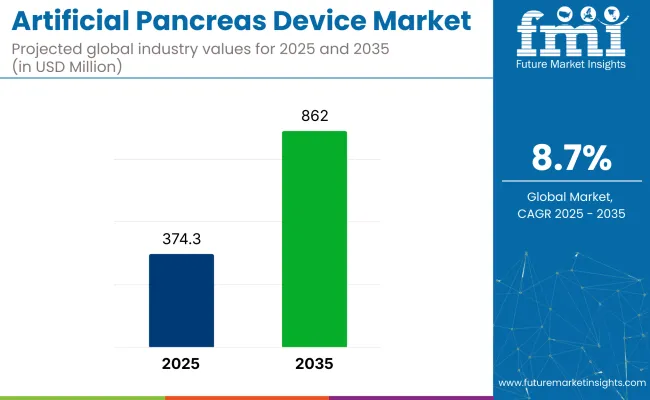

The global Artificial Pancreas Device Market is projected to be valued at USD 374.3 Million in 2025 and is expected to reach USD 862.0 Million by 2035, registering a CAGR of 8.7%. This market is currently experiencing rapid transformation, driven by increasing diabetes prevalence and evolving reimbursement frameworks.

Rising consumer preference for patient-centric, automated glycemic management coupled with streamlined regulatory approvals is fueling adoption. Key growth opportunities lie in deeper integration of interoperable continuous glucose monitors (iCGMs), adaptive closed-loop algorithms and remote monitoring platforms.

| Attributes | Value |

|---|---|

| Estimated Size, 2025 | USD 374.3 million |

| Projected Size, 2035 | USD 862.0 Million |

| Value-based CAGR (2025 to 2035) | 8.7% |

Expandable coverage through pay-as-you-go models and stronger digital health ecosystems will further enhance access. With manufacturers focusing on safety improvements and lower total cost of ownership, future outlook is robust poised to enter mainstream care across hospitals and home care settings, unlocking new use cases in paediatric, gestational and Type 1 segments also.

Major participants include Medtronic Plc., Tandem Diabetes Care, DexCom, Inc., Insulet Corporation, Abbott. In a strategic move in 2024, NHS rolls out artificial pancreas devices for children and adults living with type 1 diabetes across England. “This is another example of the NHS leading the way in healthcare, rolling out these groundbreaking devices across England over the next 5 years, as stated by Dr Clare Hambling, National Clinical Director for Diabetes, NHS.

In 2024, MCRA, the leading privately held independent medical device, diagnostics, and biologics Clinical Research Organization (CRO) and advisory firm is pleased to announce its role in aiding CamDiab’s artificial pancreas software, CamAPS FX, in achieving USA Food and Drug Administration (FDA) clearance.

“MCRA’s experts lead the industry in utilizing new and innovative approaches to secure regulatory success for our clients. By exploring these new pathways for submissions, our clients are better able to serve patients around the world.” Said, Anthony Viscogliosi, CEO of MCRA.

In North America, the Artificial Pancreas Devices Market is maturing rapidly due to strong payer reimbursement, faster FDA approvals and a dense clinical infrastructure. Activity is centered around expanding consumer access via pharmacy channels, remote monitoring, and software‑driven interoperability.

Insulet’s recent trial success with tubeless systems, Beta Bionics’ integration of FreeStyle Libre 3 Plus sensor, and CamDiab’s FDA‑cleared app solutions underscore region-specific momentum in novel, patient-friendly approaches. Major drivers include high Type‑1 diabetes prevalence, favourable reimbursement for durable medical devices along and widespread adoption of digital health frameworks.

Europe’s Artificial Pancreas Devices Market is gaining traction through government-backed pilot programs, interoperability standards, and cross-border regulatory alignment. NHS England’s pilot for 1,000 users signals public health commitment to automated devices. Manufacturers are aligning with European telehealth platforms, enhancing device adaptability in homecare.

Key factors driving growth includes centralized procurement initiatives, rising digital diabetes management literacy, and streamlined CE-marking processes for medical software. With diabetes prevalence climbing, health systems are positioning closed-loop Artificial Pancreas Devices as scalable pillars for reducing long-term complications and easing provider burden accelerating adoption of systems that are interoperable and patient-centric.

The compound annual growth rate (CAGR) of the global market for artificial pancreas device systems for the first half of 2024 and 2025 is compared in the table below. This analysis provides important insights into the performance of the industry by highlighting significant shifts and trends in revenue generation.

The first half (H1) is the period from January to June, and the second half (H2) is July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 9.6%, followed by a slightly lower growth rate of 9.3% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 9.6% |

| H2 (2024 to 2034) | 9.3% |

| H1 (2025 to 2035) | 8.9% |

| H2 (2025 to 2035) | 8.4% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 8.9% in the first half and remain relatively moderate at 8.4% in the second half. In the first half (H1) the industry witnessed a decrease of 70 BPS while in the second half (H2), the industry witnessed a decrease of 90 BPS.

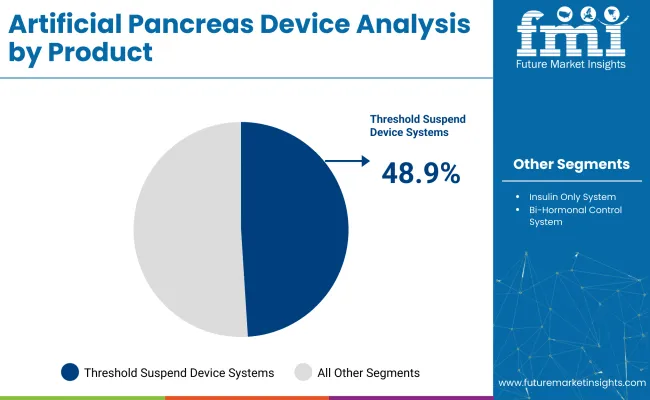

The Threshold Suspends Device Systems segment, holding approximately 48.9% of the global market revenue in 2025, is being positioned as the most clinically accepted technology across early-stage Artificial Pancreas Devices deployments. Its leadership is attributed to the ability to automatically halt insulin delivery when glucose levels drop to a predefined threshold minimizing severe hypoglycemic episodes without external intervention.

Its prominence has been reinforced through early FDA approvals and strong safety profiles demonstrated across pediatric and adult trials. Furthermore, their ease of adoption and lower learning curve have enhanced patient compliance and physician recommendation rates. Threshold suspend devices continue to be favored where safety outcomes and regulatory track records influence procurement decisions.

The Type I Diabetes segment, accounting for approximately 92.6% revenue share in 2025, has remained dominant due to the condition’s strong clinical fit with artificial pancreas solutions. Since Type I patients require lifelong insulin therapy and continuous glucose regulation, artificial pancreas devices technologies have been widely integrated into disease management protocols.

The prevalence of pediatric and early-onset Type I diabetes in high-income markets has accelerated the need for automated glycemic control systems. Closed-loop hybrid systems have particularly gained trust in this segment, due to their ability to reduce hypoglycemia and improve time-in-range metrics.

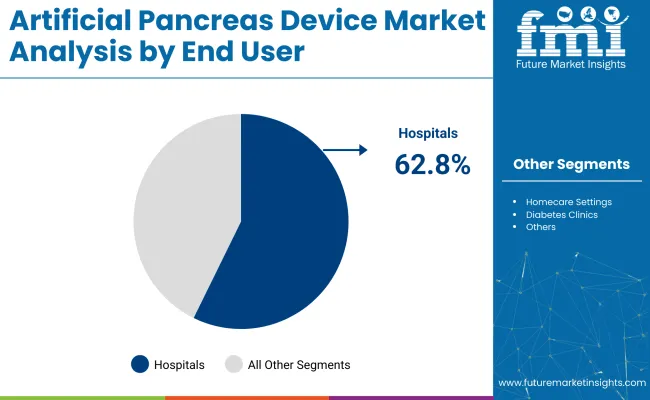

The hospitals segment, contributing to approximately 62.8% of the global revenue in 2025, has emerged as the largest end-user category, primarily due to the presence of robust diabetes management protocols in institutional settings.

Artificial pancreas systems are increasingly being adopted by hospitals for both inpatient stabilization and structured outpatient management of glycemic conditions. Hospitals are also viewed as critical validation hubs, where efficacy, patient compliance, and data feedback from artificial pancreas devices can be closely monitored and optimized.

Rising Prevalence of Diabetes is Driving Artificial Pancreas Device System Sales

According to the International Diabetes Federation, there are more than 460 million patients with diabetes worldwide, a number anticipated to grow over the coming years and decades. This worrying increase has heightened the need for advanced technologies such as APDS to promote glycemic control and enhance patient outcomes.

Diabetes, especially Type 1 and insulin-dependent Type 2, must be managed on an ongoing basis to prevent complications such as cardiovascular disease, kidney damage, and nerve disorders. APDS has emerged as the transformative solution, offering automated, real-time blood glucose monitoring and insulin delivery that closely emulates the natural function of a healthy pancreas.

With the world healthcare community moving towards innovative ways to manage this chronic condition, APDS has been accepted because it eases the burden of disease management by the patient and improves their quality of life.

Furthermore, the increasing prevalence of diabetes among younger populations, added to the rising obesity rates and the aging demographic, emphasizes the critical demand for such devices. Heavy investment in APDS technology by governments, healthcare providers, and private companies is taking place to answer this growing crisis, thus making it one of the pivotal tools in the global fight against diabetes.

The Market Is Experiencing Significant Growth Due to the Technological Advancements in Artificial Pancreas Device System

Improvements in technology have considerably improved the efficiency, reliability, and usability of APDS. Innovations related to CGM systems now yield more accurate, real-time glucose readings that are quite crucial for efficient glycemic control.

In like manner, insulin delivery pumps are becoming more accurate, compact, and user-friendly to afford patients a better level of comfort and convenience. The APDS is based on a platform of sophisticated control algorithms that achieves fully integrated coordination between CGMs and insulin pumps, enabling highly responsive and automated glucose regulation in a manner very similar to a healthy pancreas.

In addition to the core components mentioned, some of the innovative features, such as smartphone integration, Bluetooth connectivity, and cloud-based data storage, have attracted a new population of patients and healthcare providers who are interested in using APDS.

Now, with the new technology, the devices allow the tracking of glucose levels and insulin delivery via mobile apps, thus allowing users to garner personalized insights and facilitate communication with healthcare professionals more easily.

Additionally, AI-powered predictive analytics enhance APDS functionality by predicting glucose trends and preventing hypo- and hyperglycemic events.

This advancement has increased the effectiveness, adoption, and accessibility of APDS devices. These innovations will allow patients to better and more easily manage diabetes by themselves and thus improve the quality of their lives due to reduced user intervention and real-time data.

Integration of Smartphone and Wearable Technology and its Impact on this Market is emerging as a Significant Trend for the Market.

The increasing demand for user-friendly interfaces has driven the integration of smartphone applications and wearable devices with APDS. Indeed, these integrations have revolutionized the management of diabetes by offering real-time access to critical health data, which was earlier limited.

Thus, patients can now monitor glucose levels, track insulin delivery, and observe trends directly from their smartphones or wearable gadgets, leading to a great increase in adherence to treatment protocols and convenience.

Wearable devices like smartwatches and fitness trackers have made instant alerts for hypo- or hyperglycemia possible, which, in turn, allows the patients to take timely action and prevent further complications. Besides, Bluetooth connectivity enables smooth synchronization across devices for continuous and accurate glucose monitoring.

The more advanced applications attributed to APDS devices include artificial intelligence-powered predictive analytics, enabling personalized recommendations to achieve improved glycemic control.

These range from the application being able to forecast possible changes in blood glucose in relation to a user's activities, diet, and insulin use, among others, in advance, hence empowering them to act appropriately.

Regulatory Challenges and Approval Process Delays May Restrict Market Growth

One of the significant challenges of the artificial pancreas device system is the regulatory hurdles involved. It would require a few stages to obtain regulatory approval towards dimension, out of which some may include preclinical trials, clinical studies, post-market surveillance, and more, each requiring extensive evidence and documentation to show safety, efficacy, and performance.

Regulatory bodies like the USA FDA and EMA have, therefore, set strict standards to ensure these devices will not impose any hazard to the patients, and that becomes particularly important when considering the nature of APDS devices that regulate critical functions, such as insulin delivery.

The process is very long and expensive for manufacturers. Clinical trials, which are usually a prerequisite for approval, take many years to complete and delay the entry of new technologies into the market. Extended timelines for approval raise overall development costs for companies, which may impact pricing and access to the market.

Besides, the very process of approval may vary greatly from region to region, which creates additional obstacles for companies willing to bring their products onto the international market.

Some regions can have less strict requirements, but these standard variations may not allow APDS devices to enter different markets smoothly, leading to delays or even hindering market extension.

Tier 1 companies dominate the market, gaining the highest share of about 57.3% from their superior technological offerings and massive investments in R&D. Some of the noted players in this tier include Medtronic, Insulet Corporation, Tandem Diabetes Care, Inc., and Abbott Laboratories.

Tier 2 companies have significant market shares of about 21.5%, and revenues generally range between USD 90 million and USD 130 million per year. Some of the most important companies in this category are Beta Bionics, BigFoot Biomedical Inc., Diabeloop SA, and EoFlow Co. Ltd.

These are the minor players or niche-focused firms working on innovative solutions for artificial pancreas device systems. Although their share in the market is negligible, they are significant in proving specific demands and innovations in artificial pancreas device systems.

These three tiers form the competitive landscape of the artificial pancreas device market - Tier 1 companies advance on high-tech fronts, Tier 2 companies concentrate in niche markets, and Tier 3 companies bring innovation into the market.

The section below covers the industry analysis of artificial pancreas device systems in different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided.

The United States is anticipated to remain at the forefront in North America, with a CAGR of 3.6% through 2035. In Asia Pacific, China is projected to witness a CAGR of 6.0% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 3.6% |

| Germany | 4.1% |

| France | 5.9% |

| UK | 4.5% |

| China | 6.0% |

| India | 9.2% |

Germany’s artificial pancreas device market is expected to exhibit a CAGR of 4.1% between 2025 and 2035. Germany holds the highest market share in the European market.

In Germany, the market is driven by the country's high prevalence of diabetes and increasing consumer focus on preventive healthcare. With around 9% of its adult population being diabetic, Germany is home to one of the largest populations in Europe affected by diabetes. It has developed a large requirement for artificial pancreas device systems.

The German healthcare system has emphasized self-management of chronic diseases, such as diabetes, consistent with the increasing penetration of artificial pancreas device systems. Besides, the well-defined regulatory regime in Germany offers high-quality, accurate artificial pancreas device systems that promote fulfilling requirements and provide effective solutions.

The United States market is anticipated to grow at a CAGR of 3.6% throughout the forecast period.

In the United States, reimbursement policies are essential in expanding access to health technologies, such as artificial pancreas device systems. With time, Medicare, Medicaid, and private health insurance providers are recognizing their value and increasing the use of APDS as an integral part of diabetes care.

This recognition thus helps the APDS device to reach the mass majority, including patients with Type 1 and Type 2 diabetes who require continuous monitoring and insulin delivery.

Including APDS devices under reimbursement policies reduces the out-of-pocket expenses for patients who otherwise have to bear the exorbitant costs of these advanced systems.

In the context of diabetes care, long-term management requires continuous glucose monitoring and insulin delivery systems, which could be quite expensive. Thus, covering APDS devices under insurance helps patients afford such life-saving technologies, improving adherence to diabetes treatment plans and better health outcomes.

India is expected to hold a dominating position in the South Asia market of artificial pancreas device systems. It is anticipated to grow at a CAGR of 9.2% throughout the forecast period.

The increasing prevalence of diabetes among the population is creating a demand for affordable remedies in India, which, in turn, drives the industry toward the primary demand for artificial pancreas device systems.

Many of the population lives in rural or semi-urban areas, and healthcare is inaccessible and largely unaffordable. Thus, growing adoptions of an APDS at the expense of more economically constructive options activate the segment's revenues.

The local manufacturers in India are trying to make APDS more affordable by developing budget-friendly versions, and hence, the technology is becoming more accessible to the general population. These devices are often designed to meet the basic needs of diabetes management without compromising essential features such as insulin delivery and glucose monitoring.

Therefore, this artificial pancreas device market is highly competitive, with many key players actively working hard to maintain and even enhance their market positions. Major players in this industry are concentrating on innovation and investing highly in more advanced technologies and applications to cater to the different needs of healthcare providers and patients.

Such strategic approaches include forming regulatory approvals, strategic mergers, and expansions to expand such companies' product portfolios and geographic reach.

Recent Industry Developments in Artificial Pancreas Device Market

The market is segmented based on Product, Indication, End User, And Region.

the industry is divided into Threshold Suspend Device System, Insulin Only System, and Bi-Hormonal Control System.

the industry is divided into Diabetes Type I, Diabetes Type II, and Gestational Diabetes.

the industry is divided into Hospitals, Diabetes Clinics and Homecare Settings.

Regionally, the Artificial Pancreas Device Market is analysed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa (MEA).

The global artificial pancreas device industry is projected to witness CAGR of 8.7% between 2025 and 2035.

The global artificial pancreas device industry stood at USD 343.5 million in 2024.

The global artificial pancreas device industry is anticipated to reach USD 875.3 million by 2035 end.

France is expected to show a CAGR of 5.9% in the assessment period.

The key players operating in the global artificial pancreas device industry include Medtronic, Insulet Corporation, Tandem Diabetes Care, Inc., Abbott Laboratories, Beta Bionics, BigFoot Biomedical Inc., Diabeloop SA, EoFlow Co. Ltd, Inreda Diabetic B.V. among others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Artificial Intelligence (chipset) Market Forecast and Outlook 2025 to 2035

Artificial Insemination Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Construction Market Size and Share Forecast Outlook 2025 to 2035

Artificial Tears Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Artificial Urinary Sphincter Market Size and Share Forecast Outlook 2025 to 2035

Artificial Lift Systems Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Retail Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence (AI) in Automotive Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Healthcare Market Size, Growth, and Forecast for 2025 to 2035

Artificial Ventilation and Anaesthesia Masks Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence In Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Artificial Flower Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Artificial Preservative Market Outlook by Product, Type, Form, End Use Application and Others Through 2035

Artificial Hair Integration Market Growth - Trends & Forecast 2025 to 2035

Artificial Intelligence in Military Market Analysis - Size & Forecast 2025 to 2035

Analysis and Growth Projections for Artificial Sweetener Business

Artificial Turf Market Growth & Trends 2024-2034

Artificial Plants Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA