Water Works Association (AWWA) Standards: Mandatory for municipal water flow meters. Federal Energy Regulatory Commission (FERC) Guidelines: Governs metering in energy and utility sectors. |

| Canada | Measurement Canada Approval: Mandatory certification for flow meters used in trade applications. Canadian Environmental Protection Act (CEPA): Requires accurate metering for emission control in industrial operations. National Research Council Canada (NRC) Guidelines: Enforceable for precision metering in chemical and pharmaceutical industries. |

| European Union | MID (Measuring Instruments Directive) 2014/32/EU: Mandatory for flow meters used in billing applications (water, gas, and energy). EU Industrial Emissions Directive (IED): Enforces strict flow monitoring for pollution control. ATEX Certification: Required for flow meters used in explosive or hazardous environments. CE Marking: Mandatory for all flow meters sold within the EU, ensuring compliance with safety, health, and environmental standards. |

| United Kingdom | UKCA (UK Conformity Assessed) Marking: Post-Brexit equivalent of the CE Mark for flow meters sold in the UK. Environment Agency Regulations: Require precise metering in water abstraction and industrial discharge monitoring. OFGEM (Office of Gas and Electricity Industries) Standards: Enforceable for metering accuracy in the energy sector. |

| China | China Metrology Accreditation (CMA): Certification for accuracy and reliability of flow meters used in trade. National Institute of Metrology (NIM) Guidelines: Set calibration and performance standards. Ministry of Ecology and Environment (MEE) Regulations: Mandate real-time flow monitoring for industrial emissions. |

| India | Bureau of Indian Standards (BIS) Certification: Required for flow meters in water and energy applications. Central Pollution Control Board (CPCB) Regulations: Mandate accurate flow measurement for wastewater and industrial emissions compliance. Petroleum and Explosives Safety Organization (PESO) Approval: Required for flow meters in hazardous environments like oil & gas. |

| Japan | Japan Industrial Standards (JIS) Certification: Necessary for flow meters in industrial applications. Ministry of Economy, Trade, and Industry (METI) Regulations: Enforce metering accuracy in manufacturing and energy sectors. Waterworks Law Compliance: Requires certified flow meters for municipal water management. |

| South Korea | Korea Testing Certification (KTC): Ensures compliance with national metrology standards. Ministry of Environment Regulations: Enforce strict flow monitoring in industrial wastewater discharge-Korea Gas Safety Corporation (KGS) Certification: Required for flow meters used in natural gas applications. |

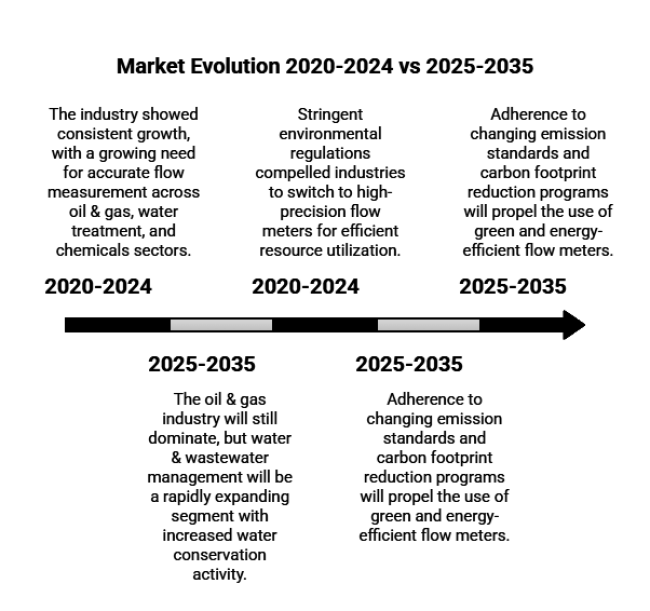

| 2020 to 2024 (Historical Performance) | 2025 to 2035 (Future Projections) |

|---|---|

| The industry showed consistent growth, with a growing need for accurate flow measurement across oil & gas, water treatment, and chemicals sectors. | The industry is poised to grow substantially, fueled by fast-paced industrialization, sustainability efforts, and the growth of IoT-enabled smart meters. |

| Advances in technology brought ultrasonic, Coriolis, and electromagnetic flow meters, enhancing accuracy and efficiency. | Real-time monitoring, predictive analytics, and remote diagnostics-enabled smart meters will become ubiquitous, ensuring efficient operation. |

| COVID-19-related disruptions affected supply chains and reduced industrial processes, influencing short-term demand. | Post-pandemic recovery and infrastructure development will fuel demand, with automation and digitalization transforming the industry. |

| Stringent environmental regulations compelled industries to switch to high-precision flow meters for efficient resource utilization. | Adherence to changing emission standards and carbon footprint reduction programs will propel the use of green and energy-efficient flow meters. |

| Major players emphasized competitive pricing and product differentiation to maintain industry presence. | Competition will intensify, with R&D spends on AI-driven flow measurement and wireless connectivity dictating the sector dynamics. |

| Growth was dominant in power generation, oil & gas, and chemicals industries owing to efficiency needs in operations. | The oil & gas industry will still dominate, but water & wastewater management will be a rapidly expanding segment with increased water conservation activity. |

The USA flow meter devices market is forecasted to expand at a CAGR of 7.8% from 2025 to 2035, driven by stringent environmental regulations, the adoption of smart metering solutions, and advancements in industrial automation. The USA Environmental Protection Agency (EPA) mandates precise flow measurement across industries such as oil & gas, water treatment, and chemical processing, propelling the demand for high-precision flow meters.

The shale gas boom and increasing pipeline infrastructure investments are accelerating the demand for custody transfer flow measurement solutions in the energy sector. The USA Department of Energy's initiatives promoting efficiency in water and power management encourage utility providers to integrate advanced metering infrastructure (AMI). Additionally, rising wastewater recycling efforts and stricter Clean Water Act regulations are expanding opportunities for flow meters in municipal applications.

However, challenges such as supply chain disruptions and fluctuating raw material prices persist. Leading manufacturers are prioritizing domestic production, automation, and IoT-enabled solutions to enhance efficiency and accuracy.

The UK is set to expand at a CAGR of 7.2% from 2025 to 2035, driven by sustainability initiatives, regulatory compliance, and smart infrastructure advancements. The UK government’s net-zero carbon emissions target by 2050 is accelerating the adoption of energy-efficient and digital flow metering solutions across industries such as water management, oil & gas, and renewable energy.

Post-Brexit regulatory changes have led to the introduction of UKCA (UK Conformity Assessed) certification, impacting manufacturers and distributors in the sector. The UK Environment Agency is enforcing stricter regulations on water abstraction and discharge monitoring, leading to higher demand for ultrasonic and electromagnetic flow meters in municipal and industrial applications. Additionally, significant investments in hydrogen and biofuel production are driving the need for precision flow measurement solutions.

The oil & gas sector continues to show stable demand for flow meters, particularly for pipeline monitoring and custody transfer applications. However, the high initial cost of smart metering systems remains a challenge for small and medium enterprises (SMEs). To address this, manufacturers are leveraging AI-powered analytics and smart manufacturing techniques to improve efficiency and reduce costs, ensuring sustained industry growth in the UK.

France is forecasted to expand at a CAGR of 7.5% from 2025 to 2035, driven by strong renewable energy investments, industrial digitalization, and strict environmental policies under the European Green Deal. The government’s push for decarbonization and water conservation is fueling demand for high-precision flow meters in energy, wastewater management, and manufacturing sectors.

Modernization in the water sector has led to increased investments in smart metering solutions to enhance resource efficiency. The oil & gas industry in France, though smaller than in neighboring countries, continues to generate stable demand for custody transfer flow meters due to stringent EU compliance requirements. The rapid shift towards hydrogen energy and biofuels is further boosting the adoption of advanced flow measurement solutions.

France’s industrial sector is embracing digitalization, integrating IoT-enabled solutions for real-time monitoring and operational efficiency. However, high implementation costs for smart technologies remain a challenge for some end-users. Government incentives and industry collaborations are helping to mitigate these concerns. As sustainability regulations tighten and digital transformation accelerates, France is emerging as a key industry for advanced industrial monitoring systems.

Germany is forecasted to expand at a CAGR of 7.6% from 2025 to 2035, propelled by Industry 4.0 adoption, stringent environmental regulations, and growing investments in process automation. The country’s robust manufacturing sector, particularly in chemicals, automotive, and pharmaceuticals, is a major driver for precision flow metering solutions.

Germany's Federal Water Act mandates accurate flow measurement in water-intensive industries, increasing the demand for electromagnetic and ultrasonic flow meters. Additionally, the German Renewable Energy Act (EEG) is accelerating investments in green hydrogen and biofuel projects, driving the need for specialized metering solutions. The country’s push for carbon neutrality is also encouraging industries to integrate smart, energy-efficient flow meters to optimize resource consumption.

With Germany being a global leader in automation and process control, industrial facilities are adopting IoT-enabled and AI-driven metering technologies for enhanced efficiency and predictive maintenance. However, challenges such as high equipment costs and complex regulatory frameworks pose barriers to industry growth. Despite this, the presence of key industry players and government-backed sustainability initiatives ensure a strong trajectory for the flow meter sector in Germany.

Italy is forecasted to expand at a CAGR of 7.3% from 2025 to 2035, fueled by investments in water infrastructure, industrial expansion, and the adoption of smart metering solutions. The Italian government’s efforts to improve water distribution networks and reduce wastage are driving the demand for advanced flow meters, particularly electromagnetic and ultrasonic variants.

The country’s manufacturing and chemical industries are also witnessing a rise in demand for precision flow meters due to increasing process automation and regulatory compliance under EU directives. Italy’s National Energy and Climate Plan (NECP) aims to enhance energy efficiency across sectors, encouraging the deployment of digital flow metering solutions for optimized resource management.

Despite strong growth prospects, challenges such as aging infrastructure and financial constraints in small enterprises hinder the adoption of high-end metering technologies. However, government grants and private-sector investments are bridging this gap, ensuring steady industry expansion. With sustainability and industrial automation at the forefront, Italy is poised to be a key player in the European flow meter devices market.

South Korea is forecasted to expand at a CAGR of 6.9% from 2025 to 2035, driven by rapid industrial automation, technological advancements, and rising investments in smart manufacturing. The government’s push for digital transformation under the "K-Smart Manufacturing Strategy" is fostering increased adoption of IoT-enabled flow meters in industries such as semiconductors, chemicals, and water treatment.

South Korea’s strict environmental regulations, particularly in wastewater management and air pollution control, have led to widespread demand for precision flow metering solutions. The country is also investing in hydrogen and renewable energy projects, creating new opportunities for specialized flow meters in the energy sector.

Despite the growing demand, high equipment costs and a fragmented supply chain remain challenges for industry players. However, government incentives and collaborations with technology providers are mitigating these hurdles, ensuring sustained growth. As South Korea continues to strengthen its smart manufacturing ecosystem, the adoption of advanced flow metering technologies is expected to rise significantly.

Japan is forecasted to expand at a CAGR of 6.5% from 2025 to 2035, supported by its strong focus on precision engineering, energy efficiency regulations, and advancements in industrial automation. The country's manufacturing sector, particularly in the electronics, chemicals, and automotive industries, relies heavily on accurate flow measurement, driving demand for high-precision metering solutions.

Government policies aimed at energy conservation and wastewater treatment are further bolstering adoption. The Japanese Ministry of Economy, Trade, and Industry (METI) has introduced stringent energy efficiency regulations, encouraging industries to adopt smart metering solutions for optimal resource management. Additionally, the rise of hydrogen energy and carbon-neutral initiatives is driving demand for advanced flow measurement solutions.

Despite its technological leadership, Japan faces high costs and slow adoption of new technologies among smaller industries. However, government subsidies and increasing collaborations with digital technology firms are driving penetration. As industrial efficiency and sustainability gain prominence, Japan is expected to maintain a steady demand for advanced flow metering solutions.

China is forecasted to expand at a CAGR of 8.1% from 2025 to 2035, fueled by strict environmental regulations, rapid industrialization, and advancements in process automation. The Chinese government’s aggressive policies on reducing industrial emissions and improving water conservation are driving demand for high-precision flow meters across industries.

The country’s large-scale investments in smart water management, oil & gas infrastructure, and chemical processing are creating strong growth opportunities for both domestic and international flow meter manufacturers. Additionally, China’s focus on renewable energy, particularly hydrogen and wind power, is increasing the demand for specialized flow metering solutions.

However, price sensitivity and intense competition from low-cost local manufacturers pose challenges for premium brands. To counter this, leading companies are focusing on technological differentiation, such as AI-driven flow monitoring and wireless IoT connectivity. With continued government support for industrial digitalization, China remains one of the most lucrative destinations for advanced monitoring solutions.

By type, the industry is segmented into flow meters, flow controllers, and flow sensors.

In terms of the end-user industry, the sector is segmented into oil and gas, chemicals and pharmaceuticals, water and wastewater, food and beverage, power generation, and others.

The industry is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Increasing industrial automation, regulatory requirements, and the need for precise fluid measurement across industries drive demand.

Oil and gas, water treatment, chemicals, power generation, food and beverage, and pharmaceuticals are the main industries using these solutions.

Innovations like ultrasonic and Coriolis meters, IoT integration, and AI-driven analytics enhance accuracy, efficiency, and automation.

Manufacturers face rising raw material costs, regulatory compliance issues, and the need for continuous innovation amid competitive pressures.

Strict accuracy and environmental standards shape design, calibration, and certification, ensuring reliability in critical applications.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flower Box Market Size and Share Forecast Outlook 2025 to 2035

Flow Pack Films Market Size and Share Forecast Outlook 2025 to 2035

Flow Pack Machine Market Size and Share Forecast Outlook 2025 to 2035

Flow Indicator Market Size and Share Forecast Outlook 2025 to 2035

Flow Chemistry Market Size and Share Forecast Outlook 2025 to 2035

Flow Wrappers Market Size and Share Forecast Outlook 2025 to 2035

Flow Computer Market Size and Share Forecast Outlook 2025 to 2035

Flow Cytometry Market - Trends & Growth Forecast 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flow Wrap Packaging Market Growth from 2025 to 2035

Flower Extract Market Analysis by Type, Application and Form Through 2035

Flow Wrap Machines Market Analysis – Size, Share & Industry Trends 2025-2035

Flow Diverter Market Analysis – Size, Trends & Forecast 2024-2034

Flow Wrap Market from 2024 to 2034

Flowback Tank Market Growth – Trends & Forecast 2024-2034

Flowpack Paper Packaging Market

Flow Meters Market Growth - Trends & Forecast 2025 to 2035

Flow Cytometer Market

Inflow Pressure Screen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Reflow Oven Market Analysis by PCB, Electronics, Semiconductor Packaging, Solar Cell Manufacturing Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA