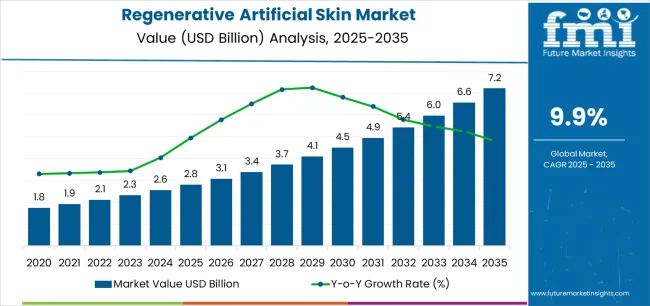

The global regenerative artificial skin market is likely to expand USD 7,214.7 million by 2035, recording an absolute increase of USD 4,407.7 million over the forecast period. The market is valued at USD 2,807.0 million in 2025 and is set to rise at a CAGR of 9.9% during the assessment period. The overall market size is expected to grow by nearly 2.6 times during the same period, supported by increasing demand for advanced wound healing solutions worldwide, driving demand for bioengineered tissue replacement systems and increasing investments in regenerative medicine research and burn treatment infrastructure projects globally.

Between 2025 and 2030, the regenerative artificial skin market is projected to expand from USD 2,807.0 million to USD 4,500.2 million, resulting in a value increase of USD 1,693.2 million, which represents 38.4% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for advanced burn treatment and chronic wound management solutions, product innovation in biocompatible scaffold technologies and cellular incorporation systems, as well as expanding integration with stem cell therapies and tissue engineering applications. Companies are establishing competitive positions through investment in advanced biomaterial research, clinical validation programs, and strategic market expansion across burn care centers, hospitals, and specialty wound clinics.

From 2030 to 2035, the market is forecast to grow from USD 4,500.2 million to USD 7,214.7 million, adding another USD 2,714.5 million, which constitutes 61.6% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized artificial skin systems, including 3D bioprinted skin constructs and vascularized tissue equivalents tailored for specific wound requirements, strategic collaborations between biomaterial manufacturers and healthcare providers, and an enhanced focus on personalized regenerative medicine and scar-free healing outcomes. The growing emphasis on quality of life improvement and aesthetic recovery will drive demand for advanced, high-performance regenerative artificial skin solutions across diverse wound care applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2,807.0 million |

| Market Forecast Value (2035) | USD 7,214.7 million |

| Forecast CAGR (2025-2035) | 9.9% |

The regenerative artificial skin market grows by enabling burn surgeons and wound care specialists to achieve superior healing outcomes and functional restoration while reducing treatment duration and scarring complications. Severe burn patients face mounting challenges with skin grafting limitations and donor site availability, with engineered artificial skin typically providing 40-60% faster wound closure compared to traditional autografts, making bioengineered skin essential for life-saving burn treatment in extensive injuries. The regenerative medicine revolution's need for biological wound coverage creates demand for advanced artificial skin solutions that can promote cellular infiltration, support neovascularization, and ensure durable tissue integration across diverse wound etiologies.

Government initiatives promoting burn care infrastructure development and trauma center capacity expansion drive adoption in burn care centers, hospitals, and specialty clinics, where advanced wound coverage has a direct impact on patient survival and long-term functional outcomes. The global shift toward regenerative therapies and tissue engineering accelerates artificial skin demand as clinicians seek alternatives to autologous grafting that creates secondary wounds and limited donor tissue availability in massive burns facilities and regions with limited specialized burn care infrastructure.

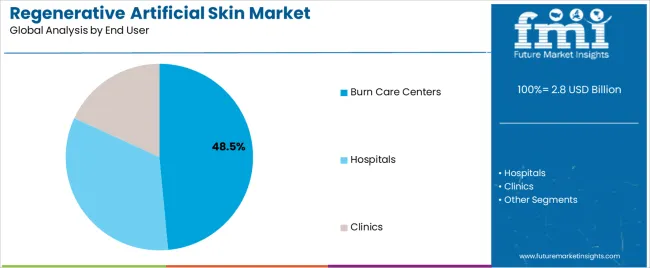

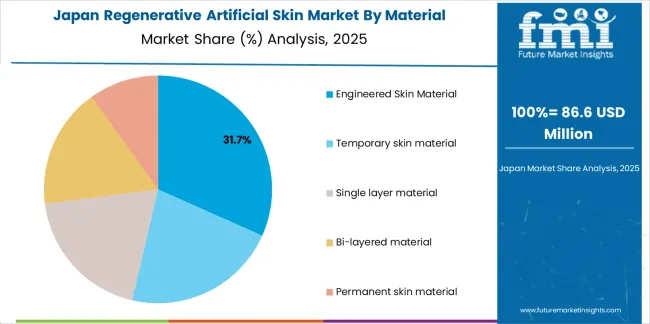

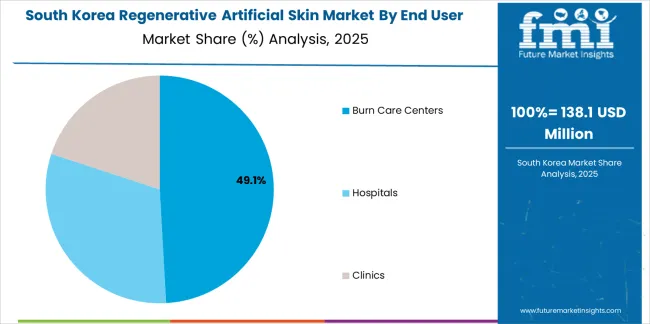

The market is segmented by material, end user, and region. By material, the market is divided into Engineered Skin Material, Temporary skin material, Single layer material, Bi-layered material, and Permanent skin material. Based on end user, the market is categorized into Burn Care Centers, Hospitals, and Clinics. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The engineered skin material segment represents the dominant force in the regenerative artificial skin market, capturing approximately 33.0% of total market share in 2025. This advanced category encompasses formulations featuring cellular components with dermal-epidermal architecture, delivering comprehensive biological wound coverage with active tissue regeneration capabilities for complex burn injuries. The Engineered Skin Material segment's market leadership stems from its exceptional biological integration promoting cellular infiltration, superior functional outcomes supporting normal skin characteristics, and compatibility with extensive burn treatment protocols requiring definitive wound closure.

The Temporary skin material segment maintains a substantial 23.0% market share, serving acute wound protection through biodegradable membranes for temporary coverage during wound bed preparation and staged reconstruction procedures. The Single layer material segment accounts for 15.0% market share, featuring simplified dermal matrices for partial-thickness wounds. The Bi-layered material segment represents 15.0% market share through dermal-epidermal constructs mimicking native skin architecture. The Permanent skin material segment encompasses 14.0% market share, serving definitive wound closure requiring long-term tissue replacement.

Key advantages driving the Engineered Skin Material segment include:

Burn care centers applications dominate the regenerative artificial skin market with approximately 48.5% market share in 2025, reflecting the specialized expertise and infrastructure requirements for managing severe thermal injuries requiring advanced wound coverage technologies. The Burn Care Centers segment's market leadership is reinforced by concentration of severe burn cases at designated trauma facilities, established protocols for biological wound coverage utilization, and multidisciplinary teams trained in advanced regenerative therapy applications.

The Hospitals segment represents 27.0% market share through general surgical departments, plastic surgery units, and emergency departments treating acute burns and traumatic wounds requiring artificial skin coverage. The Clinics segment accounts for 24.5% market share, featuring outpatient wound care facilities, diabetic foot clinics, and dermatology centers managing chronic wounds and surgical reconstruction procedures.

Key market dynamics supporting end-user preferences include:

The market is driven by three concrete demand factors tied to clinical outcomes and unmet medical needs. The increasing burn injury incidence creates expanding treatment requirements, with WHO estimating 11 million burn injuries annually requiring medical attention globally, and severe burns affecting 300,000+ patients needing advanced skin substitutes when autograft availability proves insufficient for massive total body surface area involvement exceeding 40-50%.

The chronic wound epidemic accelerates non-burn applications, with 6.5 million chronic wound patients in the U.S. alone requiring advanced wound care interventions, and artificial skin providing biological wound coverage for diabetic foot ulcers, pressure injuries, and venous leg ulcers unresponsive to conventional treatments after 4-6 weeks.

The military and disaster preparedness drives stockpiling programs, with defense departments and humanitarian organizations maintaining artificial skin inventories for mass casualty events requiring immediate burn treatment capacity surge when conventional grafting proves logistically impossible.

Market restraints include prohibitive treatment costs affecting accessibility, particularly in developing markets where artificial skin product costs of USD 2,000-8,000 per 100 cm² treatment area represent 10-50x local monthly income levels, creating insurmountable affordability barriers for the majority of burn patients requiring life-saving interventions. Reimbursement limitations pose adoption challenges in developed markets, as insurance coverage varies significantly by geography and product type, with many payers restricting artificial skin to last-resort situations after graft failure, limiting utilization despite superior clinical outcomes. Technical expertise requirements create implementation barriers, as successful artificial skin application demands specialized surgical skills, proper wound bed preparation, and comprehensive post-operative management that many general hospitals lack, concentrating utilization at academic burn centers and limiting broader market penetration.

Key trends indicate accelerated adoption of bioprinted skin constructs, with 3D bioprinting technologies enabling patient-specific artificial skin fabrication using autologous cells, creating personalized tissue grafts with superior integration and reduced immunogenicity compared to allogeneic products. Technology advancement trends toward vascularized skin equivalents incorporate pre-formed microvascular networks enabling immediate perfusion upon implantation, dramatically improving graft survival rates and reducing healing times from 3-4 weeks to 7-10 days in animal studies. The market thesis could face disruption if spray-on skin cell technologies achieve comparable outcomes at fraction of costs, delivering cellular therapy through aerosolized application eliminating expensive scaffold materials, or if regulatory authorities impose stricter safety requirements following adverse events, extending approval timelines and increasing development costs that price innovative products beyond market viability.

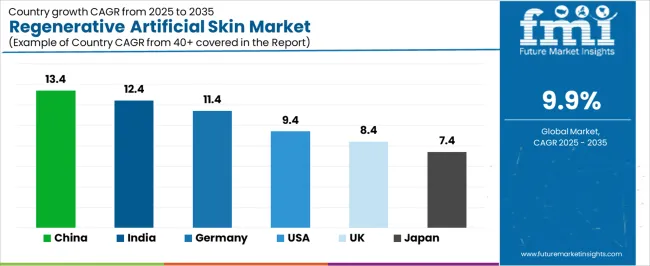

| Country | CAGR (2025-2035) |

|---|---|

| China | 13.4% |

| India | 12.4% |

| Germany | 11.4% |

| USA | 9.4% |

| UK | 8.4% |

| Japan | 7.4% |

The regenerative artificial skin market is gaining momentum worldwide, with China taking the lead thanks to expanding burn care infrastructure and regenerative medicine research investment programs. Close behind, India benefits from rising trauma incidents and growing private healthcare sector, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where universal healthcare coverage and clinical research excellence strengthen its role in European regenerative therapy adoption. The U.S. demonstrates robust growth through technology innovation leadership and established burn center networks, signaling continued investment in advanced wound care solutions. Meanwhile, the U.K. stands out for its NHS specialized burn services and regenerative medicine initiatives, while Japan continues to record steady progress driven by aging population wound care needs and quality-focused medical innovation. Together, China and India anchor the global expansion story, while established markets build stability and innovation into the market's growth path.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

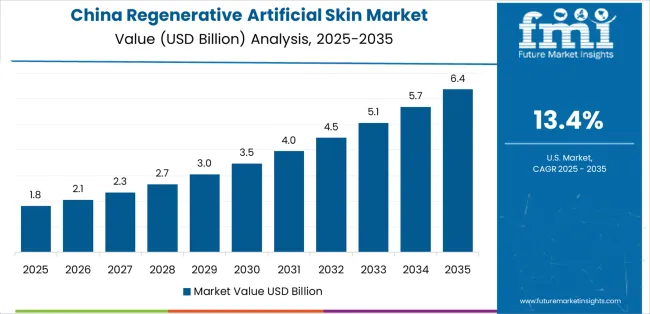

China demonstrates the strongest growth potential in the Regenerative Artificial Skin Market with a CAGR of 13.4% through 2035. The country's leadership position stems from comprehensive burn care infrastructure development, intensive regenerative medicine research programs, and aggressive healthcare modernization targets driving adoption of advanced wound treatment technologies. Growth is concentrated in major metropolitan hospitals, including Beijing, Shanghai, Guangzhou, and Chengdu, where designated burn centers, plastic surgery departments, and wound care facilities are implementing artificial skin programs for severe thermal injuries, traumatic wounds, and chronic ulcer management. Distribution channels through hospital procurement systems, medical device distributors, and direct manufacturer relationships expand deployment across tier-1 and tier-2 city hospitals with specialized burn care capabilities. The country's Healthy China 2030 initiative provides policy support for medical technology advancement, including regenerative medicine research funding and clinical trial facilitation.

Key market factors:

In major metropolitan areas, tertiary care hospitals, and trauma centers, the adoption of regenerative artificial skin systems is accelerating across burn units, plastic surgery departments, and specialized wound clinics, driven by rising trauma incidents and private healthcare expansion. The market demonstrates strong growth momentum with a CAGR of 12.4% through 2035, linked to comprehensive healthcare infrastructure development and increasing focus on advanced medical technology adoption. Indian healthcare facilities are implementing artificial skin treatment programs and specialized burn care protocols to improve patient outcomes while addressing the growing burden of thermal injuries across industrial accidents, domestic burns, and traffic trauma cases. The country's expanding medical tourism sector creates sustained demand for advanced wound care technologies, while growing health insurance penetration drives adoption of premium regenerative therapies.

Germany's advanced healthcare system demonstrates sophisticated implementation of regenerative artificial skin programs, with documented case studies showing integration at university burn centers achieving 70-80% graft survival rates through optimized surgical protocols and post-operative management expertise. The country's burn care infrastructure in major medical centers, including Berlin Charité, Munich Technical University, and Hamburg University Hospital, showcases integration of premium artificial skin technologies with existing plastic surgery and burn treatment systems, leveraging expertise in regenerative medicine and tissue engineering. German burn surgeons emphasize evidence-based treatment protocols and clinical outcomes research, creating demand for clinically validated artificial skin products that support superior healing outcomes and comprehensive quality-of-life restoration. The market maintains strong growth through focus on innovation and clinical excellence, with a CAGR of 11.4% through 2035.

Key development areas:

The USA market leads in regenerative artificial skin innovation based on robust FDA-approved product portfolio, extensive clinical evidence generation, and established burn center network supporting advanced wound care adoption. The country shows solid potential with a CAGR of 9.4% through 2035, driven by 450,000+ annual burn injuries requiring medical treatment and 40+ designated burn centers providing specialized care across major population regions. American burn surgeons are adopting multiple artificial skin technologies for definitive wound coverage in extensive burns, temporary protection during staged reconstruction, and biological wound bed preparation for autografting, particularly in major trauma centers requiring immediate intervention and in pediatric facilities optimizing scarring outcomes. Distribution channels through group purchasing organizations, hospital value analysis committees, and direct sales relationships expand coverage across diverse burn care facilities.

Leading market segments:

The UK's regenerative artificial skin market demonstrates mature implementation focused on NHS specialized burn services and academic research leadership, with documented integration at designated burn centers achieving coordinated national response to mass casualty events through established treatment protocols. The country maintains steady growth momentum with a CAGR of 8.4% through 2035, driven by NHS burn care network and regenerative medicine research excellence supporting clinical innovation. Major burn treatment facilities, including Chelsea and Westminster Hospital, University Hospital Birmingham, and Manchester Royal Infirmary, showcase advanced artificial skin applications where treatment programs integrate with existing NHS protocols and National Burn Care Review standards ensuring optimal resource utilization and patient outcomes.

Key market characteristics:

The regenerative artificial skin market in Europe is projected to grow from USD 742.5 million in 2025 to USD 1,895.3 million by 2035, registering a CAGR of 9.8% over the forecast period. Germany is expected to maintain its leadership position with a 32.8% market share in 2025, declining slightly to 32.5% by 2035, supported by its comprehensive burn care infrastructure and major university medical centers, including Berlin, Munich, and Hamburg hospital networks.

The United Kingdom follows with a 20.5% share in 2025, projected to reach 20.2% by 2035, driven by comprehensive NHS burn care network and regenerative medicine research programs implementing advanced wound coverage standards. France holds a 16.8% share in 2025, expected to rise to 17.0% by 2035 through ongoing burn center modernization and tissue engineering research advancement. Italy commands a 12.5% share in both 2025 and 2035, backed by universal healthcare coverage and plastic surgery excellence. Spain accounts for 9.2% in 2025, rising to 9.4% by 2035 on burn care infrastructure development and regenerative medicine adoption. Switzerland maintains 4.7% in 2025, reaching 4.9% by 2035 on medical innovation leadership and quality-focused healthcare delivery. The Rest of Europe region is anticipated to hold 3.5% in 2025, expanding to 3.8% by 2035, attributed to increasing artificial skin adoption in Nordic countries and emerging Central & Eastern European specialized burn care programs.

The Japanese regenerative artificial skin market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of advanced biomaterial technologies with existing burn care delivery, comprehensive plastic surgery expertise, and traditional meticulous surgical practices across quality-oriented healthcare systems. Japan's emphasis on clinical outcomes and patient safety drives demand for rigorously validated artificial skin products that support superior healing commitments and functional recovery expectations in demanding burn patient populations. The market benefits from strong partnerships between international biomaterial manufacturers and domestic medical device distributors including major pharmaceutical wholesalers, creating comprehensive service ecosystems that prioritize technical training and clinical support programs. Healthcare regions in Tokyo, Osaka, Kobe, and other major centers showcase advanced artificial skin implementations where treatment programs achieve comprehensive outcome documentation through registry participation and long-term follow-up protocols ensuring continuous quality improvement.

The South Korean regenerative artificial skin market is characterized by growing international medical device manufacturer presence, with companies maintaining significant positions through comprehensive clinical capabilities and innovation leadership for burn treatment and wound care applications. The market demonstrates increasing emphasis on regenerative medicine integration and stem cell combination therapies, as Korean healthcare facilities increasingly demand advanced artificial skin technologies that integrate with domestic tissue engineering research and sophisticated burn care protocols deployed across major university hospitals. Regional medical device distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including Korean regulatory compliance support and customized clinical training programs for plastic surgery and burn care applications. The competitive landscape shows increasing collaboration between multinational biomaterial companies and Korean regenerative medicine specialists, creating hybrid service models that combine international product technology expertise with local clinical practice adaptation capabilities and healthcare system integration knowledge.

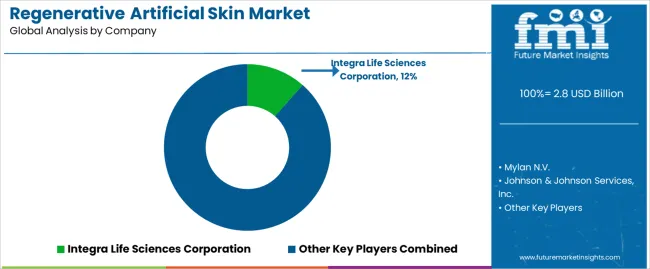

The regenerative artificial skin market features approximately 15-20 meaningful players with moderate concentration, where the top three companies control roughly 55-60% of global market share through established product portfolios and comprehensive clinical validation programs. Competition centers on clinical efficacy evidence, regulatory approval breadth, and surgeon training support rather than price competition alone. Integra Life Sciences Corporation leads with approximately 12% market share through its comprehensive dermal regeneration template and wound matrix portfolio.

Market leaders include Integra Life Sciences Corporation, Mylan N.V., and Johnson & Johnson Services, Inc., which maintain competitive advantages through extensive clinical evidence supporting superior outcomes across multiple wound types, global regulatory approvals providing market access in 50+ countries, and comprehensive surgeon education programs including hands-on training workshops and clinical fellowship support across major burn centers, creating reliability and technique expertise advantages with plastic surgeons and burn care specialists. These companies leverage research and development capabilities in biomaterial engineering and ongoing clinical research relationships to defend market positions while expanding into next-generation bioprinted constructs and vascularized tissue equivalents.

Challengers encompass Smith & Nephew and Mallinckrodt Plc., which compete through specialized product offerings and strong regional presence in key healthcare markets. Product specialists focus on specific material types or application segments, offering differentiated capabilities in cellular products, acellular matrices, and temporary wound coverage systems for staged reconstruction procedures.

Regional players and emerging tissue engineering companies create competitive pressure through innovative technology platforms and academic partnerships, particularly in high-growth markets including China and India, where domestic biomaterial development and local manufacturing capabilities provide advantages in cost-sensitive markets. Market dynamics favor companies that combine proven clinical outcomes with comprehensive surgeon support offerings including surgical technique training, post-operative care protocols, and outcomes tracking assistance that address complete burn treatment requirements across emergency wound coverage, definitive reconstruction, and long-term scar management throughout multi-year patient recovery pathways.

Regenerative artificial skin represents bioengineered tissue substitutes that enable burn surgeons to achieve 40-60% faster wound closure compared to traditional autografting, delivering superior functional outcomes and survival benefits with proven tissue integration supporting permanent wound coverage in demanding severe burn applications. With the market projected to grow from USD 2,807.0 million in 2025 to USD 7,214.7 million by 2035 at a 9.9% CAGR, these life-saving technologies offer compelling advantages - reduced scarring, improved functionality, and enhanced quality of life - making them essential for Burn Care Centers (48.5% market share), Hospital trauma departments, and patient populations facing donor site limitations when autograft availability proves insufficient for extensive injuries. Scaling market adoption and accessibility requires coordinated action across healthcare policy, reimbursement frameworks, technology manufacturers, clinical training programs, and regenerative medicine investment capital.

| Item | Value |

|---|---|

| Quantitative Units | USD 2,807.0 million |

| Material | Engineered Skin Material, Temporary skin material, Single layer material, Bi-layered material, Permanent skin material |

| End User | Burn Care Centers, Hospitals, Clinics |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, U.S., U.K., Japan, and 40+ countries |

| Key Companies Profiled | Integra Life Sciences Corporation, Mylan N.V., Johnson & Johnson Services, Inc., Smith & Nephew, Mallinckrodt Plc. |

| Additional Attributes | Dollar sales by material and end-user categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with biomaterial manufacturers and distribution networks, clinical application requirements and specifications, integration with burn care protocols and regenerative medicine initiatives, innovations in tissue engineering technology and bioprinting systems, and development of specialized artificial skin products with enhanced biological integration and functional outcomes capabilities. |

The global regenerative artificial skin market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the regenerative artificial skin market is projected to reach USD 7,214.7 billion by 2035.

The regenerative artificial skin market is expected to grow at a 9.9% CAGR between 2025 and 2035.

The key product types in regenerative artificial skin market are engineered skin material, temporary skin material, single layer material, bi-layered material and permanent skin material.

In terms of end user, burn care centers segment to command 48.5% share in the regenerative artificial skin market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Regenerative Artificial Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Regenerative Artificial Skin in USA Size and Share Forecast Outlook 2025 to 2035

Skin Health Supplement Market Size, Share and Growth Forecast Outlook 2025 to 2035

Artificial Ear Simulator Market Size and Share Forecast Outlook 2025 to 2035

Regenerative Biologic Injectables Market Size and Share Forecast and Outlook 2025 to 2035

Artificial Intelligence (chipset) Market Forecast and Outlook 2025 to 2035

Skin Lightening Product Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Regenerative Agriculture Market Size and Share Forecast Outlook 2025 to 2035

Skin Tightening Device Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Artificial Insemination Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Construction Market Size and Share Forecast Outlook 2025 to 2035

Artificial Tears Market Size and Share Forecast Outlook 2025 to 2035

Skin-Barrier Strengthening Phospholipids Market Size and Share Forecast Outlook 2025 to 2035

Skin Toner Market Size and Share Forecast Outlook 2025 to 2035

Skin Cancer Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Artificial Urinary Sphincter Market Size and Share Forecast Outlook 2025 to 2035

Artificial Lift Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA