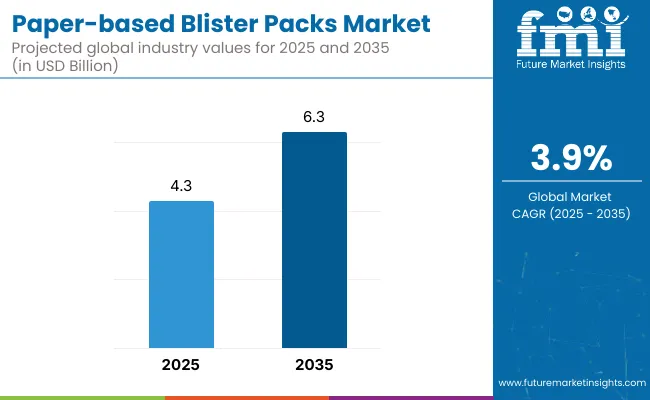

The paper-based blister packs market is projected to grow from USD 4.3 billion in 2025 to USD 6.3 billion by 2035, adding a total of USD 2.0 billion over the ten-year span. This reflects a 46.5% overall growth, with the market expanding at a compound annual growth rate (CAGR) of 3.9%. By the end of the forecast period, the market will have grown by a 1.4 multiple.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.3 billion |

| Industry Value (2035F) | USD 6.3 billion |

| CAGR (2025 to 2035) | 3.9% |

During the first half of the decade (2025-2030), the market rises from USD 4.3 billion to USD 5.1 billion, contributing USD 0.8 billion, or 40.0% of the total decadal expansion. Growth is primarily driven by the pharmaceutical and nutraceutical sectors, as companies respond to mounting pressure to replace plastic-aluminum combinations with eco-friendly formats. Child-resistance, product visibility, and compatibility with existing forming and sealing lines remain key design focuses.

In the second half of the decade (2030-2035), the market advances from USD 5.1 billion to USD 6.3 billion, adding USD 1.2 billion, which makes up 60.0% of the total growth. This phase experiences accelerated adoption across regulated markets in Europe and North America, supported by tightening Extended Producer Responsibility (EPR) laws and circular economy mandates. Technological advancements enable barrier-coated paper substrates that rival traditional plastic films in moisture resistance and shelf life, further boosting uptake in over-the-counter (OTC) and medical device applications.

From 2020 to 2024, the paper-based blister packs market grew from USD 310 million to USD 590 million, driven by hardware-centric adoption in sustainable packaging applications across personal care, nutraceuticals, and OTC pharmaceuticals. During this period, the competitive landscape was dominated by packaging machinery and substrate manufacturers controlling nearly 70% of revenue, with leaders such as Ecobliss Packaging Group, Huhtamaki, Syntegon Technology GmbH, and Van de Velde Packaging focusing on recyclable, thermoformable cellulose-based alternatives to plastic-heavy formats.

Competitive differentiation relied on formability, barrier properties, and compatibility with existing blister lines, while digital tracking or compliance layers were often bundled as auxiliary offerings rather than standalone revenue streams. Service-based models, such as sustainability consulting or contract packaging support, contributed less than 10% of the total market value during this phase.

Demand for paper-based blister packs will expand to USD 5.1 billion in 2030, and the revenue mix will shift as digital integration, compliance assurance, and sustainability services grow to over 40% share. Traditional packaging providers face rising competition from eco-innovation firms offering fiber-based barrier coatings, AR-enabled traceability, and closed-loop packaging models. Major hardware vendors are pivoting to hybrid models, integrating low-carbon material sourcing, digital print-on-demand platforms, and smart anti-counterfeit features to retain relevance.

Emerging entrants such as Atlantic Corporation, Scafa Thermoforming GmbH, r-pac International, Romaco Group, and Paperfoam are gaining share by specializing in mono-material compliance packs, biodegradable designs, and region-specific sustainability certifications. The competitive advantage is moving away from material substitution alone to full-package traceability, circular economy integration, and recurring revenue via eco-compliant packaging services.

Rising environmental concerns and regulatory pressures against single-use plastics are driving the growth of the paper-based blister packs market. These packs provide a sustainable alternative to traditional PVC- or PET-based blister formats by using recyclable or compostable paper substrates, often combined with thin barrier coatings. The push for eco-friendly primary packaging in pharmaceuticals, consumer goods, and personal care is accelerating industry adoption of fiber-based blister solutions.

Monomaterial paper blister formats have gained popularity due to their compatibility with existing form-fill-seal machines and ability to meet recyclability guidelines in key markets such as Europe and North America. Innovations in water-based and bio-based barrier coatings have improved moisture and oxygen resistance, making these packs suitable for sensitive formulations such as tablets, supplements, and skincare products.

Industries such as healthcare, nutraceuticals, and ethical cosmetics are driving demand for low-carbon, plastic-free packaging that supports circular economy initiatives. These packs reduce environmental impact, comply with extended producer responsibility (EPR) schemes, and enhance consumer perception through minimalistic, paper-forward aesthetics.

Segment growth is expected to be led by thermoformable paperboard materials, over-the-counter drug packaging in end-use categories, and recyclable barrier-coated packs due to their regulatory compliance, shelf-stability performance, and alignment with brand sustainability goals.

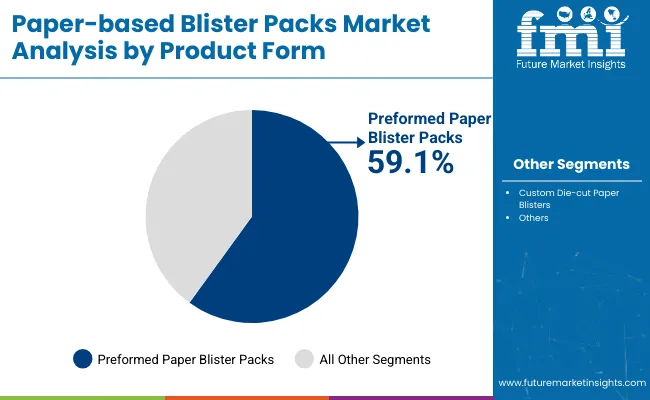

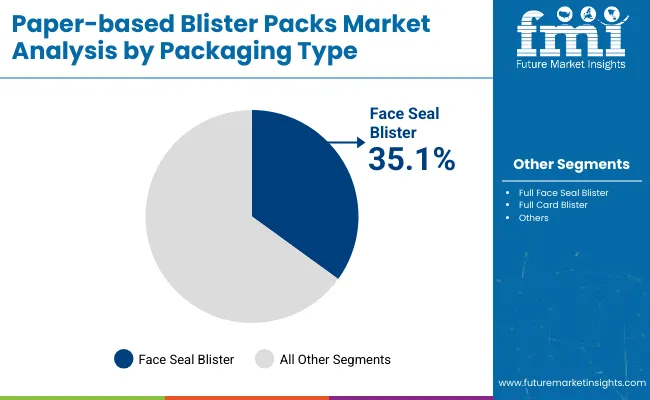

The market is segmented by product form, packaging type, end-use industry, and region. Product form includes preformed paper blister packs and custom die-cut paper blisters, offering versatility for standard and tailored packaging solutions with reduced plastic usage. Packaging type segmentation comprises face seal blister, full face seal blister, full card blister, and trapped blister, each providing varying levels of product visibility, protection, and environmental performance.

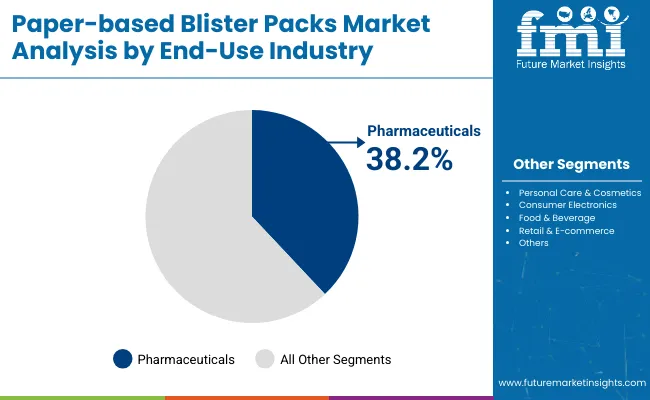

End-use industries include healthcare & pharmaceuticals, personal care & cosmetics, consumer electronics, food & beverage, and retail & e-commerce, reflecting widespread adoption of eco-friendly packaging alternatives across regulated and consumer-facing sectors. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The preformed paper blister packs segment is projected to account for the highest share of 59.1% in 2025, reflecting growing industry preference for ready-to-fill sustainable packaging. These preformed formats offer enhanced rigidity, barrier control, and sealing performance making them ideal for automated production lines in the pharmaceutical and personal care sectors.

Unlike thermoformable paper-based formats, preformed blisters reduce process time, lower machine calibration needs, and provide consistent structural strength. With brands demanding plastic-alternative blister solutions that still meet regulatory shelf-life and labeling standards, preformed designs offer a viable bridge between eco-responsibility and performance.

Manufacturers are innovating with water-based coatings and barrier laminates that enhance moisture and oxygen resistance without compromising recyclability. As demand for renewable, recyclable, and compostable primary packaging accelerates, preformed paper blister packs are positioned as a high-performance, scalable solution.

The pharmaceuticals segment is projected to lead the end-use industry category, accounting for a 38.2% market share in 2025. This leadership is driven by mounting global pressure on pharmaceutical companies to reduce plastic use in primary packaging while complying with child-resistance and product integrity standards.

With blister packaging being widely used for tablets, capsules, and unit-dose formats, paper-based alternatives offer a compliant yet eco-conscious option. Brands such as Pfizer, Bayer, and GSK are exploring recyclable and fiber-based blister designs to meet 2030 sustainability pledges and align with EU Packaging and Packaging Waste Directive (PPWD) targets.

Paper blister packs support serialization and traceability, essential for anti-counterfeiting and regulatory adherence. As healthcare shifts toward responsible manufacturing and ESG compliance, paper-based blister packaging is emerging as a strategic enabler for sustainable growth in the pharmaceutical supply chain.

The face seal blister segment is expected to account for the highest share of 35.1% in 2025 in the paper-based blister packs market. This dominance is primarily driven by the format’s simple construction, which utilizes a paperboard backing sealed with a thin layer of blister plastic, offering an optimal balance between product visibility and eco-consciousness.

With the rise in sustainable packaging mandates across regions like Europe and North America, brands are increasingly turning to face seal designs that reduce plastic usage without compromising product security.

Face seal blister packs are widely adopted in over-the-counter pharmaceuticals, stationery, electronics accessories, and personal care sectors.

Recyclability limitations and forming challenges slow down mainstream adoption, even as demand accelerates in pharmaceuticals, nutraceuticals, and consumer goods for plastic-free, eco-conscious blister packaging aligned with circular economy and regulatory targets.

Sustainability-driven Demand Across Pharmaceuticals and CPG Sectors

Paper-based blister packs are gaining traction as brands seek to eliminate plastic from their secondary and primary packaging, especially in regulated sectors such as pharmaceuticals, nutraceuticals, and health supplements. These packs offer an eco-friendly alternative to PVC- or PET-based blisters, aligning with global initiatives to reduce landfill waste and carbon emissions.

With rising consumer preference for sustainable packaging and corporate ESG mandates tightening, companies are shifting toward paper solutions that maintain product protection while reducing environmental impact. In over-the-counter (OTC) products and wellness formulations, paper blisters enhance shelf appeal, biodegradability, and ease of disposal making them a favored option among retailers and brand owners alike.

Barrier Limitations and Production Complexity

Despite strong environmental appeal, paper-based blister packs face technical barriers in terms of barrier performance and thermoformability. Achieving moisture, oxygen, and light resistance comparable to plastic requires additional coatings or laminate layers, which may compromise recyclability or increase production complexity. Converting paper into durable, formable cavities that retain structural integrity under pressure poses engineering challenges. Customizing blister dies, heat-sealing processes, and coating compatibility also raises operational costs for converters and contract packaging organizations. These constraints limit scalability and deter adoption in high-speed manufacturing environments where plastic blister lines are already optimized and validated.

Mono-material Blister Innovations and Regulatory Momentum

A growing trend in this market is the development of mono-material paper blisters with advanced barrier coatings that enable recyclability without sacrificing product integrity. Manufacturers are investing in aqueous or biodegradable barrier films to meet EU directives, Extended Producer Responsibility (EPR) rules, and voluntary zero-waste targets. Simultaneously, brands are piloting hybrid packs using recyclable paper backings with minimal plastic lidding, paving a transition path toward full-paper formats. As pharmaceutical and consumer goods companies respond to global plastic bans and green labeling demands, paper-based blister packs are evolving into a strategic differentiator for eco-conscious product launches.

The global paper-based blister packs market is gaining strong momentum across pharmaceutical, nutraceutical, and consumer goods segments due to its alignment with plastic reduction mandates and sustainable packaging goals. Recyclability, biodegradability, and compatibility with existing filling infrastructure are making paper-based alternatives increasingly viable.

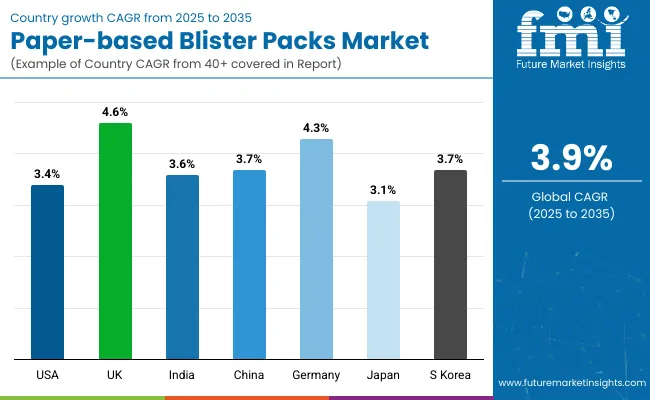

Europe is at the forefront of adoption, with the UK and Germany driving regulatory and brand-led innovation. In Asia-Pacific, China and South Korea are scaling up trials across FMCG and OTC sectors, while India mirrors similar growth due to price-competitive adoption in rural healthcare and generic medicines. The USA market is also expanding steadily, especially in retail blister packaging and eco-friendly consumer products.

The paper-based blister packs market in the United States is projected to grow at a CAGR of 3.4% between 2025 and 2035. Growth is driven by rising demand for plastic alternatives across pharmaceuticals, dietary supplements, and retail electronics. Sustainability commitments from major CPG companies and pressure from state-level plastic bans are accelerating the transition toward recyclable paper formats. Retailers are increasingly demanding FSC-certified, fiber-based blister solutions for shelf-ready displays.

The paper-based blister packs market in the United Kingdom is expected to grow at a CAGR of 4.6%, driven by Extended Producer Responsibility (EPR) legislation, plastic packaging tax enforcement, and consumer demand for low-waste solutions. Both pharmaceuticals and personal care brands are actively shifting to thermoformed paper solutions compatible with existing filling lines. Brands are also integrating cellulose coatings and barrier papers to maintain product integrity.

India’s paper-based blister packs market is forecast to grow at a CAGR of 3.6%, supported by low-cost manufacturing, government plastic phase-out programs, and rising demand in the rural pharmaceutical sector. Paper-based formats are gaining traction in generic medicine blistering, personal care samples, and unit-dose nutraceuticals. Indian converters are scaling cellulose barrier tech to enable cost-effective volume production.

The paper-based blister packs market in China is projected to grow at a CAGR of 3.7%, driven by national sustainability targets, e-commerce packaging innovation, and expanding use in consumer electronics. Large domestic brands are switching to paper-blister formats to align with China’s green packaging guidelines. Packaging OEMs are also scaling heat-sealable paperboard compatible with food contact and pharma use.

Germany’s paper-based blister packs market is expected to grow at a CAGR of 4.3%, driven by early adoption in pharma and fast-moving consumer goods (FMCG). Stringent EU directives on single-use plastics and high recycling benchmarks are accelerating demand. Packaging manufacturers are offering thermoformed paperboard solutions with PET-free sealing for mono-material compliance. German pharma players are launching blister compliance packs for elderly care using fully paper-based alternatives.

Japan’s paper-based blister packs market is forecast to grow at a CAGR of 3.1%, supported by innovations in barrier-coated fiber substrates and demand for compact, shelf-stable packaging in wellness and OTC products. Cultural emphasis on minimalism and rising interest in recyclable formats are influencing transitions across convenience and pharmacy retail sectors. Domestic packaging firms are developing hybrid models with paper outer shells and reduced plastic linings.

The paper-based blister packs market in South Korea is expected to grow at a CAGR of 3.7%, fueled by strong government push for plastic-free retail packaging and innovation in K-beauty and healthcare sectors. South Korean brands are investing in FSC-certified paperboard systems that offer aesthetic appeal and structural integrity for high-end products. Paper blisters are being integrated with transparent cellulose films to retain visibility and protection.

The paper-based blister packs market is moderately fragmented, with global packaging leaders, process-focused engineering firms, and eco-design specialists competing across pharmaceutical, nutraceutical, electronics, and personal care segments.

Global leaders such as Huhtamaki, Syntegon Technology GmbH, and Romaco Group hold significant market share, driven by their integration of renewable substrates, thermoformable fiber technologies, and blister sealing automation. Their strategies increasingly emphasize plastic replacement, circularity-driven design, and compliance with EU single-use plastic bans and pharmaceutical stability standards.

Established mid-sized players, including Ecobliss Packaging Group, Atlantic Corporation, and Van de Velde Packaging, are advancing adoption through hybrid pack formats combining molded fiber or paper-laminate shells with recyclable barrier films. These players cater to OTC pharma, small electronics, and consumer goods segments with high-speed form-fill-seal capabilities and carton-compatible secondary packaging.

Specialized providers such as Scafa Thermoforming GmbH, r-pac International, and Paperfoam focus on low-carbon, biodegradable blister solutions for eco-conscious brands and regional applications. Their core strength lies in proprietary paper-foam and pulp-based blends, compostable product lines, and customized tooling services for emerging natural beauty, supplements, and lifestyle packaging markets.

Competitive differentiation is shifting away from plastic thermoformers toward integrated fiber-based blister systems that combine monomaterial formats, heat-seal compatibility, consumer-friendly unboxing, and verified compostability or recyclability in alignment with ESG mandates and brand sustainability targets.

Key Development of Paper-based Blister Packs Market

| Item | Value |

|---|---|

| Quantitative Units | USD 4.3 billion |

| Product | Perforated Paper Blister, Custom Die-cut Paper Blister |

| Packaging Type | Face Seal, Full Face Seal, Full Card Blister, Trapped Blister |

| End-use Application | Pharmaceuticals, Personal Care and Cosmetics, Consumer Electronics, Food and Beverages and E-commerce |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | Ecobliss Packaging Group, Huthamaki Oyj, Atlantic Corpoaration, Romaco Group, Scafa Thermoforming, r-pac international |

| Additional Attributes | Market segmentation by product, packaging type, end-use application, packaging format and design analysis, pricing analysis, customer identification, competitive analysis, trade data and regulations |

The global paper-based blister packs market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the paper-based blister packs market is projected to reach USD 6.3 billion by 2035.

The paper-based blister packs market is expected to grow at a CAGR of 3.9% between 2025 and 2035.

The key product types in the paper-based blister packs market include preformed paper blister packs, press-through packs, sustainable push-through packs, and folded card blister packs.

In terms of product type, the preformed paper blister packs segment is expected to account for the highest share of 59.1% in the paper-based blister packs market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blister Card Market Analysis by Product Type, Technology Type, Material Type, End-use Industry, and Region Forecast Through 2035

Blister Paper Market

Blister Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Blister Packaging Companies

Deblistering Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Leading Deblistering Machine Providers

USA Blister Packaging Market Trends – Demand & Growth 2025-2035

PVC Blister Packs Market

Japan Blister Packaging Market Trends – Demand & Growth 2025-2035

Welded Blisters Market Size and Share Forecast Outlook 2025 to 2035

Pharma Blister Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Pharma Blister Packaging Machines Industry Share

Leading Providers & Market Share in Pharma Blister Packaging

Carded Blister Packaging Market

Alu-PVC Blister Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sliding Blister Packaging Market Size and Share Forecast Outlook 2025 to 2035

Alu Alu Blister Packaging Machine Market Insights - Trends & Forecast 2025 to 2035

Understanding Market Share Trends in Alu-Alu Blister Packaging Machines

Germany Blister Packaging Market Size – Demand & Growth 2025-2035

Global Medicine Blister Market Analysis – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA