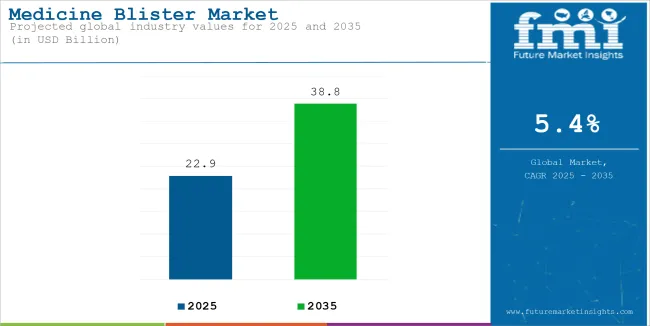

The global medicine blister market is estimated to account for USD 22.9 billion in 2025. It is anticipated to grow at a CAGR of 5.4 % during the assessment period and reach a value of USD 38.8 billion by 2035.

| Attributes | Description |

|---|---|

| Estimated Global Medicine Blister Market Size (2025E) | USD 22.9 billion |

| Projected Global Medicine Blister Market Value (2035F) | USD 38.8 billion |

| Value-based CAGR (2025 to 2035) | 5.4% |

Medication blister packs are a specialized form of packaging designed to securely hold individual doses of medication. These packs consist of small, pre-formed plastic cavities, often made from thermoformed materials, which contain pills or capsules. Each cavity is sealed with a backing, typically foil or film, ensuring that the medication remains protected until it is needed.

Blister packing is a sort of pharmaceutical package that is more specialized and mainly tailored for unit doses, such as tablets and capsules. This packing is made out of a plastic cavity series prefabricated using materials like PVC and PET, among others, hence holding individual single doses securely.

Additionally, these blister packs provide effective barrier protection against moisture and light, which can degrade medications over time.

Growing Demand for Unit-Dose Packaging

The primary drivers behind the medicine blister market are that more and more consumers and providers prefer unit doses. Blister packs make drugs easily dispensed and help a patient manage a series of dosages on a daily, weekly, monthly, or sometimes even yearly schedule.

This improved adherence to drugs since it properly organizes and dispenses medicine according to required doses, helping complex regimens patients adhere to. The shift from traditional bottles to blister packs reflects a broader trend towards more user-friendly packaging solutions that prioritize patient safety and compliance.

Regulatory Compliance and Safety Standards

Regulation and legal compliance will also determine the market of blister packaging. The government and healthcare institutions focus more on the aspects of tamper-evident and child-resistant packaging for greater safety. The Poison Prevention Packaging Act in the USA, for example, requires pharmaceutical products to have child-resistant features in their packaging.

As a result, pharmaceutical companies will use more blister packaging, as this solution can provide better safety features in terms of protecting the contents from contamination and degradation.

Technological Advancements in Packaging

Innovations in packaging technology are also advancing the medicine blister market. The integration of smart technologies into blister packs increases user experience and can prompt dose reminders and temperature indicators.

This also contributes to consumer convenience, a growing need for consumers because digital solutions are fast becoming part of healthcare delivery. As manufacturers continue to investigate new technologies, the demand for blister packaging is expected to grow even stronger, moving this industry forward.

Environmental Concerns and Packaging Waste

A major limiting factor for the medicine blister market is the rising concern over environmental sustainability and packaging waste. The more people are aware of the environmental issues, the more critical they become about the packaging materials used in the pharmaceutical industry.

Packaging materials, mostly plastics, and aluminium, contribute to waste that cannot be recycled easily. This has raised the need for more sustainable packaging solutions that do not leave deep footprints in the environment. The regulatory bodies in different regions are imposing tougher regulations on waste plastic, and this may force the manufacturers to alter their packaging plans.

Additionally, along with the pressure to adhere to these standards, it is likely that cost and production process complexity will increase, so the blister packaging market growth is going to slow down. Consumers and healthcare providers will look for greener options, and the industry will face the challenge of functionality versus responsibility for the environment.

Integration of Smart Packaging Technologies

One of the important trends in medicine blister packs is that of smart packaging technology. Such an innovation addresses user interaction with a product to improve medication management, through aspects such as information that the package may provide concerning the product itself.

Smart blister packs can thus have elements, for example, QR codes, NFC chips, or sensors that can monitor conditions including temperature and humidity. By doing so, these packs can notify the user of any change that may affect the drug's efficacy or safety. The growing demand for smart packaging goes in line with the increasing need for personalized healthcare solutions.

For instance, some smart blister packs may be connected to mobile applications, which remind the patients when they have to take their medications, record adherence, or inform their respective healthcare providers if any doses are missed. This technology not only improves patient compliance but also empowers individuals to take on an active role in managing their health.

Rise of Eco-Friendly Packaging Solutions

The major mega-consumer trend in medicine blister markets is the rise in demand for green packaging solutions. With environmental sustainability becoming a concern for consumers, the pharmaceutical industry responds by seeking packaging that reduces the impact on ecosystems.

This trend arises from a growing and rising awareness of plastic waste's negative effect on the environment and the need to be more sustainable for all industrial applications.

Moreover, consumers are increasingly becoming brand loyal to companies that care about the environment. Eco-friendly blister packaging will rise in brand loyalty and attract more environmentally conscious customers. As pharmaceutical companies realize the significance of sustainability in their operations, the trend toward eco-friendly packaging is expected to accelerate, influencing future developments in the medicine blister market.

| Attributes | Details |

|---|---|

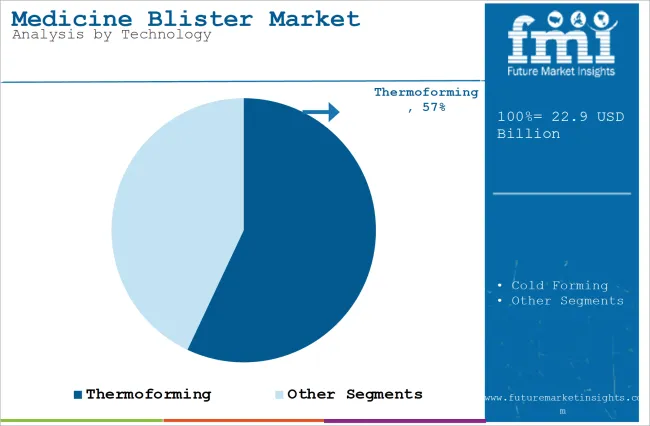

| Top Technology | Thermoforming |

| Market Share in 2025 | 57% |

Based on flavor, the market is divided into cold-forming and thermoforming. The Thermoforming segment is expected to account for a 57 % share in 2025. Thermoforming is widely used in the medicine blister market due to its cost-effectiveness, versatility, and efficiency in high-volume production.

The thermoforming process involves heating a plastic sheet until it becomes pliable and then shaping it over a mild to create cavities that securely hold individual doses of medication. This technique can be used for quick production of blister packs that come in different shapes and sizes, thereby accommodating all kinds of pharmaceutical products.

Furthermore, thermoforming makes it easy to produce transparent packaging, which helps in better visibility of the product and facilitates branding. Customization of designs and the production of multiple packs at one time are also a reason for its popularity among manufacturers, making it an ideal choice for the pharmaceutical industry focused on efficiency and scalability.

| Attributes | Details |

|---|---|

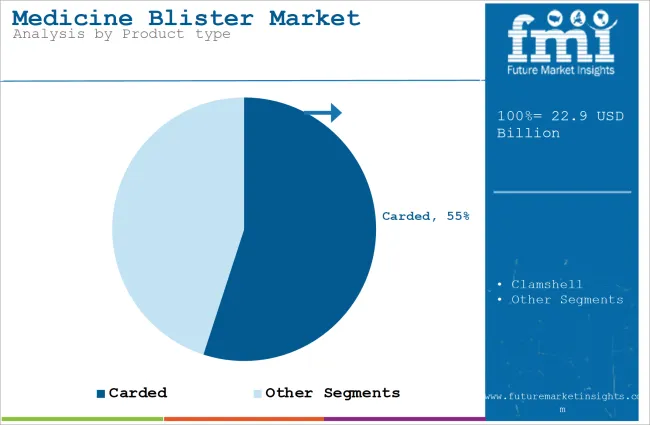

| Top Product type | Carded |

| Market Share in 2025 | 55% |

Based on product type, the market is divided into clamshell and carded. The carded segment is expected to account for a 55 % share in 2025. Carded blister packaging is widely used in the medicine blister market due to its combination of visibility, protection, and branding opportunities.

This packaging format features a plastic blister that holds the medication firmly in place and is attached to a cardboard backing, which will enables the consumer to view the product. The transparency of the blister makes it easy for the product to be identified clearly on retail shelves and helps the consumer easily recognize tampering or damage to maintain safety and integrity.

Based on material, the market is divided into plastic, aluminum, paper & paperboard, and others. Plastic (specifically PVC) is the most widely used material in medicine blister packaging due to its superior barrier properties, cost-effectiveness, and versatility. The protection that PVC offers against such external factors as moisture, light, and air ensures the stability and efficacy of medications during their shelf life.

Its thermoform ability makes it possible for manufacturers to produce customized cavities that tightly house all kinds of medications, for instance, tablets and capsules, while leaving enough clarity for easy product visibility. On the other hand, PVC is lightweight and cost-efficient, and this makes it perfect for massive pharmaceutical packaging needs.

The USA medicine blister is poised to experience a CAGR of 28.7 % till 2035. The medicine blister market is growing significantly in the USA due to several interlinked factors.

The first cause of growth is the strong pharmaceutical and healthcare industries marked by high innovation levels and a strict framework regulating these industries. Such an environment encourages the invention and introduction of blister packaging into the market, which provides benefits such as protection of medication, tamper-evidence, and extended shelf life for medication.

India is expected to achieve a CAGR of 6.9 % in the forecast period. The Indian medicine blister market is witnessing high growth based on a few key drivers. The growth in the pharmaceutical sector is a significant factor as India is one of the largest producers of generic drugs worldwide, accounting for a major portion of the global demand.

This growth is supported by a solid manufacturing base, with thousands of pharmaceutical companies operating across the country, most of which are adopting blister packaging because it is efficient and effective in preserving the quality of medication.

China is poised to witness a CAGR of 6.6 % in the forecast period. The medicine blister market in China is growing rapidly for several interrelated reasons. One of the major drivers is the rapid growth of the pharmaceutical sector, which is fueled by an increasing aging population and rising health awareness among consumers. As the demand for pharmaceuticals grows, there is a corresponding need for effective packaging solutions that ensure medication safety and integrity.

Japan is expanding to grow at a CAGR of 3.7 % from 2025 to 2035. The Japanese medicine blister market is growing at a rapid pace because the country is experiencing an aging population, which results in higher demand for pharmaceuticals.

With a population of more than 36 million above 65 years, there is an increased need for medicine that is easy to take and to dispense. Blister packaging, which allows for the dispensing of unit doses, enhances patient compliance through ease of taking the medication.

UK is poised to attain a CAGR of 2.8 % from 2025 to 2035. The UK medicine blister market is one of the fastest growing due to several interconnected factors. Mainly, increased demand for a patient-centric pack is driving sales, especially when home healthcare service usage is being emphasized. Such packaging is also convenient and, thus, ensures improved medication compliance for patients being treated outside health care settings.

The medicine blister market size in Germany will grow at around 4.7 % CAGR till 2035. The medicine blister market in Germany experiences significant growth with the robust pharmaceutical industry and raising healthcare expenditures primarily.

Germany leads one of Europe's largest sectors of the drug industry, along with a lot of research and development emphasis there, which elevates the requirements for innovative forms of packaging and thus blister packs. The main advantage of these packs is that they provide secure, tamper-evident packaging to ensure product integrity and safety, crucial in a highly regulated market.

The competitive landscape of the medicine blister market is marked by several major players who are leveraging innovative strategies to strengthen their positions. Among the prominent companies, Amcor stands out for its sustainability focus, providing eco-friendly blister packaging solutions with recycled materials. Its strategy is focused on continuous investment in research and development, improving the performance and environmental impact of its products in line with global sustainability trends.

Similarly, the ACG-automated blister packaging technologies' leader also puts attention on advanced manufacturing processes and intelligent technologies for improving the efficiency and accuracy of pharma packaging. Their ability to offer tailored solutions in the pharmaceutical and nutraceutical sectors makes them one of the strong contenders in the marketplace.

Moreover, Pharma Works, another giant of this race also emphasizes flexibility and customer-centric solutions. They provide customizable blister packaging systems that could be particularly suited to a client's individual needs. They incorporate seamless technology into their offerings, which means these machines will come out high-quality, supported with strong after-sales service to clients.

Several startups are transforming the medicine blister market with a focus on innovative solutions and sustainability.

Blister is a UK-based startup that leads in the development of biodegradable blister packaging based on seaweed and plant material. The growth strategy is based on how to reduce the environmental impact related to the use of plastic-based packaging. This UK-based company offers pharmaceutical companies an opportunity to comply with sustainability objectives while minimizing the environmental impact by providing a plastic-free, home-compostable product. This attracts eco-friendly consumers and helps manufacturers keep up with regulatory pressures on waste from packaging.

Another notable startup is V-Shapes, which is an Italian company that offers single-portion packets for the medical and pharmaceutical sectors. It focuses on user experience through innovative packaging that avoids spillage and dosing errors. V-Shapes uses vacuum packing technology to improve the shelf life of products while making them smaller and easier to manage for consumers to handle their medicines. By focusing on functionality and ease of use, V-Shapes hopes to seize a large percentage of the market share, targeting those consumers who seek practical solutions to medication administration.

These companies are a reflection of how innovation and sustainability can drive growth in the medicine blister market, answering both consumer and industry needs.

In terms of technology, the market is segmented into cold-forming and thermoforming.

In terms of product type, the market is segmented into clamshell and carded.

In terms of material, the market is segmented into plastic, aluminum, paper & paperboard, and others.

In terms of region, the market is segmented into North America, Europe, Asia Pacific, and Middle-East and Africa.

The market is predicted to reach USD 22.9 billion by 2025.

The market is predicted to reach USD 38.8 billion by 2035.

The prominent companies in the medicine blister market include Amcor Limited, Constantia Flexibles Group, Sonoco Products Company, and others.

The USA is likely to create lucrative opportunities for the medicine blister market.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type , 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product Type , 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Technology Type, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Technology Type, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 9: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 10: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Product Type , 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Product Type , 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Technology Type, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Technology Type, 2019 to 2034

Table 17: North America Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 18: North America Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 19: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 20: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type , 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Product Type , 2019 to 2034

Table 25: Latin America Market Value (US$ Million) Forecast by Technology Type, 2019 to 2034

Table 26: Latin America Market Volume (Units) Forecast by Technology Type, 2019 to 2034

Table 27: Latin America Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 28: Latin America Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type , 2019 to 2034

Table 34: Western Europe Market Volume (Units) Forecast by Product Type , 2019 to 2034

Table 35: Western Europe Market Value (US$ Million) Forecast by Technology Type, 2019 to 2034

Table 36: Western Europe Market Volume (Units) Forecast by Technology Type, 2019 to 2034

Table 37: Western Europe Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 38: Western Europe Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 39: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 40: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type , 2019 to 2034

Table 44: Eastern Europe Market Volume (Units) Forecast by Product Type , 2019 to 2034

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Technology Type, 2019 to 2034

Table 46: Eastern Europe Market Volume (Units) Forecast by Technology Type, 2019 to 2034

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 48: Eastern Europe Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 50: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type , 2019 to 2034

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product Type , 2019 to 2034

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Technology Type, 2019 to 2034

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Technology Type, 2019 to 2034

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 62: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type , 2019 to 2034

Table 64: East Asia Market Volume (Units) Forecast by Product Type , 2019 to 2034

Table 65: East Asia Market Value (US$ Million) Forecast by Technology Type, 2019 to 2034

Table 66: East Asia Market Volume (Units) Forecast by Technology Type, 2019 to 2034

Table 67: East Asia Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 68: East Asia Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 69: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 70: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type , 2019 to 2034

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product Type , 2019 to 2034

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Technology Type, 2019 to 2034

Table 76: Middle East and Africa Market Volume (Units) Forecast by Technology Type, 2019 to 2034

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2019 to 2034

Table 78: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2019 to 2034

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 80: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type , 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Technology Type, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 5: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Global Market Value (US$ Million) Analysis by Product Type , 2019 to 2034

Figure 11: Global Market Volume (Units) Analysis by Product Type , 2019 to 2034

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type , 2024 to 2034

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type , 2024 to 2034

Figure 14: Global Market Value (US$ Million) Analysis by Technology Type, 2019 to 2034

Figure 15: Global Market Volume (Units) Analysis by Technology Type, 2019 to 2034

Figure 16: Global Market Value Share (%) and BPS Analysis by Technology Type, 2024 to 2034

Figure 17: Global Market Y-o-Y Growth (%) Projections by Technology Type, 2024 to 2034

Figure 18: Global Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 19: Global Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 20: Global Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 21: Global Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 22: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 23: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 26: Global Market Attractiveness by Product Type , 2024 to 2034

Figure 27: Global Market Attractiveness by Technology Type, 2024 to 2034

Figure 28: Global Market Attractiveness by Material Type, 2024 to 2034

Figure 29: Global Market Attractiveness by Application, 2024 to 2034

Figure 30: Global Market Attractiveness by Region, 2024 to 2034

Figure 31: North America Market Value (US$ Million) by Product Type , 2024 to 2034

Figure 32: North America Market Value (US$ Million) by Technology Type, 2024 to 2034

Figure 33: North America Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 34: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 35: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 37: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 40: North America Market Value (US$ Million) Analysis by Product Type , 2019 to 2034

Figure 41: North America Market Volume (Units) Analysis by Product Type , 2019 to 2034

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type , 2024 to 2034

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type , 2024 to 2034

Figure 44: North America Market Value (US$ Million) Analysis by Technology Type, 2019 to 2034

Figure 45: North America Market Volume (Units) Analysis by Technology Type, 2019 to 2034

Figure 46: North America Market Value Share (%) and BPS Analysis by Technology Type, 2024 to 2034

Figure 47: North America Market Y-o-Y Growth (%) Projections by Technology Type, 2024 to 2034

Figure 48: North America Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 49: North America Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 50: North America Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 51: North America Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 53: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 56: North America Market Attractiveness by Product Type , 2024 to 2034

Figure 57: North America Market Attractiveness by Technology Type, 2024 to 2034

Figure 58: North America Market Attractiveness by Material Type, 2024 to 2034

Figure 59: North America Market Attractiveness by Application, 2024 to 2034

Figure 60: North America Market Attractiveness by Country, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) by Product Type , 2024 to 2034

Figure 62: Latin America Market Value (US$ Million) by Technology Type, 2024 to 2034

Figure 63: Latin America Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 64: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type , 2019 to 2034

Figure 71: Latin America Market Volume (Units) Analysis by Product Type , 2019 to 2034

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type , 2024 to 2034

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type , 2024 to 2034

Figure 74: Latin America Market Value (US$ Million) Analysis by Technology Type, 2019 to 2034

Figure 75: Latin America Market Volume (Units) Analysis by Technology Type, 2019 to 2034

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Technology Type, 2024 to 2034

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Technology Type, 2024 to 2034

Figure 78: Latin America Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 79: Latin America Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 83: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 86: Latin America Market Attractiveness by Product Type , 2024 to 2034

Figure 87: Latin America Market Attractiveness by Technology Type, 2024 to 2034

Figure 88: Latin America Market Attractiveness by Material Type, 2024 to 2034

Figure 89: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 90: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 91: Western Europe Market Value (US$ Million) by Product Type , 2024 to 2034

Figure 92: Western Europe Market Value (US$ Million) by Technology Type, 2024 to 2034

Figure 93: Western Europe Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 94: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 95: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type , 2019 to 2034

Figure 101: Western Europe Market Volume (Units) Analysis by Product Type , 2019 to 2034

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type , 2024 to 2034

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type , 2024 to 2034

Figure 104: Western Europe Market Value (US$ Million) Analysis by Technology Type, 2019 to 2034

Figure 105: Western Europe Market Volume (Units) Analysis by Technology Type, 2019 to 2034

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Technology Type, 2024 to 2034

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Technology Type, 2024 to 2034

Figure 108: Western Europe Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 109: Western Europe Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 112: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 113: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 116: Western Europe Market Attractiveness by Product Type , 2024 to 2034

Figure 117: Western Europe Market Attractiveness by Technology Type, 2024 to 2034

Figure 118: Western Europe Market Attractiveness by Material Type, 2024 to 2034

Figure 119: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 120: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type , 2024 to 2034

Figure 122: Eastern Europe Market Value (US$ Million) by Technology Type, 2024 to 2034

Figure 123: Eastern Europe Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 124: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type , 2019 to 2034

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product Type , 2019 to 2034

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type , 2024 to 2034

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type , 2024 to 2034

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Technology Type, 2019 to 2034

Figure 135: Eastern Europe Market Volume (Units) Analysis by Technology Type, 2019 to 2034

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Technology Type, 2024 to 2034

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology Type, 2024 to 2034

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 139: Eastern Europe Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 143: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 146: Eastern Europe Market Attractiveness by Product Type , 2024 to 2034

Figure 147: Eastern Europe Market Attractiveness by Technology Type, 2024 to 2034

Figure 148: Eastern Europe Market Attractiveness by Material Type, 2024 to 2034

Figure 149: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 150: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type , 2024 to 2034

Figure 152: South Asia and Pacific Market Value (US$ Million) by Technology Type, 2024 to 2034

Figure 153: South Asia and Pacific Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 154: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type , 2019 to 2034

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product Type , 2019 to 2034

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type , 2024 to 2034

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type , 2024 to 2034

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Technology Type, 2019 to 2034

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Technology Type, 2019 to 2034

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology Type, 2024 to 2034

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology Type, 2024 to 2034

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 176: South Asia and Pacific Market Attractiveness by Product Type , 2024 to 2034

Figure 177: South Asia and Pacific Market Attractiveness by Technology Type, 2024 to 2034

Figure 178: South Asia and Pacific Market Attractiveness by Material Type, 2024 to 2034

Figure 179: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 181: East Asia Market Value (US$ Million) by Product Type , 2024 to 2034

Figure 182: East Asia Market Value (US$ Million) by Technology Type, 2024 to 2034

Figure 183: East Asia Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 184: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 185: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type , 2019 to 2034

Figure 191: East Asia Market Volume (Units) Analysis by Product Type , 2019 to 2034

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type , 2024 to 2034

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type , 2024 to 2034

Figure 194: East Asia Market Value (US$ Million) Analysis by Technology Type, 2019 to 2034

Figure 195: East Asia Market Volume (Units) Analysis by Technology Type, 2019 to 2034

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Technology Type, 2024 to 2034

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Technology Type, 2024 to 2034

Figure 198: East Asia Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 199: East Asia Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 202: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 203: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 206: East Asia Market Attractiveness by Product Type , 2024 to 2034

Figure 207: East Asia Market Attractiveness by Technology Type, 2024 to 2034

Figure 208: East Asia Market Attractiveness by Material Type, 2024 to 2034

Figure 209: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 210: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type , 2024 to 2034

Figure 212: Middle East and Africa Market Value (US$ Million) by Technology Type, 2024 to 2034

Figure 213: Middle East and Africa Market Value (US$ Million) by Material Type, 2024 to 2034

Figure 214: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type , 2019 to 2034

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product Type , 2019 to 2034

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type , 2024 to 2034

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type , 2024 to 2034

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Technology Type, 2019 to 2034

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Technology Type, 2019 to 2034

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology Type, 2024 to 2034

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology Type, 2024 to 2034

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2019 to 2034

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2019 to 2034

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2024 to 2034

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2024 to 2034

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 236: Middle East and Africa Market Attractiveness by Product Type , 2024 to 2034

Figure 237: Middle East and Africa Market Attractiveness by Technology Type, 2024 to 2034

Figure 238: Middle East and Africa Market Attractiveness by Material Type, 2024 to 2034

Figure 239: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 240: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medicine Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Telemedicine Carts Market Size and Share Forecast Outlook 2025 to 2035

Telemedicine Equipment Market Size and Share Forecast Outlook 2025 to 2035

Photomedicine Market

Glass Medicine Bottles Market

Sports Medicine Sutures Market Size and Share Forecast Outlook 2025 to 2035

5G Telemedicine Platform Market Size and Share Forecast Outlook 2025 to 2035

The Sports Medicine Market Is Segmented by Product, Application and End User from 2025 To 2035

Nuclear Medicine Shielded Equipment Market Size and Share Forecast Outlook 2025 to 2035

Nuclear Medicine Equipment Market Size and Share Forecast Outlook 2025 to 2035

Plastic Medicine Spoons Market Size and Share Forecast Outlook 2025 to 2035

Plastic Medicine Bottles Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Plastic Medicine Bottles Manufacturers

Market Share Distribution Among Plastic Medicine Spoon Manufacturers

OTC Cat Medicines Market

Wax Paper Medicine Pots Market Size and Share Forecast Outlook 2025 to 2035

Aesthetic Medicine And Cosmetic Surgery Market

Preventive Medicine Market Growth - Trends & Forecast 2025 to 2035

Disposable Medicine Measuring Cups Market

Cholesterol Medicine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA