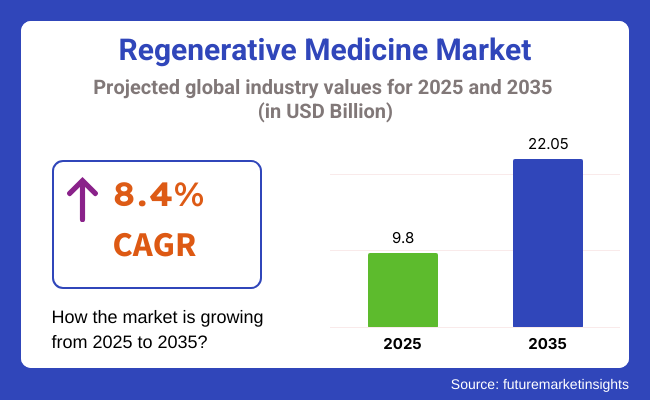

The global regenerative medicine market is estimated to be valued at USD 9.8 billion in 2025 and is projected to reach USD 22.05 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

The regenerative medicine market in 2025 is transitioning from a phase of experimental promise to one of clinical maturity. The current market is being driven by accelerated clinical approvals, maturing reimbursement frameworks, and rising physician confidence in cell- and gene-based therapies. Demand is surging across orthopaedics, wound care and oncology where regenerative solutions are no longer adjunctive but increasingly considered frontline interventions.

Advanced therapy medicinal products including stem cell and tissue-engineered products are seeing faster regulatory uptake which is supported by real-world evidence data. Large biopharmaceutical firms are consolidating their pipelines through partnerships and acquisitions, especially around allogeneic therapies with scalable manufacturing potential. Large biopharmaceutical firms are consolidating their pipelines through partnerships and acquisitions, especially around allogeneic therapies with scalable manufacturing potential.

Leading manufacturers such as Organogenesis, Smith & Nephew Plc., and Integra LifeSciences have concentrated efforts on high-growth areas including orthopaedic repair, wound healing, and soft tissue regeneration. The surge in musculoskeletal disorders, trauma-related injuries, and chronic wounds is being strategically addressed through expanded biologics portfolios and global partnerships.

Leading manufacturers are actively investing in product innovation and strategic collaborations to strengthen their market position. Organogenesis continues to grow its Advanced Wound Care segment, reporting a 11.9% YoY increase driven by product demand for venous leg ulcers and diabetic foot ulcers.

There has been a significant development in recent past in oncology space where many Cell and Gene therapy are being approved in 2024. The launch of TECELRA®, an engineered cell therapy for a solid tumor cancer and the first new therapy option for synovial sarcoma a rare soft-tissue cancer. “Dosing our first commercial TECELRA patient, in partnership with one of the top cancer centers in the USA, is an incredible milestone for the sarcoma community and for Adaptimmune” as stated by Adrian Rawcliffe, CEO, Adaptimmune.

North America remains a dominant market for regenerative medicine, driven by advanced healthcare infrastructure, robust R&D activities, and supportive regulatory frameworks. The USA has witnessed increased adoption of regenerative therapies following investments in domestic manufacturing capabilities.

Europe is experiencing substantial growth in the regenerative medicine market, propelled by stringent regulatory standards and a focus on high-quality manufacturing. Countries like UK, Germany and France have implemented policies encouraging the development and use of regenerative therapies, particularly in oncology and rare diseases. Many manufacturers have collaborated with Academic institutes and public health institution towards development of technological platforms related to oncology and rare disease research.

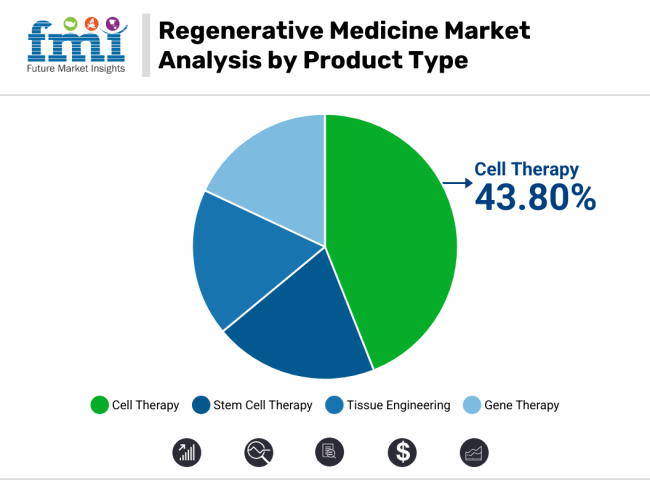

The stem cell therapy segment, commanding approximately 43.80% of the regenerative medicine market in 2025, due to its broad clinical applicability and strong investment interest across therapeutic areas. The growth of this segment has been primarily fueled by its proven efficacy in tissue regeneration, immune modulation, and repair of damaged cells in conditions such as orthopaedic injuries, neurodegenerative diseases, and cardiovascular disorders.

Increased clinical trial activity, supported by favourable regulatory pathways-such as the European Medicines Agency’s conditional marketing authorization and the FDA’s expedited programs for regenerative therapies-has significantly accelerated market adoption. Autologous and allogeneic stem cell therapies have witnessed expanded application in complex conditions including spinal cord injuries, ischemic stroke, and heart failure.

Large-scale investments in bioprocessing facilities and GMP-compliant cell manufacturing capabilities by leading players have improved scalability, quality and affordability of stem cell treatments. Technological advancements in cell sourcing, cryopreservation, and 3D bioprinting have also enhanced therapeutic outcomes, contributing to increased clinician and patient confidence.

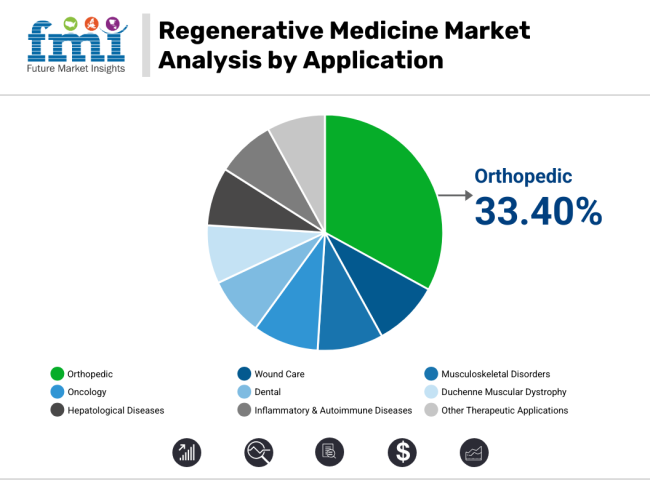

In 2025, the orthopaedic segment has accounted for approximately 33.40% of the total revenue share in the regenerative medicine market, making it the dominant application area. This leadership position has been attributed to the widespread clinical use of regenerative therapies in treating musculoskeletal injuries, cartilage damage, bone defects, and degenerative joint diseases.

The high incidence of orthopaedic conditions, such as osteoarthritis, sports-related injuries, and spinal disorders, has created a strong demand for tissue-engineered products and stem cell-based therapies. Technological innovations such as bioactive scaffolds, growth factor-enhanced allografts, and injectable cellular matrices have been widely integrated into orthopaedic surgical protocols.

These advances have significantly reduced recovery time and improved healing outcomes, especially in procedures like meniscal repair, rotator cuff surgery, and spinal fusion. Apart from these, increased sports medicine funding and high awareness among orthopaedic surgeons have also contributed to the growth of this segment. Further strategic collaborations between orthopaedic device manufacturers and regenerative medicine start-ups have accelerated the commercialization of hybrid biologic-implant solutions.

Strong research and development investments programs and favorable regulatory frameworks besides the well-established health care infrastructure are driving the regenerative medicine market in North America. The United States is the dominant country in the region with a massive stem cell and gene therapy research funding, personalization of medical applications, and increasing approvals of cell-based therapies on board.

Besides these, the innovation train is being revved by advances in 3D bioprinting and the expansion of regenerative applications in orthopedics and neurology. However, challenges such as the high cost of treatment, complexity of reimbursement issues, and standards concern over stem cell research persist.

Increasing commercialization of regenerative therapies, the emergence of clinical trial networks, and the fusion of AI-powered drug discovery are the major driving forces on the way to more market growth in North America.

Europe happens to be a key market for regenerative medicine, where positive government policies, growing levels of research funding, and widespread academic collaboration draw new investments into the industry. The UK, together with Germany and France, is a considerable share of the market mainly owing to the EMA's attempts at fast-tracking the regulatory pathway for advanced therapies.

Some of the factors that could possibly hinder market expansion are regulatory challenges, high manufacturing costs, and a sparse reimbursement outlook for regenerative therapies. Increasing implementation of cell and gene therapy, newly formed research hubs in regenerative medicine by various institutions, and increasing investments into biopharmaceutical partnerships are changing the European market landscape.

On the other hand, the advent of newer biomaterials, together with increasing emphasis on regenerative therapies for degenerative diseases, is improving service delivery and clinical efficacy.

Basically, the demand for regenerative medicine has been rapidly increasing in the Asia-Pacific region, hash traditional fast growth in the region. It can be due to the heavy investments made in healthcare, the momentum it gave to stem cell research, and an increasing demand for advanced therapies. The market opportunities with regard to these developments in the region would include countries such as China, Japan, and South Korea.

These countries all have an expanding biopharmaceutical industry, supported by governments with strong funding in R&D to promote regenerative medicine and facing increasing approvals for cell-based therapies. Still, entry barriers provided by disparate regulatory frameworks, weak sometimes clinical trial infrastructure, and possibly considerations of affordability might dampen market entry.

An increasing number of international regenerative medicine firms, the developing applicability of regenerative therapy for aging-related diseases, and an integration of AI-driven regenerative diagnostics buoys the market. Moreover, intensive collaboration between global biopharma companies and regional research institutes is speeding up the novel regenerative treatment development.

Challenges

Challenges Hindering the Adoption and Expansion of Regenerative Medicine Market

Regenerative medicine faces several challenges in the market, including high development and manufacturing costs, long regulatory approvals, and ethical issues associated with stem cell research. Moreover, market uncertainty has proliferated because of the large scalable production of cell-based therapies, the absence of standardized clinical protocols, and patient safety.

Reimbursement policies vary greatly across regions in regenerative treatment, thus restricting patient access to advanced therapy. These are some of the height barriers that present obstructing potentials to growth in the market, and clinical trials keeping long-term efficacy and safety data with immune-rejection risk and tumor formation slightly add to such barriers.

Opportunities

Expanding Regenerative Medicine Frontiers: Innovations in Bioprinting, Next-Generation Gene Therapies, and Advanced Stem Cell Applications

It includes increases in the recognition of 3D bioprinting; increasing building and establishing stem cell banks; and increased investments that result from growing private and public excitement in gene editing. Other aspects include the generation of commercial cell therapies that will be available off the shelf, advancements in nanomedicine for regenerative applications, and improved studies in bioengineered tissues for transplantation.

All of these matter in combination to propel growth. The increased push towards regulatory harmonization, improving accessibility of GMP compliance in manufacture plants, and further extending applications of personalized medicine into regenerative therapies will create new innovative avenues for players in the industry. Increased collaboration among biotech companies and academic institutions, joined by government agencies, should also push research forward and into the commercialization of regenerative treatments.

Advancements in Stem Cell and Gene Therapies

The new opportunity of CRISPR gene-editing technology, induced pluripotent stem cells (iPSCs), and autologous stem cell therapies indeed transforms the landscape of regenerative medicine. The new possibilities would likely open up in genetically disordered patients because of precise genetic modifications and thus lead personalized medicine.

iPSCs which can be differentiated mostly into all cell types are expected to advance the areas of disease modeling, drug testing, and also regenerative uses, which in turn are expected to diminish the reliance on stem cells derived from the donors. Nevertheless, autologous stem cell therapies use the patient's own cells and therefore are most likely to result in minimal immune rejection and also improvement in therapeutic effects when it comes to conditions like neurodegeneration, cardiovascular disorders, and musculoskeletal injuries.

Together, they pave new pathways in treating diseases that were thus far non-treatable using innovative therapies. However, regulatory complexities as well as ethical dilemmas and scalability hurdles remain to be tackled. Enhanced methods for differentiating cells and optimizing manufacturing will further refine gene editing so that regenerative medicine will eventually be widely adopted as research intensifies toward better patient care outcomes.

Growth of 3D Bioprinting and Tissue Engineering

The incredible effectiveness of regenerative medicine has been made possible by the developed 3D bioprinting and applications into tissue engineering, building complex tissues and organs for transplantation. 3D bioprinting has been set up to enable biomaterials along with the living cells and growth factors to build a tissue functionally, thus possibly being the answer to organ shortage in the future and decreasing dependence on donor transplant.

Innovations in developing bioinks and scaffold-free approaches have enhanced cell viability and tissue integration and, therefore, increased this likelihood with personalized medicine applications. Innovations in developing bioinks and scaffold-free approaches have enhanced cell viability and tissue integration and, therefore, increased this likelihood with personalized medicine applications.

Tissue engineering has seen incredible advances in regenerative therapies for skin grafts, cartilage repair, and vascular reconstruction according to the patients suffering from severe injuries or degenerative conditions hence creating new avenues. However, advances like these-in fact, like all great potential-tend to face their own challenges in terms of vascularization, functionality over the long term, and regulatory approval.

Thus, more promises are expected to emerge from increased attention to biomaterials, bioreactor technologies, and artificial intelligence interface that can potentially foster faster development towards the clinical translation of yet to be-certified 3D bioprinted tissue solutions-much an important force for the future breakthroughs in regenerative medicine.

Regenerative medicine market is booming, and it will grow between 2020 and 2024 due to the increasing incidence or suspected chronic diseases, progressive disorders, and chronic organ failures demanding more advanced solutions in medicine. Innovations in stem cell therapy, gene editing, and tissue engineering perceived as alternatives for classical approaches have caused demand for regenerative therapies to rise significantly.

Besides, the ongoing expansion of the cell and gene therapy trials, which include CAR-T cell and CRISPR gene editing, in addition to their regulatory approval processes, gives that extra support for widespread acceptance of this market. Development in therapies also led to improvement in the therapeutic efficacy in orthopedics, neurology, and cardiovascular applications. Further on, biomaterials and scaffold-based tissue regeneration applications proliferated.

Also, the compatible reimbursement schemes and capital infusions into the regenerative biopharmaceuticals have gotten stimulated in increased accessibility to novel therapeutic modalities.

The change is fast coming by the years 2025 to 2035, with revolutionary treatment options from precision medicine and next-generation gene therapies being very personalized and effective. The coming of 3D Bioprinting is determining the future of systems for the regeneration of tissues and organs with a much-reduced dependency on donor transplants.

Meanwhile, novel regenerative therapies are quickened by AI-enabled drug discovery and computational modeling as treatment outcomes are optimized. Furthermore, greater affordability by these innovations will come from higher penetration of biosimilars and cheaper regenerative medicines for emerging markets.

Integration of digital health through remote patient monitoring and AI-based diagnostics will render adherence to long-term regenerative treatments smoother. This will position regenerative medicine at the helm of dictating the future of personalized and curative healthcare.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | The regulatory landscape prioritizes very seriously the safety and efficacy of regenerative therapies so that regulatory bodies speed up approvals for therapies targeting unmet medical needs. |

| Technological Advancements | Technological Development The progressiveness in stem cell and gene therapy broadened the specificity and the potency of treatment that could offer better outcomes for patients undergoing those kinds of therapy. |

| Consumer Demand | Consumer Need Further heightened awareness translates into increased demand for effective and easily accessible regenerative treatments-the patients are now opting for therapies that promise better quality of life and disease management. |

| Market Growth Drivers | Market Growth Drivers Increasing incidences of chronic diseases, large investments in research and development, and government backing policies that promote innovation in therapeutics contribute to the overall market growth. |

| Sustainability | Sustainability Pollution prevention initiatives as a start towards eco-friendly manufacturing processes of pharmaceuticals and a reduction in the environmental effects of their production, and some companies are applying green chemistry in their practices. |

| Supply Chain Dynamics | Supply Chain Dynamics They rely on established distribution networks, which theoretically should be able to ensure that therapies are widely available in urban and peri-urban healthcare facilities. This often proves hard to accomplish in reaching remote communities. Digitization of supply chains through e-commerce platforms could make supply chains much more transparent, efficient and accessible in time delivery of therapies to a global patient population, including some living in remote and underserved areas. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Development of general guidelines for personalized medicine and advanced therapeutic modalities should allow for standard protocols as well as patient safety. |

| Technological Advancements | Not only that, but also a major boost is into the application of artificial intelligence and machine learning in the drug discovery and development process, resulting in attaining new therapeutic targets and optimizing treatment regimes. |

| Consumer Demand | Patients would prefer individualized treatment strategies, coming together with healthcare practitioners to customize their therapies using the patient's unique genetic profile and disease characteristics as guiding factors. |

| Market Growth Drivers | Embracing opportunities in the emerging markets with developing health care systems, increasing focus on early diagnosis and intervention, and strategic partnerships between pharmaceutical companies and research institutions foster innovation. |

| Sustainability | Adoption of sustainability practices in all dimensions, from the usage of biodegradable materials and energy-efficient manufacturing processes to initiatives of creating reduced carbon footprints by drug development and distribution. |

| Supply Chain Dynamics | Optimization of supply chains through digital technologies and e-commerce platforms, enhancing transparency, efficiency, and accessibility, ensuring timely delivery of therapies to a global patient population, including those in remote and underserved regions. |

Market Outlook

The regenerative medicine market in the United States has robust growth owing to advances in cell and gene therapies; the enormous burden of chronic diseases such as diabetes and cardiovascular ailments; and colossal investments being made by many research and development organizations into regenerative medicine. Strategic partnerships between pharmaceutical companies and research institutions foster innovation in United States.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 6.9% |

Market Outlook

The regenerative medicine market in India is expected to experience prolific growth due to increased investments in healthcare, greater awareness of advanced therapies, and a rising burden of chronic diseases. The market is further flourish with the innovations and measures towards faster approval of new therapies.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.8% |

Market Outlook

In the rapidly developing field of regenerative medicine in China, the major drivers are strong government support, tremendously large patient population, and well progressing biotechnology sector. Numerous policies have been adopted with widespread funding and relaxed regulatory pathways to speed up advances in cell and gene therapies.

Heavy density of population along with high prevalence of chronic diseases creates tremendous demand for the advanced regenerative applications.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.8% |

Market Outlook

Market for Germany's regenerative medicine sector is likely to witness a steady growth in future, backed by its strong healthcare system, substantial R&D activities and enabling regulatory frameworks. The increasing population of elderly people in the country would increase the demand for therapies for age-related conditions among others.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.8% |

Market Outlook

Increasing resilience in the Nigerian regenerative medicine market is caused by increased government healthcare investments, increased prevalence of chronic diseases, and increased application of advanced stem cell therapies within the country. In this country, developments such as CRISPR-edited allogeneic stem cells, AI-assisted donor matching for precision medicine, and improved cryopreservation technologies for long-term storage of cells taking place as developments.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.8% |

The regenerative medicine market is extremely competitive, fueled by advancements in stem cell therapies, gene editing, and tissue engineering. Firms are increasingly investing in cell-based therapies, biomaterials, and novel regenerative techniques to remain competitive. Established biopharmaceutical companies, pioneering biotechnology firms, and aspiring startups are shaping the regenerative treatment landscape together.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Novartis AG | 23.8% - 24.9% |

| Gilead Sciences (Kite Pharma) | 19.8% - 21.2% |

| Bristol-Myers Squibb | 13.3% - 15.5% |

| Organogenesis Holdings | 11.2% - 12.8% |

| Astellas Pharma Inc. | 8.0% - 9.3% |

| Other Companies (combined) | 23.8% - 26.5% |

| Company Name | Key Offerings/Activities |

|---|---|

| Novartis AG | Market leader in cell and gene therapy, including Kymriah for cancer treatment. |

| Gilead Sciences (Kite Pharma) | Specializes in CAR-T cell therapies, offering Yescarta for hematologic malignancies. |

| Bristol-Myers Squibb | Develops regenerative treatments such as Breyanzi, a CAR-T therapy for lymphoma. |

| Organogenesis Holdings | Focuses on regenerative skin substitutes and wound care solutions. |

| Astellas Pharma Inc. | Invests in stem cell therapies and gene editing for regenerative applications. |

Key Company Insights

These include:

Cell Therapy (Autologous Cell Therapy and Allogenic Cell Therapy), Stem Cell Therapy (Allogeneic Stem Cell Therapy and Autologous Stem Cell Therapy), Tissue-engineering and Gene Therapy

Wound Care, Musculoskeletal Disorders, Oncology, Dental, DMD (Duchenne Muscular Dystrophy), Hepatological Diseases, Inflammatory & Autoimmune Diseases and Other Therapeutic Applications

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for Regenerative Medicine Market was USD 9.80 billion in 2025.

The Regenerative Medicine Market is expected to reach USD 22.05 billion in 2035.

Rising Prevalence of Cancer has significantly increased the demand for Regenerative Medicine Market.

The top key players that drives the development of Regenerative Medicine Market are Novartis AG, Gilead Sciences (Kite Pharma), Bristol-Myers Squibb and Organogenesis Holdings Astellas Pharma Inc.

Bisphosphonates is expected to command significant share over the assessment period.

Table 1: Global Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Industry Analysis and Outlook Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 3: Global Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: North America Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Industry Analysis and Outlook Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 6: North America Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 7: Latin America Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Industry Analysis and Outlook Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 9: Latin America Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 12: Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 13: Eastern Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 15: Eastern Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 18: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 19: East Asia Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Industry Analysis and Outlook Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 21: East Asia Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) Forecast by Therapy Type, 2018 to 2033

Table 24: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Figure 1: Global Industry Analysis and Outlook Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 2: Global Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Industry Analysis and Outlook Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Industry Analysis and Outlook Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 8: Global Industry Analysis and Outlook Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 9: Global Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 10: Global Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 11: Global Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 12: Global Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 13: Global Industry Analysis and Outlook Attractiveness by Therapy Type, 2023 to 2033

Figure 14: Global Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 15: Global Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 16: North America Industry Analysis and Outlook Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 17: North America Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 18: North America Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Industry Analysis and Outlook Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 23: North America Industry Analysis and Outlook Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 24: North America Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 25: North America Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 26: North America Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 27: North America Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 28: North America Industry Analysis and Outlook Attractiveness by Therapy Type, 2023 to 2033

Figure 29: North America Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 30: North America Industry Analysis and Outlook Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Industry Analysis and Outlook Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 32: Latin America Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 33: Latin America Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Industry Analysis and Outlook Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 38: Latin America Industry Analysis and Outlook Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 39: Latin America Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 40: Latin America Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 41: Latin America Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 42: Latin America Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 43: Latin America Industry Analysis and Outlook Attractiveness by Therapy Type, 2023 to 2033

Figure 44: Latin America Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 45: Latin America Industry Analysis and Outlook Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Industry Analysis and Outlook Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 47: Western Europe Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 48: Western Europe Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 53: Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 54: Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 55: Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 56: Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 57: Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 58: Western Europe Industry Analysis and Outlook Attractiveness by Therapy Type, 2023 to 2033

Figure 59: Western Europe Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 60: Western Europe Industry Analysis and Outlook Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Industry Analysis and Outlook Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 62: Eastern Europe Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 63: Eastern Europe Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 68: Eastern Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 69: Eastern Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 70: Eastern Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 71: Eastern Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 72: Eastern Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 73: Eastern Europe Industry Analysis and Outlook Attractiveness by Therapy Type, 2023 to 2033

Figure 74: Eastern Europe Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 75: Eastern Europe Industry Analysis and Outlook Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 77: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 78: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 83: South Asia and Pacific Industry Analysis and Outlook Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 84: South Asia and Pacific Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 85: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: South Asia and Pacific Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: South Asia and Pacific Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: South Asia and Pacific Industry Analysis and Outlook Attractiveness by Therapy Type, 2023 to 2033

Figure 89: South Asia and Pacific Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 90: South Asia and Pacific Industry Analysis and Outlook Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Industry Analysis and Outlook Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 92: East Asia Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 93: East Asia Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Industry Analysis and Outlook Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 98: East Asia Industry Analysis and Outlook Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 99: East Asia Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 100: East Asia Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 101: East Asia Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 102: East Asia Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 103: East Asia Industry Analysis and Outlook Attractiveness by Therapy Type, 2023 to 2033

Figure 104: East Asia Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 105: East Asia Industry Analysis and Outlook Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) by Therapy Type, 2023 to 2033

Figure 107: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 108: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) Analysis by Therapy Type, 2018 to 2033

Figure 113: Middle East and Africa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Therapy Type, 2023 to 2033

Figure 114: Middle East and Africa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Therapy Type, 2023 to 2033

Figure 115: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 116: Middle East and Africa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 117: Middle East and Africa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 118: Middle East and Africa Industry Analysis and Outlook Attractiveness by Therapy Type, 2023 to 2033

Figure 119: Middle East and Africa Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 120: Middle East and Africa Industry Analysis and Outlook Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Regenerative Medicine Market Size and Share Forecast Outlook 2025 to 2035

Regenerative Biologic Injectables Market Size and Share Forecast and Outlook 2025 to 2035

Regenerative Artificial Skin Market Size and Share Forecast Outlook 2025 to 2035

Regenerative Agriculture Market Size and Share Forecast Outlook 2025 to 2035

Regenerative Braking System Market Size and Share Forecast Outlook 2025 to 2035

Regenerative Turbine Pump Market Size and Share Forecast Outlook 2025 to 2035

Regenerative Blowers Market Growth – Trends & Forecast 2025 to 2035

Regenerative Thermal Oxidizer Market Growth – Trends & Forecast 2025-2035

Automotive Regenerative Braking Market Size and Share Forecast Outlook 2025 to 2035

Antimicrobial Regenerative Wound Matrix Market - Growth & Forecast 2025 to 2035

Medicine Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Global Medicine Blister Market Analysis – Growth & Forecast 2025 to 2035

Telemedicine Carts Market Size and Share Forecast Outlook 2025 to 2035

Telemedicine Equipment Market Size and Share Forecast Outlook 2025 to 2035

Photomedicine Market

Glass Medicine Bottles Market

5G Telemedicine Platform Market Size and Share Forecast Outlook 2025 to 2035

The Sports Medicine Market Is Segmented by Product, Application and End User from 2025 To 2035

Nuclear Medicine Equipment Market Size and Share Forecast Outlook 2025 to 2035

Plastic Medicine Spoons Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA