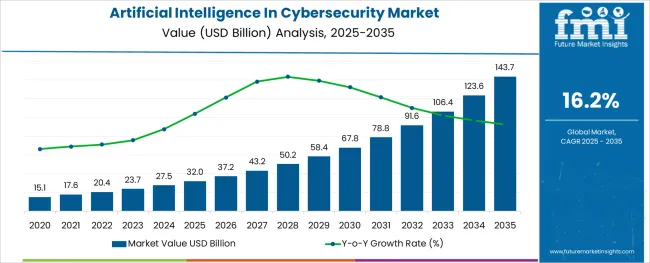

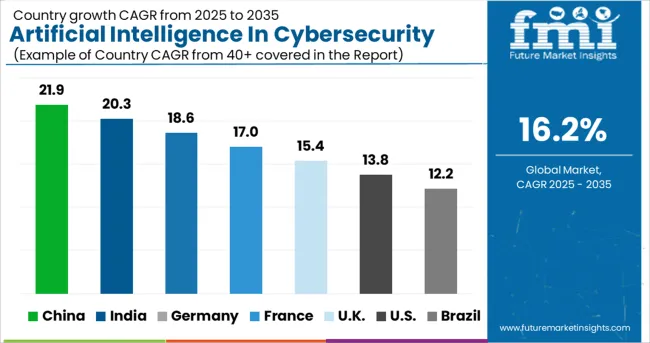

The Artificial Intelligence In Cybersecurity Market is estimated to be valued at USD 32.0 billion in 2025 and is projected to reach USD 143.7 billion by 2035, registering a compound annual growth rate (CAGR) of 16.2% over the forecast period.

The artificial intelligence in cybersecurity market is undergoing accelerated growth as organizations globally face rising threats in both volume and sophistication. Increasing instances of ransomware, zero-day exploits, and targeted attacks have prompted enterprises and government agencies to integrate AI-driven tools for real-time threat detection, anomaly monitoring, and automated response.

AI is being leveraged to reduce dwell time, improve SOC efficiency, and enhance predictive risk scoring across dynamic attack surfaces. With threat actors utilizing AI themselves to exploit vulnerabilities, defensive systems are evolving to counter with machine learning, behavioral analytics, and autonomous investigation capabilities.

The convergence of cloud-native environments, remote workforces, and IoT devices has expanded attack vectors, making scalable and adaptive AI solutions essential. Future growth is expected to be driven by the integration of generative AI, natural language processing, and digital twin technologies in security architectures, particularly within critical infrastructure and national defense systems.

The market is segmented by Offering, Deployment Type, Security Type, Technology, Application, and End-User and region. By Offering, the market is divided into Hardware, Software, and Service. In terms of Deployment Type, the market is classified into Cloud and On-Premise. Based on Security Type, the market is segmented into Network Security, Endpoint Security, Application Security, and Cloud Security. By Technology, the market is divided into Machine Learning, Natural Language Processing, and Context-Aware Computing. By Application, the market is segmented into Identity & Access Management, Risk & Compliance Management, Data Loss Prevention, Unified Threat Management, Security & Vulnerability Management, Antivirus/Antimalware, Fraud Detection/Anti-Fraud, Intrusion Detection/Prevention System, Threat Intelligence, and Others. By End-User, the market is segmented into BFSI, Retail, Government & Defence, Manufacturing, Infrastructure, Enterprise, Healthcare, Automotive & Transportation, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Offering, Deployment Type, Security Type, Technology, Application, and End-User and region. By Offering, the market is divided into Hardware, Software, and Service. In terms of Deployment Type, the market is classified into Cloud and On-Premise. Based on Security Type, the market is segmented into Network Security, Endpoint Security, Application Security, and Cloud Security. By Technology, the market is divided into Machine Learning, Natural Language Processing, and Context-Aware Computing. By Application, the market is segmented into Identity & Access Management, Risk & Compliance Management, Data Loss Prevention, Unified Threat Management, Security & Vulnerability Management, Antivirus/Antimalware, Fraud Detection/Anti-Fraud, Intrusion Detection/Prevention System, Threat Intelligence, and Others. By End-User, the market is segmented into BFSI, Retail, Government & Defence, Manufacturing, Infrastructure, Enterprise, Healthcare, Automotive & Transportation, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

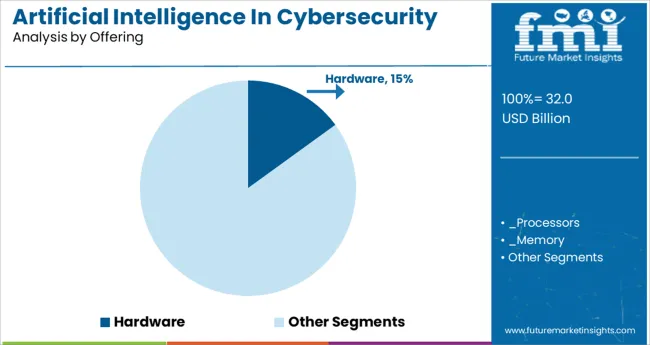

The hardware segment is anticipated to account for 15.0% of the total market revenue in 2025, making it a foundational yet smaller share compared to software. Its role remains crucial due to the computational demands of real-time AI processing, particularly in on-premise and edge environments.

Hardware components such as GPUs, AI accelerators, and neural network processors are being deployed within data centers and security appliances to support low-latency inference and encryption workloads. Growth in this segment is supported by rising demand for dedicated AI processors optimized for cybersecurity tasks, such as deep packet inspection and behavioral threat modeling.

Enterprises seeking secure and localized data handling have increasingly invested in hardware-based AI deployments, especially in regulated sectors like defense, finance, and healthcare. As the need for sovereign data protection and hardware-level encryption intensifies, the hardware segment is expected to sustain steady demand despite its modest share.

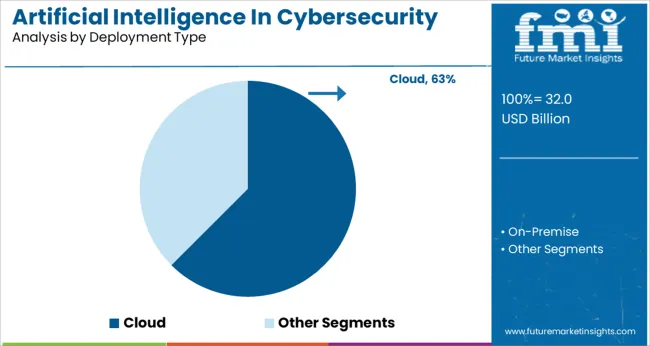

Cloud-based deployment is projected to command 62.5% of the overall revenue share in 2025, establishing it as the leading deployment model. This prominence is attributed to the increasing preference for scalable, cost-efficient, and remotely accessible cybersecurity solutions.

AI-powered security tools hosted in cloud environments allow for centralized threat intelligence sharing, faster updates, and dynamic scalability during attack spikes. Organizations are favoring cloud-based AI cybersecurity platforms for their ability to integrate with existing cloud-native infrastructures, reduce capital expenditure, and enable faster deployment cycles.

Cloud providers have also enhanced data residency compliance and built-in AI accelerators, making them suitable for sensitive industries. As hybrid and multi-cloud environments become mainstream, cloud deployment models are expected to remain dominant due to their agility, real-time collaboration capabilities, and support for continuous learning algorithms.

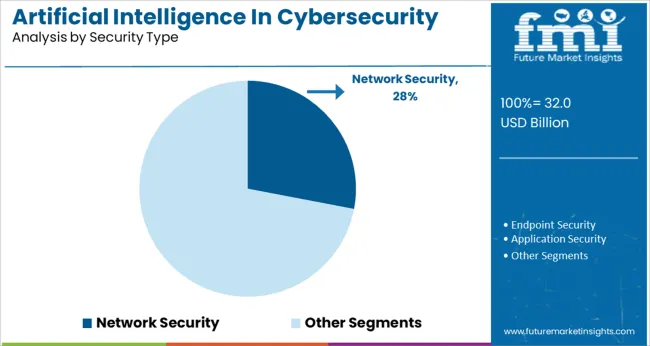

The network security segment is projected to contribute 28.0% of the total market revenue in 2025, making it the most significant security type in the AI-driven cybersecurity landscape. This leadership stems from the growing need to defend expansive and complex network infrastructures from increasingly sophisticated threats.

AI technologies are being used to monitor network traffic in real time, detect unusual behavior patterns, and respond to intrusions before they escalate. Enterprises are adopting AI-enhanced intrusion detection systems, firewalls, and zero trust frameworks to strengthen perimeter and internal network defenses.

The rising deployment of SD-WAN, IoT devices, and remote endpoints has increased network vulnerability, making AI a strategic necessity for continuous threat surveillance. By automating traffic analysis and response mechanisms, AI has substantially reduced manual oversight and improved incident response time, reinforcing network security’s pivotal role in overall cybersecurity strategies.

The global market for Artificial Intelligence in Cybersecurity Market expanded at a CAGR of 27.7% over the last four years (2020 to 2024). Many security analysts claim that in the second quarter of 2024, there were an average of 419 malware threats per minute, a rise of 44 per minute.

Every day, there are over 590 Thousand new, unique malware files, according to Interpol. In a similar vein, the 2024 Remote Workforce Cybersecurity Report found that 34% of respondents had experienced a breach as a result of the move to telework, with nearly two-thirds of respondents reporting an increase in breach attempts.

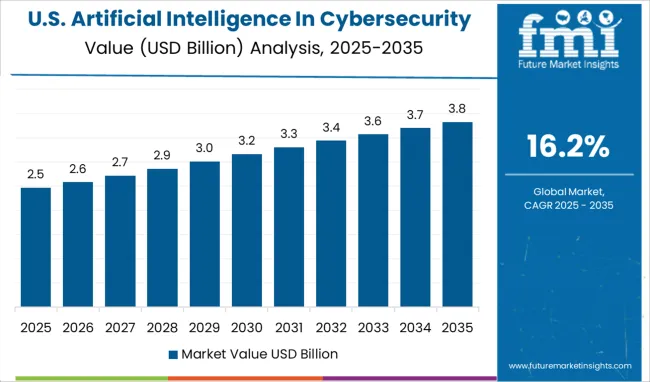

The United States will continue to be the largest user of Artificial Intelligence in Cybersecurity services throughout the analysis period accounting for over USD 16.1 Billion absolute dollar opportunity in the coming 10-year period.

Today's industries rely significantly on endpoint devices as they help organizations run as efficiently as possible and stay current with technology so they can compete. Unauthorized access, data breaches, and cyber threats are a few of the new issues that have emerged as a result of the spread of these devices.

The demand for artificial intelligence in cybersecurity has grown as people feel more secure. The introduction of digital technologies like the Internet of Things has accelerated the pace of industry verticals' digital transformation.

Cybercriminals or hackers can now attack gadgets like webcams, smart TVs, routers, printers, and even smart homes due to the development of linked devices in industry verticals including healthcare organizations and BFSI. According to Ponemon Institute, vital data and customer information were exposed by endpoint assaults in 68% of firms in 2020.

The rise in cyberattacks and data breaches has compelled businesses to use more edge-based, decentralized AI cybersecurity solutions, which is fueling the market for this technology. Artificial intelligence is thus anticipated to expand in the cybersecurity industry as a result of increased investment and growing awareness of the need for AI in cybersecurity solutions.

Numerous studies have shown that there is an imbalance between the demand for and supply of cybersecurity specialists because of a lack of skill. The demand for knowledgeable and experienced cyber security experts has grown dramatically along with the cyber threat, yet it is difficult to find them.

Leviathan Security Group estimates that 16% of the organizations have professionals that are only partially qualified and that 53% of the organization finds it challenging to obtain competent applicants. The shortage of cyberattacks is caused by the need for skilled professionals and the 2% involvement rate of women in the field of cybersecurity.

The significant market share held by North America can be attributed to the region's concentration of major players as well as a number of new start-ups, the expansion of government initiatives aimed at advancing technologies like artificial intelligence, the widespread use of cloud-based services, the growing sophistication of cyberattacks, and the rise in cyber threats.

For instance, in March 2024, The Japanese Ministry of Defense announced an investment of USD 230.0 Million to develop AI-based technology to counter cyberattacks. Such significant investments would provide the overall market for AI in cyber security a substantial boost in the ensuing years.

North America dominated the artificial intelligence in the cyber security market ecosystem in 2024, accounting for 38.3% of the total revenue.

The presence of key companies like IBM, Cisco Systems Inc., Dell Root 9B, Symantec Carpeted Micro Inc., Check Point Software Technologies Ltd., Herjavec, and Palo Alto Networks, which provide cutting-edge solutions and services to all the sectors in the area, are the key contributing factors to the regional market growth.

The United States is expected to account for over USD 143.7 Billion of the global Artificial Intelligence in the Cybersecurity Market by 2035. Artificial Intelligence in Cybersecurity Market growth from 2020 to 2024 was estimated at 27.2% CAGR. The development of AI for the purpose of supporting the manufacturing industry is now being led by the United States.

As PE firms rolled up cutting-edge, interoperable technologies to support platform investments, add-on deals accounted for 29% of transactions in the United States for the year 2024. This indicates that private equity has been active in the area. The market will benefit greatly from such investments.

The growth through the software segment expanded at a CAGR of 27.4% over the last six years (2020 to 2024). Businesses employ AI to detect malware, fraudulent payments, hacked computers, and network systems, and to automate cyber defense against spam and phishing. Another aspect of AI's development that contributes to the expansion of the range of harmful actors is the cost-effectivity nexus.

At present, Artificial Intelligence in Cybersecurity providing companies are largely setting up Joint ventures, aiming for acquisition/mergers and huge investments.

The key companies operating in the Artificial Intelligence in Cybersecurity Market include NVIDIA Corporation, Intel Corporation, Xilinx Inc., Samsung Electronics Co Ltd, Micron Technology Inc., Amazon Web Services, Inc., IBM Corporation, Microsoft Corporation, FireEye, Inc., Palo Alto Networks, Inc., Juniper Networks, Inc., Fortinet, Inc., Cisco Systems, Inc., Check Point Software Technologies Ltd., Imperva, McAfee LLC, LogRhythm, Inc., Sophos Ltd., NortonLifeLock Inc., Crowdstrike Holdings, Inc., Darktrace, Cylance Inc., Vectra AI, Inc., ThreatMetrix Inc., Securonix Inc., Sift Science, Acalvio Technologies, SparkCognition Inc., and Symantec Corporation.

Some of the recent developments by key providers of Artificial Intelligence in the Cybersecurity Market are as follows:

Similarly, recent developments related to companies providing services for Artificial Intelligence in Cybersecurity have been tracked by the team at Future Market Insights, which is available in the full report.

The global artificial intelligence in cybersecurity market is estimated to be valued at USD 32.0 billion in 2025.

It is projected to reach USD 143.7 billion by 2035.

The market is expected to grow at a 16.2% CAGR between 2025 and 2035.

The key product types are hardware, _processors, _memory, _network, software, _ai platform, _ai solutions, service, _deployment & integration and _support & maintenance.

cloud segment is expected to dominate with a 62.5% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Artificial Tears Market Size and Share Forecast Outlook 2025 to 2035

Artificial Lift Systems Market Size and Share Forecast Outlook 2025 to 2035

Artificial Ventilation and Anaesthesia Masks Market Size and Share Forecast Outlook 2025 to 2035

Artificial Pancreas Device Market Size and Share Forecast Outlook 2025 to 2035

Artificial Flower Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Artificial Preservative Market Outlook by Product, Type, Form, End Use Application and Others Through 2035

Analysis and Growth Projections for Artificial Sweetener Business

Artificial Turf Market Growth & Trends 2024-2034

Artificial Plants Market

Artificial Wood Beams Market

Artificial Airway Holders Market

Artificial Cartilage Implant Market

Artificial Insemination Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Artificial Urinary Sphincter Market Size and Share Forecast Outlook 2025 to 2035

Artificial Bowling Surface Market

Artificial Hair Integration Market Growth - Trends & Forecast 2025 to 2035

Artificial Intelligence (chipset) Market Forecast and Outlook 2025 to 2035

Artificial Intelligence in Construction Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA