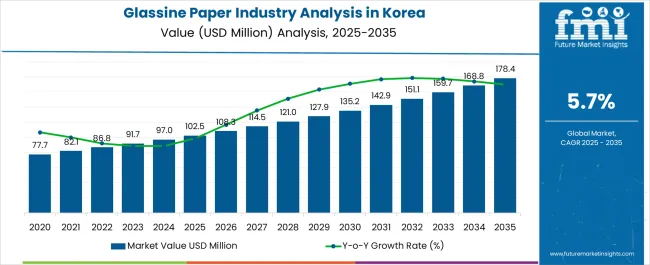

The Glassine Paper Industry Analysis in Korea is estimated to be valued at USD 102.5 million in 2025 and is projected to reach USD 178.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

| Metric | Value |

|---|---|

| Glassine Paper Industry Analysis in Korea Estimated Value in (2025 E) | USD 102.5 million |

| Glassine Paper Industry Analysis in Korea Forecast Value in (2035 F) | USD 178.4 million |

| Forecast CAGR (2025 to 2035) | 5.7% |

The glassine paper industry in Korea is experiencing sustained growth. Increasing demand for sustainable packaging solutions, rising consumer preference for eco-friendly materials, and the expansion of the food and beverage sector are driving market development. Current dynamics are characterized by strong adoption in packaging applications, regulatory support for environmentally responsible materials, and improvements in production efficiency.

Manufacturers are investing in refining processes to enhance paper strength, transparency, and grease resistance while maintaining compliance with food safety standards. The future outlook is shaped by the growing focus on biodegradable and recyclable packaging, expansion of e-commerce, and rising awareness of sustainability among consumers and enterprises.

Growth rationale is underpinned by the versatile applicability of glassine paper across food packaging and industrial applications, consistent improvements in product performance, and strategic distribution through established commercial channels These factors collectively support steady revenue growth, market penetration, and adoption across both traditional and emerging end-use segments.

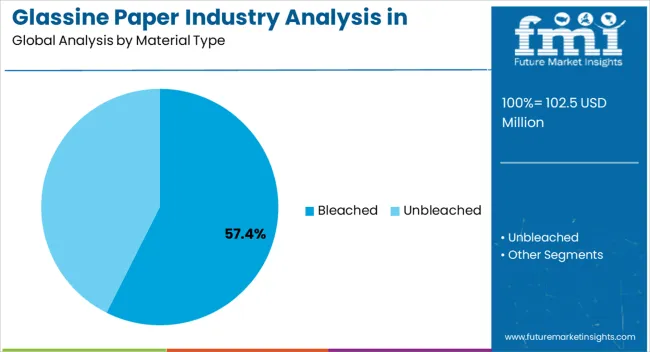

The bleached segment, accounting for 57.40% of the material type category, has emerged as the leading material due to its superior whiteness, smooth surface, and enhanced printability. Its adoption is being supported by widespread use in high-quality packaging and food contact applications.

Product reliability, consistent quality, and compliance with regulatory requirements have strengthened end-user confidence. Manufacturing efficiencies, including improved pulping and bleaching processes, have contributed to stable supply and market preference.

The segment’s growth is further reinforced by increasing demand for premium and hygienic packaging materials in the food and beverage industry Technological innovations aimed at improving grease and moisture resistance are expected to sustain the segment’s market share and ensure its continued dominance within the Korean glassine paper market.

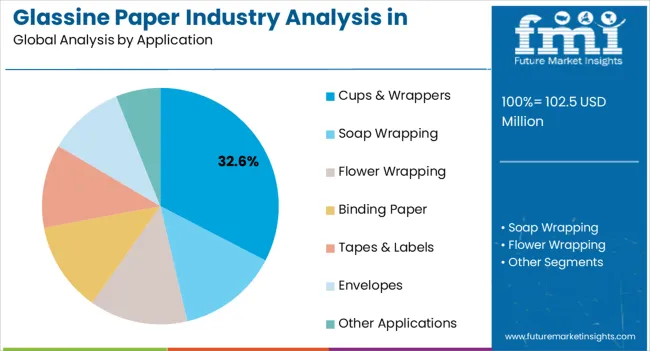

The cups and wrappers application segment, representing 32.60% of the application category, has maintained a leading position due to its extensive use in foodservice packaging and consumer products. Adoption has been facilitated by the material’s grease resistance, food safety compliance, and suitability for printing and branding.

The segment benefits from stable demand driven by coffee shops, bakeries, and packaged food manufacturers. Product performance improvements and enhanced durability have further strengthened market acceptance.

Growth is being supported by increased consumption in urban centers, expansion of food delivery services, and regulatory emphasis on sustainable packaging These factors are expected to sustain the segment’s market share and reinforce its importance within the broader glassine paper industry in Korea.

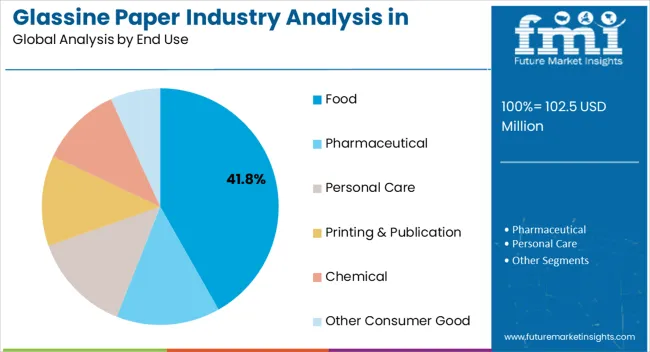

The food end-use segment, holding 41.80% of the end-use category, has been leading due to the critical role of glassine paper in hygienic and protective food packaging. Adoption has been supported by compliance with food safety standards, resistance to grease and moisture, and the ability to enhance product presentation.

Demand stability is reinforced by consistent requirements from restaurants, food processors, and retail outlets. Technological improvements in paper treatment and coating processes have improved performance and longevity, while sustainability initiatives have encouraged wider usage across the food sector.

Continued growth is expected from rising consumer preference for eco-friendly packaging and expansion of the packaged food market The segment’s prominence is anticipated to persist, supporting ongoing market development in Korea.

Substantial presence of a food processing sector in South Gyeongsang province, glassine paper emerges as a prime choice for packaging various food products. Its exceptional resistance to grease and moisture aligns perfectly with the needs of this region, covering seafood, agricultural goods, and traditional Korean foods.

Glassine paper is use in packaging sensitive cosmetic products, such as creams, lotions, or masks, aligns with the requirements of this sector, which emphasizes both functionality and aesthetic appeal. Glassine paper's transparency and printability make it useful in packaging and protecting the province's handmade crafts, art pieces, or specialty products.

The thriving agricultural output of North Jeolla Province, renowned for its rice, fruits, and vegetables, presents an opportunity for leveraging glassine paper. Its protective capabilities against moisture and grease position it as a viable solution for preserving the quality of fresh produce during storage and transportation, driving its potential use in packaging within the agricultural sector.

The demand for packaging materials remains significant in retail and e-commerce. Glassine paper, known for its protective and visually appealing properties, could be used for packaging items sold online or in retail stores across different industries in North Jeolla

Based on material, glassine paper in Korea is likely to be dominated by the bleached segment, with a share of 65.90%. Bleached glassine paper offers a pristine, white appearance, making it visually appealing. This aspect is particularly valuable in industries where product presentation and aesthetics play a significant role, such as cosmetics, high-end food packaging, and luxury goods.

Bleached glassine paper provides an excellent surface for printing. Its smooth and uniform texture allows for vibrant and high-quality printing, making it an ideal choice for brands looking to showcase their logos, designs, or product information prominently. Bleached glassine paper maintains the inherent properties of regular glassine paper, including its grease resistance, moisture resistance, and protective qualities.

| Attribute | Details |

|---|---|

| Material | Bleached |

| Value Share | 65.90% |

Based on end-use, the food segment will likely dominate glassine paper in Korea, with a share of 28.40%. In the food industry, especially for items like bakery products, confectionery, and snacks, maintaining hygiene and freshness is crucial.

The protective qualities of glassine paper helps preserve the quality of these food items. Glassine paper is used in various packaging formats, such as pouches, bags, or wrappers, making it adaptable to different types of food products, both solid and semi-solid.

With the increasing consumer demand for eco-friendly and sustainable packaging options, glassine paper's biodegradability and recyclability make it an appealing choice for food companies aiming to align with these preferences.

| Attribute | Details |

|---|---|

| End Use | Food |

| Value Share | 28.40% |

Industry players in glassine paper in Korea are using mergers & acquisitions as a critical strategy for expanding their geographical presence and for more business in terms of revenue

Product Offering

Seaman Paper Korea specializes in various specialty papers, including glassine paper. They focus on customization and providing tailored solutions to clients in industries such as food packaging, cosmetics, and crafts.

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 102.5 million |

| Projected Industry Size in 2035 | USD 178.4 million |

| Anticipated CAGR between 2025 to 2035 | 5.7% CAGR |

| Historical Analysis of Demand for Glassine Paper in Korea | 2020 to 2025 |

| Demand Forecast for Glassine Paper in Korea | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing Glassine Paper Sales in Korea, Insights on Global Players and their Industry Strategy in Korea, Ecosystem Analysis of Local Providers in Korea |

| Key Province Analyzed while Studying Opportunities Glassine Paper in Korea | South Gyeongsang, North Jeolla, South Jeolla, Jeju, Rest of Korea |

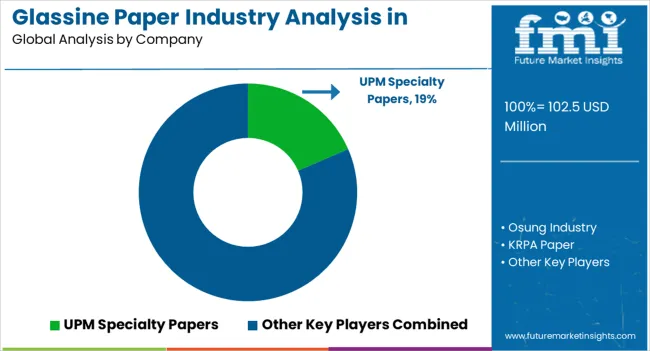

| Key Companies Profiled | Osung Industry; UPM Specialty Papers; KRPA Paper; Metsa Tissue; Riverside Paper; Glassine Canada Inc.; Nippon Paper Industries; Glatfelter Corporation; Singhvi Foils; Lintec Corp |

The global glassine paper industry analysis in Korea is estimated to be valued at USD 102.5 million in 2025.

The market size for the glassine paper industry analysis in Korea is projected to reach USD 179.0 million by 2035.

The glassine paper industry analysis in Korea is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in glassine paper industry analysis in Korea are bleached and unbleached.

In terms of application, cups & wrappers segment to command 32.6% share in the glassine paper industry analysis in Korea in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glassine Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Korea Barrier Coated Paper Market Growth – Trends & Forecast 2023-2033

Glassine Paper Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Glassine Paper Industry

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Decor Paper Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Paper Tubes & Core Industry Analysis in United States Trends, Size, and Forecast for 2025-2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Europe Retail Paper Bag Market Trends – Growth & Forecast 2023-2033

Korea Multihead Weigher Market Insights – Growth & Forecast 2024-2034

PE Coated Paper Market Trends & Industry Growth Forecast 2024-2034

Korea Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Korea Probiotic Supplement Industry – Industry Insights & Demand 2025 to 2035

Korea Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Korea Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Europe Ecommerce Paper Bags Market Analysis – Trends & Forecast 2024-2034

Korea Low Rolling Resistance Tire Market Growth – Trends & Forecast 2023-2033

Korea Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA