Over the forecast period 2025 to 2035, the demand for artificial hair integration will be gradual owing to increasing aesthetic awareness, prevalence of hair loss, and growing inclination towards non-surgical methods for hair restoration.

Consumers seeking fullness and thickness and the appearance of natural hair are increasingly turning to trichological cosmetic methods for artificial hair integration (hair extensions, wigs, hairpieces, and non-surgical hair replacement systems). In addition, the increased use of social media, celebrity promotion, and the development of new hair integration technologies are also driving market growth.

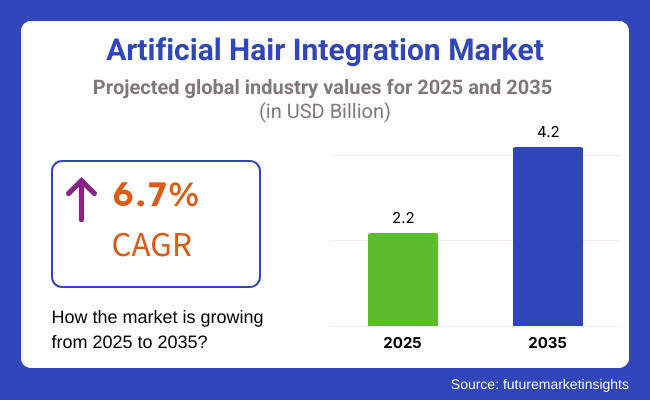

The market is expected to reach USD 2.2 Billion by 2025 and odor the increase to USD 4.2 Billion by 2035, at a CAGR of 6.7% during the forecast period. The increasing implementation of personalized, ethically sourced, and high-quality hair integration products in the industry, increasing disposable income, and the growing contribution of male consumers are influencing the industry landscape.

In addition, the potential for further growth in the high-end market due to developments in synthetic fiber production, 3D-printed hair integration, and AI-powered customization capabilities will only help to stimulate growth further.

The Artificial Hair Integration Market in North America is expected to have a significant share owing to the high consumer expenditure on beauty and personal care, growing adoption, and continuing sales of high-class hair extensions along with celebrity-endorsed beauty trends. North America is the most lucrative region, driven by increased knowledge of hair loss solutions, rising male engagement in hair restoration activities, and availability of online beauty retail platforms.

Demand for high-quality, luxury hairpieces is being driven by a rising consumer preference for ethically sourced human hair, handmade wigs, and custom hair integration solutions. Moreover, technological advancements in seamless hair extensions, lightweight wigs, and heat-resistant synthetic fibers are improving product quality. Furthermore, the rise of social media and beauty trends driven by social media influencers has also had a nice impact on the market growth in North America.

Countries of the European region, such as Germany, the UK, France, and Italy, are dominating the market for premium hair extensions, style wigs, fashion wigs, and sustainable hair integration solutions, holding a major share of the Artificial Hair Integration Market. Rapid growth in the fashion and beauty sectors in the region, the desire for organic and cruelty-free hair products, and the development of luxury salon services are boosting the market growth.

The rising prevalence of alopecia, the provision of treatment for hair loss during or post-chemotherapy, and the growing consumer demand for no-surgical hair replacement solutions are expanding the medical-grade wig and custom hairpiece market. Moreover, the European Union has strict laws regarding the use of cosmetic products, and these regulations are leading brands to develop high-end, allergenic-free, and environment-friendly hair integration products.

The Artificial Hair Integration Market is projected to be dominated by the Asia-Pacific region, where growing disposable incomes, burgeoning K-beauty trend influence, and a rapid increase in the number of e-commerce channels are expected to play key roles. In fact, high demand for hair extensions, wigs, and volumizing hairpieces is acting as a driving force enabling countries like China, Japan, South Korea, and India to become leading players in the market.

China has become a major supplier of human hair and synthetic fiber wig products, and the domestic consumption of these products is rising with the rising aesthetic awareness and the rise of social media.

Both South Korea and Japan, famous for their cutting-edge beauty technologies, are pouring resources into the innovation of AI-enhanced wig customization, lightweight synthetic hair fibers, and breathable hair integration solutions. Moreover, the strong demand for temple hair and virgin human hair extensions in India is aiding the market growth, and the region is highly contributing as a supplier and consumer of hair integration products.

Challenges

Counterfeit Products and High Cost of Premium Hair Solutions

A key challenge in the Artificial Hair Integration Market is the presence of counterfeit hair products and low-quality synthetic products impacting brand credibility and consumer trust. The high price point for premium synthetic wigs and custom human hair extensions serves as another barrier to mass adoption, especially in price-sensitive markets.

Moreover, scalp health issues, allergic responses to adhesives, and the upkeep involved with hair integration solutions pose obstacles to sustained consumer retention and product acceptance. Competition for the non-surgical hair integration market is coming from an ever-increasing array of alternative hair loss treatments, such as hair transplants and regenerative therapies.

Opportunities

AI-Driven Customization and Sustainable Hair Materials

Key Trends Shaping the Transformation of the Artificial Hair Integration MarketOverviewCOVID-19 ImpactAssessment: Artificial Hair Integration Market. AI-enabled personalization for wigs, 3D-edition wigs, and real-time virtual try-ons are acting as growth drivers for improving consumer engagement and product personalization. Relationship hair technology with integrated smart hair systems for temperature resistance and sweat-proof adhesives alongside lighter fiber establishments are allowing the new demand for next-generation hair solutions.

Sustainable and ethical hair materials are trending and require that the need for vegan, plant-based, and bio-synthetic hair rise and replace components of synthetic hair. Demand for luxury wig brands, celebrity-endorsed hair extensions, and custom medical-grade wigs will further add to the growth of the premium segment in the coming time.

Furthermore, the rising use of non-surgical hair restoration solutions among men, such as integrated hair systems and custom hair pieces, is creating new opportunities for gender-inclusive hair integration solutions. The industry of artificial hair integration is poised for further growth as more e-commerce beauty brands, digital wig marketplaces, and influencer-driven professional hair care product recommendations continue to emerge.

The artificial hair integration market was able to grow significantly, with the growth rates projected for 2020 to 2024. Market expansion was primarily driven by the increased use of all hair extensions, wigs, and hairpieces by consumers, celebrities, and individuals suffering from hair loss. Improvements in synthetic fiber technology and ethically sourced human hair processing meant that product quality, durability, and natural appearance were also improved. Moreover, the impact of social media, beauty influencers, and e-commerce platforms has propelled product adoption, especially among younger demographics.

From 2025 to 2035, the artificial hair integration sector will see groundbreaking developments such as AI-powered personalization, 3D-printed hair follicles, and bioengineered hair fibers. True-to-life hair strands, treated with nanotechnology, to improve durability, UV resistance, and scalp compatibility. AI-based personalized hair-matching algorithms will allow for virtual real-time try-ons and automated color-texture-matching for customized wigs and extensions.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with hair product safety regulations, chemical-free processing standards, and ethical sourcing guidelines. |

| Technological Advancements | Advances in high-quality synthetic fibers, lightweight wigs, and clip-in extensions. |

| Industry Applications | Used in fashion, beauty, theatrical styling, and medical hair loss solutions. |

| Adoption of Smart Equipment | Limited use of AI and automation in product personalization. |

| Sustainability & Cost Efficiency | Increasing demand for eco-friendly synthetic fibers and ethically sourced human hair. |

| Data Analytics & Predictive Modeling | Use of customer trend analysis and digital hair styling platforms. |

| Production & Supply Chain Dynamics | Challenges in human hair shortages, synthetic fiber quality control, and rising material costs. |

| Market Growth Drivers | Growth fueled by fashion trends, rising hair loss cases, and e-commerce beauty expansion. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered quality assurance, blockchain-based ethical hair sourcing verification, and sustainability certifications. |

| Technological Advancements | 3D-printed hair follicles, bioengineered keratin-based fibers, and AI-driven personalized hair matching. |

| Industry Applications | Expanded into smart hair technology, AI-powered hair restoration, and biotech-driven scalp integration. |

| Adoption of Smart Equipment | Real-time virtual try-on apps, AI-powered hair selection, and smart scalp compatibility scanning. |

| Sustainability & Cost Efficiency | Biodegradable synthetic hair, circular economy recycling models, and AI-optimized sustainable hair production. |

| Data Analytics & Predictive Modeling | AI-driven predictive hair health analytics, scalp-responsive smart wigs, and blockchain-based authenticity tracking. |

| Production & Supply Chain Dynamics | Decentralized hair material sourcing, AI-powered supply chain logistics, and lab-grown human hair fiber innovations. |

| Market Growth Drivers | Future expansion is driven by AI-powered personalized beauty, bioengineered hair materials, and sustainable hair integration technologies. |

The USA Artificial Hair Integration Market is growing consistently due to several factors, such as increasing demand for hair restoration solutions, rising consumer awareness about hair aesthetics, and expanding beauty and personal care industry. Hair loss affects more than 80 million Americans, according to the American Academy of Dermatology (AAD), and the increasing popularity of non-surgical hair replacement and other solutions has contributed to the demand for hair extensions and wigs.

The Market Divisions like 3D-printed Hair Integration, Bio-fiber Hair Implants, and Lightweight Synthetic Hair Material are becoming more and more popular. Moreover, the growing adoption of premium products on account of the increasing trend of personalized and ethically sourced human hair wigs is projected to spur market growth.

Market demand, especially for hair extension and wig segment, is also growing on account of the rising trend of celebrities, social media, and beauty influencers. Leading brands, including Great Lengths, HairUWear, and Luxy Hair, are developing expanding ranges to appeal to different consumer demands.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.9% |

The artificial Hair Integration Market in the United Kingdom is characterized by the increasing demand for hair-enhancing products, increased awareness regarding the various treatments for hair loss, and rising disposable income of individuals who are willing to opt for high celebrities' hair.

The British Association of Hair Restoration Surgery (BAHRS) is also reporting an increase in demand for non-invasive hair integration techniques, such as hair toppers, lace-front wigs, and keratin-bonded extensions. Furthermore, the increasing trend of sustainable and ethically sourced human hair also boosts market growth as brands focus on eco-friendly production techniques.

Moreover, an increase in the male population interested in hair restoration, celebrity culture, and fashion trends is boosting demand for personalized and premium quality hair integration solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.5% |

The European Union Artificial Hair Integration market is significantly fueled by factors such as increasing hair loss awareness, growing consumer demand for premium hair extension and wig products, and the growing popularity of online beauty retail channels. According to the European Hair Research Society (EHRS), hair integration methods without surgery are becoming more common and are predominantly found in Germany, France, and Italy.

As a growing number of people design, it is a top priority to consider sustainability and ethical sourcing when purchasing organic, hand-crafted, and natural hair products that are growing in prevalence. Consumers looking for affordable and long-lasting hair integration solutions are also increasingly turning to lightweight and heat-resistant synthetic fibers.

E-commerce platforms, along with digital marketing strategies, are driving sales further, making artificial hair products accessible to a wider audience.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.7% |

Japan's artificial hair integration market is growing with increasing beauty consciousness, advancement in hair integration technologies, and greater acceptance of hair augmentation products among men and women.

Japanese companies pioneered new wig-making techniques and heat-resistant synthetic fibers, as well as scalp-friendly adhesives. Furthermore, MHLW (Japanese Ministry of Health, Labour, and Welfare) established strict quality standards for synthetic and human hair wigs, maintaining quality control and inspiring consumer confidence.

Older consumers experiencing age-related hair thinning are also contributing to the demand for high-quality, natural-looking wigs in Japan, where more than 28% of citizens are 65 or older.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.8% |

These trends, in addition to the growth of K-beauty product trends driving demand for hair aesthetics in South Korea, are assisting the Artificial Hair Integration Market to grow at a rapid rate.

South Korea is the nation that produces the largest amount of heat-resistant synthetic wigs and hair extensions and is also the largest exporter. Celebrity-endorsed beauty trends and social media influencers have sparked demand for clip-in extensions, hair weaves, and lace-front wigs.

The South Korean MFDS is setting high standards for hair integration products and encouraging the use of skin-friendly adhesives and breathable wig caps. Furthermore, the growing male grooming culture will spur the demand for hairpieces and hair volumizing solutions among men.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.0% |

Key developments of the Artificial Hair Integration Market include their ever-increasing demand owing to the aesthetic of human hair utilized in manufacturing because of the high prevalence of hair disorders and other hair thinning conditions. In the synthetic hair market, Kanekalon and polyester are dominant types that are used because of their natural texture, durability, and styling flexibility.

Kanekalon Leads Market Demand Due to Its Natural Look and Heat Resistance

With regard to fiber types, Kanekalon synthetic fiber rules the sector as it has a soft texture and natural hair façade and can be styled using heat styling. Unlike common synthetic fibers, Kanekalon fibers are used in wigs, hair extensions, and braiding because they enable it to have the same appearance and texture as human hair, therefore creating the ultimate human-hair substitute.

Additionally, the rising trend of high-quality hair integration products among female consumers and the entertainment industry has led to increased adoption of Kanekalon-based products. Its lightweight, tangle-resistant, and curl-holding properties make it the go-to choice for high-fashion wigs and permanent hair replacement solutions.

Nonetheless, more expensive than basic synthetic fibers coupled with limited varieties available in low-cost product lines could limit mass adoption of this technology. Another measure to consolidate Kanekalon's position in the market is improvements in fiber technology, color retention, and durability enhancement.

Polyester Gains Traction Due to Cost-Effectiveness and Versatile Styling Applications

Polyester,A great and cheaper alternative to artificial hair integration products It is primarily used in low-maintenance wigs, temporary hairpieces, and inexpensive extensions, as it gives you the best of both worlds by being durable and affordable.

Synthetic hair, usually created from polyester, has long been favored for being lightweight, colorful, and resistant to environmental elements like humidity and UV rays. Also, it is commonly used for costume wigs, cosplay wigs, and costumes where the highest importance is placed on cost and color availability.

Polyester fibers are also less heat-resistant than Kanekalon and don't have the how-do-I-say-it natural movement that would make them ideal for wear or heat-based styling over extended periods. Manufacturers are getting around these roadblocks by hardening up the softness of fiber, boosting heat resistance, and/or developing hybrid polyester blends to render more realistic synthetic hair.

The demand for artificial hair integration is primarily influenced by female and male consumers, who seek customized hairstyling solutions for fashion, beauty, and hair restoration needs.

Female Consumers Dominate the Market as Hair Extensions and Wigs Gain Popularity

On the basis of end users, the female segment accounts for the highest revenue share in the global artificial hair integration market as women are increasingly using wigs, extensions, and braiding hairpieces for aesthetic appeal, convenience, and protective styling. Women invest in hair integration solutions like clip-ins, lace front wigs, and sew-in weaves to get voluminous, extended features without undergoing chemical treatments or retaining permanent damage.

In addition, the advent of beauty influencers, celebrity hairstyling trends, and the growing perception of wigs as fashion accessories are the factors driving the growth of the market. For women seeking comfortable, versatile hairpieces with natural, lasting looks, their top option is high-end Kanekalon-based wigs and human hair blends. Still, price sensitivity and the ongoing need for low-maintenance, affordable solutions keep polyester and synthetic fiber wigs in consumption mode.

Male Consumers Adopt Artificial Hair Integration for Hair Restoration and Fashion Trends

The male segment is booming as more men consider non-surgical hair replacement for thinning hair, baldness, or just for aesthetic styling. For men, the use of hair systems, toupees, and clip-in hairpieces has become increasingly popular in providing natural-looking, confidence-boosting hair enhancements.

New synthetic fibers that are heat-resistant and breathable have made male hairpieces much more comfortable and durable for everyday use and extended wear, resulting in added appeal. Moreover, sales in this segment have also benefitted from the increasing number of men adopting fashion-forward hairstyles, including temporary color wigs and volume-enhancing extensions.

In addition, the stigma that used to be associated with men when wearing artificial hair is now not an issue as cultural changes and celebrity endorsements have helped to voilà that hair integration is totally normal for male consumers.

The Artificial Hair Integration Market has seen a rise due to aesthetic enhancement, medical hair restoration solutions, and hairstyling trends driven by fashion. Factors such as rising consumer awareness regarding hair replacement solutions, advancements in synthetic and natural hair fibers, and increasing adoption of non-surgical hair integration techniques drive the market.

Companies that manufacture high-quality synthetic and human hair extensions, medical-grade hair prosthetic devices, and custom hair replacement systems for sale to salons, individual consumers, and for medical purposes. It features top hook-in wig manufacturers, hair extension suppliers, and medical hair restoration clinics; manufacturers advance heat-proof synthetic fibers, hair wafting techniques using real hair, and AI hair customization arrangements.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Great Lengths S.p.A. | 15-20% |

| Hairdreams Haarhandels GmbH | 12-16% |

| Aderans Co., Ltd. | 10-14% |

| HairUWear Inc. | 8-12% |

| Evergreen Products Group Limited | 6-10% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Great Lengths S.p.A. | Develops high-end keratin-bonded human hair extensions with ethical sourcing and long-lasting wearability. |

| Hairdreams Haarhandels GmbH | Specializes in premium-grade hair integration systems, medical hair thickening solutions, and hair loss treatments. |

| Aderans Co., Ltd. | Provides customized medical wigs, hairpieces, and scalp care solutions for individuals experiencing hair loss. |

| HairUWear Inc. | Manufactures ready-to-wear synthetic and human hair wigs, extensions, and volumizing hairpieces for fashion and medical use. |

| Evergreen Products Group Limited | Focuses on mass-market synthetic and blended hair products for salon and consumer applications. |

Key Company Insights

Great Lengths S.p.A. (15-20%)

Great Lengths leads the luxury hair extension market, offering ethically sourced, long-lasting keratin-bonded human hair extensions for high-end salon applications.

Hairdreams Haarhandels GmbH (12-16%)

Hairdreams specializes in medical-grade hair integration and volumizing solutions, catering to individuals with hair thinning and medical hair loss conditions.

Aderans Co., Ltd. (10-14%)

Aderans is a global leader in medical hair prosthetics, developing custom hair systems and scalp care treatments for cancer patients and individuals with alopecia.

HairUWear Inc. (8-12%)

HairUWear manufactures fashion-forward wigs, clip-in hairpieces, and synthetic hair extensions, focusing on affordable, ready-to-wear solutions for consumers.

Evergreen Products Group Limited (6-10%)

Evergreen Products supplies synthetic and blended hair integration products, serving both the professional salon market and individual consumers.

Other Key Players (35-45% Combined)

Several hair integration companies and beauty brands contribute to customized hair solutions, sustainable hair sourcing, and non-surgical hair replacement technologies. These include:

The overall market size for the Artificial Hair Integration Market was USD 2.2 Billion in 2025.

The Artificial Hair Integration Market is expected to reach USD 4.2 Billion in 2035.

Rising cases of hair loss, increasing demand for non-surgical hair restoration solutions, and growing influence of beauty and fashion trends will drive market growth.

The USA, China, India, Brazil, and the UK are key contributors.

Kanekalon and Polyester in type is expected to lead in the Artificial Hair Integration Market.

Table 1: Global Market Value (US$ Million) Forecast, By Material Type, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast, By Material Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast, By End-User, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast, By End-User, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast, By Color, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast, By Color, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast, By Extension Type, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast, By Extension Type, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 12: Global Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 13: Global Market Value (US$ Million) Forecast, By Region, 2018 to 2033

Table 14: Global Market Volume (Units) Forecast, By Region, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast, By Material Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast, By Material Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast, By End-User, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast, By End-User, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast, By Color, 2018 to 2033

Table 22: North America Market Volume (Units) Forecast, By Color, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast, By Extension Type, 2018 to 2033

Table 24: North America Market Volume (Units) Forecast, By Extension Type, 2018 to 2033

Table 25: North America Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 26: North America Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 27: North America Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 28: North America Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast, By Material Type, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast, By Material Type, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 32: Latin America Market Volume (Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast, By End-User, 2018 to 2033

Table 34: Latin America Market Volume (Units) Forecast, By End-User, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast, By Color, 2018 to 2033

Table 36: Latin America Market Volume (Units) Forecast, By Color, 2018 to 2033

Table 37: Latin America Market Value (US$ Million) Forecast, By Extension Type, 2018 to 2033

Table 38: Latin America Market Volume (Units) Forecast, By Extension Type, 2018 to 2033

Table 39: Latin America Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 40: Latin America Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 41: Latin America Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 42: Latin America Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 43: Europe Market Value (US$ Million) Forecast, By Material Type, 2018 to 2033

Table 44: Europe Market Volume (Units) Forecast, By Material Type, 2018 to 2033

Table 45: Europe Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 46: Europe Market Volume (Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 47: Europe Market Value (US$ Million) Forecast, By End-User, 2018 to 2033

Table 48: Europe Market Volume (Units) Forecast, By End-User, 2018 to 2033

Table 49: Europe Market Value (US$ Million) Forecast, By Color, 2018 to 2033

Table 50: Europe Market Volume (Units) Forecast, By Color, 2018 to 2033

Table 51: Europe Market Value (US$ Million) Forecast, By Extension Type, 2018 to 2033

Table 52: Europe Market Volume (Units) Forecast, By Extension Type, 2018 to 2033

Table 53: Europe Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 54: Europe Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 55: Europe Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 56: Europe Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 57: East Asia Market Value (US$ Million) Forecast, By Material Type, 2018 to 2033

Table 58: East Asia Market Volume (Units) Forecast, By Material Type, 2018 to 2033

Table 59: East Asia Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 60: East Asia Market Volume (Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast, By End-User, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast, By End-User, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast, By Color, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast, By Color, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast, By Extension Type, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast, By Extension Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 71: South Asia Market Value (US$ Million) Forecast, By Material Type, 2018 to 2033

Table 72: South Asia Market Volume (Units) Forecast, By Material Type, 2018 to 2033

Table 73: South Asia Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 74: South Asia Market Volume (Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 75: South Asia Market Value (US$ Million) Forecast, By End-User, 2018 to 2033

Table 76: South Asia Market Volume (Units) Forecast, By End-User, 2018 to 2033

Table 77: South Asia Market Value (US$ Million) Forecast, By Color, 2018 to 2033

Table 78: South Asia Market Volume (Units) Forecast, By Color, 2018 to 2033

Table 79: South Asia Market Value (US$ Million) Forecast, By Extension Type, 2018 to 2033

Table 80: South Asia Market Volume (Units) Forecast, By Extension Type, 2018 to 2033

Table 81: South Asia Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 82: South Asia Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 83: South Asia Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 84: South Asia Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 85: Oceania Market Value (US$ Million) Forecast, By Material Type, 2018 to 2033

Table 86: Oceania Market Volume (Units) Forecast, By Material Type, 2018 to 2033

Table 87: Oceania Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 88: Oceania Market Volume (Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 89: Oceania Market Value (US$ Million) Forecast, By End-User, 2018 to 2033

Table 90: Oceania Market Volume (Units) Forecast, By End-User, 2018 to 2033

Table 91: Oceania Market Value (US$ Million) Forecast, By Color, 2018 to 2033

Table 92: Oceania Market Volume (Units) Forecast, By Color, 2018 to 2033

Table 93: Oceania Market Value (US$ Million) Forecast, By Extension Type, 2018 to 2033

Table 94: Oceania Market Volume (Units) Forecast, By Extension Type, 2018 to 2033

Table 95: Oceania Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 96: Oceania Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 97: Oceania Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 98: Oceania Market Volume (Units) Forecast, By Country, 2018 to 2033

Table 99: MEA Market Value (US$ Million) Forecast, By Material Type, 2018 to 2033

Table 100: MEA Market Volume (Units) Forecast, By Material Type, 2018 to 2033

Table 101: MEA Market Value (US$ Million) Forecast, By Consumer Orientation, 2018 to 2033

Table 102: MEA Market Volume (Units) Forecast, By Consumer Orientation, 2018 to 2033

Table 103: MEA Market Value (US$ Million) Forecast, By End-User, 2018 to 2033

Table 104: MEA Market Volume (Units) Forecast, By End-User, 2018 to 2033

Table 105: MEA Market Value (US$ Million) Forecast, By Color, 2018 to 2033

Table 106: MEA Market Volume (Units) Forecast, By Color, 2018 to 2033

Table 107: MEA Market Value (US$ Million) Forecast, By Extension Type, 2018 to 2033

Table 108: MEA Market Volume (Units) Forecast, By Extension Type, 2018 to 2033

Table 109: MEA Market Value (US$ Million) Forecast, By Sales Channel, 2018 to 2033

Table 110: MEA Market Volume (Units) Forecast, By Sales Channel, 2018 to 2033

Table 111: MEA Market Value (US$ Million) Forecast, By Country, 2018 to 2033

Table 112: MEA Market Volume (Units) Forecast, By Country, 2018 to 2033

Figure 01: Global Market Value (US$ Million) and Volume (Units) Analysis, 2018 to 2022

Figure 02: Global Market Value (US$ Million) and Volume (Units) Forecast, 2023 to 2033

Figure 03: Global Market Value (US$ Million) Analysis, 2018 to 2022

Figure 04: Global Market Value (US$ Million) Forecast, 2023 to 2033

Figure 05: Global Market Absolute $ Opportunity Value (US$ Million), 2023 to 2033

Figure 06: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 07: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 08: Global Market Y-o-Y Growth (%) Projections, By Material Type, 2023 to 2033

Figure 09: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis By End-User, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis By End-User, 2018 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections, By End-User, 2023 to 2033

Figure 13: Global Market Attractiveness By End-User, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Color Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Color Type, 2018 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections, By Color Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Color Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Extension Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Extension Type, 2018 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections, By Extension Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Extension Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 25: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 26: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 27: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 28: Global Market Y-o-Y Growth (%) Projections, By Region, 2023 to 2033

Figure 29: Global Market Attractiveness by Region, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 33: North America Market Attractiveness by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 35: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections, By Material Type, 2023 to 2033

Figure 37: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 38: North America Market Value (US$ Million) Analysis By End-User, 2018 to 2033

Figure 39: North America Market Volume (Units) Analysis By End-User, 2018 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections, By End-User, 2023 to 2033

Figure 41: North America Market Attractiveness By End-User, 2023 to 2033

Figure 42: North America Market Value (US$ Million) Analysis by Color Type, 2018 to 2033

Figure 43: North America Market Volume (Units) Analysis by Color Type, 2018 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections, By Color Type, 2023 to 2033

Figure 45: North America Market Attractiveness by Color Type, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Extension Type, 2018 to 2033

Figure 47: North America Market Volume (Units) Analysis by Extension Type, 2018 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections, By Extension Type, 2023 to 2033

Figure 49: North America Market Attractiveness by Extension Type, 2023 to 2033

Figure 50: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 51: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 52: North America Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 53: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 58: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 59: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections, By Material Type, 2023 to 2033

Figure 61: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis By End-User, 2018 to 2033

Figure 63: Latin America Market Volume (Units) Analysis By End-User, 2018 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections, By End-User, 2023 to 2033

Figure 65: Latin America Market Attractiveness By End-User, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Color Type, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Color Type, 2018 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections, By Color Type, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Color Type, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Extension Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Extension Type, 2018 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections, By Extension Type, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Extension Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 76: Latin America Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 77: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 81: Europe Market Attractiveness by Country, 2023 to 2033

Figure 82: Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 83: Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections, By Material Type, 2023 to 2033

Figure 85: Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 86: Europe Market Value (US$ Million) Analysis By End-User, 2018 to 2033

Figure 87: Europe Market Volume (Units) Analysis By End-User, 2018 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections, By End-User, 2023 to 2033

Figure 89: Europe Market Attractiveness By End-User, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Color Type, 2018 to 2033

Figure 91: Europe Market Volume (Units) Analysis by Color Type, 2018 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections, By Color Type, 2023 to 2033

Figure 93: Europe Market Attractiveness by Color Type, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) Analysis by Extension Type, 2018 to 2033

Figure 95: Europe Market Volume (Units) Analysis by Extension Type, 2018 to 2033

Figure 96: Europe Market Y-o-Y Growth (%) Projections, By Extension Type, 2023 to 2033

Figure 97: Europe Market Attractiveness by Extension Type, 2023 to 2033

Figure 98: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 99: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 100: Europe Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 101: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 107: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections, By Material Type, 2023 to 2033

Figure 109: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) Analysis By End-User, 2018 to 2033

Figure 111: East Asia Market Volume (Units) Analysis By End-User, 2018 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections, By End-User, 2023 to 2033

Figure 113: East Asia Market Attractiveness By End-User, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Color Type, 2018 to 2033

Figure 115: East Asia Market Volume (Units) Analysis by Color Type, 2018 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections, By Color Type, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Color Type, 2023 to 2033

Figure 118: East Asia Market Value (US$ Million) Analysis by Extension Type, 2018 to 2033

Figure 119: East Asia Market Volume (Units) Analysis by Extension Type, 2018 to 2033

Figure 120: East Asia Market Y-o-Y Growth (%) Projections, By Extension Type, 2023 to 2033

Figure 121: East Asia Market Attractiveness by Extension Type, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 123: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 124: East Asia Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 126: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 129: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 130: South Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 131: South Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections, By Material Type, 2023 to 2033

Figure 133: South Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 134: South Asia Market Value (US$ Million) Analysis By End-User, 2018 to 2033

Figure 135: South Asia Market Volume (Units) Analysis By End-User, 2018 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections, By End-User, 2023 to 2033

Figure 137: South Asia Market Attractiveness By End-User, 2023 to 2033

Figure 138: South Asia Market Value (US$ Million) Analysis by Color Type, 2018 to 2033

Figure 139: South Asia Market Volume (Units) Analysis by Color Type, 2018 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections, By Color Type, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Color Type, 2023 to 2033

Figure 142: South Asia Market Value (US$ Million) Analysis by Extension Type, 2018 to 2033

Figure 143: South Asia Market Volume (Units) Analysis by Extension Type, 2018 to 2033

Figure 144: South Asia Market Y-o-Y Growth (%) Projections, By Extension Type, 2023 to 2033

Figure 145: South Asia Market Attractiveness by Extension Type, 2023 to 2033

Figure 146: South Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 147: South Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 148: South Asia Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 149: South Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 153: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 155: Oceania Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections, By Material Type, 2023 to 2033

Figure 157: Oceania Market Attractiveness by Material Type, 2023 to 2033

Figure 158: Oceania Market Value (US$ Million) Analysis By End-User, 2018 to 2033

Figure 159: Oceania Market Volume (Units) Analysis By End-User, 2018 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections, By End-User, 2023 to 2033

Figure 161: Oceania Market Attractiveness By End-User, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Color Type, 2018 to 2033

Figure 163: Oceania Market Volume (Units) Analysis by Color Type, 2018 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections, By Color Type, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Color Type, 2023 to 2033

Figure 166: Oceania Market Value (US$ Million) Analysis by Extension Type, 2018 to 2033

Figure 167: Oceania Market Volume (Units) Analysis by Extension Type, 2018 to 2033

Figure 168: Oceania Market Y-o-Y Growth (%) Projections, By Extension Type, 2023 to 2033

Figure 169: Oceania Market Attractiveness by Extension Type, 2023 to 2033

Figure 170: Oceania Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 171: Oceania Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 172: Oceania Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Sales Channel, 2023 to 2033

Figure 174: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 175: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections, By Country, 2023 to 2033

Figure 177: MEA Market Attractiveness by Country, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 179: MEA Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections, By Material Type, 2023 to 2033

Figure 181: MEA Market Attractiveness by Material Type, 2023 to 2033

Figure 182: MEA Market value (US$ Million) Analysis By End-User, 2018 to 2033

Figure 183: MEA Market Volume (Units) Analysis By End-User, 2018 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections, By End-User, 2023 to 2033

Figure 185: MEA Market Attractiveness By End-User, 2023 to 2033

Figure 186: MEA Market Value (US$ Million) Analysis by Color Type, 2018 to 2033

Figure 187: MEA Market Volume (Units) Analysis by Color Type, 2018 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections, By Color Type, 2023 to 2033

Figure 189: MEA Market Attractiveness by Color Type, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Extension Type, 2018 to 2033

Figure 191: MEA Market Volume (Units) Analysis by Extension Type, 2018 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections, By Extension Type, 2023 to 2033

Figure 193: MEA Market Attractiveness by Extension Type, 2023 to 2033

Figure 194: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 195: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 196: MEA Market Y-o-Y Growth (%) Projections, By Sales Channel, 2023 to 2033

Figure 197: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Artificial Intelligence (chipset) Market Forecast and Outlook 2025 to 2035

Artificial Insemination Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Construction Market Size and Share Forecast Outlook 2025 to 2035

Artificial Tears Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Artificial Urinary Sphincter Market Size and Share Forecast Outlook 2025 to 2035

Artificial Lift Systems Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Retail Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence (AI) in Automotive Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Healthcare Market Size, Growth, and Forecast for 2025 to 2035

Artificial Ventilation and Anaesthesia Masks Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence In Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Artificial Pancreas Device Market Size and Share Forecast Outlook 2025 to 2035

Artificial Flower Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Artificial Preservative Market Outlook by Product, Type, Form, End Use Application and Others Through 2035

Artificial Intelligence in Military Market Analysis - Size & Forecast 2025 to 2035

Analysis and Growth Projections for Artificial Sweetener Business

Artificial Turf Market Growth & Trends 2024-2034

Artificial Plants Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA