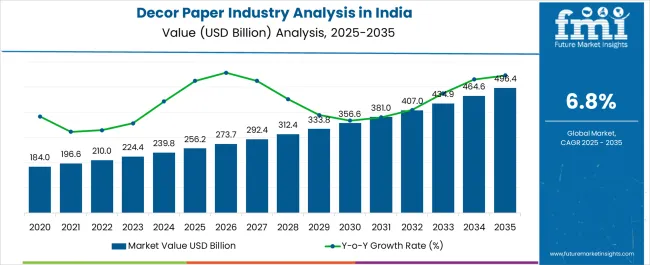

The Decor Paper Industry Analysis in India is estimated to be valued at USD 256.2 billion in 2025 and is projected to reach USD 496.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

| Metric | Value |

|---|---|

| Decor Paper Industry Analysis in India Estimated Value in (2025 E) | USD 256.2 billion |

| Decor Paper Industry Analysis in India Forecast Value in (2035 F) | USD 496.4 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The decor paper industry in India is positioned for sustained expansion as demand from furniture, interior design, and construction sectors continues to rise. Current market growth is being supported by rapid urbanization, changing consumer preferences, and rising expenditure on home and commercial décor. Increasing demand for high-quality surface finishes and design versatility has driven adoption of advanced printing and impregnation technologies.

The industry is witnessing structured supply chain integration and capacity expansion, enabling consistent product availability across regions. Regulatory focus on sustainable materials and environmentally responsible production has further accelerated the shift toward high-quality decor papers. The future outlook is favorable, with growing penetration of premium furniture, modular kitchens, and decorative panels boosting demand.

Rising investment in organized retail, coupled with expanding exports of finished laminates, is expected to support long-term growth The market rationale rests on technological advancement, improved design customization, and steady expansion of application areas, ensuring continuous revenue generation and competitive positioning within the Indian decorative materials landscape.

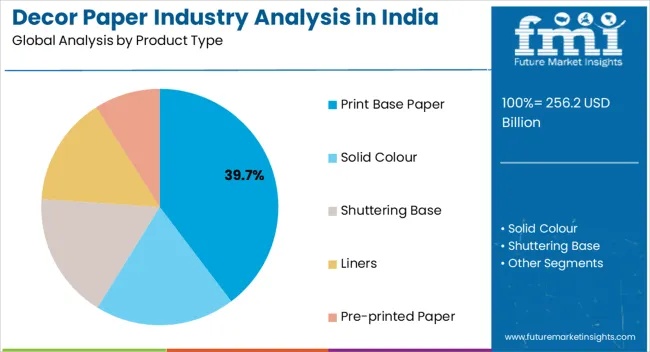

The print base paper segment, representing 39.70% of the product type category, has emerged as the leading product due to its critical role in surface design and superior compatibility with advanced printing technologies. This segment is being supported by consistent demand from furniture and flooring manufacturers seeking enhanced durability and aesthetic appeal.

High adaptability in design customization and efficient processing in lamination lines have further strengthened its market position. Growth has also been sustained by consumer preference for varied patterns, textures, and finishes in interior décor applications.

Producers are increasingly focusing on cost optimization and quality consistency, ensuring greater adoption across both mass-market and premium-grade furniture segments Expansion of organized retail distribution channels and the rise in branded furniture adoption in urban markets are expected to drive the continued dominance of print base paper within the Indian decor paper industry.

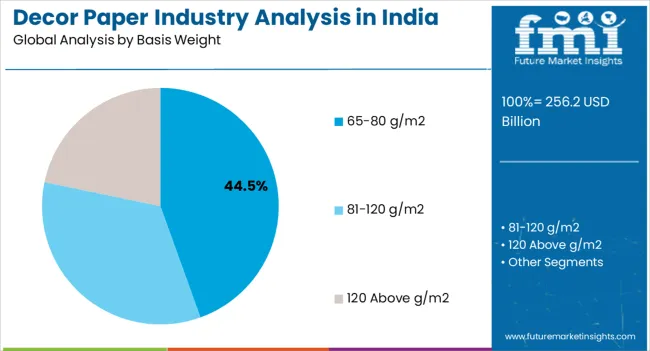

The 65–80 g/m² segment, accounting for 44.50% of the basis weight category, has maintained its lead due to its balanced properties of printability, strength, and processing efficiency. This range is preferred for its ability to deliver high-quality finishes while ensuring durability during lamination and end use.

Manufacturers have prioritized this weight category for producing versatile decor papers suited for both residential and commercial interiors. Growth has been supported by its wide applicability across low-pressure and high-pressure laminates, offering consistent performance and cost efficiency.

The stability in supply and demand has been reinforced by rising furniture production in India, supported by both domestic consumption and export markets Continued focus on improving surface smoothness, ink absorption, and structural integrity is expected to sustain this segment’s leadership, making it a preferred choice for manufacturers and end-users in the evolving decor paper landscape.

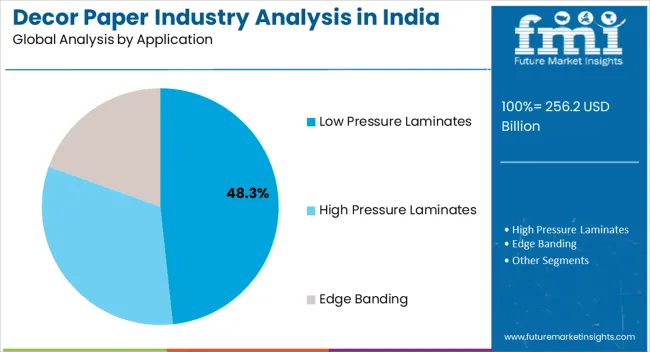

The low-pressure laminates segment, holding 48.30% of the application category, has established dominance as the primary application area within the decor paper industry in India. Its leadership has been reinforced by strong demand from modular furniture, wall panels, and surface finishing solutions. Low-pressure laminates are preferred for their cost-effectiveness, design flexibility, and widespread availability, which align with the needs of the growing middle-class consumer base.

Expansion of the real estate sector and commercial interiors has further elevated the adoption of this application. Improved lamination technologies, coupled with enhanced durability and aesthetic variety, have enabled low-pressure laminates to cater effectively to both functional and decorative requirements.

Manufacturers are investing in expanding design portfolios and capacity to address diverse market needs With rising demand for affordable and stylish interiors across residential and institutional segments, this application is expected to continue driving growth and maintain its leading share in the Indian decor paper industry.

The demand for decor paper in India is expected to experience a lucrative growth outlook during the forecast period.

Our recent estimates predict that sales could witness a significant increase during 2025 to 2035 and are further projected to generate an attractive incremental growth opportunity of USD 241.3 million, doubling the current industry value by the end of the forecast period.

The adoption of decor paper in India expanded at a CAGR of 4.7% during the historic period, with an industry value of USD 256.2 million in 2025, up from USD 184 million in 2020.

The Indian real estate industry witnessed an increasing trend of renovation and refurbishment projects, contributing to the expansion of the decor paper industry.

The expansion of the retail landscape in India, marked by the opening of new shopping malls, showrooms, and home decor stores, has provided a wider platform for decor paper products to reach consumers. Additionally, the rise of eCommerce has further enhanced accessibility and convenience for consumers to purchase decor paper products online. Consequently, this has played a significant role in helping the industry grow.

| Particular | Value CAGR from 2025 to 2035 |

|---|---|

| H1 | 7.0% (2025 to 2035) |

| H2 | 6.9% (2025 to 2035) |

| H1 | 7.2% (2025 to 2035) |

| H2 | 7.4% (2025 to 2035) |

Decor paper is gaining traction in the furniture and cabinet industry due to several factors, including affordability, versatility, durability, sustainability, and aesthetic appeal. Its cost-effectiveness makes it an attractive option for manufacturers seeking to produce appealing products with limited expenditure.

Additionally, the versatility of decor paper allows for a wide array of designs and finishes, catering to diverse tastes and preferences. Moreover, its durability ensures that it can withstand everyday wear and tear, making it suitable for long-lasting furniture and cabinets.

End-use cases within flooring, paneling, and store fixtures are also witnessing rising levels of demand for decor paper. This is owing to the growing industry for aesthetically appealing interiors, increasing urbanization, and a rising trend toward customized and modern home furnishings.

The trend of incorporating metallic accents and luxurious finishes in the decor paper industry has gained popularity in recent times, especially in India. Designers have been infusing gold, silver, and copper tones into patterns that not only make them visually attractive but also induce a sense of lavishness.

Moreover, the trend is extending to textured papers with metallic undertones, providing consumers with a visually appealing experience. These products cater to the growing number of luxurious households across the country.

India's rapidly expanding economy has been drawing both domestic and foreign investment. This has subsequently resulted in an increase in high-net-worth people (HNIs) and ultra-high-net-worth individuals (UHNIs). Consequently, this is driving the industry for luxury houses, simultaneously boosting the demand for decor paper in India.

| Product Type | Value CAGR from 2025 to 2035 |

|---|---|

| Print Base Paper | 5.8% |

| Solid Color | 8.9% |

Based on the product type, the print-based paper segment is anticipated to hold around 45% of the industry share in 2025. This is owing to advancements in printing technology, which have enabled the production of high-quality print-based decor paper with realistic textures and finishes.

Moreover, print-based decor paper is forecasted to lead the demand for decor paper in India throughout the study period driven by its versatility and visual appeal, accounting for about 40% of the industry share by 2035. The notable decline is anticipated in the forecast period due to evolving consumer preferences, technological advancements, and an increasing shift towards customizable and digitally printed solutions.

| Applications | Value CAGR from 2025 to 2035 |

|---|---|

| Low Pressure Laminates | 6.9% |

| High Pressure Laminates | 8.7% |

The low-pressure laminates segment is expected to lead the decor paper industry in India due to its lower cost, ease of manufacture, and a wide range of applications. The market for low-pressure laminates is mainly being driven by the growing demand for affordable and durable solutions across various industries, including furniture, cabinetry manufacturing, and interior design, among others.

Consequently, the segment is poised to generate an incremental opportunity of USD 496.4 million by 2035. Currently, edge banding holds the minimum industry share primarily due to its specific and niche application within the broader decor paper industry. However, edge banding is anticipated to be the rapidly growing segment, expanding at a CAGR of 9.2% until 2035.

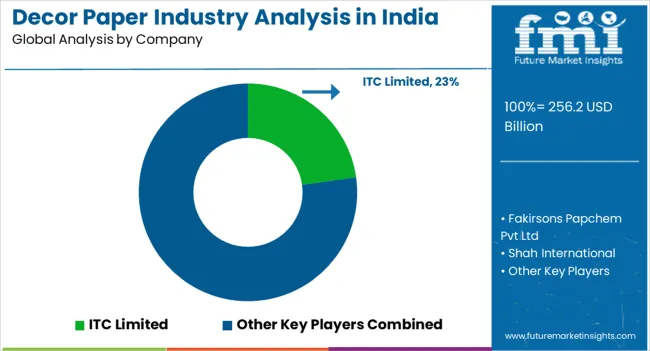

The key manufacturers operating in the Indian decor paper industry are focusing on increasing their production capacity to meet the rising demand for decor paper in India. Moreover, these key players are expanding their product portfolios to cater to the growing demand from urban households. The Indian decor paper industry is highly competitive, with several key players operating in the market.

Key Developments

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 7.2% from 2025 and 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million, Volume in Tonnes and CAGR from 2025–2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis of Decor Paper in India |

| Segments Covered | Product Type, Basis Weight, Application, End Use, Zone |

| Key Companies Profiled | ITC Limited; Fakirsons Papchem Pvt Ltd; Shah International; Ahlstrom-Munksjö Oyj; Felix Schoeller India; Pudumjee Paper Products; Fortune Paper Mills; I.DECOR Exp.Imp Co., Ltd; WestCoast Paper Mills.; Andhra Paper Limited; SILVERTON PULP & PAPERS PVT. LTD.; Toppan Holdings Inc. |

| Customization and Pricing | Available upon Request |

The global decor paper industry analysis in India is estimated to be valued at USD 256.2 billion in 2025.

The market size for the decor paper industry analysis in India is projected to reach USD 498.3 billion by 2035.

The decor paper industry analysis in India is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in decor paper industry analysis in India are print base paper, _white print base, _colour print base, solid colour, shuttering base, liners and pre-printed paper.

In terms of basis weight, 65-80 g/m2 segment to command 44.5% share in the decor paper industry analysis in India in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

India Decorative Veneer Industry Size and Share Forecast Outlook 2025 to 2035

Decor Paper Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Decor Paper Manufacturers

Paper Tubes & Core Industry Analysis in United States Trends, Size, and Forecast for 2025-2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Decorative Laminates Market Growth 2022 to 2032

Glassine Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Europe Retail Paper Bag Market Trends – Growth & Forecast 2023-2033

PE Coated Paper Market Trends & Industry Growth Forecast 2024-2034

Europe Ecommerce Paper Bags Market Analysis – Trends & Forecast 2024-2034

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Barrier Coated Paper Industry Analysis in Europe - Demand, Growth & Future Outlook 2025 to 2035

Japan Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Korea Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Saturated Kraft Paper Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA