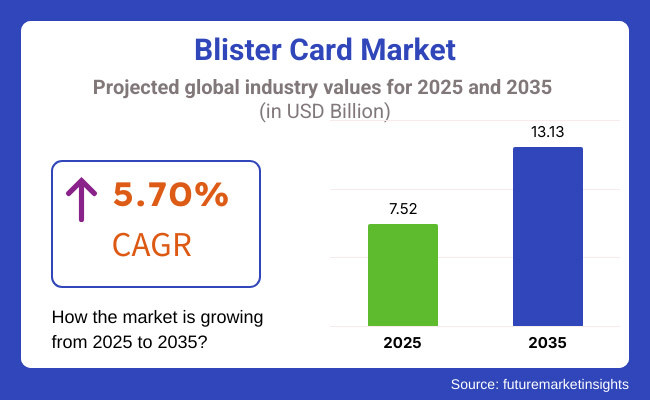

The blister card market is anticipated to be valued at USD 7.52 billion in 2025. It is expected to grow at a CAGR of 5.70% during the forecast period and reach a value of USD 13.13 billion in 2035.

A blister card is a packaging option with a transparent plastic blister welded onto a printed cardboard backing, utilized for safely showcasing and safeguarding pharmaceuticals, electronics, toys, and personal care items. It provides greater product visibility, brand awareness, and security from contamination, theft, and damage, improving shelf life in retail outlets.

Growth in the market for blister cards is induced by the increasing need for tamper-proof packaging of drugs, guaranteeing product safety and regulatory compliance, and growing retail markets, which demand inexpensive, light, and attractive packaging. These factors contribute to increased adoption, enhancing product security, branding, and extended shelf life in various industries.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry expanded with rising demand in the pharmaceutical, consumer electronics, and retail sectors where this packaging was necessary to guard products, beautify displays, and reinforce brands. | While demand will remain high, it will increasingly focus on sustainable and recyclable materials and demand a large variety of fiber-based and biodegradable materials. |

| Plastic-based solutions remained most sought after because they were inexpensive, durable, and provided safe, tamper-proof protection for fragile items. | Traditional plastic blister packaging will decline as laws prompt the quest for eco-friendly options, meaning higher use of paperboard-based and compostable materials for blister packaging. |

| Branding and beauty played a critical role in consumer purchasing decisions, with firms paying for quality prints and artistic work. | Packaging innovation will be focused on sustainability and interactivity, with companies integrating smart packaging technologies and QR codes to improve consumer engagement. |

| Regulatory measures regarding plastic waste and recycling were on the rise but not strictly applied, resulting in a gradual transition towards sustainable packaging. | Government policies will tighten, imposing extended producer responsibility (EPR) rules and demanding increased recyclability and lower plastic content. |

| The pharmaceutical industry was a key driver of demand for blister cards, driven by the need for secure, tamper-evident, and single-dose packaging solutions. | Medication blister packaging will remain a need but will face a shift in the direction of eco-friendly blister packs that can be recycled and biodegraded to align with global sustainability practices. |

| The development of e-commerce generated increased need for protective and safe blister packaging, which ensured product safety in transit. | E-commerce packaging will feature more environmentally friendly solutions, with companies exploring compostable blister packs and reusable packaging systems to minimize waste. |

| Cost was the overriding consideration in material choice, with most producers favoring cost over sustainability. | Sustainable blister cards will become increasingly cost-competitive as material technology innovations and more regulatory pressure to eliminate non-recyclable plastics come into place. |

| Recycling was still problematic owing to the mix of materials in conventional packages, which complicated separation and processing. | Circular economy models will drive innovation, with new designs allowing for effortless separation of materials, increasing recycling efficiency, and facilitating closed-loop production systems. |

Eco-Conscious and Smart Packaging Transforming the Market

The market is changing fast with brands focusing on sustainability and intelligent packaging solutions. Brands actively substitute conventional plastic with biodegradable materials, recycled paperboard, and plant-based coatings to cater to increasing eco-friendly demands. Consumers are looking for blister cards that use less plastic, easy recycling and compostable material, and businesses have been using alternative packaging solutions.

Interactive technologies like QR codes, NFC tags, and augmented reality are creating broader consumer engagement opportunities through interactive product information, digital loyalty programs, and authenticity verification. All these diminish the environmental footprint and give brands competitive advantage in an environmentally driven marketplace.

Personalization and High-Impact Design Driving Consumer Appeal

Customization and impactful visuals transform the market with brands concentrating on building consumer experience with design innovation. Brands add dramatic graphics, embossed finishes, and holographic effects to deliver visually dramatic packaging that is impossible to ignore.

Personalization continues to escalate with brands able to customize packaging with localized messaging, special color treatments, and sole limited-edition designs. Companies also test ergonomic blister designs for convenient access and enhanced functionality, providing both beauty and convenience to users. Through the integration of creativity with consumer-oriented design, companies reinforce their market positions and create stronger customer relationships.

| Attributes | Details |

|---|---|

| Top End-use Industry | Pharmaceuticals |

| Market Share in 2025 | 40.1% |

The market is heavily dominated by the pharmaceutical industry, which is expected to hold a 40.1% market share in 2025. The growing need for unit-dose packaging, tamper-evident solutions, and longer shelf life is stimulating the use of blister cards. Stringent regulatory requirements also contribute to their utilization in prescription as well as over-the-counter medications.

Pharmaceutical manufacturers prefer blister card packaging due to its cost-saving, patient compliance advantages, and contamination protection. Advances in child-resistant, elderly-friendly, and environmentally friendly blister packs are also driving demand further. The growth in self-medication patterns and e-pharmacies is also driving demand for safe and informative packaging solutions, further solidifying the dominance of the segment.

According to FMI research, the sector is dominated by two major types of products: clamshell and carded packaging. Clamshell packs are preferred for their durability, excellent visibility of the product, and strong sealing characteristics. Clamshell packaging serves the purpose of electronic goods, consumer goods, and retail packaging applications, protecting against tampering and external damage.

Carded packs find a wider spectrum of uses in pharmaceuticals, personal care, and food products. They offer cost-effective and lightweight solutions while being customizable, making them suitable for unit-dose medication and small consumer products. Greater branding potential and environmentally friendly designs have also increased their demand, especially in sustainable and recycling-based packaging trends.

The industry is driven by two key technologies: cold forming and thermoforming. Cold forming is considered the best-forming technology in terms of barrier properties against moisture, oxygen, and light. Therefore, sensitive medicines have a longer shelf life but at a higher cost. Unfortunately, limited design flexibility accompanies it.

Thermoforming is also very popular and, of course, cost-effective and versatile in design. It's the most common method among pharmaceuticals, consumer goods, and food packaging industries. Its transparency permits clear visibility of the product, is lightweight, and facilitates easy adaptation to changing requirements; hence the most preferred for high-volume production which requires efficiency in material.

| Country | CAGR |

|---|---|

| India | 7.9% |

| China | 7.3% |

| Germany | 6.5% |

| Australia | 5.9% |

| USA | 5.6% |

| India | 7.9% |

India to Lead the Market with Strong Growth

India is expanding rapidly, driven by the booming pharmaceutical sector and increasing demand for secure and tamper-proof packaging. The country’s growing healthcare infrastructure, rising chronic disease cases, and government initiatives to regulate packaging standards are major drivers boosting the demand for blister card packaging at a 7.9% CAGR.

The rise of eCommerce and organized retail in India is further accelerating market growth, as brands require visually appealing and durable packaging. Additionally, sustainability trends are influencing manufacturers to adopt eco-friendly and recyclable blister cards, aligning with India's environmental policies and consumer preferences for sustainable packaging solutions.

China’s Market to Benefit from Pharmaceutical and Consumer Goods Growth

China’s rapid urbanization and growing pharmaceutical industry are key factors driving the market, which is expected to grow at a 7.3% CAGR. The increasing demand for over-the-counter (OTC) drugs, dietary supplements, and personal care products is pushing manufacturers to invest in high-quality blister packaging to ensure product safety and extended shelf life.

The growth of China’s eCommerce sector is driving demand for packaging that offers durability and tamper resistance for shipped products. Government regulations on product safety and anti-counterfeiting measures are also pushing businesses to adopt innovative solutions, strengthening China’s position in the market.

Germany Expand with Sustainable Packaging Innovations

Germany is growing at a 6.5% CAGR, driven by the country’s strong pharmaceutical and medical device industries. With stringent regulations for safe and tamper-evident packaging, pharmaceutical companies are increasingly adopting blister packaging to meet compliance standards while ensuring consumer protection.

Sustainability is a major driver, as Germany leads in eco-friendly packaging innovations. The push for recyclable and biodegradable blister cards is transforming the market, with companies investing in sustainable materials to reduce plastic waste. Additionally, the expansion of the cosmetics and consumer electronics sectors is further fueling demand for packaging.

Australia Driven by Healthcare and Retail Demand

Australia is experiencing steady growth at a 5.9% CAGR, fueled by rising healthcare awareness and an aging population. The demand for secure and user-friendly pharmaceutical packaging is increasing, prompting pharmaceutical companies to adopt for better medication management and dosage accuracy.

Additionally, the retail and FMCG (Fast-Moving Consumer Goods) sectors are driving the demand for blister packaging. The growing preference for convenient and visually appealing packaging in supermarkets and pharmacies is encouraging manufacturers to innovate. The shift toward sustainable materials are also gaining traction, in line with Australia's environmental regulations.

The USA Witness Growth with Regulatory and Retail Developments

The USA is seeing increased demand in packaging due to strict FDA regulations for pharmaceutical packaging. The market is expected to grow at a 5.6% CAGR, driven by rising consumption of prescription and OTC drugs, along with growing concerns about child-resistant and senior-friendly packaging.

Additionally, the expansion of eCommerce and retail industries is accelerating demand for secure and tamper-proof packaging. Blister cards are widely used in consumer electronics, personal care products, and small hardware items. Sustainability initiatives are also pushing manufacturers to develop recyclable blister packaging, aligning with the USA focus on eco-friendly solutions.

The blister card industry is fragmented. Leading companies such as Amcor, Berry Global, and Sealed Air dominate the sector, offering diverse packaging solutions across various industries. These firms continuously innovate, focusing on sustainable materials and advanced technologies to meet evolving consumer demands.

The pharmaceutical industry plays a major role in driving demand, using transparent packaging designs that display detailed drug information for informed consumers. Similarly, the electronics sector relies on this packaging for small components like USB drives, ensuring protection and visibility.

Sustainability trends are shaping the market, with companies adopting eco-friendly materials and production methods. For example, Teijin introduced Tesliner, a thin, flexible material that provides a lightweight and user-friendly packaging solution.

Despite market fragmentation, leading players maintain their positions through continuous innovation, strategic partnerships, and responsiveness to consumer demands. The focus on sustainability and advanced packaging solutions indicates a dynamic and evolving industry landscape.

The blister card market is expanding due to rising demand for effective packaging solutions across various industries. This growth is driven by the need for secure and visually appealing packaging that enhances product visibility and consumer trust.

Sustainability concerns are prompting manufacturers to adopt eco-friendly materials and innovative designs. Companies are increasingly using recycled materials and incorporating features like QR codes and RFID tags to improve product tracking and reduce environmental impact.

The market is highly competitive, featuring key players such as Amcor, Berry Global, Sealed Air, and Teijin. These companies focus on technological advancements and strategic partnerships to maintain their market positions and meet evolving consumer demands.

The market continues to evolve as companies focus on cost efficiency, durability, and consumer convenience. Customization and branding play a crucial role in attracting buyers, leading manufacturers to offer visually appealing and functional packaging solutions. The growing emphasis on anti-counterfeiting measures also influences design choices, ensuring product authenticity and security.

The market is segmented by product type into clamshell and carded.

Based on the technology type, the market is segmented into cold forming technology and thermoforming technology.

The market are categories based on material type, including plastic, aluminum, paper & paperboard, and others.

Based on end-use industry, the market is segmented into food, pharmaceuticals, veterinary & nutraceuticals, medical devices, electronics & electricals, industrial goods, and consumer goods.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

The market is anticipated to reach USD 7.52 billion in 2025 and grow to USD 13.13 billion by 2035.

The future prospects of product sales are strong, driven by increasing demand for tamper-proof packaging, sustainability trends, and expanding retail sectors.

Key product manufacturers include Amcor, Berry Global, Sealed Air, Teijin, Rohrer Corp, and SupplyOne, Inc.

The Asia-Pacific region, particularly India and China, is expected to generate lucrative opportunities for market players due to rapid industrialization and a growing pharmaceutical sector.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 16: Global Market Attractiveness by Type, 2024 to 2034

Figure 17: Global Market Attractiveness by Application, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 34: North America Market Attractiveness by Type, 2024 to 2034

Figure 35: North America Market Attractiveness by Application, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carded Blister Packaging Market

Cardiac Rehabilitation Market Size and Share Forecast Outlook 2025 to 2035

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Blister Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Monitoring And Cardiac Rhythm Management Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Surgical Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Rhythm Management Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Valvulotome Market Size and Share Forecast Outlook 2025 to 2035

Cardamom Oil Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular Prosthetic Devices Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Ambulatory Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Carded Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cardiometabolic Drugs Market Size and Share Forecast Outlook 2025 to 2035

Cardboard Flask Market Size, Share & Forecast 2025 to 2035

Cardboard Crates Market Size and Share Forecast Outlook 2025 to 2035

Cardiac Rhythm Remote Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA