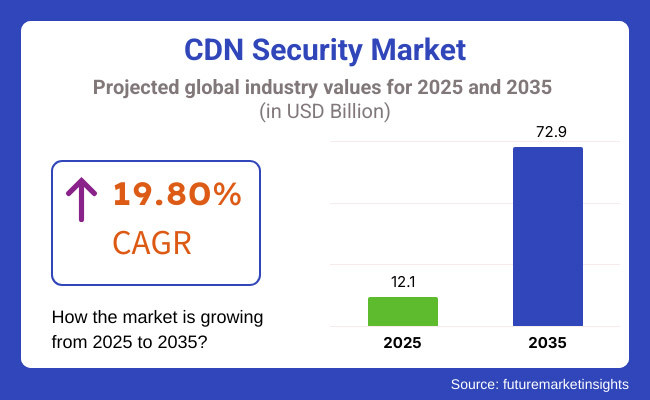

The CDN security market is anticipated to be worth USD 12.1 billion in 2025. Growing at 19.80% CAGR from 2025 to 2035, the industry is set to reach USD 72.9 billion by 2035.

The CDN security industry will have a remarkable growth trajectory since CDN content delivery network utilization is constantly on the rise, and at the same time, there is a growing number of threats related to cyber-attacks on digital assets and web applications.

Digital content streaming, cloud computing, and e-commerce platforms are the driving forces behind security needing more forces to counter increased risks of Distributed Denial of Service (DDoS) attacks, bot traffic, and data breaches.

Popular platforms such as Netflix and Disney+ employ CDN security protocols to guarantee that their customers can have uninterrupted video content while effectively dodging such potential breaches of user data. Likewise, top e-commerce platforms like Amazon and Shopify rest on the back of secure CDN services to thwart customer transaction assaults and violations by credential stuffing and phishing attacks respectively.

Owing to the increase in cyberattacks, companies are pouring a lot of money into security measures for instance; Web Application Firewalls (WAF), DDoS protection, and bot management. The governments and regulatory agencies are pushing the implementation of stringent cybersecurity measures to make sure data is protected from theft and there will be no monetary losses.

For example, the General Data Protection Regulation (GDPR) in Europe, and the California Consumer Privacy Act (CCPA) require businesses to adopt robust data security practices that process user information, thus boosting the implementation of these solutions.

The significant challenge that companies must deal with is the rapid evolution of cyber threats. The hackers are more and more taking the advantage of AI-based malware through botnets as well as the Advanced Persistent Threats (APTs) to ruin the CDN. The additional vector attacks, Credential stuffing, and API threats have changed the landscape of cyber-attacks that traditional security models became unable to handle.

Web Application Firewalls (WAFs) have emerged as a crucial element of CDN security, providing protection against cyber threats like SQL injection, cross-site scripting (XSS), and distributed denial-of-service (DDoS) attacks. Enterprises are eyeing real-time threat detection as the definitive security measure.

WAFs integrated with the CDN can filter malicious traffic without much latency, therefore providing high-performance security. For example, Cloudflare’s WAF leverages machine learning for pattern recognition to improve adaptive protection.

Modern WAFs use AI to detect threats in an automated fashion, allowing them to handle zero day attacks, minimizing false positives in the process. As organizations move towards zero-trust security models, WAFs are incorporating strict access controls along with real-time analytics.

Regulatory requirements like GDPR (Europe), CCPA (California) and PCI-DSS (financial sector) drive the need for more robust security solutions. For instance, Akamai’s Kona Site Defender assists companies in complying with financial data protection laws while diminishing threats.

Large enterprises are the largest consumers of these solutions because of their widespread online existence which makes them overly exposed to DDoS, credential stuffing and exploits aimed to APIs. These need multi-layered security models that integrate CDN protection, Web Application Firewalls (WAFs), and threat intelligence, with millions of user interactions daily.

For instance, AWS utilizes AWS CloudFront which offers DDoS protection by default to protect the global data from being compromised and the service from an outage. For added protection, large enterprises have also adopted zero-trust security frameworks, which require continuous monitoring and authentication.

The BFSI (Banking, Financial Services, and Insurance) sector is the largest end user of these solutions because of its paramount requirement for data protection, regulatory compliance, and real-time threat prevention. Banks process huge volumes of sensitive customer data, such as banking transactions, credit card information, and personal identification information, making them ideal targets for cyberattacks.

DDoS attacks, phishing attacks, and ransomware threats are critical threats to financial platforms, and strong solutions are needed to provide seamless services, secure data transfer, and fraud protection.

Key criteria for CDN security are compared in this table across the four stakeholder groups of enterprise IT, small and medium businesses, digital media companies, and cloud service providers. DDoS mitigation, performance optimization and global reach are key components to robust, reliable networks for enterprise IT and cloud service providers.

In contrast, SMBs attach average importance to these factors as they have less resources to work, and digital media companies rate them important - integration, and ease of use to support the content delivery. Enterprise IT and cloud providers place a greater emphasis on scalability and flexibility, while SMBs and digital consistently prioritize them less.

SMBs rate cost efficiency as the highest priority while other groups weigh cost against performance. On the whole, the table reflects priorities that vary according to organizational size and operational needs.

From 2020 to 2024, the CDN (Content Delivery Network) security industry grew at a fast rate due to increased cyberattacks, increased cloud adoption, and growing reliance on digital content. The ongoing threats of DDoS attacks, API vulnerabilities, and bot traffic stimulated the need for advanced security solutions within the CDN architecture.

Business drove content delivery with real-time threat detection, artificial intelligence-enabled security, and zero-trust architectures to safeguard their content. As more people are working from their homes, and there is an increase in streaming services, this fueled growth in the industry, and regulatory needs put pressure on companies to improve the quality of their data protection facilities.

The industry will continue to grow over the period 2025 to 2035, with artificial intelligence-powered threat intelligence, automated response systems, and blockchain-based content security. Quantum encryption, in combination with edge security, will also strengthen CDN protection against advanced cyber threats.

Low-latency, secure content delivery will be in greater demand with 5G and IoT. The more advanced the cyberattack becomes, companies will remain increasingly reliant on adaptive security systems, thereby making the industry an essential part of the strength of digital infrastructure.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter data privacy regulations like GDPR and CCPA led enterprises to enhance compliance measures for data breaches and content manipulation risks. | Governments enforce sovereign cloud frameworks, requiring region-specific infrastructure and compliance. AI-driven content moderation becomes mandatory. |

| Rising DDoS attacks, bot traffic, and credential stuffing drove adoption of web application firewalls and AI-based anomaly detection. | AI-generated cyber threats fuel demand for fully autonomous, self-healing security. Deepfake detection and AI-content manipulation protection become critical. |

| Zero trust principles gained traction, incorporating multi-factor authentication (MFA) and identity verification for network protection. | Zero Trust models become standard, using AI behavioral analysis and blockchain-based identity verification to block unauthorized access. |

| Edge computing growth pushed solution providers to enhance threat detection at edge nodes, reducing response time. | AI-driven, self-learning edge security solutions dynamically adapt to new threats, securing real-time data flow across global nodes. |

| API traffic exploits within CDNs led vendors to develop API security tools with rate limiting and token-based authentication. | API security becomes a top priority with AI-powered risk scoring, runtime security, and secure API gateways embedded in CDN infrastructures. |

| AI-assisted bot detection protected against scraping, automated attacks, and web content fraud. | Next-gen bot mitigation uses deep learning to identify human-like bots with fewer false positives and improved automation. |

| Enterprises shifted from on-premises solutions to cloud-based WAF and AI-driven DDoS protection. | Multi-cloud and hybrid models require adaptive security policies across cloud vendors with automated enforcement. |

| Security vendors integrated real-time threat intelligence feeds to detect and block malware traffic. | AI-driven predictive threat intelligence anticipates attack patterns, enabling proactive countermeasures. |

| The shift from TLS 1.2 to TLS 1.3 improved encryption efficiency and reduced latency for secure content delivery. | Post-quantum cryptography adoption secures CDN infrastructure against quantum threats, with lightweight encryption ensuring speed and security. |

Protection against web attacks like DDoS, web application, and bot abuse are a major role of CDN security services. Cyber threats are growing in scale and complexity, and providers want to keep their defenses continuously updated. Not being able to stop large-scale attacks can hurt a provider’s reputation and push customers toward competitors.

New threats, such as attacks targeting APIs and zero-day vulnerabilities, heighten the risks even more. Security vendors need to keep investing in R&D and infrastructure to remain ahead of adversaries because any failure in protection translates into client breaches and a loss of trust.

In turn, CDN security means that your traffic will be inspected, which can lead to privacy issues with some regulations (e.g., GDPR). Failure to handle personal data appropriately, for instance, user IPs, can trigger non-compliance penalties. BFSI and political clients, which need local data traffic filtration, have to invest in regional infrastructure.

Governments audit CDN providers for validation compliance and may impose certifications or encryption standards upon them, and if a content provider is a potential target for a government it needs to be able to reassure it that the CDN it is using meets privacy guidelines. Similar to regulatory changes, telecom licensing for security services in countries around the world could impact operations and be costly to adjust to.

The CDN security services are generally delivered via a SaaS model with tiered pricing. Providers have free or low-cost entry plans with basic protection, and advanced security features can be unlocked at higher subscription tiers. Cloudflare offers free DDoS protection but premiums for advanced features (like WAF and bot mitigation). This freemium model builds a likely giant base of users, a percentage of which convert to paid plans, also the money has all the time to grow.

Certain CDN security services have usage-based aspects, for example billing per traffic amount or security events that pass through. On the enterprise side, there are also set-fee structures - like AWS Shield Advanced, which offers full-on DDoS mitigation for USD 3,000/month. Creating end-user pricing that only charges for what they use and charges additional fees for overages on traffic or request volumes to align prices to actual usage and ensure customers with heavy traffic pay their fair share.

This includes security features such as advanced bot mitigation and zero-trust security, which is usually priced according to the value of the business it protects. SLA guarantees, enhanced security, and dedicated customer support - enterprises pay more for that sort of thing. Well, when Cloudflare and Akamai charge extra for premium WAF rules and real-time analytics, they do so because value-based pricing allows them to maximize revenue from security conscious customers.

AWS and Google Cloud include security as part of their broader cloud services, applying pricing pressure to standalone CDN security vendors. In order to stay competitive, most CDN providers either package security with their CDN or group multiple security features for less than they cost if bought individually. Enterprise clients routinely have custom pricing arrangements, either based on volume discounts or bundled services agreements to keep security costs down.

North America leads the industry, with the USA spearheading innovation as a result of stringent data privacy laws, fast cloud migration, and heightened cyber threats. The region's robust digital foundation and regulatory ecosystem, such as CCPA and NIST recommendations, compel businesses to invest more in security. Industry leaders like Akamai Technologies, Cloudflare, and Fastly are also pushing forward with their DDoS protection, WAF (Web Application Firewall), and AI-based security analytics to fight the new threats.

The European industry is growing swiftly, with the thrust coming from GDPR compliance, mounting cyber-attacks, and digital service growth. Countries such as Germany, the UK, and France are seeing heavy investments in cloud security, Web Application Firewalls (WAFs), and bot management solutions. The European Commission’s initiatives to combat online fraud, data breaches, and misinformation have further strengthened cybersecurity adoption.

Asia Pacific is the most rapidly growing industry, fueled by accelerating digital transformation, e-commerce growth, and growing cyber threats. China, India, and Japan are making significant investments in cybersecurity infrastructure, cloud security solutions, and AI-powered threat detection.

However, challenges such as cybersecurity awareness gaps, regulatory fragmentation, and infrastructure limitations hinder seamless adoption. Despite these challenges, Asia-Pacific’s booming digital economy and government-backed cybersecurity initiatives will continue to fuel adoption, making it a critical region for global providers in the coming years.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 8.2% |

| China | 9% |

| Germany | 7.5% |

| Japan | 7.8% |

| India | 9.3% |

| Australia | 7.1% |

The USA industry is expanding at a phenomenal rate, driven by mounting cyber threats, robust government measures, and aggressive cloud adoption. The country has numerous largest cloud service providers in the world, including AWS, Microsoft Azure, and Google Cloud, which are driving the demand for secure Content Delivery Networks (CDNs).

The government of the USA, through agencies like the Department of Homeland Security (DHS) and the Cybersecurity & Infrastructure Security Agency (CISA), is implementing stronger security measures to shield national infrastructure against cyber threats. FMI is of the opinion that the USA CDN security market is set to witness 8.2% CAGR during the study period.

Market Growth Drivers

| Key Drivers | Details |

|---|---|

| Cybersecurity Defense Programs | The USA government alone spent USD 15 billion on cybersecurity in 2024, leaving business organizations with no option but to use secure solutions. |

| Cloud Services | The USA has excellent cloud providers in AWS, Azure, and Google Cloud, so secure CDNs are also a necessity. |

Chinese industry is growing quickly on the basis of government policy, increasing cyberattacks, and the sheer amount of internet traffic in the nation. China has over 1 billion internet users that generate a huge amount of internet traffic that must be protected for transit.

China has imposed measures like the Great Firewall to control and govern access to the internet, forcing organizations to pay for compliant and secure CDN solutions. FMI states that the Chinese industry is expected to observe 9% CAGR during the study period.

Market Growth Drivers

| Key Drivers | Details |

|---|---|

| Cybersecurity Legislation | The Data Security Law (DSL) and Personal Information Protection Law (PIPL) regulate internet usage and require safe CDNs to be implemented. |

| Cyberattack Surge | More than 250 million malware incidents hit China in 2024, and cybersecurity infrastructure becomes essential. |

German industry is expanding with the regulation of the General Data Protection Regulation (GDPR), growing adoption of cloud technologies, and the rising number of cyberattacks conducted on firms. As the largest economy in Europe, Germany has the strongest data protection regulations that force firms to invest considerable resources into securing data using safe CDN solutions. FMI cites that the German industry is poised to observe 7.5% CAGR during the study period.

Market Growth Drivers

| Key Drivers | Details |

|---|---|

| GDPR Compliance | Germany’s stringent data protection laws force businesses to spend money on safe CDN services. |

| Cybersecurity Investment | Germany spent heavily in 2024 on the improvement of national cybersecurity. |

Japan's CDN security market is growing with increased cyberattacks, expansion in 5G networks, and more online payment transactions. Japan's government Digital Agency demands more cybersecurity law, which fosters the culture of which CDN security is a requirement. Japan's high-performance video gaming and content media companies also require secure and reliable content delivery to keep latency minimal. FMI states that the Japanese industry is anticipated to register 7.8% CAGR during the forecast period.

Market Growth Drivers

| Key Drivers | Details |

|---|---|

| 5G Investment | Japan's USD 50 billion investment in 5G will create demand for secure content delivery. |

| Finance Cybersecurity Threats | Japan banks lost USD 3 billion to fraudulent attacks in 2024, and improved CDN security is necessary. |

Indian industry is expanding rapidly with the increase in digital transactions, online video watching, and the government's transition towards cybersecurity. India with over 700 million internet users has seen a massive rise in cyberattacks, and this has encouraged business houses to lay greater stress on secure CDN solutions. FMI is of the opinion that the Indian industry is set to register 9.3% CAGR during the study period.

Market Growth Drivers

| Key Drivers | Details |

|---|---|

| Digital Payment Growth | UPI transactions reached more than USD 1.8 trillion in 2024, and more cybersecurity was required. |

| Government Cybersecurity Initiative | The Indian government invested ₹5,000 crore in strengthening the country's cybersecurity infrastructure. |

Australian CDN security market continues to expand with rising cybercrime, digitization policies at the government level, and growing usage of cloud computing. Cyber threats to Australian businesses in 2025 increased by a record 35%, according to the Australian Cyber Security Centre (ACSC), and thus saw enhanced demand for secure CDNs. FMI states that the Australian industry is anticipated to obtain 7.1% CAGR during the forecast period.

Market Growth Drivers

| Key Drivers | Details |

|---|---|

| Government Cybersecurity Spending | The government expended AUD 9.9 billion in 2025 on improving cybersecurity resilience to industries. |

| Cloud and Edge Computing Expansion | Australia's rapid expansion of its AUD 15 billion cloud market creates the need for secure CDNs. |

The industry is highly competitive, with tier 1 players like Akamai Technologies, Nexusguard Inc., and Radware Ltd., which all have advanced security solutions, AI-driven threat mitigation, and Zero Trust architectures. These majors leverage their extensive global infrastructure, real-time monitoring capabilities, and robust DDoS protection to address the ever-increasing complexity of cyber threats.

While their current offerings allow them to provide scalable, adaptive frameworks for security, they can maintain and continue that position in the industry in the terms of protecting digital assets and optimizing performance when it comes to content delivery.

Tier 2 players that are building up their brands in integrated security solutions for business and emerging markets are Verizon Digital Media Services, StackPath LLC, and Tencent Cloud. These businesses focus on cost-effective, scalable security models to gain competitive advantages in special sections.

The emerging trends in the marketplace have been enhanced by the popularity of edge computing and increased investments in AI-powered risk assessment, which compel providers to ensure best practices on real-time threat intelligence and automated mitigation strategies. Those who specialize in innovative predictive security analytics and compliance-driven architectures will enjoy the benefits of long-term market relevance in this period of increased cyber risks.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Akamai Technologies | 18-23% |

| Nexusguard Inc. | 10-15% |

| Radware Ltd. | 8-12% |

| Verizon Digital Media Services | 5-10% |

| StackPath LLC | 4-8% |

| Tencent Cloud | 3-7% |

| Other Companies (combined) | 37-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Akamai Technologies | Advanced edge security, DDoS mitigation, Zero Trust framework, bot protection. |

| Nexusguard Inc. | Specializes in cloud-based DDoS mitigation and AI-driven threat intelligence. |

| Radware Ltd. | Multi-layered security solutions with behavioral analytics and attack prevention. |

| Verizon Digital Media Services | CDN-integrated web application firewall (WAF) and enterprise-grade security. |

| StackPath LLC | Edge computing with integrated threat detection and automated security policies. |

| Tencent Cloud | AI-driven security solutions tailored for APAC enterprises, focusing on large-scale cyber threat mitigation. |

Key Company Insights

Akamai Technologies (18-23%)

Akamai remains a leader in the CDN security industry with its cutting-edge edge computing and Zero Trust security solutions. It is always updating its DDoS mitigation and bot management technologies, making it an attractive option for enterprises that require protection against large-scale cyber threats.

Nexusguard Inc. (10-15%)

Nexusguard is a well-known name in cloud-based DDoS mitigation and AI-backed threat intelligence. The company has made a co-resident security portfolio through the introduction of machine-learning-based anomaly detection, thus positioning itself as a key player with ISPs and enterprises or government entities.

Radware Ltd. (8-12%)

Radware is the pioneer in behavioral analytics and multi-layered protection solutions in cybersecurity. The company aims its products at APT (Advanced Persistent Threats) and volumetric DDoS attacks, with its latest partnerships with operators in telecom enhancing the provider's network security features.

Verizon Digital Media Services (5-10%)

Verizon combines CDN security with other enterprise offerings, including its robust WAF and network protection. The carrier recently unveiled a new edge security solution intended to boost content protection and lower latency while unaffiliated with its typical enterprise offerings.

StackPath LLC (4-8%)

StackPath Across the edge, real-time threat detection and automated enforcement of security threats are the two most essential prerogatives. Startup and small and medium-sized enterprises are conveniently reached through the affordable pricing on their security solutions, while the new AI-enhanced firewall upgrades improve its breach prevention capabilities.

Tencent Cloud (3-7%)

Tencent Cloud also has a fast-growing footprint in the APAC region through AI-driven security frameworks. The newly introduced adaptive security framework has for the first time enabled real-time cyber threat attenuation for large enterprises.

With respect to application, the industry is divided into web application firewall, authentication management, DNS, DDoS protection, and bot mitigation.

With respect to end user, the industry is divided into large enterprise, medium enterprise, and small enterprise.

With respect to industry, the industry is split into BFSI, healthcare, IT & telecom, retail, media & entertainment, and manufacturing.

Key countries of North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA) have been covered in the report.

The industry is anticipated to reach a size of USD 12.1 billion in 2025.

The industry is predicted to reach a size of USD 72.9 billion by 2035.

Large enterprises are major end users.

China, set to expand at 9% CAGR during the study period, is expected to witness fastest growth.

The key players operating in the market include Akamai Technologies, Cloudflare Inc., Amazon Web Services, Microsoft Corporation, Radware Ltd., Verizon Digital Media Services, StackPath LLC, Fastly Inc., Tata Communications Limited, International Business Machines Corporation (IBM), Google LLC, ChinaCache, Distil Networks, Arbor Networks, Limelight Networks, and Nexusguard Inc.

Table 1: Global Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 3: Global Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 4: Global Industry Analysis and Outlook Value (US$ Million) Forecast by Industries, 2018 to 2033

Table 5: North America Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 7: North America Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: North America Industry Analysis and Outlook Value (US$ Million) Forecast by Industries, 2018 to 2033

Table 9: Latin America Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 11: Latin America Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 12: Latin America Industry Analysis and Outlook Value (US$ Million) Forecast by Industries, 2018 to 2033

Table 13: Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 15: Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: Western Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Industries, 2018 to 2033

Table 17: Eastern Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 19: Eastern Europe Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 20: Eastern Europe Industry Analysis and Outlook Value (US$ Million) Forecast by Industries, 2018 to 2033

Table 21: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 23: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) Forecast by Industries, 2018 to 2033

Table 25: East Asia Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 27: East Asia Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 28: East Asia Industry Analysis and Outlook Value (US$ Million) Forecast by Industries, 2018 to 2033

Table 29: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 31: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) Forecast by Industries, 2018 to 2033

Figure 1: Global Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 2: Global Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Industry Analysis and Outlook Value (US$ Million) by Industries, 2023 to 2033

Figure 4: Global Industry Analysis and Outlook Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 9: Global Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 10: Global Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 11: Global Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 12: Global Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 13: Global Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 14: Global Industry Analysis and Outlook Value (US$ Million) Analysis by Industries, 2018 to 2033

Figure 15: Global Industry Analysis and Outlook Value Share (%) and BPS Analysis by Industries, 2023 to 2033

Figure 16: Global Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Industries, 2023 to 2033

Figure 17: Global Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 18: Global Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 19: Global Industry Analysis and Outlook Attractiveness by Industries, 2023 to 2033

Figure 20: Global Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 21: North America Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 22: North America Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 23: North America Industry Analysis and Outlook Value (US$ Million) by Industries, 2023 to 2033

Figure 24: North America Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 29: North America Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 30: North America Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 31: North America Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 32: North America Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 33: North America Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 34: North America Industry Analysis and Outlook Value (US$ Million) Analysis by Industries, 2018 to 2033

Figure 35: North America Industry Analysis and Outlook Value Share (%) and BPS Analysis by Industries, 2023 to 2033

Figure 36: North America Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Industries, 2023 to 2033

Figure 37: North America Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 38: North America Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 39: North America Industry Analysis and Outlook Attractiveness by Industries, 2023 to 2033

Figure 40: North America Industry Analysis and Outlook Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 42: Latin America Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 43: Latin America Industry Analysis and Outlook Value (US$ Million) by Industries, 2023 to 2033

Figure 44: Latin America Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 50: Latin America Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 51: Latin America Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 52: Latin America Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 53: Latin America Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 54: Latin America Industry Analysis and Outlook Value (US$ Million) Analysis by Industries, 2018 to 2033

Figure 55: Latin America Industry Analysis and Outlook Value Share (%) and BPS Analysis by Industries, 2023 to 2033

Figure 56: Latin America Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Industries, 2023 to 2033

Figure 57: Latin America Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 58: Latin America Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 59: Latin America Industry Analysis and Outlook Attractiveness by Industries, 2023 to 2033

Figure 60: Latin America Industry Analysis and Outlook Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 62: Western Europe Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 63: Western Europe Industry Analysis and Outlook Value (US$ Million) by Industries, 2023 to 2033

Figure 64: Western Europe Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 69: Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 70: Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 71: Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 72: Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 73: Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 74: Western Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Industries, 2018 to 2033

Figure 75: Western Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Industries, 2023 to 2033

Figure 76: Western Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Industries, 2023 to 2033

Figure 77: Western Europe Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 78: Western Europe Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 79: Western Europe Industry Analysis and Outlook Attractiveness by Industries, 2023 to 2033

Figure 80: Western Europe Industry Analysis and Outlook Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 82: Eastern Europe Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 83: Eastern Europe Industry Analysis and Outlook Value (US$ Million) by Industries, 2023 to 2033

Figure 84: Eastern Europe Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 89: Eastern Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 90: Eastern Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 91: Eastern Europe Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 92: Eastern Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 93: Eastern Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 94: Eastern Europe Industry Analysis and Outlook Value (US$ Million) Analysis by Industries, 2018 to 2033

Figure 95: Eastern Europe Industry Analysis and Outlook Value Share (%) and BPS Analysis by Industries, 2023 to 2033

Figure 96: Eastern Europe Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Industries, 2023 to 2033

Figure 97: Eastern Europe Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 98: Eastern Europe Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 99: Eastern Europe Industry Analysis and Outlook Attractiveness by Industries, 2023 to 2033

Figure 100: Eastern Europe Industry Analysis and Outlook Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 102: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 103: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) by Industries, 2023 to 2033

Figure 104: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: South Asia and Pacific Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 110: South Asia and Pacific Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 111: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 112: South Asia and Pacific Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 113: South Asia and Pacific Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 114: South Asia and Pacific Industry Analysis and Outlook Value (US$ Million) Analysis by Industries, 2018 to 2033

Figure 115: South Asia and Pacific Industry Analysis and Outlook Value Share (%) and BPS Analysis by Industries, 2023 to 2033

Figure 116: South Asia and Pacific Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Industries, 2023 to 2033

Figure 117: South Asia and Pacific Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 118: South Asia and Pacific Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 119: South Asia and Pacific Industry Analysis and Outlook Attractiveness by Industries, 2023 to 2033

Figure 120: South Asia and Pacific Industry Analysis and Outlook Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 122: East Asia Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 123: East Asia Industry Analysis and Outlook Value (US$ Million) by Industries, 2023 to 2033

Figure 124: East Asia Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 129: East Asia Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 130: East Asia Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 131: East Asia Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 132: East Asia Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 133: East Asia Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 134: East Asia Industry Analysis and Outlook Value (US$ Million) Analysis by Industries, 2018 to 2033

Figure 135: East Asia Industry Analysis and Outlook Value Share (%) and BPS Analysis by Industries, 2023 to 2033

Figure 136: East Asia Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Industries, 2023 to 2033

Figure 137: East Asia Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 138: East Asia Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 139: East Asia Industry Analysis and Outlook Attractiveness by Industries, 2023 to 2033

Figure 140: East Asia Industry Analysis and Outlook Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 142: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) by End User, 2023 to 2033

Figure 143: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) by Industries, 2023 to 2033

Figure 144: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 149: Middle East and Africa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 150: Middle East and Africa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 151: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 152: Middle East and Africa Industry Analysis and Outlook Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 153: Middle East and Africa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 154: Middle East and Africa Industry Analysis and Outlook Value (US$ Million) Analysis by Industries, 2018 to 2033

Figure 155: Middle East and Africa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Industries, 2023 to 2033

Figure 156: Middle East and Africa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Industries, 2023 to 2033

Figure 157: Middle East and Africa Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 158: Middle East and Africa Industry Analysis and Outlook Attractiveness by End User, 2023 to 2033

Figure 159: Middle East and Africa Industry Analysis and Outlook Attractiveness by Industries, 2023 to 2033

Figure 160: Middle East and Africa Industry Analysis and Outlook Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

cDNA Synthesis Market

Content Delivery Network (CDN) Market Report - Growth, Demand & Forecast 2025 to 2035

Internet Protocol Television (IPTV) CDN Market Size and Share Forecast Outlook 2025 to 2035

Security Alarm Communicator Market Size and Share Forecast Outlook 2025 to 2035

Security and Vulnerability Management Market Forecast and Outlook 2025 to 2035

Security Holograms Market Size and Share Forecast Outlook 2025 to 2035

Security Paper Market Size and Share Forecast Outlook 2025 to 2035

Security System Tester Market Size and Share Forecast Outlook 2025 to 2035

Security Advisory Services Market Size and Share Forecast Outlook 2025 to 2035

Security Room Control Market Size and Share Forecast Outlook 2025 to 2035

Security Cameras (IR Illuminator) Market Size and Share Forecast Outlook 2025 to 2035

Security Operation Centre as a Service Market Size and Share Forecast Outlook 2025 to 2035

Security Robots Market Size and Share Forecast Outlook 2025 to 2035

Security Service Edge Market Size and Share Forecast Outlook 2025 to 2035

Security and Surveillance Equipment Market Size and Share Forecast Outlook 2025 to 2035

Security Orchestration Automation and Response (SOAR) Market Size and Share Forecast Outlook 2025 to 2035

Security Bags Market Size and Share Forecast Outlook 2025 to 2035

Security Screening Market Analysis - Size, Share, and Forecast 2025 to 2035

Security Bottles Market Size and Share Forecast Outlook 2025 to 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA