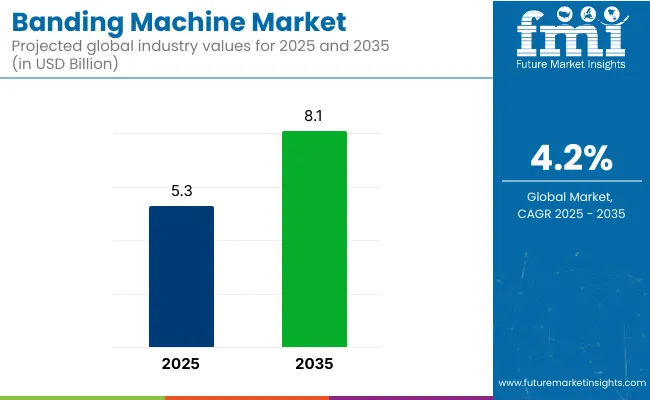

The global banding machine market is expected to cross USD 8.1 billion by 2035, up from USD 5.3 billion in 2025, reflecting a steady CAGR of 4.2% over the decade. This growth is being shaped by manufacturers’ shift toward automation for improved operational efficiency and reduced packaging waste. High demand from the food & beverage industry and increasing integration of automatic banding systems across production lines are reinforcing the role of banding equipment in modern industrial packaging strategies.

This growth has been attributed to the rising need for efficient and eco-friendly packaging solutions in sectors such as food and beverage, pharmaceuticals, logistics, and e-commerce. The increasing adoption of banding machines for their ability to ensure product safety, prevent contamination, and reduce material usage has further propelled the market's expansion.

Additionally, advancements in automation and the integration of smart technologies have enhanced the efficiency and precision of banding processes, contributing to the market's growth.

In April 2025, ATS-Tanner showcases banding solutions at Empack 2025. “The main current trend at the moment is reducing plastic to reach sustainability goals. We are seeing banding expand beyond traditional graphic products and brochures to industries like F&B and laundry to get rid of plastic bags.”

“We have developed the ATS US-3000, the most advanced banding machine on the market,” Johan Van Veen, the company’s national sales manager for the Netherlands says. “It features an easy operating system that allows any operator to work with this machine. The machine is ready for integration into fully automated production lines.”

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5.3 Billion |

| Industry Value (2035F) | USD 8.1 Billion |

| CAGR (2025 to 2035) | 4.2% |

The shift towards environmentally friendly solutions has significantly influenced the banding machine market. Manufacturers have been focusing on developing machines that are energy-efficient, compatible with recyclable materials, and offer excellent sealing properties. Innovations include the integration of advanced materials, modular designs, and the use of natural additives to enhance machine performance.

These advancements align with global sustainability goals and regulatory requirements, making banding machines an attractive option for environmentally conscious industries. Additionally, the development of automated manufacturing processes has enhanced efficiency and consistency in production, further driving market growth.

The banding machine market is poised for significant growth, driven by increasing demand in food and beverage, pharmaceuticals, logistics, and e-commerce packaging industries.

Companies investing in sustainable materials, innovative designs, and eco-friendly production processes are expected to gain a competitive edge. As global supply chains expand and environmental regulations become more stringent, the adoption of banding machines is anticipated to rise, offering cost-effective and eco-friendly solutions for packaging.

Furthermore, the integration of smart technologies and automation in packaging applications is expected to enhance operational efficiency and meet the evolving needs of various industries.

The market is segmented based on operation, strapping speed, end use, and region. By operation, the market is divided into semi-automatic and automatic machines. In terms of strapping speed, the market is categorized into 1.0-1.5 sec/straps, 1.6-2.0 sec/straps, and above 2.0 sec/straps.

By end use, the market includes food & beverage, e-commerce, pharmaceuticals, electrical & electronics, household, shipping & logistics, and printing sectors. Regionally, the market is analyzed across North America, Latin America, Europe, South Asia, East Asia, the Middle East & Africa, and Oceania.

The automatic segment is projected to account for 64.7% of the global banding machine market by 2025, as large-scale production environments have increasingly required high-speed, low-intervention systems for bundling, securing, and branding packaged items.

Automatic machines have been integrated with conveyor lines and smart controls to ensure consistency, reduce manual handling, and increase output in food, pharma, and logistics sectors.

Servo-driven motors, programmable logic controllers (PLCs), and touchscreens have been incorporated to allow for custom tension settings, barcode printing, and seamless switching between product formats. Their deployment has been supported by reduced energy consumption, material optimization, and minimal downtime during continuous operations.

In industries with stringent hygiene and traceability requirements, automatic banding systems have been favored for offering tamper-evidence, brand labeling, and compliance with safety standards. As manufacturers pursue automation, traceability, and cost efficiency, automatic machines are expected to remain the primary solution for high-throughput packaging needs.

The food & beverage segment is expected to account for 38.5% of the banding machine market by 2025, as increasing demand for multi-pack bundling, shelf-ready packaging, and brand labeling has driven adoption across bakeries, dairy, meat, and beverage industries. Banding machines have been used to bundle trays, cups, pouches, and cartons while preserving product visibility and ventilation.

Compliance with food safety regulations and cleanroom standards has made non-adhesive paper and film banding attractive in fresh and frozen food lines. Banding systems have been integrated with inline printers to enable real-time coding, QR tagging, and expiration date labeling, meeting traceability mandates.

Reduced use of shrink wrap and adhesive tapes has further promoted banding machines as a sustainable and cost-efficient solution. As demand rises for tamper-evident, recyclable, and visually appealing food packaging, the food & beverage sector is expected to retain dominance in the banding machine market.

High Costs and Regulatory Complexities

The Banding Machine Market encounters specific obstacles because of its expensive manufacturing procedures and necessary compliance requirements and supply network limitations. The exact engineering requirements and robust elements for banding machines result in elevated production expenses.

The Banding Machines Market needs to comply with multiple regulatory requirements which involve industrial automation standards alongside workplace safety regulations and packaging material certification standards under CE certification and ISO standards. Affordable prices require businesses to implement cost-effective production methods and energy-efficient designs and advanced automated systems.

Market Saturation and Technological Adaptation

A substantial number of manufacturers throughout different regions and globally are active in this competitive banding machine market sector. The high market concentration has produced extreme price competition which reduces available earning potential for manufacturers.

The shift towards automated packaging systems alongside Industry 4.0 implementations forces companies to invest in traditional machine upgrades that may be expensive. Manufacturers who want to maintain their market position must develop technological improvements and personalized solutions with smart machine capabilities that follow changing packaging requirements.

Growing Demand for Automated and Sustainable Packaging Solutions

Manufacturers of banding machines benefit from increasing solutions requirements for automated packaging operations across the logistics sector. The food & beverage sector together with pharmaceuticals and logistics industries choose automated banding processes to reach higher efficiency levels and decrease operating costs and improve product safety standards.

The rise of sustainability initiatives produces market demand for environment-friendly banding solutions which reduce plastic waste during operations. Organizations that use sustainable packaging materials and efficient equipment and automation features will dominate the expanding market sector.

Advancements in Smart Banding Machines and IoT Integration

Modern banding machines can transform the industry because of their IoT-enabled monitoring features and AI-driven maintenance systems which combine with real-time data analytics capabilities. Smart sensors coupled with cloud-based monitoring systems boost machine performance and decrease maintenance periods while providing better operational data analysis results.

The growth of e-commerce and just-in-time manufacturing activities requires precise and high-speed banding solutions for market expansion. The Banding Machine Market will experience its next major growth period from companies who focus on digital transformation alongside AI-powered diagnostics and connectivity features.

Market Insights Report provides a comprehensive analysis of the United States banding machine market, exploring industry trends, growth drivers, and competitive landscape. Increasing e-commerce and retail packaging are propelling market growth.

Some of the advanced features of modern banding machines that manufacturers are emphasizing include adjustable banding tension, high-quality and eco-friendly banding materials, and smart automation to facilitate high-throughput operations.

Moreover, consumer movement toward sustainable and minimal packaging solutions is driving the businesses to use banding machines instead of traditional packaging methods.

| Country | CAGR (2025 to 2035) |

|---|---|

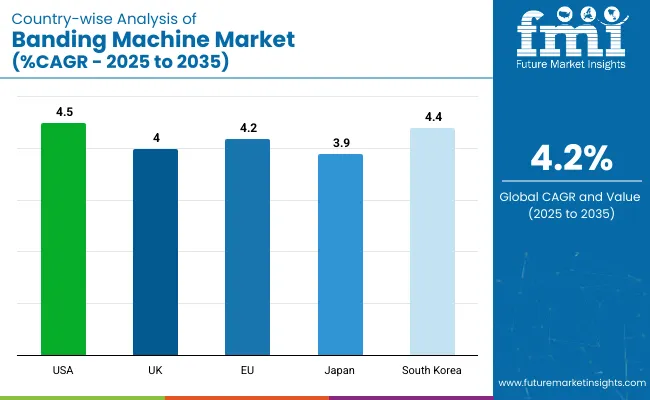

| USA | 4.5% |

The UK is seen steady growth of the banding machine market across several industries searching for cost-effective and eco-friendly packaging solutions. Growing demand for disposable banding materials such as paper and biodegradable is paving way for market growth.

Due to increasing demand for accuracy and speed during the banding process in the pharmaceutical and food industries, there is an increasing trend towards more OEE efficient machine automation and at the same time digital integration. Furthermore, stringent government regulations mandating the use of sustainable packaging are forcing the manufacturers to adopt advanced banding.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.0% |

The demand for the banding machines in the EU is high, and the market is growing fast in Germany, France and Italy. Rigid government regulations towards the reduction of packaging waste, along with sustainability, is pushing the adoption of green banding solutions.

Growing manufacturing, logistics, and food processing industries present strong demand for high-speed, automated banding systems. Moreover, the escalating adoption of Industry 4.0 components is driving the innovation of smart banding machines rich in IoT solutions for real-time inspection and operational effectiveness.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.2% |

Japan's banding machine market is expanding at a moderate pace owing to growth in demand from food, electronics, and industrial goods sectors. With the country’s focus on precision engineering and automation, banding machine technology is getting a lot of attention.

To maximize efficiency, manufacturers offer more features in banding machines such as AI-powered quality control and automated adjustments. Moreover, Japan’s emphasis on sustainability is promoting the development of compact and energy efficient banding solutions across the industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

The rapid growth in the e-commerce and logistics sectors is advancing the banding machine market in South Korea. Automated packaging solutions are an essential factor that is being adopted by the business across the globe, to maintain operational efficiency and increase profitability.

High Precision Banding Machines Demand is triggered by Strong Electronics and Automotive Industryociation Moreover, the market is being driven by various government initiatives that have been implemented to encourage eco-friendly packaging and smart manufacturing practices.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

The banding machine market is experiencing steady growth due to increasing demand for efficient packaging solutions across industries such as food & beverage, pharmaceuticals, logistics, and printing. Banding machines are widely used for bundling products securely using paper or plastic bands, offering an eco-friendly and cost-effective alternative to shrink-wrapping and adhesives.

The market is driven by the need for automation in packaging, rising e-commerce shipments, and sustainability initiatives favouring minimal packaging waste. Leading manufacturers are focusing on advanced automation, IoT-enabled smart banding solutions, and high-speed, customizable systems to meet evolving industry demands.

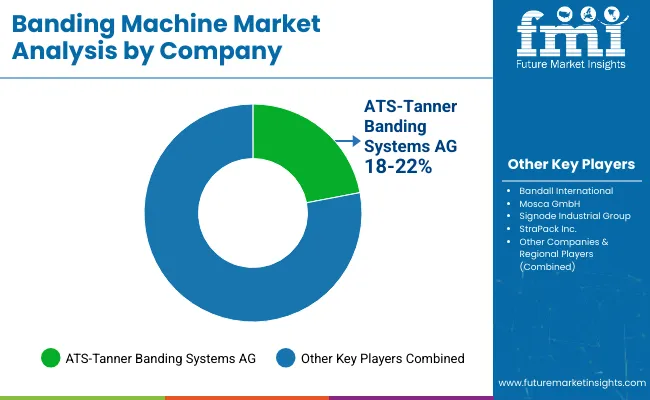

Other Key Players

Several other manufacturers contribute to the banding machine market by focusing on sustainability, automation, and customization. Notable players include:

The overall market size for Banding Machine Market was USD 5.39 Billion in 2025.

The Banding Machine Market expected to reach USD 8.13 Billion in 2035.

The demand for the banding machine market will grow due to increasing automation in packaging, rising demand for efficient bundling solutions in logistics and manufacturing, advancements in sustainable packaging technologies, and the growing need for cost-effective and high-speed strapping solutions across industries.

The top 5 countries which drives the development of Banding Machine Market are USA, UK, Europe Union, Japan and South Korea.

Automatic Banding Machines and Food & Beverage lead market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Metal Banding Machine Market Trends - Growth & Forecast 2025 to 2035

Pallet Banding Machine Market Analysis - Growth & Forecast 2025 to 2035

Automatic Banding Machine Market Insights - Growth & Forecast 2025 to 2035

Plastic Banding Market Size and Share Forecast Outlook 2025 to 2035

Strapping and Banding Equipment Market – Key Trends & Growth Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA