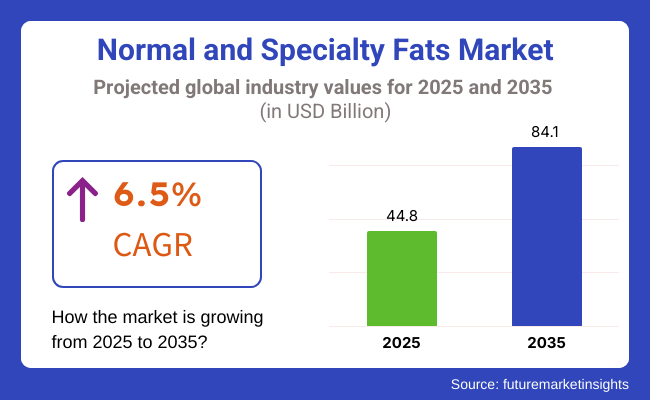

The normal and specialty fats market is experiencing steady growth, with an estimated valuation of USD 44.8 billion in 2025. The overall industry is projected to exhibit a CAGR of 6.5% over the forecast period between 2025 and 2035. The net valuation of the industry is expected to reach USD 84.1 billion by 2035.

The normal and specialty fats industry is exhibiting a constant rise, mainly due to the ascending utilization in the foods, bakery, confectionery, and personal care industries. Normal fats, for instance, vegetable oils, and animal-based fats are chiefly added in daily foods, while specialty fats like cocoa butter alternatives, structured lipids, and emulsified fats are preferable more because of their functional benefits and health-oriented applications.

The industry growth takes place primarily by means of rising consumer demand for healthier fat alternatives and functional ingredients in food processing. Specialty fats are progressively incorporated in baked products, sweets, and dairy substitutes, where they improve texture, mouthfeel, and durability. And, with consumers selecting environmentally friendly and socially responsible alternatives, palm oil substitutes and shea butter are the main influences on the industry.

One more thing that can be mentioned is the processed food industry that is getting expanded and the growing popularity of clean labels and food formulations that do not include trans-fat, which are also factors contributing to industry growth.

Food companies are creating new products with specialty fats that are beneficial to health, for example, high-oleic and omega-3-enriched fats to suit with the latest trends of consumer health. The pursuit of non-hydrogenated and low-saturated fats is a power behind the development of innovations in fat-making and structuring technologies.

The advanced technologies used in fat modification methods, which include inter-esterification and fractionation, these enterprises are to create unique fat solutions that have more functions. The parallel enterprise growth inclusions in the colour cosmetic and personal care sectors, where specialty fats get used up in skin-care products, lip balms, and hair therapy also, is more strengthening industry growth.

On the other hand, a few issues are being foreseen, one being the adverse effect of fluctuating raw material costs, palm oil production being a sustainability issue, and regulatory scrutiny on fat content in food products.

The interest in sustainable and deforestation-free palm oil is leading companies to implement different sourcing measures and certifications, like RSPO (Roundtable on Sustainable Palm Oil), in order to comply with the customer demands.

On the other hand, prosperity is a field that is open for industry development. The need for plant-based and functional fats in vegan and dairy-free products will increase significantly and as a result, the sales will also grow.

Furthermore, the creation of structured fats for printing nutrition and performing better in both sports and medical nutrition is a new line of innovation. As food, personal care, and other industries continue to operate, the normal and special fats industry will witness progressive growth through the next years.

The industry is undergoing change because of drivers like rising demand for functional and health-focused fats in food, cosmetic, and pharmaceutical industries. Specialty fats like cocoa butter alternatives, structured lipids, and non-hydrogenated fats are gaining momentum, driven by clean-labelling and regulatory trends.

Consumers in the food and beverage sector call for more nutritious fats that are more stable and functional. The bakery and confectionery sector focuses on texture, stability, and trans-free solutions, while dairy replacers require fat of plant origin that is healthy.

Pharmaceutical industry applies specialty fats in drug development with a focus on purity and bioavailability. Specialty fats used in personal care and cosmetics are valued for moisturizing and emollient activity, with natural and sustainable sources showing an increasing demand.

With sustainability and responsible sourcing being the prime focus, manufacturers are investing in palm oil substitutes, regenerative farming, and transparent supply chains, making them attractive to environmentally conscious consumers.

Below is a comparative analysis table of six-month growth for CAGR for the base year (2024) and current year (2025) for the industry. The above analysis depicts some of the major changes in terms of industry performance. It highlights revenue realization, providing stakeholders with better visibility into the growth trend of the industry across 2023.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.3% |

| H2 (2024 to 2034) | 6.5% |

| H1 (2025 to 2035) | 6.6% |

| H2 (2025 to 2035) | 6.8% |

The above table provides the projected CAGR for the normal & specialty fats demand domain for the bi-annual period of 2025 to 2035. The industry is expected to grow at a CAGR of 6.3% in H1 2024 before increasing to 6.5% in H2 2024. The CAGR forecast bringing us to 2025 shows a slight increase, with 6.6% in H1 and 6.8% in H2.

The industry witnessed steady growth from 2020 to 2024, driven by increasing demand for functional fats in food and beverage products. Growing consumer awareness of the nutritional benefits of fats, such as omega-3, MCTs (medium-chain triglycerides), and plant-based fats, boosted industry expansion.

Specialty fats acquired applications in bakery, confectionery, and food processing industries because of better texture, flavor, and shelf life. Plant-based diets boosted demand for coconut, palm, shea, and sunflower specialty fats.

Functional health trend also influenced value-added and fortified fat product innovation. However, industry constraints included problems of sustainability issues in palm oil manufacturing and health issues in saturated fat. Companies focused on product reformulation and sustainable sourcing to reduce trans fats as well as unhealthy saturated fats.

Between 2025 and 2035, the industry is expected to experience technological and formulation advancements. Precision fermentation and bioengineered fats development will enable creating healthier, sustainable fats with enhanced nutritional content. Product innovation with the help of AI will enable manufacturing tailored fat blends that are tailored to taste and nutrition.

Specialty fats will have greater applications in plant-based meat, dairy alternative, and functional nutrition foods. Clean-label and non-GMO consumer trends will generate demand for organic and natural specialty fats.

Palm oil substitutes that are sustainable and carbon-neutral manufacturing will be company investments to address environmental goals. Regulatory adjustments and consumer need for healthier fats will propel product reformulation to unsaturated and functional fat mixtures.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increase in demand for functional fats as a food ingredient and beverage use. | Precision-fermented and bioengineered fats gain prominence. |

| Specialty fats in bakery, confectionery, and processed food applications. | Growing use of specialty fats in meat and dairy plant-based alternatives. |

| Growing coconut, palm, and shea plant-based fats. | Transition towards sustainable, non-GMO, and clean-label fats. |

| Health issues with saturated and trans fats. | Developing healthier blends of fats with better nutrition profiles. |

| Focus on sustainably sourced palm oil. | Carbon-neutral production and alternatives to sustainable palm oil. |

The industry for both normal and specialty fats is expanding significantly owing to the increasing consumption in food, cosmetics, and pharmaceutical industries. Despite that, strict regulations concerning trans fats, conditions like palm oil sustainability, and the need for accurate product labelling bring the compliance issue to the forefront. Enterprises have to obey health and environmental regulations to lose their consumers' trust and their industry entry.

The disruption in the supply chain, such as changes in the raw materials sector, climate conditions affecting palm and soybean oil sources, and bilateral trade embargoes are adding more burden to the financial risks. The companies are to embrace green sourcing moves, go for supplier diversification, and pump in money to alternative fats in order to bolster the resilience of their supply chains.

Fluctuations in the price of essential raw materials like palm oil, shea butter, and cocoa butter, direct detrimental effects on profit and industry sustainability. To cope with the financial risks, firms ought to develop variable pricing structures, consider less expensive ingredient alternatives, and initiate long-term procurement obligations.

Industry dynamics are swayed by economic insecurities, changing dietary preferences, and environment-consciousness. In pursuit of sustainable growth, businesses are to commit themselves to innovation in product, honest labelling, and eco-friendly production practices while becoming in line with health and ethical needs of the consumers.

Rising Demand for Dairy Fat Alternatives in Non-Dairy Applications

| Segment | Value Share (2025) |

|---|---|

| Dairy & Ice cream (Application) | 34.6% |

In 2025, the dairy & ice cream segment dominated the market by 34.6% in terms of total share. This is thanks to increasing demand for premium dairy products with better creaminess, texture, and stability. Anhydrous milk fat (AMF), milk fat replacer, structured lipids, and specialty fats are frequently used and their IP is crucial for ice cream, yogurts, and cheese formulations to improve mouthfeel and to achieve cost optimization.

Dairy fat mimetic, high-performance fat solutions with long shelf-life are now offered by companies like Friesland Campina, Cargill, and Fonterra. The increasing trend toward plant-based dairy alternatives has also spurred demand for specialty fats from palm, coconut, and shea butter and added fats used in vegan ice creams and dairy-free cheeses.

This is followed by the Bakery segment, which represents 26% of the industry. Demand for emulsified shortenings, structured vegetable fats, cocoa butter alternatives, and other specialty fats to support the growth of cakes, pastries, cookies, and functional baked goods.

These fat solutions provide enhanced aeration, moisture retention, and shelf stability, which makes them a must-have for bakery manufacturers. Provide custom fat formulations for clean-label, non-trans-fat, and palm-free bakery solution. Leading suppliers including AAK, Bunge, and Wilmar International.

Enzymatically modified fats and non-hydrogenated oils are also trending as health-conscious consumers demand better-for-you baked goods. As dairy, bakery, and snack markets respond to growing consumer demand for healthy, plant-based, and functional food solutions, specialty fats play a key role in helping them meet the demands for quality and sustainability.

Growing Consumer Preference for Specialty Fats in Home Cooking

| Segment | Value Share (2025) |

|---|---|

| Household (End Use) | 45.3% |

By End-Use, the industry is classified into Household and Industrial, which are anticipated to be the major contributing segments for the growth of this industry in 2025. The adoption of cooking oils and margarine, as well as plant-based butter alternatives, among households, has grown massively, leading to a 45.3% revenue share, and a high growth rate in the segment.

The push against trans-fat, hydrogenated, and rancid fat products is moving consumers towards more functional fat solutions that fit a more healthful diet. Brands including Unilever’s Flora, Upfield’s Country Crock, and Nutiva have taken advantage of this trend with sustainable, plant-based, and organic fat substitutes for everyday home cooking and baking.

Systematic, eco-friendly, and health-conscious consumers have driven demand for specialty fats such as ghee, cocoa butter equivalent, and coconut-based spreads, and the rising trend of home baking and culinary experimentation fueled by social media fads and digitalized (recipes) have also contributed positively.

The industrial segment dominates the industry, accounting for 32.5%, which is mainly used in food processing, confectionery, and bakery. Specialty fats such as fractionated palm oil, emulsifying shortenings, and cocoa butter alternatives are commonly used in processed foods, snacks, and Frozen Desserts to provide better texture, mouthfeel, and shelf stability.

Top companies like Cargill, AAK, and Wilmar International provide customized fat solutions, owing to the increased demand for vegan, sustainable, and functional fat ingredients in industrial formulations. The growing emphasis on sustainability and ethical sourcing has also seen manufacturers seek palm-free and enzymatically modified fat solutions to service clean-label food production requirements.

Products are also expected to be innovative and the industry to expand both in household and industrial applications, as consumers call for healthier and more sustainable fat alternatives.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

| UK | 4.5% |

| France | 4.2% |

| Germany | 4.3% |

| Italy | 4% |

| South Korea | 5.1% |

| Japan | 4.6% |

| China | 6.2% |

| Australia | 4.4% |

| New Zealand | 4.1% |

The USA industry is expected to grow at a CAGR of 4.8% from 2025 to 2035. Bakery, confectionery, and plant-based alternatives are witnessing increasing demand for high health awareness and aversion towards non-hydrogenated fats. The country has a well-established food processing base with big global industry players like ADM and Cargill, which are investing in R&D to enhance product quality and sustainability.

Moreover, increased consumer preference for organic and clean-label food products has contributed to the demand for vegetable-source specialty fats obtained from sustainable sources such as palm and shea butter. The rising trend towards veganism and keto diets is also driving demand for high-end plant-based fats, and hence, the United States is a lucrative industry for specialty fat production.

The UK industry will reach a CAGR of 4.5% from 2025 to 2035. Shifting consumer attitudes towards sustainable and ethical food products are compelling manufacturers to innovate in specialty fats. Unilever and AAK UK are developing alternatives for non-dairy fats to respond to growing demands for allergen-free and plant-based foods.

In addition, the UK's confectionery and bakery industries are the main drivers for the demand for specialty fats. High-end pastry and chocolate producers employ higher levels of specialty cocoa butter alternatives and structured fats to meet product texture and shelf stability. Trans-fat pressure has also compelled the trend towards healthier formulations.

France is expected to achieve a CAGR of 4.2% during 2025 to 2035, driven by its strong food culture and huge demand for bakery and confectionery products. French pastry and chocolate products require quality fats in order to maintain product quality, thereby propelling the demand for high-quality specialty fats and cocoa butter replacers.

The country is also increasingly demanding clean-label and organic foods, and this is compelling manufacturers to develop fats that fit sustainability sourcing opportunities. Manufacturers such as Avril Group and Roquette are focusing on plant-based alternative fats, capitalizing on the expanding vegan and flexitarian industry in the country.

Germany's specialty and conventional fats business is expected to record a CAGR of 4.3% during the 2025 to 2035 period. The strong industrial food processing industry in the nation, including processed food, bakery, and confectionery, is fueling the healthy demand for specialty fats.

Sustainability is of great importance in the German industry, and regulators and consumers demand responsibly sourced palm oil and emerging fat replacers. Bunge and Henkel are investing in research and development to launch healthier, sustainable fats that comply with stringent European food safety regulations.

Italy's specialty fats industry will experience a CAGR of 4% from 2025 to 2035. Its demand for premium-quality confectionery, artisan bakeries, and better-quality dairy alternatives drives the consumption of specialty fats.

Italian companies such as Ferrero and Barilla are incorporating high-performance fats in their offerings to enhance texture and shelf life without sacrificing real flavors. Growing veganism in Italy also fuels the demand for plant butter and margarine, pushing the specialty fats industry ahead.

South Korea is likely to experience a 5.1% CAGR growth during 2025 to 2035 on the back of increasing demand for K-food from the rest of the world. The surging bakery and confectionery industries in South Korea, combined with the increasing export of Korean snacks, create a high demand for specialty fats.

Industry leaders such as Lotte and CJ CheilJedang are committing to healthier, trans-fat-zero products. Moreover, the increasingly booming demand for food service is presenting opportunities for premium cooking oil and specialty fry oils.

Japan's industry will grow at a CAGR of 4.6% during 2025 to 2035. Japan's focus on high-quality confectionery and functional foods is driving the demand for specialty fats. Japan is also leading in terms of technological advancements, dictating the evolution of structured fats and emulsifiers in food products.

Firms like Meiji and Nisshin OilliO are producing specialty fats for the aging Japanese population, who are looking towards the health impacts of reducing cholesterol and improving digestion. Demand remains high for gourmet chocolate and pastry fat, especially in the food premium industry.

China would have the highest growth among the listed countries at a CAGR of 6.2% from 2025 to 2035. The rapidly growing food processing industry and increasing disposable incomes fuel demand for specialty fats, especially in the bakery, confectionery, and dairy alternative segments.

Domestic players like COFCO and Bright Dairy & Food are making investments in specialty fat production to cater to shifting consumer preferences. China's increasing middle class and appetite for global foodstuffs also propel industry expansion, and China is a key contributor to the specialty fats industry.

The Australian specialty fats industry is forecasted to grow at a CAGR of 4.4% during 2025 to 2035. The Australian dairy and bakery sectors drive demand for premium-grade fats, and the increasing trend gives demand for non-dairy fat alternatives a boost for plant-based diets.

Companies like Goodman Fielder and Peerless Foods are leading the way in creating specialty fats through a health-conscious and allergen-free strategy. In addition, Australia's regulatory emphasis on reducing trans-fat has encouraged the manufacture of healthier alternative fats for food production.

New Zealand's economy is expected to grow at 4.1% CAGR from 2025 to 2035 in its dairy industry and high-end demand for food. With its expertise in specialty dairy fats, such as butter and anhydrous milk fat, New Zealand is a specialist in the international industry of specialty fats.

These companies, like Fonterra and Westland Dairy, focus on innovation for plant and dairy fats with the intent of serving international markets. In addition, demand for functional foods and nutritionally enhanced fats creates industry expansion opportunities for domestic and export markets.

Normal and specialty fats are marketed today in a wider scope, being driven by increased consumer demand for healthier alternatives, plant-based formulations, and sustainable sources of fats. The increased awareness of consumers on functional and specialty fats in bakery and confectioneries and in other processed foods continues to fuel competition among major players in the industry, such as Cargill, Bunge, Wilmar International, AAK AB, and Fuji Oil Holdings, which are working on innovative fat formulations, sustainable palm oil alternatives, and trans-fat-free solutions.

Investment in enzymatic interesterification, engineered lipids, and high-performance specialty fats continues to revolutionize product development. The influence of changes in market trends is created by regulatory compulsion against trans fats and rising demand for plant-based fats. Technological advances in lipid modification have made a further contribution to the transformation of the industry.

North America and Europe are the leading regions when it comes to innovative changes in specialty fat; however, given the status of Asia-Pacific as a promising industry due to the expanding food processing industries and rising health-conscious consumers, this region will become just as much of a key growth area in the future.

Competitive strategic factors are driven by sustainable sourcing (RSPO-certified palm oil, non-GMO alternatives), supply chain optimization, and expansion into ever-increasing developed markets. Companies use strategic partnerships, product reformulations and functional ingredient innovations to make themselves competitive in normal and specialty fats markets.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill Inc. | 16-20% |

| AAK AB | 12-16% |

| Bunge Limited | 10-14% |

| Wilmar International | 8-12% |

| Fuji Oil Holdings Inc. | 6-10% |

| Other Players (Combined) | 28-40% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Cargill Inc. | Leading provider of customized fat solutions focusing on sustainability and non-GMO ingredients. |

| AAK AB | Specializes in plant-based fats and oils, catering to bakery, confectionery, and dairy alternatives. |

| Bunge Limited | Offers specialty fats with a focus on organic and clean-label formulations. |

| Wilmar International | Focuses on edible oils, margarine, and trans-fat-free alternatives. |

| Fuji Oil Holdings | Innovates in chocolate, confectionery, and emulsified fat solutions, emphasizing health-conscious formulations. |

Key Company Insights

Cargill Inc. (16-20%)

Industry leader investing in clean-label fat solutions, sustainable fat processing, and plant-based substitutes.

AAK AB (12-16%)

The dominant player in the field of value-added fat solutions with an emphasis on dairy-free and plant-based solutions.

Bunge Limited (10-14%)

Competitor in organic as well as special fats, pushing its portfolio with functional and non-GMO oil solutions.

Wilmar International (8-12%)

Growing Asian presence, delivering affordable specialty fat solutions.

Fuji Oil Holdings (6-10%)

Creates chocolate fats and emulsifiers with a focus on healthy formulations.

By type, this segment is further categorized into normal and specialty fats, shortenings, spread fat, margarine, cocoa butter equivalent, and other types.

By application, this segment is further categorized into Bakery, Convenience Food, Confectionery, Dairy, and Others.

By end use, this segment is further categorized into Industrial, Commercial, and Household.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

The industry is expected to generate USD 44.8 billion in revenue by 2025.

The industry is projected to reach USD 84.1 billion by 2035, growing at a CAGR of 6.5%.

Key players include Cargill Inc., AAK AB, Bunge Limited, Wilmar International, Fuji Oil Holdings Inc., Olenex, Mewah Group, IOI Corporation Berhad, Manildra Group, and BASF SE.

Asia-Pacific and North America, driven by rising consumption of processed foods, growing demand for plant-based fats, and innovations in fat alternatives.

Specialty fats such as cocoa butter alternatives and fractionated palm oils dominate due to their extensive use in confectionery, bakery, and dairy applications.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tonnes) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Applications, 2018 to 2033

Table 6: Global Market Volume (Tonnes) Forecast by Applications, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 8: Global Market Volume (Tonnes) Forecast by End-use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Applications, 2018 to 2033

Table 14: North America Market Volume (Tonnes) Forecast by Applications, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 16: North America Market Volume (Tonnes) Forecast by End-use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Applications, 2018 to 2033

Table 22: Latin America Market Volume (Tonnes) Forecast by Applications, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 24: Latin America Market Volume (Tonnes) Forecast by End-use, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Europe Market Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Applications, 2018 to 2033

Table 30: Europe Market Volume (Tonnes) Forecast by Applications, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 32: Europe Market Volume (Tonnes) Forecast by End-use, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Applications, 2018 to 2033

Table 38: Asia Pacific Market Volume (Tonnes) Forecast by Applications, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 40: Asia Pacific Market Volume (Tonnes) Forecast by End-use, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: MEA Market Volume (Tonnes) Forecast by Product Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Applications, 2018 to 2033

Table 46: MEA Market Volume (Tonnes) Forecast by Applications, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 48: MEA Market Volume (Tonnes) Forecast by End-use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Applications, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tonnes) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Applications, 2018 to 2033

Figure 14: Global Market Volume (Tonnes) Analysis by Applications, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 18: Global Market Volume (Tonnes) Analysis by End-use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Applications, 2023 to 2033

Figure 23: Global Market Attractiveness by End-use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Applications, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Applications, 2018 to 2033

Figure 38: North America Market Volume (Tonnes) Analysis by Applications, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 42: North America Market Volume (Tonnes) Analysis by End-use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Applications, 2023 to 2033

Figure 47: North America Market Attractiveness by End-use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Applications, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Applications, 2018 to 2033

Figure 62: Latin America Market Volume (Tonnes) Analysis by Applications, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 66: Latin America Market Volume (Tonnes) Analysis by End-use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Applications, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Applications, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End-use, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Europe Market Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Applications, 2018 to 2033

Figure 86: Europe Market Volume (Tonnes) Analysis by Applications, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 90: Europe Market Volume (Tonnes) Analysis by End-use, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Applications, 2023 to 2033

Figure 95: Europe Market Attractiveness by End-use, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Applications, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by End-use, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Applications, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Tonnes) Analysis by Applications, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Tonnes) Analysis by End-use, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Applications, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by End-use, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Applications, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by End-use, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: MEA Market Volume (Tonnes) Analysis by Product Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Applications, 2018 to 2033

Figure 134: MEA Market Volume (Tonnes) Analysis by Applications, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Applications, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Applications, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 138: MEA Market Volume (Tonnes) Analysis by End-use, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Applications, 2023 to 2033

Figure 143: MEA Market Attractiveness by End-use, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Normal Flow Filtration Products Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Dandruff Control Shampoos Market Size and Share Forecast Outlook 2025 to 2035

Candidiasis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA