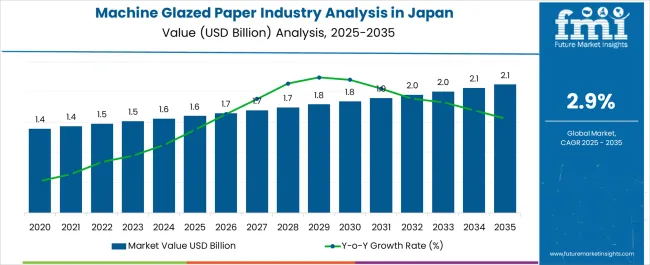

The Machine Glazed Paper Industry Analysis in Japan is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 2.9% over the forecast period.

| Metric | Value |

|---|---|

| Machine Glazed Paper Industry Analysis in Japan Estimated Value in (2025 E) | USD 1.6 billion |

| Machine Glazed Paper Industry Analysis in Japan Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 2.9% |

The machine glazed paper industry in Japan is experiencing stable growth. Demand has been supported by expanding applications in packaging, hygiene products, and specialty printing. Current market dynamics are influenced by rising domestic consumption, the prevalence of advanced paper manufacturing technologies, and regulatory emphasis on sustainable and eco-friendly production.

Price stability in raw materials, particularly pulp and recycled fibers, is shaping procurement strategies. The future outlook is expected to be driven by continued modernization of paper mills, innovation in high-quality and specialty paper variants, and increasing adoption of lightweight and functional papers to meet evolving end-user requirements. Growth rationale is based on the efficient production processes, high-performance attributes of machine glazed paper, and sustained industrial demand.

Technological advancements in coating, calendering, and moisture resistance are enhancing product quality, while supply chain optimization is ensuring timely delivery These factors collectively support consistent market expansion, improved product availability, and the maintenance of Japan’s competitive position in the regional and global machine glazed paper market.

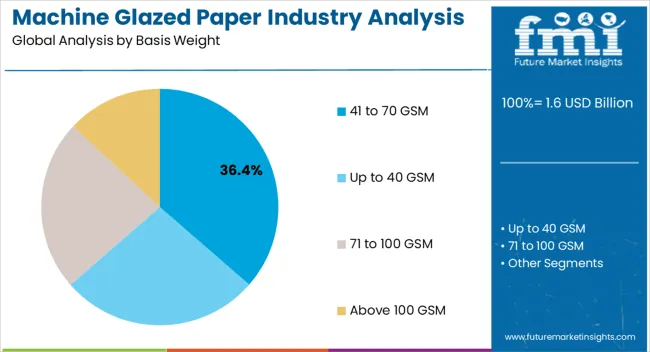

The 41 to 70 GSM segment, representing 36.40% of the basis weight category, has emerged as the leading segment due to its suitability for lightweight packaging, hygiene, and industrial paper applications. Adoption has been supported by processing efficiency, cost-effectiveness, and compatibility with high-speed converting and printing equipment.

The segment benefits from consistent raw material availability and stable production output, which reinforces market confidence. Growth has been facilitated by rising demand for lightweight and functional papers in both domestic and export markets.

Operational efficiencies, including optimized fiber utilization and improved calendering techniques, have enhanced quality and reduced waste Technological innovations, combined with evolving end-user requirements, are expected to sustain the segment’s market share and reinforce its position as a key contributor to the overall industry growth.

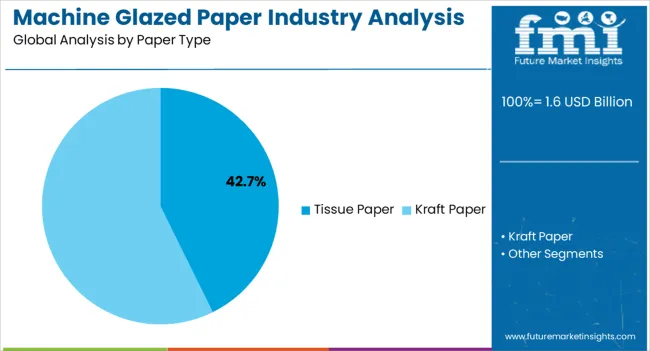

The tissue paper segment, holding 42.70% of the paper type category, has maintained market leadership due to its widespread adoption in hygiene, household, and commercial applications. Demand has been driven by high consumer acceptance, integration into hygiene-focused product lines, and adherence to quality and safety standards.

Production efficiency and standardized manufacturing processes have reinforced market stability. Continued innovations in softness, absorbency, and strength characteristics have enhanced product differentiation and market penetration.

Supply chain reliability and established distribution networks have further supported adoption The segment’s market share is expected to remain robust as tissue paper continues to be a preferred choice across multiple applications, sustaining its dominant role in Japan’s machine glazed paper industry.

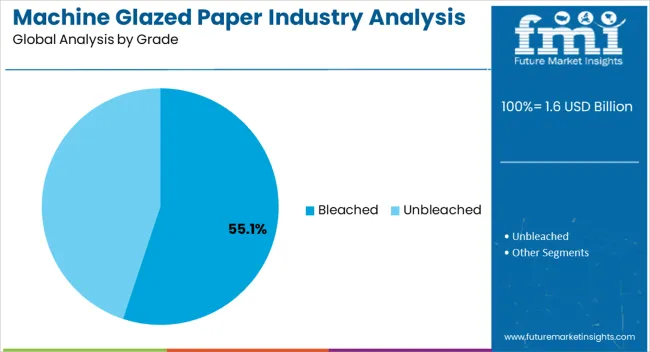

The bleached grade segment, accounting for 55.10% of the grade category, has emerged as the leading choice due to its superior brightness, cleanliness, and compatibility with diverse printing and packaging applications. Its adoption has been facilitated by advanced bleaching and pulp processing technologies that enhance product quality and consistency.

The segment benefits from high demand in premium and consumer-focused paper applications, where visual appeal and performance are critical. Regulatory compliance, safety standards, and sustainable production practices have strengthened market acceptance.

Continuous improvements in manufacturing processes, including environmentally friendly bleaching methods, are expected to sustain the segment’s market share and reinforce its prominence within the Japanese machine glazed paper industry.

Kraft Paper is versatile and can be used in various applications, including packaging, printing, and labeling. Its adaptability to different uses makes it a preferred choice for businesses with diverse needs.

| Machine Glazed Paper in Japan based on Paper Type | Kraft Paper |

|---|---|

| Share in % in 2025 | 79.1% |

Based on paper type, the kraft paper segment is expected to account for a share of 79.1% in 2025. The growth of e-commerce typically leads to increased demand for packaging materials, and kraft paper is often used for corrugated boxes and packaging solutions. The demand for kraft paper is expected to experience growth, with the continuous expansion of e-commerce in Japan.

Demand from the manufacturing sector for packaging materials can significantly impact the kraft paper segment. The manufacturing sector in Japan is robust, which is anticipated to augment the need for kraft paper for various industrial applications.

Kraft paper provides opportunities for customization and branding through printing. The printability of kraft paper can be a significant factor, as businesses seek to differentiate their products and enhance brand visibility.

Unbleached paper can provide a unique canvas for printing and branding. Businesses looking to convey a natural or eco-friendly image may prefer unbleached paper for its printability and customization options.

| Machine Glazed Paper in Japan based on Grade | Unbleached |

|---|---|

| Share in % in 2025 | 68.7% |

Based on grade, the unbleached segment is expected to account for a share of 68.7% in 2025. Increasing consumer awareness about the environmental impact of various products, including packaging materials, can drive a demand for more natural and minimally processed options. Unbleached paper, being closer to its natural state, can appeal to environmentally conscious consumers.

Unbleached paper is commonly used in the packaging of food products. The demand for unbleached paper for applications like food packaging can increase, as the food industry continues to grow.

Unbleached paper is often more easily recyclable and biodegradable than bleached paper. The emphasis on circular economy principles and waste reduction can drive the demand for materials that can be recycled or decompose naturally.

The growth of e-commerce often leads to increased demand for packaging materials. There is a significant expansion of e-commerce activities in the Kanto region, which is expected to boost the demand for machine glazed paper for packaging goods sold online.

The Kanto region is an economic hub with significant manufacturing and industrial activities. Growth in these sectors often translates to increased demand for packaging materials like machine glazed paper.

Advances in paper manufacturing technology can lead to improved quality and cost effectiveness of machine glazed paper, making it more attractive to businesses in the region.

Machine glazed paper offers printing capabilities, allowing for customization and branding on packaging materials, which can be a key factor for companies looking to enhance their brand visibility.

The printing capabilities of machine glazed paper allow for customization and branding on packaging materials, which can be particularly important for local businesses looking to enhance their brand visibility.

Consumers in Kyushu and Okinawa show a preference for products packaged with sustainable materials and there is an increasing demand for premium packaging, which is expected to positively impact the machine glazed paper ecosystem.

A holistic understanding of the competitive landscape in the machine glazed paper industry in Japan involves considering industry dynamics, technological advancements, sustainability efforts, strategic initiatives, consumer trends, distribution channels, and regulatory influences.

Recent Development Observed in Machine Glazed Paper Industry in Japan

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 1.6 billion |

| Projected Industry Size in 2035 | USD 2.1 billion |

| Anticipated CAGR from 2025 to 2035 | 2.9% |

| Historical Analysis of Demand for Machine Glazed Paper in Japan | 2020 to 2025 |

| Demand Forecast for Machine Glazed Paper in Japan | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing machine glazed paper adoption in Japan, Insights on Global Players and their Industry Strategy in Japan, Ecosystem Analysis of Providers in Japan |

| Key Regions Analyzed while Studying Opportunities in Machine Glazed Paper in Japan | Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, Rest of Japan |

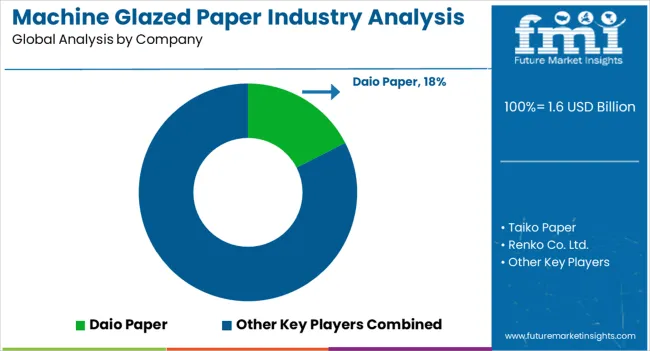

| Key Companies Profiled | Taiko Paper; Daio Paper; Renko Co. Ltd.; Enza MG; Siam Nippon Industrial Paper; Mondi Group; Heinzel Group; Burgo Group; SCG Packaging; Verso Corporation; Stora Enso; Smurfit Kappa Group |

The global machine glazed paper industry analysis in Japan is estimated to be valued at USD 1.6 billion in 2025.

The market size for the machine glazed paper industry analysis in Japan is projected to reach USD 2.1 billion by 2035.

The machine glazed paper industry analysis in Japan is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in machine glazed paper industry analysis in Japan are 41 to 70 gsm, up to 40 gsm, 71 to 100 gsm and above 100 gsm.

In terms of paper type, tissue paper segment to command 42.7% share in the machine glazed paper industry analysis in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Machine Glazed Paper Industry

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Glassine Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Paper Loading Machine in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Paper Machine Systems Market

Paper Cup Machine Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Paper Cup Machine Market Share

Paper Making Machines Market

Paper Loading Machine Market Trend Analysis Based on Product, End-Use, Loading Mechanism, Machine Size/Capacity, Automation Level and Regions 2025 to 2035

Decor Paper Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Kraft Paper Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Japan Micro Flute Paper Market Analysis – Size, Share & Industry Trends 2025-2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Tubes & Core Industry Analysis in United States Trends, Size, and Forecast for 2025-2035

Paper Napkin Making Machine Market Analysis, Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA