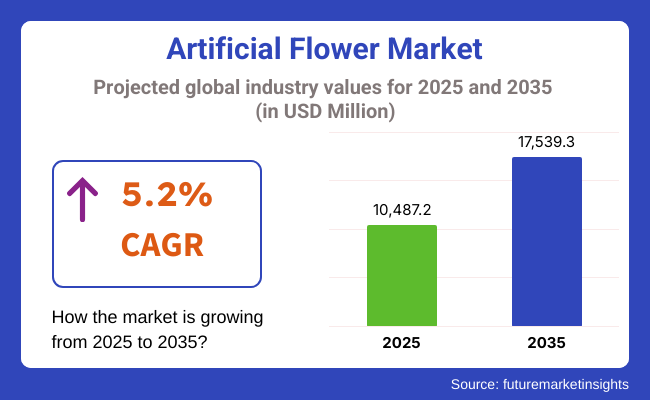

The industry valuation is roughly USD 10,487.2 million as of 2025. During 2024, the valuation stood at USD 9.89 billion. The industry is anticipated to grow at a healthy and consistent rate between 2025 and 2035 at a CAGR of 5.2%. The revenue size in 2035 will be USD 17,539.3 million. One of the major drives for this growth is the increasing popularity of decorative flower arrangements for home, business, and occasion decoration due to their long lifespan, aesthetic appeal, and low maintenance.

Synthetic flowers are becoming increasingly popular as an economical, allergen-free alternative to fresh flowers. With consumers placing more emphasis on interior decoration, year-round continuity of decorations, and the environment, decorative flower products are gathering greater appeal as a convenient and style-driven option. Technology improvements in manufacturing processes are also assisting the growth of hyper-realistic colors and textures to bridge the gap between fake and real flowers in terms of beauty appeal.

Hospitality, retail, and event planning industry commercial uses are also propelling demand. Plastic floral arrangements are used by hotels, restaurants, malls, and wedding halls to conserve the expense of repeated replacements while guaranteeing a high-end appearance. In addition, the increased use of e-commerce sites has greatly improved consumer access to a wide variety of customizable arrangements, adding to the global appeal.

Asia Pacific dominates because of cost-effective manufacturing and growing domestic demand. North America and Europe, meanwhile, present mature but stable markets with increasing demand for seasonal and luxury floral arrangements. A growing trend towards DIY home decoration and home staging, whereby synthetic flowers demonstrate flexibility, creativity and long-term usage without degrading, is also present.

With the awareness of the environment gaining traction, there is increasing pressure on the material used in producing decorative flowers. Industry stakeholders are responding with biodegradable polymers, recycled products, and sustainable packaging to address sustainability goals. The action is forecasted to drive innovation and brand attractiveness.

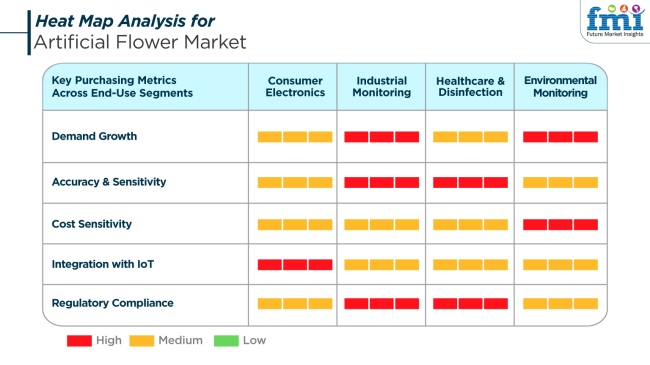

Customer needs vary greatly in the industry. Home buyers typically consider realistic appearance, color durability, and affordability. Consumers are looking for arrangements that blend in with interior styles without maintenance, and plastic flowers are a convenient home fashion choice. In business environments such as hotels, offices, and retail displays, precision and design consistency are crucial.

Customers in these markets prefer high-quality, dust-free materials that retain their color for years. Additionally, custom floral arrangements that align with brand aesthetics or seasonal requirements are increasingly gaining popularity.

Price remains a factor, particularly in bulk purchasing. Although bulk buyers opt for cheap options, there are premium markets among consumers who value intricate designs and materials such as silk or ecologically friendly fiber. The conflict between price, realism, and environmental sustainability will also continue to drive purchase decisions among all consumer segments.

The industry grows stably but is also exposed to major risks that may impact its long-term scalability. Top of these risks is the rising demand for eco-friendly products from consumers. Most traditional synthetic flowers are made from non-biodegradable plastics and artificial components, which pose an environmental hazard. Unless the manufacturers quickly adapt to green-friendly materials, they stand to be rendered obsolete by increasingly environmentally conscious-markets

The other problem is low-cost segment saturation with mass-produced, homogenous designs. This can devalue brand differentiation and deflate margins for mid-tier players. In order to remain in the competition, manufacturers must invest in product design innovation, customizability, and green packaging to counter a shifting consumer base.

Furthermore, changing fashion and decoration trends imply a certain riskiness. Purchasers' taste for flower arrangements is strongly susceptible to seasonally and geographically evolving beauty. Without versatile manufacturing facilities and inventory plans, suppliers risk having to obsolete their inventory or underperform. Style versatility, on-time product overhauls, and demand forecasting will become crucial if the risks associated with these operations are to be minimized.

Between 2020 and 2024, the industry expanded gradually due to increased demand for long-term and low-maintenance decorative products. New manufacturing technologies led to the making of more realistic and aesthetically pleasing flowers, increasing their demand in residential as well as commercial settings. The growth of online e-commerce sites also grew development by allowing consumers easy access to a wide range of goods.

During the forecast period 2025 to 2035, Technological innovation will propel the production of smart flowers with integrated lights and fragrance emission, offering more sensory stimulation to consumers. The agenda will be sustainability, with producers investing capital in green raw materials and processes. Besides, the incorporation of synthetic flowers into complete interior design solutions will make them popular, and they will become an integral part of modern interior design.

Comparative Market Shift Analysis: Artificial Flower Market 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Product Focus: Emphasis on natural appearance and longer lifespan. | Technological Integration: Integration of intelligent features like integrated lighting and fragrance release. |

| Distribution Channels: Set up internet-based systems for ease of application. | Integra ted Design Solutions: Wholesale distribution as turnkey interior design packages. |

| Consumer Demographics: Highly focused targeting of homeowners and event professionals. | Extended Audiences: Increased populations of users for commercial buildings and hospitality venues. |

| Green Initiatives: First, we will incorporate more environmentally friendly packaging solutions and material usage. | Green- Friendly Innovations: Biodegradable product assortment and environmentally friendly manufacturing processes. |

| Key Drivers: Low maintenance and long lifespan of interior design products are needed. | Advanced Aesthe tic Solutions: Incorporation within smart homes and personalized interiors. |

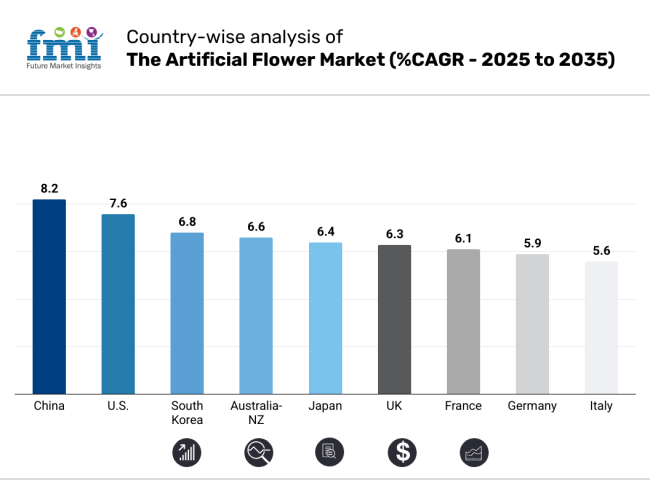

The USA will grow at 7.6% CAGR over the study period. The demand in the USA is increasing continuously, driven by an increasing demand for low-maintenance home décor and event styling. Residential and commercial users are increasingly choosing artificial floral arrangements because of their long lifespan, aesthetic uniformity, and allergy-free nature. Seasonal and holiday-themed decorations also contribute significantly to demand, especially during Christmas, Thanksgiving, and spring-themed events.

The growth of the DIY decoration segment and the role of social media platforms influencing interior design trends have driven awareness and purchasing behavior. Retail outlets, such as large home improvement centers and online websites, are the focus of product distribution, allowing wide availability of artificial floral products at both mass-market and high-end levels.

Material innovations, such as silk, latex, and blends of polyethylene, are enhancing the realism and attractiveness of synthetic flowers. The corporate world also increasingly incorporates artificial arrangements for office, hospitality, and event environments because they prove more economical in the long term. With increasing urbanization, shifting lifestyles of consumers, and a shift towards eco-friendly and reusable interior décor solutions, the USA is on track for sustained growth in the coming decade.

The UK is anticipated to witness a 6.3% CAGR during the forecast period. In the UK, the industry is gaining popularity in residential and commercial interior design as a result of changing tastes toward long-lasting and allergen-free decorative options.

A rising trend toward minimalist and Scandinavian interior design aesthetics is driving demand for artificial arrangements that provide beauty without the need for daily maintenance. In addition, the trend for flower-inspired weddings, boutique hotels, and seasonal décor has created new opportunities for expansion in both urban and semi-urban locations.

The retail environment is adapting to serve evolving tastes, with online platforms becoming increasingly popular as a preferred shopping medium. Numerous small enterprises and artisans are using E-commerce to sell customized floral arrangements to niche customer segments.

Moreover, socially responsible consumers are looking for eco-friendly artificial materials, prompting brands to develop new products based on recycled or biodegradable content. While consumer knowledge and appreciation of high-quality flowers have become more profound, the UK is likely to grow steadily over the forecast years.

France is expected to grow at 6.1% CAGR over the study years. France has always had a flair for aesthetics and décor. Buyers are interested in high-quality synthetic flowers that look and feel exactly like real flowers because they enjoy the look of elegance combined with the convenience of being artificial. Residential and commercial spaces all over urban areas are being decorated with realistic flower arrangements, adding to the product's wider appeal.

The hospitality and event planning industries are also major consumers, utilizing flowers for weddings, corporate events, and seasonal decorating. Moreover, the availability of specialty craft shops and internet venues facilitates ease and customizability. Companies are launching increasingly varied styles, such as local and exotic flower reproductions, to appeal to many different consumer tastes.

Growing awareness about the environment and the need for reduced waste is favoring the use of durable artificial alternatives. Coupled with a favoring cultural attitude towards aesthetic living, France is set to exhibit stable growth trends through the next several years.

Germany is anticipated to expand at 5.9% CAGR throughout the study. Germany is experiencing rising demand for synthetic flowers due to the practicality, durability, and convenience they provide over natural flowers. Customers are increasingly interested in high-fidelity designs that complement modern and traditional décor, particularly in residential and working spaces. Offices, restaurants, and retail spaces are adopting artificial arrangements as affordable options for permanent decoration with little maintenance. The focus on sustainability in Germany further underlines the change.

Flowers manufactured from recycled items or meant to last for long periods are in increasing demand from environmentally friendly customers. Moreover, the aging population is looking for less labor-intensive décor, boosting demand further. The availability of big-box home improvement stores and internet retailers allows easy access to a broad spectrum of products. As materials and aesthetics continue to evolve, Germany is expected to see stable, moderate growth during the forecast period.

Italy is expected to rise at 5.6% CAGR during the study period. Italy has a strong heritage in art and design, which makes synthetic flowers increasingly popular. Demand is especially high in urban areas where lifestyle and space pressures cause consumers to turn to low-maintenance yet fashionable decorative alternatives.

Italian weddings and cultural ceremonies similarly use artificial florals for convenience, durability, and preservation as mementos of events. Real flowers remain an integral part of traditional events, but artificial alternatives are being viewed more and more as convenient and practical.

High-end florists and design studios are embracing top-grade materials such as silk and foam to create elaborate botanical details, targeting sophisticated clients. Appreciation for aesthetics is favoring the trend. As the integration of art design and innovation continues, Italy is well set to see upward growth in the industry within the next ten years.

South Korea is forecast to expand by 6.8% CAGR over the period under study. South Korea is growing fast with the back of contemporary lifestyle habits, space-saving urban life, and a love for beauty-driven home upgrades. K-design trends and lifestyle shows on TV, social media, and websites are influencing consumer preferences and prompting the use of artificial floral decoration in homes, cafés, and boutique environments. Manufacturing innovation, with a focus on realism and artistic presentation, is enhancing sales.

Numerous consumers like arrangements that do not need water, sunlight, or frequent replacement, especially in high-density urban areas. Furthermore, cafés and workshops are also becoming lifestyle experiences, further consolidating the notion into the cultural mainstream. With younger generations leading demand for fashionable and value-priced home furnishings and growing usage in weddings and corporate functions, South Korea has a high potential for significant and sustainable growth.

Japan will grow at 6.4% CAGR over the study period. Japan is a culture of innovation and tradition, and synthetic flowers are proving to be popular both for their practical application and their cultural compatibility with contemporary interior design ethics. With its aging population and reduced urban dwelling space, there is increasing demand for low-maintenance decorative alternatives that remain elegant and culturally significant.

Artificial floral arrangements are also being applied in ceremonial and seasonal occasions where regular florist changes were previously the norm. The companies in Japan stress a great deal on handwork, producing greatly detailed and nature-like imitation flowers. Domestic capacity and domestic consumer demand are giving a boost to products combining quality, eco-friendliness, and artwork aesthetics.

Physical shop retailers, as well as web shop retailers, offer offerings to everyday home consumers and trade decorators alike. The convergence of artificial flower use with values such as efficiency, cleanliness, and longevity makes Japan a promising region with robust growth prospects until 2035.

The China market is projected to expand at 8.2% CAGR throughout the study. China is showing good growth not only because of its vast manufacturing base but also because of a fast-growing domestic market. Growing disposable incomes, urban lifestyles, and a heightened focus on interior design are driving robust demand in residential, commercial, and hospitality establishments.

Online platforms provide an extensive range, enabling customers to pick and choose from a wide variety of styles, materials, and prices. Mass production and cost-effectiveness allow ongoing innovation and customization, ensuring that artificial flowers become affordable across various demographic segments.

Weddings, business launches, and cultural festivals are major events that continue to drive seasonal spikes in sales. In addition, the rise of livestream selling and influencer marketing in China has brought about visibility for high-quality products. With technology getting better and wider distribution channels, China will continue to be the most vibrant and fastest-growing market in the next decade.

The Australia-New Zealand market is anticipated to grow at 6.6% CAGR throughout the study. The Australia-New Zealand market is experiencing consistent growth in demand, stimulated by home décor lifestyle trends towards low-maintenance and eco-friendly home décor. The trend is aided in Australia by the warm climate, making real flowers difficult to maintain for an extended period. Synthetic flowers offer an appealing and convenient option for home, retail, and event decorations.

In New Zealand, a robust passion for sustainability and home renovation is encouraging consumers to choose long-lasting floral choices that minimize waste. Both nations are seeing online sales expand, with a boost from influencers and home styling content on digital media. DIY culture is also at work, with consumers buying artificial flowers for crafting and creative endeavors. With continuing improvement in design quality and greater recognition of environmental benefits, the Australian-New Zealand market for artificial flowers is forecasted to grow steadily to 2035.

Polyester will lead with a share of 36.3%, and plastic accounts for a 25.4% share. Polyester's glass-top status is attributed to its versatility, durability, and authenticity in representing real flowers' look and feel. This material is used extensively in making artificial flowers- they are light in weight, easily dyed, and have long-lasting shapes and colors. Therefore, polyester has become the choice material, and leading manufacturers like Afloral and Nearly Natural use it to manufacture very realistic, high-quality artificial blooms for commercial and residential end-users.

That's not all; polyester floral products are preferred for their durability against wear and tear, especially in high-traffic places. They are good for both décor and durability. The current trend of home decoration with less-maintenance house plants augurs well for the growth of polyester-based flowers. The second-most used plastic is extensively available because it is inexpensive and forms flowers with detailed features.

Compared to polyester flowers, those made of plastic are cheaper and, therefore, less expensive, making them a favorite with a price-minded clientele. Most of these flowers are used to beautify a commercial place, in event decorations, and in mass-produced arrangements. Silk Flowers Factory and Balsa Circle are two examples of companies that use plastic in their flowers, and they have targeted a broad segment.

Polyester's dominance is present in the trend toward relatively higher-end premium and affluent artificial flowers. At the same time, plastic still enjoys usage among those who seek budgetary and stylistically flexible solutions.

The commercial sector will dominate with 62.1%, with the residential one behind it accounting for 37.9%. This huge share in the commercial sector is because artificial flowers find extensive use in businesses and commercial establishments like hotels, offices, restaurants, etc. Their long life span and low maintenance make synthetic flowers far more attractive in the commercial sector than fresh flowers, which are costly and need constant upkeep.

Artificial flowers permit decorative arrangements all year round, thus maintaining the aesthetics of the setting without being hindered by seasonal availability. Companies like Afloral and Silk Flowers Factory customize their offerings for big commercial clients, promoting bulk orders, custom designs, and low-budget solutions for corporate environments.

Residential applications still account for a large portion of the overall industry. The massive consumer appeal in homes is due to their low cost and convenience. These flowers are used in living rooms, dining rooms, and bedrooms in a maintenance-free way to add color and style to interiors.

Growing home décor trends and DIY projects keep the demand surging. While the commercial application dominates the industry owing to the magnitude and durability of flowers in commercial setups, the residential segment continues to blossom, keeping in step with changing consumer tastes toward easy-care, cost-effective, and appealing home accessories.

The industry is experiencing a refined transformation, marked by advances in design realism, sustainable materials, and global sourcing optimization. A high diversity for decoration, event, and commercial display. Companies focus on increasingly hyper-realistic textures, tougher polymers, and seasonal customization for both retail and B2B segments.

Prominent for FRS Holding S.R.L. sells Italian craftsmanship and age-old floras to access elite interior designers and extravagant event planners. Style, detail, and exclusivity, taken together, add up to an unusual position of leadership in the decorative segment. Otherwise, Diane James Designs, Inc. has the same kind of boutique appeal within North America: it combines labor-intensive assemblage with an upscale distribution pathway via specialty retailers and direct to the consumer.

Asian producers such as Dongguan Fusheng Arts Products Co., Ltd and Foshan Tongxin Artificial Flowers Co., Ltd. are seen in a high share in midrange and bulk categories. They provide mass-market products using the cost-effective, scalable designs they offer. Being agile in changing seasonal and trend-based categories in mass, a unique feature of their business, keeps them ahead in international e-commerce and export.

It has also become the forefront of consumer differentiation when completing artificial floral products because of the improvement of the types of fabric and the realistic gradients in colors. Finally, consumers want beauty as much as sustainability in artificial floral offerings.

Market Share Analysis by Company

| Company | Estimated Market Share (%) |

|---|---|

| FRS Holding S.R.L. | 12-15% |

| Dongguan Fusheng Arts Products Co., Ltd | 10-13% |

| Diane James Designs, Inc. | 8-11% |

| Foshan Tongxin Artificial Flowers Co., Ltd | 7-10% |

| Tree Locate | 6-9% |

| Other Players | 42-50% |

Key Company Insights

FRS Holding S.R.L. (12-15%)

FRS Holding S.R.L. (12-15%) has built a robust brand identity around luxury artificial floral arrangements, often handcrafted and positioned as permanent botanical art. A curated product strategy and a growing network of exclusive retail partners reinforce its dominant presence in the European interior design sector. The company benefits from strong brand loyalty, particularly in hospitality and upscale residential design markets.

Dongguan Fusheng Arts Products Co., Ltd (10-13%)

Dongguan Fusheng Arts Products Co., Ltd (10-13%) commands a significant share of the global export industry, particularly in North America and Europe, by offering competitively priced designs at scale. Known for agile manufacturing and customization capabilities, it supports bulk buyers and private labels with short lead times and wide assortments.

Diane James Designs, Inc. (8-11%)

Diane James Designs, Inc. (8-11%) continues to thrive in the luxury floral niche, favored for its lifelike arrangements assembled in the USA and its reputation among design professionals.

Foshan Tongxin Artificial Flowers Co., Ltd (7-10%)

Foshan Tongxin Artificial Flowers Co., Ltd (7-10%) and Tree Locate (6-9%) round out the top five by addressing both commercial décor and landscaping applications, with growing product lines that emphasize UV resistance and outdoor durability. These firms are aligning with hospitality and retail clients seeking low-maintenance greenery that replicates organic beauty.

The segmentation is into Polyester, Plastic, Paper, Silk, Nylon, and Others.

The segmentation is into Residential and Commercial.

The segmentation is into Online and Offline.

The regions covered include North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is expected to reach USD 10,487.2 million in 2025.

The industry valuation is projected to grow to USD 17,539.3 million by 2035.

The industry is expected to grow at a CAGR of 5.2% during the forecast period.

Polyester is a key material used in artificial flowers.

Key players include FRS Holding S.R.L., Diane James Designs, Inc., Dongguan Fusheng Arts Products Co., Ltd, Tree Locate, Foshan Tongxin Artificial Flowers Co., Ltd, NGAR TAT Production Fty. Ltd., Oriental Fine Art Co., Ltd., Xuzhou Pleasant Arts Flower Co., Ltd, and SG Silk Flower Limited.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Bunch) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 4: Global Market Volume (Bunch) Forecast by Material, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Bunch) Forecast by Application, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 8: Global Market Volume (Bunch) Forecast by Distribution Channel, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Bunch) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 12: North America Market Volume (Bunch) Forecast by Material, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 14: North America Market Volume (Bunch) Forecast by Application, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 16: North America Market Volume (Bunch) Forecast by Distribution Channel, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Bunch) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 20: Latin America Market Volume (Bunch) Forecast by Material, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 22: Latin America Market Volume (Bunch) Forecast by Application, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Latin America Market Volume (Bunch) Forecast by Distribution Channel, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Bunch) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 28: Western Europe Market Volume (Bunch) Forecast by Material, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Western Europe Market Volume (Bunch) Forecast by Application, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 32: Western Europe Market Volume (Bunch) Forecast by Distribution Channel, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Bunch) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 36: Eastern Europe Market Volume (Bunch) Forecast by Material, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 38: Eastern Europe Market Volume (Bunch) Forecast by Application, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 40: Eastern Europe Market Volume (Bunch) Forecast by Distribution Channel, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Bunch) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Bunch) Forecast by Material, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Bunch) Forecast by Application, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Bunch) Forecast by Distribution Channel, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Bunch) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 52: East Asia Market Volume (Bunch) Forecast by Material, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 54: East Asia Market Volume (Bunch) Forecast by Application, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 56: East Asia Market Volume (Bunch) Forecast by Distribution Channel, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Bunch) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Bunch) Forecast by Material, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Bunch) Forecast by Application, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Bunch) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Material, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Bunch) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 10: Global Market Volume (Bunch) Analysis by Material, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 14: Global Market Volume (Bunch) Analysis by Application, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 18: Global Market Volume (Bunch) Analysis by Distribution Channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 21: Global Market Attractiveness by Material, 2024 to 2034

Figure 22: Global Market Attractiveness by Application, 2024 to 2034

Figure 23: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Material, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Bunch) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 34: North America Market Volume (Bunch) Analysis by Material, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 38: North America Market Volume (Bunch) Analysis by Application, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 42: North America Market Volume (Bunch) Analysis by Distribution Channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 45: North America Market Attractiveness by Material, 2024 to 2034

Figure 46: North America Market Attractiveness by Application, 2024 to 2034

Figure 47: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Material, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Bunch) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 58: Latin America Market Volume (Bunch) Analysis by Material, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 62: Latin America Market Volume (Bunch) Analysis by Application, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 66: Latin America Market Volume (Bunch) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Material, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Material, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Bunch) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 82: Western Europe Market Volume (Bunch) Analysis by Material, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 86: Western Europe Market Volume (Bunch) Analysis by Application, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 90: Western Europe Market Volume (Bunch) Analysis by Distribution Channel, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Material, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Material, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Bunch) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Bunch) Analysis by Material, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Bunch) Analysis by Application, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Bunch) Analysis by Distribution Channel, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Material, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Material, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Bunch) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Bunch) Analysis by Material, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Bunch) Analysis by Application, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Bunch) Analysis by Distribution Channel, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Material, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Material, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Bunch) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 154: East Asia Market Volume (Bunch) Analysis by Material, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 158: East Asia Market Volume (Bunch) Analysis by Application, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 162: East Asia Market Volume (Bunch) Analysis by Distribution Channel, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Material, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Material, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Bunch) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Bunch) Analysis by Material, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Bunch) Analysis by Application, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Bunch) Analysis by Distribution Channel, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Material, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Artificial Intelligence (chipset) Market Forecast and Outlook 2025 to 2035

Artificial Insemination Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Construction Market Size and Share Forecast Outlook 2025 to 2035

Artificial Tears Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Artificial Urinary Sphincter Market Size and Share Forecast Outlook 2025 to 2035

Artificial Lift Systems Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Retail Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence (AI) in Automotive Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Healthcare Market Size, Growth, and Forecast for 2025 to 2035

Artificial Ventilation and Anaesthesia Masks Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence In Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Artificial Pancreas Device Market Size and Share Forecast Outlook 2025 to 2035

Artificial Preservative Market Outlook by Product, Type, Form, End Use Application and Others Through 2035

Artificial Hair Integration Market Growth - Trends & Forecast 2025 to 2035

Artificial Intelligence in Military Market Analysis - Size & Forecast 2025 to 2035

Analysis and Growth Projections for Artificial Sweetener Business

Artificial Turf Market Growth & Trends 2024-2034

Artificial Plants Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA