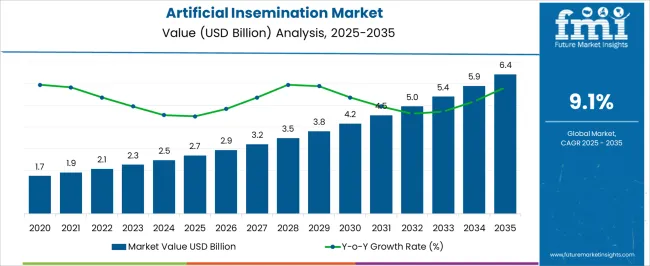

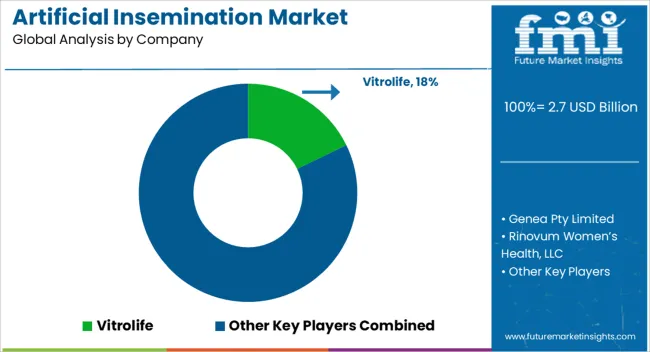

The Artificial Insemination Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate (CAGR) of 9.1% over the forecast period.

| Metric | Value |

|---|---|

| Artificial Insemination Market Estimated Value in (2025 E) | USD 2.7 billion |

| Artificial Insemination Market Forecast Value in (2035 F) | USD 6.4 billion |

| Forecast CAGR (2025 to 2035) | 9.1% |

The Artificial Insemination market is experiencing steady growth, driven by rising infertility rates and increasing awareness about assisted reproductive technologies. Advances in reproductive medicine and the development of innovative insemination techniques are improving success rates and patient outcomes, which is encouraging broader adoption. Increasing focus on personalized fertility treatments, coupled with advancements in sperm and egg quality assessment, has enhanced the effectiveness of artificial insemination procedures.

Additionally, the expansion of fertility clinics and specialized reproductive healthcare centers is making services more accessible to patients globally. Regulatory frameworks supporting safe and ethical assisted reproduction practices are also contributing to market growth. Rising demand in emerging economies, along with growing acceptance of donor-assisted procedures, is further fueling adoption.

Ongoing research and development efforts aimed at improving procedure efficiency, reducing complications, and integrating advanced technologies such as cryopreservation and AI-based monitoring are shaping the market landscape The market is expected to continue expanding as patients increasingly seek reliable, cost-effective, and clinically validated solutions for infertility treatment.

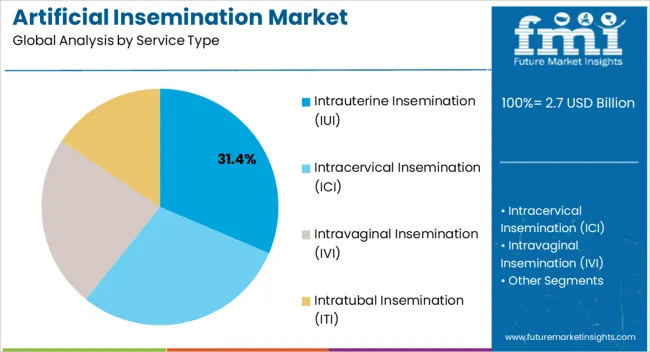

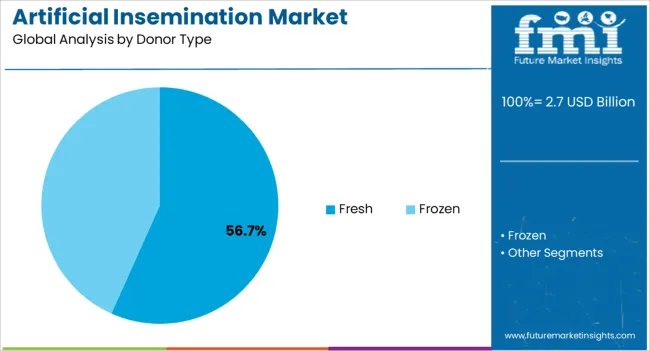

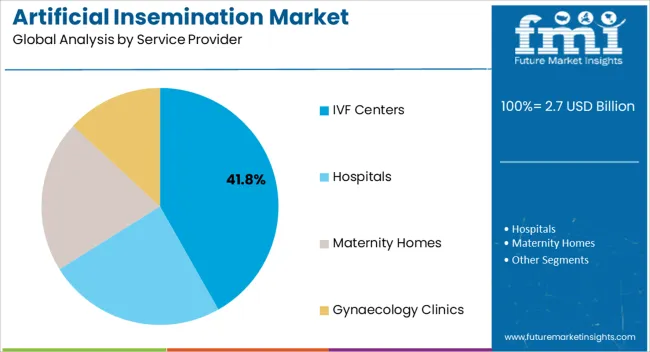

The artificial insemination market is segmented by service type, donor type, service provider, and geographic regions. By service type, artificial insemination market is divided into Intrauterine Insemination (IUI), Intracervical Insemination (ICI), Intravaginal Insemination (IVI), and Intratubal Insemination (ITI). In terms of donor type, artificial insemination market is classified into Fresh and Frozen. Based on service provider, artificial insemination market is segmented into IVF Centers, Hospitals, Maternity Homes, and Gynaecology Clinics. Regionally, the artificial insemination industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The intrauterine insemination (IUI) segment is projected to hold 31.4% of the market revenue in 2025, establishing it as the leading service type. Growth in this segment is driven by the procedure’s minimally invasive nature, higher success rates in specific patient groups, and lower cost compared with more complex reproductive interventions. IUI allows precise placement of sperm into the uterus, improving fertilization chances while reducing patient discomfort and recovery time.

The procedure’s compatibility with both partner and donor sperm, along with the ability to combine it with ovulation induction therapies, further enhances adoption. Clinics offering IUI have focused on improving procedural protocols, sperm preparation techniques, and patient monitoring to optimize outcomes.

Increasing awareness about fertility options and access to specialized reproductive healthcare services has expanded the patient base for IUI As healthcare providers continue to emphasize safe, effective, and patient-friendly assisted reproductive techniques, the IUI segment is expected to maintain its leading position, supported by growing clinical adoption and rising patient preference.

The fresh donor segment is expected to account for 56.7% of the market revenue in 2025, making it the leading donor type. Growth in this segment is driven by the superior viability and quality of fresh gametes, which enhances fertilization rates and improves clinical outcomes. Fresh donor gametes allow for precise timing with ovulation cycles, reducing the risk of procedural failure and supporting higher pregnancy success rates.

The segment is further supported by rigorous donor screening, quality control, and ethical practices that ensure patient safety and compliance with regulatory standards. Fertility clinics and hospitals are increasingly adopting fresh donor programs to meet patient demand for reliable and effective treatment options.

The ability to customize donor selection based on genetic compatibility, blood type, and other criteria adds clinical value and strengthens patient confidence As advancements in reproductive technology continue and demand for donor-assisted procedures rises, the fresh donor segment is expected to maintain market leadership, supported by improved procedural success and growing patient preference.

The IVF centers segment is anticipated to hold 41.8% of the market revenue in 2025, establishing it as the leading service provider category. Growth in this segment is driven by the increasing number of specialized IVF centers offering comprehensive fertility services, including artificial insemination, ovulation induction, and donor programs. IVF centers provide structured, technologically advanced facilities with experienced clinical staff, which enhances procedural success and patient trust.

Integration of cutting-edge reproductive technologies, patient-specific treatment planning, and continuous monitoring ensures optimized outcomes. The expansion of IVF centers in urban and emerging regions has increased accessibility and convenience for patients seeking assisted reproductive services.

Additionally, the adoption of AI and data-driven monitoring systems enables IVF centers to improve efficiency, track success rates, and personalize treatment plans As the demand for professional, reliable, and clinically advanced reproductive services grows, IVF centers are expected to remain the dominant service provider segment, supported by high patient confidence and rising adoption of assisted reproductive technologies.

One of the significant factors shaping the market is the rising infertility rates, with a rise in public awareness of alternative reproductive treatments.

Artificial insemination is a method of assisted reproduction in which the semen is administered into the vagina, oviducts, or uterus of a female patient. Artificial insemination homologous (AIH) or artificial insemination donor semen (AID) procedures are used to do it swiftly and with little discomfort.

Self-insemination kits that can be used in the comfort of your home are now available on the market. Currently, artificial insemination is a popular procedure in animal breeding as well, aiding in effective breeding and the conservation of endangered species. Additionally, it reduces animal sterility caused by genital issues and the development of various diseases.

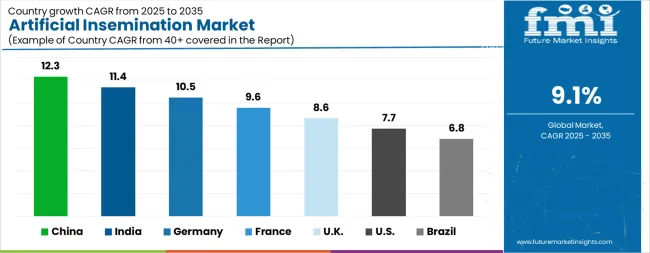

| Country | CAGR |

|---|---|

| China | 12.3% |

| India | 11.4% |

| Germany | 10.5% |

| France | 9.6% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

The Artificial Insemination Market is expected to register a CAGR of 9.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 12.3%, followed by India at 11.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.8%, yet still underscores a broadly positive trajectory for the global Artificial Insemination Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.5%. The USA Artificial Insemination Market is estimated to be valued at USD 990.3 million in 2025 and is anticipated to reach a valuation of USD 2.1 billion by 2035. Sales are projected to rise at a CAGR of 7.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 122.6 million and USD 87.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Billion |

| Service Type | Intrauterine Insemination (IUI), Intracervical Insemination (ICI), Intravaginal Insemination (IVI), and Intratubal Insemination (ITI) |

| Donor Type | Fresh and Frozen |

| Service Provider | IVF Centers, Hospitals, Maternity Homes, and Gynaecology Clinics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Vitrolife, Genea Pty Limited, Rinovum Women’s Health, LLC, Pride Angel, HI-TECH SOLUTIONS, FUJIFILM Irvine Scientific, Kitazato Corporation, Rocket Medical plc, and Conceivex, Inc. |

The global artificial insemination market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the artificial insemination market is projected to reach USD 6.4 billion by 2035.

The artificial insemination market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in artificial insemination market are intrauterine insemination (iui), intracervical insemination (ici), intravaginal insemination (ivi) and intratubal insemination (iti).

In terms of donor type, fresh segment to command 56.7% share in the artificial insemination market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA